Flavor Enhancers Market by Type (Acidulants, Glutamates, Hydrolyzed Vegetable Proteins, Yeast Extracts), Application (Processed & Convenience Foods, Beverages, Meat & Fish Products), Form, Source, & Region - Global Forecast to 2022

[130 Pages Report] The flavor enhancers market, in terms of value, is projected to reach around USD 8.18 Billion by 2022, at a CAGR of 5.6% from 2017 to 2022. The market has been segmented on the basis of type, source, form, application, and region.

The years considered for the study are as follows:

-

Base year - 2016

-

Estimated years –2017

-

Projected year - 2022

-

Forecast period – 2017 to 2022

The Objectives of the Study Include:

- To define, segment, and project the global market for flavor enhancers

- To understand the structure of the flavor enhancers market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and value chain)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

Research Methodology

This report includes an estimation of market size in terms of value (USD Million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the flavor enhancers market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research such as Hoovers, Forbes, and Bloomberg Businessweek, company websites, annual reports, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the flavor enhancers market include Cargill (U.S.), Tate & Lyle PLC (U.K.), Associated British Foods plc (U.S.), Corbion N.V. (Netherlands), Sensient Technologies (U.S.) among others. The maximum value addition of a product in the global flavor enhancers industry is observed in the stage of manufacturing. The key companies that offer flavor enhancers mainly invest in new product developments and expansions. Companies formulate new sales strategies to establish their innovative products in the market. These companies highlight product specifications and certifications from food safety authorities while promoting their bread improver products. Value addition in the distribution and sales stage varies with key players, addressable markets, manufacturing units, and end consumers.

Target Audience:

- Flavor enhancers manufacturers

- Technology providers to the flavor enhancers manufacturers

- Flavor ingredient manufacturers/suppliers

- Importers and exporters of flavor ingredients

- Food & beverage manufacturers/suppliers

- Raw material suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Intermediary suppliers

- Dealers

- End users (artisan bakers, industrial bread manufacturers, and bakery product manufacturers)

Scope of the Report

This research report categorizes the Flavor enhancers market based on type, source, form, application, and region.

Based on Type, the market has been segmented as follows:

- Acidulants

- Glutamates

- Hydrolyzed vegetable protein

- yeast extracts

- Others (sweetness enhancers and nucleotides)

Based on Application, the market has been segmented as follows:

- Processed & convenience foods

- Beverages

- Meat & fish products

- others (bakery, dairy, confectionery products, and condiments)

Based on Form, the market has been segmented as follows:

- Powder

- Liquid & semi-liquid

Based on Source, the market has been segmented as follows:

- Natural

- Synthetic

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (South America and the Middle East & Africa)

Available Customization

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global flavor enhancers market witnessed steady growth in the last few years. The market size is projected to reach USD 8.18 Billion by 2022, at a CAGR of around 5.6% from 2017 to 2022. Increasing demand for convenience food & beverage products and rise in consumption of monosodium glutamate are the major driving factors of this market.

The flavor enhancers market, by type, is segmented into acidulants, glutamates, hydrolyzed vegetable protein, yeast extracts, and others (sweetness enhancers and nucleotides). Glutamates are largely used as flavor enhancers to enhance the umami taste in foods. Monosodium glutamate (MSG) is the most widely used glutamate in meat products and savory foods. The market was followed by acidulants in terms of market size in 2016.

By form, the market has been segmented on the basis of powder and liquid & semi-liquid. Powdered flavor enhancers are most widely used by manufacturers, since these enhancers are easier to handle; hence, flavor enhancers in the powdered form account for the largest share in the market. Flavor enhancers enhance the original taste and aroma of food, without imparting a characteristic taste or aroma of its own.

On the basis of application, the flavor enhancers market is segmented by into processed & convenience foods, beverages, meat & fish products, and others (bakery, dairy, confectionery products, and condiments). The processed & convenience foods segment accounted for the highest market share in 2016. Flavor enhancers are used to enhance the umami taste in savory foods and hence its widest application lies in the processed & convenience foods. The market for convenience & processed foods is established in the developed regions, such as North America and Europe, which offer a stable growth for the market. Countries such as India and China witness a high consumption of MSG in processed foods, which is expected to augment the market for flavor enhancers in the Asia-Pacific region.

