Full-Body Scanners Market by Type (single view, dual view, 3D), Detection (Manual, Automatic), Component (Hardware, Software), End Use (Transport, Critical Infrastructure), Technology (X-ray, Millimeter Wave), and Region - Global Forecast to 2027

Update: 10/22/2024

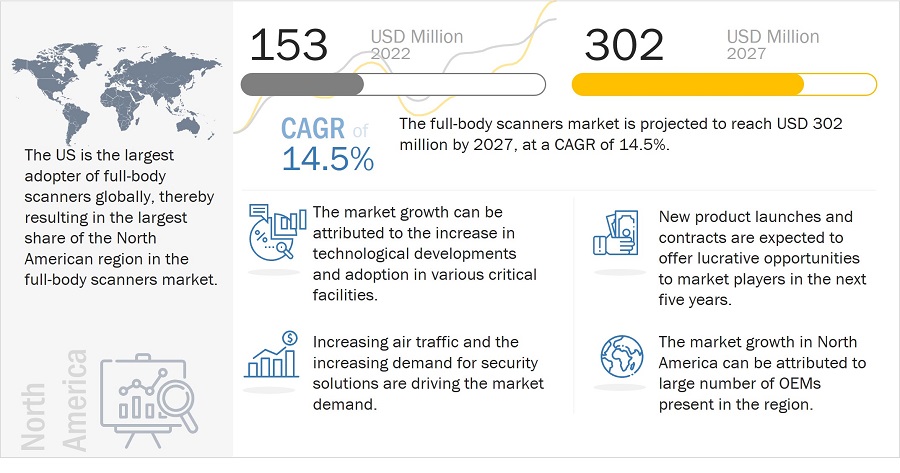

The Full-Body Scanners Market Size is expected to grow from USD 153 Million in 2022 to USD 302 Million in 2027, at a CAGR of 14.5%. The growth of the Full-Body Scanners Industry is driven by several factors. The need for advanced security screening systems with and reduced wait times in security checks is driving the adoption of full-body scanners across different applications.

Full-Body Scanners Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

A full-body scanner is a device that can detect objects inside and on a person for security screening. It allows to perform the screening with physically removing and clothing or making any physical contact. Full-body scanners can detect nonmetal objects and metal objects. The adoption of Full-body scanners increased with increase in terrorist activities and transportation of illicit objects across all transportation and government buildings.

Full-body scanners, especially x-ray full-body scanners, are finding increasing adoption in Prisons and Jails to tackle the increasing trafficking of illicit objects into prisons. Airports and other transportation facilities like seaports and metro stations are also adopting full-body scanners to increase security across these facilities. Major countries in North America, Europe and Asia Pacific are investing in Full-body scanners to increase the security of and reduce wait time in important facilities.

Full-Body Scanners Market Dynamics:

Driver: Increasing passenger and tourism traffic

The annual world traffic forecast predicts that flight passenger traffic growth will rise at an average rate of 4.5% year on year. Industry figures suggest that annual passenger numbers could reach 10.9 billion international travelers and 11.3 billion domestic passengers by 2040. It has been revealed that there are regional differences from emerging economies that can impact figures by 61.6% over the next 20 years. The Asia Pacific region is showing the fastest growth, which is expected to increase to over 38.8% in the period 2016-2040. With passenger growth increasing so significantly, and mandatory requirements for data transfer and security also placing greater pressure on the operational environment, countries are investing on advanced security solutions that include Full-body scanners to be adopted in transportation facilities.

Opportunity: Artificial Intelligence and proliferation of bio metrics

AI is used in every aspect of aviation, from facial recognition at borders to self-service check-in automation. Current research using computer-aided security screening to support operators and deep learning approaches demonstrated promising outcomes. AL systems utilize a variety of datasets. Machine learning is being used by technologists to analyze data for airport security and identify hazards more quickly than people. Passengers can keep items that previously required separate scanning in their checked bags as they move through security checkpoints. Biometrics is a noteworthy addition to scanning and security solutions. In the upcoming years, developments are being made to integrate biometrics solutions into scanning and security solutions. This will allow the reduction in multiple processes and enable complete security checks in a single go.

Challenge: Low dosage of wave transmission

Due to the increasing terror threats and trafficking of illicit objects airports and other transportation facilities are adopting Full-body scanners as an advanced security screening solution. The advanced security screening solutions have generated slight controversies due to the usage of low dose radiation used as part of the technology for the people screening solutions. Though research and experts have claimed the low dose radiation does not effectively cause any harm to humans, public perception has always been skeptical about the radiations emitted by these solutions. During the initial adoption of Transmission x-ray body scanners, public protest the adoption of people scanning solutions and equipment forced airports to not implement the change or sell their equipment to go back to traditional screening solutions.

