Garage Equipment Market by Type (OEM, Independent), Application (Body Shop, Diagnostic & Testing, Emission, Lifting, Wheel & Tire, Washing), Installation (Mobile, Fixed), Function (Mechanical, Electronic), Vehicle, and Region - Global Forecast to 2027

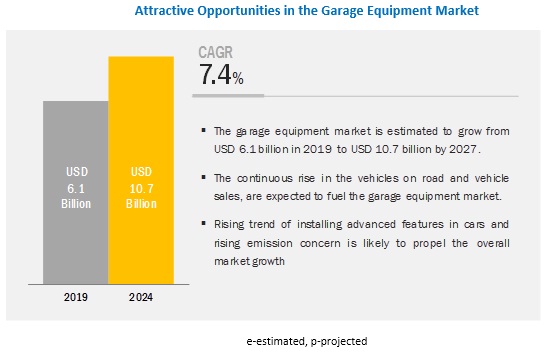

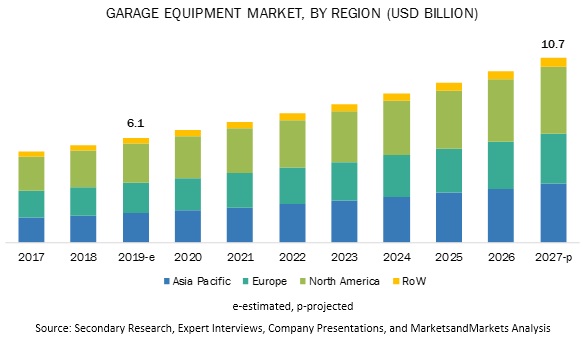

[122 Pages Report] The global garage equipment market is projected to grow from USD 6.1 billion in 2019 to USD 10.7 billion by 2027, at a CAGR of 7.4%. Factors such as the advent of autonomous vehicles, implementation of advanced connectivity features, OEM and government focus on electric vehicles, use of sensor data for preventive maintenance, and concerns of vehicle and passenger safety are driving the market.

The emission equipment segment is expected to be the fastest-growing market during the forecast period

The emission equipment segment is expected to be the fastest-growing market during the forecast period. The increasing pollution level is one of the major concerns for the government and OEMs around the world. Common emission equipment includes exhaust gas analyzers, diesel smoke meters, and emission testers. This equipment measures various pollutants such as carbon monoxide, carbon dioxide, and nitrogen oxides. Such toxic compounds present in combustion gases have an adverse effect on the health conditions of people living in urban areas. Long term exposure to pollutant gases can even lead to permanent health deteriorations.

Due to the availability of emission equipment, the existing vehicles now periodically go through emission testing to comply with the latest emission standards of the respective countries. Boston Garage Equipment Ltd., Manatec Electronics Private Ltd., and Arex are major players for emission equipment in the garage equipment market. Boston Garage Equipment Ltd. offers exhaust gas analyzers with both cabled and wireless configurations. On the other hand, Manatec Electronics Private Ltd. provides more compact and portable emission tester for real-world driving tests.

Independent garages are expected to lead the garage equipment market during the forecast period

Post-warranty, majority of the car owners approach independent garages due to inexpensive labor cost in these garages. Also, the usage of genuine after-market products has grown significantly in the independent garages to attract premium car owners. Usage of authorized products and affordable labor costs made independent garages, a preferred option for preventive maintenance such as routine repairs, oil check-ups, and others. Moreover, due to the increasing repair and maintenance cost in the OEM authorized garages, the car owners are getting their cars serviced from independent garages. Such trends will increase the demand for garage equipment for independent garages.

North America is expected to lead the market during the forecast period

The North American automotive industry is one of the most advanced in the world. The US is the major country fuelling the growth in the region. The automotive industry in the country is inclined towards innovation, technology, and development of high-performance and fuel-efficient vehicles. The advancements in sensors and IoT devices had led the OEMs to implement advanced features. The country is expected to play a major role in the growth of autonomous vehicles in the US. Also, commercial vehicle sales increased by 6.9% to reach 15,152,39 units in 2018. The rising logistic demand and innovation from American OEMs will influence the demand for more garage equipment. Also, The North American Free Trade Agreement (NAFTA) has fostered the growth of the automotive industry in the region. The large customer base and high disposable income levels in the country have fuelled the demand for premium connected vehicles. The increasing number of these vehicles would boost the market for garage equipment in the future.

