FinFET Technology Market by Technology (22nm, 20nm, 16nm, 14nm, 10nm, 7nm), Product (CPU, SoC, FPGA, GPU, MCU, Network Processor), End-User (Smartphones, Computers & Tablets, Wearables, High-End Networks, Automotive) & Geography - Global Forecast to 2022

The FinFET technology market is expected to grow from USD 4.91 Billion in 2015 to USD 35.12 Billion by 2022, at a CAGR of 26.2% between 2016 and 2022. Although the market is currently dominated with laptops and tablets end user segment, the smartphones and wearables segments are expected to gain traction and grow at the highest rate during the forecast period. This report forecasts the market size and future growth potential of market across different segments such as technology, product, end user, and region. The base year considered for the study is 2015, and the market size forecast is provided for the period between 2016 and 2022.

According to MarketsandMarkets forecast, the FinFET technology market is expected to grow from USD 4.91 Billion in 2015 to USD 35.12 Billion by 2022, at a CAGR of 26.2% between 2016 and 2022. The miniaturization of semiconductor devices to continue the progression of Moore’s law, along with an increase in the performance of devices, is creating a huge demand for the adoption of FinFET technology across the world. Moreover, growing smartphones and consumer electronics market, and high performance with a lower current leakage than the bulk technology are also driving the growth of the market.

The scope of this report covers the FinFET technology market segmented on the basis of technology, product, end user, and region. On basis of technology, the 22nm process node segment is expected to hold the largest market share of the global market, and the 7nm FinFET process is expected be the fastest-growing technology to manufacture chips in various applications during the forecast period.

On the basis of products, the FinFET technology market is segmented into CPU, SoC, FPGA, GPU, MCU, and network processor. CPU segment led the market in 2015; however, the market for GPUs is expected to grow at the highest CAGR during the forecast period. Application processors in smartphones have the same functionalities as that of CPUs. Samsung (South Korea) led the market for application processors in 2015 by introducing its Exynos Octa 7 chips manufactured using the 14nm FinFET technology. In 2016, the next chip in the Exynos series (Exynos Octa 8) is expected to power the smartphones with more functionalities and improved performance.

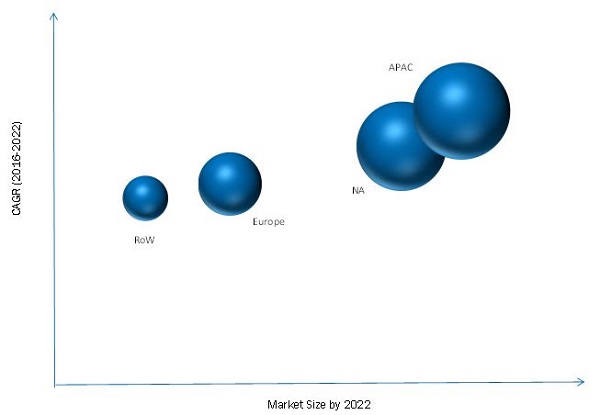

North America held the largest share of the FinFET market in 2015. Certain end use segment such as wearable technologies and smartphones in this region have shown a positive outlook for the growth of the FinFET technology market. This is a result of the necessity to adhere to the stringent corporate compliance and regulation requirements for these sectors, in which applications of FinFET technology account for a major share of the North American market.

The market in APAC region is estimated to grow rapidly between 2016 and 2022. The growth in the demand for high-end smartphones in this region has driven the FinFET technology market. Samsung (South Korea) is the first company to manufacture chips using the technology at 14nm process. Exynos Octa 7 is manufactured using the 14nm process which is used in Samsung Galaxy S6 and S6 edge phones. Also, the presence of two key players – TSMC, Ltd. (Taiwan) and Samsung (South Korea) is responsible for the popularity of FinFET technology in this region. TSMC (Taiwan) and Samsung (South Korea) manufactured the A9 processor for Apple (U.S.) using FinFET technology.

The complexities in the FinFET design process restrain the growth of FinFET technology market. The major challenge for the adoption of FinFET technology is low costs of wafers and gate cost of FD-SOIs. The cost of processed wafer and gate in SOIs is lesser compared to bulk CMOS and FinFETs, and the considerations include processing and mask steps, tool depreciation, die shrink area, and parametric yield. The low cost of FDSOI is a one of the major challenges for the market as there is not much difference between the performance of these two technologies; the former provides equal or better power consumption at a lower cost.

