Field Device Management Market by Offering (Hardware and Software), Deployment (Cloud and On-premises), Industry (Oil & Gas, Energy & Power, Chemicals, Pharmaceuticals, Automotive, Manufacturing), Protocol and Geography - Global Forecast to 2024

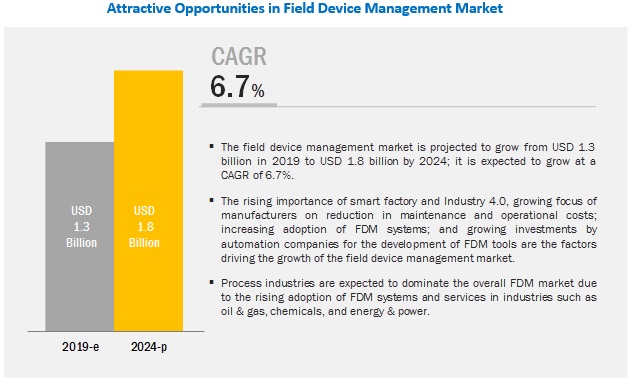

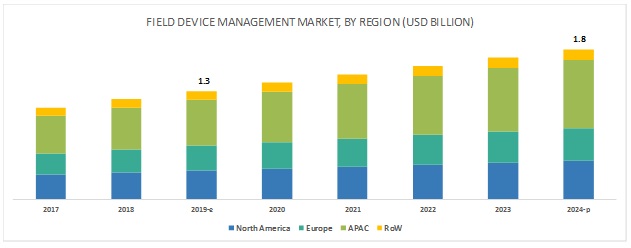

[157 Pages Report] The field device management market is projected to grow from USD 1.3 billion in 2019 to USD 1.8 billion by 2024; it is expected to grow at a compound annual growth rate (CAGR) of 6.7%. The rising importance of Industry 4.0 and smart factory, growing focus of manufacturers on reduction in maintenance and operational costs, surging need for FDM systems, and increasing investments for the development of FDM solutions by automation companies are the major factors driving the growth of the market.

Software segment would account for larger share of field device management market, by offering, by 2024

Most of the players provide software-based solutions for better analysis of field devices. Software offerings are expected to dominate the market due to the rising adoption of advanced technologies such as industrial automation, Industry 4.0, and the IIoT. Field device management (FDM) acts as a configuration tool for smart field devices and a maintenance tool for diagnostics and troubleshooting applications. FDM tools are used by control engineers for commissioning and configuration tasks and by instrument technicians for troubleshooting and maintenance activities. FDM solutions help to remotely access smart devices and provide field data of the asset/machine, which can be used for predictive maintenance.

Process industry to account for largest market share during forecast period

Oil & gas, chemicals, energy & power, food & beverages, pharmaceuticals, metals & mining are among a few major process industries. The emergence of Industry 4.0 and the evolution of big data have presented process industries with unique opportunities for taking their performance to a new level. Almost all process industries require critical monitoring and controlling processes. Many smart sensors and smart field devices have been introduced to perform data analysis of critical industries. FDM solutions help field engineers to optimize their maintenance tasks.

APAC to witness highest CAGR in field device management market during forecast period

The rising demand for FDM solutions in the automation industry, growing adoption of Industry 4.0, smart factory, IoT, and IIoT technologies, and increasing investments in the development of FDM solutions are some of the factors driving the growth of FDM market in APAC. China is expected to lead the FDM market in the APAC region. Manufacturing, automotive, and energy & power are the major industries that would drive the market growth in the APAC region.

Key Market Players

Siemens (Germany), Emerson (US), Honeywell (US), ABB (Switzerland), Schneider Electric (France), Rockwell Automation (US), Yokogawa (Japan), OMRON (Japan), Mitsubishi Electric (Japan), Fanuc (Japan), Metso (Finland), Valmet (Finland), Hamilton Company (US), Phoenix Contact (Germany), Endress+Hauser (Switzerland), Festo (Germany), Omega Engineering (UK), Hach (US), Azbil Corporation (Japan), and Weidmüller (Germany) are among the major players in the field device management market.

Siemens was founded in 1847 by Werner von Siemens. Further, the company became a global pioneer in electrical engineering. Siemens is a conglomerate company having headquarters in Munich, Germany. It is among major industrial manufacturing companies in Europe. The company operates in the following segments: Power and Gas, Energy Management, Building Technologies, Mobility, Digital Factory, Process Industries and Drives, Healthineers, and Siemens Gamesa Renewable Energy. The company offers software products for field device management. The Process Industries and Drives segment offers various products, software, and solutions across the oil & gas, shipbuilding, mining, cement, fiber, chemicals, food & beverages, and pharmaceuticals industries, among others.