The Transportation segment is estimated to lead the full-body scanners market in 2022

Based on End Use, the transportation segment is expected to the grow at higher CAGR in the forecast period. Since early 2000, transportation facilities have been ramping up their security systems to tackle terrorist activities and trafficking of illegal substances. Due to these factors’ transportation facilities like Airports, Seaports, Railways & metro station are all witnessing increasing adoption of Full-body scanners to increase the security solutions in these facilities.

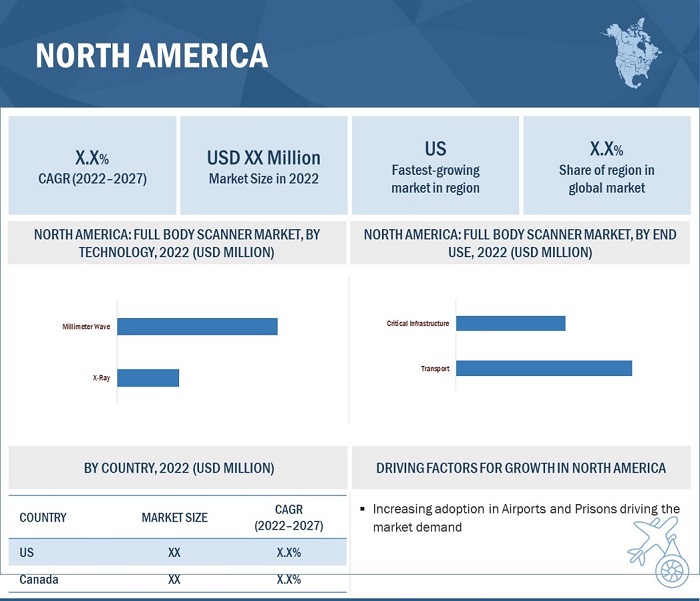

The Millimeter wave segment to witness highest growth in the forecast period

Based on technology, the millimeter wave technology is witnessing highest CAGR growth in the forecast period. Millimeter wave scanners provide a more detailed image to provide a better screening of people. Millimeter wave has a better approval among people as the public perception is that it radiates less compared to X-rays. Due to these factors Millimeter wave FBS are finding increasing adoptions across all facilities.

North American region is expected to have the highest market share during the forecast period

North American region constitutes the largest Full-body scanner manufacturers among all the regions. North America has the largest adoption of Full-body scanners across all the regions. The Airports in the US have the largest adoption of FBS. The adoptions of X-ray scanners across County Jails and Federal prisons are also a major factor driving the market growth in the region. North America region also invests heavily in research and development of advanced screening technologies required for current security solutions as well as future technologies.

Full-Body Scanners Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Full-Body Scanners Industry Companies: Top Key Market Players

The Full-Body Scanners Companies are dominated by globally established players such as Smiths Detection (UK), Leidos Security Detection & Automation (Scotland), LINEV Systems (UK), OD Security (Netherlands), and TEK 84 Inc. (US) among others. These key players offer Full-body scanner and services to different key stakeholders.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 153 Million in 2022

|

|

Projected Market Size

|

USD 302 Million in 2027

|

|

Growth Rate

|

CAGR of 14.5%

|

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

End Use, Technology, Type, Detection, Component and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World. |

|

Companies covered |

Smiths Detection (UK), Leidos Security Detection & Automation (Scotland), LINEV Systems (UK), OD Security (Netherlands), and TEK 84 Inc. (US) |

Full-Body Scanners Market Highlights

This research report categorizes the Full-body scanners market into End Use, Technology, Type, Detection, Component and Region.

|

Segment |

Subsegment |

|

End Use |

|

|

Technology |

|

|

Type |

|

|

Detection |

|

|

Component |

|

|

Regions |

|

Recent Developments

- In December 2022, LaCelle County Jail approved a bid from TEK 84 Inc. for X-ray Full-body scanner to implemented in the Jail. It will be used to detect contrabands on inmates.

- In May 2019, Thruvision, a leading provider of people screening solutions, announced its selection by Los Angeles World Airports (LAWA) to provide a Full-body scanner for employee screening.

Frequently Asked Questions (FAQ):

What is the Current Size of the Full-Body Scanners Market?

The Full-Body Scanners Market is projected to grow from USD 153 Million in 2022 to USD 302 Million by 2027, at a CAGR of 14.5% during the forecast period.

Who Are the Winners and Small Enterprises in the Full-Body Scanners Market?

