Geospatial Solutions Market by Technology (Earth Observation, Scanning), Solution (Hardware, Software, Service), End-User (Utility, Business, Transportation, Defense & Intelligence, Infrastructural Development), Application, Region Global Forecast to 2024

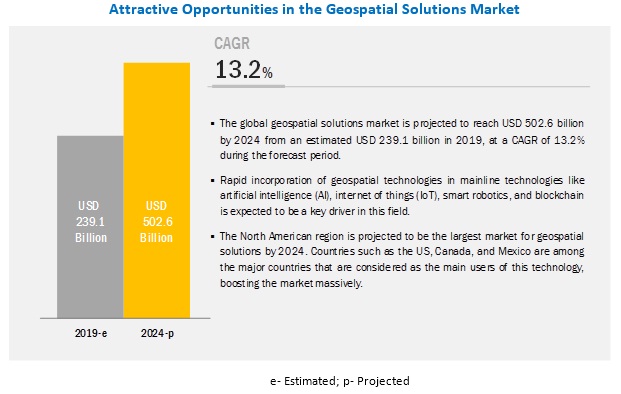

[182 Pages Report] The global geospatial solutions market is projected to reach USD 502.6 billion by 2024 from an estimated USD 239.1 billion in 2019, at a CAGR of 13.2% during the forecast period. Development of the Geographic Information System (GIS) industry is due to the incorporation of new and upcoming technologies like 3D, Augmented Reality (AR), and Virtual Reality (VR) in GIS systems. Artificial Intelligence (AI), automation, cloud, Internet of Things (IoT), and miniaturization of sensors are expected to be the catalysts driving the development..

The earth observation segment is expected to be the largest contributor to the geospatial solution market, by technology, during the forecast period

The geospatial solutions market is segmented, by technology, into geospatial analytics, GNSS & positioning, scanning, and earth observation. The earth observation segment is projected to hold the largest market share by 2024. Earth observation satellites observe the planet for changes in everything, from temperature to forestation to ice sheet coverage. This is possible through satellite imagery, Light Detection and Ranging (LiDAR), and other related technologies. With the growth of these technologies, this particular segment market is also expected to grow.

The software segment is expected to be the fastest growing market during the forecast period

The geospatial solutions market, by solution type, is segmented into hardware, software, and service. The software segment brings the majority of revenues and therefore has a higher share of the geospatial technologies and solutions sector. Geospatial-specific software form a platform, which acts as a user interface on which the various geospatial data is executed and analysis is performed.

North America is expected to be the largest market during the forecast period

In this report, the geospatial solutions market has been analyzed with respect to 5 regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East & Africa. Asia Pacific is estimated to be the largest market from 2019 to 2024. Increasing integration of geospatial technologies into mainline technologies is likely to be a key component driving the market in North America. The developed economies are expected to give more thrust to the geospatial solution market. Globally, the implementation of geospatial technologies has seen a gradual increase over the past few years. This, along with the easy availability of geospatial technology in evolved countries such as the US and Canada, will surely positively boost the market in the region.

Key Market Players

The major players in the global geospatial solutions market are HERE Technologies (the Netherlands), Esri (US), Hexagon (Sweden), Atkins Plc (UK), Pitney Bowes (US), Topcon (Japan), DigitalGlobe Inc (Maxar Group) (US), General Electric (US), Harris Corporation (US), Google (US), Bentley (UK), Geospatial Corporation (US), Baidu (China), Telenav (US), TomTom International B.V. (the Netherlands), Apple (US), Oracle (US), Microsoft (US), Amazon (US), IBM (US), SAP (US), China Geo-Engineering Corporation (CGC) (China), RMSI (India), and Orbital Insights (US).

Trimble (US) is a key player in this segment. Its geospatial business segments offer GIS and surveying and geospatial solutions. Its surveying and geospatial portfolio includes solutions such as mapping, 2D or 3D modeling, measurement, reporting, analysis, and land management through field-based technologies for construction, engineering, mining, oil & gas, energy & utilities, and government. Its field-based technologies include handheld mobile, airborne applications, and other technologies such as mobile application software, high-precision GNSS, robotic measurement systems, inertial positioning, 3D laser scanning, digital imaging, optical or laser measurement, and unmanned aerial vehicles. Currently, the company is focusing on organic growth strategies. In 2018, the companys overall revenue increased by USD 461.9 million due to its organic growth across all segments. Its geospatial segment revenue was increased by USD 64.6 million for 201819. The revenue increase was primarily due to organic growth for optical and GNSS survey products, across most major regions, namely, North America and Europe.

