Polyethylene (PE) Foams Market by Type (Non-XLPE and XLPE), Density (LDPE,HDPE), End-Use Application (Protective Packaging, Automotive, Building & Construction, Footwear, Sports & Recreational, Medical), and Region - Global Forecast to 2026

Updated on : September 02, 2025

Polyethylene (PE) Foams Market

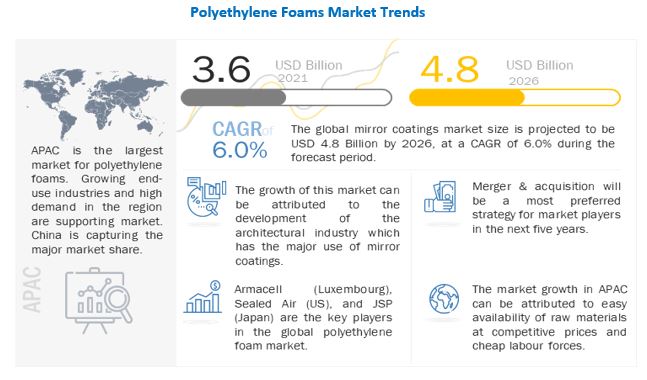

The polyethylene foams market was valued at USD 3.6 billion in 2021 and is projected to reach USD 4.8 billion by 2026, growing at 6.0% cagr from 2021 to 2026. The demand and use of polyethylene foams is rapidly increasing due to the growth in industries such as packaging, automotive, and medical especially in the APAC region.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Polyethylene Foams Market

COVID-19 has made a significant economic impact on various financial as well as industrial sectors, such as travel and tourism, manufacturing, and aviation. The worst economic recession is expected during 2020-2021, according to World Bank and IMF. With the increasing number of countries imposing and extending lockdowns, economic activities are declining, impacting the global economy.

In the recent past, the global economy became substantially more interconnected. The adverse consequences of various steps related to the containment of COVID-19 are evident from global supply chain disruptions, weaker demand for imported products and services, and an increase in the unemployment rate. Risk aversion has increased in the financial market, with all-time low interest rates and sharp declines in equity and commodity prices. Consumer and business confidence have also reduced significantly.

Polyethylene Foams Market Dynamics

Driver: Growth of major end-use industries segments

Major industries of polyethylene foams include building & construction, protective packaging, automotive, medical, and footwear, sports & recreational. Polyethylene foams are used in the building & construction industry for forging, pipe-in-pipe, doors, roof board, and slab applications. XLPE foams have excellent thermal insulation, moisture resistance, and sound and vibration absorption properties and are appropriate for use in the building & construction industry. Packaging is necessary for all kinds of materials for safety and insulation. The application areas of polyethylene foams in the automotive industry include headliners, door panels & water shields, seat liners, mirror seal, dashboard padding, air conditioning ducts, and trunk liner. The automobile manufacturers are continuously trying to lower vehicle weight, which tends to improve fuel consumption and better performance, for which polyethylene foams are used. In the medical industry, XLPE foam is used, which is hypoallergenic, non-toxic, and latex-free, and can also be used in operating rooms.

Restraint: Volatility in raw material prices

The factors that determine the cost structure of products are the price and availability of raw materials. The key raw materials used to make polyethylene foams are naphtha, low-density polyethylene (LDPE) resin, high-density polyethylene (HDPE) resin, and additives. Volatile raw material prices affect the manufacturing cost structure of the products. Oil prices have been highly volatile for the past two years (2019-2020) due to the rising global demand, conflict, and foreign military intervention in the Middle East. Such fluctuating raw material prices act as a restraint in the polyethylene foams market. Over the last few years, the price fluctuation in petrochemical-based raw materials has affected the polyethylene foams market. The consistent global demand, coupled with capacity constraints of primary chemicals and resins, has tightened the supply of raw materials, and increased their prices.

Opportunity: Growing demand for CO-2 based polyols

The continuous development of chemistry and polymer architecture has increased the use of polyethylene foams, as they can meet sustainability requirements. It is expected that there will be a gradual reduction in the availability of resources, for instance, drilled oil. It is also expected that CO2-based polyols may completely replace petroleum-based products because CO2 is cheaper than petroleum-based raw materials. In comparison to petroleum-based products, natural oil-based polymers consume less drilled oil, but the production of natural oil-based polyols requires land useful for crop production. This is a major reason CO2-based polyols are replacing conventional polyols.

