Gear Oil Market by Base Oil (Mineral, Synthetic, Semi-Synthetic, Bio-based), End-Use Industry (General Industrial (Manufacturing, Mining, Construction, Oil & Gas), Transportation (Automotive, Marine, Aviation)), Region - Global Forecasts to 2022

[171 Pages Report] on Gear Oil Market was valued at USD 7.32 Billion in 2016 and is projected to reach USD 8.58 Billion by 2022, at a CAGR of 2.69% from 2017 to 2022. In this report, 2016 is considered as the base year for the study on the gear oil market, while the forecast period is from 2017 to 2022.

The objectives of this study on the gear oil market are:

- To define, describe, and analyze the gear oil market on the basis of base oil, end-use industry, and region

- To forecast and analyze the size of the gear oil market (in terms of value and volume) and its submarkets for five regions, namely, Asia-Pacific, Europe, North America, the Middle East & Africa, and South America

- To forecast and analyze the gear oil market at the country-level for each region

- To strategically analyze each submarket with respect to individual growth trends and its contribution to the gear oil market

- To analyze opportunities in the gear oil market for the stakeholders by identifying high-growth segments of the market

- To identify significant market trends and factors driving or inhibiting the growth of the gear oil market and its submarkets

- To strategically profile the key market players operating in the gear oil market and comprehensively analyze their growth strategies

- To analyze competitive developments, such as expansions, joint ventures, new products launches, and acquisitions adopted by the leading players to strengthen their position in the gear oil market

See how this study impacted revenues for other players in Gear Oil Market

Clients Problem Statement

Our client, a fuels and lubricant additive company, was keen to increase its market penetration in the gear oil business. The senior management needed to know who the major gearbox manufacturers across the globe are, which gearbox manufacturers to target, and what offering/value proposition to build for target customers.

MnM Approach

For the target product, MnM assisted the client with an outside-in perspective on the market potential in supplying gear oil to major gearbox suppliers across the globe. Further, we helped them identify top gearbox manufacturers to collaborate with, the annual turnover from gearboxes, the total number of gearboxes sold in a year, the average volume of oil in their gearboxes, and oil refill intervals for each application area. Interviews with a host of potential customers in different regions were conducted to understand their unmet needs, supplier selection criteria, and what they looked for in a product. This helped our client refine their value proposition to quickly gain a market share.

Revenue Impact (RI)

Our findings helped the client to penetrate USD 3-3.5 million market, with projected revenue of USD 1 million in 5 years. The client was able to grow its customer base across the globe.

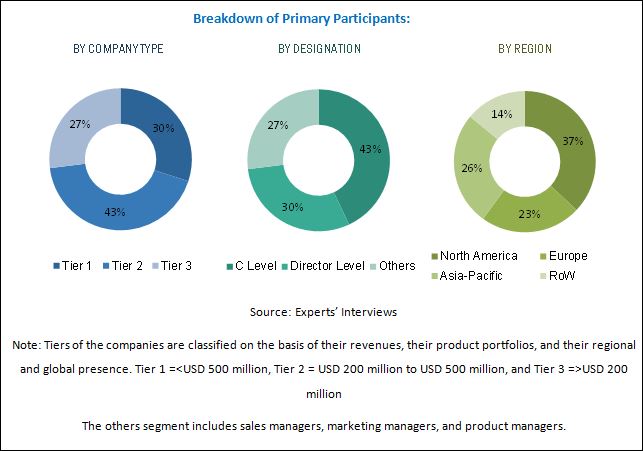

This technical, market-oriented, and commercial research study of the gear oil market involves the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, among others, to identify and collect information on the gear oil market. The primary sources mainly include several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. After arriving at the overall market size, the total market has been split into several segments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during the research study on the gear oil market:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of gear oils includes various raw material manufacturing companies, such as Exxon Mobil Corporation (U.S.), Royal Dutch Shell plc (Netherlands), and BP p.l.c. (U.K.), among others. These companies are vertically integrated into the value chain and produce crude oil for manufacturing different types of gear oils. However, companies such as Amalie Oil Co. (U.S.) and Eni SpA (Italy) are engaged in the production of gear oils from crude oil and different types of additives that are provided by various raw material suppliers. After the completion of the production process, gear oils are distributed in the market through different channels. The blending plants supply their products to distributors, which are further distributed among retailers, independent workshops, and garages. The major end-use industries for gear oils are construction, mining, metal production, cement production, automotive, power generation, marine, food processing, oil & gas, paper, wood, and aviation, among others.

