IIoT Platform Market by Platforms (Device Management, Application Enablement, & Connectivity Management), Services, Application (Predictive Maintenance, Process Optimization, & Automation Control), Vertical and Region - Global Forecast to 2028

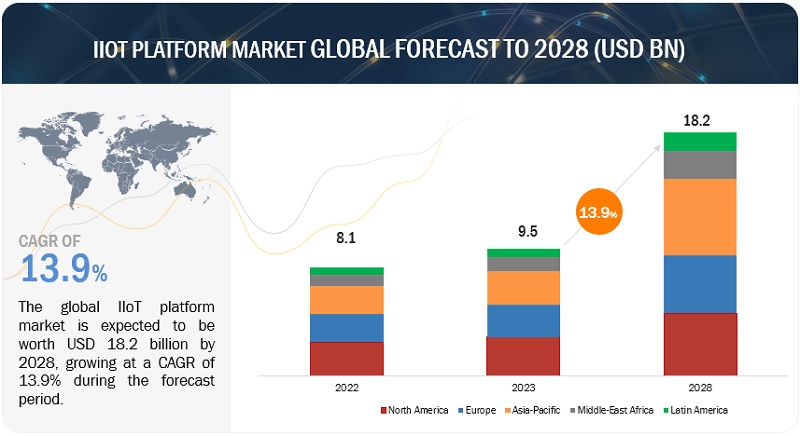

The global IIoT platform market size was estimated at USD 9.5 billion in 2023 and is projected to reach USD 18.2 billion by 2028, growing at a CAGR of 13.9% from 2023 to 2028. The major factors driving the growth of the IIoT platform industry include the rising need for centralized monitoring and predictive maintenance of assets, growing demand for automation in industries, including increased investments in Industry 4.0, and government initiatives aimed at promoting industrial automation.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

IIoT Platform Market Dynamics

Driver: Growing demand for automation in industries

The growing demand for automation in industries is a significant driver of the IIoT (Industrial Internet of Things) platform market. Automation enables industries to streamline their processes, reduce manual intervention, and optimize resource utilization. By leveraging IIoT platforms, industries can gather real-time data, monitor operations, and automate decision-making processes, leading to improved operational efficiency. IIoT platform plays an important role in enhancing the process of industrial automation in industries. IIoT platforms help generate cooperative communications and interaction from manufacturing field input or output involving actuators, robotics, and analyzers. These platforms help improve flexibility and deliver enhanced manufacturing..

Restraint: Absence of standardization in IoT protocols

A common protocol and communication standard are required to enable communication among IoT-enabled devices to share data or form an intelligent network. Interoperability and easy exchange of information among connected devices is of utmost importance. However, the current technical and market scenarios pertaining to the IIoT platform lack a promising architectural solution or a universal standard to solve the interoperability issues among connected devices. Hence, a universal standard or protocol for connectivity and data formatting is urgently required, as the IIoT platform is not just a network of internet-connected devices but machines, humans, and software. However, the absence of a universal standard for IoT is restraining this diverse IIoT platform ecosystem from being more effective and scalable.

Opportunity: Shift from on-premises to cloud-based data management strategy

IoT as a technology involves storing, managing, and analyzing data in real time. Storing and managing the huge volume of data on-premises lead to challenges that are related to scalability, security, IT infrastructure security, skilled IT workforce, and costs related to implementation and management. To address these challenges, organizations opt for a cloud-based data management strategy. Cloud platforms present a perfectly cost-effective and easily deployable alternative for data storage and eliminate the need to build on-premises data centers. While IoT is all about connected devices that produce huge amounts of data, the cloud platform enables analytics to help derive value from the data. Cloud computing technologies are providing companies a way to connect traditional information systems of enterprises to IoT-enabled devices. This capability enables enterprises to build IoT-based sensors and respond to systems quickly and economically.

The cloud platform is considered a secure platform for storage and computation of massive amounts of data due to in-built security and data management, and data analytics. Besides, the cloud also provides a unified platform that manages the service life cycle and organizes deployment. The adoption of IIoT Platform as a Service (PaaS) has increased the deployment of IoT solutions across many industry verticals. The cloud platform helps deploy various applications that provide organizations with newer ways of connecting traditional information systems to IoT-enabled devices. Moreover, many applications cannot run without cloud technology, making the cloud an essential part of the IoT ecosystem. Organizations are shifting from on-premises IIoT solutions to cloud-based IIoT platforms to leverage the benefits of cloud technology.

Challenge: Interoperability issues of legacy infrastructure and communication networks

Legacy systems are outdated computer software and hardware that remain in use even after the installation of modern technologies. Legacy systems are crucial for organizations as they support some key business functionalities. Organizations must upgrade their legacy systems as it becomes difficult to continue with systems whose services are discontinued by vendors. Most legacy systems do not have the configuration required to connect with smart devices and enhanced communication networks. Replacing these legacy systems can incur huge costs to companies. The market vendors face challenges integrating these legacy systems with various components in the IIoT platform ecosystem.

Machines must have built-in components facilitating Machine-to-Machine (M2M) communication for industrial applications. These components are connected to a wired or wireless network, such as Wi-Fi or RFID module. Thus, connected components collect relevant data from equipment and transmit it to a central computer for storage and analysis. The machinery in old industrial units may not be equipped with these data transmission components. As such, these components require to be fitted externally. Some legacy equipment may also require alterations to retrofit these components into them, thereby resulting in increased expenditure. This acts as a significant hindrance for organizations using old machinery. The impact of this restraint is expected to reduce gradually in the next few years as most industries have begun to realize the benefits of M2M communication. A few organizations have already started developing solutions to integrate their legacy equipment with communication networks. For instance, General Electric (US) has developed field agents or gateways that can be attached directly to industrial equipment to facilitate network connectivity.

