Frequency Converter Market by Type (Static and Rotary), by End-User (Aerospace & Defense, Power & Energy, Process Industry, Traction, Oil & Gas, and Marine/Offshore), and by Region - Global Forecast and Trends to 2020

[223 Pages Report] Global frequency converter is one of the high growth markets owing to distinct end-users across all verticals of the industry from developing economies, such as China, India, Brazil and South Africa. Static frequency converter, one of the types, is gaining market attraction due to increasing electricity prices all across the world as well as growing awareness on reduction of air and noise pollution, especially by aerospace & defense and marine/offshore end-users.

Static frequency converters are expected to grow higher in developing economies from Asia-Pacific and the Middle East & Africa. Economies from these regions are spending more on modernization of infrastructure such as, manufacturing & production facilities, ports, airports, etc. The electric devices and equipment used at these industries need specific current frequency to run efficiently. Need for clean and efficient process is expected to drive the demand for frequency converters. Above mentioned drivers are expected to enhance the global frequency converter market to USD 23.2 billion by 2020, at a CAGR of 9.1% from 2015 to 2020. In 2014, the market size of global frequency converter was valued at USD 13.7 Billion.

Frequency Converter Market report has been segmented on the basis of type, end-user, and region as follows:

On the basis of Type: The report considers basic types of frequency converters, Static Frequency Converter, and Rotary Frequency Converter

On the basis of End-Users: Under this segmentation, the report considers various types of end users such as, Aerospace & Defense, Power & Energy, Process Industry, Traction, Oil & Gas, and Marine/Offshore

On the basis of Region: The regions analysed in the report include Asia-Pacific, Europe, North America, Latin America, and the Middle East & Africa. Developing economies from the regions, Asia-Pacific and the Middle East & Africa offer lucrative market opportunities to frequency converter manufacturers.

The report caters to power utilities, energy infrastructure contractors and equipment providers, aircraft manufacturers, vessel/port owners, oil & gas producers, traction substation installers, electric locomotive manufacturers, power electronics manufacturers and providers, manufacturing sector, dealers, and suppliers, raw material providers, consulting companies in the energy and power sector, government and research organizations, venture capital firms, and investment banks.

The end-users considered in the scope of the study include aerospace & defense, marine/offshore, oil & gas, power & energy, manufacturing industry, traction, grid interconnections, and research & testing labs among others, that are studied under the scope of study of market. Its main function is to provide the connected equipment with the desired current frequency and voltage level. Growing aerospace infrastructure, defense mechanisms, and other simulator applications are driving growth of frequency converters. Frequency converters reduce the dependency on auxiliary power units while aircraft is under maintenance, as ground power unit is connected through frequency converter to supply power at desired frequency to the aircraft. Aerospace & defense, process industry, and traction are the fastest growing end-users in the frequency converter market by 2020.

The report provides insights about the major players of the market and the growth strategies adopted by them. The leading players of the market such as ABB Ltd. (Switzerland), Danfoss A/S (Denmark), General Electric Company (U.S.), Siemens AG (Germany), Magnus Power (U.K.), Sinepower (Portugal), Aplab Ltd. (India), Power System & Control (Virginia), and Piller GmbH (Germany) among others have been profiled in this report.

The report also offers the following customizations:

- Detailed analysis and profiling of additional market players (Up to 5).

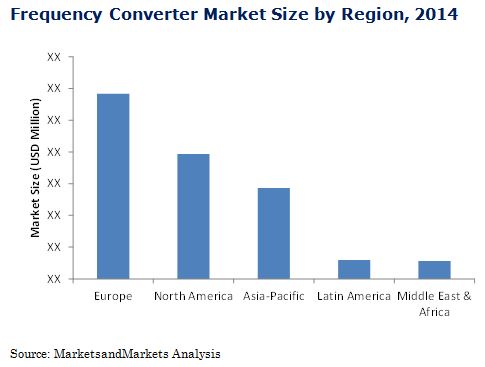

Global frequency converters market was dominated by Europe with a share of about 42% in 2014. It is estimated to grow at a CAGR of 8.0% from 2015 to 2020. Asia-Pacific is expected to be the fastest growing market, at a CAGR of 11.3% during the forecast period. Increasing expenditure in several industrial infrastructure and stringent government regulations is expected to increase demand of frequency converters, and drive the market in the Asia-Pacific region.