Challenge: Stringent government regulations

Overexposure to volatile organic compounds (VOCs) is hazardous to health and can cause skin, eye, and nose, throat, and lung irritations. The use of chlorofluorocarbons (CFCs) as a blowing agent during the manufacturing process of foams is a major cause for the depletion of the ozone layer. Hence, regulators, such as Control of Substances Hazardous to Health (COSHH), European Union (EU), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and the Environmental Protection Agency (EPA) in Europe and North America regulate the use of foams in various applications. It is a challenge for the market players to develop cost-effective, eco-friendly polyethylene foam products to cater to the demand while complying with stringent environmental regulations

Non-XLPE foam type accounted for the largest share of the Polyethylene foams market.

Non-XLPE foam is also known as non-cross-linked polyethylene foam. Non-XLPE foam is easy to fabricate, and it is both non-abrasive and resilient. This polyethylene foam provides excellent shock and vibration protection during product transport. It has good flotation properties and is also water-resistant for recreational and sporting applications. It has good thermal insulation properties and has the added benefit of being recyclable. It is also a great alternative to more traditional types of packaging, such as corrugated paper.

Automotive is the second-largest end-use industry of Polyethylene foams market in 2021.

The automotive industry is continuously trying to lower vehicle weight. Lower weight tends to improve fuel consumption and better performance. Polyethylene foams are used in both small private vehicles and commercial vehicles, as well as in large quantities in coaches and buses. Polyethylene foams find their applications in the interior as well as the exterior of automobiles. These foams have a multifunctional role varying from simple product usage to acoustic and thermal insulation, as well as acting as a water seal. The application areas of polyethylene foams in the automotive industry include headliners, door panels & water shields, seat liners, wing mirror seal, dashboard padding, air conditioning ducts, and trunk liner.

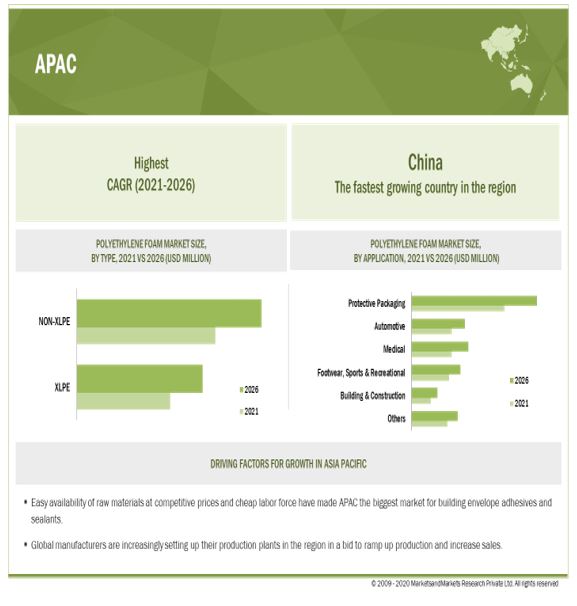

APAC is the largest polyethylene foam market in the forecast period

APAC has emerged as one of the leading producers as well as consumers of polyethylene foam. In India, low-cost labor, government initiatives, such as Make in India, and the proposed scheme on entrepreneurship development may open up opportunities in the industrial and infrastructure segments. The major applications of polyethylene foam in the APAC region are packaging, automotive, and medical. The increasing middle-class population in the region (with a high disposable income) and the rising demand for sustainable construction, transportation, and medical facilities are major factors supporting the growth of these application segments.

China is the leading market for polyethylene foams in the APAC. The Chinese market for polyethylene foams has grown rapidly and is projected to witness high growth in the near future due to the continuous shift of polyethylene foams production facilities from several countries to China. Most of the leading players in North America and Europe are planning to shift their production bases to China as it offers comparatively inexpensive raw materials, low cost of production, and the ability to serve the emerging local market.

To know about the assumptions considered for the study, download the pdf brochure

Polyethylene Foams Market Players

The key players operating in the market are Armacell (Luxembourg), JSP ( Japan), Zotefoams PLC (UK), Recticel NV (Belgium), and Sealed Air (US)

Polyethylene Foams Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin Type |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players are Armacell (Luxembourg), JSP (Japan), Sealed Air (US), Zotefoams PLC (UK), and Recticel NV (Belgium (Total of 25 companies) |

This research report categorizes the polyethylene foams market based on type, density, end-use industry, and region.

Polyethylene Foams Market, By Type:

- Non- XLPE

- XLPE

Polyethylene Foams Market, By Density

- LDPE Foam

- HDPE Foam

Polyethylene Foams Market, By End-use Industry:

- Protective Packaging

- Automotive

- Building & Construction

- Footwear, Sports & Recreational

- Medical

- Others (aviation & aerospace, marine, refrigeration, and electrical & electronics)

Polyethylene Foams Market, By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2021, Recticel NV completed the acquisition of FoamPartner. The new organization will leverage numerous synergies in resources and talents to promote excellence, increase its worldwide presence, and accelerate the commercialization of sustainable innovations and leading-edge solutions to global markets.

