Food Grade Gases Market by Type (Nitrogen, Oxygen, Carbon Dioxide), Application (Freezing & Chilling, Packaging, Carbonation), Industry (Dairy & Frozen Products, Beverages, Meat, Poultry & Seafood) and Region - Global Forecast to 2027

The food-grade gases market is projected to achieve a value of USD 10.6 billion by 2027, exhibiting a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period, starting from its valuation of $7.6 billion in 2022.

The food-grade gases market is seeing a surge in demand due to several key factors such as the increasing popularity of convenience food and carbonated drinks. Consumers are becoming more concerned about the safety of their food, which has resulted in food manufacturers turning to advanced packaging technologies like oxygen scavenging, MAP, CAP, and active packaging. These technologies create a controlled environment within the packaging, preserving the freshness of food products and reducing the need for additives while ensuring the quality of the food is not compromised.

"The growing demand for frozen and packaged food products by the youth in the Asia Pacific and South America region, as well as the development of retail channels, cold chain infrastructure and the rise in disposable incomes and working women, is driving growth in the food-grade gas industry."

Food-grade gas manufacturers find attractive opportunities for growth in the emerging economies of the Asia Pacific and South America. Due to the rising demand for frozen and packaged food products by the youth in these regions, the demand for food-grade gases is witnessing growth. Also, due to the developing retail channels and cold chain infrastructure and rise in disposable incomes and the number of working women, there has been a growing demand for convenience food products in these regions, which, in turn, results in an increased demand for food-grade gases. Also, because of the continuous new product launches and advancements in packaging technologies, there has been a growing need for food-grade gases for various end uses. These all pose as opportunities, thereby fueling the demand for food-grade gases, globally.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Grade Gases Market Dynamics

Drivers: Shift toward convenient packaged foods

Food-grade gases such as carbon dioxide (CO2), nitrogen (N), and oxygen (O) are mainly used in the packaging of convenience foods to enhance the shelf-life of fresh food products. Rising health concerns among consumers, especially in North America and Europe, have led to a shift toward the consumption of safer, healthier, and higher-quality food products.

Owing to the rising concerns about food safety amongst consumers, food manufacturers are focusing on various advanced packaging technologies such as oxygen scavengers, modified atmosphere packaging (MAP), controlled atmosphere packaging (CAP), and active packaging. These technologies help in maintaining the levels of gases such as oxygen and nitrogen inside the packaging, prevent the oxidation of food products, and reduce the need for additives while maintaining product quality.

The global food-grade gases market is mainly driven by the increasing demand for packaged food. On-the-go lifestyles have emerged because of several factors. Longer working hours & commuting time and the growing number of smaller households contribute to the increased demand for convenient single-serving or packaged food products. The increase in the utilization of these packaging technologies in the food packaging industry will lead to the growth of the food-grade gases market.

Restraints: Strict government regulations to meet quality standards

Legislations have been sanctioned in most countries in North America and Europe to protect food products from spoilage and contamination due to inferior manufacturing and refrigerated storage processes. Therefore, each country has appointed agencies to inspect consumer health issues and inspect the type of material and processes used to deem whether they are considered safe for food & beverage operations. In the US, this is done by the FDA, and in Canada, by the Food Inspection Agency.

Regulations for food-grade gases are not uniform, even between countries in proximity such as the US and Canada. Therefore, the Compressed Gas Association has created the standards document: CGA M-10 (2012) Food Safety Management Systems and Good Manufacturing Practices for food gas manufacturers. The document is to be used in combination with the federal, state, and provincial legal standards concerning food gas implementation. The following gases are uniformly believed to be safe to be used as an ingredient or food contact substance. Also, by law, all gas cylinders supplied for beverage manufacturers must have a product traceability label on the gas cylinder, valve, or valve guard. A small label is added to the cylinder with a series of numbers, and letters or cylinders are barcoded. The labels are used to trace the cylinders and their content in the event of quality issues.

Food-grade gas manufacturers need to abide by the government regulations to maintain quality standards for supply to the food & beverage industry

Opportunities: Increasing consumer preference for frozen and chilled food products to propel the market demand

The increasing popularity of shelf-stable foods among consumers on a global level is expected to propel the demand for frozen and chilled food products over the next few years. According to an article published in Progressive Grocer in August 2021, the popularity of these foods including breakfast meals rose by 10.9%, and dinners/entrees were up by 4.9%. frozen meat, up 2.7%, and processed chicken (up 10.4%). Moreover, the utilization of these products by numerous end users such as full-service restaurants, hotels & resorts, and quick-service restaurants will further support the growth of this market.

Increasing demand for frozen sea food in countries away from the coast are escalating the market for food-grade gases. Additionally, the market is also expected to expand due to the increasing import and export of various packaged food products. For instance, in October 2021, Amul, the Indian food retailer expanded its frozen and ready-to-eat food offerings including food such as frozen potatoes, paneer, cheese parathas, and patties.