The target audiences for the gear oil market report are as follows:

- Manufacturers of Gear Oils

- Raw Material Suppliers

- Investment Banks

- Distributors of Gear Oils

- Government Bodies

Scope of the Report

This report categorizes the gear oil market on the basis of base oil, end-use industry, and region.

Gear Oil Market, by Base Oil:

- Mineral Oil

- Synthetic Oil

- Polyalphaolefin (PAO)

- Polyalkylene Glycol (PAG)

- Esters

- Group III (Hydro Cracking)

- Semi-Synthetic Oil

- Bio-based Oil

Gear Oil Market, by End-use Industry:

- General Industrial

- Manufacturing

- Power Generation

- Metal Production

- Cement Production

- Others

- Paper

- Textile

- Food

- Lumber & Wood

- Rubber & Plastic

- Construction

- Agriculture

- Oil & Gas

- Mining

- Others

- Manufacturing

- Transportation

- Automotive

- Marine

- Aviation

- Railway

Gear Oil Market, by Region:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country and additional end-use industry

Country Information

- Additional country information (up to three)

Company Information

- Detailed analysis and profiles of additional market players (up to five)

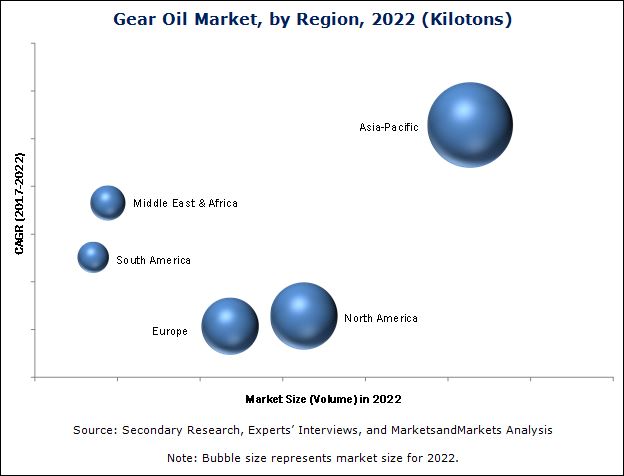

The gear oil market was valued at USD 7.32 Billion in 2016 and is projected to reach USD 8.58 Billion by 2022, at a CAGR of 2.69% from 2017 to 2022. In terms of volume, the market is projected to reach 2,496.0 kilotons by 2022. The massive industrial growth in the Middle East & Africa and Asia-Pacific regions, coupled with the rising demand for gear oils from the automotive and power industries are key factors driving the growth of the gear oil market during the forecast period.

On the basis of the base oil, the gear oil market has been classified into mineral oil, synthetic oil [polyalphaolefin (PAO), polyalkylene glycol (PAG), esters, and group III], semi-synthetic oil, and bio-based oil. The mineral oil segment is projected to lead the gear oil market during the forecast period. The growth of the mineral oil segment of the market can be attributed to the easy availability of mineral oils at low cost. However, the semi-synthetic oil segment of the gear oil market is projected to grow at the highest CAGR during the forecast period mainly due to advanced properties offered by these oils at low cost.

Based on the end-use industry, the gear oil market has been segmented into general industrial [manufacturing (power, metal, cement, and others), mining, construction, oil & gas, agriculture, and others (defense, port handling equipment, and forestry)], and transportation (automotive, marine, aviation, and railway). The demand for gear oils is high from the general industrial segment due increase in the construction activities in the residential sector of China and rapid infrastructural developments taking place in India.

