Foam Insulation Market by Product Type (Polystyrene, Polyurethane & Polyisocyanurate, Polyolefin, Elastomeric, and Phenolic), End-use Industry (Building & Construction, Transportation, and Consumer Appliances), and Region - Global Forecast to 2021

[136 Pages Report] The Foam Insulation Market size was USD 17.58 Billion in 2016 and is projected to reach USD 22.39 Billion by 2021, at a CAGR of 4.95% from 2016 to 2021. In this study, 2015 has been considered as the base year, and 20162021 the forecast period to estimate the market size for foam insulation.

Objectives of the study:

- To analyze and forecast the foam insulation market size in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, and opportunities) influencing the growth of the market

- To define, describe, and forecast the foam insulation market by product type and end-use industry

- To forecast the market size, in terms of volume and value, of different segments based on regions, namely, Europe, North America, Asia-Pacific, South America, and the Middle East & Africa

- To analyze and forecast the size of the foam insulation market, by end-use industry for major countries, such as the U.S., China, India, Japan, Turkey, Italy, Brazil, and Germany

- To strategically analyze the market with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide of a competitive landscape for market leaders

- To track and analyze competitive developments, such as expansions, new product launches, agreements, acquisitions, and joint ventures, in the foam insulation market

- To strategically profile key players and comprehensively analyze their core competencies

Note: Core competencies of the companies are determined in terms of their key developments, and key strategies adopted by them to sustain their position in the market.

Research Methodology:

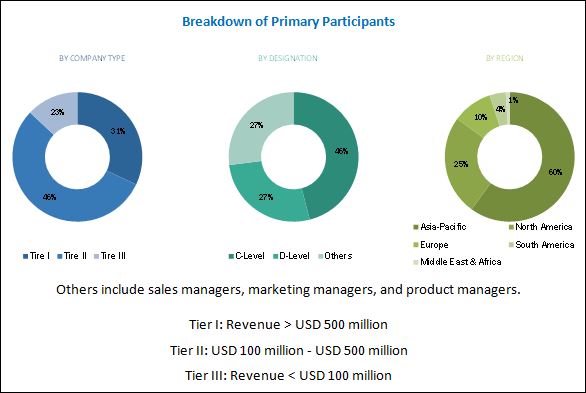

In this report, the market size has been derived using both, bottom-up and top-down approaches. First, the market size for product type (polystyrene, polyurethane & polyisocyanurate, polyolefin, phenolic, and elastomeric), end-use industry (building & construction, transportation, and consumer appliances), and region (Asia-Pacific, North America, Europe, South America, Middle East & Africa) is identified through both, secondary and primary research. The overall foam insulation market size for various regions and countries has been calculated by adding these individual market sizes. The foam insulation market has been further segmented based on end-use industry, using percentage splits gathered during the research. Future growth (CAGRs) trends of the foam insulation market have been analyzed with respect to the end-use industry building & construction, transportation, and consumer appliances. The secondary resources include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, Bloomberg, and so on. Findings of this study were verified through primary research by conducting extensive interviews with key officials, such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key market players include BASF SE (Germany), Covestro AG (Germany), Huntsman International LLC (U.S.), Kingspan Group PLC (Republic of Ireland), Lapolla Industries, Inc. (U.S.), Owens Corning (U.S.), Recticel Group (Belgium), Saint-Gobain (France), the Dow Chemical Company (U.S.), Armacell International S.A. (Luxembourg), and Johns Manville (U.S.).

Target Audience:

Foam Insulation Manufacturers, Dealers, and Suppliers

- Government Bodies

- Feedstock Suppliers

- Industry Associations

- Large Infrastructure Companies

- Investment Banks

- Consulting Companies/Consultants in the chemical and material sectors

- End-use Industries

This study answers several questions for the stakeholders, primarily, which market segments they need to focus on during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

This report categorizes the global foam insulation market based on product type, end-use industry, and region.

Market Segmentation, by Product Type:

- Polystyrene foam

- Polyurethane & polyisocyanurate foam

- Polyolefin foam

- Phenolic foam

- Elastomeric foam

Market Segmentation, by End-Use Industry:

- Building & construction

- Transportation

- Consumer Appliances

Market Segmentation, by Region:

- Asia-Pacific

- North America

- Europe

- South America

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional end-use industry, and/or product type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

The foam insulation market is projected to reach USD 22.39 Billion by 2021, at a CAGR of 4.95% from 2016 to 2021. The market is driven by the increased demand from end-use industries, such as building & construction, transportation, and consumer appliances. Focus on the reduction of greenhouse gas emissions and strict government regulations on the construction of energy efficient buildings are expected to drive the demand for foam insulation. The major restraining factor for the market is the lack of awareness about the benefits of foam insulation.