- In February 2020, PAI Partners are now Armacell’s majority shareholders. The remaining shares are held by the holding and investment company KIRKBI and Armacell’s senior management team.

Frequently Asked Questions (FAQs):

What is the current size of the global polyethylene foams market?

The global polyethylene foams market is projected to grow from USD 3.6 billion in 2021 and is projected to reach USD 4.8 billion by 2026, at a CAGR of 6.0%, between 2021 and 2026 period.

Who are the major players of polyethylene foams market?

Companies such as are Armacell (Luxembourg), JSP ( Japan), Zotefoams PLC (UK), Recticel NV (Belgium), and Sealed Air (US) are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. Investment & expansion and merger & acquisition are the key strategies adopted by companies operating in this market.

Which segment has the potential to register the highest market share for polyethylene foams market?

Protective packaging is the largest end-use industry segment, in terms of both value and volume, in 2020.

Which is the fastest-growing region in the market?

APAC is projected to be the fastest-growing market for polyethylene foams market during the forecast period. Easy availability of raw materials at competitive prices and cheap labor force have made APAC the biggest market for polyethylene foams. Global manufacturers are increasingly setting up their production plants in the region in a bid to ramp up production and increase sales. The major end-use industries of polyethylene foams are protective packaging, automotive, medical, and footwear, sports & recreational. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSION

1.3 MARKET SCOPE

1.3.1 POLYETHYLENE FOAMS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 POLYETHYLENE FOAMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 POLYETHYLENE FOAMS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RISK ANALYSIS ASSESSMENT

2.6 LIMITATIONS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 POLYETHYLENE FOAMS MARKET SNAPSHOT (2021 VS. 2026)

FIGURE 5 NON-XLPE TYPE DOMINATED THE POLYETHYLENE FOAMS MARKET IN 2020

FIGURE 6 PROTECTIVE PACKAGING END-USE APPLICATION LED THE MARKET FOR POLYETHYLENE FOAMS IN 2020

FIGURE 7 ASIA PACIFIC TO BE THE LARGEST AND FASTEST-GROWING MARKET FOR POLYETHYLENE FOAMS

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE POLYETHYLENE FOAMS MARKET

FIGURE 8 POLYETHYLENE FOAMS MARKET TO WITNESS MODERATE GROWTH THE DURING FORECAST PERIOD

4.2 POLYETHYLENE FOAMS MARKET GROWTH, BY END-USE APPLICATION

FIGURE 9 PROTECTIVE PACKAGING TO BE THE LARGEST END-USE APPLICATION DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SHARE, BY END-USE APPLICATION AND COUNTRY, 2020

FIGURE 10 CHINA AND PROTECTIVE PACKAGING END-USE APPLICATION ACCOUNTED FOR LARGEST SHARES IN ASIA PACIFIC

4.4 POLYETHYLENE FOAMS MARKET: MAJOR COUNTRIES

FIGURE 11 CHINA AND INDIA TO EMERGE AS LUCRATIVE MARKETS FOR POLYETHYLENE FOAMS DURING THE FORECAST PERIOD

4.5 POLYETHYLENE FOAMS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 12 POLYETHYLENE FOAMS MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

FIGURE 13 CHINA TO REGISTER THE HIGHEST CAGR IN ASIA PACIFIC DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE POLYETHYLENE FOAMS MARKET

5.2.1 DRIVERS

5.2.1.1 Growth of major end-use application segments

5.2.1.2 High demand in Asia Pacific

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for CO2-based polyols

5.2.4 CHALLENGES

5.2.4.1 Stringent government regulations

5.2.4.2 Growing demand for bio-based polyols

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 PORTER’S FIVE FORCES ANALYSIS: POLYETHYLENE FOAMS MARKET

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS: POLYETHYLENE FOAMS MARKET

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 THREAT OF NEW ENTRANTS

5.4 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 3 GDP TRENDS AND FORECASTS, PERCENTAGE CHANGE, 2019-2026

5.4.3 TRENDS AND FORECASTS FOR THE GLOBAL CONSTRUCTION INDUSTRY

FIGURE 16 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

5.4.4 TRENDS AND FORECASTS FOR THE GLOBAL AUTOMOTIVE INDUSTRY

TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION (2019–2020)

5.4.5 TRENDS AND FORECASTS FOR THE GLOBAL PACKAGING INDUSTRY

5.5 COVID-19 IMPACT

5.5.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 17 WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.5.2 COVID-19 ECONOMIC IMPACT – SCENARIO ASSESSMENT