Major players in this market are Intel (U.S.), Samsung (South Korea), GlobalFoundries (U.S.), and TSMC (Taiwan). These players have adopted various strategies such as partnerships, agreements, mergers & acquisitions, and new product developments to achieve growth in the global FinFET technology market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Market Share Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Global FinFET Technology Market

4.2 Market, By Product, 2016–2022

4.3 Market, By Technology, 2016–2022

4.4 Market Size, By End User, 2016–2022

4.5 Market, By Geography

4.6 Life Cycle Analysis, By Geography, 2015

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 Market, By Technology

5.3.2 Market, By Product

5.3.3 Market, By End User

5.3.4 Geographic Analysis

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Improved Performance With A Lower Current Leakage Than the Bulk Technology

5.4.1.2 Growing Mobile and Consumer Electronics Market

5.4.2 Restraints

5.4.2.1 Complexity in FinFET Design Process

5.4.3 Opportunities

5.4.3.1 Growing Ic Industry to Pave New Growth Avenues

5.4.4 Challenges

5.4.4.1 Lower Wafer Cost and Gate Cost of FD-SOI

6 Industry Trends (Page No. - 43)

6.1 Ntroduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 FinFET Technology Market, By Technology (Page No. - 50)

7.1 Introduction

7.2 22nm

7.3 20nm

7.4 16nm

7.5 14nm

7.6 10nm

7.7 7nm

8 FinFET Technology Market, By Product (Page No. - 57)

8.1 Introduction

8.2 CPU

8.3 SOC

8.4 FPGA

8.5 GPU

8.6 MCU

8.7 Network Processors

9 FinFET Technology Market, By End User (Page No. - 85)

9.1 Introduction

9.2 Smartphones

9.3 Computers and Tablets

9.4 Wearables

9.5 High-End Networks

9.6 Automotive

10 Geographical Analysis (Page No. - 92)

10.1 Introduction

10.2 North America (U.S., And Others)

10.3 Europe (Germany, France And Others)

10.4 Asia-Pacific (APAC) (South Korea, China, Taiwan and Others)

10.5 Rest of the World (Middle East, Africa, and Others)

11 Competitive Landscape (Page No. - 103)

11.1 Introduction

11.2 Market Ranking Analysis, 2015

11.3 Competitive Situations and Trends

11.3.1 Collaborations

11.3.2 Acquisitions, Joint Ventures, and Partnerships

11.3.3 New Product Launches

11.3.4 Others

12 Company Profiles (Page No. - 109)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Taiwan Semiconductor Manufacturing Company Limited (TSMC Ltd.)

12.3 Samsung Electronics Corporation, Ltd.

12.4 Globalfoundries

12.5 Intel Corporation

12.6 United Microelectronics Corporation

12.7 Qualcomm Incorporated

12.8 Mediatek, Inc.

12.9 Arm Holdings PLC.

12.10 Semiconductor Manufacturing International Corp.

12.11 Xilinx Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 138)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing Rt: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (69 Tables)

Table 1 Analysis of Market Drivers

Table 2 Analysis of Market Restraints

Table 3 Analysis of Market Opportunities

Table 4 Analysis of Market Challenges

Table 5 Market Size, By Technology, 2014–2022 (USD Million)

Table 6 Market Size for 22nm, By Product, 2014–2022 (USD Million)

Table 7 Market Size for 20nm, By Product, 2014–2022 (USD Million)

Table 8 Market Size for 16nm, By Product, 2014–2022 (USD Million)

Table 9 Market Size for 14nm, By Product, 2014–2022 (USD Million)

Table 10 Market Size for 10nm, By Product, 2014–2022 (USD Million)

Table 11 Market Size for 7nm, By Product, 2014–2022 (USD Million)

Table 12 Market Size, By Product, 2014–2022 (USD Million)

Table 13 CPU : FinFET Technology Market Size, By End User, 2014–2022 (USD Million)

Table 14 Market Size, for CPU, By Region, 2013 - 2022 (USD Million)

Table 15 CPU: FinFET Technology Market Size for Smartphones, By Region, 2014–2022 (USD Million)