By end-use industry, the building & construction segment dominated the foam insulation market in 2015. The foam insulation market is driven by the growing building & construction industry in the Middle East, as well as in Asia-Pacific countries, such as China, Japan, and India. However, the consumer appliances segment is expected to witness the highest growth rate between 2016 and 2021 due to the growing demand for appliances, such as freezers, refrigerators, and air conditioners, in various regions.

The foam insulation market is segmented based on product type into polystyrene, polyurethane & polyisocyanurate, polyolefin, phenolic, and elastomeric. The polystyrene segment dominated the market in 2015, in terms of both value and volume, owing to the attributes of polystyrene foam, such as low thermal conductivity and lightweight. The polyolefin segment is projected to grow at the highest CAGR, in terms of volume, during the forecast period. The demand for polyolefin foam is due to its light and flexible nature, which is required in the HVAC (heating, ventilation and air conditioning) application. Several countries and regional organizations, including the U.S., China, South Korea, and the European Union, have various building codes for construction of new residential and commercial buildings.

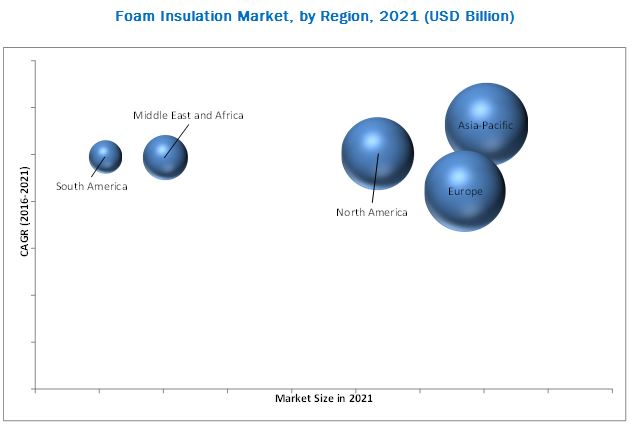

Asia-Pacific is the fastest growing market for foam insulation, both in terms of value and volume. Population growth and rapid urbanization in key countries, such as China and India, accompanied by the rising demand for consumer appliances have contributed to the growth of the foam insulation market in this region. Increasing investments in the regions building & construction industry also help drive the demand for foam insulation. Besides, major market players, such as Covestro AG (Germany), BASF SE (Germany), Saint-Gobain (France), and Huntsman Corporation (U.S.), are setting up manufacturing plants in the Asia-Pacific region due to the availability of cheap labor and low production cost.

Companies focus on strengthening their position in the foam insulation market through expansions and new product launches. Major players active in the market include BASF SE (Germany), Covestro AG (Germany), Huntsman International LLC (U.S.), Kingspan Group PLC (Republic of Ireland), Lapolla Industries, Inc. (U.S.), Owens Corning (U.S.), Recticel Group (Belgium), Saint-Gobain (France), the Dow Chemical Company (U.S.), Armacell International S.A. (Luxembourg), and Johns Manville (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Package Size

1.7 Limitation

1.8 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Key Industry Insights

2.3 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.5 Data Triangulation

2.6 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in Foam Insulation Market