This growth is also fuelled by new legislation in the retail environment, which gives foreign investors and multinational retail chains access to these markets. These retail chains have organized distribution channels across these markets, which provides opportunities for setting up food & beverage industries here. The growing importance of food safety and the quality of processed foods in these countries has increased the need to prevent the deterioration of food with the use of proper packaging technologies, which has increased investments in refrigerated storage facilities.

Challenges: Need to provide right mixture of gases in controlled environment packaging

The need to provide the right mix of gases in controlled environment packaging technologies such as modified atmosphere packaging and active packaging is a key challenge faced by packaging technology & equipment manufacturers. For example, ready-to-eat meals contain a complex mixture of ingredients that require the right mix of different gases to prolong their shelf-life; MAP packaging includes providing the right mix of gases in the packaging. The gases used in MAP include oxygen, nitrogen, and carbon dioxide. For example, in the packaging of meat products, the mix of 20% carbon dioxide and 80% oxygen is a good proportion that balances the attractive colour of meat and increases the visual appeal; any discrepancy otherwise can deteriorate the product quality.

The beverage industry is projected to grow at the highest CAGR during the forecast period, owing to the growing per capita global consumption of drinks in major developing regions due to rising disposable incomes and changing preferences towards ready-to-drink beverages

The beverage industry is the largest industry segment in the food-grade gases market. The beverage industry uses food-grade gases for various purposes, such as chilling, freezing, and carbonation. Nitrogen and carbon dioxide are the most widely used gases in the beverage industry.

Carbonation or fizz is the process of dissolving carbon dioxide in a liquid. The process usually involves carbon dioxide under high pressure. When the pressure is reduced, the carbon dioxide is released from the solution in the form of small bubbles, which causes the solution to become effervescent, or fizzy. This gives an acidic flavor to the beverage. Carbon dioxide is mainly used as an ingredient in carbonated beverages, which include soft drinks and beer. Non-alcoholic beverages also require nitrogen gas for blanketing and packaging.

Technological Advancements for Gas Sensors is one of the Major Trends

Toxic gas sensors play an important role in food production and control. Therefore, researchers have recently devoted significant attention to various gas sensing materials to achieve high-performance gas sensors. The prospects for the use of sensor technology in food production and monitoring are: (1) Development of simple sensors that operate at low temperatures and preferably Real time to save energy consumed during the monitoring process and the lifespan of the sensing material and accordingly, (2) the design of high-precision sensors to monitor the strategic stock of foodstuffs, especially C2H4 gas, to monitor the quality of stored fruits and vegetables and control their ripening. Researchers are interested in obtaining improvements in the sensitivity, selectivity, limit of detection, and operating temperature using a new mixture of nanomaterials that display different shapes.

To know about the assumptions considered for the study, download the pdf brochure

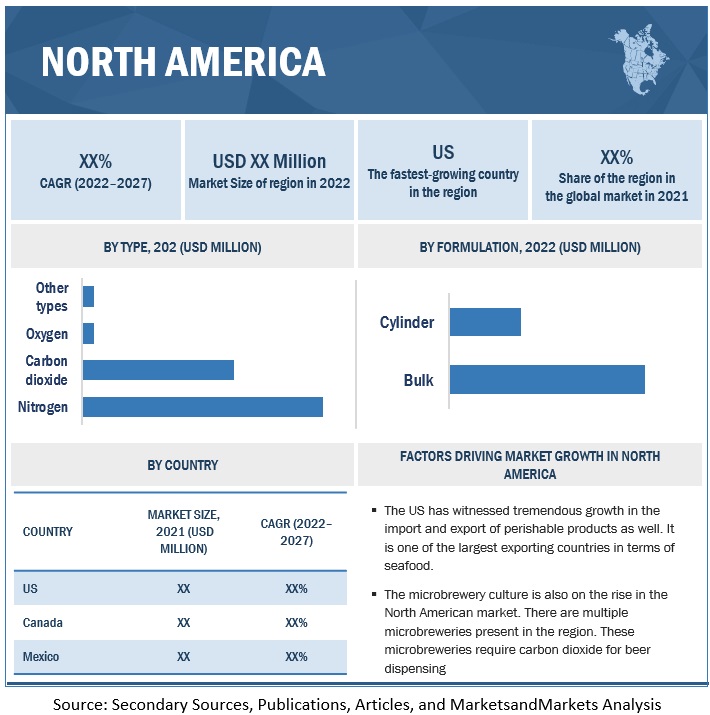

North America dominated the food grade gases market

Canada and Mexico witness the largest import of meat, fish, and seafood. In 2018, Canada was the largest export market for US agricultural products and accounted for 17% of the total exports. The major commodities exported to Canada are prepared foods, fresh & processed vegetables, fresh & processed fruit, meat & meat products, snack foods, certain non-alcoholic beverages, chocolate & cocoa products, condiments & sauces, coffee, wine, beer, and pet food.

"The growth of perishable food imports and microbreweries in North America has increased the demand for food-grade gases like nitrogen and carbon dioxide for preservation and carbonation."

