Foam Plastics Market by Type (PU, PS, PO, Phenolic), End-Use Industry (Building & Construction, Packaging, Automotive, Furniture & Bedding, Footwear, Sports & Recreational), and Region - Global Forecast to 2025

Updated on : June 18, 2024

Foam Plastics Market

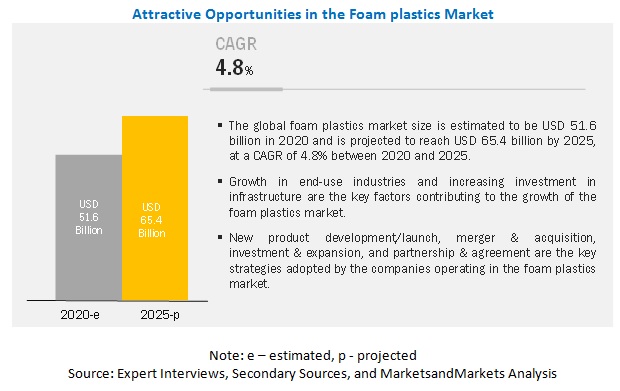

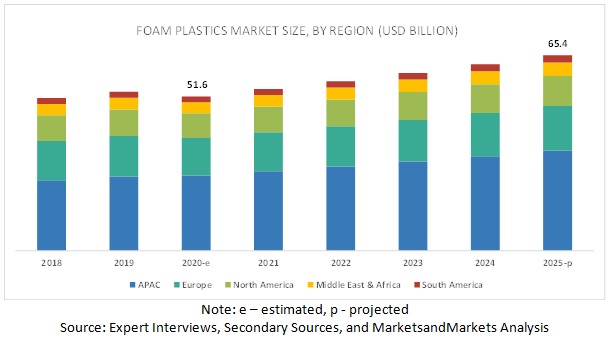

Foam Plastics Market was valued at USD 51.6 billion in 2020 and is projected to reach USD 65.4 billion by 2025, growing at 4.8% cagr from 2020 to 2025. Foam plastics are resins used in manufacturing polymer foams, which are used in various end-use industries such as building & construction, furniture & bedding, packaging, and automotive among others. The global foam plastics market is witnessing high growth on account of growing end-use industries. The economic growth in developing countries and growth in the major end-use industries such as building & construction, automotive, packaging, and furniture & bedding industries are leading to the growth of the market.

Attractive Opportunities in the Foam plastics Market

Building & construction segment accounted for the largest share of the foam plastics market in 2019.

Foam plastics are used to make foams used in the building & construction industry for forging, doors, roof board, and slabs. PU is the dominant resin used in the building & construction industry for insulation. It has low heat conduction coefficient, low density, low water absorption, and relatively good mechanical strength and insulating properties, which are helpful in the building & construction sector. The COVID-19 pandemic has affected various end-use industries, and almost all divisions of the supply chain continue to be affected, which also includes the construction industry. According to the National Association of Home Builders (NAHB), US, the GDP growth rate during the first two quarters is expected to be negative. This decline can be compared to the aftermath of the global performance of the 2008 Great Recession. However, the fourth quarter of 2020 is expected to be a rebound period.

Polyurethane segment is projected to witness the fastest growth during the forecast period.

The polyurethane resin segment is forecasted to register the highest CAGR. Polyurethane has low heat conduction coefficient, low density, low water absorption, relatively good mechanical strength, and good insulating properties. PU resin-based foams are available in a wide range of rigidity, hardness, and density levels. Low-density flexible foams are used in upholstery, bedding, automotive and truck seating, and novel inorganic plant substrates for roof or wall gardens. Low-density foams are used in thermal insulation and RTM cores.

APAC is the fastest-growing foam plastics market.

APAC is projected to be the fastest-growing market during the forecast period. The region comprises countries with different levels of economic development. The growth in the region is mainly attributed to the high economic growth rate followed by heavy investment across industries, such as building & construction, packaging, automotive, building & construction, and furniture & bedding.

Foam Plastics Market Players

BASF SE (Germany), Covestro (Germany), Huntsman International LLC (US), The Dow Chemical Company (US), and Wanhua Chemical Group Co., Ltd. (China) are the major players in the foam plastics market.

BASF SE (Germany) is a diversified chemical company. The company has five business segments: Functional Materials & Solutions, Chemicals, Performance Products, Agricultural Solutions, and Others. The company operates through six integrated production sites and 390 other production sites in Europe. It has a strong customer base and operates in many countries in Europe, North America, APAC, Africa, and the Middle East.