Table 16 CPU: Market Size for Computers and Tablets, By Region, 2014 - 2022 (USD Million)

Table 17 CPU: Market Size for Wearables, By Region, 2014 - 2022 (USD Million)

Table 18 CPU: Market Size for High-End Networks, By Region, 2014 - 2022 (USD Million)

Table 19 CPU: Market Size for Automotive, By Region, 2014 - 2022 (USD Million)

Table 20 SOC: FinFET Technology Market Size, By End User, 2014–2022 (USD Million)

Table 21 Market Size, for SOC, By Region, 2013 - 2022 (USD Million)

Table 22 SOC: FinFET Technology Market Size, for Smartphones, By Region, 2014 - 2022 (USD Million)

Table 23 SOC: Market Size for Computers and Tablets, By Region, 2014–2022 (USD Million)

Table 24 SOC : Market Size for Wearables, By Region, 2014 - 2022 (USD Million)

Table 25 SOC: Market Size for High-End Networks, By Region, 2014–2022 (USD Million)

Table 26 SOC: Market Size for Automotive, By Region, 2014 - 2022 (USD Million)

Table 27 FPGA: FinFET Technology Market Size, By End User, 2014–2022 (USD Million)

Table 28 FPGA: Market Size for Smartphones, By Region, 2014–2022 (USD Million)

Table 29 FPGA: Market Size for Computers and Tablets, By Region, 2014–2022 (USD Million)

Table 30 FPGA: Market Size for Wearables, By Region, 2014 - 2022 (USD Million)

Table 31 FPGA: Market Size for High-End Networks, By Region, 2014 - 2022 (USD Million)

Table 32 FPGA: Market Size for Automotive, By Region, 2014 - 2022 (USD Million)

Table 33 GPU : Market Size, By End User, 2014–2022 (USD Million)

Table 34 GPU : Market Size for Smartphones, By Region, 2014–2022 (USD Million)

Table 35 GPU : Market Size for Computers and Tablets, By Region, 2014–2022 (USD Million)

Table 36 GPU : Market Size for Wearables, By Region, 2014–2022 (USD Million)

Table 37 GPU: Market Size for High End Networks, By Region, 2014 - 2022 (USD Million)

Table 38 GPU: Market Size for Automotive, By Region, 2014–2022 (USD Million)

Table 39 MCU : FinFET Technology Market Size By End User, 2014–2022 (USD Million)

Table 40 MCU: Market Size for Smartphones, By Region, 2014–2022 (USD Million)

Table 41 MCU: Market Size for Computers and Tablets, By Region, 2014–2022 (USD Million)

Table 42 MCU: Market Size for Wearables, By Region, 2014–2022 (USD Million)

Table 43 MCU: Market Size for High-End Networks, By Region, 2014–2022 (USD Million)

Table 44 MCU: Market Size for Automotive, By Region, 2014–2022 (USD Million)

Table 45 Network Processors: Market Size, By End User, 2014–2022 (USD Million)

Table 46 Network Processors: Market Size for Smartphones, By Region, 2014–2022 (USD Million)

Table 47 Network Processors: Market Size for Computers and Tablets, By Region, 2014–2022 (USD Million)

Table 48 Network Processors: Market Size for Wearables, By Region, 2014–2022 (USD Million)

Table 49 Network Processors: Market Size for High-End Networks, By Region, 2014–2022 (USD Million)

Table 50 Network Processors: FinFET Technology Market Size for Automotive, By Region, 2014–2022 (USD Million)

Table 51 Market Size, By End User, 2014–2022 (USD Million)

Table 52 Market Size for Smartphones, By Region, 2014–2022 (USD Million)

Table 53 Market Size for Computers and Tablets, By Region, 2014–2022 (USD Million)

Table 54 Market Size for Wearables, By Region, 2014–2022 (USD Million)

Table 55 Market Size for High-End Networks, By Region, 2014–2022 (USD Million)

Table 56 Market Size for Automotive, By Region, 2014–2022 (USD Million)

Table 57 Market Size, By Region, 2014–2022 (USD Million)

Table 58 North America: Market Size, By End User, 2014–2022 (USD Million)

Table 59 North America: Market Size, By Product, 2014–2022 (USD Million)