The demand for perishable food imports has grown rapidly over the last 25 years since the introduction of supermarket food distribution systems in Mexico. Food Grade Gases are liquefied to promote a cryonic state for the preservation of frozen food items, which offers several chilling advantages: faster freeze rate and improved efficiency over mechanical freezers; increased production; reduced product dehydration; reduced bacterial activity; and increased shelf life. For this reason, nitrogen is most liquefied. Carbon dioxide may also be frozen as dry ice. As the demand for perishable foods is growing in North America, the need to chill, freeze, and package these products to improve their shelf life will increase, thereby increasing the scope for food-grade gases.

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, which includes the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

Food Grade Gases Market Share

The key players in this market include Air products & Chemicals, Inc. (US), Cryogenic Gases (US), American Welding & Gas (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 7.6 billion |

|

Revenue forecast in 2027 |

USD 10.6 billion |

|

Growth Rate |

CAGR of 6.9% from 2022 to 2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Segments covered |

Type, Application, Mode of supply, Industry, and Region |

|

Regional scope |

North America, Asia Pacific, South America, Europe, and RoW |

|

Dominant Geography |

North America |

|

Key companies profiled |

|

|

Food Grade Gases Market Drivers: |

|

|

Food Grade Gases Market Opportunities: |

|

Food grade gases Market Report Scope:

This research report categorizes the food grade gases market, based on Type, Application, Mode of supply, Industry, and Region.

Food Grade Gases Market by Type

- Carbon Dioxide

- Nitrogen

- Oxygen

- Other Types (Hydrogen & Argon)

By Application

- Freezing And Chilling

- Packaging

- Carbonation

- Other Applications (Hydrogenation, Blanketing, Purging, Sparging)

Food Grade Gases Market by Industry

- Meat, Poultry & Seafood Industry

- Dairy & Frozen Products Industry

- Beverages Industry

- Fruits & Vegetables Industry

- Convenience Food Products Industry

- Bakery & Confectionery Products Industry

- Other Industries

By Mode of Supply

- Bulk

- Cylinder

Food Grade Gases Market by Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Food Grade Gases Market Trends

- Increasing Demand for Convenience Foods: With changing lifestyles and increasing urbanization, there's a growing demand for convenience foods that have longer shelf lives. Food grade gases such as nitrogen, carbon dioxide, and oxygen are used for packaging and preservation of such foods, driving the market growth.

- Technological Advancements: Continuous technological advancements in food processing and packaging techniques are leading to the adoption of food grade gases for various applications such as modified atmosphere packaging (MAP), carbonation, and freezing.

- Stringent Food Safety Regulations: Regulatory bodies across the globe are imposing stringent regulations regarding food safety and quality. Food grade gases play a crucial role in maintaining the freshness and quality of packaged foods, thereby complying with these regulations.

- Rising Demand for Carbonated Beverages: The increasing consumption of carbonated beverages, both alcoholic and non-alcoholic, is driving the demand for food grade carbon dioxide. This gas is used in the carbonation process to add fizz to beverages.

- Growing Awareness Regarding Food Waste Reduction: There's a growing awareness among consumers and food manufacturers regarding food waste reduction. Food grade gases are utilized for extending the shelf life of perishable foods, reducing food wastage throughout the supply chain.

- Expansion in Emerging Markets: Emerging economies are witnessing rapid urbanization, changing dietary habits, and increasing disposable incomes. This is driving the demand for processed and packaged foods, subsequently boosting the market for food grade gases in these regions.

- Focus on Sustainable Packaging Solutions: With increasing environmental concerns, there's a shift towards sustainable packaging solutions. Food grade gases are being used in eco-friendly packaging techniques such as MAP and controlled atmosphere storage, contributing to sustainability efforts.

- Innovations in Gas Mixtures: Manufacturers are focusing on developing specialized gas mixtures tailored to specific food products and packaging requirements. This customization enhances the efficacy of food grade gases in preserving the quality and freshness of packaged foods.

Target Audience:

- Manufacturers, importers & exporters, traders, distributors, and suppliers of food-grade gases

- Food grade gas equipment suppliers

- Food & beverage product manufacturers

- Research & development institutions

- Trade associations

- Research & Development (R&D) institutions and financial institutions

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- World Health Organization (WHO)

- Food Industry Association of Austria (FIAA)

- The European Industrial gases Association (EIGA)

- The Asia Industrial gases association (AIGA)

Food Grade Gases Market Industry News

- In October 2022, Linde collaborated with JSL to expand the production capacity of JSL’s unit in Kalinga Nagar. Linde primarily supplies carbon dioxide, argon, and oxygen for this plant.

- In October 2022, Air Products’ Middle East Merchant Industrial Gas Joint Venture, Abdullah Hashim Industrial Gases & Equipment Co. Ltd., acquired Air Liquide’s Merchant Industrial Gases Business in the Kingdom of Saudi Arabia

- In February 2022, Linde signed a long-term agreement with BASF, one of the world's largest chemical companies, to supply hydrogen and steam. This helped Linde expand its business into newer geographies.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the global food grade gases market?

