Geofoam Market by Type (Expanded Polystyrene (EPS) Geofoam, and Extruded Polystyrene (XPS) Geofoam), End-Use (Road & Highway Construction, Building & Infrastructure, Airport Runways & Taxiways), Application, Region - Global Forecast to 2026

Updated on : September 03, 2025

Geofoam Market

The global geofoam market was valued at USD 755 million in 2021 and is projected to reach USD 1,037 million by 2026, growing at 6.5% cagr from 2021 to 2026. Geofoams offer excellent load-bearing capacity and help optimize the overall cost and time of construction projects.

Geofoam Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global geofoams market

The pandemic is estimated to have an impact on various factors of the value chain of the geofoams market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is as follows:

COVID-19 had a significant economic impact on various financial as well as industrial sectors, such as travel & tourism, manufacturing, construction, and aviation. The end-use sectors of geofoam, such as road construction & paving, and airport construction have been impacted. Construction was one of the severely impacted sectors due to strict lockdowns and curfew in most countries to prevent the spread of coronavirus. Also, the ban on international as well as domestic flights across the globe have affected airport areas across the globe.

Geofoam Market Dynamics

Driver: Low cost compared to traditional land stabilization materials

Geofoams are a preferred alternative to traditional fill materials which offer excellent physical properties at a low cost and help engineers to execute projects without cost and time overruns. Geofoams can be installed by hand using simple hand tools, which limits the labor requirements for construction thereby eliminating the investment and operating cost. These are some of the qualities of geofoams, which make them a preferred alternative to traditional land stabilization materials.

Restraints: Flammability and vulnerability to petroleum solvents

Through the use of geofoams offers savings in terms of cost and time in construction projects, flammability and susceptibility to chemical changes are the major factors restraining the widespread acceptance of geofoams at a global level. Untreated geofoams are likely to catch fire if left unattended. Appropriate precautions are required to be implemented at project sites if open flame procedures, such as welding and cutting, are performed. In addition, geofoams are also susceptible to chemical changes. The properties of geofoams change when they come in contact with petroleum solvents, forming a glue-like substance. This reduces their ability to support heavy loads. Apart from this, geofoams are also adversely affected by UV light, buoyancy, and insect infestation, which can cause degradation and ultimately lead to the collapse of structures in case of prolonged exposure

Opportunity: Increasing infrastructural activities and technological developments in geofoams

The large-scale development of infrastructure in emerging economies and the maintenance of existing infrastructure in developed countries are driving the market for geofoam. Expanded polystyrene offers several advantages compared to conventional earthen embankments, which include rapid construction and the use of pre-fabricated bridge and bridge support components. Such innovations are serving as opportunities for the growth of the geofoam market.

Challenge: Limited technical knowledge and awareness about geofoams in emerging markets

Since the usage of geofoams for infrastructural development is more prevalent in developed countries, civil engineers in these regions have more knowledge about the use of geofoams. However, in emerging markets, the level of awareness is low, and construction standards do not include geofoams as basic construction material.

The challenge lies in this limited awareness among engineers. The design criteria of civil construction should include the usage of geofoams in the development of roads, highways, bridges, housing, and commercial complexes.

By type, expanded polystyrene segment is expected to lead the geofoams market during the forecast period

By type, expanded polystyrene is expected to lead the market during the forecast period. This can be attributed to its multi-functionality, wide-ranging applications for construction on soft ground, superior strength, flexibility, and low cost compared to extruded polystyrene geofoam.

By end-use, road & highway construction segment is expected to lead the geofoams market during the forecast period

Road & highway construction is the largest application of geofoams. They are extensively used in construction over poor soils, for the stabilization of foundations, railway embankments, bridge abutments, and other applications.

By application, the structure foundation segment is expected to lead the geofoams market during the forecast period

Structure foundation is one of the most common applications of geofoam, owing to its excellent properties such as structural integrity, thermal barrier, durability, and low cost of foundation blocks.

North America dominated the global geofoam market, in terms of value, in 2020

North America is one of the major geofoam markets in the world. The use of geofoams in the maintenance and reconstruction of existing roads, highways, and flyovers has increased in recent years in the region. This is majorly due to the rising awareness among civil engineers regarding the use and the extensive applications of geofoams in building & infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

Geofoam Market Players

The key market players include Carlisle (US), Amvic Building Systems (Canada), Atlas Roofing Corporation (US), Insulation Company of America (US), Foam Products Corporation (US), Jablite (UK), ThermaFoam, LLC (US), Expol (New Zealand), Pacific Allied Products, Ltd. (US), Airfoam (Canada), Harbor Foam (US), Groupe Legerlite Inc. (Canada), Drew Foam (US), and Plasti-Fab Ltd. (Canada). These players have adopted product launches, acquisitions, expansions, partnerships as their growth strategies.