Frequency converters are useful in distinctive industrial applications, to match the frequency of power supply with the frequency of any electrical equipment connected. Demand to run the electric machinery and equipment effectively and cost efficiently across diverse sectors is the primary reason behind a rise in the usage of frequency converters. Since more than a decade, frequency converters are being used in industries such as aerospace & defense, process industry, power & energy, oil & gas, marine/offshore, and traction among others. These are basically used to convert the input supply frequency from one level to the desired frequency, as per the requirement and the specification of the equipment or machinery.

The frequency converter market is segmented on the basis of two types; first type is static frequency converter; it consists of components such as a rectifier, a DC bus or internal power storage battery, an inverter, and a control panel. Rectifiers and inverters are a combination of capacitor banks and semiconductor switches (such as GTO, power transistor, and IGBT,), along with diodes and control electronics. The other type is rotary frequency converter; it is robust in design and is mostly used in gas turbine power plants, offshore activities, and traction power supply. Although other industries use rotary frequency converters, they prefer static frequency converters for their compactness.

Frequency converter is used in varied end-use industries depending on the frequency requirement of the equipment connected to the converter. The end-users of frequency converters, considered for study include aerospace & defense, power & energy, oil & gas, traction, process industry, marine/offshore, research & testing laboratories, and grid interconnections among others. Differences in electrical standards of mains electricity supply worldwide, international trading, and an increase in the demand for energy-efficient frequency converters are driving the market. The global frequency converter market is projected to reach USD 23.2 Billion by 2020, from an around USD 15.0 Billion in 2015, at a CAGR of 9.1% from 2015 to 2020.

In 2014, in the global frequency converter market, Europe accounted for the largest share due to the massive investments from Germany and U.K. towards expansion of the aerospace & defense, manufacturing, marine/offshore, and energy infrastructures. North America was the second largest market in 2014, by value.

Frequency Converter market has been analyzed for different geographies including North and Latin Americas, Asia-Pacific, Europe, and the Middle East & Africa. The market size has been further analyzed in detail for key countries.

The study also includes profiling of key market players, including ABB Ltd. (Switzerland), Danfoss A/S (Denmark), General Electric Company (U.S.), and Siemens AG (Germany). Other key players that offer frequency converters at different output levels, and also provide services for various end-users worldwide include Magnus Power (U.K.), Sinepower (Portugal), Aplab Ltd. (India), Power System & Control (Virginia), and Piller GmbH (Germany).

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Breakdown of Primary Interviews

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Market Opportunities for Static Frequency Converters

