Corn Wet-Milling Market by End Product (Starches, Sweeteners, Ethanol, and Gluten Feed & Gluten Meal), Application (Feed, Food, and Industrial), Source (Dent and Waxy), and Equipment (Milling, Steeping, and Centrifuge System) - Global Forecast to 2021

[159 Pages Report] The corn wet-milling market is projected to grow from USD 58.09 billion in 2015 to USD 77.50 billion by 2021, at a CAGR of 5.0% from 2016 to 2021. Increased demand for corn-based sweeteners such as high-fructose corn syrup in processed food & beverages, consumption of corn gluten meal-based feed products, and rise in demand for biofuels such as ethanol is expected to drive the market.

The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Increasing demand for high fructose corn syrup in processed food & beverage

- Increasing consumption of corn gluten meal-based feed products

- Multifunctionality of cornstarch in non-food applications

Restraints

- Highly energy- & capital-intensive technology

Opportunities

- Increasing demand for corn ethanol as a biofuel

Challenges

- Competition from other plant proteins existing in the market

Increased demand for high fructose corn syrup in processed food & beverage drives the global market

Increased demand for HFCS in the carbonated beverage industry owing to its 55% fructose content, which makes it sweeter compared to sucrose, resulting in low production cost for manufacturers. Since HFCS is the key product manufactured in the wet-milling process, increase in its demand is expected to drive the market for corn wet-milling in the near future. The global beverage industry is expected to rise significantly irrespective of the global economic downturn. This increase in the sales of ready-to-drink beverages which include products such as carbonated & dairy beverages, tea, fruit drinks, and alcoholic beverages such as beer, ciders, and malted beverages is the key factor leading to increased demand for HFCS.

The following are the major objectives of the study.

- To describe and forecast the corn wet-milling market, in terms of type, form, application, function, and brand

- To describe and forecast the corn wet-milling market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the corn wet-milling

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the corn wet-milling ecosystem

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the corn wet-milling market

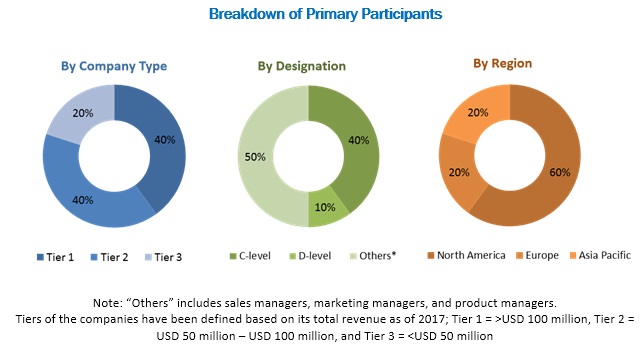

During this research study, major players operating in the corn wet-milling market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Key players considered in the analysis of the corn wet-milling market are Tate & Lyle PLC (UK), Archer Daniels Midland Company (US), Cargill, Incorporated (US), Ingredion Incorporated (US), Agrana Beteiligungs-AG (Austria), The Roquette Freres (France). Other players include Bunge Limited (US), China Agri-Industries Holding Limited (China), Global Bio-Chem Technology Group Company Limited (Hong Kong), and Grain Processing Corporation (US).

Major Market Developments

- In July 2016, ADM introduced high-quality protein source PROPLEX DY for swine feed. This product was produced from the corn wet-milling process and was to improve the growth of animals.

- In February 2016, ADM acquired Morocco-based corn wet mill from Tate & Lyle (UK). This would help ADM to produce glucose and native starch.

- In January 2016, Cargill set up its new corn wet-milling plant in Karnataka, India by investing USD 100.0 million. The plant's capacity was to provide 800 tons of corn daily.

- In February 2016, Ingredion Incorporated acquired Shandong Huanong Specialty Corn Development Co., Ltd (China), to enhance its growth in the Asia Pacific region and generate a manufacturing base for specialty ingredients.

