Glufosinate Market by Crop Type (Genetically Modified Crops, Conventional Crops), Form (Liquid Formulation, Dry Formulation), Application (Agricultural, Non Agricultural), and Region - Global Forecast to 2022

[129 Pages Report] The global glufosinate market is projected to grow at a CAGR of 9.25% to reach USD 2.34 Billion by 2022 in terms of value. The objective of this study is to define, segment, and project the size of the glufosinate market on the basis of crop type, form, application, and region, and to provide detailed information about the crucial factors influencing market dynamics (drivers, restraints, opportunities, and industry-specific challenges). The market opportunities and competitive landscape of market leaders are also studied for the stakeholders. Competitive developments such as new product launches, expansions, and investments are also included.

The years considered for the study are as follows:

- Base year: 2015

- Estimated year: 2016

- Projected year: 2022

- Forecast period: 2016 to 2022

Research Methodology

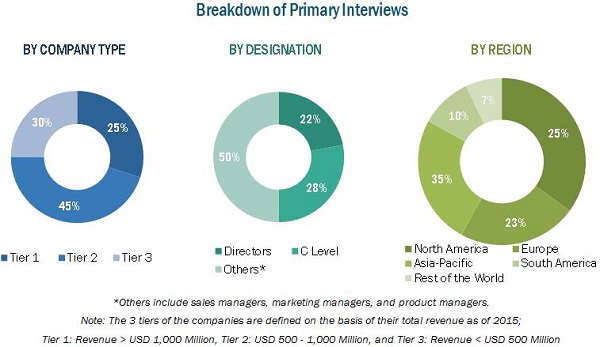

This report includes estimations of market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the glufosinate market and of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources, such as reports published the Organization for Economic Co-operation and Development's (OECD), National Pesticide Association, Food and Agriculture Organization (FAO), U.S. Environmental Protection Association (EPA), and Department of Environment, Food and Rural Affairs (DEFRA), and have been verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The various contributors involved in the value chain of the glufosinate market include pesticide manufacturers, importers & exporters, traders, distributors, suppliers, and consumers which include farmers. The value chain comprises key manufacturers in the glufosinate market, such as Bayer AG (Germany), The Dow Chemical Company (U.S.), E. I. du Pont de Nemours and Company (U.S.), Syngenta AG (Switzerland), and UPL (India), which have diversified product portfolios, proprietary technologies, and strong distribution networks and offices at strategic locations across the globe. These companies focus on innovation and enhancing the functional and physiological properties of glufosinate products and cater to the growing demand in the glufosinate industry. Other players in this market are Nufarm Ltd (Australia), Jiangsu Huangma Agrochemicals Co, Ltd. (China), Jiangsu Sevencontinent Green Chemical Co., Ltd. (China), Hebei Veyong Bio-Chemical Co., Ltd. (China), and Zhejiang Yongnong Chem. Ind. Co. Ltd. (China), which also have a strong presence in the market. Glufosinate production has increased in recent years in China for catering to the growing demand across globe.

Target Audience:

- Pesticide manufacturers

- Pesticide importers and exporters

- Pesticide traders, distributors, and suppliers

- Consumers (including farmers)

- Government and research organizations

- Legislative and regulatory bodies

- Associations and industry bodies

Scope of the report

Based on Crop Type, the market has been segmented as follows:

- By crop type

- Genetically modified crops

- Conventional crops

Based on Application, the market has been segmented as follows:

- Agricultural

- Grains & cereals

- Oilseeds & pulses

- Fruits & vegetables

- Others (sugarcane, plantation crops, and pastures)

- Non-agricultural

Based on Form, the market has been segmented as follows:

- Liquid

- Dry

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- South America

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific glufosinate market into Malaysia, Thailand, and Vietnam

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The glufosinate market is estimated to be valued at USD 1.37 Billion in 2016, and is projected to grow at a CAGR of 9.25% from 2016 to 2022. Glufosinate finds wide applications in agricultural and non-agricultural sectors. Factors such as its broad weed spectrum and high efficacy has fueled the growth of this market.

On the basis of crop type, the global market is segmented into genetically modified crops and conventional crops. The genetically modified crops dominated the market owing to its major use in the production of various products and wider availability. Genetic modified techniques are widely used to make crops herbicide-resistant.

The global glufosinate market, on the basis of application, is segmented into agricultural and non-agricultural applications. The demand for glufosinate is expected to increase in the next few years due to the growing yield of agricultural crops such as corn, soybean, beans, canola, sugar beets, sugar cane, and sweet potato that are genetically modified to tolerate glufosinate. The grains & cereals segment accounted for the largest market share in 2015.