The gear oil market has been studied for Asia-Pacific, Europe, North America, the Middle East & Africa, and South America. The Asia-Pacific region is the largest for gear oils across the globe. The Asia-Pacific gear oil market is projected to grow at the highest CAGR during the forecast period. The increasing disposable income of the middle-class population of the Asia-Pacific region makes it an attractive market for manufacturers of gear oils. The tremendous increase in the industrial production and growth in trade activities in the region are primarily responsible for the high consumption of gear oils in the Asia-Pacific region.

The increase in the use of automatic transmission systems is hindering the growth of manual transmission systems, which, in turn, is expected to restrain the growth of the gear oil market as gear oils do not contain the additives required for the easy functioning of automatic transmissions. Thus, the growth of the gear oil market is expected to decline between 2017 and 2022. Moreover, the stringent implementation of various environmental regulations related to the use of environment-friendly products in developed economies is expected to limit the demand for gear oils between 2017 and 2022.

Some of the key players in the gear oil market are Exxon Mobil Corporation (U.S.), Royal Dutch Shell plc (Netherlands), Chevron Corporation (U.S.), BP p.l.c. (U.K.), Total S.A. (France), PetroChina Company Limited (China), Sinopec Limited (China), LUKOIL (Russia), Fuchs Petrolub SE (Germany), and Idemitsu Kosan Co., Ltd (Japan), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Market Scope

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Significant Opportunities in Gear Oil Market

4.2 Gear Oil Market, By Region, 20172022

4.3 Gear Oil Market in Asia-Pacific, By Base Oil, and Country

4.4 Gear Oil Market Share, By Base Oil

4.5 Gear Oil Market Attractiveness

4.6 Gear Oil Market Share, By End-Use Industry and Region, 2016

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Massive Industrial Growth in Asia-Pacific and Middle East & Africa

5.2.1.2 Improved Quality of Gear Oils

5.2.1.3 Growing Automotive Industry in Asia-Pacific

5.2.1.4 Increasing Demand From Power Industry

5.2.2 Restraints

5.2.2.1 Technological Advancements

5.2.2.2 Stringent Environmental Regulations

5.2.3 Opportunities

5.2.3.1 Availability of Semi-Synthetic Gear Oils

5.2.3.2 Zinc Free (Ash Less) Gear Oils

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Industry Outlook

5.4.1 Automotive

5.4.2 Manufacturing Industry

6 Gear Oil Market, By Base Oil (Page No. - 54)

6.1 Introduction

6.2 Market Size Estimation

6.3 Mineral Oil

6.3.1 Asia-Pacific Driving Growth of Mineral Based Gear Oil

6.4 Synthetic Oil

6.4.1 Increased Industrial Production to Drive Demand for Synthetic Based Gear Oil Between 2017 and 2022

6.4.2 PAO

6.4.3 PAG

6.4.4 Esters

6.4.5 Group III (Hydrocracking)

6.5 Semi-Synthetic Oil

6.5.1 High Performance at Low Cost to Drive Demand for Semi-Synthetic Based Gear Oil Between 2017 and 2022

6.6 Bio-Based Oil

7 Gear Oil Market, By End-Use Industry (Page No. - 65)

7.1 Introduction

7.2 Market Size Estimation

7.3 General Industrial

7.3.1 Manufacturing

7.3.1.1 Power Generation

7.3.1.2 Metal Production

7.3.1.3 Cement Production

7.3.1.4 Others

7.3.1.4.1 Paper

7.3.1.4.2 Textile

7.3.1.4.3 Food

7.3.1.4.4 Lumber & Wood

7.3.1.4.5 Rubber & Plastic

7.3.2 Mining

7.3.3 Construction

7.3.4 Oil & Gas

7.3.5 Agriculture

7.3.6 Others

7.4 Transportation

7.4.1 Automotive

7.4.2 Marine

7.4.3 Aviation

7.4.4 Railway

8 Gear Oil Market, By Region (Page No. - 87)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 India

8.2.3 Japan

8.2.4 Australia & New Zealand

8.2.5 South Korea

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 U.K.