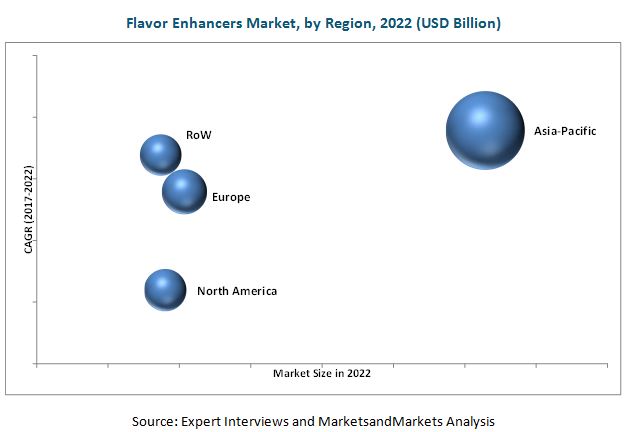

The market for flavor enhancers in Asia-Pacific was the largest in 2016, and it is projected to grow at the highest CAGR during the forecast period. The major driver for the growth of the market in the region is due to the growth of the food & beverage industry in emerging economies such as India and China.

Stringent regulations and international quality standards for flavor enhancers is the major factor restraining the flavor enhancers market. For instance, the assessment of flavor enhancers is done for safety purpose before using them in food. These enhancers are strictly reviewed, and in the case of non-adherence, actions can be enforced by the regulatory bodies. The European Union (EU) Legislation requires the flavor enhancers to be labeled with an E-number. These E-numbers should pass the safety test and must be approved by the regulatory body. According to the USDA FSIS (Food Safety & Inspection Service) regulation, animal or vegetable proteins must be specifically identified on the label in the list of ingredients, and the source of the protein also must be disclosed. This poses as a restraint for the market growth.

The market for flavor enhancers is characterized by medium to high competition due to the presence of a number of large- and small-scale firms with low product differentiation. New product launches, acquisitions, and expansions are the key strategies adopted by these players to ensure their growth in the market. The market is dominated by players such as Cargill (U.S.), Tate & Lyle PLC (U.K.), Associated British Foods plc (U.S.), Corbion N.V. (Netherlands), Sensient Technologies (U.S.). Other players in the industry include Novozymes A/S (Denmark), E.I. DuPont de Nemours and Company (U.S.), Angel Yeast Co., Ltd (China), Innova Flavors (U.S.), Savoury Systems International, Inc. (U.S.), Senomyx, Inc. (U.S.), and Ajinomoto Co., Inc. (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

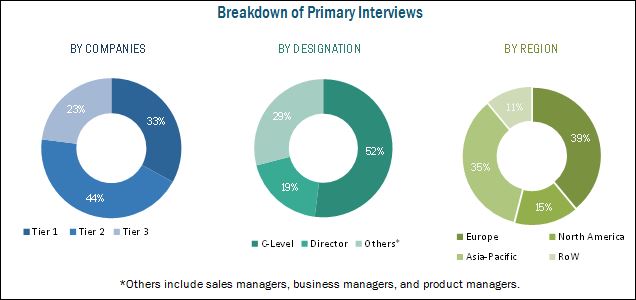

2.1.2.1 Breakdown of Primary Interviews

2.1.3 Market Breakdown and Data Triangulation

2.2 Market Size Estimation

2.3 Research Assumptions & Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Opportunities in the Flavor Enhancers Market

4.2 Flavor Enhancers Market, By Type & Region

4.3 Asia-Pacific: Flavor Enhancers Market, By Application & Country

4.4 Market, By Application & Region

4.5 Market: Regional Shares, By Form

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Popularity of Convenience Food & Beverage Products

5.2.1.2 High Consumption of Monosodium Glutamate (MSG) as an Umami Flavor Enhancer

5.2.2 Restraints

5.2.2.1 Stringent Regulations and International Quality Standards for Flavor Enhancers

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Innovative Flavors in the Market

5.2.4 Challenges

5.2.4.1 Consumer Awareness About the Ill-Effects of Flavor Enhancers and Growing Demand for Clean Labels

5.3 Value Chain Analysis

6 Flavor Enhancers Market, By Type (Page No. - 35)

6.1 Introduction

6.2 Acidulants

6.3 Glutamates

6.4 Hydrolyzed Vegetable Proteins

6.5 Yeast Extracts

6.6 Other Types

7 Market for Flavor Enhancers, By Form (Page No. - 43)

7.1 Introduction

7.2 Powder

7.3 Liquid & Semi-Liquid

8 Flavor Enhancers Market, By Application (Page No. - 48)

8.1 Introduction

8.2 Processed & Convenience Foods

8.3 Beverages

8.4 Meat & Fish Products

8.5 Other Applications

9 Market for Flavor Enhancers, By Source (Page No. - 53)

9.1 Introduction

9.2 Natural Flavor Enhancers

9.3 Synthetic Flavor Enhancers

10 Flavor Enhancers Market, By Region (Page No. - 54)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Middle East & Africa