Market Ecosystem

Platforms segment, by offering to account for a larger market size during the forecast period

IIoT platforms connect various devices, sensors, machines, routers, controllers, gateways, and edge computing systems centrally to streamline business processes and increase operational efficiency. The IIoT platform can be consumed as a technology suite, an open, general-purpose application platform, or both in conjunction. IIoT platforms are engineered to support the safety, security, and mission-criticality requirements associated with industrial assets and their operating environments. In addition, IIoT platforms monitor IoT endpoints and event streams, and support and translate various manufacturer and industry proprietary protocols. IIoT platform also analyzes data at the IoT edge and in the cloud.

Application enablement platform segment, by platforms is expected to grow at a higher CAGR during the forecast period

The application enablement platform is designed to ease the management of various applications, including packing, deployment, and a containerized Software-Defined Environment (SDE). The application enablement platform helps manage distinct application provisioning and ensure application-level security services. Moreover, application enablement platforms are being deployed to address the needs, such as intelligent product enhancements, dynamic response to market demands, lower costs, optimized resource use, and waste reduction.

Support and maintenance segment, by services is expected to lead the IIoT platform market during the forecast period

The support and maintenance service segment in the market is driven by various factors. These include the complexity of IIoT systems, which require technical expertise for troubleshooting and resolving issues. The continuous improvement of platforms necessitates ongoing support and updates to ensure optimal performance. Organizations also demand high reliability and minimal downtime to avoid disruptions in their operations..

Asset management segment, by application area is expected to lead the IIoT platform market during the forecast period

With the explosion of low-cost sensors, location-based services with GPS, affordable connectivity, and gateways, more and more assets are being equipped with tracking devices, sensors, and actuators, thus providing a centralized connection to the IIoT platform. IIoT platform-enabled asset management solutions minimize these risks by updating component location as soon as they arrive. Asset management is instrumental in managing physical assets and equipment performance on the manufacturing floor. The protection of physical assets, such as plants, machinery, and fleet, is the backbone of manufacturing operations. The asset management industrial application is crucial, as it provides a unified view of operations to all stakeholders and is instrumental in maintaining the effectiveness of manufacturing enterprises.

Discrete industry segment, by vertical is expected to grow at a higher CAGR during the forecast period

The discrete industry is concerned with the manufacturing and production of distinct units, such as automobiles, furniture, toys, smartphones, and airplanes. The discrete industry comprises a variety of verticals, such as automotive, machine manufacturing, semiconductor and electronics, medical devices, and logistics and transportation. IIoT platforms help these industries by offering solutions, such as predictive management, workforce tracking, and logistics and supply chain management, which enable organizations to improve operational efficiency, enhance asset life, and reduce downtime.

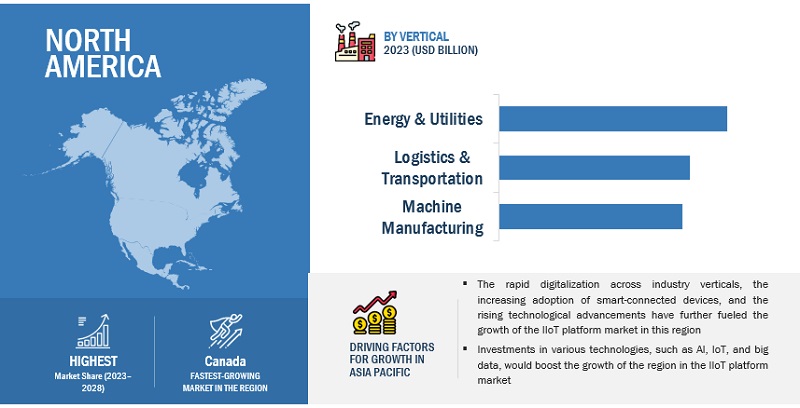

North America to account for the largest market size during the forecast period

IIoT platform is a steady-growing market in North America, which includes the US and Canada. These include technological advancements, the increasing adoption of industrial automation to enhance efficiency and reduce costs, the focus on data analytics and AI for informed decision-making, the need for regulatory compliance and safety measures, the growing emphasis on cybersecurity to protect industrial systems, and government initiatives and funding that support the development and implementation of IIoT platforms in various industries throughout North America.

Market Players

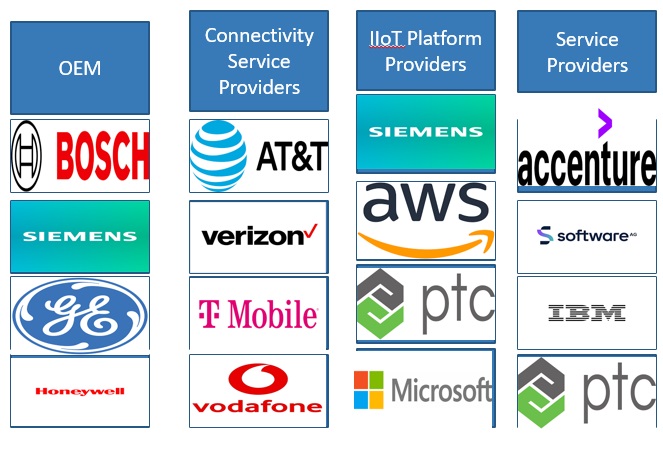

The report includes the study of key players offering IIoT platform market offerings. It profiles major vendors in the global IIoT platform market. The major vendors include Software AG (Germany), PTC (US), Hitachi (Japan), IBM (US), Microsoft (US), Cisco (US), Intel (US), SAP (Germany), Siemens AG(Germany), Accenture (US), Atos (France), Amazon Web Services (US), Oracle (US), Bosch.IO (US), Schneider Electric (France), Davra Networks (US), Eurotech (Italy), Altizon (US), QiO Technologies (UK), Litmus Automation (US), ROOTCLOUD (China), Augury (US), Braincube (France), UnifyTwin (US), and Samsara (US). The study includes an in-depth competitive analysis of these key players in the IIoT platform industry with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Offering, Application Area, Vertical, and Regions. |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Software AG (Germany), PTC (US), Hitachi (Japan), IBM (US), Microsoft (US), Cisco (US), Intel (US), SAP (Germany), Siemens AG(Germany), Accenture (US), Atos (France), Amazon Web Services (US), Oracle (US), Bosch.IO (US), Schneider Electric (France), Davra Networks (US), Eurotech (Italy), Altizon (US), QiO Technologies (UK), Litmus Automation (US), ROOTCLOUD (China), Augury (US), Braincube (France), UnifyTwin (US), and Samsara (US). |

