Functional Printing Market by Materials (Substrate, Inks), Technology (Inkjet, Screen, Flexo, Gravure), Application (Sensors, Displays, Batteries, RFID, Lighting, PV, Medical), and Geography (North America, Europe, APAC, ROW) - Global Forecasts and Analysis 2013 – 2020

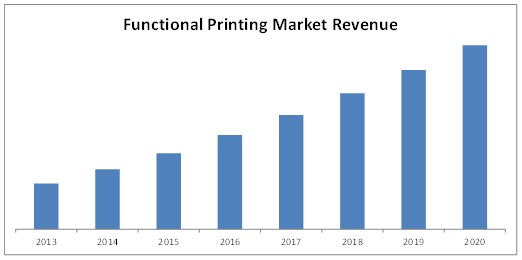

The Functional Printing Market is expected to reach $13.79 Billion by 2020, at a CAGR of 22.08% from 2013 to 2020.

The functional printing market report is a comprehensive research study on the printing technologies and functional inks used for printing electronics. The report covers the entire market with a special focus on the various technologies involved, namely, inkjet, flexo, gravure, screen, and others. The report also showcases market statistics and insights for the major applications. The applications covered in the report are displays, lighting, sensors, photovoltaics, batteries, and RFID.

Over the last decade, the display and lighting markets have realized the potentials of OLED technology and have been witnessing significant developments with regards to this technology. The major restraint compelling the technology from entering the mass markets like smartphones and tablets is its high rate of production. Barring LG and Samsung, in 2012, even the television market did not see many product launches. Moreover, the OLED TVs launched by these companies have been priced to the north of $8000. This trend is expected to soon change with the advent of functional printing. A number of companies have already adopted it for the production of OLED panels. The advantages like lower costs, increased efficiency, durability, higher resolution, and lower material consumption offered by functional printing technologies will, only, see the market, growing in the coming years.

The report contains a detailed comparative study of the major technologies involved in functional printing. The market statistics for these technologies with respect to the major applications and geographies have also been presented. A holistic study of the supporting value chain segments of the market, like the materials (inks and substrates), has been conducted in perspective of the market. The market statistics for the end products; that is the applications like displays, lighting, sensors, photo-voltaics, batteries, and RFID— have been given in the report. All these statistics shown are aimed at providing the revenue stream of the functional printing whilst identifying the major revenue pockets.

Functional printing is a production process that deposits a functional material in a controlled and selective pattern upon a material. It holds a major potential to enable the next wave in high volume electronic production. The existing printing technologies are not only used for printing graphics but, also, have extended their application for printing electronic components and are, hence, used for functional printing. It is used for a number of novel applications like photovoltaic, OLED displays, sensors, RFID, batteries, and OLED lighting.

The report provides the dynamics of the market along with comprehensive forecasts of revenue with regards to— technology, materials, applications, coating, and geography. The functional printing technologies are classified into inkjet, screen printing, gravure, flexography, and others. The material section is further segmented into substrates and ink; and substrates section includes glass, plastic, and paper; and ink has been segmented into conductive inks, dielectric ink, graphene inks, and so on. Applications of functional printing include sensors, displays, batteries, RFID tags, lighting, photovoltaic, medical, and others. This report covers geographical regions which include North America, Europe, Asia Pacific, and Rest of the World.

Source: MarketsandMarkets Analysis

The major factor that is fuelling the growth of the market, currently, is the fact that it is a low cost manufacturing process. The conventional high-volume-low-cost printing techniques enable the production of lightweight and robust electronic components at a lower cost; and this printing process does not involve etching, metalizing, and copper plating, thus eliminating the wastewater treatment.

The stability of the ink for drop formation, the viscosity that must be suitable for the print heads and the ink interaction with the substrate— is taken into account while printing. These are the major factors inhibiting the growth of the market.

The market has been witnessing the convergence of several industry sectors such as printing, materials (substrate, inks, and chemicals), and electronics; which facilitate the development of new products.

The major companies into the functional printing market are GSI technologies (U.S.), Eastman Kodak Company (U.S.), Mark Andy Inc (U.S.), Toppan Printing Co.Ltd (Japan), BASF SE (Germany), DuPont (U.S.), KovioInc (U.S.), Toya Ink International Corp (U.S.), Vorbeck Materials (U.S.), Haiku Tech (U.S.), Xaar (U.K.), Avery Dennison (U.S.), Blue spark Technologies Inc (U.S.), Universal Display Corporation (U.S.), and so on.