4.2 Foam Insulation Market, By Region

4.3 By Market in Asia-Pacific, By Type and Country

4.4 By Market Attractiveness

4.5 By Market, By End-Use Industry

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Greenhouse Gas Emissions

5.2.1.2 Growth in End-Use Industry

5.2.1.3 Increasing Demand for Energy-Efficient Equipment

5.2.2 Restraints

5.2.2.1 Lack of Awareness

5.2.3 Opportunities

5.2.3.1 Global Demand for Energy

5.3 Porters Five Forces Analysis

5.3.1 Threat 0f New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

6 Foam Insulation Market, By Product Type (Page No. - 45)

6.1 Introduction

6.2 Market Size Estimation

6.2.1 Polystyrene Foam

6.2.1.1 Expanded Polystyrene

6.2.1.2 Extruded Polystyrene

6.2.2 Polyurethane & Polyisocyanurate Foam

6.2.3 Polyolefin Foam

6.2.4 Elastomeric Foam

6.2.5 Phenolic Foam

7 Foam Insulation Market, By End-Use Industry (Page No. - 56)

7.1 Introduction

7.2 Building & Construction

7.3 Transportation

7.4 Consumer Appliances

8 Foam Insulation Market, By Region (Page No. - 63)

8.1 Introduction

8.2 Asia Pacific

8.2.1 Overview

8.2.2 China

8.2.3 Japan

8.2.4 Indonesia

8.2.5 India

8.2.6 South Korea

8.2.7 Malaysia

8.2.8 Thailand

8.2.9 Rest of Asia-Pacific

8.3 Europe

8.3.1 Overview

8.3.2 Germany

8.3.3 U.K.

8.3.4 France

8.3.5 Italy

8.3.6 Russia

8.3.7 Spain

8.3.8 Rest of Europe

8.4 North America

8.4.1 Overview

8.4.2 U.S.

8.4.3 Canada

8.4.4 Mexico

8.5 Middle East & Africa

8.5.1 Overview

8.5.2 Saudi Arabia

8.5.3 Turkey

8.5.4 South Africa

8.5.5 Qatar

8.5.6 Rest of Middle East & Africa

8.6 South America

8.6.1 Overview

8.6.2 Brazil

8.6.3 Argentina

8.6.4 Rest of South America

9 Competitive Landscape (Page No. - 106)

9.1 Market Share Analysis

9.2 Competitive Benchmarking

10 Company Profiles (Page No. - 108)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 BASF SE

10.2 Covestro AG

10.3 Huntsman Corporation

10.4 Kingspan Group PLC

10.5 Lapolla Industries, Inc.

10.6 Owens Corning

10.7 Saint-Gobain

10.8 The DOW Chemical Company

10.9 Recticel Group

10.10 Armacell International SA

10.11 Johns Manville

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 127)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (106 Tables)

Table 1 International Emission Targets By Country:

Table 2 International Emission Targets of European Union

Table 3 Foam Insulation Market Size, By Product Type, 20142021 (Kiloton)

Table 4 Foam Insulation Market Size, By Product Type, 20142021 (USD Million)

Table 5 Polystyrene Foam Insulation Market Size, By Region, 20142021 (Kiloton)

Table 6 Polystyrene Foam Insulation Market Size, By Region, 20142021 (USD Million)

Table 7 Polyurethane & Polyisocyanurate Foam Insulation Market Size, By Region, 20142021 (Kiloton)

Table 8 Polyurethane & Polyisocyanurate Foam Insulation Market Size, By Region, 20142021 (USD Million)

Table 9 Polyolefin Foam Insulation Market Size, By Region, 20142021 (Kiloton)

Table 10 Polyolefin Foam Insulation Market Size, By Region, 20142021 (USD Million)

Table 11 Elastomeric Foam Insulation Market Size, By Region, 20142021 (Kiloton)

Table 12 Elastomeric Foam Insulation Market Size, By Region, 20142021 (USD Million)

Table 13 Phenolic Foam Insulation Market Size, By Region, 20142021 (Kiloton)

Table 14 Phenolic Foam Insulation Market Size, By Region, 20142021 (USD Million)

Table 15 Foam Insulation Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 16 By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 17 By Market Size in Building & Construction, By Region, 20142021 (Kiloton)

Table 18 By Market Size in Building & Construction, By Region, 20142021 (USD Million)

Table 19 By Market Size in Transportation, By Region, 20142021 (Kiloton)

Table 20 By Market Size in Transportation, By Region, 20142021 (USD Million)

Table 21 By Market Size in Consumer Appliances, By Region, 20142021 (Kiloton)

Table 22 By Market Size in Consumer Appliances, By Region, 20142021 (USD Million)

Table 23 By Market Size, By Region, 20142021 (Kiloton)

Table 24 By Market Size, By Region, 20142021 (USD Million)

Table 25 Asia-Pacific: Foam Insulation Market Size, By Country, 20142021 (Kiloton)

Table 26 Asia-Pacific: By Market Size, By Country, 20142021 (USD Million)

Table 27 Asia-Pacific: By Market Size, By Product Type, 20142021 (Kiloton)

Table 28 Asia-Pacific: By Market Size, By Product Type, 20142021 (USD Million)

Table 29 Asia-Pacific: By Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 30 Asia-Pacific: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 31 China: Foam Insulation Market Size, By Product Type, 20142021 (Kiloton)

Table 32 China: By Market Size, By Product Type, 20142021 (USD Million)

Table 33 Japan: By Market Size, By Product Type, 20142021 (Kiloton)

Table 34 Japan: By Market Size, By Product Type, 20142021 (USD Million)

Table 35 Indonesia: By Market Size, By Product Type, 20142021 (Kiloton)