This research report categorizes the IIoT platform market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering, the market has the following segments:

-

Platforms

- Device Management Platform

- Application Enablement Platform

- Connectivity Management Platform

-

Services

- Consulting Services

- System Integration and Deployment

- Support and Maintenance

Based on Application Area, the market has the following segments:

- Asset Managament

- Supply Chain and Management

- Business Process Optimization

- Workforce Management

- Automation Control

- Emergency and Incident Management

Based on Vertical, the market has the following segments:

-

Process Industry

- Energy and Utilities

- Chemical and Materials

- Food and Beverages

- Others(Pharmaceutical, Mining and Metals, and Pulp and Paper)

-

Discrete Industry

- Automotive

- Machine Manufacturing

- Semiconductor and Electronics

- Medical Devices

- Logistics and Transportation

- Others(Packaging and Printing, Textile, and Apparel etc)

Based on regions, the IIoT platform market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- India

- Rest of APAC

-

MEA

- Saudi Arabia

- Israel

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2023, Accenture acquired Flutura, an internet of things (IoT) and data science services firm, for an undisclosed sum to boost the industrial AI services it sells under Applied Intelligence's umbrella.

- In January 2023, PTC acquired ServiceMax a Service Execution Management company. The acquisition adds important field service management (FSM) capabilities to PTC’s closed-loop product lifecycle management (PLM) and digital thread offerings.

- In February 2022, Software AG acquired treamSets, a leader in data integration for the modern data stack. With this acquisition, Software AG adds a sizeable and fast-growing SaaS and subscription business that is growing rapidly.

- In March 2021, SAP acquired Signavio, one of the leaders in the enterprise business process intelligence and process management space. As a part of the acquisition, Signavio’s products become part of SAP’s business process intelligence portfolio and complement SAP’s holistic process transformation portfolio. As a result of the deal, SAP can help companies quickly understand, improve, transform and manage their business processes at scale.

- In February 2021, Siemens, IBM, and Red Hat collaborated to use a hybrid cloud designed to deliver an open, flexible, and more secure solution for manufacturers and plant operators to increase the real-time value of industrial IoT data. Through the collaboration, Siemens Digital Industries Software will apply IBM's open hybrid cloud approach, built on Red Hat OpenShift, to extend the deployment flexibility of MindSphere. This will enable customers to run MindSphere on-premise, unlocking the speed and agility in factory and plant operations and through the cloud for seamless product support, updates, and enterprise connectivity.

Frequently Asked Questions (FAQ):

What is the projected market value of the global IIoT platform market?

The IIoT platform market size is projected to grow from USD 9.5 billion in 2023 to USD 18.2 billion in 2028, at a Compound Annual Growth Rate (CAGR) of 13.9% during the forecast period.

Which region have the highest market share in IIoT platform market?

North America is expected to hold largest market share in the IIoT platform market. The region is a major contributor to the IIoT platform market as the region is set to dominate IoT, cloud, AI, big data, and mobility, due to its size, diversity, and the strategic lead taken by countries, including US and Canada.

Which platform segment is expected to witness higher adoption rate in coming years?

The application enablement platform is is expected to witness higher adoption rate in coming years. The platform is designed to ease the management of various applications, including packing, deployment, and a containerized Software-Defined Environment (SDE). The application enablement platform helps in managing distinct application provisioning and ensuring application-level security services. Moreover, application enablement platforms are being deployed to address the needs, such as intelligent product enhancements, dynamic response to market demands, lower costs, optimized resource use, and waste reduction.

Who are the major vendors in the IIoT platform market?

Major vendors in the IIoT platform market are Software AG (Germany), PTC (US), Hitachi (Japan), IBM (US), Microsoft (US), Cisco (US), Intel (US), SAP (Germany), Siemens AG(Germany), Accenture (US), Atos (France), Amazon Web Services (US), Oracle (US), Bosch.IO (US), Schneider Electric (France), Davra Networks (US), Eurotech (Italy), Altizon (US), QiO Technologies (UK), Litmus Automation (US), ROOTCLOUD (China), Augury (US), Braincube (France), UnifyTwin (US), and Samsara (US).

Which application area segment is expected to lead the IIoT platform market ?

Based on application area, the asset management segment is expected to lead the IIoT platform market during the forecast period. The asset management industrial application is crucial, as it provides a unified view of operations to all stakeholders and is instrumental in maintaining the effectiveness of manufacturing enterprises.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Increased need for centralized monitoring and predictive maintenance of assets- Rise in demand for automation across industries- Proliferation of IoT devices- Rise in number of cost-effective connected devices and sensors- Increased IoT-related government initiatives and R&D activities worldwide- Emergence of Internet Protocol version 6RESTRAINTS- Lack of standardization in IoT protocols- Complications related to integration with legacy systems and lack of skilled workforceOPPORTUNITIES- Rise in demand for IoT-enabled digital transformation in businesses across verticals- Shift from on-premises to cloud-based data management strategy- Emergence of 5G technology- Increased demand for system integratorsCHALLENGES- Issues related to data security and privacy- Interoperability issues related to legacy infrastructure and communication networks- Requirement of high initial investments in implementing IIoT platforms