North America dominated the food grade gases market, with a value of USD 2.5 billion in 2022; it is projected to reach USD 3.4 billion by 2027, at a CAGR of 6.5% during the forecast period. Major players present in the North American food grade gases market are Air products & Chemicals, Inc. (US), Cryogenic Gases (US), American Welding & Gas (US).

What is the current size of the global food grade gases market?

The global food grade gases market is estimated to be valued at USD 7.6 billion in 2022. It is projected to reach USD 10.6 billion by 2027, recording a CAGR of 6.9% during the forecast period.

Who are the major players in the food grade gases market?

The major players in the food grade gases market include Linde PLC. (Ireland), Air Products & Chemicals, Inc. (US), Air Liquide (France), The Messer Group GmbH (Germany), Taiyo Nippon Sanso Corporation (Japan).

What are food grade gases and what are they used for?

Food grade gases are gases that are used in the food and beverage industry for a variety of purposes such as preservation, packaging, carbonation, and more. They include gases like carbon dioxide, nitrogen, oxygen, and others.

What are the main applications of food grade gases in the food and beverage industry?

The main applications of food grade gases in the food and beverage industry include preservation, packaging, carbonation, and more. They are used to keep food fresh, to create packaging that extends the shelf life of food, and to carbonate beverages.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.1.1 MARKET DEFINITION

1.2 MARKET SCOPE

1.2.1 MARKETS COVERED

FIGURE 1 FOOD-GRADE GASES MARKET SEGMENTATION

1.2.2 REGIONAL SEGMENTATION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 FOOD-GRADE GASES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 FOOD-GRADE GASES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 FOOD-GRADE GASES MARKET SIZE ESTIMATION (DEMAND SIDE)

2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 6 FOOD-GRADE GASES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 FOOD-GRADE GASES MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

2.3 GROWTH RATE FORECAST ASSUMPTION

2.4 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 ASSUMPTIONS

TABLE 2 ASSUMPTIONS

2.6 RESEARCH LIMITATIONS & ASSOCIATED RISKS

TABLE 3 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 4 FOOD-GRADE GASES MARKET SHARE, 2022 VS. 2027

FIGURE 9 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY MODE OF SUPPLY, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY INDUSTRY, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 FOOD-GRADE GASES MARKET OVERVIEW

FIGURE 13 HIGH DEMAND FOR CARBONATED BEVERAGES TO DRIVE MARKET GROWTH

4.2 FOOD-GRADE GASES MARKET, BY APPLICATION & REGION (2022 VS. 2027)

FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF FOOD-GRADE GASES MARKET

4.3 ASIA PACIFIC: FOOD-GRADE GASES MARKET, BY KEY COUNTRY & TYPE (2021)

FIGURE 15 CHINA TO DOMINATE FOOD-GRADE GASES MARKET IN ASIA PACIFIC

4.4 FOOD-GRADE GASES MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 16 ASIAN COUNTRIES TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

5 FOOD-GRADE GASES MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 RISING CONSUMER DEMAND FOR PERISHABLE GOODS

FIGURE 17 GROWING SALES OF CONVENIENCE FOODS, 2020 (% CHANGE IN SALES)

5.2.2 GROWTH IN INTERNATIONAL FOOD TRADE DUE TO TRADE LIBERALIZATION

FIGURE 18 FOOD & BEVERAGE TRADE VALUE IN 2020 (USD MILLION)

5.3 MARKET DYNAMICS

FIGURE 19 FOOD-GRADE GASES MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Shift toward convenient packaged foods

5.3.1.2 Growing number of microbreweries across all regions

5.3.2 RESTRAINTS

5.3.2.1 Strict government regulations to meet quality standards

TABLE 5 LIST OF FOOD-GRADE GASES AND APPLICATIONS

TABLE 6 REGULATIONS ON TRANSPORTATION AND STORAGE OF GAS CYLINDERS

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing consumer preference for frozen and chilled food products

5.3.3.2 Recent advances in target chemi-resistive gas sensors

5.3.4 CHALLENGES

5.3.4.1 Safe & proper handling of food-grade gases

5.3.4.2 Need to provide right mixture of gases in controlled-environment packaging

6 FOOD-GRADE GASES INDUSTRY TRENDS (Page No. - 59)

6.1 INTRODUCTION

6.2 REGULATORY FRAMEWORK

6.2.1 NORTH AMERICA

6.2.1.1 US

6.2.1.2 Canada

6.2.1.3 Mexico

6.2.2 EUROPE

6.2.3 ASIA PACIFIC

6.2.3.1 China

6.2.3.2 India

6.2.3.3 Thailand

6.3 PATENT ANALYSIS

FIGURE 20 NUMBER OF PATENTS APPROVED FOR FOOD-GRADE GASES IN GLOBAL MARKET, 2020–2022

FIGURE 21 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR FOOD-GRADE GASES, 2020–2022

TABLE 7 LIST OF MAJOR PATENTS PERTAINING TO FOOD-GRADE GASES, 2020–2022

6.4 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN OF FOOD-GRADE GASES MARKET