Foam Plastics Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018-2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

Type, End-use Industry, and Region |

|

Regions covered |

APAC, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

BASF SE (Germany), Covestro (Germany), Huntsman International LLC (US), The Dow Chemical Company (US), and Wanhua Chemical Group Co., Ltd. (China). A total of 26 players have been covered. |

This research report categorizes the foam plastics market based on type, end-use industry, and region.

By Type:

- Polyurethane

- Polystyrene

- Polyolefin

- Phenolic

- Others (melamine, PVC, silicone, rubber, and polyvinylidene fluoride (PVDF))

By Application:

- Building & Construction

- Packaging

- Automotive

- Furniture & Bedding

- Footwear, Sports & Recreational

- Others (aerospace, marine, refrigeration, medical, and wind energy)

By Region

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2019, BASF enhanced its regional innovation capabilities with new facilities at the Innovation Campus Shanghai to further strengthen collaboration with the automotive industry and to offer new process catalysts to the chemical industry. With an investment of approximately USD 38.0 million, the new 5,000-square-meter facility includes the Automotive Application Center and the Process Catalysis Research & Development (R&D) Center. One of the innovations includes polyurethane (PU) integral foam solutions with an open cell structure offering unique performance, which are light-weight and have excellent sound insulation and flame resistance.

- In February 2020, Huntsman Corporation announced that it completed the acquisition of Icynene-Lapolla, a leading North American manufacturer and distributor of spray polyurethane foam (SPF) insulation systems for residential and commercial applications. Huntsman acquired the business from an affiliate of FFL Partners, LLC, for USD 350 million, subject to customary closing adjustments, in an all-cash transaction funded from available liquidity.

Critical questions the report answers:

- Where will all these developments take the industry in the mid-to-long term?

- What are the upcoming applications of foam plastics?

- Which segment has the potential to register the highest market share?

- What is the current competitive landscape in the foam plastics market in terms of new technologies, production, and sales?

- What will be the future of foam plastics?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN THE FOAM PLASTICS MARKET

4.2 FOAM PLASTICS MARKET GROWTH, BY TYPE

4.3 APAC: FOAM PLASTICS MARKET SHARE, BY END-USE INDUSTRY AND COUNTRY

4.4 FOAM PLASTICS MARKET: MAJOR COUNTRIES

4.5 FOAM PLASTICS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth of major end-use industries of foam plastics

5.2.1.2 Energy sustainability and energy conservation

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Investment in emerging markets