FIGURE 18 FACTORS IMPACTING ECONOMIES OF SELECT G20 COUNTRIES IN 2020

5.5.3 IMPACT ON THE CONSTRUCTION INDUSTRY

5.5.4 IMPACT ON THE AUTOMOTIVE INDUSTRY

5.6 VALUE CHAIN ANALYSIS

FIGURE 19 POLYETHYLENE FOAMS: VALUE CHAIN ANALYSIS

5.7 PRICING ANALYSIS

FIGURE 20 AVERAGE PRICE COMPETITIVENESS IN POLYETHYLENE FOAMS MARKET

5.8 FOAMS ECOSYSTEM

FIGURE 21 FOAMS ECOSYSTEM

5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.10 TRADE ANALYSIS

5.10.1 TRADE SCENARIO OF POLYETHYLENE FOAMS

TABLE 5 IMPORT TRADE DATA FOR US, 2019

TABLE 6 MONTHLY IMPORT DATA FOR US, BY PARTNER, 2019

TABLE 7 MAJOR IMPORT PARTNERS OF US, 2019

TABLE 8 MONTHLY TRADE DATA FOR INDIA, 2019

TABLE 9 MONTHLY TRADE DATA FOR INDIA, BY PARTNER, 2019

TABLE 10 MAJOR TRADE PARTNERS OF INDIA, MONTHLY DATA, 2019

5.11 REGULATIONS

5.11.1 FOOD CONTACT-EU

5.11.2 US FOOD AND DRUG ADMINISTRATION (FDA)

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 PUBLICATION TRENDS

FIGURE 22 NUMBER OF PATENTS PUBLISHED, 2015-2021

5.12.3 TOP APPLICANTS

FIGURE 23 PATENTS PUBLISHED BY MAJOR PLAYERS, 2015-2021

5.12.4 JURISDICTION

FIGURE 24 PATENTS PUBLISHED BY JURISDICTION, 2015-2021

TABLE 11 RECENT PATENTS BY COMPANIES

5.13 CASE STUDY ANALYSIS

5.14 TECHNOLOGY ANALYSIS

6 POLYETHYLENE FOAMS MARKET, BY TYPE (Page No. - 89)

6.1 INTRODUCTION

FIGURE 25 NON-XLPE FOAM TO LEAD THE OVERALL POLYETHYLENE FOAMS MARKET DURING THE FORECAST PERIOD

TABLE 12 POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 13 POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 14 POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 15 POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

6.2 NON-XLPE

6.2.1 ACCOUNTS FOR A LARGER SHARE OF THE MARKET

TABLE 16 NON-XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 NON-XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 NON-XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 19 NON-XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3 XLPE

6.3.1 TO BE THE FASTER-GROWING SEGMENT OF THE MARKET

TABLE 20 XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 23 XLPE: POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7 POLYETHYLENE FOAMS MARKET, BY DENSITY (Page No. - 96)

7.1 INTRODUCTION

7.2 LDPE FOAM

7.3 HDPE FOAM

8 POLYETHYLENE FOAMS MARKET, BY END-USE APPLICATION (Page No. - 98)

8.1 INTRODUCTION

FIGURE 26 PROTECTIVE PACKAGING END-USE APPLICATION TO LEAD THE POLYETHYLENE FOAMS MARKET

TABLE 24 POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 25 POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 26 POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (KILOTON)

TABLE 27 POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (KILOTON)

8.2 PROTECTIVE PACKAGING

8.2.1 LARGEST CONSUMER OF POLYETHYLENE FOAMS

TABLE 28 POLYETHYLENE FOAMS MARKET SIZE IN PROTECTIVE PACKAGING, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 POLYETHYLENE FOAMS MARKET SIZE IN PROTECTIVE PACKAGING, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 POLYETHYLENE FOAMS MARKET SIZE IN PROTECTIVE PACKAGING, BY REGION, 2017–2020 (KILOTON)

TABLE 31 POLYETHYLENE FOAMS MARKET SIZE IN PROTECTIVE PACKAGING, BY REGION, 2021–2026 (KILOTON)

8.3 AUTOMOTIVE

8.3.1 TO BE THE SECOND-LARGEST END USER OF POLYETHYLENE FOAMS

TABLE 32 POLYETHYLENE FOAMS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 POLYETHYLENE FOAMS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 POLYETHYLENE FOAMS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2020 (KILOTON)

TABLE 35 POLYETHYLENE FOAMS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2026 (KILOTON)

8.4 BUILDING & CONSTRUCTION

8.4.1 GROWING INFRASTRUCTURAL AND NEW HOUSING CONSTRUCTIONS TO DRIVE THE MARKET FOR POLYETHYLENE FOAMS

TABLE 36 POLYETHYLENE FOAMS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 POLYETHYLENE FOAMS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 POLYETHYLENE FOAMS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2017–2020 (KILOTON)