The forms of glufosinate considered for the study are liquid and dry. Liquid formulation of glufosinate is widely used as it has low temperature stability as compared to dry formulations, which has a long process of usage.

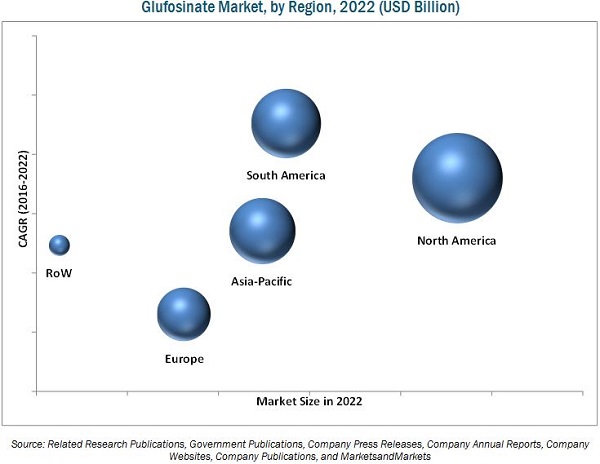

The North American region dominated the market and accounted for the largest share, in terms of both value and volume, in the global glufosinate market, in 2015. The North American market is projected to grow at a CAGR of 9.60% from 2016 to 2022. Factors such as increasing acreage under glufosinate-tolerance crops, and resistance development to glyphosate herbicide products in countries of the North American region are driving the growth of the glufosinate market.

In Europe, glufosinate ammonium is considered as a highly toxic product, thus the European Union has considered banning it from October 2017. The present EU registration for glufosinate ammonium is valid until 31 July 2018. The European Commission, under Regulation 1107/2009 suggested that glufosinate ammonium should be substituted in January 2015. Hence, products that contain glufosinate ammonium are to mandatorily go through comparative assessment by Member States.

The leading players that dominated the glufosinate market include Bayer AG (Germany), The Dow Chemical Company (U.S.), E. I. du Pont de Nemours and Company (U.S.), Syngenta AG (Switzerland), and UPL (India). Other players include Nufarm Ltd (Australia), Jiangsu Huangma Agrochemicals Co, Ltd. (China), Jiangsu Sevencontinent Green Chemical Co., Ltd. (China), Hebei Veyong Bio-Chemical Co., Ltd. (China), and Zhejiang Yongnong Chem. Ind. Co. Ltd. (China). Key players have adopted strategic developments such as new product launches, acquisitions, joint ventures, expansions, collaborations & partnerships, and agreements & investments in order to capture this emerging market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities for Glufosinate Producers and Processors

4.2 Glufosinate Market, By Region

4.3 North America: Largest Glufosinate Market

4.4 Market: By Type

4.5 Market, By Form

4.6 Market, By Application

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.2.3 By Form

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Steady Expansion of Use of Herbicide-Tolerant Crops

5.3.1.2 The Rise in Demand for Glufosinate as A Substitute for Glyphosate and Paraquat

5.3.1.3 Herbicide Contribution in Securing Food Bowl

5.3.2 Restraints

5.3.2.1 Toxic Effects of Glufosinate

5.3.2.2 Banned in European Market

5.3.3 Opportunities

5.3.3.1 Herbicide-Tolerant Gm Crop Acceptance and Approval Trend

5.3.3.2 Rapid Growth in the Glufosinate Market

5.3.4 Challenges

5.3.4.1 Stringent Regulations

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.3.1.1 Regulatory Bodies

6.3.1.2 Prominent Companies

6.3.1.3 Small and Medium Enterprises

6.3.1.4 End Users

6.4 Patent Analysis for Glufosinate Products

7 Glufosinate Market, By Crop Type (Page No. - 44)

7.1 Introduction

7.2 Genetically Modified Crops

7.3 Conventional Crops

8 Glufosinate Market, By Form (Page No. - 50)

8.1 Introduction

8.2 Liquid

8.3 Dry

9 Global Glufosinate Market, By Application (Page No. - 54)

9.1 Introduction

9.2 Agricultural

9.2.1 Grains & Cereals

9.2.2 Oilseeds & Pulses

9.2.3 Fruits & Vegetables

9.2.4 Others

9.3 Non-Agricultural

10 Glufosinate Market, By Region (Page No. - 63)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 France

10.3.2 Germany

10.3.3 Spain

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Australia

10.4.3 Malaysia

10.4.4 Japan

10.4.5 India

10.4.6 Rest of Asia-Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 RoW

10.6.1 Africa

10.6.2 Middle East

11 Competitive Landscape (Page No. - 94)

11.1 Overview

11.2 Ranking Analysis

11.3 New Product Launches

11.4 Expansion

11.5 Investments

12 Company Profiles (Page No. - 97)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Introduction

12.2 E.I. Du Pont De Nemours and Company

12.3 The DOW Chemical Company

12.4 Syngenta AG

12.5 UPL

12.6 Bayer AG

12.7 Nufarm Limited

12.8 Jiangsu Huangma Agrochemicals Co.,Ltd.

12.9 Zhejiang Yongnong Chem. Ind. Co., Ltd

12.10 Jiangsu Sevencontinent Green Chemical Co., Ltd.

12.11 Veyong (Hebei Veyong Bio-Chemical Co. Ltd)

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 120)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Company Developments