Table 60 Europe: Market Size, By End User, 2014–2022 (USD Million)

Table 61 Europe: Market Size, By Product, 2014–2022 (USD Million)

Table 62 APAC: Market Size, By End User, 2014–2022 (USD Million)

Table 63 APAC: Market Size, By Product, 2014–2022 (USD Million)

Table 64 Row: Market Size, By End User, 2014–2022 (USD Million)

Table 65 Row: Market Size, By Product, 2014–2022 (USD Million)

Table 66 Most Significant Collaborations in the Market, 2012–2015

Table 67 Most Significant Acquisitions, Joint Ventures, and Partnerships in the Market, 2013–2015

Table 68 Most Significant New Product Launches in the Market, 2014–2015

Table 69 Most Significant Other Strategies in the Market, 2014–2015

List of Figures (74 Figures)

Figure 1 FinFET Market Segmentation

Figure 2 The Market: Research Design

Figure 3 Process Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Market Size, By Type, 2016–2022

Figure 9 CPUs to Hold the Largest Market Size in 2016, While the GPU to Grow at the Highest Rate During 2016–2022

Figure 10 Smartphones to Hold the Largest Market in 2016

Figure 11 North America Had the Largest Market in 2015, While That in APAC Would Grow at the Highest Rate During the Forcast Period

Figure 12 Miniaturization of Semiconductor Devices With Increased Performance and Reduced Size Would Spur the Market Growth From 2015 to 2022

Figure 13 The Market for GPUS Likely to Grow at the Highest Rate During the Forecast Period

Figure 14 Market for the 7nm Technology to Grow at A High Rate During the Forecast Period

Figure 15 Smartphones to Hold the Largest Market Size in 2016, While the Wearables Market Likely to Grow at the Highest Rate During the Forecast Period

Figure 16 Market in APAC Expected to Grow at the Highest Rate During Forecast Period

Figure 17 Market in APAC Was in the Growth Phase in 2015

Figure 18 Evolution of FinFET Technology

Figure 19 Market, By Geography

Figure 20 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Wafer Cost (300mm) (FinFET vs FD-SOI)

Figure 22 Gate Cost (300mm) (FinFET vs FD-SOI)

Figure 23 Value Chain Analysis: Maximum Value is Added During Design Service and Fabrication Stages

Figure 24 Porter’s Five Forces Analysis, 2015

Figure 25 Porter’s Five Forces Analysis, 2015

Figure 26 Market: Threat of New Entrants

Figure 27 Maket: Threat of Substiutes

Figure 28 Market: Bargaining Power of Suppliers

Figure 29 Market: Bargaining Power of Buyers

Figure 30 Market: Intensity of Competitive Rivalry

Figure 31 Market, By Technology

Figure 32 Market for the 22nm to Be the Largest in 2016

Figure 33 Market for GPUS to Grow at the Highest Rate During the Forecast Period

Figure 34 Market for GPUS to Grow at the Highest Rate During the Forecast Period

Figure 35 Market, By Product

Figure 36 Market for GPUS Expected to Grow at the Highest Rate During the Forecast Period

Figure 37 Market for FinFET Technology in CPUs for Smartphones Expected Grow at the Highest Rate During the Forecast Period

Figure 38 Market for FinFET Technology in CPUs for Computers and Tablets in APAC Expected Grow at the Highest Rate During the Forecast Period

Figure 39 Market for the FinFET Technology in SOCs for Smartphones in APAC Expected Grow at the Highest Rate During the Forecast Period

Figure 40 Market for the FinFET Technology in SOCs for Wearables in North America Expected to Grow at the Highest Rate During the Forecast Period

Figure 41 Market for the FinFET Technology in FPGAs for Wearables Expected to Grow at the Highest Rate During the Forecast Period

Figure 42 Market the for FinFET Technology in FPGAs for Computers and Tablets Expected to Grow at the Highest Rate in APAC During the Forecast Period

Figure 43 Market for FinFET Technology in FPGA for High End Networks is Expected Grow at the Highest Rate in APAC During the Forecast Period

Figure 44 Market for FinFET Technology in GPU for Wearables is Expected to Grow at the Highest Rate During the Forecast Period