Another major player in the segment is the Environmental Systems Research Institute (Esri). The company is a global market solution provider of GIS, mapping, and spatial analytics software to various industries such as commercial, government, manufacturing, and utilities. The company offers various products such as ArcGIS, ArcGIS Pro, ArcGIS Enterprise for location intelligence, and cloud-based ArcGIS Online. Under this product portfolio, the company offers geospatial and GIS solutions. Esri focuses on its R&D capabilities to gain a competitive advantage over its peers. The company is also focusing on inorganic strategies such as collaborations, mergers & acquisitions, and contracts & agreements. For instance, in February 2018, Esri acquired ClearTerra (US) to provide ArcGIS platform users the ability to easily discover and extract geographic coordinates from unstructured textual data such as emails, briefings, and reports, instantly generating intelligent map-based information. The Port Authority of Rotterdam uses ArcGIS to keep operations running smoothly and efficiently.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Technology, Solution, End-User, Application, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies covered |

HERE Technologies (the Netherlands), Esri (US), Hexagon (Sweden), Atkins PLC (UK), Pitney Bowes (US), Topcon (Japan), DigitalGlobe Inc (Maxar Group) (US), General Electric (US), Harris Corporation (US), Google (US), Bentley (UK), Geospatial Corporation (US), Baidu (China), Telenav (US), TomTom International B.V. (the Netherlands), Apple (US), Oracle (US), Microsoft (US), Amazon (US), IBM (US), SAP (US), China Geo-Engineering Corporation (CGC) (China), RMSI (India), and Orbital Insights (US) |

This research report categorizes the market by technology, solution, end-user, application, and region.

The geospatial solutions market, by technology, has been segmented as follows:

- Geospatial Analytics

- GNSS & Positioning

- Scanning

- Earth Observation

The geospatial solutions market, by solution type, has been segmented as follows:

- Hardware

- Software

- Service

The geospatial solutions market, by end-user, has been segmented as follows:

- Utility

- Business

- Transportation

- Defence & Intelligence

- Infrastructural Development

- Natural Resource

- Others

The geospatial solutions market, by application, has been segmented as follows:

- Surveying & Mapping

- Geovisualization

- Asset Management

- Planning & Analysis

- Others

The geospatial solutions market, by region, has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In April 2019, HERE launched Here XYZ for mapmaking and geospatial data management for developers and non-coders. It also launched a new cloud service for fast and flexible management of location data. HERE XYZ aims to maximize ease of use, flexibility, and interoperability by leveraging the best of the open-source ecosystem and tools from the companys long history of building standard and high-definition maps at a global scale.

Key Questions Addressed by the Report

- What are the revolutionary technology trends that will be seen over the next 5 years?

- Which of the geospatial solutions market elements will lead by 2024?

- Which of the application segments will have the maximum opportunity to grow during the forecast period?

- Which will be the leading region within the highest market share by 2024?

- How are companies introducing their geospatial solutions in different applications?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Scope

2.2 Market Size Estimation

2.2.1 Demand-Side Analysis

2.2.1.1 Calculation

2.2.1.2 Assumptions

2.2.2 Supply-Side Analysis

2.2.2.1 Assumptions

2.2.2.2 Calculation

2.2.3 Forecast

2.3 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Geospatial Solutions Market

4.2 Geospatial Solution Market, By Technology

4.3 Geospatial Solution Market, By Solution Type

4.4 Geospatial Solution Market, By Application

4.5 Geospatial Solution Market, By End-User

4.6 Geospatial Solution Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Integration of Geospatial Technology With Mainstream Technologies