-

5.3 CASE STUDY ANALYSISUSE CASE 1: CISCO HELPED SENTRYO MANAGE SECURITY AND VISIBILITY IN ITS MANUFACTURING OPERATIONSUSE CASE 2: IBM HELPED SHENZHEN CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD. IMPROVE PRODUCTION QUALITY AND THROUGHPUTUSE CASE 3: MICROSOFT HELPED LEGRAND ACHIEVE SMART BUILDING INNOVATIONS WITH OPEN IOTUSE CASE 4: PTC HELPED QUANT TRANSFORM ITS BUSINESS OF FACTORY SERVICESUSE CASE 4: BOSCH.IO HELPED HOLMER UTILIZE BOSCH IOT SUITE TO GAIN VALUABLE INSIGHTS INTO ITS AGRICULTURAL IOT DATA

-

5.4 TECHNOLOGY ANALYSISINTRODUCTIONDIGITAL TWINEDGE COMPUTING5GMQTT PROTOCOLAUGMENTED REALITYDISRUPTIONS IMPACTING BUYERS/CLIENTS IN IIOT PLATFORM MARKET

-

5.5 ECOSYSTEMOEM MANUFACTURERSCONNECTIVITY SERVICE PROVIDERSIIOT PLATFORM PROVIDERSSERVICE PROVIDERSEND USERS/APPLICATIONS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 PORTER’S FIVE FORCES MODELTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSDEGREE OF COMPETITION

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.9 AVERAGE SELLING PRICE TREND

-

5.10 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPES- Top applicants

- 5.11 KEY CONFERENCES AND EVENTS IN 2023

-

5.12 REGULATORY IMPLICATIONSISO STANDARDS- ISO/IEC JTC 1- ISO/IEC 27001- ISO/IEC 19770- ISO/IEC JTC 1/SWG 5- ISO/IEC JTC 1SC 31- ISO/IEC JTC 1/SC 27- ISO/IEC JTC 1/WG 7GENERAL DATA PROTECTION REGULATIONINSTITUTE OF ELECTRICAL AND ELECTRONICS ENGINEERSCEN/ISOCEN/CENELECEUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTEITU-T

- 5.13 HISTORY OF IIOT PLATFORM

- 5.14 BEST PRACTICES FOLLOWED WHILE ADOPTING IIOT PLATFORMS

-

5.15 FUTURE DIRECTION OF IIOT PLATFORM MARKETIIOT PLATFORM MARKET ROADMAP TILL 2030- Short-term (2023-2025)- Mid-term (2026-2028)- Long-term (2029-2030)

- 6.1 INTRODUCTION

-

6.2 PLATFORMSNEED TO IDENTIFY, ANALYZE, AND OPTIMIZE INDUSTRIAL DATA TO DRIVE SEGMENTPLATFORMS: MARKET DRIVERSDEVICE MANAGEMENT PLATFORM- Rise in number of connected devices to drive segment- Device management platform: IIoT platform market driversAPPLICATION ENABLEMENT PLATFORM- Need to drive innovation and achieve operational excellence to propel segment- Application enablement platform: market driversCONNECTIVITY MANAGEMENT PLATFORM- Increased requirement for common platform to manage entire network to boost segment- Connectivity management platform: market drivers- Improved business operations to drive segment

-

6.3 SERVICES

SERVICES: MARKET DRIVERSCONSULTING SERVICES- Need to identify right platform and reduce complexities to drive segment- Consulting services: IIoT platform market driversSYSTEM INTEGRATION AND DEPLOYMENT- Need to upgrade existing business operations to drive segment- System integration and deployment: market driversSUPPORT AND MAINTENANCE- Requirement for proactive monitoring and remote diagnostics to drive segment- Support and maintenance: market drivers

- 7.1 INTRODUCTION

-

7.2 ASSET MANAGEMENTINCREASED FOCUS ON OPTIMIZING ASSET UTILIZATION TO PROPEL SEGMENTASSET MANAGEMENT: MARKET DRIVERSCONDITION MONITORING- Need to enhance equipment reliability and reduce unplanned downtime to boost segmentPREDICTIVE MAINTENANCE- Extensive use to minimize maintenance costs to propel segment

-

7.3 SUPPLY CHAIN MANAGEMENTUSE IN IMPROVING SUPPLY CHAIN OPERATIONS TO DRIVE SEGMENTSUPPLY CHAIN MANAGEMENT: MARKET DRIVERS

-

7.4 BUSINESS PROCESS OPTIMIZATIONNEED TO STREAMLINE BUSINESS OPERATIONS TO BOOST SEGMENTBUSINESS PROCESS OPTIMIZATION: IIOT PLATFORM MARKET DRIVERS

-

7.5 WORKFORCE MANAGEMENTDATA-DRIVEN DECISION-MAKING CAPABILITIES AND IMPROVED WORKFORCE ALLOCATION TO DRIVE SEGMENTWORKFORCE MANAGEMENT: MARKET DRIVERS

-

7.6 AUTOMATION CONTROLENHANCED PRODUCTIVITY AND IMPROVED EQUIPMENT PERFORMANCE TO BOOST SEGMENTAUTOMATION CONTROL: MARKET DRIVERS

-

7.7 EMERGENCY AND INCIDENT MANAGEMENTINCREASED ADOPTION IN PREVENTING FATAL ACCIDENTS TO DRIVE SEGMENTEMERGENCY AND INCIDENT MANAGEMENT: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 PROCESS INDUSTRYIMPROVED OPERATIONAL EFFECIENCY ACROSS PROCESSES TO BOOST SEGMENTPROCESS INDUSTRY: MARKET DRIVERSENERGY AND UTILITIES- Demand for energy efficiency and grid optimization to propel segment- Energy and utilities: Use casesCHEMICALS AND MATERIALS- Need for enhanced safety and operational efficiency to drive segment- Chemicals and materials: Use casesFOOD AND BEVERAGES- Requirement to maintain food safety and regulatory compliances to boost segment- Food and beverages: Use casesOTHERS