5.2.3.2 Growth potential in less regulated regions

5.2.4 CHALLENGES

5.2.4.1 High pricing pressure

5.2.4.2 Stringent regulations

5.2.4.3 Growing demand for bio-based polyols

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 THREAT OF NEW ENTRANTS

5.4 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

5.4.3 TRENDS AND FORECAST OF GLOBAL AUTOMOTIVE INDUSTRY

5.4.4 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

5.5 COVID-19 IMPACT

6 FOAM PLASTICS MARKET, BY TYPE (Page No. - 50)

6.1 INTRODUCTION

6.2 POLYURETHANE

6.2.1 POLYURETHANE TO LEAD THE FOAM PLASTICS MARKET

6.3 POLYSTYRENE

6.3.1 EXPANDED POLYSTYRENE FOAM (EPS)

6.3.2 EXTRUDED POLYSTYRENE FOAM (XPS)

6.4 POLYOLEFIN

6.4.1 POLYETHYLENE FOAM (PE)

6.4.2 POLYPROPYLENE FOAM (PP)

6.4.3 EVA FOAM

6.5 PHENOLIC

6.5.1 PHENOLIC FOAM PLASTICS ARE USED IN HIGH-END APPLICATIONS

6.6 OTHERS

6.6.1 PVC

6.6.2 MELAMINE

6.6.3 SILICONE

6.6.4 PVDF

6.6.5 RUBBER

7 FOAM PLASTICS MARKET, BY END-USE INDUSTRY (Page No. - 61)

7.1 INTRODUCTION

7.2 BUILDING & CONSTRUCTION

7.2.1 BUILDING & CONSTRUCTION TO LEAD THE FOAM PLASTICS MARKET

7.3 PACKAGING

7.3.1 FOAM PLASTICS SUCH AS PU, PS, AND PO MOSTLY USED IN PACKAGING

7.4 AUTOMOTIVE

7.4.1 AUTOMOTIVE IS ONE OF FASTEST-GROWING END USERS OF FOAM PLASTICS

7.5 FURNITURE & BEDDING

7.5.1 APAC IS LARGEST AND FASTEST-GROWING MARKET FOR FOAM PLASTICS IN FURNITURE & BEDDING

7.6 FOOTWEAR, SPORTS & RECREATIONAL

7.6.1 FOAM PLASTICS USED IN PROTECTIVE GUARDS, LIFE JACKETS, SPORTS, CAMPING, AND TREKKING MATTRESSES

7.7 OTHERS

7.7.1 AVIATION & AEROSPACE

7.7.2 WIND ENERGY

7.7.3 MARINE

7.7.4 MEDICAL

7.7.5 REFRIGERATION

8 FOAM PLASTICS MARKET, BY REGION (Page No. - 73)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 US

8.2.1.1 Automotive industry driving the demand for foam plastics

8.2.2 CANADA

8.2.2.1 State-of-the-art manufacturing facilities and excellent infrastructure to provide growth opportunities

8.2.3 MEXICO

8.2.3.1 Mexico attracting key market players

8.3 EUROPE

8.3.1 GERMANY

8.3.1.1 Presence of major automobile companies and production facilities to boost the demand

8.3.2 FRANCE

8.3.2.1 Growing demand for auto parts and packaging materials to drive the market growth

8.3.3 ITALY

8.3.3.1 Footwear, sports & recreational segment to be fastest-growing market in Italy

8.3.4 POLAND

8.3.4.1 Growth in construction industry to play an important role in growth of foam plastics

8.3.5 SPAIN

8.3.5.1 Growth of construction industry to propel the demand for foam plastics

8.3.6 RUSSIA

8.3.6.1 Government investments for modernizing and expanding infrastructure to boost the demand

8.3.7 TURKEY

8.3.7.1 Presence of key automotive players to positively influence the foam plastics market

8.3.8 REST OF EUROPE

8.4 APAC

8.4.1 CHINA

8.4.1.1 Expanding automotive sector, improved public infrastructure, and construction sectors to boost the demand

8.4.2 JAPAN

8.4.2.1 Foam plastics market in Japan is mature and estimated to grow at a moderate rate

8.4.3 INDIA

8.4.3.1 Availability of resources, rapid economic growth, increasing disposable income, and urbanization to influence the market

8.4.4 SOUTH KOREA

8.4.4.1 Growth in automotive industry to drive the demand for foam plastics

8.4.5 MALAYSIA

8.4.5.1 Increase in demand for PU resin-based foam in renovation activities of the construction sector to drive the market

8.4.6 INDONESIA

8.4.6.1 High growth in building & construction and automotive industries to drive the foam plastics market

8.4.7 THAILAND

8.4.7.1 Strong local supply chain, efficient infrastructure, and strong automobile production to drive the demand for foam plastics

8.4.8 REST OF APAC

8.5 MIDDLE EAST & AFRICA

8.5.1 SAUDI ARABIA

8.5.1.1 Increased local car sales to drive the demand for foam plastics

8.5.2 SOUTH AFRICA

8.5.2.1 Growth of various manufacturing industries to positively influence the growth of the foam plastics market

8.5.3 UAE

8.5.3.1 Building of new resorts, shopping malls, and other ongoing projects to boost the demand for foam plastics

8.5.4 REST OF MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

8.6.1 BRAZIL

8.6.1.1 Expansion of production capacity, established distribution channels, and proximity to South American countries to propel the market

8.6.2 ARGENTINA

8.6.2.1 Growing automobile sector to drive the foam plastics market

8.6.3 CHILE

8.6.3.1 Government investment in end-use industries to drive the demand for foam plastics market

8.6.4 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 123)

9.1 OVERVIEW

9.2 COMPETITIVE SCENARIO

9.2.1 MERGERS & ACQUISITIONS

9.2.2 NEW PRODUCT LAUNCH

9.2.3 INVESTMENT & EXPANSION

9.2.4 PARTNERSHIP & AGREEMENT

10 COMPANY PROFILES (Page No. - 128)

(Business overview, Products offered, Recent Developments, SWOT Analysis, Right to Win)*