4.2 Frequency Converter Market: Two Types of Frequency Converters

4.3 Aerospace & Defense Dominated the Frequency Converter Market in 2014

4.4 Frequency Converters: Top 15 Countries

4.5 Europe Dominated Frequency Converter Market in 2014

4.6 Demand for Static Frequency Converters is Projected to Increase in the Next Five Years

5 Market Overview (Page No. - 45)

5.1 By Type

5.1.1 Rotary Frequency Converter

5.1.2 Static Frequency Converter

5.2 By End-User

5.3 By Region

5.4 Drivers

5.4.1 Highest Electrical Efficiency

5.4.2 Suitable for Varied Applications

5.4.3 High Electricity Prices

5.4.4 Development & Modernization of Infrastructure

5.5 Restraints

5.5.1 Cost Impact

5.5.2 Electricity Standards

5.6 Opportunities

5.6.1 Growing Concerns Over Emissions From Conventional Power Generation Methods

5.6.2 Demand for Electrical Devices & Equipment

5.6.3 Huge Market Potential for Frequency Converter Devices

5.7 Challenges

5.7.1 Power Ratings as Per the Requirements of A Client

5.7.2 Noise From Frequency Converters

6 Industry Trends (Page No. - 55)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of Substitutes

6.4.2 Bargaining Power of Buyers

6.4.3 Bargaining Power of Suppliers

6.4.4 Threat of New Entrants

6.4.5 Intensity of Rivalry

7 Frequency Converter Market, By Type (Page No. - 66)

7.1 Introduction

7.2 Rotary Frequency Converter

7.3 Static Frequency Converter

8 Frequency Converter Market, By End-User (Page No. - 70)

8.1 Introduction

8.2 Aerospace & Defense

8.3 Power & Energy

8.4 Process Industry

8.5 Traction

8.6 Oil & Gas

8.7 Marine/Offshore

8.8 Other End-Users

9 Frequency Converter Market, By Region (Page No. - 87)

9.1 Introduction

9.2 Europe

9.2.1 Introduction

9.2.2 By End-User

9.2.2.1 By Country Analysis

9.2.3 By Type

9.2.3.1 By Country Analysis

9.3 North America

9.3.1 Introduction

9.3.2 By End-User

9.3.2.1 By Country Analysis

9.3.3 By Type

9.3.3.1 By Country Analysis

9.4 Asia-Pacific

9.4.1 Introduction

9.4.2 By End-User

9.4.2.1 By Country Analysis

9.4.3 By Type

9.4.3.1 By Country Analysis

9.5 Latin America

9.5.1 Introduction

9.5.2 By End-User

9.5.2.1 By Country Analysis

9.5.3 By Type

9.5.3.1 By Country Analysis

9.6 Middle East & Africa

9.6.1 Introduction

9.6.2 By End-User

9.6.2.1 By Country Analysis

9.6.3 By Type

9.6.3.1 By Country Analysis

10 Competitive Landscape (Page No. - 158)

10.1 Overview

10.2 Competitive Situation & Trends

10.3 Partnerships/Agreements/Collaborations

10.4 Expansions

10.5 New Product Developments

11 Company Profiles (Page No. - 165)

11.1 Introduction

11.2 ABB Ltd.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments, 2012-2014

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 General Electric Company

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Siemens AG

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments, 2011-2015

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Aplab Ltd.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.6 Danfoss A/S

11.6.1 Business Overview

11.6.2 Products & Services Offered

11.6.3 Recent Developments, 2013

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 Magnus Power

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments, 2013

11.8 Aelco

11.8.1 Business Overview

11.8.2 Products & Services Offered

11.8.3 Recent Developments

11.9 Georator Corporation

11.9.1 Business Overview

11.9.2 Products & Services Offered

11.9.3 Recent Developments

11.10 KGS Electronics

11.10.1 Business Overview

11.10.2 Products & Services Offered

11.10.3 Recent Developments

11.11 NR Electric

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments, 2013

11.12 Piller GmbH

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Recent Developments, 2015

11.13 Avionic Instruments LLC

11.13.1 Business Overview

11.13.2 Products Offered

11.13.3 RECENT DEVELOPMENTS

11.14 Power System & Control

11.14.1 Business Overview

11.14.2 Products Offered

11.14.3 Recent Developments, 2012-2015

11.15 Sinepower

11.15.1 Business Overview

11.15.2 Products Offered

11.15.3 Recent Developments, 2013-2014

12 Appendix (Page No. - 209)

12.1 Insights of Industry Experts

12.2 Other Developments

12.3 Discussion Guide

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (74 Tables)

Table 1 High Electrical Efficiency, Versatility in Applications, & Development of Infrastructure Propelling Growth of the Frequency Converter Market

Table 2 Cost Impact & Different Electricity Standards Restrain Market Growth

Table 3 Growing Concerns Over Emissions, Increasing Demand for Electronic Devices, & Huge Market Potential are the Key Opportunities of the Frequency Converter Market

Table 4 Power Ratings on the Demand of A Client & Noise From Frequency Converters are the Challenges of the Frequency Converter Market

Table 5 Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 6 Rotary Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 7 Static Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 8 Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 9 Aerospace & Defense: Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 10 Power & Energy: Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 11 Process Industry: Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 12 Traction: Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 13 Oil & Gas: Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 14 Marine/Offshore: Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 15 Other End-Users: Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 16 Frequency Converter Market Size, By Region, 2013-2020 (USD Million)

Table 17 Europe: Frequency Converter Market Size, By Country, 2013-2020 (USD Million)

Table 18 Europe: Market Size, By End-User, 2013-2020 (USD Million)

Table 19 U.K.: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 20 Germany: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 21 Russia: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 22 France: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 23 Rest of Europe: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 24 Europe: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 25 U.K.: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 26 Germany: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 27 Russia: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 28 France: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 29 Rest of Europe: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 30 North America: Frequency Converter Market Size, By Country, 2013-2020 (USD Million)

Table 31 North America: Market Size, By End-User, 2013-2020 (USD Million)

Table 32 U.S.: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 33 Canada: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 34 North America: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 35 U.S.: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 36 Canada: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 37 Asia-Pacific: Frequency Converter Market Size, By Country, 2013-2020 (USD Million)

Table 38 Asia-Pacific: Market Size, By End-User, 2013-2020 (USD Million)