Table Of Contents

1 Introduction (Page No. - 21)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 Key Data Points Taken From Primary Sources

1.5.4 Assumptions Made For This Report

2 Executive Summary (Page No. - 34)

3 Cover Story – Interview With Director of Marketing And Sales, Trident-ITW (Page No. - 38)

4 Market Overview (Page No. - 42)

4.1 Introduction

4.2 Market Definition & Segmentation

4.3 History and Evolution

4.4 Value Chain Analysis

4.5 Market Dynamics

4.5.1 Drivers

4.5.1.1 Low Manufacturing Cost, Wide Range of Substrates and High Speed Manufacturing

4.5.1.2 Simplified Additive Manufacturing to Print Fine Features And Structures Onto All Substrates

4.5.1.3 Roll-To-Roll Printing for Large Area Processing, Which Offers Significant Cost Advantage in Fabrication

4.5.1.4 Functional Printing Has the Potential to Reduce Environmental Impact, Energy Consumption, and Material Wastage

4.5.1.5 Push Towards Thin and Flexible Form Factors in Electronics are Expected to Facilitate New Kind Of Devices That Can be Folded Or Rolled

4.5.2 Restraints

4.5.2.1 Challenges to The Electrically Functional Inks is Limiting the Growth of the Global Printed Electronics Market

4.5.2.2 Existing Technologies are Not Designed for Printed Electronics, They are Just Being Modified

4.5.3 Opportunities

4.5.3.1 Emergence of New Functionalities, Applications; and Integration Into Multiple Products

4.5.3.2 Additive Manufacturing/3d Printing, Another Game Changing Trend That Can Scale Into Many Functional Printing Applications.

4.5.4 Burning Issues

4.5.4.1 The Manufacturing Processes are Complex And Require High Level of Accuracy to Get A Desired Output

4.5.5 Winning Imperative

4.5.5.1 The Convergence Of Several Industries and Vertical Sectors Expand the Potential of Functional Printing and Will Help Leverage Untapped Markets