Key Market Players

The global garage equipment market is dominated by major players such as Arex Test Systems B.V. (Netherland), Gray Manufacturing Company Inc. (US), Snap-On Incorporated (US), Vehicle Service Group (US), Robert Bosch (Germany), Continental AG (Germany), Maha Maschinenbau Haldenwang GmbH & Co. (Germany), Boston Garage Equipment Ltd (UK) and many others. These companies have strong distribution networks at a global level. Besides, these companies offer a wide range of equipment in the market. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Thousand Units), Value (USD Million) |

|

Segments covered |

Garage Type, application, installation, vehicle, function type, and region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies Covered |

Arex Test Systems B.V. (Netherland), Gray Manufacturing Company Inc (US), Snap-On Incorporated (US), Vehicle Service Group (US), Robert Bosch (Germany), Continental AG (Germany), Maha Maschinenbau Haldenwang Gmbh & Co (Germany), Boston Garage Equipment Ltd (UK) and many others. Total of 25 major players are covered under the report. |

This research report categorizes the garage equipment market based on garage type, application, installation, function, vehicle type, and region.

Based on garage type, the market has been segmented as follows:

- OEM authorized garage

- Independent garage

Based on application, the market has been segmented as follows:

- Body Shop Equipment

- Diagnostic & Testing Equipment

- Emission Equipment

- Lifting Equipment

- Washing Equipment

- Wheel & Tire Equipment

- Others

Based on the installation type, the market has been segmented as follows:

- Mobile

- Fixed

Based on function type, the market has been segmented as follows:

- Electronic

- Mechanical

Based on vehicle type, the market has been segmented as follows:

- PC

- CV

Based on the region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Rest of Europe

-

Rest of the World

- Brazil

- Iran

- Rest of RoW

Recent Developments

- In February 2019, Continental launched TPMS GO, an entry-level service tool for tire pressure monitoring systems (TPMS). According to the company, this new device would be practical, rugged, and economical as workshop equipment.

- In July 2019, John Bean launched a new swing arm tire changer called John Bean T2545T. It would be ideal for handling passenger cars and light trucks due to its compact design, easy, and quick set up.

- In May 2019, OMCN unveiled a newly developed lift model 190/EV, specially designed for electric vehicles. This lift would help to install and to remove battery packs easy for electric vehicles.

- In July 2019, Workshop supplier MAHA had opened a new training center in Haldenwang. This new center would provide hands-on training and practical guide to the workshop technicians.

Critical Questions:

- How will increasing vehicle parc impact the growth of garage equipment?

- What is the impact of stringent emission norms on the market?

- What are the upcoming trends in garage equipment? What impact would they make post-2022?

- What are the key strategies adopted by the top players to increase their revenue?

- Which are the highest revenue-generating countries in the world?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.1.2.3 Key Data From Primary Sources

2.2 Garage Equipment Market Size Estimation

2.2.1 Bottom-Up Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Garage Equipment Market to Grow at A Significant Rate During the Forecast Period (2019–2027)

4.2 North America to Lead the Global Market

4.3 Market, By Vehicle Type and Garage Type

4.4 Market, By Garage Type

4.5 Market, By Equipment Type

4.6 Market, By Installation Type

4.7 Market, By Function Type

4.8 Market, By Vehicle Type

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Garage Equipment Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Sales of Pre-Owned Vehicles