Target Audience

- Animal feed manufacturers

- Food & beverage manufacturers & processors

- Research & development laboratories

- Bio-fuel manufacturers and users

- Pharmaceutical products manufacturers/suppliers

- Personal care products manufacturers/suppliers

- Paper & textile manufacturers/suppliers

Report Scope

By End-product

- Starch

- Sweetener

- Ethanol

- Corn gluten meal & gluten feed

- Others (corn oil, proteins, corn germ meal, and steep liquor)

By Application:

- Feed

- Food

- Industrial

By Source:

- Dent corn

- Waxy corn

By Equipment:

- Milling equipment

- Steeping equipment

- Centrifuge systems

- Washing & filtration systems

- Other (heating & cooling systems, dryers, and other utility equipment)

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers

- What are new application areas which the corn wet-milling companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in Rest of Asia Pacific based on application

- Further country-wise breakdown of the market in Rest of Europe based on application

- Further country-wise breakdown of the market in RoW based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall market is expected to grow from USD 58.09 billion in 2015 to USD 77.50 billion by 2021, at a CAGR of 5.0% from 2016 to 2021. The increased demand for corn-based sweeteners such as high-fructose corn syrup in processed food & beverages, increase in consumption of corn gluten meal-based feed products, and increased demand for biofuels such as ethanol are the key factors driving the growth of this market.

The corn wet-milling market has been segmented, on the basis of the end product, into sweeteners, gluten feed & gluten meal, ethanol, starches, and others. The market for sweeteners is expected to grow at the highest CAGR between 2016 and 2021. Among all the end products, sweeteners are the most widely used in the food & beverage as well as the pharmaceutical industry.

The market has been segmented, on the basis of application, into feed, food, and industrial. The market for feed application is expected to grow at the highest CAGR between 2016 and 2021. Among all the applications, corn wet-milling is used the most in the feed industry owing to demand for abundant, safe, and affordable animal protein. Apart from this, increased demand for meat such as poultry, swine & beef, dairy, and fish especially in emerging economies such as Asia Pacific, South America, and the Middle East & Africa are expected to create high growth prospects for corn-wet milling producers in the coming years amidst rise in income among individuals in these regions.

The corn wet-milling market has been segmented, on the basis of source, into dent corn and waxy corn. The market for dent corn is projected to grow at the highest CAGR between 2016 and 2021. Among both the sources, dent corn is the most commonly used corn in corn wet-milling process to manufacture corn syrup, food starch, feed, and ethanol.

The market has been segmented, on the basis of equipment, into milling equipment, steeping equipment, centrifuge systems, washing & filtration systems, and others. The centrifuge systems are projected to grow at the highest CAGR between 2016 and 2021. They are the most widely used widely used equipment in the corn wet-milling market.

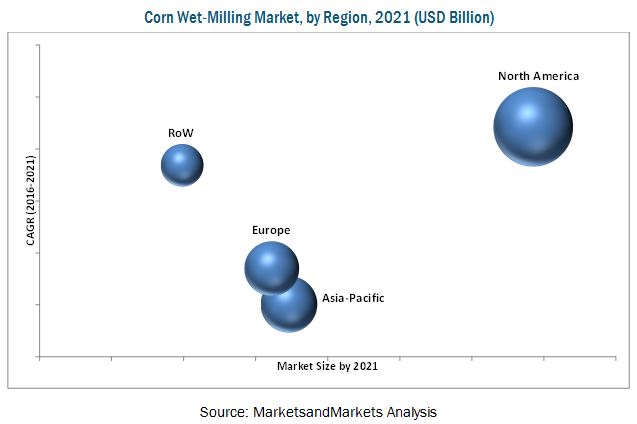

The global market in North America is expected to grow at the highest CAGR during the forecast period. North America is the fastest-growing and largest market for corn wet-milling products. It held a major share in the ethanol segment, which is obtained from the corn wet-milling process. Corn wet-milling products are used in various industries such as food, feed, textiles, paper, pharmaceuticals, personal & healthcare, and others. This is the major factor driving the growth of the market in North America. Apart from this, the region is home to a number of multinational food processing giants such as ADM (US), Cargill (US), and Ingredion (US). The region is also the largest consumer market at a global level for corn products. As a result, North America holds a significant share of the overall corn wet-milling market.

Corn wet-milling applications in feed, food, and industrials space drive the growth of this market

Feed

The end products of the corn wet-milling process such as corn gluten meal, corn gluten feed, corn germ meal, corn steep liquor, and amino acids are used in feed. Corn gluten is used in dairy & cattle, poultry, and swine feed while corn steep liquor is beef and dairy feed ingredients. Increased demand for meat such as poultry, swine & beef, dairy, and fish in countries such as China and Brazil are expected to boost demand for feed in these countries, thus driving the market.