5.2.1.2 Advancements in Geospatial Technologies With the Introduction of Ai and Big Data Analytics

5.2.1.3 Increasing Use of Lbs

5.2.1.4 Digital Revolution Such as Ai, Automation, Cloud, Iot, and Miniaturization of Sensors are Adding to the Momentum of the Geospatial Industry

5.2.2 Restraints

5.2.2.1 Regulations and Legal Issues

5.2.2.2 Limited Availability of Skilled Staff

5.2.3 Opportunities

5.2.3.1 Development of 4D Gis Software

5.2.3.2 Development of the Gis Industry Using New and Upcoming Technologies Such as 3D, AR, and VR

5.2.4 Challenges

5.2.4.1 Complexities Involved in the Integration of Geospatial Data With Enterprise Solutions

6 Geospatial Solutions Market, By Technology (Page No. - 42)

6.1 Introduction

6.2 Geospatial Analytics

6.2.1 Geospatial Analytics Segment is Driven By Cloud Solutions as It has Emerged as an Analytical Platform

6.3 Gnss & Positioning

6.3.1 Growing Demand for Location-Based Information is Expected to Drive Gnss & Positioning Segment

6.4 Scanning

6.4.1 Increasing Demand for Lidar & Laser Scanning is Expected to Drive the Scanning Segment During the Forecast Period

6.5 Earth Observation

6.5.1 Ai & Big Data are Expected to Drive the Earth Observation Segment During the Forecast Period

7 Geospatial Solutions Market, By Solution Type (Page No. - 47)

7.1 Introduction

7.2 Hardware

7.2.1 Geospatial Analytics Segment is Driven By Cloud Solutions as It has Emerged as an Analytical Platform

7.3 Software

7.3.1 Integration of Technologies Such as Ai and Cloud Solutions is Expected to Drive the Software Segment During the Forecast Period

7.4 Service

7.4.1 Increasing Demand for Analytical & Consulting Service is Expected to Drive the Service Segment During the Forecast Period

8 Geospatial Solutions Market, By Application (Page No. - 52)

8.1 Introduction

8.2 Surveying & Mapping

8.2.1 Increasing Use of Technologies Such as Lidar and Remote Sensing for Data Capturing is Expected to Drive the Surveying & Mapping Solution Market During the Forecast Period

8.3 Geovisualization

8.3.1 Increasing Demand for Geovisualization Applications in North America is Expected to Drive the Segment During Forecast Period

8.4 Asset Management

8.4.1 Increasing Need to Enhance Operational Performance is Expected to Drive the Asset Management Segment During the Forecast Period

8.5 Planning & Analysis

8.5.1 Telecom, Urban Planning, Transportation Planning, Environmental Planning, and Land Use Planning are Major Sectors Driving the Segment During the Forecast Period

8.6 Others

9 Geospatial Solutions Market, By End-User (Page No. - 58)

9.1 Introduction

9.2 Utility

9.2.1 Increasing Demand for Geospatial Solutions for Asset Management, Environmental Monitoring, Disaster Management, and Grid Management is Expected to Drive the Utility Segment During the Forecast Period

9.3 Business

9.3.1 North America is Expected to Dominate the Business Segment During Forecast Period

9.4 Transportation

9.4.1 Increasing Need to Manage Transportation Infrastructure is Expected to Drive the Segment During the Forecast Period

9.5 Defense & Intelligence

9.5.1 Increasing Adoption of Technologies Such as Iot & Remote Sensing is Expected to Drive the Defense & Intelligence Segment During the Forecast Period

9.6 Infrastructural Development

9.6.1 Applications Such as Urban Development and Infrastructure Planning are Expected to Drive the Segment During the Forecast Period

9.7 Natural Resource

9.7.1 Increasing Need to Efficiently Use Natural Resources is Expected to Drive the Segment During the Forecast Period

9.8 Others

10 Geospatial Solutions Market, By Region (Page No. - 66)

10.1 Introduction

10.2 North America

10.2.1 By Technology

10.2.2 By Solution Type

10.2.3 By End-User

10.2.4 By Application

10.2.5 By Country

10.2.5.1 US

10.2.5.1.1 The US has A Rich Heritage of Having the Largest-Scale Thematic Layers Such as Cadastral, Topography, Utility Network, and Transport Network73