Geofoam Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million ) |

|

Segments Covered |

Type, End-use, Application, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Carlisle (US), Amvic Building Systems (Canada), Atlas Roofing Corporation (US), Insulation Company of America (US), Foam Products Corporation (US), Jablite (UK), ThermaFoam, LLC (US), Expol (New Zealand), Pacific Allied Products, Ltd. (US), Airfoam (Canada), Harbor Foam (US), Groupe Legerlite Inc. (Canada), Drew Foam (US), Plasti-Fab Ltd. (Canada), Benchmark Foam Inc. (US), Mega Packaging Corporation (Philippines), StarRFoam (US), Poly Molding LLC (US), Beaver Plastics Ltd. (Canada), Foamex (Australia), Universal Foam Products (US), Polyfoam XPS (UK), Galaxy Polystyrene LLC (UAE), Styro Insulations Mat. Ind. LCC. (UAE), Technopol SA (South Africa) |

This research report categorizes the geofoam market based on type, end-use, application, and region.

Based on type, the geofoam market has been segmented as follows:

- Expanded Polystyrene

- Extruded Polystyrene

Based on end-use, the geofoam market has been segmented as follows:

- Road & Highway Construction

- Building & Infrastructure

- Airport Runway & Taxiways

- Others (railway embankments and green roofs)

Based on application, the geofoams market has been segmented as follows:

- Structure Foundation

- Embankments

- Slope Stabilization

- Insulation

- Retaining Structures

- Others (void filling, stadium & theatre seating, and impact protection)

Based on region, the geofoams market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In June 2021, Airfoam launched a new product, Foamshield, which is one of the most long-lasting and economical ways to insulate a home. The FoamShield wall assembly is made up of stiff Korolite EPS insulation, which can be applied to the outside of an uninsulated wood-frame wall with a sheathing membrane.

- In August 2020, Amvic Inc. launched Envirostrap, a rigid foam insulation with integrated strapping. Envirostrap is made of expanded polystyrene (EPS) closed cell and can be used for a variety of applications such as frost walls, exterior foundation walls, and so on.

- In August 2018, Atlas Roofing Corporation acquired ACH Foam Technologies, which is a leading manufacturer of molded polystyrene solutions in North America. This acquisition helped Atlas to expand its polystyrene foam business in North American region.

Frequently Asked Questions (FAQ):

Where is geofoam used?

The Geofoam is used for road & highway construction, building & infrastructure, airport runways & taxiways industry.

What is the current size of the global geofoams market?

The global market size for geofoam is estimated at USD 755 million in 2021 and is projected to reach USD 1,037 million by 2026, at a CAGR of 6.5% between 2021 and 2026.

Who are the leading players in the global geofoams market?

The leading companies in the geofoams market include Carlisle (US), Amvic Building Systems (Canada), Atlas Roofing Corporation (US), Insulation Company of America (US), Foam Products Corporation (US), Jablite (UK), ThermaFoam, LLC (US), Expol (New Zealand), Pacific Allied Products, Ltd. (US), Airfoam (Canada), Harbor Foam (US), Groupe Legerlite Inc. (Canada), Drew Foam (US), and Plasti-Fab Ltd. (Canada). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVE OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 SCOPE-RELATED LIMITATIONS

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

1.8.1 GEOFOAM MARKET, BY COUNTRY: INCLUSIONS & EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 GEOFOAM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 2 MAIN MATRIX CONSIDERED FOR ASSESSING DEMAND FOR GEOFOAMS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MARKET

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.3.4 APPROACH: BASED ON GLOBAL MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.5 APPROACH 4: BASED ON TYPE, BY REGION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 9 GEOFOAM MARKET: DATA TRIANGULATION

2.6 KEY ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 1 GEOFOAM MARKET SNAPSHOT

FIGURE 10 EXPANDED POLYSTYRENE SEGMENT PROJECTED TO LEAD OVERALL MARKET DURING THE FORECAST PERIOD

FIGURE 11 ROAD & HIGHWAY CONSTRUCTION SEGMENT PROJECTED TO LEAD MARKET DURING THE FORECAST PERIOD

FIGURE 12 STRUCTURE FOUNDATION SEGMENT PROJECTED TO LEAD OVERALL MARKET DURING THE FORECAST PERIOD

FIGURE 13 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 SIGNIFICANT OPPORTUNITIES IN GEOFOAM MARKET

FIGURE 14 INCREASE INFRASTRUCTURAL ACTIVITIES AND TECHNOLOGICAL DEVELOPMENTS TO DRIVE THE GEOFOAM MARKET

4.2 MARKET, BY REGION

FIGURE 15 GEOFOAM MARKET IN SOUTH AMERICA EXPECTED TO GROW AT HIGHEST RATE DURING THE FORECAST PERIOD

4.3 GEOFOAM MARKET, BY TYPE

FIGURE 16 EXPANDED POLYSTYRENE SEGMENT TO HOLD LARGEST SIZE OF MARKET IN 2020

4.4 MARKET, BY APPLICATION

FIGURE 17 STRUCTURE FOUNDATION SEGMENT DOMINATED THE MARKET

4.5 MARKET, BY END-USE

FIGURE 18 ROAD & HIGHWAY CONSTRUCTION SEGMENT DOMINATED THE MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE GEOFOAM MARKET

