Friction Materials Market by Product (Pads, Linings, Discs, Blocks), Business Type (OE and Aftersales), Application (Brakes, Clutches), End-use Industry (Automotive, Railway, Construction), and Region - Global Forecast to 2023

[135 Pages Report] The friction materials market size is projected to grow from USD 42.54 million in 2017 to USD 57.04 million by 2023, at a CAGR of 5.0%.

The objectives of this study are:

- To estimate and forecast the friction materials market in terms of value

- To define, describe, and forecast the friction materials market based on product, business type, application, end-use industry, and region

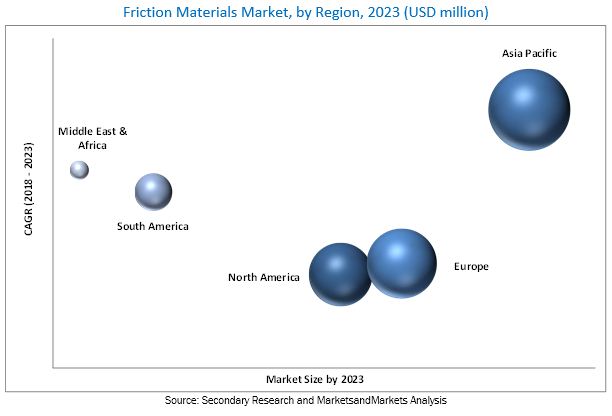

- To estimate and forecast the size of the friction materials market in five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA)

- To identify and analyze drivers, restraints, challenges, and opportunities influencing the friction materials market

- To profile key players in the friction materials market and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the friction materials market, along with an analysis of business and corporate strategies, such as mergers & acquisitions, new product launches & developments, and expansions adopted by the key market players

Years considered for the study are:

- Base Year 2017

- Estimated Year 2018

- Projected Year 2023

- Forecast Period 2018 to 2023

For company profiles, 2017 was considered as the base year. In cases, wherein information was unavailable for the base year, the years prior to it were considered.

Research Methodology

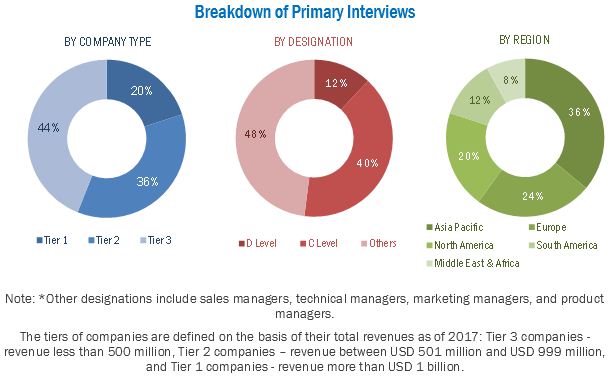

This study aims to estimate the size of the friction materials market for 2018 and projects the demand till 2023. It also provides a detailed qualitative and quantitative analysis of the friction materials market. Various secondary sources such as directories, industry journals, and databases (which include D&B Hoovers, Bloomberg, Chemical Weekly, Factiva, government and private websites, and metal associations), were used to identify and collect information useful for this extensive commercial study on the friction materials market. Primary sources such as experts from related industries and suppliers were interviewed to obtain and verify the critical information as well as assess prospects of the friction materials market. The breakdown of profiles of primary interviewees is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the friction materials market includes formulators and manufacturers of friction materials and friction products such as Akebono Brake Industry (Japan), Federal-Mogul Holdings (US), Miba (Austria), Fras-Le (Brazil), Nisshinbo Holdings (Japan), Aisin Seiki (Japan), Valeo Friction Materials India (India), Yantai Hi-Pad Brake Technology (China), and Carlisle Brake & Friction (US), among others.

Key Target Audience

- Raw material manufacturers

- Friction materials formulators and manufacturers

- Manufacturers from the end-use Industry

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- Environment support agencies

- Investment banks and private equity firms

Scope of the Report:

This research report categorizes the friction materials market based on product, business type, application, end-use industry, and region. The report forecasts revenues as well as analyze the trends in each of these submarkets.

Friction Materials Market, By Product:

- Lining

- Pads

- Blocks

- Discs

- Others (Rolls, Sheets, Etc.)

Friction Materials Market, By Business Type:

- OE

- Aftersales

Friction Materials Market, By Application:

- Brakes

- Clutches

- Industrial Brake & Transmission Systems

Friction Materials Market, By End-Use Industry:

- Automotive

- Railway

- Construction

- Aerospace & Marine

- Others (Agriculture, Mining, Etc.)