10.1 BASF SE

10.2 COVESTRO

10.3 HUNTSMAN INTERNATIONAL LLC

10.4 THE DOW CHEMICAL COMPANY

10.5 WANHUA CHEMICAL GROUP CO., LTD.

10.6 HEXION INC.

10.7 MCNS

10.8 SABIC

10.9 SHELL INTERNATIONAL B.V.

10.10 TOTAL S.A.

10.11 ALCHEMIE LTD.

10.12 CANGZHOU DAHUA GROUP CO. LTD.

10.13 CHINA PETROCHEMICAL CORPORATION (SINOPEC GROUP)

10.14 KUMHO MITSUI CHEMICALS CORP.

10.15 KUWAIT POLYURETHANE INDUSTRIES W.L.L.

10.16 LANXESS

10.17 LG CHEM

10.18 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

10.19 NOVA CHEMICALS CORPORATE

10.20 RAVAGO CHEMICALS

10.21 REPSOL

10.22 STEPAN COMPANY

10.23 TAITA CHEMICAL CO., LTD.

10.24 TOSOH CORPORATION

10.25 WEBAC-CHEMIE GMBH

10.26 WUXI XINGDA GROUP

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, Right to Win might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 167)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 RELATED REPORTS

11.4 AVAILABLE CUSTOMIZATIONS

11.5 AUTHOR DETAILS

LIST OF TABLES (119 Tables)

TABLE 1 FOAM PLASTICS MARKET SNAPSHOT (2020 VS. 2025)

TABLE 2 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2019–2024

TABLE 3 AUTOMOBILE PRODUCTION (2018-2019)

TABLE 4 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 5 MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 6 POLYURETHANE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 POLYURETHANE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 8 POLYSTYRENE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 POLYSTYRENE MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 10 POLYOLEFIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 POLYOLEFIN MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 12 PHENOLIC MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 PHENOLIC MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 14 OTHER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 OTHER MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 16 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 17 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 18 MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018–2025 (KILOTON)

TABLE 20 MARKET SIZE IN PACKAGING, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 MARKET SIZE IN PACKAGING, BY REGION, 2018–2025 (KILOTON)

TABLE 22 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2025 (KILOTON)

TABLE 24 MARKET SIZE IN FURNITURE & BEDDING, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 MARKET SIZE IN FURNITURE & BEDDING, BY REGION, 2018–2025 (KILOTON)

TABLE 26 MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2018–2025 (KILOTON)

TABLE 28 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (KILOTON)

TABLE 30 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 32 NORTH AMERICA: FOAM PLASTICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2025 (KILOTON)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 38 US: FOAM PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 39 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 40 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 41 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 42 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 43 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 44 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 46 EUROPE: MARKET SIZE, BY RESIN TYPE, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY RESIN TYPE, 2018–2025 (KILOTON)

TABLE 48 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 50 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 51 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 52 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 53 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 54 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 55 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 56 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 57 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 58 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 59 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 60 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 61 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 62 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 63 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 64 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 65 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 66 APAC: FOAM PLASTICS MARKET SIZE, BY COUNTRY, 2018–2025 USD MILLION)

TABLE 67 APAC: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 68 APAC: MARKET SIZE, BY RESIN TYPE, 2018–2025 (USD MILLION)

TABLE 69 APAC: MARKET SIZE, BY RESIN TYPE, 2018–2025 (KILOTON)

TABLE 70 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 71 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 72 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 73 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 74 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 75 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 76 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 77 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 78 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 79 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 80 MALAYSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 81 MALAYSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 82 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 83 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 84 THAILAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 85 THAILAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 86 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 87 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 88 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 90 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2018–2025 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 92 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 94 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 95 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 96 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 97 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 98 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 99 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 100 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 101 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 102 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 103 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 104 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2025 (USD MILLION)

TABLE 105 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2025 (KILOTON)

TABLE 106 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 107 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 108 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 109 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 110 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 111 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 112 CHILE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 113 CHILE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 114 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 115 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 116 MERGER & ACQUISITION, 2016–2020

TABLE 117 NEW PRODUCT LAUNCH, 2016–2020

TABLE 118 INVESTMENT & EXPANSION, 2016–2020

TABLE 119 PARTNERSHIP & AGREEMENT, 2016–2020

LIST OF FIGURES (38 Figures)