TABLE 39 POLYETHYLENE FOAMS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2021–2026 (KILOTON)

8.5 FOOTWEAR, SPORTS & RECREATIONAL

8.5.1 LIGHTWEIGHT AND DURABLE PROPERTIES SUITABLE FOR SPORTING APPLICATIONS

TABLE 40 POLYETHYLENE FOAMS MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 POLYETHYLENE FOAMS MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 POLYETHYLENE FOAMS MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2017–2020 (KILOTON)

TABLE 43 POLYETHYLENE FOAMS MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2021–2026 (KILOTON)

8.6 MEDICAL

8.6.1 FASTEST-GROWING END-USE APPLICATION OF POLYETHYLENE FOAMS

TABLE 44 POLYETHYLENE FOAMS MARKET SIZE IN MEDICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 POLYETHYLENE FOAMS MARKET SIZE IN MEDICAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 POLYETHYLENE FOAMS MARKET SIZE IN MEDICAL, BY REGION, 2017–2020 (KILOTON)

TABLE 47 POLYETHYLENE FOAMS MARKET SIZE IN MEDICAL, BY REGION, 2021–2026 (KILOTON)

8.7 OTHERS

TABLE 48 POLYETHYLENE FOAMS MARKET SIZE IN OTHER END-USE APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 POLYETHYLENE FOAMS MARKET SIZE IN OTHER END-USE APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 POLYETHYLENE FOAMS MARKET SIZE IN OTHER END-USE APPLICATIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 51 POLYETHYLENE FOAMS MARKET SIZE IN OTHER END-USE APPLICATIONS, BY REGION, 2021–2026 (KILOTON)

9 POLYETHYLENE FOAMS MARKET, REGIONAL ANALYSIS (Page No. - 114)

9.1 INTRODUCTION

FIGURE 27 ASIA PACIFIC TO EMERGE AS A STRATEGIC REGION IN THE POLYETHYLENE FOAMS MARKET

TABLE 52 POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 55 POLYETHYLENE FOAMS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 28 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SNAPSHOT

TABLE 56 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 59 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 60 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 63 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 64 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (KILOTON)

TABLE 67 NORTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (KILOTON)

9.2.2 US

9.2.2.1 Automotive and building & construction industries driving demand for polyethylene foams

TABLE 68 US: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 US: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 70 US: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 71 US: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.2.3 CANADA

9.2.3.1 State-of-the-art manufacturing facilities and infrastructure to provide growth opportunities

TABLE 72 CANADA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 73 CANADA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 74 CANADA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 75 CANADA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.2.4 MEXICO

9.2.4.1 Mexico attracting key players

TABLE 76 MEXICO: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 77 MEXICO: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 78 MEXICO: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 79 MEXICO: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON EUROPE

FIGURE 29 EUROPE: POLYETHYLENE FOAMS MARKET SNAPSHOT

TABLE 80 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 83 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 84 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 85 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 86 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 87 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 88 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 89 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 90 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (KILOTON)

TABLE 91 EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (KILOTON)

9.3.2 GERMANY

9.3.2.1 Presence of major automobile companies and production facilities to boost the demand

TABLE 92 GERMANY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 93 GERMANY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 94 GERMANY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 95 GERMANY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3.3 FRANCE

9.3.3.1 Growing demand for auto parts and packaging materials to drive market growth

TABLE 96 FRANCE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 FRANCE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 98 FRANCE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 99 FRANCE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3.4 ITALY

9.3.4.1 Increased investments by foreign investors in end-use industries

TABLE 100 ITALY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 101 ITALY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 102 ITALY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 103 ITALY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3.5 UK

9.3.5.1 Automotive industry significantly driving demand for polyethylene foams

TABLE 104 UK: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 105 UK: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 106 UK: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 107 UK: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3.6 SPAIN

9.3.6.1 Growth of building & construction industry to propel demand for polyethylene foams

TABLE 108 SPAIN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 SPAIN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 SPAIN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 111 SPAIN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3.7 RUSSIA

9.3.7.1 Government investments for modernizing and expanding infrastructure to boost demand for polyethylene foams

TABLE 112 RUSSIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 RUSSIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 114 RUSSIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 115 RUSSIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3.8 TURKEY

9.3.8.1 Rapid urbanization, rising standards of living, growing middle-class population to positively influence market

TABLE 116 TURKEY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 TURKEY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 118 TURKEY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 119 TURKEY: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.3.9 REST OF EUROPE

TABLE 120 REST OF EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 REST OF EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 122 REST OF EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 123 REST OF EUROPE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4 ASIA PACIFIC