8.4.3 France

8.4.4 Italy

8.4.5 Russia

8.4.6 Spain

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 Iran

8.5.4 South Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Chile

8.6.4 Peru

9 Competitive Landscape (Page No. - 132)

9.1 Introduction

9.1.1 Dynamic

9.1.2 Innovator

9.1.3 Vanguard

9.1.4 Emerging

9.2 Overview

9.3 Product Offerings

9.4 Business Strategy

9.5 Market Share Analysis

9.5.1 Exxonmobil Corporation (U.S.)

9.5.2 Royal Dutch Shell PLC. (Netherland)

9.5.3 BP P.L.C. (U.K.)

10 Company Profiles (Page No. - 137)

10.1 Royal Dutch Shell PLC.

10.1.1 Business Overview

10.1.2 Product Offering Scorecard

10.1.3 Products Offered

10.1.4 Business Strategy Scorecard

10.1.5 Recent Developments

10.2 Exxonobil Corporation

10.2.1 Business Overview

10.2.2 Product Offering Scorecard

10.2.3 Products Offered

10.2.4 Business Strategy Scorecard

10.2.5 Recent Developments

10.3 BP P.L.C.

10.3.1 Business Overview

10.3.2 Product Offering Scorecard

10.3.3 Products Offered

10.3.4 Business Strategy Scorecard

10.4 Chevron Corporation

10.4.1 Business Overview

10.4.2 Product Offering Scorecard

10.4.3 Products Offered

10.4.4 Business Strategy Scorecard

10.4.5 Recent Developments

10.5 Total S.A.

10.5.1 Business Overview

10.5.2 Product Offering Scorecard

10.5.3 Products Offered

10.5.4 Business Strategy Scorecard

10.6 Petrochina Company Limited

10.6.1 Business Overview

10.6.2 Product Offering Scorecard

10.6.3 Products Offered

10.6.4 Business Strategy Scorecard

10.7 Sinopec Limited

10.7.1 Business Overview

10.7.2 Product Offering Scorecard

10.7.3 Products Offered

10.7.4 Business Strategy Scorecard

10.8 Lukoil

10.8.1 Business Overview

10.8.2 Product Offering Scorecard

10.8.3 Products Offered

10.8.4 Business Strategy Scorecard

10.9 Fuchs Petrolub Se

10.9.1 Business Overview

10.9.2 Product Offering Scorecard

10.9.3 Products Offered

10.9.4 Business Strategy Scorecard

10.9.5 Recent Developments

10.10 Idemitsu Kosan Co., Ltd

10.10.1 Business Overview

10.10.2 Product Offering Scorecard

10.10.3 Products Offered

10.10.4 Business Strategy Scorecard

10.11 Other Key Market Players

10.11.1 Phillips 66 Company (U.S.)

10.11.2 Bel-Ray Company LLC. (New Jersey, U.S.)

10.11.3 Morris Lubricants (Shrewsbury, U.K.)

10.11.4 Penrite Oil (Melbourne, Australia)

10.11.5 Bechem Lubrication Technology LLC. (Ohio, U.S.)

10.11.6 Valvoline Inc. (Lexington, U.S.)

10.11.7 Peak Lubricants Pty Lyd (Victoria, Australia)

10.11.8 Rock Valley Oil & Chemical Co. (Illinois, U.S.)

10.11.9 Liqui Moly GmbH (ULM, Germany)

10.11.10 Indian Oil Corporation Ltd (Delhi, India)

10.11.11 ENI SPA (Rome, Italy)

10.11.12 Croda International PLC. (Yorkshire, U.K.)

10.11.13 Addinol Lube Oil GmbH (Leuna, Germany)

10.11.14 Advanced Lubrication Specialitis Inc. (Pennsylvania)

10.11.15 Amalie Oil Co. (Florida, U.S.)

11 Appendix (Page No. - 166)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (105 Tables)

Table 1 Annual GDP and Industrial Production Growth Rate of Countries in Asia-Pacific