10.2.5.2 Canada

10.2.5.2.1 The Maritime and Ports Authority of Singapore Launched Several Iot and Connectivity-Based Applications

10.2.5.3 Mexico

10.2.5.3.1 Slowly and Steadily Mexico is Developing the Infrastructure and the Expertise to Adopt Geospatial Technologies

10.3 Europe

10.3.1 By Technology

10.3.2 By Solution Type

10.3.3 By End-User

10.3.4 By Application

10.3.5 By Country

10.3.5.1 Germany

10.3.5.1.1 The Country is Expected to Conduct Numerous Projects on Lidar

10.3.5.2 UK

10.3.5.2.1 The Nation is Working Rigorously on Commercializing Geospatial Technologies

10.3.5.3 Italy

10.3.5.3.1 Major Developments in the Form of Mergers & Acquisitions are Expected to Drive the Geospatial Solution Market in the Region Significantly

10.3.5.4 France

10.3.5.4.1 Major Developments in the Form of Mergers & Acquisitions are Expected to Drive the Geospatial Solution Market in the Region Significantly

10.3.5.5 Rest of Europe

10.4 Asia Pacific

10.4.1 By Technology

10.4.2 By Solution Type

10.4.3 By End-User

10.4.4 By Application

10.4.5 By Country

10.4.5.1 China

10.4.5.1.1 Major Investments are Expected to Revamp Infrastructure and Build Data-Driven Solutions

10.4.5.2 Japan

10.4.5.2.1 The Government is Strongly Supporting the Development of Uav and Its Implementation in Geospatial Technologies

10.4.5.3 India

10.4.5.3.1 The Nation is Implementing Geospatial Technologies Massively to Reach the 100 Smart Cities Program

10.4.5.4 South Korea

10.4.5.4.1 The Country is Readily Implementing Geospatial Technologies in Improving Its Renewable Energy Generation

10.4.5.5 Rest of Asia Pacific

10.5 South America

10.5.1 By Technology

10.5.2 By Solution Type

10.5.3 By End-User

10.5.4 By Application

10.5.5 By Country

10.5.5.1 Brazil

10.5.5.1.1 Brazil to Make Massive Investments in the Data Storage Front, Supporting the Geospatial Industry

10.5.5.2 Colombia

10.5.5.2.1 The Nation is Using these Technologies to Study the Unexplored Parts of the Colombian Amazon

10.5.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 By Technology

10.6.2 By Solution Type

10.6.3 By End-User

10.6.4 By Application

10.6.5 By Country

10.6.5.1 UAE

10.6.5.1.1 The UAE is Taking Gigantic Leaps in Implementing Geospatial Technologies

10.6.5.2 Saudi Arabia

10.6.5.2.1 National Savings Would Be Key to Drive The Geospatial Market Forward

10.6.5.3 South Africa

10.6.5.3.1 Transnet to Take an Interest in The South African Geospatial Solutions Space

10.6.5.4 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 113)

11.1 Overview

11.2 Ranking of Players and Industry Concentration, 2018

11.2.1 Contracts & Agreements

11.2.2 New Product Launches

11.2.3 Mergers & Acquisitions

11.2.4 Partnerships & Collaborations

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Innovators

11.3.3 Dynamic Differentiators

11.3.4 Emerging Companies

12 Company Profiles (Page No. - 120)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1 Trimble

12.2 Esri

12.3 Here Technologies

12.4 Pitney Bowes

12.5 Hexagon Geospatial

12.6 Maxar Technologies

12.7 Bentley

12.8 Geospatial Corporation

12.9 Topcon Positioning Systems

12.10 Snc-Lavalin

12.11 GE

12.12 Google

12.13 Baidu

12.14 Telnav

12.15 Harris Corporation

12.16 Tomtom

12.17 Apple

12.18 Oracle

12.19 Microsoft

12.20 Amazon

12.21 IBM

12.22 SAP

12.23 RMSI

12.24 Orbital Insights

12.25 China Geo-Engineering Corporation

*Details on Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 174)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (92 tables)

Table 1 Investments in Geospatial Technologies Have Been Considered to Arrive at The Global Market Size