9.4.1 IMPACT OF COVID-19 ON ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SNAPSHOT

TABLE 124 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 125 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 126 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 127 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 128 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 129 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 130 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 131 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 132 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 133 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 134 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (KILOTON)

TABLE 135 ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (KILOTON)

9.4.2 CHINA

9.4.2.1 Expanding automotive industry, along with improved public infrastructure and building & construction industry, to boost demand for polyethylene foams

TABLE 136 CHINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 137 CHINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 138 CHINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 139 CHINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4.3 JAPAN

9.4.3.1 Market is mature and projected to grow at a moderate rate

TABLE 140 JAPAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 JAPAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 142 JAPAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 143 JAPAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4.4 INDIA

9.4.4.1 Availability of resources, rapid economic growth, increasing disposable income, and urbanization to influence the market

TABLE 144 INDIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 INDIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 146 INDIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 147 INDIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4.5 SOUTH KOREA

9.4.5.1 Growth in the automotive industry to increase demand for polyethylene foams

TABLE 148 SOUTH KOREA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 149 SOUTH KOREA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 150 SOUTH KOREA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 151 SOUTH KOREA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4.6 SINGAPORE

9.4.6.1 High penetration of end-use industries to propel demand

TABLE 152 SINGAPORE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 153 SINGAPORE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 154 SINGAPORE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 155 SINGAPORE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4.7 INDONESIA

9.4.7.1 Impact of COVID-19 has been severe, but the market is recovering

TABLE 156 INDONESIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 157 INDONESIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 158 INDONESIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 159 INDONESIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4.8 THAILAND

9.4.8.1 Strong local supply chain, efficient infrastructure, and high automobile production to boost the market

TABLE 160 THAILAND: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 161 THAILAND: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 162 THAILAND: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 163 THAILAND: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.4.9 REST OF ASIA PACIFIC

TABLE 164 REST OF ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 167 REST OF ASIA PACIFIC: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.5 MIDDLE EAST & AFRICA

9.5.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

TABLE 168 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY/REGION, 2017–2020 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY/REGION, 2017–2020 (KILOTON)

TABLE 171 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (KILOTON)

TABLE 172 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 175 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 176 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (KILOTON)

TABLE 179 MIDDLE EAST & AFRICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (KILOTON)

9.5.2 SAUDI ARABIA

9.5.2.1 Increased local car sales to support market growth

TABLE 180 SAUDI ARABIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 181 SAUDI ARABIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 182 SAUDI ARABIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 183 SAUDI ARABIA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.5.3 AFRICAN REGION

9.5.3.1 Growth of various manufacturing industries to positively influence the market

TABLE 184 AFRICAN REGION: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 185 AFRICAN REGION: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 186 AFRICAN REGION: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 187 AFRICAN REGION: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.5.4 IRAN

9.5.4.1 Growth in automotive industry to boost the market of polyethylene foams

TABLE 188 IRAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 189 IRAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 190 IRAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 191 IRAN: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.5.5 REST OF MIDDLE EAST

TABLE 192 REST OF MIDDLE EAST: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 194 REST OF MIDDLE EAST: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 195 REST OF MIDDLE EAST: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.6 SOUTH AMERICA

TABLE 196 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 197 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 198 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 199 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 200 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 201 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 202 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 203 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 204 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 205 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 206 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2017–2020 (KILOTON)

TABLE 207 SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY END-USE APPLICATION, 2021–2026 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Expansion of production capacity, established distribution channels, and proximity to major South American countries

TABLE 208 BRAZIL: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 209 BRAZIL: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 210 BRAZIL: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 211 BRAZIL: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Growing automotive industry to drive the market

TABLE 212 ARGENTINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 213 ARGENTINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 214 ARGENTINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 215 ARGENTINA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.6.3 CHILE

9.6.3.1 Government investment in end-use industries to drive the demand for polyethylene foams

TABLE 216 CHILE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 217 CHILE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 218 CHILE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 219 CHILE: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

9.6.4 REST OF SOUTH AMERICA

TABLE 220 REST OF SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 221 REST OF SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 222 REST OF SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 223 REST OF SOUTH AMERICA: POLYETHYLENE FOAMS MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 182)

10.1 OVERVIEW

10.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY POLYETHYLENE FOAM PLAYERS

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITION AND METHODOLOGY, 2020

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 PARTICIPANTS

FIGURE 31 POLYETHYLENE FOAMS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

10.3 SME MATRIX, 2020

10.3.1 RESPONSIVE COMPANIES

10.3.2 PROGRESSIVE COMPANIES

10.3.3 STARTING BLOCKS

10.3.4 DYNAMIC COMPANIES

FIGURE 32 POLYETHYLENE FOAMS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