Table 2 Asia Wind Power Capacity, 2016

Table 3 Europe Wind Power Capacity, 2016

Table 4 North America Wind Power Capacity, 2016

Table 5 Latin America & Caribbean Wind Power Capacity, 2016

Table 6 Pacific Region Wind Power Capacity, 2016

Table 7 Vehicles in Use, By Region & Country, 2010-2014

Table 8 Gear Oil Market Size, By Base Oil, 20152022 (USD Million)

Table 9 Gear Oil Market Size, By Base Oil, 20152022 (Kiloton)

Table 10 Mineral Based Gear Oil Market Size, By Region, 20152022 (USD Million)

Table 11 Mineral Based Market Size, By Region, 20152022 (Kiloton)

Table 12 Synthetic Based Gear Oil Market Size, By Region, 20152022 (USD Million)

Table 13 Synthetic Based Market Size, By Region, 20152022 (Kiloton)

Table 14 Semi-Synthetic Based Gear Oil Market Size, By Region, 20152022 (USD Million)

Table 15 Semi-Synthetic Based Market Size, By Region, 20152022 (Kiloton)

Table 16 Bio-Based Gear Oil Market Size, By Region, 20152022 (USD Million)

Table 17 Bio-Based Market Size, By Region, 20152022 (Kiloton)

Table 18 Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 19 Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 20 Market Size in General Industrial, By Region, 20152022 (USD Million)

Table 21 Market Size in General Industrial, By Region, 20152022 (Kiloton)

Table 22 Market Size in Manufactuirng, By Region, 20152022 (USD Million)

Table 23 Market Size in Manufacturing, By Region, 20152022 (Kiloton)

Table 24 Market Size in Mining, By Region, 20152022 (USD Million)

Table 25 Market Size in Mining, By Region, 20152022 (Kiloton)

Table 26 Market Size in Construction, By Region, 20152022 (USD Million)

Table 27 Market Size in Construction, By Region, 20152022 (Kiloton)

Table 28 Market Size in Oil & Gas, By Region, 20152022 (USD Million)

Table 29 Market Size in Oil & Gas, By Region, 20152022 (Kiloton)

Table 30 Market Size in Agriculture, By Region, 20152022 (USD Million)

Table 31 Market Size in Agriculture, By Region, 20152022 (Kiloton)

Table 32 Market Size in Others, By Region, 20152022 (USD Million)

Table 33 Market Size in Others, By Region, 20152022 (Kiloton)

Table 34 Market Size in Transportation, By Region, 20152022 (USD Million)

Table 35 Market Size in Transportation, By Region, 20152022 (Kiloton)

Table 36 Market Size in Automotive, By Region, 20152022 (USD Million)

Table 37 Market Size in Automotive, By Region, 20152022 (Kiloton)

Table 38 Market Size in Marine, By Region, 20152022 (USD Million)

Table 39 Market Size in Marine, By Region, 20152022 (Kiloton)

Table 40 Market Size in Aviation, By Region, 20152022 (USD Million)

Table 41 Market Size in Aviation, By Region, 20152022 (Kiloton)

Table 42 Market Size in Railway, By Region, 20152022 (USD Million)

Table 43 Market Size in Railway, By Region, 20152022 (Kiloton)

Table 44 Market Size, By Region, 20152022 (USD Million)

Table 45 Market Size, By Region, 20152022 (Kiloton)

Table 46 Asia-Pacific: Gear Oil Market Size, By Country, 20152022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Country, 20152022 (Kiloton)

Table 48 Asia-Pacific: Market Size, By Base Oil, 20152022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Base Oil, 20152022 (Kiloton)

Table 50 Asia-Pacific: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 51 Asia-Pacific: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 52 China: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 53 China: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 54 India: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 55 India: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 56 Japan: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 57 Japan: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 58 North America: Gear Oil Market Size, By Country, 20152022 (USD Million)

Table 59 North America: Market Size, By Country, 20152022 (Kiloton)