11 Competitive Landscape (Page No. - 85)

11.1 Introduction

11.2 Vendor Dive Analysis

11.2.1 Vanguards

11.2.2 Innovators

11.2.3 Dynamic

11.2.4 Emerging

11.3 Competitive Benchmarking

11.3.1 Product Offerings

11.3.2 Business Strategy

*Top Companies Analyzed for This Study are – Cargill (U.S.); Tate & Lyle PLC (U.K.);Associated British Foods PLC (U.S.); Corbion N.V. (Netherlands); Sensient Technologies (U.S.); Novozymes A/S (Denmark); E. I. Du Pont De Nemours and Company (U.S.); Angel Yeast Co., Ltd (China); Innova Flavors (U.S.); Savoury Systems International, Inc. (U.S.); Ajinomoto Co., Inc. (Japan); A&B Ingredients (U.S.); Univar Inc. (U.S.); Mc Food Specialties Inc. (Japan); the Chemical Company (U.S.); Aipu Food Industry Co., Ltd. (China); the Food Source International Inc. (U.S.); Senomyx, Inc. (U.S.); Lesaffre (France); Qingdao Huifenghe MSG Co., Ltd (China); Fufeng Group (China); Meihua Holdings Group Co., Ltd. (China); Henan Lianhua Monosodium Glutamate Group Co., Ltd. (China); Shandong Qilu Biotechnology Group Co., Ltd. (China); Invetek, Inc. (U.S.)

12 Company Profiles (Page No. - 90)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

12.1 Cargill

12.2 Tate & Lyle PLC

12.3 Associated British Foods PLC

12.4 Corbion N.V.

12.5 Sensient Technologies Corporation

12.6 Novozymes A/S

12.7 E.I. Dupont De Nemours and Company

12.8 Angel Yeast Co., Ltd

12.9 Innova Flavors

12.10 Savoury Systems International, Inc.

12.11 Senomyx, Inc.

12.12 Ajinomoto Co, Inc.

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 123)

13.1 Key Primary Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (68 Tables)

Table 1 Flavor Enhancers Market Size, By Type, 2015–2022 (USD Million)

Table 2 Flavor Enhancers Market Size, By Type, 2015–2022 (KT)

Table 3 Acidulants Market Size, By Region, 2015–2022 (USD Million)

Table 4 Acidulants Market Size, By Region, 2015–2022 (KT)

Table 5 Glutamates Market Size, By Region, 2015–2022 (USD Million)

Table 6 Glutamates Market Size, By Region, 2015–2022 (KT)

Table 7 Hydrolyzed Vegetable Proteins Market Size, By Region, 2015–2022 (USD Million)

Table 8 Hydrolyzed Vegetable Proteins Market Size, By Region, 2015–2022 (KT)

Table 9 Yeast Extracts Market Size, By Region, 2015–2022 (USD Million)

Table 10 Yeast Extracts Market Size, By Region, 2015–2022 (KT)

Table 11 Market for Flavor Enhancers Size for Other Types, By Region, 2015–2022 (USD Million)

Table 12 Market Size for Other Types, By Region, 2015–2022 (KT)

Table 13 Market for Flavor Enhancers Size, By Form, 2015–2022 (USD Million)

Table 14 Market Size, By Form, 2015–2022 (KT)

Table 15 Powder: Flavor Enhancers Market Size, By Region, 2015–2022 (USD Million)

Table 16 Powder: Market Size, By Region, 2015–2022 (KT)

Table 17 Liquid & Semi-Liquid: FE Market Size, By Region, 2015–2022 (USD Million)

Table 18 Liquid & Semi-Liquid: Market Size, By Region, 2015–2022 (KT)

Table 19 Market for Flavor Enhancers Size, By Application, 2015–2022 (USD Million)

Table 20 Processed & Convenience Foods: Market for Flavor Enhancers Size, By Region, 2015–2022 (USD Million)

Table 21 Beverages: Market Size, By Region, 2015–2022 (USD Million)

Table 22 Meat & Fish Products: Market Size, By Region, 2015–2022 (USD Million)

Table 23 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 24 Flavor Enhancers Market Size, By Region, 2015–2022 (USD Million)

Table 25 Market Size, By Region, 2015–2022 (KT)

Table 26 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 27 North America: Flavor Enhancers Market Size, By Country, 2015–2022 (KT)

Table 28 North America: Market Size, By Type, 2015–2022 (USD Million)

Table 29 North America: Market Size, By Type, 2015–2022 (KT)

Table 30 North America: Market Size, By Form, 2015–2022 (USD Million)

Table 31 North America: Market Size, By Form, 2015–2022 (KT)