Table 36 Indonesia: By Market Size, By Product Type, 20142021 (USD Million)

Table 37 India: By Market Size, By Product Type, 20142021 (Kiloton)

Table 38 India: By Market Size, By Product Type, 20142021 (USD Million)

Table 39 South Korea: By Market Size, By Product Type, 20142021 (Kiloton)

Table 40 South Korea: By Market Size, By Product Type, 20142021 (USD Million)

Table 41 Malaysia: By Market Size, By Product Type, 20142021 (Kiloton)

Table 42 Malaysia: By Market Size, By Product Type, 20142021 (USD Million)

Table 43 Thailand: By Market Size, By Product Type, 20142021 (Kiloton)

Table 44 Thailand: By Market Size, By Product Type, 20142021 (USD Million)

Table 45 Rest of Asia-Pacific: By Market Size, By Product Type, 20142021 (Kiloton)

Table 46 Rest of Asia-Pacific: By Market Size, By Product Type, 20142021 (USD Million)

Table 47 Europe: Foam Insulation Market Size, By Country, 20142021 (Kiloton)

Table 48 Europe: By Market Size, By Country, 20142021 (USD Million)

Table 49 Europe: By Market Size, By Product Type, 20142021 (Kiloton)

Table 50 Europe: By Market Size, By Product Type, 20142021 (USD Million)

Table 51 Europe: By Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 52 Europe: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 53 Germany: By Market Size, By Product Type, 20142021 (Kiloton)

Table 54 Germany: By Market Size, By Product Type, 20142021 (USD Million)

Table 55 U.K.: By Market Size, By Product Type, 20142021 (Kiloton)

Table 56 U.K.: By Market Size, By Product Type, 20142021 (USD Million)

Table 57 France: By Market Size, By Product Type, 20142021 (Kiloton)

Table 58 France: By Market Size, By Product Type, 20142021 (USD Million)

Table 59 Italy: By Market Size, By Product Type, 20142021 (Kiloton)

Table 60 Italy: By Market Size, By Product Type, 20142021 (USD Million)

Table 61 Russia: By Market Size, By Product Type, 20142021 (Kiloton)

Table 62 Russia: By Market Size, By Product Type, 20142021 (USD Million)

Table 63 Spain: By Market Size, By Product Type, 20142021 (Kiloton)

Table 64 Spain: By Market Size, By Product Type, 20142021 (USD Million)

Table 65 Rest of Europe: By Market Size, By Product Type, 20142021 (Kiloton)

Table 66 Rest of Europe: By Market Size, By Product Type, 20142021 (USD Million)

Table 67 North America: Foam Insulation Market Size, By Country, 20142021 (Kiloton)

Table 68 North America: By Market Size, By Country, 20142021 (USD Million)

Table 69 North America: By Market Size, By Product Type, 20142021 (Kiloton)

Table 70 North America: By Market Size, By Product Type, 20142021 (USD Million)

Table 71 North America: By Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 72 North America: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 73 U.S.: By Market Size, By Product Type, 20142021 (Kiloton)

Table 74 U.S.: By Market Size, By Product Type, 20142021 (USD Million)

Table 75 Canada: By Market Size, By Product Type, 20142021 (Kiloton)

Table 76 Canada: By Market Size, By Product Type, 20142021 (USD Million)

Table 77 Mexico: By Market Size, By Product Type, 20142021 (Kiloton)

Table 78 Mexico: By Market Size, By Product Type, 20142021 (USD Million)

Table 79 Middle East & Africa: Foam Insulation Market Size, By Country, 20142021 (Kiloton)

Table 80 Middle East & Africa: By Market Size, By Country, 20142021 (USD Million)

Table 81 Middle East & Africa: By Market Size, By Product Type, 20142021 (Kiloton)

Table 82 Middle East & Africa: By Market Size, By Product Type, 20142021 (USD Million)

Table 83 Middle East & Africa: By Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 84 Middle East & Africa: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 85 Saudi Arabia: By Market Size, By Product Type, 20142021 (Kiloton)

Table 86 Saudi Arabia: By Market Size, By Product Type, 20142021 (USD Million)

Table 87 Turkey: By Market Size, By Product Type, 20142021 (Kiloton)

Table 88 Turkey: By Market Size, By Product Type, 20142021 (USD Million)

Table 89 South Africa: By Market Size, By Product Type, 20142021 (Kiloton)

Table 90 South Africa: By Market Size, By Product Type, 20142021 (USD Million)

Table 91 Qatar: By Market Size, By Product Type, 20142021 (Kiloton)