-

8.3 DISCRETE INDUSTRYEXTENSIVE USE TO ENHANCE ASSET LIFE AND REDUCE DOWNTIME TO DRIVE SEGMENTDISCRETE INDUSTRY: MARKET DRIVERSAUTOMOTIVE- Rise in demand for use in connected cars to boost segment- Automotive: Use casesMACHINE MANUFACTURING- Extensive use in optimizing production processes and improving equipment performance to drive segment- Machine manufacturing: Use casesSEMICONDUCTOR AND ELECTRONICS- Increased demand for smart manufacturing and predictive maintenance to drive segment- Semiconductor and electronics: Use casesMEDICAL DEVICES- Real-time patient monitoring and remote healthcare services to boost segment- Medical devices: Use casesLOGISTICS AND TRANSPORTATION- Need for supply chain visibility to propel segment- Logistics and transportation: Use casesOTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: MARKET REGULATORY IMPLICATIONSNORTH AMERICA: IIOT PLATFORM MARKET DRIVERSUS- Presence of developed IT infrastructure and early adoption of advanced technologies to drive market- US: IIoT platform market driversCANADA- Rapid technological advancements across industries to drive market- Canada: market drivers

-

9.3 EUROPEEUROPE: MARKET REGULATORY IMPLICATIONSEUROPE: MARKET DRIVERSUK- Increased emphasis on industry 4.0 and digital transformation to propel market- UK: market driversGERMANY- Advanced IT infrastructure in manufacturing sector to drive market- Germany: market driversFRANCE- Rise in focus on digitalization and industry modernization to boost market- France: market driversREST OF EUROPE

-

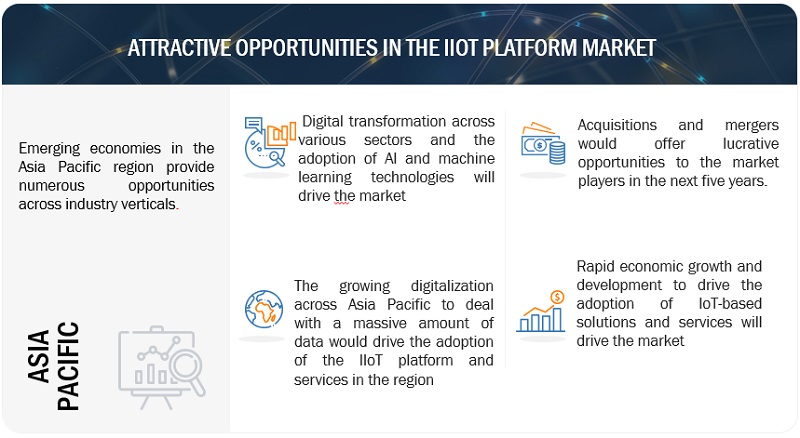

9.4 ASIA PACIFICASIA PACIFIC: MARKET REGULATORY IMPLICATIONSASIA PACIFIC: MARKET DRIVERSCHINA- Government support for technological advancements to drive market- China: market driversJAPAN- Increased government investments in smart city and connected cars projects to boost market- Japan: market driversREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET REGULATORY IMPLICATIONSMIDDLE EAST & AFRICA: MARKET DRIVERSSAUDI ARABIA- Implementation of Saudi Vision 2030 framework to drive market- Saudi Arabia: market driversISRAEL- Strong focus on technological innovations to propel market- Israel: market driversREST OF MIDDLE EAST AND AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: IIOT PLATFORM MARKET REGULATORY IMPLICATIONSLATIN AMERICA: MARKET DRIVERSBRAZIL- implementation of digital transformation initiatives to boost market- Brazil: market driversMEXICO- Advancements in connectivity technologies to propel market- Mexico: market driversREST OF LATIN AMERICA

- 10.1 OVERVIEW

-

10.2 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHESDEALS

- 10.3 MARKET RANKING

- 10.4 MARKET SHARE ANALYSIS

- 10.5 HISTORICAL REVENUE ANALYSIS

-

10.6 COMPANY EVALUATION MATRIX

-

10.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.8 COMPETITIVE BENCHMARKINGCOMPETITIVE BENCHMARKING OF KEY PLAYERSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

10.9 STARTUPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSSOFTWARE AG- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewPTC- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewHITACHI- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Platforms/Solutions/Services offered- Recent developments- MNM viewCISCO- Business overview- Platforms/Solutions/Services offered- Recent developmentsINTEL- Business overview- Platforms/Solutions/Services offered- Recent developmentsSAP- Business overview- Platforms/Solutions/Services offered- Recent developmentsSIEMENS- Business overview- Platforms/Solutions/Services offered- Recent developmentsACCENTURE- Business overview- Platforms/Solutions/Services offered- Recent developmentsATOSAMAZON WEB SERVICES (AWS)ORACLEBOSCH.IOSCHNEIDER ELECTRICDAVRAEUROTECH

-

11.3 STARTUPS/SMESALTIZONQIO TECHNOLOGIESLITMUSROOTCLOUDAUGURYSAMSARABRAINCUBEUNIFYTWIN

-

12.1 ADJACENT/RELATED MARKETIOT IN SMART CITIES MARKET – GLOBAL FORECAST TO 2025- Market definition- Market overview- IoT in smart cities market, by offering- IoT in smart cities market, by solution- IoT in smart cities market, by service- IoT in smart cities market, by application- IoT in smart cities market, by regionIOT IN HEALTHCARE MARKET – GLOBAL FORECAST TO 2025- Market definition- Market overview- IoT in healthcare market, by component- IoT in healthcare market, by application- IoT in healthcare market, by end user- IoT in healthcare market, by region5G IOT MARKET- Market definition- Market overview- 5G IoT market, by radio technology- 5G IoT market, by range- 5G IoT market, by vertical- 5G IoT market, by region