6.4.1 INPUT

6.4.2 MANUFACTURING

6.4.3 STORAGE

6.4.4 DISTRIBUTION

6.4.5 MARKETING & SALES

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS IN FOOD-GRADE GASES MARKET

FIGURE 23 ECO-FRIENDLY PRODUCTS AND GAS SENSORS TO ENHANCE FUTURE REVENUE MIX

6.6 ECOSYSTEM ANALYSIS

TABLE 8 FOOD-GRADE GASES: ECOSYSTEM VIEW

FIGURE 24 FOOD-GRADE GASES MARKET MAP

6.7 TECHNOLOGY ANALYSIS

6.7.1 CHEMI-RESISTIVE GAS SENSORS

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PORTER’S FIVE FORCES ANALYSIS

6.8.1 INTENSITY OF COMPETITIVE RIVALRY

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT FROM NEW ENTRANTS

6.8.5 THREAT FROM SUBSTITUTES

7 FOOD-GRADE GASES MARKET, BY TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 25 CARBON DIOXIDE SEGMENT TO DOMINATE FOOD-GRADE GASES MARKET DURING FORECAST PERIOD

TABLE 10 FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 11 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 CARBON DIOXIDE

7.2.1 GROWING DEMAND FOR AERATED DRINKS TO DRIVE MARKET

TABLE 12 CARBON DIOXIDE: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 13 CARBON DIOXIDE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 NITROGEN

7.3.1 RISING DEMAND FOR NITROGEN IN MODIFIED-ATMOSPHERE PACKAGING APPLICATIONS TO SUPPORT GROWTH

TABLE 14 NITROGEN: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 15 NITROGEN: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 OXYGEN

7.4.1 GROWING USE OF OXYGEN TO INHIBIT MICROBIAL GROWTH IN FOOD PACKAGES TO PROPEL MARKET

TABLE 16 OXYGEN: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 17 OXYGEN: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 OTHER GASES

TABLE 18 OTHER GASES: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 OTHER GASES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY (Page No. - 81)

8.1 INTRODUCTION

FIGURE 26 BULK SUPPLY OF FOOD-GRADE GASES TO ACCOUNT FOR LARGER MARKET SHARE

TABLE 20 FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017–2021 (USD MILLION)

TABLE 21 MARKET, BY MODE OF SUPPLY, 2022–2027 (USD MILLION)

8.2 BULK

8.2.1 EASE OF STORAGE AND TRANSPORTATION OF GASES IN BULK TO DRIVE DEMAND

TABLE 22 BULK: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 BULK: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CYLINDER

8.3.1 HIGH DEMAND FOR FOOD-GRADE GASES FROM SMALL-SCALE FOOD & BEVERAGE MANUFACTURERS TO SUPPORT MARKET

TABLE 24 CYLINDER: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 CYLINDER: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 FOOD-GRADE GASES MARKET, BY INDUSTRY (Page No. - 86)

9.1 INTRODUCTION

FIGURE 27 BEVERAGE INDUSTRY TO HOLD LARGEST SHARE OF FOOD-GRADE GASES MARKET DURING FORECAST PERIOD

TABLE 26 FOOD-GRADE GASES MARKET, BY INDUSTRY, 2017–2021 (USD MILLION)

TABLE 27 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2 BEVERAGE INDUSTRY

9.2.1 GROWING NUMBER OF MICROBREWERIES TO DRIVE MARKET

TABLE 28 BEVERAGE INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 BEVERAGE INDUSTRY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 MEAT, POULTRY, AND SEAFOOD INDUSTRY

9.3.1 WIDE APPLICATION OF FREEZING AND PACKAGING IN MEAT, POULTRY, AND SEAFOOD PRODUCTS TO SUPPORT GROWTH

TABLE 30 MEAT, POULTRY, AND SEAFOOD INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 MEAT, POULTRY, AND SEAFOOD INDUSTRY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 DAIRY & FROZEN PRODUCTS INDUSTRY

9.4.1 CONVENIENCE OF FROZEN FOOD PRODUCTS TO DRIVE MARKET DEMAND

TABLE 32 DAIRY & FROZEN PRODUCTS INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 DAIRY & FROZEN PRODUCTS INDUSTRY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 FRUITS & VEGETABLES INDUSTRY

9.5.1 DEMAND FOR PROLONGED SHELF-LIFE OF FRUITS & VEGETABLES TO SUPPORT ADOPTION

TABLE 34 FRUITS & VEGETABLES INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 FRUITS & VEGETABLES INDUSTRY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 CONVENIENCE FOOD INDUSTRY

9.6.1 GROWING CONSUMPTION OF READY-TO-EAT MEALS TO DRIVE MARKET

TABLE 36 CONVENIENCE FOOD INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 CONVENIENCE FOOD INDUSTRY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 BAKERY & CONFECTIONERY PRODUCTS INDUSTRY