13.3.1 New Product Launches

13.3.2 Expansions

13.3.3 Investments

13.4 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Introducing RT: Real-Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

13.8 Author Details

List of Tables (67 Tables)

Table 1 Patents for Glufosinate Products

Table 2 Glufosinate Market Size, By Crop Type, 20142022 (USD Million)

Table 3 Market Size, By Crop Type, 20142022 (KT)

Table 4 Genetically Modified Crops Market Size, By Region, 20142022 (USD Million)

Table 5 Genetically Modified Crops Market Size, By Region, 20142022 (KT)

Table 6 Conventional Crops Market Size, By Region, 20142022 (USD Million)

Table 7 Conventional Crop Market Size, By Region, 20142022 (KT)

Table 8 Glufosinate Market Size By Form, 2014-2022 (USD Million)

Table 9 Liquid Glufosinate Market Size , By Region, 2014-2022 (USD Million)

Table 10 Dry Glufosinate Market Size, By Region, 2014-2022 (USD Million)

Table 11 Global Glufosinate Market Size By Application, 20142022 (USD Million)

Table 12 Glufosinate Market Size, By Application, 20142022 (KT)

Table 13 Agricultural Gluofosinate Market Size, By Region, 2014-2022 (USD Million)

Table 14 Glufosinate Market Size in Agricultural Applications, By Region, 20142022 (KT)

Table 15 Glufosinate Market Size for Grains & Cereals, By Region, 2014-2022 (USD Million)

Table 16 Market Size for Oilseeds & Pulses, By Region, 2014-2022 (USD Million)

Table 17 Glufosinate Market Size for Fruits & Vegetables, By Region, 2014-2022 (USD Million)

Table 18 Gufosinate Market Size for Other Crops, By Region, 2014-2022 (USD Million)

Table 19 Glufosinate Market Size in Non-Agricultural Applications, By Region, 20142022 (USD Million)

Table 20 Market Size in Non-Agricultural Applications, By Region, 20142022 (KT)

Table 21 Glufosinate Market Size, By Region, 20142022 (USD Million)

Table 22 Market Size, By Region, 20142022 (KT)

Table 23 North America: Glufosinate Market Size, By Country, 20142022 (USD Million)

Table 24 North America: Market Size, By Country, 20142022 (KT)

Table 25 North America: Market Size By Crop Type, 20142022 (USD Million)

Table 26 North America: Market Size, By Crop Type, 20142022 (KT)

Table 27 North America: Market Size, By Form, 20142022 (USD Million)

Table 28 North America: Market Size, By Application, 20142022 (USD Million)

Table 29 U.S.: Market Size, By Application, 20142022 (USD Million)

Table 30 Canada: Market Size, By Application, 20142022 (USD Million)

Table 31 Mexico: Market Size, By Application, 20142022 (USD Million)

Table 32 Europe: Glufosinate Market Size, By Country, 20142022 (USD Million)

Table 33 Europe: Market Size, By Country, 20142022 (KT)

Table 34 Europe: Market Size, By Crop Type, 2014-2022 (USD Million)

Table 35 Europe: Market Size, By Crop Type, 2014-2022 (KT)

Table 36 Europe: Market Size, By Form, 2014-2022 (USD Million)

Table 37 Europe: Market Size, By Application, 2014-2022 (USD Million)

Table 38 France: Market Size, By Application, 20142022 (USD Million)

Table 39 Germany: Market Size, By Application, 20142022 (USD Million)

Table 40 Spain: Market Size, By Application, 20142022 (USD Million)

Table 41 Italy: Market Size, By Application, 20142022 (USD Million)

Table 42 Rest of Europe: Glufosinate Market Size, By Application, 20142022 (USD Million)

Table 43 Asia-Pacific: Glufosinate Market Size, By Country, 20142022 (USD Million)

Table 44 Asia-Pacific: Market Size, By Country, 20142022 (KT)

Table 45 Asia-Pacific: Market Size, By Crop Type, 20142022 (USD Million)