Friction Materials Market, By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Country Level Analysis

- A further breakdown of the Europe friction materials market into Austria and Switzerland

- A further breakdown of the Asia Pacific friction materials market into Singapore, Indonesia, and Malaysia

- Further breakdown of the South America friction materials market into Colombia, Venezuela, and Chile

- Further breakdown of the Middle East & Africa friction materials market into Saudi Arabia and the UAE

Company Information

- Detailed analysis and profiling of additional market players

The friction materials market size is projected to grow from USD 44.65 million in 2018 to USD 57.04 million by 2023, at a CAGR of 5.0%. The market is driven by the rising demand for passenger and commercial vehicles, which leads to the growth of friction materials consumption in auto components.

On the basis of product, the friction materials market for the pads segment is projected to witness the highest CAGR during the forecast period. Pads are used in brake systems and are exposed to significant friction, which leads to wear and tear. Friction pads are less prone to release dust on abrasion and can withstand high temperature.

Based on business type, the aftersales segment is expected to lead the overall friction materials market in 2018. The growth of this segment can be attributed to the increased demand for replacement friction products, particularly in the automotive industry.

Based on application, the friction materials market in the brakes segment is projected to register the highest CAGR between 2018 and 2023. Brake systems are essential to decelerate or control acceleration of vehicles or machiner. High demand for friction brakes from end-use industries such as automotive and railway is driving the growth of the friction materials market in the brakes application segment.

Based on end-use industry, the market is projected to witness the highest growth in the automotive industry during the forecast period. Friction materials are widely used in automotive applications such as brakes and clutches. Friction products such as pads, linings, discs, and blocks are consumable components that are used as original equipment as well as aftersales components. These friction products have high demand in the automotive industry as they are prone to wear & tear. Hence, the growth in automotive friction components is driving the growth of the friction materials market in the automotive end-use industry.

The Asia Pacific region is the largest consumer of friction materials across the globe. The friction materials market in Asia Pacific is projected to register the highest CAGR during the forecast period. Countries such as China, India, and South Korea are highly populated economies with rising preference for personal vehicles, which is fueling the growth of the friction materials market in the region.

However, advancements in braking technologies are estimated to eradicate the use of friction materials across the major end-use industries. Leading players operating in the friction materials market have initiated R&D for non-friction material brake products.

The key companies operating in the friction materials market include Akebono Brake Industry (Japan), Federal-Mogul Holdings (US), Miba (Austria), Fras-Le (Brazil), Nisshinbo Holdings (Japan), Aisin Seiki (Japan), Valeo Friction Materials India (India), Yantai Hi-Pad Brake Technology (China), and Carlisle Brake & Friction (US), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Growth Opportunities in the Friction Materials Market

4.2 Friction Materials Market, By Region

4.3 Friction Materials Market, By Product and End-Use Industry

4.4 Friction Materials Market, By Country

4.5 Friction Materials Market, By End-Use Industry and Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Upsurge in Worldwide Demand for Passenger and Commercial Vehicles

5.2.2 Restraints

5.2.2.1 Underdeveloped Friction Materials Market in Middle East & Africa Region in Automotive End-Use Industry

5.2.3 Opportunities

5.2.3.1 Demand for Lightweight Friction Products in Automotive End-Use Industry

5.2.4 Challenges

5.2.4.1 Advancements in Braking Technologies to Eradicate the Use of Friction Materials

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Value Chain Analysis

5.5 Friction Materials: Material Overview

5.5.1 Non-Asbestos Organic (Nao)

5.5.2 Low Steel

5.5.3 Semi-Metallic

5.5.4 Sintered Metals

5.5.5 Ceramic

5.5.6 Asbestos

5.5.7 Others (Aramid Fiber, Glass Fiber, Carbon Fiber, Rubber, Paper, Etc.)

5.6 Macroeconomic Indicator

5.6.1 Automotive

5.6.2 Construction

6 Friction Materials Market, By Product (Page No. - 46)

6.1 Introduction

6.2 Pads

6.3 Lining

6.4 Discs

6.5 Blocks

6.6 Others

7 Friction Materials Market, By Business Type (Page No. - 53)

7.1 Introduction

7.2 Original Equipment (OE)

7.3 Aftersales

8 Friction Materials Market, By Application (Page No. - 57)

8.1 Introduction

8.2 Brakes

8.3 Clutches

8.4 Industrial Brake & Transmission Systems

9 Friction Materials Market, By End-Use Industry (Page No. - 62)

9.1 Introduction

9.2 Automotive

9.3 Railway

9.4 Construction

9.5 Aerospace & Marine

9.6 Others

10 Regional Analysis (Page No. - 69)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Mexico

10.2.3 Canada

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Rest of Asia Pacific

10.4 Europe

10.4.1 Germany

10.4.2 France

10.4.3 UK

10.4.4 Spain

10.4.5 Italy

10.4.6 Belgium

10.4.7 Netherlands

10.4.8 Rest of Europe

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 South Africa

10.6.2 Iran

10.6.3 Egypt

10.6.4 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 97)