Major players operating in the Full-Body Scanners Market include Smiths Detection (UK), Leidos Security Detection & Automation (Scotland), LINEV Systems (UK), OD Security (Netherlands), and TEK 84 Inc. (US) among others. These key players offer Full-body scanner and services to different key stakeholders.

What Are Some of the Technological Advancements in the Full-Body Scanners Market?

3D scanner systems offer the following advantages of using millimeter waves, which are a type of non-ionizing radiation that is not harmful to people. It employs extremely low-powered millimeter waves that can easily permeate clothes. Because of the scanner's small system footprint, it can be placed in limited areas. 3D body scanning technology has recently been adopted in several airports across the world for security purposes, as well as in many other areas for research, health care, and the garment business. However, the accuracy of the human body images produced by these scanners has prompted privacy and ethical concerns among researchers and the public.

What Are the Factors Driving the Growth of the Full-Body Scanners Market?

Increasing need for security solutions in transportation facilities and important government facilities are driving the need for Full-Body Scanners across regions. Adoption of Full-Body Scanners also reduces the need for long wait lines during security checks in comparison to traditional security check methods that include a two-step process of walk through metal detection and a physical body pat downs.

Which Sectors Are Witnessing Larger Adoptions in Full-Body Scanners Market?

The transport industry which includes Airports, Seaports, Railway & Metros are witnessing larger adoption in the coming years. Aviation industry across the globe have invested in facility expansion and ramping up security solution to cater to the increasing passenger traffic and the possible.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising safety concerns due to increased terrorism incidents- Growing need to detect contraband in prisons- Smooth passenger experience at airportsRESTRAINTS- Privacy concerns- Health concerns associated with exposure to radiation- High procurement and operational costsOPPORTUNITIES- Artificial intelligence and proliferation of biometricsCHALLENGES- Technical vulnerabilities of existing scanners

- 5.3 PRICING ANALYSIS

- 5.4 VALUE CHAIN

-

5.5 FULL-BODY SCANNERS MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 TRADE DATA STATISTICS

-

5.7 TECHNOLOGY TRENDS IN FULL-BODY SCANNERS MARKET3D BODY SCANNERSAUTOMATED TARGET RECOGNITIONARTIFICIAL-INTELLIGENCE-BASED SCANNERS

-

5.8 CASE STUDY ANALYSISHEXWAVE: BEING BETA-TESTED AT METRO TORONTO CONVENTION CENTREEVOLV EDGE: USED BY MAJOR US AIRPORTS TO IMPROVE EMPLOYEE SCREENING

-

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR FULL-BODY SCANNERS PRODUCTS AND SOLUTIONS MANUFACTURERS

-

5.10 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 RECESSION IMPACT ANALYSIS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

- 5.14 TARIFF AND REGULATORY LANDSCAPE FOR FULL-BODY SCANNERS MARKET

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGICAL ADVANCEMENTS IN FULL-BODY SCANNERSADVANCED 3D SCANNING TECHNOLOGIESSUBMILLIMETER WAVE SCANNERSROBOTICS

-

6.3 EMERGING TRENDS IN FULL-BODY SCANNER MANUFACTURINGBIG DATAARTIFICIAL INTELLIGENCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 USE CASESFULL-BODY SCANNERS OFFER SMOOTH PASSENGER CHECK-IN EXPERIENCEGOVERNMENT INVESTMENTS IN FULL-BODY SCANNERS AT AIRPORTS

-

6.6 FULL-BODY SCANNERS MARKET: PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 TRANSPORTAIRPORTS- Rising passenger traffic to prompt countries to invest in security solutions- Large airports- Medium airports- Small airports- Seaports- Railways & metro stations

-

7.3 CRITICAL INFRASTRUCTUREPRISONS- Efficient modes of screening solutions to help prevent inmate conflictsGOVERNMENT FACILITIES & HOMELAND SECURITY- Need to deter potential threats to drive use of full-body scanners in government facilities

- 8.1 INTRODUCTION

-

8.2 X-RAYTRANSMISSION X-RAY- Transmission x-ray scanners used to reduce smuggling and prison violenceBACKSCATTER X-RAY- Backscatter x-ray scanners widely used at airports and other transport hubs

-

8.3 MILLIMETER WAVEPASSIVE MILLIMETER WAVE SCANNERS- Passive millimeter wave scanners used to capture naturally emitted energy of human bodyACTIVE MILLIMETER WAVE SCANNERS- Active millimeter wave scanners used to generate high-resolution scanned images