Table 92 Qatar: By Market Size, By Product Type, 20142021 (USD Million)

Table 93 Rest of Middle East & Africa: By Market Size, By Product Type, 20142021 (Kiloton)

Table 94 Rest of Middle East & Africa: By Market Size, By Product Type, 20142021 (USD Million)

Table 95 South America: Foam Insulation Market Size, By Country, 20142021 (Kiloton)

Table 96 South America: By Market Size, By Country, 20142021 (USD Million)

Table 97 South America: By Market Size, By Product Type, 20142021 (Kiloton)

Table 98 South America: By Market Size, By Product Type, 20142021 (USD Million)

Table 99 South America: By Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 100 South America: Foam Insulation Market Size, By End-Use Industry, 20142021 (USD Million)

Table 101 Brazil: By Market Size, By Product Type, 20142021 (Kiloton)

Table 102 Brazil: By Market Size, By Product Type, 20142021 (USD Million)

Table 103 Argentina: By Market Size, By Product Type, 20142021 (Kiloton)

Table 104 Argentina: By Market Size, Byproduct Type, 20142021 (USD Million)

Table 105 Rest of South America: By Market Size, By Product Type, 20142021 (Kiloton)

Table 106 Rest of South America: By Market Size, By Product Type, 20142021 (USD Million)

List of Figures (42 Figures)

Figure 1 Foam Insulation: Market Segmentation

Figure 2 Foam Insulation Market: Research Design

Figure 3 Key Data From Secondary Sources

Figure 4 Key Data From Primary Sources

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation: Top-Down Approach

Figure 7 Foam Insulation Market: Data Triangulation

Figure 8 Consumer Appliances to Register the Highest CAGR

Figure 9 Rising Demand for Polystyrene Foam Insulation to Drive Foam Insulation Market

Figure 10 Europe Was the Largest Foam Insulation Market in 2015

Figure 11 Growth in Foam Insulation Market, 20162021

Figure 12 Asia-Pacific to Be the Fastest-Growing Market for Foam Insulation Between 2016 and 2021

Figure 13 China Accounted for Major Share in the Asia-Pacific Foam Insulation Market in 2015

Figure 14 India, China, and Indonesia Expected to Witness Fastest Growth During Forecast Period

Figure 15 South America Had the Largest Share in Building & Construction Industry in 2015

Figure 16 Factors Governing the Foam Insulation Market

Figure 17 Residential Construction Market in Europe: 2011-2017

Figure 18 Energy Consumption in Residential Buildings, By End Use, 2013

Figure 19 Porters Five Forces Analysis of the Foam Insulation Market

Figure 20 Polystyrene Foam to Dominate the Market During Forecast Period

Figure 21 Europe to Be the Largest Polystyrene Foam Insulation Market Between 2016 and 2021

Figure 22 Asia-Pacific to Be the Largest Polyurethane & Polyisocyanurate Foam Insulation Market Between 2016 and 2021

Figure 23 Asia-Pacific to Be the Largest Polyolefin Foam Insulation Market Between 2016 and 2021

Figure 24 North America to Be the Largest Elastomeric Foam Insulation Market Between 2016 and 2021

Figure 25 North America to Be the Second-Largest Phenolic Foam Insulation Market Between 2016 and 2021

Figure 26 Building & Construction End-Use Industry to Dominate the Foam Insulation Market

Figure 27 Europe to Be the Largest Foam Insulation Market in Building & Construction Industry

Figure 28 Asia-Pacific to Be the Largest Foam Insulation Market in Transportation Industry

Figure 29 North America to Be the Second-Largest Foam Insulation Market in Consumer Appliances Industry

Figure 30 Asia-Pacific to Be the Fastest-Growing Foam Insulation Market Between 2016 and 2021

Figure 31 Asia Pacific: Foam Insulation Market Snapshot

Figure 32 Europe: Foam Insulation Market Snapshot

Figure 33 BASF SE: Company Snapshot

Figure 34 Covesrto AG: Company Snapshot

Figure 35 Huntsman Corporation: Company Snapshot

Figure 36 Kingspan Group PLC: Company Snapshot

Figure 37 Lapolla Industries, Inc.: Company Snapshot

Figure 38 Owens Corning: Company Snapshot

Figure 39 Saint-Gobain: Company Snapshot

Figure 40 The DOW Chemical Company: Company Snapshot

Figure 41 Recticel Group: Company Snapshot

Figure 42 Armacell International S.A.: Company Snapshot

Growth opportunities and latent adjacency in Foam Insulation Market