Table 32 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 33 U.S.: Market Size, By Application, 2015–2022 (USD Million)

Table 34 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 35 Mexico: Market Size, By Application, 2015–2022 (USD Million)

Table 36 Europe: Flavor Enhancers Market Size, By Country, 2015–2022 (USD Million)

Table 37 Europe: Market Size, By Country, 2015–2022 (KT)

Table 38 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 39 Europe: Market Size, By Type, 2015–2022 (KT)

Table 40 Europe: Market Size, By Form, 2015–2022 (USD Million)

Table 41 Europe: Market Size, By Form, 2015–2022 (KT)

Table 42 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 43 Germany: Market Size, By Application, 2015–2022 (USD Million)

Table 44 France: Market Size, By Application, 2015–2022 (USD Million)

Table 45 U.K.: Market Size, By Application, 2015–2022 (USD Million)

Table 46 Italy: Market Size, By Application, 2015–2022 (USD Million)

Table 47 Rest of Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 48 Asia-Pacific: Flavor Enhancers Market Size, By Country, 2015–2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Country, 2015–2022 (KT)

Table 50 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Million)

Table 51 Asia-Pacific: Market Size, By Type, 2015–2022 (KT)

Table 52 Asia-Pacific: Market Size, By Form, 2015–2022 (USD Million)

Table 53 Asia-Pacific: Market Size, By Form, 2015–2022 (KT)

Table 54 Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 55 China: Market Size, By Application, 2015–2022 (USD Million)

Table 56 Japan: Market Size, By Application, 2015–2022 (USD Million)

Table 57 India: Market Size, By Application, 2015–2022 (USD Million)

Table 58 Australia: Market Size, By Application, 2015–2022 (USD Million)

Table 59 Rest of Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 60 RoW: Market Size, By Region, 2015–2022 (USD Million)

Table 61 RoW: Flavor Enhancers Market Size, By Region, 2015–2022 (KT)

Table 62 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 63 RoW: Market Size, By Type, 2015–2022 (KT)

Table 64 RoW: Market Size, By Form, 2015–2022 (USD Million)

Table 65 RoW: Market Size, By Form, 2015–2022 (KT)

Table 66 RoW: Market Size, By Application, 2015–2022 (USD Million)

Table 67 South America: Market Size, By Application, 2015–2022 (USD Million)

Table 68 Middle East & Africa: Flavor Enhancers Market Size, By Application, 2015–2022 (USD Million)

List of Figures (36 Figures)

Figure 1 Flavor Enhancers Market Segmentation

Figure 2 Market Segmentation, By Region

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Research Assumptions

Figure 8 Research Limitations

Figure 9 Flavor Enhancers Market Size, By Type, 2015–2022 (USD Billion)

Figure 10 Market Size, By Form, 2017 vs 2022 (USD Billion)

Figure 11 Flavor Enhancers Market Size, By Application, 2017 vs 2022 (USD Billion)

Figure 12 Market Share, By Region, 2016

Figure 13 Rise in Demand for Flavor Enhancers in Convenience Food Products to Drive the Market

Figure 14 Glutamates Segment Estimated to Record the Largest Share in 2016

Figure 15 Processed & Convenience Foods Segment Held the Largest Share in Asia-Pacific, 2016

Figure 16 Processed & Convenience Foods Estimated to Be the Largest Segment in 2016

Figure 17 Powder Form of Flavor Enhancers Estimated to Hold the Largest Share Across All Regions in 2017

Figure 18 Demand for Processed & Convenience Food Products to Drive the Market Growth

Figure 19 Value Chain Analysis: Major Value is Added During the Manufacturing Stage

Figure 20 Glutamates Segment is Projected to Dominate the Market Through 2022

Figure 21 Powder Segment is Projected to Dominate the Market Through 2022

Figure 22 Processed & Convenience Foods Segment to Lead the Market By 2022 (USD Million)

Figure 23 Asia-Pacific is Projected to Dominate the Market for Flavor Enhancers Through 2022

Figure 24 North America Market Snapshot

Figure 25 Europe Market Snapshot

Figure 26 Asia - Pacific Market Snapshot

Figure 27 Flavor Enhancers Market: Dive Chart

Figure 28 Cargill: Company Snapshot

Figure 29 Tate & Lyle PLC: Company Snapshot

Figure 30 Associated British Foods PLC: Company Snapshot

Figure 31 Corbion N.V.: Company Snapshot

Figure 32 Sensient Technologies Corporation: Company Snapshot

Figure 33 Novozymes A/S: Company Snapshot

Figure 34 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 35 Senomyx, Inc.: Company Snapshot

Figure 36 Ajinomoto Co, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Flavor Enhancers Market