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 IMPACT ANALYSIS: DRIVERS AND OPPORTUNITIES

- TABLE 5 IMPACT ANALYSIS: RESTRAINTS AND CHALLENGES

- TABLE 6 CUMULATIVE GROWTH ANALYSIS

- TABLE 7 ECOSYSTEM: IIOT PLATFORM MARKET

- TABLE 8 PORTER’S FIVE FORCES ANALYSIS: IIOT PLATFORM MARKET

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 11 PATENTS GRANTED TO VENDORS IN IIOT PLATFORM MARKET

- TABLE 12 IIOT PLATFORM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 13 MARKET SIZE, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 14 IIOT PLATFORM MARKET SIZE, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 15 MARKET SIZE, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 16 IIOT PLATFORM MARKET SIZE, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 17 PLATFORMS: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 PLATFORMS: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 DEVICE MANAGEMENT PLATFORM: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 DEVICE MANAGEMENT PLATFORM: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 APPLICATION ENABLEMENT PLATFORM: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 APPLICATION ENABLEMENT PLATFORM: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 CONNECTIVITY MANAGEMENT PLATFORM: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 CONNECTIVITY MANAGEMENT PLATFORM: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 IIOT PLATFORM MARKET SIZE, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 26 MARKET SIZE, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 27 SERVICES: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 SERVICES: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 CONSULTING SERVICES: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 CONSULTING SERVICES: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 SYSTEM INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 SYSTEM INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 IIOT PLATFORM MARKET SIZE, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 36 MARKET SIZE, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 37 MARKET SIZE, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 38 IIOT PLATFORM MARKET SIZE, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 39 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 CONDITION MONITORING: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 CONDITION MONITORING: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 PREDICTIVE MAINTENANCE: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 PREDICTIVE MAINTENANCE: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 BUSINESS PROCESS OPTIMIZATION: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 BUSINESS PROCESS OPTIMIZATION: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 AUTOMATION CONTROL: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 AUTOMATION CONTROL: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 EMERGENCY AND INCIDENT MANAGEMENT: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 EMERGENCY AND INCIDENT MANAGEMENT: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 IIOT PLATFORM MARKET SIZE, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 56 MARKET SIZE, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 57 MARKET SIZE, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 58 IIOT PLATFORM MARKET SIZE, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 PROCESS INDUSTRY: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 PROCESS INDUSTRY: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 CHEMICALS AND MATERIALS: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 CHEMICALS AND MATERIALS: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 FOOD AND BEVERAGES: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 FOOD AND BEVERAGES: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OTHER PROCESS INDUSTRY: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 OTHER PROCESS INDUSTRY: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 MARKET SIZE, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 70 IIOT PLATFORM MARKET SIZE, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 DISCRETE INDUSTRY: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 DISCRETE INDUSTRY: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 AUTOMOTIVE: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 AUTOMOTIVE: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 MACHINE MANUFACTURING: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 MACHINE MANUFACTURING: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 SEMICONDUCTOR AND ELECTRONICS: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 SEMICONDUCTOR AND ELECTRONICS: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 MEDICAL DEVICES: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 MEDICAL DEVICES: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 LOGISTICS AND TRANSPORTATION: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 LOGISTICS AND TRANSPORTATION: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 OTHER DISCRETE INDUSTRY: MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 OTHER DISCRETE INDUSTRY: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 IIOT PLATFORM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: IIOT PLATFORM MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 US: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 106 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 107 US: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 108 US: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 109 US: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 110 US: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 111 US: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 112 US: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 113 US: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 114 US: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 115 US: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 116 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 117 US: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 118 US: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 US: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 120 US: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 121 CANADA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 122 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 123 CANADA: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 124 CANADA: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 125 CANADA: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 126 CANADA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 127 CANADA: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 128 CANADA: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 129 CANADA: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 130 CANADA: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 131 CANADA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 132 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 133 CANADA: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 134 CANADA: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 135 CANADA: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 136 CANADA: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 138 EUROPE: IIOT PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 140 EUROPE: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 142 EUROPE: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 144 EUROPE: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 146 EUROPE: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 148 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 149 EUROPE: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 150 EUROPE: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 152 EUROPE: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 153 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 154 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 UK: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 156 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 157 UK: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 158 UK: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 159 UK: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 160 UK: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 161 UK: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 162 UK: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 163 UK: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 164 UK: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 165 UK: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 166 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 167 UK: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 168 UK: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 169 UK: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 170 UK: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 172 ASIA PACIFIC: IIOT PLATFORM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 188 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 189 CHINA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 190 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 191 CHINA: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 192 CHINA: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 193 CHINA: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 194 CHINA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 195 CHINA: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 196 CHINA: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 197 CHINA: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 198 CHINA: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 199 CHINA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 200 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 201 CHINA: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 202 CHINA: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 203 CHINA: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 204 CHINA: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: IIOT PLATFORM MARKET, BY PLATFORMS, 2018–2022 (USD MILLION)

- TABLE 226 LATIN AMERICA: MARKET, BY PLATFORMS, 2023–2028 (USD MILLION)

- TABLE 227 LATIN AMERICA: MARKET, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 228 LATIN AMERICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 229 LATIN AMERICA: MARKET, BY APPLICATION AREA, 2018–2022 (USD MILLION)

- TABLE 230 LATIN AMERICA: MARKET, BY APPLICATION AREA, 2023–2028 (USD MILLION)