5.2.1 DRIVERS

5.2.1.1 Wide application of geofoams due to superior properties and extensive cost savings

TABLE 2 MARKET, BY APPLICATION

5.2.1.2 Low cost compared to traditional land stabilization materials

FIGURE 20 IMPACT OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 Flammability and vulnerability to petroleum solvents

FIGURE 21 IMPACT OF RESTRAINT ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing infrastructural activities and technological developments in geofoams

FIGURE 22 PROJECTED PUBLIC AND PRIVATE INFRASTRUCTURE SPENDING, BY SECTOR (2016–2040)

FIGURE 23 GLOBAL INFRASTRUCTURE INVESTMENT IN DIFFERENT SECTOR

FIGURE 24 IMPACT OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Limited technical knowledge and awareness about geofoams in emerging markets

5.2.4.2 Impact of COVID-19 on geofoam

FIGURE 25 IMPACT OF CHALLENGES ON GEOFOAM MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 GEOFOAM MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 27 OVERVIEW OF GEOFOAM SUPPLY CHAIN

TABLE 4 GEOFOAM MARKET: SUPPLY CHAIN

5.4.1 RAW MATERIALS AND THEIR SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 DISTRIBUTORS

5.4.4 END-USE INDUSTRIES

5.4.5 ECOSYSTEM/MARKET MAP

FIGURE 28 ECOSYSTEM /MARKET MAP OF GEOFOAM

5.5 MANUFACTURING PROCESS/TECHNOLOGY ANALYSIS FOR EPS GEOFOAM

5.5.1 EPS GEOFOAM

5.6 AVERAGE PRICING

5.7 TRADE DATA STATISTICS

TABLE 5 COUNTRY-WISE IMPORT OF POLYMERS OF STYRENE, 2019-2020 (USD THOUSAND)

TABLE 6 COUNTRY-WISE EXPORT OF POLYMERS OF STYRENE, 2019-2020 (USD THOUSAND)

5.8 TRENDS AND DISRUPTIONS IN TECHNOLOGY

5.8.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR PROVIDERS

FIGURE 29 REVENUE SHIFT FOR MARKET

5.9 PATENT ANALYSIS

5.9.1 DOCUMENT TYPE

FIGURE 30 NUMBER OF PATENTS REGISTERED, BY TYPE (2010-2020)

5.9.2 PATENT PUBLICATION TREND

FIGURE 31 PATENT PUBLICATION TREND, 2010-2020

5.9.3 JURISDICTION ANALYSIS

FIGURE 32 JURISDICTION ANALYSIS – TOP REGIONS (2010-2020)

5.9.4 TOP COMPANIES/APPLICANTS

FIGURE 33 TOP APPLICANTS/COMPANIES WITH HIGHEST NUMBER OF PATENTS

TABLE 7 LIST OF PATENTS BY SEKISUI PLASTICS CO. LTD.

TABLE 8 LIST OF PATENTS BY BASF SE

TABLE 9 LIST OF PATENTS BY ARKEMA S.A.

TABLE 10 LIST OF PATENTS BY KANEKA CORP.

TABLE 11 TOP 10 PATENT OWNERS (US) IN LAST 11 YEARS

5.10 REGULATIONS

5.10.1 AMERICAN SOCIETY FOR TESTING AND MATERIALS (ASTM)

TABLE 12 ASTM D6817 PHYSICAL PROPERTY REQUIREMENTS OF ESP GEOFOAM

5.10.2 REGULATIONS RELATED TO EXPANDED POLYSTYRENE

5.11 CASE STUDY ANALYSIS

5.11.1 GEOFOAM USED AS IN-FILL MATERIAL FOR CONSTRUCTION PROJECT AT A HIGH SCHOOL IN ENCINITAS, CALIFORNIA

5.11.2 GEOFOAM USED IN CONSTRUCTION OF NATIONAL HIGHWAY IN INDIA

6 COVID-19 IMPACT ON GEOFOAM ECOSYSTEM (Page No. - 69)

6.1 INTRODUCTION

6.2 EFFECT OF COVID-19 ON END-USE SECTORS OF GEOFOAM

6.2.1 ROAD CONSTRUCTION & PAVING

6.2.2 AIRPORT CONSTRUCTION

TABLE 13 AIRPORT REVENUES IN 2020: FORECASTED (PRE-COVID-19) VS. ESTIMATED UNDER (COVID-19) (MILLION USD)

6.3 EFFECT OF COVID-19 ON MAJOR COUNTRIES

6.3.1 CHINA

6.3.2 INDIA

6.3.3 GERMANY

6.3.4 UK

6.3.5 US

6.3.6 CANADA

6.3.7 BRAZIL

7 GEOFOAM MARKET, BY TYPE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 34 EXPANDED POLYSTYRENE SEGMENT TO LEAD GEOFOAM MARKET DURING THE FORECAST PERIOD

TABLE 14 MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 15 MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 16 MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 17 MARKET SIZE, BY TYPE, 2020–2026 (TON)