5.2.1.2 Vehicle Inspection Mandates

5.2.2 Restraints

5.2.2.1 International Trade Regulations

5.2.3 Opportunities

5.2.3.1 Demand for Ecu and Other Electronic Features

5.2.3.2 Strict Emission Regulations

5.2.4 Challenges

5.2.4.1 Intense Competition

5.2.5 Impact of Market Dynamics

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Porter’s Five Forces

6.3 Value Chain Analysis

6.4 Macroeconomic Indicator Analysis

6.4.1 Growth of Garage Equipment

6.4.2 GDP (USD Billion)

6.4.3 GNI Per Capita: Atlas Method (USD)

6.4.4 GDP Per Capita (PPP) (USD)

6.4.5 Macroindicators Influencing the Garage Equipment Market in the Top Three Countries

6.4.5.1 Germany

6.4.5.2 Us

6.4.5.3 China

7 Garage Equipment Market, By Function Type (Page No. - 41)

7.1 Introduction

7.2 Research Methodology

7.3 Mechanical

7.3.1 Adoption of Mechanical Garage Equipment in Developing Countries Will Drive the Market

7.4 Electronic

7.4.1 Garage Automation Will Drive the Demand for Advanced Electronic Garage Equipment

8 Garage Equipment Market, By Garage Type (Page No. - 46)

8.1 Introduction

8.2 Research Methodology

8.3 OEM Authorized Garage

8.3.1 Adoption of Certified Equipment Would Drive the Market for Garage Equipment in OEM Authorized Garages

8.4 Independent Garage

8.4.1 Safe Garage Operations Will Demand Better Garage Equipment for Independent Garages

9 Garage Equipment Market, By Installation Type (Page No. - 51)

9.1 Introduction

9.2 Research Methodology

9.3 Mobile

9.3.1 Increase in Mobile Auto Repair Solutions Would Drive the Market

9.4 Fixed

9.4.1 Increase in Number of Heavy Duty Vehicles Will Require More Fixed Equipment

10 Garage Equipment Market, By Equipment Type (Page No. - 56)

10.1 Introduction

10.2 Research Methodology

10.3 Body Shop Equipment

10.3.1 New Lightweight Body Materials Will Fuel the Growth of Body Shop Equipment

10.4 Diagnostic & Testing Equipment

10.4.1 Use of Efficient Engines Will Enhance the Demand for Specialized Garage Equipment

10.5 Emission Equipment

10.5.1 Stringent Emission Standards Would Drive the Demand for Emission Equipment

10.6 Lifting Equipment

10.6.1 Rising Demand for Suvs Over Hatchbacks Would Boost the Demand for High Capacity Lifts

10.7 Washing Equipment

10.7.1 Adoption of Automatic Car Washing System Will Drive the Washing Equipment Market

10.8 Wheel & Tire Equipment

10.8.1 Adoption of Smart Tires Would Enhance the Demand for Periodic Tire and Wheel Maintenance

10.9 Others

10.9.1 Demand for Preventive Measures Will Drive the Market During the Forecast Period

11 Garage Equipment Market, By Vehicle Type (Page No. - 67)

11.1 Introduction

11.2 Research Methodology

11.3 Passenger Car

11.3.1 Implementation of Advanced Safety Features Will Require Regular Inspection of Passenger Cars

11.4 Commercial Vehicle

11.4.1 Implementation of Stringent Emission Regulation Will Require Advanced Emission Testing Equipment

12 Garage Equipment Market, By Region (Page No. - 72)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.2 India

12.2.3 Japan

12.2.4 South Korea

12.2.5 Rest of Asia Pacific

12.3 Europe

12.3.1 France

12.3.2 Germany

12.3.3 Italy

12.3.4 Russia

12.3.5 Spain

12.3.6 UK

12.3.7 Rest of Europe

12.4 North America

12.4.1 Canada

12.4.2 Mexico

12.4.3 US

12.5 Rest of the World (RoW)

12.5.1 Brazil

12.5.2 Iran

12.5.3 Others

13 Competitive Landscape (Page No. - 85)

13.1 Overview

13.2 Garage Equipment Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 New Product Developments

13.3.2 Expansions

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Innovators

13.4.3 Dynamic Differentiators

13.4.4 Emerging Companies

13.5 Strength of Product Portfolio

13.6 Business Strategy Excellence

14 Company Profiles (Page No. - 93)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

14.1 Dover Corporation

14.2 Continental AG

14.3 Robert Bosch GmbH

14.4 Snap-On Incorporated

14.5 Fortive Corporation

14.6 Cemb S.P.A

14.7 Boston Garage Equipment Ltd

14.8 Aro Equipments Pvt. Ltd

14.9 Arex Test Systems B.V.

14.10 Gray Manufacturing Company

14.11 Guangzhou Jingjia Auto Equipment Co. Ltd

14.12 Maha Maschinenbau Haldenwang GmbH & Co

14.13 Beissbarth Automotive Service Equipment

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14.14 Other Key Players

14.14.1 Asia Pacific

14.14.1.1 Sarveshwari Engineers

14.14.1.2 Oil Lube Systems Pvt Ltd

14.14.1.3 Manatec Electronics Private Limited

14.14.2 Europe

14.14.2.1 Istobal

14.14.2.2 Straightset

14.14.2.3 V-Tech

14.14.2.4 Corghi

14.14.3 North America

14.14.3.1 Hunter Engineering Company

14.14.3.2 National Auto Tools

14.14.3.3 Twin Busch Lp

14.14.3.4 Mohawk Lifts

14.14.3.5 Standard Tools and Equipment Co

15 Appendix (Page No. - 116)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (56 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Germany: Macroeconomic Indicators Influencing the Market

Table 3 US: Macroeconomic Indicators Influencing the Market

Table 4 China: Macroeconomic Indicators Influencing the Market

Table 5 Garage Equipment Market, By Function Type, 2017–2027 (000’ Units)

Table 6 Market, By Function Type, 2017–2027 (USD Million)

Table 7 Mechanical: Market, By Region, 2017–2027 (000’ Units)

Table 8 Mechanical: Market, By Region, 2017–2027 (USD Million)