Scope of the Report

|

Report Metric |

Detail |

|

Market Size Availability for Years |

2015–2024 |

|

Base Year |

2018 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Offering, Industry, and Communication Protocol |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

Siemens (Germany), Emerson (US), ABB (Switzerland), Schneider Electric (France), and Honeywell (US), among others |

This research report categorizes the field device management market, by offering, industry, protocol, and region.

Based on Offerings, the field device management market has been classified into the following segments:

- Hardware

- Software

Based on Industries, the field device management market has been classified into the following segments:

- Process

- Oil & Gas

- Chemicals

- Power & Energy

- Food & Beverages

- Pharmaceuticals

- Metals & Mining

- Others

- Discrete

- Automotive

- Manufacturing

- Aerospace & Defence

Based on Protocols, the field device management market has been classified into the following segments:

- FOUNDATION Fieldbus and HART

- PROFIBUS

- PROFINET

- Modbus TCP/IP

- EtherNet/IP

- Others (ISA 100.11A and BRAIN)

Based on Regions, the field device management market has been classified into the following segments:

- North America

- Europe

- APAC

- RoW

Recent Developments

- Siemens launched Simatic RTU3031C – a remote terminal unit with integrated GPS functionality. This is used for the monitoring of distributed measuring points in the water industry.

- Emerson upgraded its AMS device manager—a plant asset management software that provides alert optimization capabilities and mobile device health dashboards.

- ABB launched ABB Ability, its industry-leading portfolio of digital solutions. ABB Ability includes more than 210 solutions and services for customers in customers in utilities, industry, transport, and infrastructure markets to develop new processes and advance existing ones.

- Schneider Electric launched EcoStruxure Foxboro DCS Control Software 7.1 is an open, interoperable, and future-proof process automation system that provides control over a manufacturing plant’s operational profitability.

Key Questions Addressed by the Report

- Which are the major industries in the field device management market?

- Which region would lead the market during the forecast period?

- What strategies are adopted by FDM providers to stay ahead in the market?

- What are the growth perspectives of this market in different regions?

- What are drivers, opportunities, restraints, and challenges that influence the growth of the market?

Frequently Asked Questions (FAQ):

Which offering is expected to drive the growth of the market in the next 5 years?

Most of the players provide software-based solutions for better analysis of field devices. Software offerings are expected to dominate the market due to the rising adoption of advanced technologies such as industrial automation, Industry 4.0, and the IIoT. Field device management (FDM) acts as a configuration tool for smart field devices and a maintenance tool for diagnostics and troubleshooting applications. FDM tools are used by control engineers for commissioning and configuration tasks and by instrument technicians for troubleshooting and maintenance activities. FDM solutions help to remotely access smart devices and provide field data of the asset/machine, which can be used for predictive maintenance.

Which are the major players in the market? What are their major strategies to strengthen their market presence?

Siemens (Germany), Emerson (US), Honeywell (US), ABB (Switzerland), Schneider Electric (France), Rockwell Automation (US), Yokogawa (Japan), OMRON (Japan), Mitsubishi Electric (Japan), Fanuc (Japan), Metso (Finland), Valmet (Finland), Hamilton Company (US), Phoenix Contact (Germany), Endress+Hauser (Switzerland), and Festo (Germany) are the major players in the market. Product launches and upgradation of exisiting products are the major starategies adopted by these players. Apart from this, these players are indulging in inorganic growth strategies to maintain its position in the market.

Which region is expected to witness significant demand for FDM in the coming years?

The rising demand for FDM solutions in the automation industry, growing adoption of Industry 4.0, smart factory, IoT, and IIoT technologies, and increasing investments in the development of FDM solutions are some of the factors driving the growth of FDM market in APAC. China is expected to lead the FDM market in the APAC region. Manufacturing, automotive, and energy & power are the major industries that would drive the market growth in the APAC region

Which are the major industries of this market?

The process industries are expected to witness a significant growth in the FDM market. Oil & gas, chemicals, energy & power, food & beverages, pharmaceuticals, metals & mining are among a few major process industries. The emergence of Industry 4.0 and the evolution of big data have presented process industries with unique opportunities for taking their performance to a new level.

Which are the major opportunities in the FDM market?