- TABLE 231 LATIN AMERICA: MARKET, BY ASSET MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 232 LATIN AMERICA: MARKET, BY ASSET MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 233 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 234 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 235 LATIN AMERICA: MARKET, BY PROCESS INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 236 LATIN AMERICA: MARKET, BY PROCESS INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 237 LATIN AMERICA: MARKET, BY DISCRETE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 238 LATIN AMERICA: MARKET, BY DISCRETE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 241 MARKET: PRODUCT LAUNCHES (2020–2023)

- TABLE 242 IIOT PLATFORM MARKET: DEALS (2020-2023)

- TABLE 243 IIOT PLATFORM MARKET: DEGREE OF COMPETITION

- TABLE 244 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 245 COMPANY FOOTPRINT: PRODUCT

- TABLE 246 COMPANY FOOTPRINT: APPLICATION

- TABLE 247 COMPANY FOOTPRINT: VERTICAL

- TABLE 248 COMPANY FOOTPRINT: REGION

- TABLE 249 DETAILED LIST OF STARTUPS/SMES

- TABLE 250 SOFTWARE AG: BUSINESS OVERVIEW

- TABLE 251 SOFTWARE AG: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 SOFTWARE AG: DEALS

- TABLE 253 PTC: BUSINESS OVERVIEW

- TABLE 254 PTC: DEALS

- TABLE 255 PTC: OTHERS

- TABLE 256 HITACHI: BUSINESS OVERVIEW

- TABLE 257 HITACHI: PRODUCT LAUNCHES

- TABLE 258 HITACHI: DEALS

- TABLE 259 IBM: BUSINESS OVERVIEW

- TABLE 260 IBM: DEALS

- TABLE 261 MICROSOFT: BUSINESS OVERVIEW

- TABLE 262 MICROSOFT: DEALS

- TABLE 263 CISCO: BUSINESS OVERVIEW

- TABLE 264 CISCO: PRODUCT LAUNCHES

- TABLE 265 CISCO: DEALS

- TABLE 266 CISCO: OTHERS

- TABLE 267 INTEL: BUSINESS OVERVIEW

- TABLE 268 INTEL: DEALS

- TABLE 269 SAP: BUSINESS OVERVIEW

- TABLE 270 SAP: DEALS

- TABLE 271 SIEMENS: BUSINESS OVERVIEW

- TABLE 272 SIEMENS: DEALS

- TABLE 273 ACCENTURE: BUSINESS OVERVIEW

- TABLE 274 ACCENTURE: DEALS

- TABLE 275 IOT IN SMART CITIES MARKET SIZE, BY OFFERING, 2016–2019 (USD BILLION)

- TABLE 276 IOT IN SMART CITES MARKET SIZE, BY OFFERING, 2019–2025 (USD BILLION)

- TABLE 277 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2016–2019 (USD BILLION)

- TABLE 278 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2019–2025 (USD BILLION)

- TABLE 279 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 280 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

- TABLE 281 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

- TABLE 282 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

- TABLE 283 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

- TABLE 284 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2019–2025 (USD BILLION)

- TABLE 285 IOT IN SMART CITIES MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

- TABLE 286 IOT IN SMART CITIES MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

- TABLE 287 IOT IN HEALTHCARE MARKET SIZE, BY COMPONENT, 2015–2019 (USD BILLION)

- TABLE 288 IOT IN HEALTHCARE MARKET SIZE, BY COMPONENT, 2019–2025 (USD BILLION)

- TABLE 289 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

- TABLE 290 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

- TABLE 291 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

- TABLE 292 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

- TABLE 293 SERVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

- TABLE 294 SERVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

- TABLE 295 IOT IN HEALTHCARE MARKET SIZE, BY APPLICATION, 2015–2019 (USD BILLION)

- TABLE 296 IOT IN HEALTHCARE MARKET SIZE, BY APPLICATION, 2019–2025 (USD BILLION)

- TABLE 297 IOT IN HEALTHCARE MARKET SIZE, BY END USER, 2015–2019 (USD BILLION)

- TABLE 298 IOT IN HEALTHCARE MARKET SIZE, BY END USER, 2019–2025 (USD BILLION)

- TABLE 299 IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

- TABLE 300 IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

- TABLE 301 5G IOT MARKET SIZE, BY RADIO TECHNOLOGY, 2020–2025 (USD MILLION)

- TABLE 302 5G IOT MARKET SIZE, BY RANGE, 2020–2025 (USD MILLION)

- TABLE 303 SHORT-RANGE IOT DEVICES: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 304 WIDE-RANGE IOT DEVICES: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 305 5G IOT MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

- TABLE 306 MANUFACTURING: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 307 ENERGY AND UTILITIES: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 308 GOVERNMENT: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 309 HEALTHCARE: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 310 TRANSPORTATION AND LOGISTICS: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 311 MINING: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 312 OTHERS: 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 313 5G IOT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

- TABLE 314 5G IOT CONNECTIONS, BY REGION, 2020–2025 (MILLION)

- FIGURE 1 IIOT PLATFORM MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 IIOT PLATFORM MARKET SIZE ESTIMATION: TOP-DOWN APPROACH - SUPPLY-SIDE ANALYSIS

- FIGURE 4 IIOT PLATFORM MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH AND SUPPLY-SIDE ANALYSIS (1/2)

- FIGURE 5 IIOT PLATFORM MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH AND SUPPLY-SIDE ANALYSIS (2/2)