9.7.1 GROWING PACKAGING APPLICATIONS TO AVOID RANCIDITY IN BAKERY PRODUCTS TO FUEL MARKET

TABLE 38 BAKERY & CONFECTIONERY PRODUCTS INDUSTRY: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 BAKERY & CONFECTIONERY PRODUCTS INDUSTRY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 OTHER INDUSTRIES

TABLE 40 OTHER INDUSTRIES: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 OTHER INDUSTRIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 FOOD-GRADE GASES MARKET, BY APPLICATION (Page No. - 97)

10.1 INTRODUCTION

FIGURE 28 FREEZING & CHILLING APPLICATIONS TO DOMINATE FOOD-GRADE GASES MARKET IN 2027

TABLE 42 FOOD-GRADE GASES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 43 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 FREEZING & CHILLING

10.2.1 GROWING DEMAND FOR READY-TO-EAT MEALS TO DRIVE GROWTH

TABLE 44 FREEZING & CHILLING APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 FREEZING & CHILLING APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 PACKAGING

10.3.1 INCREASING DEMAND FOR PACKAGED AND CONVENIENCE FOOD TO FUEL GROWTH

TABLE 46 PACKAGING APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 PACKAGING APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 CARBONATION

10.4.1 POPULARITY OF CARBONATED DRINKS TO AID MARKET GROWTH

TABLE 48 CARBONATION APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 CARBONATION APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 OTHER APPLICATIONS

TABLE 50 OTHER APPLICATIONS: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 FOOD-GRADE GASES MARKET, BY REGION (Page No. - 104)

11.1 INTRODUCTION

FIGURE 29 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 52 FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: FOOD-GRADE GASES MARKET SNAPSHOT

TABLE 54 NORTH AMERICA: FOOD-GRADE GASES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY MODE OF SUPPLY, 2017–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY MODE OF SUPPLY, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY INDUSTRY, 2017–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 High demand for gases for refrigeration and carbonation applications to fuel market

TABLE 64 US: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 65 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Demand for ready-to-eat foods and fizzy beverages to drive market

TABLE 66 CANADA: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 67 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 High production and consumption of meat and meat products to propel demand for food-grade gases

FIGURE 31 PORK PRODUCTION IN MEXICO, 2017–2021

FIGURE 32 BEEF & VEAL PRODUCTION IN MEXICO, 2017–2022

TABLE 68 MEXICO: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 69 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

TABLE 70 EUROPE: FOOD-GRADE GASES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: FOOD-GRADE GASES MARKET, BY MODE OF SUPPLY, 2017–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY MODE OF SUPPLY, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: FOOD GRADE GASES MARKET, BY INDUSTRY, 2017–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: FOOD GRADE GASES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 High demand for alcoholic beverages to boost market

TABLE 80 GERMANY: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Large production and export of beef to create demand for food-grade gases

TABLE 82 FRANCE: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 83 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 Growing consumer demand for frozen food products to drive market

TABLE 84 UK: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 85 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Growing demand for functional food & beverages to propel market

TABLE 86 ITALY: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 87 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Meat & meat products to create demand for food-grade gases for freezing & chilling applications

TABLE 88 SPAIN: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 89 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.6 NETHERLANDS

11.3.6.1 Presence of large number of food & beverage manufacturers to create opportunities for market

TABLE 90 NETHERLANDS: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 91 NETHERLANDS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 92 REST OF EUROPE: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: FOOD-GRADE GASES MARKET SNAPSHOT

TABLE 94 ASIA PACIFIC: FOOD GRADE GASES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY INDUSTRY, 2017–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY MODE OF SUPPLY, 2017–2021(USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY MODE OF SUPPLY, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Rapid growth of microbreweries to create demand for food-grade gases

TABLE 104 CHINA: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 105 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Expanding cold chain industry to drive market

TABLE 106 INDIA: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 107 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Innovations in sustainable food packaging to support growth

TABLE 108 JAPAN: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 109 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA

11.4.4.1 Organized retail chain and growing demand for frozen products to create opportunities

TABLE 110 AUSTRALIA: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 111 AUSTRALIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.5 NEW ZEALAND

11.4.5.1 High exports of fruits and meat products to create demand

TABLE 112 NEW ZEALAND: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 113 NEW ZEALAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 114 REST OF ASIA PACIFIC: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 115 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 116 SOUTH AMERICA: FOOD-GRADE GASES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 117 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 118 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 119 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 120 SOUTH AMERICA: MARKET, BY MODE OF SUPPLY, 2017–2021 (USD MILLION)

TABLE 121 SOUTH AMERICA: MARKET, BY MODE OF SUPPLY, 2022–2027 (USD MILLION)

TABLE 122 SOUTH AMERICA: MARKET, BY INDUSTRY, 2017–2021 (USD MILLION)

TABLE 123 SOUTH AMERICA: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 124 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 125 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Large-scale beef and veal production to drive demand for meat packaging and preservation

TABLE 126 BRAZIL: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 127 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Growing demand for packaged meat products to fuel growth

TABLE 128 ARGENTINA: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 129 ARGENTINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