- 9.1 INTRODUCTION

-

9.2 SINGLE VIEWSINGLE-VIEW SCANNERS ARE POPULARLY USED IN AIRPORTS AND OTHER TRANSPORT HUBS

-

9.3 DUAL VIEWHIGHER IMAGE QUALITY DELIVERED BY DOUBLE-VISION TECHNOLOGY

-

9.4 3D-VIEW SCANNERS3D SCANNERS GENERATE 3D IMAGES OF WHOLE BODY TO DETECT CONTRABAND

- 10.1 INTRODUCTION

-

10.2 HARDWAREHEAVY-DUTY HARDWARE REQUIRED TO PREVENT EXPOSURE TO X-RAY AND MILLIMETER WAVE SOURCES

-

10.3 SOFTWAREIMAGING SOFTWARE USED TO DETECT CONTRABAND

- 11.1 INTRODUCTION

-

11.2 AUTOMATIC DETECTIONAUTOMATIC DETECTION TO LEAD MARKET DUE TO HIGH ACCURACY AND AFFORDABILITY

-

11.3 MANUAL DETECTIONOPERATOR ESSENTIAL FOR MANUAL DETECTION TO IDENTIFY CONTRABAND

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAREGIONAL RECESSION IMPACT ANALYSIS: NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Presence of large airports and prisons to drive marketCANADA- Presence of medium airports to drive market growth

-

12.3 EUROPEREGIONAL RECESSION IMPACT ANALYSIS: EUROPEPESTLE ANALYSIS: EUROPEUK- Government funds for prison improvement to drive UK marketGERMANY- Rising investments in air and railway connectivity to drive marketRUSSIA- Increased adoption of full-body scanner systems in aerospace industry to drive marketFRANCE- Significant investments in modernization and expansion of aerospace industry to drive marketITALY- Aviation industry growing in air freight and passenger volumeREST OF EUROPE

-

12.4 ASIA PACIFICREGIONAL RECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- China's growing airport infrastructure to drive market expansionINDIA- Rapid expansion of existing airport infrastructure to increase demand for full-body scannersSOUTH KOREA- Rising air traffic and cargo operations to drive marketJAPAN- Full-body scanner purchases to be encouraged by successful completion of trial programsREST OF ASIA PACIFIC- Upgrading of security at airports and commercial sites to drive full-body scanners market

-

12.5 REST OF THE WORLDREGIONAL RECESSION IMPACT ANALYSIS: REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDAFRICA- Airport modernization programs to drive market in AfricaLATIN AMERICA- Investment in airport enhancement projects to drive market in Latin AmericaMIDDLE EAST- High investments in airport development to fuel market in Middle East

- 13.1 INTRODUCTION

- 13.2 COMPETITIVE OVERVIEW

- 13.3 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2021

- 13.4 MARKET SHARE ANALYSIS, 2021

- 13.5 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

-

13.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.7 START-UPS/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.8 COMPETITIVE SCENARIODEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSSMITHS DETECTION GROUP LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEIDOS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLINEV SYSTEMS- Business overview- Products/Solutions/Services offered- MnM viewTEK 84, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWESTMINSTER INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOD SECURITY- Business overview- Products/Solutions/Services offeredNUCTECH- Business overview- Products/Solutions/Services offeredBRAUN & COMPANY LTD.- Business overview- Products/Solutions/Services offeredBRIJOT- Business overview- Products/Solutions/Services offered3F ADVANCED SYSTEMS- Business overview- Products/Solutions/Services offeredCANON USA INC.- Business overview- Products/Solutions/Services offeredTHRUVISION LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsMETRASENS- Business overview- Products/Solutions/Services offeredROHDE & SCHWARZ- Business overview- Products/Solutions/Services offeredQINETIQ- Business overview- Products/Solutions/Services offeredLIBERTY DEFENSE- Business overview- Products/Solutions/Services offered- Recent developmentsEVOLV TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developmentsHI-TECH DETECTION SYSTEMS- Business overview- Products/Solutions/Services offeredVMI SECURITY- Business overview- Products/Solutions/Services offeredQILOOTECH- Business overview- Products/Solutions/Services offeredSCAN-X SECURITY LTD.- Business overview- Products/Solutions/Services offeredTERASENSE GROUP INC.- Business overview- Products/Solutions/Services offeredCST DIGITAL COMMUNICATION (PTY) LTD.- Business overview- Products/Solutions/Services offeredXSCANN- Business overview- Products/Solutions/Services offered

-

14.3 OTHER PLAYERSMISTRAL SOLUTIONS

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN FULL-BODY SCANNERS MARKET

- TABLE 2 KEY PRIMARY SOURCES

- TABLE 3 FULL-BODY SCANNERS MARKET: SEGMENTS AND SUBSEGMENTS

- TABLE 4 AVERAGE SELLING PRICE RANGE: FULL-BODY SCANNERS, BY TYPE (USD)