Table 9 Electronic: Market, By Region, 2017–2027 (000’ Units)

Table 10 Electronic: Market, By Region, 2017–2027 (USD Million)

Table 11 Market, By Garage Type, 2017–2027 (000’ Units)

Table 12 Market, By Garage Type, 2017–2027 (USD Million)

Table 13 OEM Authorized Garage: Market, By Region, 2017–2027 (000’ Units)

Table 14 OEM Authorized Garage: Market, By Region, 2017–2027 (USD Million)

Table 15 Independent Garage: Market, By Region, 2017–2027 (000’units)

Table 16 Independent Garage: Market, By Region, 2017–2027 (USD Million)

Table 17 Market Size, By Installation Type, 2017–2027 (‘000 Units)

Table 18 Market Size, By Installation Type, 2017–2027 (USD Million)

Table 19 Mobile: Market Size, By Region, 2017–2027 (‘000 Units)

Table 20 Mobile: Market, By Region, 2017–2027 (USD Million)

Table 21 Fixed: Market Size, By Region, 2017–2027 (‘000 Units)

Table 22 Fixed: Market Size, By Region, 2017–2027 (USD Million)

Table 23 Market, By Equipment Type, 2017–2027 (000’ Units)

Table 24 Garage Equipment Market, By Equipment Type, 2017–2027 (USD Million)

Table 25 Body Shop Equipment: Market, By Region, 2017–2027 (000’ Units)

Table 26 Body Shop Equipment: Market, By Region, 2017–2027 (USD Million)

Table 27 Diagnostic & Testing Equipment: Market, By Region, 2017–2027 (000’ Units)

Table 28 Diagnostic & Testing Equipment: Market, By Region, 2017–2027 (USD Million)

Table 29 Emission Equipment: Market, By Region, 2017–2027 (000’ Units)

Table 30 Emission Equipment: Market, By Region, 2017–2027 (USD Million)

Table 31 Lifting Equipment: Market, By Region, 2017–2027 (000’ Units)

Table 32 Lifting Equipment: Market, By Region, 2017–2027 (USD Million)

Table 33 Washing Equipment: Market, By Region, 2017–2027 (000’units)

Table 34 Washing Equipment: Market, By Region, 2017–2027 (USD Million)

Table 35 Wheel & Tire Equipment: Market, By Region, 2017–2027 (000’units)

Table 36 Wheel & Tire Equipment: Market, By Region, 2017–2027 (USD Million)

Table 37 Others: Market, By Region, 2017–2027 (000’units)

Table 38 Others: Market, By Region, 2017–2027 (USD Million)

Table 39 Market, By Vehicle Type, 2017–2027 (000’ Units)

Table 40 Market, By Vehicle Type, 2017–2027 (USD Million)

Table 41 Passenger Car: Market, By Region, 2017–2027 (000’ Units)

Table 42 Passenger Car: Market, By Region, 2017–2027 (USD Million)

Table 43 Commercial Vehicle: Market, By Region, 2017–2027 (000’ Units)

Table 44 Commercial Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 45 Market, By Region, 2017–2027 (000’ Units)

Table 46 Garage Equipment Market, By Region, 2017–2027 (USD Million)

Table 47 Asia Pacific: Market, By Country, 2017–2027 (000’ Units)

Table 48 Asia Pacific: Market, By Country, 2017–2027 (USD Million)

Table 49 Europe: Market, By Country, 2017–2027 (000’ Units)

Table 50 Europe: Market, By Country, 2017–2027 (USD Million)

Table 51 North America: Market, By Country, 2017–2027 (000’ Units)

Table 52 North America: Market, By Country, 2017–2027 (USD Million)

Table 53 Rest of the World: Market, By Country, 2017–2027 (000’ Units)

Table 54 Rest of the World: Market, By Country, 2017–2027 (USD Million)

Table 55 New Product Developments, 2016–2019

Table 56 Expansions, 2019

List of Figures (46 Figures)

Figure 1 Garage Equipment Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Market: Market Dynamics

Figure 8 Market, By Region, 2019–2027

Figure 9 OEM Authorized Segment Holds the Largest Share, By Value, in the Market in 2019

Figure 10 Rising Vehicle Parc, Vehicle Sales, and Connected Services Will Boost the Market

Figure 11 Market Share, By Region, 2019

Figure 12 Passenger Car is Expected to Account for the Largest Share of the Market in 2019

Figure 13 OEM Authorized Garage to Hold the Largest Market Share, 2019 Vs. 2027 (USD Million)

Figure 14 Lifting Equipment to Hold the Largest Market Share, 2019 Vs. 2027 (USD Million)