- FIGURE 6 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

- FIGURE 7 IIOT PLATFORM MARKET, BY REGION, 2023

- FIGURE 8 GROWING NEED FOR ADVANCED MONITORING SOLUTIONS TO DRIVE GROWTH OF MARKET

- FIGURE 9 PLATFORMS AND US TO HOLD LARGER MARKET SHARES IN 2023

- FIGURE 10 PLATFORMS TO HOLD THE LARGER SHARE AND CHINA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2020

- FIGURE 11 CHINA TO WITNESS HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IIOT PLATFORM MARKET

- FIGURE 13 IIOT PLATFORM MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 14 IIOT PLATFORM ECOSYSTEM

- FIGURE 15 IIOT PLATFORM MARKET: VALUE CHAIN

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 17 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 18 NUMBER OF PATENTS GRANTED IN YEARLY OVER LAST 3 YEARS, 2021–2023

- FIGURE 19 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2021–2023

- FIGURE 20 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 21 SUPPLY CHAIN MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 DISCRETE INDUSTRY SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 23 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 24 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 27 KEY DEVELOPMENTS IN IIOT PLATFORM MARKET, 2021–2023

- FIGURE 28 MARKET RANKING IN 2022

- FIGURE 29 MARKET SHARE ANALYSIS OF COMPANIES IN IIOT PLATFORM MARKET

- FIGURE 30 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

- FIGURE 31 IIOT PLATFORM MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2022

- FIGURE 32 IIOT PLATFORM MARKET (GLOBAL), STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 33 SOFTWARE AG: COMPANY SNAPSHOT

- FIGURE 34 PTC: COMPANY SNAPSHOT

- FIGURE 35 HITACHI: COMPANY SNAPSHOT

- FIGURE 36 IBM: COMPANY SNAPSHOT

- FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 38 CISCO: COMPANY SNAPSHOT

- FIGURE 39 INTEL: COMPANY SNAPSHOT

- FIGURE 40 SAP: COMPANY SNAPSHOT

- FIGURE 41 SIEMENS: COMPANY SNAPSHOT

- FIGURE 42 ACCENTURE: COMPANY SNAPSHOT

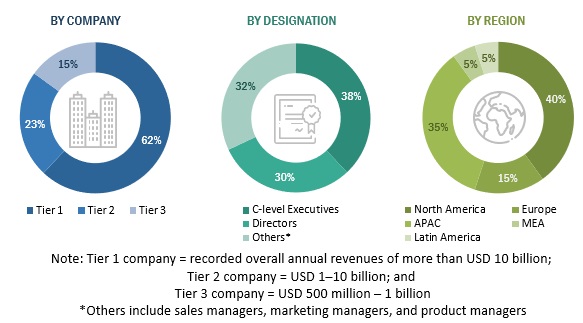

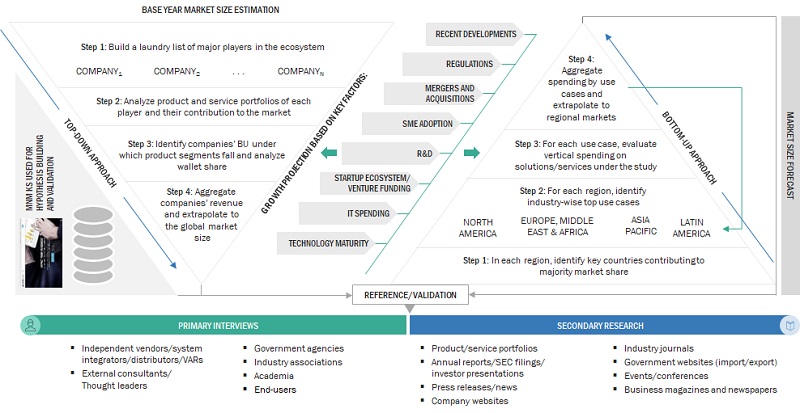

The study involved four major activities to estimate the current market size for the IIoT platform market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the IIoT platform market.

Secondary Research

In the secondary research process, various secondary sources, such as D & B Hoovers and Bloomberg BusinessWeek, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, investor presentations of companies, whitepapers, articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The IIoT platform market comprises several stakeholders, such as System design and development vendors, System integrators providers, Migration service providers, Consultants, Advisory firms, Support and maintenance service providers, Network service providers, Communication Service Providers (CSPs), IoT technology vendors, Academic and research institutes, Technology partners, Consulting firms, Research organizations, Resellers and distributors, Enterprise users, and Technology providers. The demand side of the IIoT platform market consists of the firms that deploy the IIoT platform. The supply side includes IIoT platform providers, offering IIoT platform. Various primary sources were interviewed from the supply and demand sides to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the IIoT platform market. The first approach involves estimating the market size by the summation of the revenue companies generate through the sale of solutions and services.

Bottom-Up Approach

The bottom-up procedure was employed to arrive at the overall size of the IIoT platform market from the revenues of key players (companies) and their market shares. The calculation was done based on estimations and by verifying key companies’ revenue through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of other individual segments (component, deployment mode, organization size, vertical, and region) via the percentage splits of the market segments from secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained. Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primary interviews, the exact values of the overall parent market size and its segments’ market size were determined and confirmed using this study.

Top-Down Approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the IIoT platform market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

The list of vendors for estimating the market size is not limited to those profiled in the report. However, MarketsandMarkets prepared a list of vendors offering IIoT platform solutions and services. They mapped their products related to the IIoT platform market to identify major vendors operating in the market.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The IIoT platform is a software capability that connects smart devices, sensors, machines, routers, controllers, gateways, and edge computing systems in industries centrally to streamline business processes and increase operational efficiency by catering to various application areas, such as business process optimization, asset tracking, predictive maintenance, workforce tracking, and asset control management.

Key Stakeholders

- IoT hardware vendors

- IoT platform and software vendors

- IoT connectivity providers

- Communications Service Providers (CSPs)

- Consulting and advisory firms

- Regional and global government organizations

- Investors and venture capitalists

- Independent Software Vendors (ISVs)

- Value-Added Resellers (VARs) and distributors

- System integrators

Report Objectives

- To determine and forecast the global IIoT platform market by offering, application area, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the IIoT platform market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IIoT Platform Market