Figure 45 Market for GPUS in Wearables Expected to Grow at the Highest CAGR in North America During the Forecast Period

Figure 46 Market for FinFET Technology in MCUs for Automotive to Grow at the Highest CAGR During the Forecast Period

Figure 47 Market for FinFET Technology in MCUs for Computers and Tablets Expected to Grow at the Highest Rate in Asia-Pacific During the Forecast Period

Figure 48 Market for FinFET Technology in Network Processors for Computers and Tablets Expected to Grow at the Highest Rate During the Forecast Period

Figure 49 Market for FinFET Technology in Network Processors for Wearables Expected to Grow at the Highest CAGR in North America During the Forecast Period

Figure 50 Market, By End Users

Figure 51 Market for Wearables to Grow at the Highest Rate During the Forecast Period

Figure 52 Geographic Snapshot, 2016–2022

Figure 53 APAC Expected to Witness Highest Growth During the Forecast Period

Figure 54 North America: Market Snapshot

Figure 55 Europe: Market Snapshot

Figure 56 APAC: Market Snapshot

Figure 57 Companies Adopted Collaborations as the Key Growth Strategy Between 2012 and 2015

Figure 58 Market Evaluation Framework

Figure 59 Battle for Market Share: Collaboration Was the Key Strategy

Figure 60 Geographic Revenue Mix of Top Four Market Players

Figure 61 TSMC Ltd.: Company Snapshot

Figure 62 TSMC Ltd.: SWOT Analysis

Figure 63 Samsung Electronics Corporation: Company Snapshot

Figure 64 Samsung Electronics Corporation: SWOT Analysis

Figure 65 Globalfoundries, Inc.: SWOT Analysis

Figure 66 Intel Corporation: Company Snapshot

Figure 67 Intel Corporation: SWOT Analysis

Figure 68 United Microelectronics Corporation: Company Snapshot

Figure 69 United Microelectronics Corporation: SWOT Analysis

Figure 70 Qualcomm Incorporated.: Company Snapshot

Figure 71 Mediatek,Inc.: Business Overview

Figure 72 Arm Holdings PLC.: Business Overview

Figure 73 SMIC: Business Overview

Figure 74 Xilinx Inc.: Business Overview

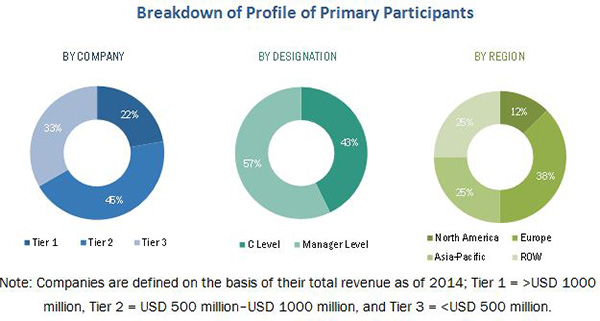

The research methodology used to estimate and forecast the FinFET technology market begins with capturing data on key vendor revenues through the secondary research. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall size of the global market from the revenue of key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary interviews is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the market include Intel (U.S.), TSMC, Ltd. (Taiwan), Samsung (South Korea), and GlobalFoundries (U.S.), among others. These players have adopted various strategies such as partnerships, agreements, contracts, mergers & acquisitions, and new product developments to achieve growth in the global FinFET technology market.

Key Target audience

- Wafer Manufacturers

- Raw Material and Manufacturing Equipment Suppliers

- Chip Manufacturers

- System Integrators

- Device Manufacturers

- Foundry Players

- Distributors and Retailers

- Research Organizations

- Technology Standard Organizations, Forums, Alliances, and Associations

- Technology Investors

Scope of the Report

The research report segments the FinFET technology market to following subsegments:

By Technology:

- 22nm

- 20nm

- 16nm

- 14nm

- 10nm

- 7nm

By Product:

- CPU

- SoC

- FPGA

- GPU

- MCU

- Network Processor

By End User:

- Smartphones

- Computers and Tablets

- Wearables

- High-End Networks

- Automotive

By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North America FinFET technology market

- Further breakdown of the Europe FinFET technology market

- Further breakdown of the APAC FinFET technology market

- Further breakdown of the RoW FinFET technology market

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in FinFET Technology Market