Table 39 Japan: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 40 China: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 41 India: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 42 Australia: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 43 Rest of Asia-Pacific: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 44 Asia-Pacific: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 45 Japan: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 46 China: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 47 India: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 48 Australia: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 49 Rest of Asia-Pacific: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 50 Latin America: Frequency Converter Market Size, By Country, 2013-2020 (USD Million)

Table 51 Latin America: Market Size, By End-User, 2013-2020 (USD Million)

Table 52 Brazil: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 53 Mexico: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 54 Argentina: Frequency Converter Market, By End-User, 2013-2020 (USD Million)

Table 55 Rest of Latin America: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 56 Latin America: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 57 Brazil: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 58 Mexico: Frequency Converter Market Size , By Type, 2013-2020 (USD Million)

Table 59 Argentina: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 60 Rest of Latin America: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 61 Middle East & Africa: Frequency Converter Market Size, By Country, 2013-2020 (USD Million)

Table 62 Middle East & Africa: Market Size, By End-User, 2013-2020 (USD Million)

Table 63 Saudi Arabia: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 64 South Africa: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 65 UAE: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 66 Rest of the Middle East & Africa: Frequency Converter Market Size, By End-User, 2013-2020 (USD Million)

Table 67 Middle East & Africa: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 68 UAE: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 69 Saudi Arabia: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 70 South Africa: Frequency Converter Market Size, By Type, 2013-2020 (USD Million)

Table 71 Rest of the Middle East & Africa: Frequency Converter Market, By Type, 2013-2020 (USD Million)

Table 72 Partnerships/Agreements/Collaborations, 2014-2015

Table 73 Expansions, 2013-2015

Table 74 New Product Developments, 2013-2014

List of Figures (42 Figures)

Figure 1 Markets Covered: Frequency Converter Market

Figure 2 Frequency Converter Market: Research Design

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Breakdown of Primary Interviews: By Company, Designation, & Region

Figure 6 Market Estimation Approach & Data Triangulation Methodology

Figure 7 Frequency Converter Market: End-User Snapshot

Figure 8 Europe Dominated the Frequency Converter Market in 2014

Figure 9 Maximum Demand for Frequency Converter in the Aerospace & Defense Sector is Expected to Come From the European Market During the Forecast Period

Figure 10 Static Frequency Converter is Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 Attractive Market Opportunities in Frequency Converters

Figure 12 Static Frequency Converters Expected to Grow at the Highest Rate

Figure 13 Aerospace & Defense Frequency Market is Expected to Capture the Major Share By 2020

Figure 14 Potential Markets for Frequency Converter

Figure 15 Europe Accounted for the Largest Share in the Market in 2014

Figure 16 Static Frequency Converters Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Market Segmentation: Frequency Converter Market

Figure 18 Market Dynamics: Market

Figure 19 Value Chain Analysis: Major Value is Added at Manufacturing & Assembly Process of Frequency Converters

Figure 20 Supply Chain Analysis: Frequency Converters Market

Figure 21 Porter’s Five Forces Analysis – Frequency Converters Market

Figure 22 Companies Adopted Partnerships/Agreements/Collaborations as the Key Growth Strategy in the Past Three Years

Figure 23 Market Evaluation Framework: Partnership/Agreements/Collaborations Have Fueled Growth From 2012 to 2015

Figure 24 Geographic Revenue Mix of the Top 5 Players

Figure 25 ABB Ltd.: Company Snapshot

Figure 26 ABB Ltd.: SWOT Analysis

Figure 27 General Electric Company: Company Snapshot

Figure 28 General Electric Company: SWOT Analysis

Figure 29 Siemens AG: Company Snapshot

Figure 30 Siemens AG: SWOT Analysis

Figure 31 Aplab Ltd.: Company Snapshot

Figure 32 Danfoss A/S: Company Snapshot

Figure 33 Danfoss A/S: SWOT Analysis

Figure 34 Magnus Power : Company Snapshot

Figure 35 Aelco : Company Snapshot

Figure 36 Georator Corporation: Company Snapshot

Figure 37 KGS Electronics: Company Snapshot

Figure 38 NR Electric: Company Snapshot

Figure 39 Piller GmbH: Company Snapshot

Figure 40 Avionic Instruments LLC: Company Snapshot

Figure 41 Power System & Control: Company Snapshot

Figure 42 Sinepower : Company Snapshot

Growth opportunities and latent adjacency in Frequency Converter Market