4.6 Porter’s Five Forces Model – Functional Printing Market

4.6.1 Degree of Competition

4.6.2 Bargaining Power of Buyers

4.6.3 Bargaining Power of Suppliers

4.6.4 Threat From Substitutes

4.6.5 Threat From New Entrants

5 Functional Printing Market By Materials (Page No. - 77)

5.1 Introduction

5.2 Substrates

5.2.1 Glass

5.2.2 Plastic

5.2.2.1 Polyethylene Naphthalene (PEN)

5.2.2.1.1 Benefits of PEN

5.2.2.2 Polyethylene Terephthalate (PET)

5.2.2.2.1 Benefits Of PET

5.2.3 Paper

5.2.4 Silicon Carbide

5.2.5 Gallium Nitride (GAN)

5.2.6 Others

5.3 Inks

5.3.1 Conductive Inks

5.3.1.1 Conductive Silver Inks

5.3.1.2 Conductive Copper Inks

5.3.2 Graphene Ink

5.3.3 Dielectric Inks

5.3.4 Others

6 Functional Printing Market Segmentation By Technology (Page No. - 90)

6.1 Introduction

6.2 Inkjet Printing

6.2.1 The Benefits of Inkjet Printing

6.2.2 Challenges in Inkjet Printing

6.2.3 New Opportunities Offered By Inkjet Printing

6.2.4 Major Companies Into Inkjet Printing Technology

6.3 Screen Printing

6.3.1 Benefits of Screen Printing

6.3.2 Challenges in Screen Printing

6.3.3 New Opportunities Offered By Screen Printing

6.3.4 Major Companies Into Screen Printing Technology

6.4 Flexography

6.4.1 Benefits of Flexographic Printing

6.4.2 Challenges in Flexographic Printing

6.4.3 New Opportunities Offered By Flexographic Printing

6.4.4 Major Companies Into Flexographic Printing Technology

6.5 Gravure Printing

6.5.1 Benefits of Gravure Printing

6.5.2 Challenges in Gravure Printing

6.5.3 New Opportunities Offered By Gravure Printing

6.5.4 Major Companies Into Gravure Printing Technology

6.6 Others

6.6.1 Offset Printing

6.6.1.1 Benefits of Offset Printing

6.6.1.2 Challenges In Offset Printing

6.6.1.3 Major Companies Into Offset Printing Technology

6.6.2 Nanoimprint Lithography

6.6.2.1 Major Companies Into Nanoimprint Lithography

6.6.3 Microcontact Printing

6.6.3.1 Characteristics of Microcontact Printing

6.6.3.2 Challenges With Microcontact Printing

6.6.3.3 Major Companies Into Microcontact Printing Technology

6.6.4 Aerosol Jet Printing

7 Functional Printing Market By Application (Page No. - 113)

7.1 Introduction

7.2 Sensors

7.2.1 Major Companies Manufacturing Printed Sensors

7.3 Displays

7.3.1 E-Paper Displays

7.3.1.1 Applications Based on E-Paper Technology

7.3.1.2 Benefits of E-Paper Display

7.3.1.3 Challenges in E-Paper Display

7.3.1.4 Type Of E-Paper Display

7.3.1.4.1 Electrophoretic

7.3.1.4.2 Electrochromic

7.3.1.4.3 Others

7.3.1.4.3.1 Electrowetting

7.3.1.4.3.2 Cholesteric Liquid Crystal Display (CH-LCD)

7.3.1.5 Comparison Analysis Of E-Paper Display Technologies

7.3.2 Oled Display

7.3.2.1 Benefits Of Oled Displays

7.3.2.2 Challenges In Oled Display

7.3.2.3 Major Company Offering Oled Display

7.3.2.4 E-Paper Display Vs OLED

7.3.3 Liquid Crystal Display (LCE)

7.4 Batteries

7.4.1 Printed Batteries By Rechargeability

7.4.2 Printed Batteries By Voltage Type

7.4.3 Benefits Of Printed Battery

7.4.3.1 Highly Flexible

7.4.3.2 Lightweight and Compact Structure

7.4.3.3 Environment-Friendliness of The Batteries

7.4.3.4 No Thermal Runaway for Batteries

7.4.3.5 Adoption of Pervasive Power Application

7.4.4 Challenges in Printed Battery

7.4.4.1 Heavy Capital Investments

7.4.4.2 Manufacturing Processes are Tedious, Time Consuming, and Involves A Lot of Defects

7.4.4.3 Limited Number of Buyers

7.5 Rfid Tags

7.5.1 Benefits of Rfid Tag

7.5.2 Challenges in RFID

7.6 Lighting

7.6.1 Major Players Offering Oled Lighting

7.7 Photovoltaic

7.7.1 Benefits of Printed Photovoltaic

7.7.2 Challenges in Printed Photovoltaic

7.8 Others

8 Functional Printing Market Segmentation By Coatings (Page No. - 172)

8.1 Introduction

8.2 Coating

8.2.1 Conductive Coating

8.2.1.1 Materials Used to Form Conductive Coating

8.2.1.2 Applications Areas of Conductive Coating

8.2.2 Conformal Coating

8.2.2.1 Materials Used to Form Conformal Coating

8.2.2.2 Application of Conformal Coating

9 Functional Printing Market By Geography (Page No. - 185)

9.1 Introduction

9.1.1 North America

9.1.2 Europe

9.1.3 Asia Pacific

9.1.4 Rest Of World (ROW)

10 Competitive Landscape (Page No. - 197)

10.1 Market Share Analysis

10.1.1 Major Equipment Manufacturers of Functional Printing Systems

10.1.2 Major Suppliers of Functional Printing Materials

10.1.3 Major Players in Screen Printing Technology