FIGURE 1 FOAM PLASTICS MARKET SEGMENTATION

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET: DATA TRIANGULATION

FIGURE 6 POLYURETHANE FOAM TO DOMINATE FOAM PLASTICS MARKET

FIGURE 7 BUILDING & CONSTRUCTION TO LEAD THE MARKET FOR FOAM PLASTICS

FIGURE 8 APAC TO BE LARGEST AND FASTEST-GROWING MARKET FOR FOAM PLASTICS

FIGURE 9 MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

FIGURE 10 POLYURETHANE TO BE THE LARGEST SEGMENT BETWEEN 2020 AND 2025

FIGURE 11 CHINA ACCOUNTED FOR LARGEST SHARE OF THE APAC MARKET IN 2019

FIGURE 12 INDIA TO EMERGE AS A LUCRATIVE MARKET FOR FOAM PLASTICS DURING THE FORECAST PERIOD

FIGURE 13 FOAM PLASTICS MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

FIGURE 14 INDIA AND CHINA TO REGISTER THE HIGHEST CAGR IN APAC DURING FORECAST PERIOD

FIGURE 15 FACTORS GOVERNING THE FOAM PLASTICS MARKET

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: MARKET

FIGURE 17 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2017–2025

FIGURE 18 PERCENTAGE CHANGE IN CHEMICAL PRODUCTION DUE TO COVID-19 OUTBREAK BETWEEN DECEMBER 2019 AND FEBRUARY 2020

FIGURE 19 POLYURETHANE TO DOMINATE THE FOAM PLASTICS MARKET TILL 2025

FIGURE 20 BUILDING & CONSTRUCTION TO BE LEADING END-USE INDUSTRY OF FOAM PLASTICS, 2020 VS. 2025

FIGURE 21 REGIONAL SNAPSHOT: INDIA AND CHINA TO EMERGE AS STRATEGIC LOCATIONS

FIGURE 22 NORTH AMERICA SNAPSHOT: US TO DOMINATE FOAM PLASTICS MARKET

FIGURE 23 EUROPE SNAPSHOT: CHINA TO LEAD THE MARKET IN APAC

FIGURE 24 APAC SNAPSHOT: CHINA TO LEAD THE FOAM PLASTICS MARKET IN APAC

FIGURE 25 COMPANIES ADOPTED INVESTMENT & EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

FIGURE 26 BASF SE: COMPANY SNAPSHOT

FIGURE 27 BASF: SWOT ANALYSIS

FIGURE 28 COVESTRO: COMPANY SNAPSHOT

FIGURE 29 COVESTRO: SWOT ANALYSIS

FIGURE 30 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

FIGURE 31 HUNTSMAN INTERNATIONAL LLC: SWOT ANALYSIS

FIGURE 32 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 33 DOW CHEMICAL COMPANY: SWOT ANALYSIS

FIGURE 34 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY SNAPSHOT

FIGURE 35 WANHUA CHEMICAL GROUP CO., LTD.: SWOT ANALYSIS

FIGURE 36 HEXION INC.: COMPANY SNAPSHOT

FIGURE 37 SHELL INTERNATIONAL B.V.: COMPANY SNAPSHOT

FIGURE 38 TOTAL S.A.: COMPANY SNAPSHOT

Foam plastics are resins used in manufacturing polymer foams, which are used in various end-use industries such as building & construction, furniture & bedding, packaging, and automotive among others. The study involves four major activities in estimating the current market size of foam plastics. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Primary Research

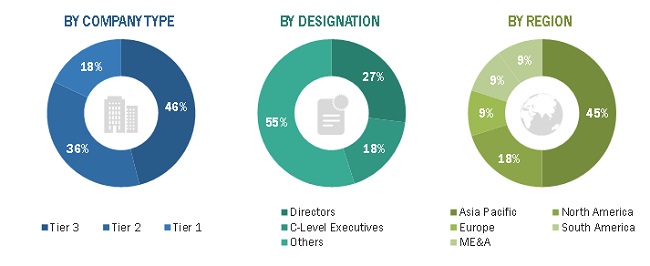

The foam plastics market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as building & construction, packaging, automotive, furniture & bedding, footwear, sports & recreational, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the foam plastics market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the foam plastics market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market based on type and end-use industry

- To estimate and forecast the market size based on five regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa, and South America

- To estimate and forecast the foam plastics market at the country-level in each of the regions

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as new product launch, investment & expansion, merger & acquisition, and partnership & agreement in the market

- To strategically identify and profile the key market players and analyze their core competencies1

Note: Core competencies1 of the companies are determined in terms of their key developments and key strategies to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the foam plastics market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Foam Plastics Market