11.1 Overview

11.2 Ranking of Key Market Players

11.3 Competitive Scenario

11.3.1 New Product Development

11.3.2 Expansions

11.3.3 Acquisitions

11.3.4 Partnerships/Agreements/Contracts/Joint Venture

12 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Akebono Brake Industry

12.2 Federal-Mogul Holdings

12.3 Fras-Le

12.4 Nisshinbo Holdings

12.5 Aisin Seiki

12.6 Itt Inc.

12.7 MIBA AG

12.8 Valeo Friction Materials India Private Limited

12.9 Carlisle Brake & Friction (CBF)

12.10 Yantai Hi-Pad Brake Technology

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 125)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (75 Tables)

Table 1 Friction Materials Market Snapshot

Table 2 International Automotive Production Outlook, 2012-2017 (Million Units)

Table 3 Friction Materials By Market Size, By Product, 20162023 (USD Million)

Table 4 Friction Materials By Market in Pads, By Region, 20162023 (USD Million)

Table 5 Friction Materials By Market in Linings, By Region, 20162023 (USD Million)

Table 6 Friction Materials By Market in Discs, By Region, 20162023 (USD Million)

Table 7 Friction Materials By Market in Block, By Region, 20162023 (USD Million)

Table 8 By Market in Others Product Segment, By Region, 20162023 (USD Million)

Table 9 By Market Size, By Business Type, 20162023 (USD Million)

Table 10 By Market in Original Equipment (OE), By Region, 20162023 (USD Million)

Table 11 By Market in Aftersales, By Region, 20162023 (USD Million)

Table 12 By Market Size, By Application, 20162023 (USD Million)

Table 13 By Market in Brakes, By Region, 20162023 (USD Million)

Table 14 By Market in Clutches, By Region, 20162023 (USD Million)

Table 15 By Market in Industrial Brake & Transmission Systems, By Region, 20162023 (USD Million)

Table 16 By Market, By End-Use Industry, 20162023 (USD Million)

Table 17 By Market in Automotive, By Region, 20162023 (USD Million)

Table 18 By Market in Railway, By Region, 20162023 (USD Million)

Table 19 By Market in Construction, By Region, 20162023 (USD Million)

Table 20 By Market in Aerospace & Marine, By Region, 20162023 (USD Million)

Table 21 By Market in Others End-Use Industry, By Region, 20162023 (USD Million)

Table 22 By Market Size, By Region, 20162023 (USD Million)

Table 23 North America By Market Size, By Country, 20162023 (USD Million)

Table 24 North America By Market Size, By Product, 20162023 (USD Million)

Table 25 North America By Market Size, By Business Type, 20162023 (USD Million)

Table 26 North America By Market Size, By Application, 20162023 (USD Million)

Table 27 North America By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 28 US By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 29 Mexico By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 30 Canada By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 31 Asia Pacific By Market Size, By Country, 20162023 (USD Million)

Table 32 Asia Pacific By Market Size, By Product, 20162023 (USD Million)

Table 33 Asia Pacific By Market Size, By Business Type, 20162023 (USD Million)

Table 34 Asia Pacific By Market Size, By Application, 20162023 (USD Million)

Table 35 Asia Pacific By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 36 China By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 37 Japan By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 38 India By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 39 South Korea By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 40 Thailand By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 41 Rest of Asia Pacific By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 42 Europe By Market Size, By Country, 20162023 (USD Million)

Table 43 Europe By Market Size, By Product, 20162023 (USD Million)

Table 44 Europe By Market Size, By Business Type, 20162023 (USD Million)

Table 45 Europe By Market Size, By Application, 20162023 (USD Million)

Table 46 Europe By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 47 Germany By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 48 France By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 49 UK By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 50 Spain By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 51 Italy By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 52 Belgium By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 53 Netherlands By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 54 Rest of Europe By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 55 South America By Market Size, By Country, 20162023 (USD Million)

Table 56 South America By Market Size, By Product, 20162023 (USD Million)

Table 57 South America By Market Size, By Business Type, 20162023 (USD Million)

Table 58 South America By Market Size, By Application, 20162023 (USD Million)