7.2 EXPANDED POLYSTYRENE GEOFOAMS

7.2.1 BROAD APPLICATIONS, SIMPLE MANUFACTURING PROCESS, AND LOW-COST DRIVE GROWTH OF EXPANDED POLYSTYRENE GEOFOAM

TABLE 18 EXPANDED POLYSTYRENE: GEOFOAM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 EXPANDED POLYSTYRENE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 20 EXPANDED POLYSTYRENE: MARKET SIZE, BY REGION, 2017–2019 (TON)

TABLE 21 EXPANDED POLYSTYRENE: MARKET SIZE, BY REGION, 2020–2026 (TON)

7.3 EXTRUDED POLYSTYRENE GEOFOAM

7.3.1 RISING DEMAND FOR INSULATION APPLICATIONS DRIVES GROWTH OF THIS SEGMENT

TABLE 22 EXTRUDED POLYSTYRENE: GEOFOAM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 23 EXTRUDED POLYSTYRENE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 24 EXTRUDED POLYSTYRENE: MARKET SIZE, BY REGION, 2017–2019 (TON)

TABLE 25 EXTRUDED POLYSTYRENE: MARKET SIZE, BY REGION, 2020–2026 (TON)

8 GEOFOAM MARKET, BY END-USE (Page No. - 79)

8.1 INTRODUCTION

FIGURE 35 ROAD & HIGHWAY CONSTRUCTION SEGMENT TO LEAD GEOFOAM MARKET DURING THE FORECAST PERIOD

TABLE 26 GEOFOAM MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 28 MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 29 MARKET SIZE, BY END-USE, 2020–2026 (TON)

8.2 ROAD & HIGHWAY CONSTRUCTION

8.2.1 EASE OF HANDLING AND HIGH LOAD-BEARING CAPACITY FUEL CONSUMPTION OF GEOFOAMS IN ROAD & HIGHWAY CONSTRUCTION

8.2.2 ROAD WIDENING

8.2.3 BRIDGE ABUTMENT

8.2.4 BRIDGE UNDERFILL

8.2.5 CULVERTS, PIPELINES, AND BURIED STRUCTURES

TABLE 30 ROAD & HIGHWAY CONSTRUCTION: GEOFOAM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 31 ROAD & HIGHWAY CONSTRUCTION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 32 ROAD & HIGHWAY CONSTRUCTION: MARKET SIZE, BY REGION, 2017–2019 (TON)

TABLE 33 ROAD & HIGHWAY CONSTRUCTION: MARKET SIZE, BY REGION, 2020–2026 (TON)

8.3 BUILDING & INFRASTRUCTURE

8.3.1 BUILDING & INFRASTRUCTURE SEGMENT ACCOUNTED FOR SECOND-HIGHEST CONSUMPTION OF GEOFOAMS IN 2020

8.3.2 COMPENSATING FOUNDATIONS

8.3.3 SLOPE STABILIZATION

8.3.4 STADIUM & THEATER SEATING

TABLE 34 BUILDING & INFRASTRUCTURE: GEOFOAM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 BUILDING & INFRASTRUCTURE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 36 BUILDING & INFRASTRUCTURE: MARKET SIZE, BY REGION, 2017–2019 (TON)

TABLE 37 BUILDING & INFRASTRUCTURE: MARKET SIZE, BY REGION, 2020–2026 (TON)

8.4 AIRPORT RUNWAY & TAXIWAYS

8.4.1 EXPANDED POLYSTYRENE GEOFOAM IS MAJORLY USED FOR AIRPORT RUNWAY & TAXIWAYS

TABLE 38 AIRPORT RUNWAY & TAXIWAYS: GEOFOAM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 AIRPORT RUNWAY & TAXIWAYS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 40 AIRPORT RUNWAY & TAXIWAYS: MARKET SIZE, BY REGION, 2017–2019 (TON)

TABLE 41 AIRPORT RUNWAY & TAXIWAYS: MARKET SIZE, BY REGION, 2020–2026 (TON)

8.5 OTHERS

TABLE 42 OTHERS: GEOFOAM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 43 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 44 OTHERS: MARKET SIZE, BY REGION, 2017–2019 (TON)

TABLE 45 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (TON)

9 GEOFOAM MARKET, BY APPLICATION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 36 STRUCTURE FOUNDATION SEGMENT TO LEAD GEOFOAM MARKET DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 47 MARKET SIZE, BY APPLICATION, 2017–2019 (TON)

TABLE 48 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 49 MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

9.2 STRUCTURE FOUNDATION

9.2.1 STRUCTURAL INTEGRITY, THERMAL BARRIER, DURABILITY, AND LOW COST OF FOUNDATION BLOCKS DRIVING GROWTH IN THIS SEGMENT