TABLE 130 REST OF SOUTH AMERICA: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 131 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 132 REST OF THE WORLD: FOOD-GRADE GASES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 133 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 134 REST OF THE WORLD: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 135 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 136 REST OF THE WORLD: MARKET, BY MODE OF SUPPLY, 2017–2021 (USD MILLION)

TABLE 137 REST OF THE WORLD: MARKET, BY MODE OF SUPPLY, 2022–2027 (USD MILLION)

TABLE 138 REST OF THE WORLD: MARKET, BY INDUSTRY, 2017–2021 (USD MILLION)

TABLE 139 REST OF THE WORLD: MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 140 REST OF THE WORLD: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 141 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.1 AFRICA

11.6.1.1 Growing demand for on-the-go snacks to support growth

TABLE 142 AFRICA: FOOD GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 143 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Growing use of food-grade gases for freezing & chilling applications to create opportunities

TABLE 144 MIDDLE EAST: FOOD-GRADE GASES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 145 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 151)

12.1 OVERVIEW

12.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 34 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

12.3 MARKET SHARE ANALYSIS

TABLE 146 FOOD GRADE GASES MARKET: DEGREE OF COMPETITION, 2021

12.4 STRATEGIES OF KEY PLAYERS

12.5 COMPETITIVE LEADERSHIP MAPPING (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 35 FOOD-GRADE GASES MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

12.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 36 FOOD-GRADE GASES MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SMES)

12.7 COMPANY FOOTPRINT

TABLE 147 COMPANY FOOTPRINT, BY TYPE

TABLE 148 COMPANY FOOTPRINT, BY APPLICATION

TABLE 149 COMPANY FOOTPRINT, BY REGION

TABLE 150 OVERALL COMPANY FOOTPRINT

TABLE 151 FOOD-GRADE GASES MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 152 FOOD GRADE GASES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.8 COMPETITIVE LANDSCAPE

12.8.1 DEALS

TABLE 153 DEALS, 2017–2022

12.8.2 OTHER DEVELOPMENTS

TABLE 154 OTHER DEVELOPMENTS, 2017–2022

13 COMPANY PROFILES (Page No. - 170)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

13.1.1 LINDE PLC

TABLE 155 LINDE PLC: BUSINESS OVERVIEW

FIGURE 37 LINDE PLC: COMPANY SNAPSHOT (2021)

TABLE 156 LINDE PLC: DEALS

TABLE 157 LINDE PLC: OTHER DEVELOPMENTS

13.1.2 AIR PRODUCTS & CHEMICALS, INC.

TABLE 158 AIR PRODUCTS & CHEMICALS, INC.: BUSINESS OVERVIEW

FIGURE 38 AIR PRODUCTS & CHEMICALS, INC.: COMPANY SNAPSHOT (2021)

TABLE 159 AIR PRODUCTS & CHEMICALS, INC.: OTHER DEVELOPMENTS

13.1.3 AIR LIQUIDE

TABLE 160 AIR LIQUIDE: BUSINESS OVERVIEW

FIGURE 39 AIR LIQUIDE: COMPANY SNAPSHOT (2021)

13.1.4 THE MESSER GROUP GMBH

TABLE 161 THE MESSER GROUP GMBH: BUSINESS OVERVIEW

FIGURE 40 THE MESSER GROUP GMBH: COMPANY SNAPSHOT (2021)

TABLE 162 THE MESSER GROUP GMBH: OTHER DEVELOPMENTS

13.1.5 TAIYO NIPPON SANSO CORPORATION

TABLE 163 TAIYO NIPPON SANSO CORPORATION: BUSINESS OVERVIEW

FIGURE 41 TAIYO NIPPON SANSO CORPORATION: COMPANY SNAPSHOT (2021)

TABLE 164 TAIYO NIPPON SANSO CORPORATION: DEALS

13.1.6 WESFARMERS LIMITED

TABLE 165 WESFARMERS LIMITED: BUSINESS OVERVIEW

FIGURE 42 WESFARMERS LIMITED: COMPANY SNAPSHOT (2021)

13.1.7 PT ANEKA GAS INDUSTRI TBK

TABLE 166 PT ANEKA GAS INDUSTRI TBK: BUSINESS OVERVIEW

FIGURE 43 PT ANEKA GAS INDUSTRI TBK: COMPANY SNAPSHOT (2021)

13.1.8 MASSY GROUP, INC.

TABLE 167 MASSY GROUP, INC.: BUSINESS OVERVIEW

FIGURE 44 MASSY GROUP, INC.: COMPANY SNAPSHOT (2021)

13.1.9 AIR WATER, INC.

TABLE 168 AIR WATER, INC.: BUSINESS OVERVIEW

FIGURE 45 AIR WATER, INC.: COMPANY SNAPSHOT (2021)

13.1.10 LES GAZ INDUSTRIELS LTD.

TABLE 169 LES GAZ INDUSTRIELS LTD.: BUSINESS OVERVIEW

FIGURE 46 LES GAZ INDUSTRIELS LTD.: COMPANY SNAPSHOT (2021)