Table 60 North America: Market Size, By Base Oil, 20152022 (USD Million)

Table 61 North America: Market Size, By Base Oil, 20152022 (Kiloton)

Table 62 North America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 63 North America: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 64 U.S.: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 65 U.S.: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 66 Canada: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 67 Canada: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 68 Mexico: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 69 Mexico: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 70 Europe: Gear Oil Market Size, By Country, 20152022 (USD Million)

Table 71 Europe: Market Size, By Country, 20152022 (Kiloton)

Table 72 Europe: Market Size, By Base Oil, 20152022 (USD Million)

Table 73 Europe: Market Size, By Base Oil, 20152022 (Kiloton)

Table 74 Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 75 Europe: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 76 Germany: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 77 Germany: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 78 U.K.: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 79 U.K.: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 80 Fance: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 81 France: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 82 Middle East & Africa: Gear Oil Market Size, By Country, 20152022 (USD Million)

Table 83 Middle East & Africa: Market Size, By Country, 20152022 (Kiloton)

Table 84 Middle East & Africa: Market Size, By Base Oil, 20152022 (USD Million)

Table 85 Middle East & Africa: Market Size, By Base Oil, 20152022 (Kiloton)

Table 86 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 87 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 88 Saudi Arabia: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 89 Saudi Arabia: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 90 UAE: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 91 UAE: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 92 Iran: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 93 Iran: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 94 South America: Gear Oil Market Size, By Country, 20152022 (USD Million)

Table 95 South America: Market Size, By Country, 20152022 (Kiloton)

Table 96 South America: Market Size, By Base Oil, 20152022 (USD Million)

Table 97 South America: Market Size, By Base Oil, 20152022 (Kiloton)

Table 98 South America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 99 South America: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 100 Brazil: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 101 Brazil: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 102 Argentina: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 103 Argentina: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 104 Chile: Gear Oil Market Size, By End-Use Industry, 20152022 (USD Million)

Table 105 Chile: Market Size, By End-Use Industry, 20152022 (Kiloton)

List of Figures (77 Figures)

Figure 1 Gear Oil: Market Segmentation

Figure 2 Gear Oil Market: Research Design

Figure 3 Gear Oil: Data Triangulation

Figure 4 General Industrial to Be Largest Industry in the Gear Oil Market in 2017

Figure 5 Semi-Synthetic Oil to Be Fastest-Growing Base Oil in Gear Oil Market During Forecast Period

Figure 6 Asia-Pacific to Be Fastest-Growing Market of Gear Oil Between 2017 and 2022

Figure 7 Moderate Growth in Gear Oil Market Between 2017 and 2022

Figure 8 Asia-Pacific to Be the Largest Market for Gear Oil

Figure 9 China Accounted for Largest Market Share in Asia-Pacific Gear Oil Market in 2016

Figure 10 Mineral Gear Oil Market to Account for Largest Share

Figure 11 Massive Industrial Growth in Asia-Pacific to Drive the Gear Oil Market in the Region, During the Forecast Period

Figure 12 General Industrial Was Largest Industry in Gear Oil Market in 2016

Figure 13 Overview of Factors Governing Gear Oil Market

Figure 14 Porters Five Forces Analysis

Figure 15 Vehicles in Use, By Region, 2014

Figure 16 Manufacturing Industry Growth Rate, 2015

Figure 17 Mineral to Be Largest Base Oil in Gear Oil Market Between 2017 and 2022

Figure 18 Asia-Pacific is Projected to Be Largest Mineral Oil Market for Gear Oil Between 2017 and 2022

Figure 19 Europe Projected to Be the Largest Synthetic Based Gear Oil Market Between 2017 and 2022

Figure 20 Europe Projected to Be the Largest Semi-Synthetic Based Gear Oil Market Between 2017 and 2022

Figure 21 Europe Projected to Be Largest Bio-Based Oil Market for Gear Oil Between 2017 and 2022

Figure 22 General Industrial to Be the Largest Industry of Gear Oil Between 2017 and 2022