Table 2 Global Geospatial Solutions Market Snapshot

Table 3 General Standards Information (Agency, Federal, and International) Which Apply to Spatial Data Content Or Exchange

Table 4 Market Size, By Technology, 20172024 (USD Billion)

Table 5 Geospatial Analytics Market Size, By Region, 20172024 (USD Billion)

Table 6 Gnss & Positioning Market Size, By Region, 20172024 (USD Billion)

Table 7 Scanning Market Size, By Region, 20172024 (USD Billion)

Table 8 Earth Observation Market Size, By Region, 20172024 (USD Billion)

Table 9 Geospatial Solutions Market Size, By Solution Type, 20172024 (USD Billion)

Table 10 Hardware: Market Size, By Region,20172024 (USD Billion)

Table 11 Software: Market Size, By Region, 20172024 (USD Billion)

Table 12 Service: Market Size, By Region, 20172024 (USD Billion)

Table 13 Geospatial Solutions Market Size, By Application, 20172024 (USD Billion)

Table 14 Surveying & Mapping: Market Size, By Region, 20172024 (USD Billion)

Table 15 Geovisualization: Market Size, By Region, 20172024 (USD Billion)

Table 16 Asset Management: Market Size, By Region, 20172024 (USD Billion)

Table 17 Planning & Analysis: Market Size, By Region, 20172024 (USD Billion)

Table 18 Others: Market Size, By Region, 20172024 (USD Billion)

Table 19 Geospatial Solutions Market Size, By End-User, 20172024 (USD Billion)

Table 20 Utility: Market Size, By Region, 20172024 (USD Billion)

Table 21 Business: Market Size, By Region, 20172024 (USD Billion)

Table 22 Transportation: Market Size, By Region, 20172024 (USD Billion)

Table 23 Defense & Intelligence: Market Size, By Region, 20172024 (USD Billion)

Table 24 Infrastructural Development: Market Size,By Region, 20172024 (USD Billion)

Table 25 Natural Resource: Market Size, By Region, 20172024 (USD Billion)

Table 26 Others: Market Size, By Region,20172024 (USD Billion)

Table 27 Geospatial Solution Market Size, By Region, 20172024 (USD Billion)

Table 28 North America: Geospatial Solutions Market Size, By Technology, 20172024 (USD Billion)

Table 29 North America: Market Size, By Solution Type, 20172024 (USD Billion)

Table 30 North America: Market Size, By End-User, 20172024 (USD Billion)

Table 31 North America: Market Size, By Application, 20172024 (USD Billion)

Table 32 North America: Market Size, By Country, 20172024 (USD Billion)

Table 33 US: Market Size, By Solution Type,20172024 (USD Billion)

Table 34 US: Geospatial Solutions Market Size, By End-User,20172024 (USD Billion)

Table 35 Canada: Market Size, By Solution Type, 20172024 (USD Billion)

Table 36 Canada: Market Size, By End-User, 20172024 (USD Billion)

Table 37 Mexico: Market Size, By Solution Type, 20172024 (USD Billion)

Table 38 Mexico: Market Size, By End-User, 20172024 (USD Billion)

Table 39 Europe: Geospatial Solutions Market Size, By Technology, 20172024 (USD Billion)

Table 40 Europe: Market Size, By Solution Type, 20172024 (USD Billion)

Table 41 Europe: Market Size, By End-User, 20172024 (USD Billion)

Table 42 Europe: Market Size, By Application, 20172024 (USD Billion)

Table 43 Europe: Market Size, By Country, 20172024 (USD Billion)

Table 44 Germany: Market Size, By Solution Type, 20172024 (USD Billion)

Table 45 Germany: Market Size, By End-User, 20172024 (USD Billion)

Table 46 UK: Geospatial Solutions Market Size, By Solution Type, 20172024 (USD Billion)

Table 47 UK: Market Size, By End-User, 20172024 (USD Billion)

Table 48 Italy: Market Size, By Solution Type, 20172024 (USD Billion)

Table 49 Italy: Market Size, By End-User, 20172024 (USD Billion)

Table 50 France: Market Size, By Solution Type, 20172024 (USD Billion)

Table 51 France: Market Size, By End-User, 20172024 (USD Billion)