- TABLE 5 FULL-BODY SCANNERS: MARKET ECOSYSTEM

- TABLE 6 TRADE DATA TABLE FOR FULL-BODY SCANNERS

- TABLE 7 FULL-BODY SCANNERS MARKET: PORTER'S FIVE FORCE ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF FULL-BODY SCANNERS PRODUCTS AND SYSTEMS (%)

- TABLE 9 KEY BUYING CRITERIA FOR FULL-BODY SCANNER PRODUCTS AND SYSTEMS

- TABLE 10 FULL-BODY SCANNERS MARKET: CONFERENCES AND EVENTS, 2022–2023

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA-PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 16 MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 17 MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 18 TRANSPORT: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 19 TRANSPORT: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 20 MARKET, BY AIRPORT SIZE, 2018–2021 (USD MILLION)

- TABLE 21 MARKET, BY AIRPORT SIZE, 2022–2027 (USD MILLION)

- TABLE 22 CRITICAL INFRASTRUCTURE: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 23 CRITICAL INFRASTRUCTURE: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 24 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 25 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 26 MARKET, BY X-RAY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 27 MARKET, BY X-RAY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 28 MARKET, BY MILLIMETER WAVE TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 29 MARKET, BY MILLIMETER WAVE TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 30 MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 31 MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 32 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 33 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 34 MARKET, BY DETECTION, 2018–2021 (USD MILLION)

- TABLE 35 MARKET, BY DETECTION, 2022–2027 (USD MILLION)

- TABLE 36 MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

- TABLE 37 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 REGIONAL RECESSION IMPACT ANALYSIS: NORTH AMERICA

- TABLE 39 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 42 NORTH AMERICA: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 44 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 45 US: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 46 US: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 47 US: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 48 US: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 49 CANADA: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 50 CANADA: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 51 CANADA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 52 CANADA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 53 REGIONAL RECESSION IMPACT ANALYSIS: EUROPE

- TABLE 54 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 55 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 56 EUROPE: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 57 EUROPE: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 58 EUROPE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 59 EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 60 UK: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 61 UK: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 62 UK: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 63 UK: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 64 GERMANY: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 65 GERMANY: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 66 GERMANY: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 67 GERMANY: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 68 RUSSIA: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 69 RUSSIA: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 70 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 71 RUSSIA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 72 FRANCE: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 73 FRANCE: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 74 FRANCE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 75 FRANCE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 76 ITALY: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 77 ITALY: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 78 ITALY: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 79 ITALY: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 80 REST OF EUROPE: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 81 REST OF EUROPE: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 82 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 83 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 84 REGIONAL RECESSION IMPACT ANALYSIS: ASIA PACIFIC

- TABLE 85 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 91 CHINA: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 92 CHINA: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 93 CHINA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 94 CHINA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 95 INDIA: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 96 INDIA: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 97 INDIA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 98 INDIA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 99 SOUTH KOREA: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 100 SOUTH KOREA: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 101 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 102 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 103 JAPAN: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 104 JAPAN: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 105 JAPAN: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 106 JAPAN: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 111 REGIONAL RECESSION IMPACT ANALYSIS: REST OF THE WORLD

- TABLE 112 REST OF THE WORLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 113 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 114 REST OF THE WORLD: MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 115 REST OF THE WORLD: MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 116 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 117 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 118 AFRICA: FULL-BODY SCANNERS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 119 AFRICA: FULL-BODY SCANNERS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 120 AFRICA: FULL-BODY SCANNERS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 121 AFRICA: FULL-BODY SCANNERS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 122 LATIN AMERICA: FULL-BODY SCANNERS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 123 LATIN AMERICA: FULL-BODY SCANNERS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 124 LATIN AMERICA: FULL-BODY SCANNERS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 125 LATIN AMERICA: FULL-BODY SCANNERS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 126 MIDDLE EAST: FULL-BODY SCANNERS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 127 MIDDLE EAST: FULL-BODY SCANNERS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 128 MIDDLE EAST: FULL-BODY SCANNERS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 129 MIDDLE EAST: FULL-BODY SCANNERS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 130 KEY DEVELOPMENTS BY LEADING PLAYERS IN FULL-BODY SCANNERS MARKET BETWEEN 2018 AND 2022