Food

The major food ingredients obtained from corn wet-milling process are corn syrup, corn starch, and corn oil other co-products include organic acids, vitamins, amino acid, citric acid, lactic acid, and food gums. Corn syrup can be used as a sweetener in food items such as candies, ice creams, confectionery, and infant formula. High-fructose corn syrup is used in various consumer products such as baked goods, dairy products, fruit-flavored beverages, and soft drinks. Cornstarch is used in various instant and ready-to-eat foods to maintain the textural characteristics during heating, thawing, and freezing. It is also used in jellies, candies, and food sauces. The products obtained from refined corn oil are cooking oil and salad oil, which are used in salad dressings to provide health benefits with concentrated energy content. It is also used to produce margarine, mayonnaise, and other such condiments.

Industrial applications

The products obtained from the corn wet-milling are used in application that serves industries such as textile, paper, personal care, and pharmaceuticals. In the paper and textile industry, industrial corn starch is used for surface coating, sizing, and adhesion. It is also used in the production of construction material, mining, oil & gas drilling, and water filtration. Starch is also used in household items such as batteries, cleaners, matches, and trash bags. It also serves the personal and healthcare industry as an ingredient in items such as cosmetics, soaps, deodorants & hair styling products, medicines, and cough drops. Apart from this, corn starch is used in diapers, bandages, napkins, and baby powders. It can be used as an adhesive to replace petroleum-based acetates. It is also used as a raw material for the production of industrial chemicals and plastics, a relatively new market for cornstarch.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for corn wet-milling?

The major restraining factor in the corn wet-milling market is the high cost of operations. Corn wet-milling is a highly energy-intensive processing technology in the food & beverage industry and consumes approximately 15% of the total energy used in the entire food industry. Among raw materials, energy cost is the second-largest after corn prices in the wet-milling process. Furthermore, high energy-price volatility adds on to the variable cost of the wet-milling process resulting in reduced predictable earnings for millers. The amount of energy consumed in the milling industry is growing, which in turn restrains the market growth.

Key players in the market include Tate & Lyle PLC (UK), ADM (US), Cargill (US), Ingredion Incorporated (US), Agrana Beteiligungs-AG (Austria), The Roquette Freres (France). Other players include Bunge (US), China Agri-Industries Holding Limited (China), Global Bio-Chem Technology Group Company Limited (Hong Kong), and Grain Processing Corporation (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Unit

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increased Demand for Corn Gluten MEAl in Animal Feed

2.2.2.2 Globally Increasing Ethanol Production

2.2.3 Supply-Side Analysis

2.2.3.1 Global Corn Production

2.2.3.2 Global Corn Prices

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in this Market

4.2 Corn Wet-Milling Market, By End Product

4.3 Corn Wet-Milling Market in the North American Region

4.4 Corn Wet-Milling Market: Major Countries

4.5 Corn Wet-Milling Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Source

5.2.2 By Application

5.2.3 By End Product

5.2.4 By Equipment

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for High Fructose Corn Syrup in Processed Food & Beverages

5.3.1.2 Increasing Consumption of Corn Gluten MEAl-Based Animal Feed Products

5.3.1.3 Multifunctionality of Corn Starch in Non-Food Applications

5.3.2 Restraints

5.3.2.1 Highly Energy- & Capital-Intensive Technology

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Corn Ethanol as Biofuel

5.3.4 Challenges

5.3.4.1 Controlling Adverse Environmental Emissions

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Global Corn Wet-Milling Market: Value Chain Analysis

6.3 Raw Material Price Trend Analysis

6.4 Global Corn Wet-Milling Market: Trade Analysis

6.4.1 Global Corn Trade Share, By Country

6.4.2 The U.S. High Fructose Corn Syrup Market: Exports Analysis

6.4.3 U.S.: Ethanol Exports vs Imports

7 Market for Corn Wet-Milling, By End Product (Page No. - 58)

7.1 Introduction

7.2 Starch

7.3 Sweetener

7.4 Ethanol

7.5 Corn Gluten MEAl & Gluten Feed

7.6 Other Co-Products

8 Market for Corn Wet-Milling, By Application (Page No. - 65)

8.1 Introduction

8.2 Feed

8.3 Food

8.4 Industrial Applications

9 Market for Corn Wet-Milling, By Source (Page No. - 70)

9.1 Introduction

9.2 Dent Corn

9.3 Waxy Corn

10 Market for Corn Wet-Milling, By Equipment (Page No. - 73)

10.1 Introduction

10.2 Milling Equipment

10.3 Steeping Equipment

10.4 Centrifuge Systems

10.5 Washing & Filtration Systems

10.6 Other Equipment

11 Market for Corn Wet-Milling, By Region (Page No. - 77)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Latin America