Table 59 South America By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 60 Brazil By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 61 Argentina By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 62 North America By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 63 Middle East & Africa By Market Size, By Count20162023 (USD Million)

Table 64 Middle East & Africa By Market Size, By Product, 20162023 (USD Million)

Table 65 Middle East & Africa By Market Size, By Business Type, 20162023 (USD Million)

Table 66 Middle East & Africa By Market Size, By Application, 20162023 (USD Million)

Table 67 Middle East & Africa By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 68 South Africa By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 69 Iran By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 70 Egypt By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 71 Rest of Middle East & Africa By Market Size, By End-Use Industry, 20162023 (USD Million)

Table 72 New Product Development, 2013-2017

Table 73 Expansions, 2013-2017

Table 74 Acquisitions, 2013-2017

Table 75 Partnerships/Agreements/Contracts/Joint Venture, 2013-2017

List of Figures (50 Figures)

Figure 1 Friction Materials Market: Research Design

Figure 2 Market Size Estimation: Top-Down Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Friction Materials By Market: Data Triangulation

Figure 5 Friction Materials By Market, By Product, 2018 & 2023 (USD Billion)

Figure 6 Friction Materials By Market, By Business Type, 2018 & 2023 (USD Billion)

Figure 7 Friction Materials By Market, By Application, 2018 & 2023 (USD Billion)

Figure 8 Friction Materials By Market, By End-Use Industry, 2018 & 2023 (USD Billion)

Figure 9 Asia Pacific Expected to Be Fastest-Growing Market for Friction Materials During Forecast Period

Figure 10 Increasing Demand for Friction Materials From Automotive End-Use Industry Segment Projected to Drive Market Growth

Figure 11 Asia Pacific Friction Materials Market Projected to Witness Highest Growth Between 2018 and 2023

Figure 12 Friction Pads Product Segment Estimated to Account for Largest Share of Friction Materials Market in 2018

Figure 13 Friction Materials Market in China and India Projected to Register High Growth During Forecast Period

Figure 14 Asia Pacific and Europe Expected to Lead Friction Materials Market in Various Applications

Figure 15 Friction Materials Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Porters Five Forces Analysis of Friction Materials Market

Figure 17 The Linings Product Segment of the Friction Materials Market is Projected to Grow at A Higher Cagr From 2018 to 2023

Figure 18 Pads Product Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 19 Asia Pacific is Expected to Lead the Linings Product Segment From 2018 to 2023

Figure 20 Discs Product Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 21 Block Product Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 22 Others Product Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 23 The Aftersales Business Type Segment of the Friction Materials Market is Projected to Grow at A Higher Cagr ThanEquipmentBusinesFrom 54

Figure 24 Asia Pacific is Expected to Lead the Original Equipment (OE) Business Type Segment From 2018 to 2023

Figure 25 Aftersales Business Type Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 26 Brakes is Estimated to Be the Largest Application Segment of the Friction Materials Market During the Forecast Period

Figure 27 Asia Pacific is Expected to Lead the Brakes Application Segment From 2018 to 2023

Figure 28 Clutches Application Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 29 Industrial Brake & Transmission Systems Application Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the 61

Figure 30 Automotive is Estimated to Be the Largest End-Use Industry Segment of the Friction Materials Market During the Forecast Period

Figure 31 Asia Pacific is Expected to Lead the Automotive End-Use Industry Segment From 2018 to 2023

Figure 32 Railway End-Use Industry Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 33 Construction End-Use Industry Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 34 Aerospace & Marine End-Use Industry Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 35 Others End-Use Industry Segment in Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 36 The China Friction Materials Market is Projected to Grow at the Highest Cagr From 2018 to 2023

Figure 37 North America Friction Materials Market Snapshot

Figure 38 Asia Pacific Friction Materials Market Snapshot

Figure 39 Europe Friction Materials Market Snapshot

Figure 40 South America Friction Materials Market Snapshot

Figure 41 Middle East & Africa Friction Materials Market Snapshot

Figure 42 New Product Development Was the Most Preferred Strategy Adopted By the Key Companies to Grow in the Market

Figure 43 Market Ranking Analysis, 2017

Figure 44 Akebono Brake Industry: Company Snapshot

Figure 45 Federal-Mogul Holdings: Company Snapshot

Figure 46 Fras-Le: Company Snapshot

Figure 47 Nisshinbo Holdings: Company Snashot

Figure 48 Aisin Seiki: Company Snapshot

Figure 49 Itt Inc.: Company Snapshot

Figure 50 MIBA: Company Snapshot

Growth opportunities and latent adjacency in Friction Materials Market