Figure 23 Asia-Pacific to Be the Largest Gear Oil Market in the General Industrial Between 2017 and 2022

Figure 24 Asia-Pacific to Be the Largest Gear Oil Market in the Manufacturing Between 2017 and 2022

Figure 25 Asia-Pacific to Be the Largest Market for Gear Oil in the Mining Industry Between 2017 and 2022

Figure 26 Asia-Pacific to Be the Largest Market for Gear Oil in the Construction Industry Between 2017 and 2022

Figure 27 North America to Be the Second-Largest Market for Gear Oil in the Oil & Gas Industry Between 2017 and 2022

Figure 28 Asia-Pacific to Be the Largest Market for Gear Oil in the Agriculture Industry Between 2017 and 2022

Figure 29 Asia-Pacific to Be the Largest Market for Gear Oil in the Others Industry Between 2017 and 2022

Figure 30 Asia-Pacific to Be the Largest Market for Gear Oil in the Transportation Industry Between 2017 and 2022

Figure 31 Asia-Pacific to Be the Largest Market for Gear Oil in the Automotive Industry Between 2017 and 2022

Figure 32 North America to Be the Second-Largest Market for Gear Oil in the Marine Industry Between 2017 and 2022

Figure 33 Asia-Pacific to Be the Largest Market for Gear Oil in the Aviation Industry Between 2017 and 2022

Figure 34 North America to Be the Second-Largest Market for Gear Oil in the Railway Industry Between 2017 and 2022

Figure 35 India is the Emerging Market for Gear Oil

Figure 36 Asia-Pacific Market Snapshot: China Dominates the Gear Oil Market in Asia-Pacific

Figure 37 Australia & New Zealand: Gear Oil Market Size, 20152022

Figure 38 South Korea: Gear Oil Market Size, 20152022

Figure 39 North America Market Snapshot: U.S. Dominates the Gear Oil Market

Figure 40 Europe Market Snapshot: U.K. to Register the Highest CAGR During the Forecast Period

Figure 41 Italy: Gear Oil Market Size, 20152022

Figure 42 Russia: Gear Oil Market Size, 20152022

Figure 43 Spain: Gear Oil Market Size, 20152022

Figure 44 South Africa: Gear Oil Market Size, 20152022

Figure 45 Peru: Gear Oil Market Size, 20152022

Figure 46 Dive Chart

Figure 47 Gear Oil Market Share, By Company: 2016

Figure 48 Royal Dutch Shell PLC.: Company Snapshot

Figure 49 Product Offering: Scorecard

Figure 50 Business Strategy: Scorecard

Figure 51 Exxonmobil Corporation: Company Snapshot

Figure 52 Product Offering: Scorecard

Figure 53 Business Strategy: Scorecard

Figure 54 BP P.L.C.: Company Snapshot

Figure 55 Product Offering: Scorecard

Figure 56 Business Strategy: Scorecard

Figure 57 Chevron Corporation: Company Snapshot

Figure 58 Product Offering: Scorecard

Figure 59 Business Strategy: Scorecard

Figure 60 Total S.A.: Company Snapshot

Figure 61 Product Offering: Scorecard

Figure 62 Business Strategy: Scorecard

Figure 63 Petrochina Company Limited: Company Snapshot

Figure 64 Product Offering: Scorecard

Figure 65 Business Strategy: Scorecard

Figure 66 Sinopec Limited: Company Snapshot

Figure 67 Product Offering: Scorecard

Figure 68 Business Strategy: Scorecard

Figure 69 Lukoil : Company Snapshot

Figure 70 Product Offering: Scorecard

Figure 71 Business Strategy: Scorecard

Figure 72 Fuchs Petrolub Se: Company Snapshot

Figure 73 Product Offering: Scorecard

Figure 74 Business Strategy: Scorecard

Figure 75 Idemitsu Kosan Co., Ltd.: Company Snapshot

Figure 76 Product Offering: Scorecard

Figure 77 Business Strategy: Scorecard

Growth opportunities and latent adjacency in Gear Oil Market