11.5.2 Middle East

11.5.3 Africa

12 Competitive Landscape (Page No. - 115)

12.1 Overview

12.2 Competitive Situation & Trends

12.2.1 Expansions

12.2.2 Agreements & Joint Ventures

12.2.3 Acquisitions

12.2.4 New Product Launches

13 Company Profiles (Page No. - 123)

13.1 Introduction

13.2 Tate & Lyle PLC (U.K.)

13.3 Archer Daniels Midland Company (U.S.)

13.4 Cargill, Incorporated (U.S.)

13.5 Ingredion Incorporated (U.S.)

13.6 Agrana Beteiligungs-Ag (Austria)

13.7 Bunge Limited (U.S.)

13.8 Global Bio-Chem Technology Group Company Limited (Hong Kong)

13.9 China Agri-Industries Holdings Limited (China)

13.10 Grain Processing Corporation (U.S.)

13.11 The Roquette Frères (France)

14 Appendix (Page No. - 149)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 More Company Developments

14.4 Introducing RT : Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (85 Tables)

Table 1 Standard Capital Cost in A Conventional Corn Wet-Milling Plant

Table 2 Market Size, By End Product, 2014–2021 (USD Million)

Table 3 Market Size, By End Product, 2014–2021 (MMT)

Table 4 Corn Wet-Milling for Starches Market Size, By Region, 2014–2021 (USD Million)

Table 5 Corn Wet-Milling for Sweeteners Market Size, By Region, 2014–2021 (USD Million)

Table 6 Corn Wet-Milling for Ethanol Market Size, By Region, 2014–2021 (USD Million)

Table 7 Corn Wet-Milling for Gluten Feed & Gluten Meal Market Size, By Region, 2014–2021 (USD Million)

Table 8 Corn Wet-Milling for Other Co-Products Market Size, By Region, 2014–2021 (USD Million)

Table 9 Market Size, By Application, 2014–2021 (USD Million)

Table 10 Feed: Corn Wet-Milling Market Size, By Region, 2014–2021 (USD Million)

Table 11 Food: Corn Wet-Milling Market Size, By Region, 2014–2021 (USD Million)

Table 12 Industrial Applications: Corn Wet-Milling Market Size, By Region, 2014–2021 (USD Million)

Table 13 Corn Wet-Milling Market Size, By Source, 2014–2021 (USD Million)

Table 14 Market Size, By Source, 2014–2021 (MMT)

Table 15 Corn Wet-Milling Market Size, By Equipment, 2014–2021 (USD Million)

Table 16 Market Size, By Region, 2014–2021 (USD Million)

Table 17 Market Size, By Region, 2014–2021 (MMT)

Table 18 North America: Corn Wet-Milling Market Size, By Country, 2014–2021 (USD Million)

Table 19 North America: Market Size, By End Product, 2016–2021 (USD Million)

Table 20 North America: Starches Market Size, By Country, 2014–2021 (USD Million)

Table 21 North America: Sweeteners Market Size, By Country, 2014–2021 (USD Million)

Table 22 North America: Ethanol Market Size, By Country, 2014–2021 (USD Million)

Table 23 North America: Gluten Feed & Gluten Meal Market Size, By Country, 2014–2021 (USD Million)

Table 24 North America: Other Co-Products Market Size, By Country, 2014–2021 (USD Million)

Table 25 North America: Corn Wet-Milling Market Size, By Application, 2016–2021 (USD Million)

Table 26 U.S.: Corn Wet-Milling Market Size, By End Product, 2016–2021 (USD Million)

Table 27 U.S.: Market Size, By Application, 2016–2021 (USD Million)

Table 28 Canada: Corn Wet-Milling Market Size, By End Product, 2016–2021 (USD Million)

Table 29 Canada: Market Size, By Application, 2016–2021 (USD Million)

Table 30 Mexico: Corn Wet-Milling Market Size, By End Product, 2016–2021 (USD Million)