- TABLE 131 DEGREE OF COMPETITION

- TABLE 132 COMPANY PRODUCT FOOTPRINT

- TABLE 133 COMPANY FOOTPRINT, BY END USE

- TABLE 134 COMPANY FOOTPRINT, BY OFFERING

- TABLE 135 COMPANY REGION FOOTPRINT

- TABLE 137 FULL-BODY SCANNERS MARKET: DEALS, JULY 2018–DECEMBER 2022

- TABLE 138 SMITHS DETECTION GROUP LTD.: BUSINESS OVERVIEW

- TABLE 139 SMITHS DETECTION GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 SMITHS DETECTION GROUP LTD.: DEALS

- TABLE 141 LEIDOS: BUSINESS OVERVIEW

- TABLE 142 LEIDOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 LEIDOS: DEALS

- TABLE 144 LINEV SYSTEMS; BUSINESS OVERVIEW

- TABLE 145 LINEV SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 TEK 84, INC.: BUSINESS OVERVIEW

- TABLE 147 TEK 84, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 TEK 84, INC.: DEALS

- TABLE 149 WESTMINSTER INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 150 WESTMINSTER INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 WESTMINSTER INTERNATIONAL INC.: DEALS

- TABLE 152 OD SECURITY: BUSINESS OVERVIEW

- TABLE 153 OD SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 NUCTECH: BUSINESS OVERVIEW

- TABLE 155 NUCTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 BRAUN & COMPANY LTD.: BUSINESS OVERVIEW

- TABLE 157 BRAUN & COMPANY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 BRIJOT: BUSINESS OVERVIEW

- TABLE 159 BRIJOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 3F ADVANCED SYSTEMS: BUSINESS OVERVIEW

- TABLE 161 3F ADVANCED SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 CANON USA INC.: BUSINESS OVERVIEW

- TABLE 163 CANON USA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 THRUVISION LTD.: BUSINESS OVERVIEW

- TABLE 165 THRUVISION LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 THRUVISION LTD.: DEALS

- TABLE 167 METRASENS: BUSINESS OVERVIEW

- TABLE 168 METRASENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 ROHDE & SCHWARZ: BUSINESS OVERVIEW

- TABLE 170 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 QINETIQ: BUSINESS OVERVIEW

- TABLE 172 QINETIQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 LIBERTY DEFENSE: BUSINESS OVERVIEW

- TABLE 174 LIBERTY DEFENSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 EVOLV TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 176 EVOLV TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 HI-TECH DETECTION SYSTEMS: BUSINESS OVERVIEW

- TABLE 178 HI-TECH DETECTION SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 VMI SECURITY: BUSINESS OVERVIEW

- TABLE 180 VMI SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 QILOOTECH: BUSINESS OVERVIEW

- TABLE 182 QILOOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 SCAN-X SECURITY LTD.: BUSINESS OVERVIEW

- TABLE 184 SCAN-X SECURITY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 TERASENSE GROUP INC.: BUSINESS OVERVIEW

- TABLE 186 TERASENSE GROUP INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 CST DIGITAL COMMUNICATION (PTY) LTD: BUSINESS OVERVIEW

- TABLE 188 CST DIGITAL COMMUNICATION (PTY) LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 189 XSCANN (PTY) LTD.: BUSINESS OVERVIEW

- TABLE 190 XSCANN (PTY) LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 MISTRAL SOLUTIONS: COMPANY OVERVIEW

- FIGURE 1 FULL-BODY SCANNERS MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 FULL-BODY SCANNERS MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 REVENUE PASSENGER PER KILOMETER, SEPTEMBER 2022 YOY %

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 BY TECHNOLOGY, MILLIMETER WAVE SEGMENT TO WITNESS LARGEST MARKET SHARE IN 2022

- FIGURE 9 BY COMPONENT, HARDWARE SEGMENT TO ACCOUNT FOR MAJOR SHARE IN 2022

- FIGURE 10 FULL-BODY SCANNERS MARKET IN NORTH AMERICA TO REGISTER LARGEST MARKET SHARE IN 2022

- FIGURE 11 INCREASING PASSENGER TRAFFIC TO DRIVE MARKET GROWTH FROM 2022 TO 2027

- FIGURE 12 TRANSPORT SEGMENT PROJECT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 13 DUAL VIEW SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 14 FULL-BODY SCANNERS MARKET IN INDIA PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 15 FULL-BODY SCANNERS: MARKET DYNAMICS

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 FULL-BODY SCANNERS MARKET ECOSYSTEM MAP

- FIGURE 18 REVENUE SHIFT IN FULL-BODY SCANNERS MARKET

- FIGURE 19 FULL-BODY SCANNERS MARKET: PORTER'S FIVE FORCE ANALYSIS

- FIGURE 20 RECESSION IMPACT ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF FULL-BODY SCANNERS PRODUCTS AND SYSTEMS