Table 52 Rest of Europe: Market Size, By Solution Type, 20172024 (USD Billion)

Table 53 Rest of Europe: Market Size, By End-User, 20172024 (USD Billion)

Table 54 Asia Pacific: Geospatial Solutions Market Size, By Technology, 20172024 (USD Billion)

Table 55 Asia Pacific: Market Size, By Solution Type, 20172024 (USD Billion)

Table 56 Asia Pacific: Market Size, By End-User, 20172024 (USD Billion)

Table 57 Asia Pacific: Market Size, By Application, 20172024 (USD Billion)

Table 58 Asia Pacific: Market Size, By Country, 20172024 (USD Billion)

Table 59 China: Market Size, By Solution Type, 20172024 (USD Billion)

Table 60 China: Market Size, By End-User, 20172024 (USD Billion)

Table 61 Japan: Geospatial Solutions Market Size, By Solution Type, 20172024 (USD Billion)

Table 62 Japan: Market Size, By End-User,20172024 (USD Billion)

Table 63 India: Market Size, By Solution Type, 20172024 (USD Billion)

Table 64 India: Market Size, By End-User, 20172024 (USD Billion)

Table 65 South Korea: Market Size, By Solution Type, 20172024 (USD Billion)

Table 66 South Korea: Market Size, By End-User, 20172024 (USD Billion)

Table 67 Rest of Asia Pacific: Market Size, By Solution Type, 20172024 (USD Billion)

Table 68 Rest of Asia Pacific: Market Size, By End-User, 20172024 (USD Billion)

Table 69 South America: Geospatial Solutions Market Size, By Technology, 20172024 (USD Billion)

Table 70 South America: Market Size, By Solution Type, 20172024 (USD Billion)

Table 71 South America: Market Size, By End-User, 20172024 (USD Billion)

Table 72 South America: Market Size, By Application,20172024 (USD Billion)

Table 73 South America: Market Size, By Country, 20172024 (USD Billion)

Table 74 Brazil: Geospatial Solutions Market Size, By Solution Type, 20172024 (USD Billion)

Table 75 Brazil: Market Size, By End-User, 20172024 (USD Billion)

Table 76 Colombia: Market Size, By Solution Type, 20172024 (USD Billion)

Table 77 Colombia: Market Size, By End-User, 20172024 (USD Billion)

Table 78 Rest of South America: Market Size, By Solution Type, 20172024 (USD Billion)

Table 79 Rest of South America: Market Size, By End-User, 20172024 (USD Billion)

Table 80 Middle East & Africa: Geospatial Solutions Market Size, By Technology, 20172024 (USD Billion)

Table 81 Middle East & Africa: Market Size, By Solution Type, 20172024 (USD Billion)

Table 82 Middle East & Africa: Market Size, By End-User, 20172024 (USD Billion)

Table 83 Middle East & Africa: Market Size, By Application, 20172024 (USD Billion)

Table 84 Middle East & Africa: Market Size, By Country, 20172024 (USD Billion)

Table 85 UAE: Market Size, By Solution Type, 20172024 (USD Billion)

Table 86 UAE: Geospatial Solutions Market Size, By End-User, 20172024 (USD Billion)

Table 87 Saudi Arabia: Market Size, By Solution Type, 20172024 (USD Billion)

Table 88 Saudi Arabia: Market Size, By End-User, 20172024 (USD Billion)

Table 89 South Africa: Market Size, By Solution Type, 20172024 (USD Billion)

Table 90 South Africa: Market Size, By End-User, 20172024 (USD Billion)

Table 91 Rest of the Middle East & Africa: Market Size, By Solution Type, 20172024 (USD Billion)

Table 92 Rest of the Middle East & Africa: Market Size, By End-User, 20172024 (USD Billion)

List of Figures (34 Figures)

Figure 1 Earth Observation Segment is Expected to Dominate the Geospatial Solutions Market, By Technology, From 2019 to 2024

Figure 2 Software Segment is Expected to Dominate the Geospatial Solutions Market, By Solution Type, From 2019 to 2024

Figure 3 Surveying & Mapping Segment is Expected to Dominate the Geospatial Solutions Market, By Application, From 2019 to 2024