9.3 EMBANKMENTS

9.3.1 ADVANTAGEOUS PROPERTIES OVER TRADITIONAL LIGHTWEIGHT MATERIALS FUELLING THE SEGMENT GROWTH

9.4 SLOPE STABILIZATION

9.4.1 INCREASING HIGHWAY CONSTRUCTION/REPAIRING ACTIVITIES DRIVING GROWTH OF THE MARKET

9.5 INSULATION

9.5.1 INCREASING DEMAND FOR EPS GEOFOAM WITH HIGH-DENSITY & HIGHER R-VALUE TO DRIVE THE MARKET GROWTH

9.6 RETAINING STRUCTURES

9.6.1 GEOFOAM USED IN RETAINING STRUCTURES FOR ITS LIGHTWEIGHT, COMPRESSIBILITY, THERMAL INSULATION, AND WATER RESISTANCE

9.7 OTHERS

10 GEOFOAM MARKET, BY REGION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 37 ASIA PACIFIC TO LEAD GEOFOAM MARKET DURING THE FORECAST PERIOD

TABLE 50 GEOFOAM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 51 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 52 MARKET SIZE, BY REGION, 2017–2019 (TON)

TABLE 53 MARKET SIZE, BY REGION, 2020–2026 (TON)

10.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: GEOFOAM MARKET SNAPSHOT

TABLE 54 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (TON)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.2.1 US

10.2.1.1 High level of innovation and new product development contributing to market growth

TABLE 66 US: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 67 US: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 68 US: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 69 US: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 70 US: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 71 US: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 72 US: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 73 US: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.2.2 CANADA

10.2.2.1 Canada accounted for second-largest share of geofoam market in North America

TABLE 74 CANADA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 76 CANADA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 77 CANADA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 78 CANADA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 81 CANADA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.2.3 MEXICO

10.2.3.1 Growing road construction is contributing to market growth

TABLE 82 MEXICO: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 83 MEXICO: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 84 MEXICO: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 85 MEXICO: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 86 MEXICO: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 87 MEXICO: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 88 MEXICO: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 89 MEXICO: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3 EUROPE

FIGURE 39 EUROPE: GEOFOAM MARKET SNAPSHOT

TABLE 90 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (TON)

TABLE 93 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 94 EUROPE MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 97 EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 98 EUROPE: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 101 EUROPE MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3.1 GERMANY

10.3.1.1 Heavy investment in construction sector to drive the market

TABLE 102 GERMANY: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 103 GERMANY: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 104 GERMANY: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 105 GERMANY: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 106 GERMANY: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 107 GERMANY: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 108 GERMANY: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 109 GERMANY: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3.2 FRANCE

10.3.2.1 Growth in railway network is driving the market

TABLE 110 FRANCE: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 111 FRANCE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 112 FRANCE: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 113 FRANCE: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 114 FRANCE: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 115 FRANCE: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 116 FRANCE: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 117 FRANCE: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3.3 UK

10.3.3.1 Government initiatives in infrastructure development expected to boost growth of the market

TABLE 118 UK: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 119 UK: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 120 UK: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 121 UK: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 122 UK: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 123 UK: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 124 UK: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 125 UK: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3.4 ITALY

10.3.4.1 Construction of residential buildings will drive the market

TABLE 126 ITALY: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 127 ITALY: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 128 ITALY: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 129 ITALY: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 130 ITALY: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 131 ITALY: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 132 ITALY: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 133 ITALY: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3.5 RUSSIA

10.3.5.1 Investment in infrastructure by the government will drive the demand

TABLE 134 RUSSIA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 135 RUSSIA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 136 RUSSIA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 137 RUSSIA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 138 RUSSIA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 139 RUSSIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 140 RUSSIA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 141 RUSSIA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3.6 SPAIN

10.3.6.1 Increasing road infrastructure will drive the demand

TABLE 142 SPAIN: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 143 SPAIN: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 144 SPAIN: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 145 SPAIN: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 146 SPAIN: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 147 SPAIN: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 148 SPAIN: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 149 SPAIN: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.3.7 REST OF EUROPE

TABLE 150 REST OF EUROPE: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 151 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 152 REST OF EUROPE: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 153 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 154 REST OF EUROPE: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 155 REST OF EUROPE: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 156 REST OF EUROPE: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 157 REST OF EUROPE: MARKET SIZE, BY END-USE, 2020–2026 (TON)

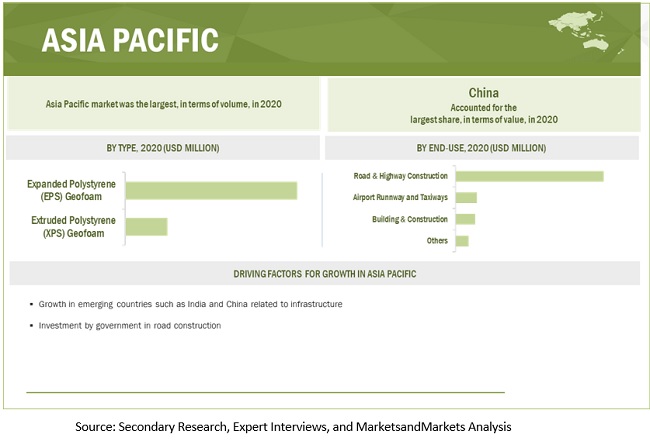

10.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: GEOFOAM MARKET SNAPSHOT