10.1.4 Major Players in Inkjet Printing Technology

10.1.5 Major Players in Gravure Printing Technology

10.1.6 Major Players in Flexography Printing Technology

10.1.7 Major Players in Printed Electronics Market

10.2 New Product Launches: The Most Preferred Strategic Approach; While Partnerships And Agreements are on the Rise

10.3 New Product Developments

10.4 Partnerships, Agreements, Collaborations and Strategic Cooperations

10.5 Mergers & Acquisitions

10.6 Others

11 Company Profiles (Overview, Products and Services, Financials, Strategy & Development)* (Page No. - 237)

11.1 Avery Dennison Corporation

11.2 BASF SE

11.3 Blue Spark Technologies

11.4 Duratech Industries Inc

11.5 E Ink Holdings Inc

11.6 Eastman Kodak Company

11.7 Enfucell OY

11.8 Esma

11.9 Gsi Technologies LLC

11.10 Isorg

11.11 Kovio Inc.

11.12 Mark Andy Inc.

11.13 Nanosolar Inc.

11.14 Novaled AG

11.15 Optomec Inc.

11.16 Palo Alto Research Center Incorporated

11.17 Toppan Forms Co. Ltd.

11.18 Toyo Ink Sc Holdings Co. Ltd.

11.19 Trident Industrial Inkjet

11.20 Vorbeck Materials Corporation

11.21 XAAR PLC

11.22 Xennia Technology Ltd.

*Details On Overview, Products And Services, Financials, Strategy & Development Might Not be Captured in Case of Unlisted Companies.

List Of Tables (81 Tables)

Table 1 General Assumptions, Terminology & Application Key Notes

Table 2 Global Functional Printing Market Value, By Technology, 2012 - 2020 ($Billion)

Table 3 Global Market Value, By Application, 2012 - 2020 ($Billion)

Table 4 Comparison Between Traditional Printing And Existing Printing Technologies

Table 5 Major Parameters Taken Into Account for Different Applications Using Functional Printing

Table 6 Functional Printing Porters Five Forces: Impact Analysis, 2013 – 2020

Table 7 Impact Analysis of Degree Of Competition

Table 8 Impact Analysis of Buyer’s Bargaining Power

Table 9 Impact Analysis of Supplier’s Bargaining Power

Table 10 Impact Analysis of Threat From Substitutes

Table 11 Impact Analysis of Threat Of New Entrants

Table 12 Global Functional Printing Market Value, By Materials, 2012 - 2020 ($Billion)

Table 13 Global Functional Printing Market Value, By Substrate, 2012 - 2020 ($Billion)

Table 14 Global Functional Printing Market Value, By Inks, 2012 - 2020 ($Billion)

Table 15 Comparison: Nanosilver Inks Vs Nano Copper Inks

Table 16 Global Functional Printing Market Value, By Technology, 2012 - 2020 ($Billion)

Table 17 Characteristics Of Printing Technologies

Table 18 Global Functional Inkjet Printing Market Value, By Application, 2012 - 2020 ($Million)

Table 19 Global Screen Printing Market Value, By Application, 2012 - 2020 ($Million)

Table 20 Global Flexography Printing Market Value, By Application, 2012 - 2020 ($Million)

Table 21 Global Gravure Printing Market Value, By Application, 2012 - 2020 ($Million)

Table 22 Global Other Printing Technologies Market Value, By Application, 2012 - 2020 ($Million)

Table 23 Global Market Value, By Application, 2012 - 2020 ($Billion)

Table 24 Conventional Vs Printed Electronics

Table 25 Global Printed Electronics Market Value, By Application, 2012 - 2020 ($Billion)

Table 26 Global Printed Sensors Equipment Market, By Technology, 2012 - 2020 ($Million)

Table 27 Global Printed Sensors Equipment Market, By Geography, 2012 - 2020 ($Million)

Table 28 Global Printed Sensors Market Value, By Type, 2012 - 2020 ($Million)

Table 29 Global Printed Sensors Market Value, By Application, 2012 - 2020 ($Million)

Table 30 Global Printed Sensors Market Value, By Geography, 2012 - 2020 ($Million)

Table 31 Global Printed Display Equipment Market, By Technology, 2012 - 2020 ($Million)

Table 32 Global Printed Display Equipment Market, By Geography, 2012 - 2020 ($Million)

Table 33 Global Printed Display Market Value, By Geography, 2012 - 2020 ($Million)

Table 34 Global E-Paper Display Market Value, By Technology, 2012 - 2020 ($Million)

Table 35 Global Electrophoretic Displays Market Value, By Geography, 2012 - 2020 ($Million)

Table 36 Global Electrochromic Displays Market Value, By Geography, 2012 - 2020 ($Million)

Table 37 Global Other E-Paper Displays Market Value, By Geography, 2012 - 2020 ($Million)

Table 38 Comparison Analysis Of Different E-Paper Technologies

Table 39 Global Oled Displays Market Value, By Geography, 2012 - 2020 ($Million)