10.4 STRENGTH OF PRODUCT PORTFOLIO

10.5 BUSINESS STRATEGY EXCELLENCE

10.6 COMPETITIVE SCENARIO

TABLE 224 PRODUCT FOOTPRINT OF COMPANIES

TABLE 225 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 226 REGIONAL FOOTPRINT OF COMPANIES

10.6.1 MARKET EVALUATION MATRIX

TABLE 227 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 228 MOST FOLLOWED STRATEGIES

TABLE 229 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

10.7 POLYETHYLENE FOAMS MARKET SHARE ANALYSIS

FIGURE 33 POLYETHYLENE FOAMS MARKET SHARE ANALYSIS, 2020

10.8 REVENUE ANALYSIS

FIGURE 34 REVENUE ANALYSIS OF TOP 4 PLAYERS, 2016–2020

10.8.1 SEALED AIR

10.8.2 JSP

10.8.3 ARMACELL

10.8.4 ZOTEFOAMS PLC

10.9 MARKET RANKING ANALYSIS

FIGURE 35 MARKET RANKING ANALYSIS 2020

10.10 COMPETITIVE SITUATION AND TRENDS

TABLE 230 POLYETHYLENE FOAMS MARKET: PRODUCT LAUNCHES, 2016–2021

TABLE 231 POLYETHYLENE FOAMS MARKET: DEALS, 2016–2021

11 COMPANY PROFILES (Page No. - 200)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats)*

11.1.1 ARMACELL

TABLE 232 ARMACELL: BUSINESS OVERVIEW

FIGURE 36 ARMACELL: COMPANY SNAPSHOT

TABLE 233 ARMACELL: DEALS

11.1.2 JSP

TABLE 234 JSP: BUSINESS OVERVIEW

FIGURE 37 JSP: COMPANY SNAPSHOT

11.1.3 ZOTEFOAMS PLC

TABLE 235 ZOTEFOAMS PLC: BUSINESS OVERVIEW

FIGURE 38 ZOTEFOAMS PLC: COMPANY SNAPSHOT

TABLE 236 ZOTEFOAMS PLC: PRODUCT LAUNCH

TABLE 237 ZOTEFOAMS PLC: DEALS

11.1.4 SEALED AIR

TABLE 238 SEALED AIR: BUSINESS OVERVIEW

FIGURE 39 SEALED AIR: COMPANY SNAPSHOT

TABLE 239 SEALED AIR: PRODUCT LAUNCH

TABLE 240 SEALED AIR: DEALS

11.1.5 RECTICEL NV

TABLE 241 RECTICEL NV: BUSINESS OVERVIEW

FIGURE 40 RECTICEL NV: COMPANY SNAPSHOT

TABLE 242 RECTICEL NV: DEALS

11.1.6 INOAC CORPORATION

TABLE 243 INOAC CORPORATION: BUSINESS OVERVIEW

11.1.7 THERMOTEC PTY LTD.

TABLE 244 THERMOTEC PTY LTD: BUSINESS OVERVIEW

11.1.8 WISCONSIN FOAM PRODUCTS

TABLE 245 WISCONSIN FOAM PRODUCTS: BUSINESS OVERVIEW

11.1.9 DAFA A/S

TABLE 246 DAFA A/S: BUSINESS OVERVIEW

11.1.10 PALZIV INC.

TABLE 247 PALZIV INC.: BUSINESS OVERVIEW

11.2 OTHER COMPANIES

11.2.1 HIRA INDUSTRIES LLC

TABLE 248 HIRA INDUSTRIES LLC: BUSINESS OVERVIEW

11.2.2 PREGIS LLC

TABLE 249 PREGIS LLC: BUSINESS OVERVIEW

TABLE 250 PREGIS LLC: DEALS

11.2.3 QUALITY FOAM PACKAGING, INC.

TABLE 251 QUALITY FOAM PACKAGING, INC BUSINESS OVERVIEW

11.2.4 SANWA KAKO CO., LTD.

TABLE 252 SANWA KAKO CO., LTD.: BUSINESS OVERVIEW

11.2.5 PROTAC INC.

TABLE 253 PROTAC INC: BUSINESS OVERVIEW

11.2.6 KANEKA CORPORATION

TABLE 254 KANEKA CORPORATION: BUSINESS OVERVIEW

TABLE 255 KANEKA CORPORATION: DEALS

11.2.7 SONOCO PRODUCTS COMPANY

TABLE 256 SONOCO PRODUCTS COMPANY: BUSINESS OVERVIEW

11.2.8 RHYNO FOAM (RAHIL FOAM PVT. LTD.)

TABLE 257 RHYNO FOAM (RAHIL FOAM PVT. LTD.): BUSINESS OVERVIEW

11.2.9 SUPREME INDUSTRIES LIMITED

TABLE 258 SUPREME INDUSTRIES LIMITED: BUSINESS OVERVIEW

11.2.10 PLYMOUTH FOAM

TABLE 259 PLYMOUTH FOAM: BUSINESS OVERVIEW

11.2.11 INNOVO PACKAGING CO., LTD

TABLE 260 INNOVO PACKAGING CO., LTD: BUSINESS OVERVIEW

11.2.12 MITSUI CHEMICALS