- FIGURE 22 KEY BUYING CRITERIA FOR FULL-BODY SCANNER PRODUCTS AND SYSTEMS

- FIGURE 23 SUPPLY CHAIN ANALYSIS

- FIGURE 24 TRANSPORT SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 25 MILLIMETER WAVE SCANNERS TO DOMINATE MARKET FROM 2022 TO 2027

- FIGURE 26 DUAL VIEW SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 27 SOFTWARE SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 28 AUTOMATIC SEGMENT TO LEAD FULL-BODY SCANNERS MARKET FROM 2022 TO 2027

- FIGURE 29 FULL-BODY SCANNERS MARKET: REGIONAL SNAPSHOT

- FIGURE 30 NORTH AMERICA FULL-BODY SCANNERS MARKET SNAPSHOT

- FIGURE 31 EUROPE: FULL-BODY SCANNERS MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: FULL-BODY SCANNERS MARKET SNAPSHOT

- FIGURE 33 REST OF THE WORLD: FULL-BODY SCANNERS MARKET SNAPSHOT

- FIGURE 34 RANKING ANALYSIS OF TOP FIVE PLAYERS: FULL-BODY SCANNERS MARKET, 2021

- FIGURE 35 MARKET SHARE OF TOP PLAYERS: FULL-BODY SCANNERS MARKET, 2021 (%)

- FIGURE 36 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS IN FULL-BODY SCANNERS MARKET

- FIGURE 37 FULL-BODY SCANNERS MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 38 FULL-BODY SCANNERS MARKET START-UPS/SME COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 39 SMITHS GROUP PLC: COMPANY SNAPSHOT

- FIGURE 40 LEIDOS: COMPANY SNAPSHOT

- FIGURE 41 WESTMINSTER INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 42 THRUVISION LTD.: COMPANY SNAPSHOT

- FIGURE 43 QINETIQ GROUP PLC: COMPANY SNAPSHOT

- FIGURE 44 EVOLV TECHNOLOGY: COMPANY SNAPSHOT

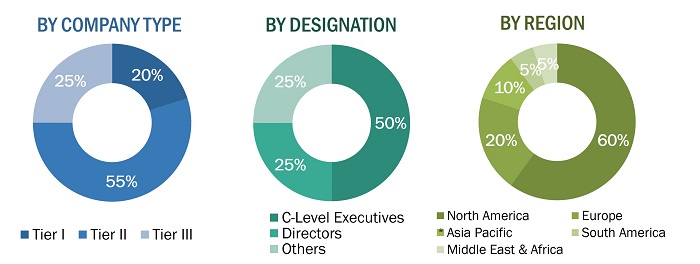

The research study conducted on the Full-body scanners market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the Full-body scanners market. The primary sources considered included industry experts from the Full-body scanners market as well as raw material providers, Full-body scanners manufacturers, solution providers, technology developers, alliances, government agencies, and aftermarket service providers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the Full-body scanners market as well as to assess the growth prospects of the market.

Secondary Research

The ranking of companies operating in the Full-body scanners market was arrived at based on secondary data made available through paid and unpaid sources, the analysis of product portfolios of the major companies in the market and rating them on the basis of their performance and quality. These data points were further validated by primary sources.

Secondary sources referred for this research study on the Full-body scanners market included government sources, such as corporate filings that included annual reports, investor presentations, and financial statements, and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by various primary respondents.

Primary Research

The full-body scanner market comprises several stakeholders, such as component suppliers, technology providers, end-product manufacturers, and integrative & regulatory organizations in its supply chain. End users such as commercial, government, and defense organizations from various countries make up the demand side of this market. The supply side is characterized by millimeter and transmission technology suppliers catering to platforms such as airports, railways, and critical infrastructure. Following is the breakdown of primary respondents that were interviewed to obtain qualitative and quantitative information about the full-body scanners market.

To know about the assumptions considered for the study, download the pdf brochure