Table 40 Comparison Analysis Of E-Paper Display And Oled

Table 41 Global Printed Batteries Equipment Market, By Technology, 2012 - 2020 ($Million)

Table 42 Global Printed Batteries Equipment Market, By Geography, 2012 - 2020 ($Million)

Table 43 Global Printed Batteries Market Value, By Voltage, 2012 - 2020 ($Million)

Table 44 Global Printed Batteries Market Value, By Application, 2012 - 2020 ($Million)

Table 45 Global Printed Batteries Market Value, By Geography, 2012 - 2020 ($Million)

Table 46 Global Printed Rfid Equipment Market, By Technology, 2012 - 2020 ($Million)

Table 47 Global Printed Rfid Equipment Market, By Geography, 2012 - 2020 ($Million)

Table 48 Global Printed Rfid Market Value, By Application, 2012 - 2020 ($Million)

Table 49 Global Printed Rfid Market Value, By Geography, 2012 - 2020 ($Million)

Table 50 Global Lighting Equipment Market, By Technology, 2012 - 2020 ($Million)

Table 51 Global Printed Lighting Equipment Market, By Geography, 2012 - 2020 ($Million)

Table 52 Global Printed Lighting Market Value, By Geography, 2012 - 2020 ($Million)

Table 53 Global Printed Pvs Equipment Market, By Technology, 2012 - 2020 ($Million)

Table 54 Global Printed Pvs Equipment Market, By Geography, 2012 - 2020 ($Million)

Table 55 Global Printed Pvs Market, By Application, 2012 - 2020 ($Million)

Table 56 Global Printed Pvs Market, By Geography, 2012 - 2020 ($Million)

Table 57 Global Others Equipment Market, By Technology, 2012 - 2020 ($Million)

Table 58 Global Others Equipment Market, By Geography, 2012 - 2020 ($Million)

Table 59 Global Others Market, By Geography, 2012 - 2020 ($Million)

Table 60 Global Functional Coatings Market, By Type, 2012 - 2020 ($Million)

Table 61 Global Conductive Coatings Market Value, By Material, 2012 - 2020 ($Million)

Table 62 Global Conductive Coatings Market Value, By Applications, 2012 - 2020 ($Million)

Table 63 Global Conformal Coatings Market Overview, 2012 - 2020 ($Million)

Table 64 Characteristics: Conformal Coating

Table 65 Global Conformal Coatings Market Value, By Application, 2012 - 2020 ($Million)

Table 66 Global Market Value, By Geography, 2012 - 2020 ($Billion)

Table 67 North America: Functional Printing Equipment Market Value, By Application, 2012 - 2020 ($Million)

Table 68 Europe: Functional Printing Equipment Market Value, By Application, 2012 - 2020 ($Million)

Table 69 APAC: Functional Printing Equipment Market Value, By Application, 2012 - 2020 ($Million)

Table 70 Row: Functional Printing Equipment Market Value, By Application, 2012 - 2020 ($Million)

Table 71 Key Manufacturers: Equipment And Technology, 2013

Table 72 Key Suppliers: Inks and Coatings, 2013

Table 73 Key Players: Screen Printing, 2013

Table 74 Key Players: Inkjet Printing, 2013

Table 75 Key Players: Gravure Printing, 2013

Table 76 Key Players: Flexography Printing, 2013

Table 77 Key Players: Printed Electronics, 2013

Table 78 Functional Printing Market: New Product Launches, 2009 – 2013

Table 79 Functional Printing Market: Partnership, Agreements,Collaborations and Strategic Cooperations, 2009 – 2013

Table 80 Functional Printing Market: Mergers & Acquisitions, 2009 – 2013

Table 81 Functional Printing Market: Other Developments, 2008 – 2013

List Of Figures (63 Figures)

Figure 1 Functional Printing Market Segmentation

Figure 2 Functional Printing Market Research Methodology

Figure 3 Functional Printing Market Size Estimation of Functional Printing

Figure 4 Functional Printing Market Crackdown & Data Triangulation

Figure 5 Functional Printing Market Segmentation

Figure 6 Roadmap of Functional Printing

Figure 7 Value Chain Analysis

Figure 8 Impact Analysis of Functional Printing Market Drivers, 2013 – 2020

Figure 9 Impact Analysis of Functional Printing Market Restraints, 2013 – 2020

Figure 10 Functional Printing Market: Impact Analysis of Market Opportunities, 2013 – 2020