TABLE 261 MITSUI CHEMICALS: BUSINESS OVERVIEW

11.2.13 SEKISUI CHEMICAL CO., LTD.

TABLE 262 SEKISUI CHEMICAL CO., LTD.: BUSINESS OVERVIEW

TABLE 263 SEKISUI CHEMICAL CO., LTD.: DEAL

11.2.14 FURUKAWA ELECTRIC CO., LTD.

TABLE 264 FURUKAWA ELECTRIC CO., LTD.: BUSINESS OVERVIEW

11.2.15 TORAY INDUSTRIES, INC.

TABLE 265 TORAY INDUSTRIES, INC: BUSINESS OVERVIEW

TABLE 266 TORAY INDUSTRIES, INC: DEALS

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 240)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 POLYMER FOAMS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 POLYMER FOAMS MARKET ANALYSIS, BY FOAM TYPE

12.4 FLEXIBLE FOAMS

12.5 RIGID FOAMS

12.5.1 POLYMER FOAMS MARKET, BY RESIN TYPE

TABLE 267 POLYMER FOAMS MARKET SIZE, BY RESIN TYPE, 2018–2025 (USD MILLION)

TABLE 268 POLYMER FOAMS MARKET SIZE, BY RESIN TYPE, 2018–2025 (KILOTON)

12.5.2 POLYMER FOAMS MARKET, BY END-USE INDUSTRY

TABLE 269 POLYMER FOAMS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 270 POLYMER FOAMS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

12.5.3 POLYMER FOAMS MARKET, BY REGION

TABLE 271 POLYMER FOAMS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 272 POLYMER FOAMS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

13 APPENDIX (Page No. - 246)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study of global polyethylene foams market involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, ICIS, and OneSource. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research.

Secondary Research

Secondary sources of data include company information from annual reports, press releases, investor presentations, white papers, and articles from recognized authors and databases. In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to gather, verify, and validate the market figures.

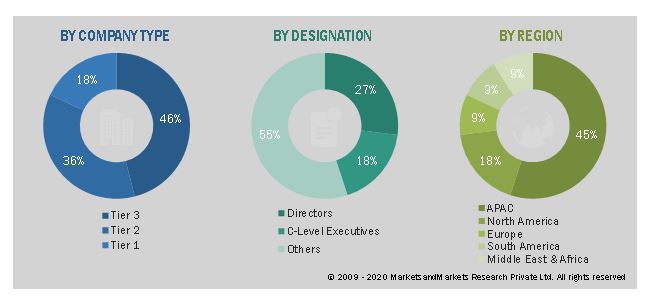

Primary Research

The polyethylene foams market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as protective packaging, automotive, footwear, sports & recreational, building & construction, medical and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

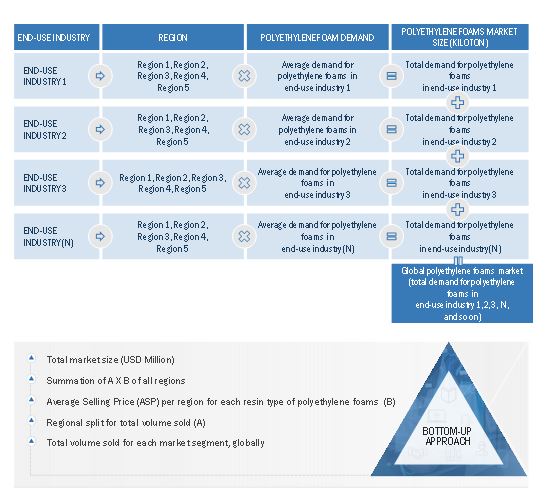

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the market sizes of polyethylene foams for various end-use industries in each region. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Polyethylene foams Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the polyethylene foams market, in terms of both value (USD million/billion) and volume (Kiloton)

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by type, by density, end-use industry, and region

- To forecast the market size with respect to five main regions: North America, Europe, APAC, Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as Joint venture & partnership, Investment & expansion, new product launch and merger & acquisition.

- To strategically profile the key players and comprehensively analyze their market shares.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polyethylene (PE) Foams Market