Table 31 Mexico: Market Size, By Application, 2016–2021 (USD Million)

Table 32 Europe: Corn Wet-Milling Market Size, By Country, 2014–2021 (USD Million)

Table 33 Europe: Market Size, By End Products, 2014–2021 (USD Million)

Table 34 Europe: Starches Market Size, By Country, 2014–2021 (USD Million)

Table 35 Europe: Sweeteners Market Size, By Country, 2014–2021 (USD Million)

Table 36 Europe: Ethanol Market Size, By Country, 2014–2021 (USD Million)

Table 37 Europe: Gluten Feed & Gluten Meal Market Size, By Country, 2014–2021 (USD Million)

Table 38 Europe: Other Co-Products Market Size, By Country, 2014–2021 (USD Million)

Table 39 Europe: Corn Wet-Milling Market Size, By Application, 2014–2021 (USD Million)

Table 40 Germany: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 41 Germany: Market Size, By Application, 2014–2021 (USD Million)

Table 42 U.K.: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 43 U.K.: Market Size, By Application, 2014–2021 (USD Million)

Table 44 France: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 45 France: Market Size, By Application, 2014–2021 (USD Million)

Table 46 Rest of Europe: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 47 Rest of Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 48 Asia-Pacific: Corn Wet-Milling Market Size, By Country, 2014–2021 (USD Million)

Table 49 Asia-Pacific: Market Size, By End Product, 2014–2021 (USD Million)

Table 50 Asia-Pacific: Starches Market Size, By Country, 2014–2021 (USD Million)

Table 51 Asia-Pacific: Sweeteners Market Size, By Country, 2014–2021 (USD Million)

Table 52 Asia-Pacific: Ethanol Market Size, By Country, 2014–2021 (USD Million)

Table 53 Asia-Pacific: Gluten Feed & Gluten Meal Market Size, By Country, 2014–2021 (USD Million)

Table 54 Asia-Pacific: Other Co-Products Market Size, By Country, 2014–2021 (USD Million)

Table 55 Asia-Pacific: Market Size for Corn Wet-Milling, By Application, 2014–2021 (USD Million)

Table 56 China: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 57 China: Market Size, By Application, 2014–2021 (USD Million)

Table 58 India: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 59 India: Market Size, By Application, 2014–2021 (USD Million)

Table 60 Japan: Market Size for Corn Wet-Milling, By End Product, 2014–2021 (USD Million)

Table 61 Japan: Market Size, By Application, 2014–2021 (USD Million)

Table 62 Rest of Asia-Pacific: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 63 Rest of Asia-Pacific: Market Size, By Application, 2014–2021 (USD Million)

Table 64 RoW: Market Size for Corn Wet-Milling, By Country, 2014–2021 (USD Million)

Table 65 RoW: Market Size, By End Product, 2014–2021 (USD Million)

Table 66 RoW: Starches Market Size, By Country, 2014–2021 (USD Million)

Table 67 RoW: Sweeteners Market Size, By Country, 2014–2021 (USD Million)

Table 68 RoW: Ethanol Market Size, By Country, 2014–2021 (USD Million)

Table 69 RoW: Gluten Feed & Gluten Meal Market Size, By Country, 2014–2021 (USD Million)

Table 70 RoW: Other Co-Products Market Size, By Country, 2014–2021 (USD Million)

Table 71 RoW: Corn Wet-Milling Market Size, By Application, 2014–2021 (USD Million)

Table 72 Latin America: Market Size for Corn Wet-Milling, By End Product, 2014–2021 (USD Million)

Table 73 Latin America: Market Size, By Application, 2014–2021 (USD Million)

Table 74 Middle East: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 75 Middle East: Market Size, By Application, 2014–2021 (USD Million)

Table 76 Africa: Corn Wet-Milling Market Size, By End Product, 2014–2021 (USD Million)

Table 77 Africa: Market Size, By Application, 2014–2021 (USD Million)

Table 78 Expansions, 2011-2016 (Till July)

Table 79 Agreements & Joint Ventures, 2011-2016 (Till July)

Table 80 Acquisitions, 2011-2016 (Till July)

Table 81 New Product Launches, 2011-2016 (Till July)

Table 82 Expansion (March 2011-2016 (Till July))

Table 83 Agreements & Joint Ventures (March 2011-2016 (Till July))