Figure 4 Utility Segment is Expected to Dominate the Geospatial Solutions Market, By End-User, From 2019 to 2024

Figure 5 North America Held the Largest Share of the Geospatial Solutions Market in 2018

Figure 6 Digital Revolution Created From Ai, Automation, Cloud, Internet of Things (Iot), and Miniaturization of Sensors are Adding to the Momentum of the Geospatial Industry

Figure 7 Earth Observation Segment Dominated the Geospatial Solutions Market in 2018

Figure 8 Software Segment is Expected to Dominate the Geospatial Solutions Market During the Forecast Period

Figure 9 Surveying & Mapping Segment is Expected to Dominate the Geospatial Solutions Market During the Forecast Period

Figure 10 Utility Segment is Expected to Dominate the Geospatial Solutions Market During the Forecast Period

Figure 11 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Geospatial Solutions Market: Drivers, Restraints, Opportunities, and Challenges

Figure 13 Number of Lbs Users in the US From 2013 to 2018 (In Million)

Figure 14 Percentage Investment in Disruptive Technologies Globally

Figure 15 Geospatial Solutions Market, By Technology, 2018

Figure 16 Market, By Solution Type, 2019 & 2024

Figure 17 Market, By Application, 2018

Figure 18 Market, By End-User, 2018

Figure 19 Regional Snapshot: Asia Pacific Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Market Size, By Region, 20192024

Figure 21 Market Share (Value), By Region, 2018

Figure 22 North America: Regional Snapshot

Figure 23 Europe: Regional Snapshot

Figure 24 Asia Pacific: Regional Snapshot

Figure 25 Key Developments in the Geospatial Solutions Market, 20162019

Figure 26 Trimble and Hexagon Led the Geospatial Solutions Market in 2018

Figure 27 Market (Global) Competitive Leadership Mapping, 2018

Figure 28 Trimble: Company Snapshot

Figure 29 Pitney Bowes: Company Snapshot

Figure 30 Hexagon: Company Snapshot

Figure 31 Maxar Technologies: Company Snapshot

Figure 32 Snc-Lavalin: Company Snapshot

Figure 33 GE: Company Snapshot

Figure 34 Google: Company Snapshot

This study involved 4 major activities in estimating the current size of the geospatial solutions market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sour ces, directories, and databases such as UNCTAD data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and geospatial solutions journal to identify and collect information useful for a technical, market-oriented, and commercial study of the geospatial solutions market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

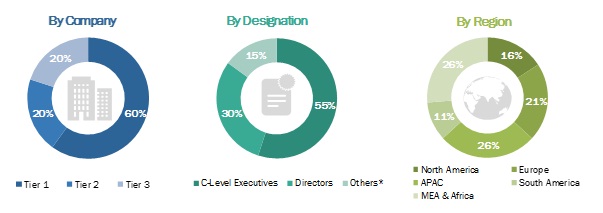

The geospatial solutions market comprise several stakeholders such as companies related to the industry, consulting companies in the geospatial technology infrastructure & sustainability sector, government & research organizations, investment banks, organizations, forums, alliances & associations, geospatial solution providers, digital automation players, geospatial software platform providers, state & national utility authorities, geospatial equipment manufacturers, dealers & suppliers, and vendors. The demand side of this market is characterized by its applications such as the Geographic Information System (GIS), Global Navigation Satellite System (GNSS), location intelligence, and their incorporation in mainline technologies like Internet of Things (IoT), digitalization, artificial intelligence, blockchain, and others. The supply side is characterized by advancements in geographic information systems, smart traffic management, Automated Information System (AIS), Real-Time Location System (RTLS), and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global geospatial solutions market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the geospatial solutions sector.

Report Objectives

- To define, describe, and forecast the global geospatial solutions market by technology, solution, end-user, application, and region

- To provide detailed information on the major factors influencing the growth of the geospatial solution market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the geospatial solution market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the geospatial solution market with respect to the major regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To track and analyze the competitive developments such as contracts & agreements, expansions, new product developments, mergers & acquisitions, and partnerships in the geospatial solution market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Geospatial Solutions Market