Table 46 Asia-Pacific: Market Size, By Form, 20142022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Application, 20142022 (USD Million)

Table 48 China: Glufosinate Market Size, By Application, 20142022 (USD Million)

Table 49 Australia: Market Size, By Application, 20142022 (USD Million)

Table 50 Malaysia: Market Size, By Application, 20142022 (USD Million)

Table 51 Japan: Market Size, By Application, 20142022 (USD Million)

Table 52 India: Market Size, By Application, 20142022 (USD Million)

Table 53 Rest of Asia-Pacific: Glufosinate Market Size, By Application, 20142022 (USD Million)

Table 54 South America: Glufosinate Market Size, By Country, 20142022 (USD Million)

Table 55 South America: Market Size, By Crop Type, 20142022 (USD Million)

Table 56 South America: Market Size, By Crop Type, 20142022 (KT)

Table 57 South America: Market Size, By Form, 20142022 (USD Million)

Table 58 South America: Market Size, By Application, 20142022 (USD Million)

Table 59 Brazil: Glufosinate Market Size, By Application, 20142022 (USD Million)

Table 60 Argentina: Market Size, By Application, 20142022 (USD Million)

Table 61 Rest of South America: Market Size, By Application, 20142022 (USD Million)

Table 62 RoW: Glufosinate Market Size, By Region, 20142022 (USD Million)

Table 63 Africa: Market Size, By Application, 20142022 (USD Million)

Table 64 Middle East: Market Size, By Application, 20142022 (USD Million)

Table 65 New Product Launches, 20122016

Table 66 Expansion, 2015

Table 67 Investments, 2013

List of Figures (45 Figures)

Figure 1 Glufosinate Market Segmentation

Figure 2 Research Design: Glufosinate Market

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Study

Figure 7 Limitations of the Study

Figure 8 Glufosinate Market Snapshot, 2016 vs 2022

Figure 9 Grains & Cereals: Most Attractive Agricultural Application for Investment in Next Five Years

Figure 10 North America Projected to Register High Growth Rate, 20162022

Figure 11 Attractive Growth Opportunities in the Glufosinate Market for Manufacturers

Figure 12 South American Glufosinate Market Projected to Grow at the Highest Rate From 2016 to 2022 (KT)

Figure 13 Grains & Cereals Segment Estimated to Account for the Largest Share in the North American Glufosinate Market, 2016

Figure 14 Genetically Modified Crops Accounted for the Largest Share in the Glufosinate Market Throughout the Forecast Period

Figure 15 Liquid Form is Expected to Dominate the Glufosinate Market Throughout the Forecast Period

Figure 16 Agricultural Application Estimated to Dominate the Glufosinate Market Across All Regions in 2016 (KT)

Figure 17 Glufosinate Market Segmentation, By Type

Figure 18 Market Segmentation, By Application

Figure 19 Market Segmentation, By Form

Figure 20 Market Segmentation, By Region

Figure 21 Sturdy Expansion of Herbicide Tolerant Crops Will Spur the Demand for Glufosinate

Figure 22 Value Chain Analysis

Figure 23 Supply Chain Analysis

Figure 24 Glufosinate Market, By Crop Type

Figure 25 Genetically Modified Crops Segment is Projected to Dominate the Glufosinate Market Through 2022

Figure 26 Glufosinate Market Size, By Form, 2016 & 2022 (USD Million)

Figure 27 Glufosinate Market, By Application

Figure 28 Agricultural Applications to Dominate the Glufosinate Market (USD Million) Through Forecast Period

Figure 29 Market in South America Expected to Grow Strongly By 2022

Figure 30 North American Glufosinate Market Snapshot

Figure 31 European Market Snapshot

Figure 32 Asia-Pacific: Glufosinate Market Snapshot

Figure 33 Ranking Analysis of Top 5 Market Players

Figure 34 Geographical Revenue Mix of Top 5 Market Players

Figure 35 E.I. Du Pont De Nemours and Company: Company Snapshot

Figure 36 E.I. Du Pont De Nemours and Company : SWOT Analysis

Figure 37 The DOW Chemicals Company: Company Snapshot

Figure 38 The DOW Chemicals Company: SWOT Analysis

Figure 39 Syngenta AG: Company Snapshot

Figure 40 Syngenta AG: SWOT Analysis

Figure 41 UPL: Company Snapshot

Figure 42 UPL: SWOT Analysis

Figure 43 Bayer AG: Company Snapshot

Figure 44 Bayer AG: SWOT Analysis

Figure 45 Nufarm Limited: Company Snapshot

Growth opportunities and latent adjacency in Glufosinate Market