Table 84 Acquisitions (March 2011-2016 (Till July))

Table 85 New Product Launches (March 2011-2016 (Till July))

List of Figures (57 Figures)

Figure 1 Market Segmentation

Figure 2 Market Segmentation, By Equipment

Figure 3 Corn Wet-Milling: Research Design

Figure 4 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 5 Global Ethanol Production, By Country, 2011-2015

Figure 6 Global Corn Production, By Country, 2014-2016 (Million Tons)

Figure 7 Global Corn Production Projected Annual Growth Rate, By Country, 2016-2017

Figure 8 Global Corn Prices (USD/Mt), 2011-2017

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Market Size Estimation Methodology: Top-Down Approach

Figure 11 Data Triangulation Methodology

Figure 12 Corn Wet-Milling Market By Application, 2016 vs 2021

Figure 13 North America is Projected to Be the Fastest-Growing Region for the Corn Wet-Milling Market From 2016 to 2021

Figure 14 Sweeteners Segment is Projected to Be the Fastest-Growing End-Product of Corn Wet-Milling (2016 to 2021)

Figure 15 Key Players Adopted Expansions Was the Key Strategy From 2011 to 2015

Figure 16 Emerging Economies Offer Attractive Opportunities in this Market

Figure 17 Sweeteners to Account for the Largest Share During the Review Period

Figure 18 U.S. Was the Largest Market for Corn Wet-Milling in 2015

Figure 19 U.S. is Projected to Be the Fastest-Growing Country-Level Market for Corn Wet-Milling From 2016 to 2021

Figure 20 The Corn Wet-Milling Market in Asia-Pacific is Expected to Experience Steady Growth

Figure 21 Market Segmentation, By Source

Figure 22 Market Segmentation, By Application.

Figure 23 Market Segmentation, By End Product

Figure 24 Market Segmentation, By Equipment

Figure 25 Market Segmentation, By Region

Figure 26 Corn Wet Milling: Drivers, Restraints, Opportunities and Challenges

Figure 27 Global High Fructose Corn Syrup Market, 2005–2015

Figure 28 Global Market: Value Chain Analysis

Figure 29 Global Corn Price Trend Analysis, 2011–2015 (USD/Kg)

Figure 30 Global Corn Trade Analysis, Imports vs Exports, By Country, 2015

Figure 31 U.S. High Fructose Corn Syrup Exports, By Destination (Mt)

Figure 32 U.S.: High Fructose Corn Syrup Exports Share (Volume), By Destination, 2014 vs 2015

Figure 33 U.S.: Ethanol Exports vs Imports, 2011-2015 (Million Gallons)

Figure 34 Corn Wet-Milling Market Size, By End Product, 2016 vs 2021 (USD Million)

Figure 35 Market Size, By Application, 2014 vs 2021 (USD Million)

Figure 36 Geographic Snapshot (2016-2021): U.S. is Projected to Be the Fastest-Growing Market

Figure 37 North American Corn Wet-Milling Market Snapshot

Figure 38 Europe: Corn Wet-Milling Market

Figure 39 Asia-Pacific Corn Wet-Milling Market: China & India to Drive Regional Market Growth

Figure 40 Expansions Was the Most Preferred Strategy By Key Corn Wet-Milling Companies, 2011–July 2016

Figure 41 Expansions Fueled Growth,2011–July 2016

Figure 42 Expansions: the Key Strategy, 2011–July 2016

Figure 43 Annual Developments in the Corn Wet-Milling Market, 2011-2016 (Till July)

Figure 44 Geographical Revenue Mix of Top Five Players

Figure 45 Tate & Lyle: Company Snapshot

Figure 46 ADM: Company Snapshot

Figure 47 ADM: SWOT Analysis

Figure 48 Cargill: Company Snapshot

Figure 49 Cargill: SWOT Analysis

Figure 50 Ingredion Incorporated: Company Snapshot

Figure 51 Ingredion: SWOT Analysis

Figure 52 Agrana: Company Snapshot

Figure 53 Agrana: SWOT Analysis

Figure 54 Bunge: Company Snapshot

Figure 55 Global Bio-Chem Technology Group Company Limited : Company Snapshot

Figure 56 China Agri-Industries Holdings Limited : Company Snapshot

Figure 57 Roquette : Company Snapshot

Growth opportunities and latent adjacency in Corn Wet-Milling Market