Figure 11 Porter’s Five Forces Analysis for Functional Printng Market

Figure 12 Degree of Competition in Functional Printing Market

Figure 13 Buyer’s Bargaining Power in Functional Printing Market

Figure 14 Supplier’s Bargaining Power in Functional Printing Market

Figure 15 Threat From Substitutes in Functional Printing Market

Figure 16 Threat of New Entrants in Functional Printing Market

Figure 17 Types of Materials

Figure 18 Printing Technologies

Figure 19 Inkjet Printing Technology

Figure 20 Functional Printing Technology: Applications

Figure 21 Traditional Sensor Making Process

Figure 22 Printed Sensor Making Process

Figure 23 Global Printed Sensors Market Value, 2012 - 2020 ($Million)

Figure 24 Major Challenges In Printing Sensors

Figure 25 Types of Display

Figure 26 Global Printed Display Market Value, 2012 - 2020 ($Million)

Figure 27 Global Printed Batteries Market Value, 2012 - 2020 ($Million)

Figure 28 Global Printed RFID Market Value, 2012 - 2020 ($Million)

Figure 29 Global Printed Lighting Market Value, 2012 - 2020 ($Million)

Figure 30 Global Printed PVS Market Value, 2012 - 2020 ($Million)

Figure 31 Global Others Market Value, 2012 - 2020 ($Million)

Figure 32 Types of Coating

Figure 33 By Geography

Figure 34 Global Functional Printing Market Share Analysis for Printing Techniques (2013 And 2020)

Figure 35 Global Functional Prinitng Market Share, By Growth Strategies, 2009 –2013

Figure 36 Avery Dennison Corporation: Company Snapshot

Figure 37 Avery Dennison Corporation: Major Operating Segments

Figure 38 Avery Dennison Corporation: SWOT Analysis

Figure 39 BASF SE: Company Snapshot

Figure 40 Blue Spark Technologies Inc.: Product Portfolio

Figure 41 Duratech Industries Inc.: Major Operation Segments

Figure 42 E Ink Holdings Inc.: Company Snapshot

Figure 43 E Ink Holdings Inc.: Product Categories

Figure 44 Eastman Kodak Company: Company Snapshot

Figure 45 Eastman Kodak Company: SWOT Analysis

Figure 46 GSI Technologies Llc: Product Classification

Figure 47 Isorg: Product Portfolio

Figure 48 Isorg: Photo Detector On Plastic

Figure 49 Isorg: Large Area Image Sensor

Figure 50 Mark Andy, Inc.: Products Portfolio

Figure 51 Nanosolar, Inc.: Application Segments

Figure 52 Nanosolar, Inc.: SWOT Analysis

Figure 53 Novaled AG: Product Portfolio

Figure 54 Optomec, Inc.: Product Portfolio

Figure 55 PARC: SWOT Analysis

Figure 56 Toppan Forms Co Ltd: Company Snapshot

Figure 57 Toppan Forms Co Ltd: Major Business Segments

Figure 58 Printing Business Segment: Product Portfolio

Figure 59 Toyo Ink SC Holdings Co Ltd: Company Snapshot

Figure 60 Toyo Ink SC Holdings Co Ltd.: Major Operating Segments

Figure 61 XAAR PLC: Company Snapshot

Figure 62 XAAR PLC: Major Business Segments

Figure 63 Xennia Technology Ltd.: Product Portfolio

Growth opportunities and latent adjacency in Functional Printing Market

I am interested in the following sections - 6.3 Screen Printing 6.3.1 Benefits of Screen Printing 6.3.2 Challenges in Screen Printing 6.3.3 New Opportunities Offered By Screen Printing 6.3.4 Major Companies Into Screen Printing Technology 9 Functional Printing Market By Geography (Page No. - 185) 9.1 Introduction 9.1.1 North America 9.1.2 Europe 9.1.3 Asia Pacific 9.1.4 Rest Of World (ROW 10.1.3 Major Players in Screen Printing Technology 10.1.7 Major Players in Printed Electronics Market Table 19 Global Screen Printing Market Value, By Application, 2012 - 2020 ($Million)

I'm interested in the sensors market segment: physical, chemical and biological sensors; colorimetric and electrochemical sensors.