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2019 (TON)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.4.1 CHINA

10.4.1.1 China is largest market for geofoam in Asia Pacific

TABLE 170 CHINA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 172 CHINA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 173 CHINA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 174 CHINA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 175 CHINA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 176 CHINA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 177 CHINA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.4.2 JAPAN

10.4.2.1 Government initiative to promote residential and civil construction expected to drive the demand

TABLE 178 JAPAN: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 179 JAPAN: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 180 JAPAN: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 181 JAPAN: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 182 JAPAN: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 183 JAPAN: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 184 JAPAN: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 185 JAPAN: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.4.3 SOUTH KOREA

10.4.3.1 Growing urbanization supporting the growth of geofoam market

TABLE 186 SOUTH KOREA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 187 SOUTH KOREA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 188 SOUTH KOREA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 189 SOUTH KOREA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 190 SOUTH KOREA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 191 SOUTH KOREA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 192 SOUTH KOREA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 193 SOUTH KOREA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.4.4 INDIA

10.4.4.1 Construction of residential & commercial complexes and railway networks creating demand for geofoam

TABLE 194 INDIA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 195 INDIA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 196 INDIA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 197 INDIA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 198 INDIA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 199 INDIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 200 INDIA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 201 INDIA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.4.5 THAILAND

10.4.5.1 New construction and repair of roads creating demand for geofoam

TABLE 202 THAILAND: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 203 THAILAND: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 204 THAILAND: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 205 THAILAND: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 206 THAILAND: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 207 THAILAND: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 208 THAILAND: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 209 THAILAND: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.4.6 INDONESIA

10.4.6.1 Increasing infrastructure investment projects are expected to boost demand for geofoam

TABLE 210 INDONESIA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 211 INDONESIA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 212 INDONESIA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 213 INDONESIA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 214 INDONESIA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 215 INDONESIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 216 INDONESIA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 217 INDONESIA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.4.7 REST OF ASIA PACIFIC

TABLE 218 REST OF ASIA PACIFIC: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 219 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 221 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 222 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 223 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 224 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 225 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.5 MIDDLE EAST & AFRICA

TABLE 226 MIDDLE EAST & AFRICA: GEOFOAM MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 227 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 228 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2019 (TON)

TABLE 229 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 230 MIDDLE EAST & AFRICA MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 231 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 232 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 233 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 234 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 235 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 236 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 237 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.5.1 SAUDI ARABIA

10.5.1.1 Construction of new hotels and tourist spots will fuel demand for geofoam

TABLE 238 SAUDI ARABIA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 239 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 240 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 241 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 242 SAUDI ARABIA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 243 SAUDI ARABIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 244 SAUDI ARABIA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 245 SAUDI ARABIA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.5.2 UAE

10.5.2.1 Need for housing complexes to support rising population will enhance demand for geofoam

TABLE 246 UAE: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 247 UAE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 248 UAE: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 249 UAE: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 250 UAE: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 251 UAE: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 252 UAE: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 253 UAE: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.5.3 EGYPT

10.5.3.1 Increasing infrastructure will support growth of geofoam market

TABLE 254 EGYPT: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 255 EGYPT: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 256 EGYPT: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 257 EGYPT: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 258 EGYPT: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 259 EGYPT: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 260 EGYPT: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 261 EGYPT: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 262 REST OF MIDDLE EAST & AFRICA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 263 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 264 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 265 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 266 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 267 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 268 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 269 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.6 SOUTH AMERICA

TABLE 270 SOUTH AMERICA: GEOFOAM MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 271 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 272 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (TON)

TABLE 273 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 274 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 275 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 276 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 277 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 278 SOUTH AMERICA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 279 SOUTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 280 SOUTH AMERICA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 281 SOUTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.6.1 BRAZIL

10.6.1.1 Rapid growth of road & highway construction creating demand for geofoam

TABLE 282 BRAZIL: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 283 BRAZIL: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 284 BRAZIL: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 285 BRAZIL: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 286 BRAZIL: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 287 BRAZIL: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 288 BRAZIL: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 289 BRAZIL: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.6.2 ARGENTINA

10.6.2.1 Growth in infrastructure expected to drive the market for geofoam

TABLE 290 ARGENTINA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 291 ARGENTINA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 292 ARGENTINA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 293 ARGENTINA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 294 ARGENTINA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 295 ARGENTINA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 296 ARGENTINA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 297 ARGENTINA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.6.3 COLOMBIA

10.6.3.1 Implementation of various highway projects expected to propel demand for geofoam in the country

TABLE 298 COLOMBIA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 299 COLOMBIA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 300 COLOMBIA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 301 COLOMBIA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 302 COLOMBIA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 303 COLOMBIA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 304 COLOMBIA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 305 COLOMBIA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

10.6.4 REST OF SOUTH AMERICA

TABLE 306 REST OF SOUTH AMERICA: GEOFOAM MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 307 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 308 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2019 (TON)