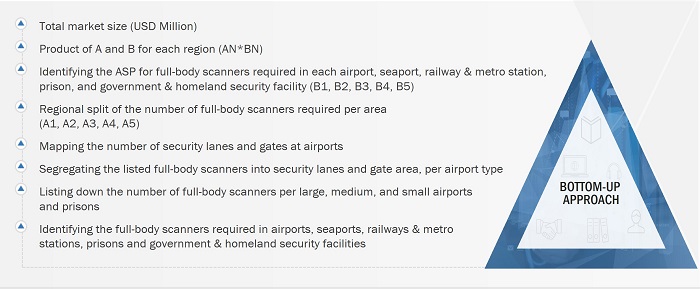

Market Size Estimation

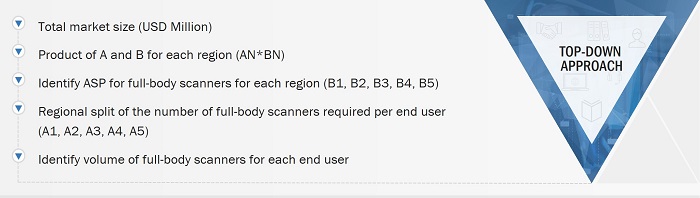

Both top-down and bottom-up approaches were used to estimate and validate the size of the Full-body scanners market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the Full-body scanners market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the Full-body scanners market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market Size Estimation Methodology: Bottom-up Approach

Market size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Full-Body Scanners and Mass Screening Solutions Overview

Full-body scanners and mass screening solutions refer to technologies and methods used to scan large groups of people in order to detect potential threats to public safety or security.

Mass screening solutions typically involve the use of technologies such as thermal imaging cameras, metal detectors, and facial recognition software to identify potential threats or individuals of interest. These solutions can be used in a variety of settings such as public transportation hubs, sports stadiums, and other large gatherings.

While full-body scanners and mass screening solutions can be effective in detecting potential threats, there are concerns about privacy and civil liberties. Some people argue that the use of these technologies violates individual privacy rights and can lead to discrimination and profiling. Additionally, there are concerns about the potential health risks associated with the use of full-body scanners that use ionizing radiation.

The use of full-body scanners and mass screening solutions is a complex issue that requires careful consideration of both their effectiveness in enhancing public safety and their potential impact on privacy and civil liberties.

Integration of Full-Body Scanners into Mass Screening Solutions

The mass screening solutions market is expected to have a positive effect on the growth of the full-body scanners market. As more and more public spaces are implementing mass screening solutions, the demand for full-body scanners is likely to increase as well.

The increased use of mass screening solutions has led to a greater emphasis on security and safety in public spaces, and full-body scanners are an effective tool for identifying potential threats. This has led to an increase in demand for full-body scanners in airports, government buildings, and other high-security locations.

Advancements in technology have led to the development of more advanced full-body scanners that are more accurate and faster than earlier models. This has also contributed to the growth of the full-body scanners market.

The growth of the mass screening solutions market is likely to have a positive effect on the growth of the full-body scanners market, as both technologies are closely related and serve a similar purpose in enhancing public safety and security.

From Demand to Innovation: The Positive Impact of Mass Screening Solutions Companies on the Full-Body Scanners Market

Mass screening solutions companies are driving positive growth opportunities for the full-body scanners market by increasing demand for full-body scanners, integrating them into their screening systems, and driving technological advancements in full-body scanner technology. The implementation of mass screening solutions in various industries is increasing the need for full-body scanners, while advancements in technology are creating new opportunities for growth. As a result, the full-body scanners market is expected to experience continued growth in the future.

Conclusion: The Importance of Full-Body Scanners and Mass Screening Solutions for Public Safety and Security

The use of full-body scanners and mass screening solutions has become increasingly important in enhancing public safety and security in various industries, including transportation, sports, and government. While these technologies have proven to be effective in detecting potential threats, there are concerns about privacy and civil liberties that need to be addressed.

Mass screening solutions companies are driving positive growth opportunities for the full-body scanners market by increasing demand, integrating full-body scanners into their screening systems, and driving technological advancements in full-body scanner technology. This trend is expected to continue in the future as the need for enhanced security measures continues to grow.

It is clear that the full-body scanners market has significant growth potential in the coming years, as the demand for these technologies continues to rise. However, it is important to balance the need for security with the protection of individual privacy rights and civil liberties. As advancements in technology continue to evolve, it is essential to ensure that these technologies are used in an ethical and responsible manner.

Report Objectives

- To define, describe, segment, and forecast the Full-body scanners market based on End Use, Technology, Type, Detection, Component and Region.

- To analyze demand- and supply-side indicators influencing the growth of the market

- To understand the market structure by identifying high-growth segments and subsegments of the market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To forecast the revenues of market segments with respect to 6 main regions: North America, Europe, Asia Pacific, and Rest of the World.

- To analyze technological advancements and new product launches in the market from 2017 to 2022

- To provide a detailed competitive landscape of the market, in addition to market share analysis of leading players

- To identify the financial position, product portfolio, and key developments of leading players operating in the market

- To analyze micromarkets with respect to their individual growth trends, prospects, and contribution to the overall market

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players.

- To profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Full-Body Scanners Market