Figure 15 Fixed Installation to Play A Major Role in the Market, 2019 Vs. 2027 (USD Million)

Figure 16 Electronic is Expected to Be the Fastest Growing Segment of Market, 2019 Vs. 2027 (USD Million)

Figure 17 Passenger Car to Dominate the Market, 2019 Vs. 2027 (USD Million)

Figure 18 Automotive Garage Equipment: Market Dynamics

Figure 19 Porter’s Five Forces

Figure 20 Value Chain Analysis

Figure 21 Garage Equipment Market, By Function Type, 2019 Vs. 2027 (USD Million)

Figure 22 Key Primary Insights

Figure 23 Market, By Garage Type, 2019 Vs. 2027 (USD Million)

Figure 24 Key Primary Insights

Figure 25 Market Size, By Installation Type, 2019 Vs. 2027 (USD Million)

Figure 26 Key Primary Insights

Figure 27 Market, By Equipment Type, 2019 Vs. 2027 (USD Million)

Figure 28 Key Primary Insights

Figure 29 Market, By Vehicle Type, 2019 Vs. 2027 (USD Million)

Figure 30 Key Primary Insights

Figure 31 Market, By Region, 2019 Vs. 2027 (USD Million)

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Europe: Market Snapshot

Figure 34 Key Developments By Leading Players in the Market, 2016–2019

Figure 35 Ranking of Key Players

Figure 36 Market (Global): Competitive Leadership Mapping, 2019

Figure 37 Dover Corporation: Company Snapshot

Figure 38 Dover Corporation: SWOT Analysis

Figure 39 Continental AG: Company Snapshot

Figure 40 Continental AG: SWOT Analysis

Figure 41 Robert Bosch GmbH: Company Snapshot

Figure 42 Robert Bosch: SWOT Analysis

Figure 43 Snap-On Incorporated: Company Snapshot

Figure 44 Snap-On: SWOT Analysis

Figure 45 Fortive Corporation: Company Snapshot

Figure 46 Fortive Corporation: SWOT Analysis

The study involved estimating the current size of the garage equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used for estimating the market size of segments and subsegments.

Secondary Research

Various secondary sources were used in the secondary research process to identify and collect information useful for an extensive commercial study of the global garage equipment market. Secondary sources include company annual reports/presentations, press releases, paid databases, journals, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and MarketsandMarkets data repository.

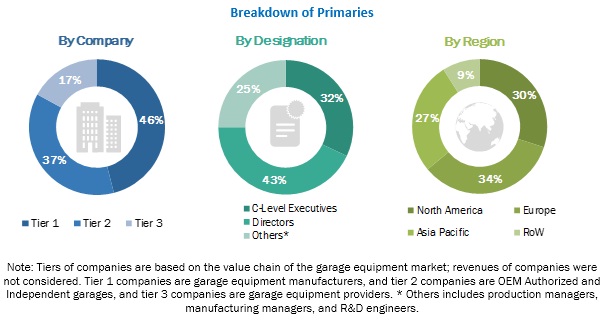

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the garage equipment market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side (OEM Authorized and independent garages) and supply-side (garage equipment providers, OEMs, software providers, and component manufacturers) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 26% and 74% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the garage equipment market. In this approach, the total market size is derived by calculating the number of garages in each country for each vehicle type.

To calculate the volume of the garage equipment market at country level, a total number of garages in each country is multiplied with the penetration of each equipment at a country level and the average number of units of each equipment in a garage. To calculate the value of the market, the average selling price (ASP) of each equipment is identified at the country level. The ASP of each equipment is multiplied with the volume of each equipment for each country. The country-level data are summed up to calculate the regional data, and regional data is added up to derive the total volume and value of the market. All region-level data is added to derive the global market, by application, by function, installation, garage type, and vehicle type.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To estimate the overall garage equipment market size and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the garage equipment market, in terms of volume (Thousand Units) and value (USD billion)

- To define, describe, and forecast the automotive garage equipment market based on garage type, application, installation, function, vehicle, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size by garage-type (OEM authorized and independent garage)

- To segment and forecast the market size by application (body shop equipment, diagnostic & testing equipment, emission equipment, lifting equipment, washing equipment, wheel & tire equipment, and others)

- To segment and forecast the market by vehicle (passenger car and commercial vehicle)

- To segment and forecast the market size by installation (mobile and fixed)

- To segment and forecast the market size by function (electronic and mechanical)

- To forecast the market with respect to key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities for stakeholders and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the garage equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Garage equipment market, by application at country level (for countries not covered in the report)

- Garage equipment market, by vehicle at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Garage Equipment Market