TABLE 309 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (TON)

TABLE 310 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE, 2017–2019 (USD MILLION)

TABLE 311 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (USD MILLION)

TABLE 312 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE, 2017–2019 (TON)

TABLE 313 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE, 2020–2026 (TON)

11 COMPETITIVE LANDSCAPE (Page No. - 173)

11.1 KEY PLAYERS’ STRATEGIES

TABLE 314 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2020

11.2 MARKET SHARE ANALYSIS

FIGURE 41 GEOFOAM MARKET: MARKET SHARE ANALYSIS

TABLE 315 MARKET: DEGREE OF COMPETITION

11.2.1 CARLISLE

11.2.2 AMVIC INC.

11.2.3 ATLAS ROOFING CORPORATION

11.2.4 INSULATION COMPANY OF AMERICA

11.2.5 FOAM PRODUCTS CORPORATION

TABLE 316 GEOFOAM MARKET: PRODUCT FOOTPRINT

TABLE 317 MARKET: APPLICATION FOOTPRINT

TABLE 318 MARKET: END-USE FOOTPRINT

TABLE 319 MARKET: REGION FOOTPRINT

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STAR

11.3.2 PERVASIVE

11.3.3 EMERGING LEADER

11.3.4 PARTICIPANT

FIGURE 42 GEOFOAM MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

11.4 COMPETITIVE LEADERSHIP MAPPING OF SME, 2020

11.4.1 PROGRESSIVE COMPANIES

11.4.2 RESPONSIVE COMPANIES

11.4.3 STARTING BLOCKS

11.4.4 DYNAMIC COMPANIES

FIGURE 43 OTHER ADDITIONAL PLAYERS/SMES EVALUATION MATRIX FOR GEOFOAM MARKET

11.5 COMPETITIVE SCENARIO

TABLE 320 GEOFOAM MARKET: PRODUCT LAUNCHES, 2018-2021

TABLE 321 MARKET: DEALS, 2018-2019

TABLE 322 MARKET: OTHER DEVELOPMENTS, 2018

12 COMPANY PROFILES (Page No. - 186)

12.1 INTRODUCTION

12.2 KEY COMPANIES

(Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, MnM View)*

12.2.1 CARLISLE

TABLE 323 CARLISLE: BUSINESS OVERVIEW

FIGURE 44 CARLISLE: COMPANY SNAPSHOT

TABLE 324 CARLISLE: PRODUCT OFFERINGS

TABLE 325 CARLISLE: DEALS

12.2.2 AMVIC INC.

TABLE 326 AMVIC INC.: BUSINESS OVERVIEW

TABLE 327 AMVIC INC.: PRODUCT OFFERINGS

TABLE 328 AMVIC INC.: PRODUCT LAUNCHES

12.2.3 ATLAS ROOFING CORPORATION

TABLE 329 ATLAS ROOFING CORPORATION: BUSINESS OVERVIEW

TABLE 330 ATLAS ROOFING CORPORATION: PRODUCT OFFERINGS

TABLE 331 ATLAS ROOFING CORPORATION: DEALS

12.2.4 INSULATION COMPANY OF AMERICA, LLC

TABLE 332 INSULATION COMPANY OF AMERICA, LLC: BUSINESS OVERVIEW

TABLE 333 INSULATION COMPANY OF AMERICA, LLC: PRODUCT OFFERINGS

TABLE 334 INSULATION COMPANY OF AMERICA, LLC: OTHERS

12.2.5 FOAM PRODUCTS CORPORATION

TABLE 335 FOAM PRODUCTS CORPORATION: BUSINESS OVERVIEW

TABLE 336 FOAM PRODUCTS CORPORATION: PRODUCT OFFERINGS

12.2.6 JABLITE

TABLE 337 JABLITE: BUSINESS OVERVIEW

TABLE 338 JABLITE: PRODUCT OFFERINGS

TABLE 339 JABLITE: PRODUCT LAUNCHES

TABLE 340 JABLITE: DEALS

12.2.7 THERMAFOAM, LLC

TABLE 341 THERMAFOAM, LLC: BUSINESS OVERVIEW

TABLE 342 THERMAFOAM, LLC: PRODUCT OFFERINGS

12.2.8 EXPOL

TABLE 343 EXPOL: BUSINESS OVERVIEW

TABLE 344 EXPOL: PRODUCT OFFERINGS

TABLE 345 EXPOL: PRODUCT LAUNCHES

12.2.9 PACIFIC ALLIED PRODUCTS, LTD.

TABLE 346 PACIFIC ALLIED PRODUCTS, LTD.: BUSINESS OVERVIEW

TABLE 347 PACIFIC ALLIED PRODUCTS, LTD.: PRODUCT OFFERINGS

12.2.10 AIRFOAM