13.1.11 SOL GROUP

TABLE 170 SOL GROUP: BUSINESS OVERVIEW

FIGURE 47 SOL GROUP: COMPANY SNAPSHOT (2021)

13.1.12 GULF CRYO

TABLE 171 GULF CRYO: BUSINESS OVERVIEW

13.1.13 NATIONAL GASES LTD.

TABLE 172 NATIONAL GASES LTD.: BUSINESS OVERVIEW

13.1.14 GRUPPO SIAD

TABLE 173 GRUPPO SIAD: BUSINESS OVERVIEW

TABLE 174 GRUPPO SIAD: OTHER DEVELOPMENTS

13.1.15 CRYOGENIC GASES

TABLE 175 CRYOGENIC GASES: BUSINESS OVERVIEW

13.2 OTHER PLAYERS

13.2.1 ADITYA AIR PRODUCTS

TABLE 176 ADITYA AIR PRODUCTS: BUSINESS OVERVIEW

13.2.2 SIDEWINDER DRY ICE & GAS

TABLE 177 SIDEWINDER DRY ICE & GAS: BUSINESS OVERVIEW

13.2.3 AXCEL GASES

TABLE 178 AXCEL GASES: BUSINESS OVERVIEW

13.2.4 CHENGDU TAIYU INDUSTRIAL GASES CO., LTD.

TABLE 179 CHENGDU TAIYU INDUSTRIAL GASES CO., LTD.: BUSINESS OVERVIEW

13.2.5 YINGDE GAS GROUP SHANGHAI

TABLE 180 YINGDE GAS GROUP SHANGHAI: BUSINESS OVERVIEW

13.2.6 SIDDHI VINAYAKA INDUSTRIAL GASES PVT. LTD.

13.2.7 AMERICAN WELDING & GAS

13.2.8 IJSFABRIEK STROMBEEK N.V.

13.2.9 AIR SOURCE INDUSTRIES

13.2.10 PURITY CYLINDRICAL GASES

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 217)

14.1 INTRODUCTION

14.2 FOOD PACKAGING TECHNOLOGY AND EQUIPMENT MARKET

14.2.1 LIMITATIONS

14.2.2 MARKET DEFINITION

14.2.3 MARKET OVERVIEW

14.2.4 FOOD PACKAGING TECHNOLOGY AND EQUIPMENT MARKET, BY TYPE

TABLE 181 FOOD PACKAGING TECHNOLOGY MARKET, BY TYPE, 2016–2023 (USD MILLION)

14.2.5 FOOD PACKAGING TECHNOLOGY AND EQUIPMENT MARKET, BY REGION

TABLE 182 FOOD PACKAGING TECHNOLOGY MARKET, BY REGION, 2016–2023 (USD MILLION)

14.3 COLD CHAIN MARKET

14.3.1 LIMITATIONS

14.3.2 MARKET DEFINITION

14.3.3 MARKET OVERVIEW

14.3.4 COLD CHAIN MARKET, BY TEMPERATURE TYPE

TABLE 183 COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2017–2019 (USD MILLION)

TABLE 184 COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2020–2025 (USD MILLION)

14.3.5 COLD CHAIN MARKET, BY REGION

TABLE 185 COLD CHAIN MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 186 COLD CHAIN MARKET, BY REGION, 2020–2025 (USD MILLION)

15 APPENDIX (Page No. - 223)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

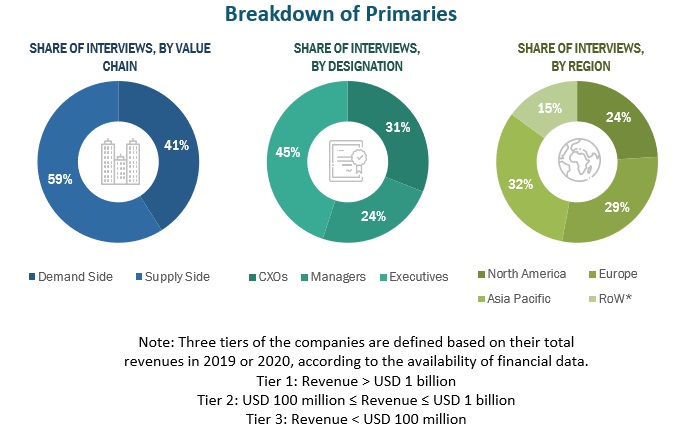

This research study involved the extensive use of secondary sources—directories and databases such as Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the food grade gases market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the food grade gases market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the food grade gases market.

To know about the assumptions considered for the study, download the pdf brochure

Food Grade Gases Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food grade gases market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major food grade gas manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the food grade gases market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Food Grade Gases Market Report Objectives

- To define, segment, and project the global market for food grade gases on the basis of type, application, mode of supply, industry, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the food grade gases market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Asia Pacific food-grade gases market, by key country

- Further breakdown of the Rest of European food-grade gases market, by key country

- Further breakdown of the Rest of the World food-grade gases market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Grade Gases Market