TABLE 348 AIRFOAM: BUSINESS OVERVIEW

TABLE 349 AIRFOAM: PRODUCT OFFERINGS

TABLE 350 AIRFOAM: PRODUCT LAUNCHES

12.2.11 HARBOR FOAM

TABLE 351 HARBOR FOAM: BUSINESS OVERVIEW

TABLE 352 HARBOR FOAM: PRODUCT OFFERINGS

12.2.12 GROUPE LEGERLITE INC.

TABLE 353 GROUPE LEGERLITE INC.: BUSINESS OVERVIEW

TABLE 354 GROUPE LEGERLITE INC.: PRODUCT OFFERINGS

12.2.13 DREW FOAM

TABLE 355 DREW FOAM: BUSINESS OVERVIEW

TABLE 356 DREW FOAM: PRODUCT OFFERINGS

TABLE 357 DREW FOAM: PRODUCT LAUNCHES

12.2.14 PLASTI-FAB LTD.

TABLE 358 PLASTI-FAB LTD.: BUSINESS OVERVIEW

FIGURE 45 PLASTI-FAB LTD.: COMPANY SNAPSHOT

TABLE 359 PLASTI-FAB LTD.: PRODUCT OFFERINGS

TABLE 360 PLASTI-FAB LTD.: PRODUCT LAUNCHES

12.3 OTHER COMPANIES

12.3.1 BENCHMARK FOAM INC.

TABLE 361 BENCHMARK FOAM INC.: COMPANY OVERVIEW

12.3.2 MEGA PACKAGING CORPORATION

TABLE 362 MEGA PACKAGING CORPORATION: COMPANY OVERVIEW

12.3.3 STARRFOAM

TABLE 363 STARRFOAM: COMPANY OVERVIEW

12.3.4 FOAMEX

TABLE 364 FOAMEX: COMPANY OVERVIEW

12.3.5 UNIVERSAL FOAM PRODUCTS

TABLE 365 UNIVERSAL FOAM PRODUCTS: COMPANY OVERVIEW

12.3.6 GALAXY POLYSTYRENE LLC

TABLE 366 GALAXY POLYSTYRENE LLC: COMPANY OVERVIEW

12.3.7 POLYFOAM XPS

TABLE 367 POLYFOAM XPS: COMPANY OVERVIEW

12.3.8 TECHNOPOL SA

TABLE 368 TECHNOPOL SA: COMPANY OVERVIEW

12.3.9 BEAVER PLASTICS LTD.

TABLE 369 BEAVER PLASTICS LTD.: COMPANY OVERVIEW

12.3.10 POLY MOLDING LLC

TABLE 370 POLY MOLDING LLC: COMPANY OVERVIEW

12.3.11 STYRO INSULATIONS MAT. IND. LCC.

TABLE 371 STYRO INSULATIONS MAT. IND. LCC.: COMPANY OVERVIEW

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 222)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHORS DETAILS

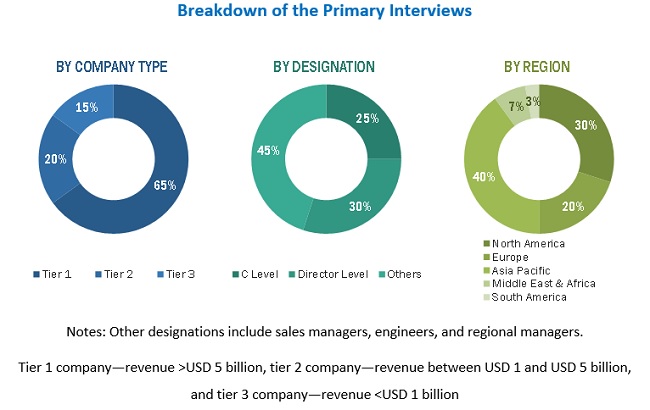

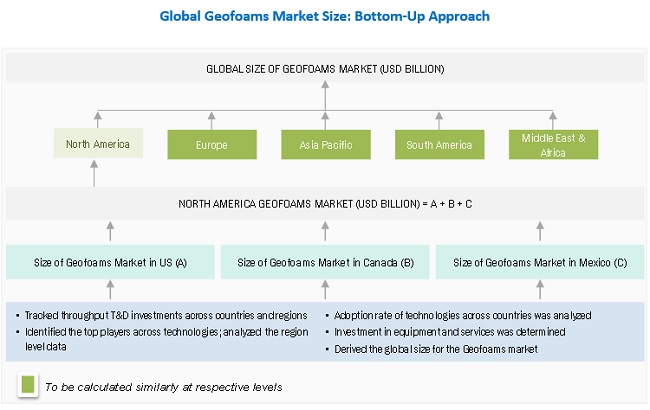

The study involved four major activities in estimating the current size of the geofoams market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the geofoams value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports; press releases and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, geofoam manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The geofoam market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of geofoam manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by the presence of key technology providers for geofoams, end users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of construction companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and geofoam manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the geofoam market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the geofoams market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the geofoams market in terms of value and volume

- To define, describe, and forecast the market size by type, end-use, application, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, expansions, partnerships as in the geofoams market

Competitive Intelligence

- To identify and profile the key players in the geofoams market

- To determine the top players offering various products in the geofoams market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Geofoam Market