Major opportunities for the FDM market includes benefits offered By cloud computing technology, investment opportunities in cloud computing, and initiatives of FDM providers and alliances towards product development.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Field Device Management Market

4.2 Market, By Protocol

4.3 Market, By Offering

4.4 Market in APAC, By Industry and Country

4.5 Country-Wise Field Device Management Market Growth Rate

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Importance of Industry 4.0 and Smart Factory

5.2.1.2 Growing Focus of Manufacturers on Reduction in Maintenance and Operational Costs

5.2.1.3 Surging Need for FDM Systems

5.2.1.4 Increasing Investments for Development of IIoT Solutions By Automation Companies

5.2.2 Restraints

5.2.2.1 Dearth of Skilled Workforce

5.2.3 Opportunities

5.2.3.1 Benefits Offered By Cloud Computing Technology

5.2.3.2 Investment Opportunities in Cloud Computing

5.2.3.3 Initiatives of FDM Providers and Alliances Toward Product Development and Modification

5.2.4 Challenges

5.2.4.1 Maintain Data Privacy and Cybersecurity

6 Field Device Management Market, By Offering (Page No. - 40)

6.1 Introduction

6.2 Hardware

6.2.1 Substantial Growth is Expected in the Hardware-Based Products Owing to the Use of Hand-Held Devices to Monitor on Field Parameters

6.3 Software

6.3.1 Software-Offering is Expected to Have A Strong Growth Owing to the Higher Adoption of IIoT and Industry 4.0

7 Field Device Management Market, By Communication Protocol (Page No. - 50)

7.1 Introduction

7.2 Foundation Fieldbus & Hart

7.2.1 Hart

7.2.1.1 Hart Device Connectivity Preferred By Various Industries as It Ensures Interoperability

7.2.2 Foundation Fieldbus

7.2.2.1 Foundation Fieldbus Primarily Reduces Opex Through Improved Plant Efficiencies, Better Asset Management, and Reduced Maintenance Requirements

7.3 Profibus

7.3.1 Profibus Preferred for Hazardous Environment Providing Opportunity for Chemical and Petrochemical Industries

7.4 Profinet

7.4.1 Profinet Enables High Amount of Flexibility and Real Time Communication

7.5 Ethernet/IP

7.5.1 Ethernet/IP Offers Digital Interconnectivity and A Unified Communications Network

7.6 Modbus

7.6.1 Modbus Offers Ease of Deployment and Usage in Various Industries

7.7 Others

7.7.1 ISA100.11a

7.7.2 Brain

8 Field Device Management Market, By Deployment (Page No. - 60)

8.1 Introduction

8.2 Cloud

8.2.1 Cloud Based Systems is Expected to Have the Highest Growth Rate as Many Tier 1 Players are Investing in IoT-Based Services Through Partnerships and Acquisitions

8.3 On-Premises

8.3.1 The Market for On-Premises Type Offering is Expected to Hold A Major Share Due to the Cyber-Security Concerns

9 Field Device Management Market, By Industry (Page No. - 64)

9.1 Introduction

9.2 Process Industries

9.2.1 Oil & Gas

9.2.1.1 Oil & Gas Industry is Expected to Hold A Significant Share in the FDM Market as FDM Provides Monitoring of On-Field Parameters That Helps to Prioritize the Operational and Maintenance Tasks

9.2.2 Chemicals

9.2.2.1 Substantial Growth in the Chemical Industry is Expected as FDM Solutions Can Help Operators to Monitor the Chemical Production Process Remotely and Can Help in Predictive Maintenance Tasks

9.2.3 Energy & Power

9.2.3.1 Energy & Power Industry is Expected to Hold the Largest Share and Grow at the Highest CAGR Owing to the Higher Adoption of Automation Solutions in This Industry

9.2.4 Food & Beverages

9.2.4.1 Sturdy Growth is Expected in the Food & Beverages Industry for FDM Based Solutions as These Solutions are Expected to Be Used for Daily Maintenance Tasks

9.2.5 Pharmaceuticals

9.2.5.1 Pharmaceuticals Industry is Expected to Have A Steady Growth in the FDM Market Owing to the Adoption of FDM Solutions in the Multi-Product Production Facilities

9.2.6 Metals & Mining

9.2.6.1 Metals & Mining Industry is Expected to Have A Sturdy Growth Owing to the Adoption of Advanced Industrial Solutions to Increase Production and Reduce Operating Costs

9.2.7 Other Process Industries

9.3 Discrete Industries

9.3.1 Automotive

9.3.1.1 FDM is Used By Automotive Players Due to the Increasing Need for Reduction in Operational Costs

9.3.2 Manufacturing

9.3.2.1 Manufacturing Industry is Expected to Have the Highest Growth Rate as FDM Helps to Control and Monitor the Overall Manufacturing Processes Reducing the Downtime and the Maintenance Cost

9.3.3 Aerospace & Defence

9.3.3.1 Sluggish Growth for Aerospace and Defence Industry is Expected as FDM is Used for Safe, Efficient, and Qualitative Operations.

10 Geographic Analysis (Page No. - 87)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Strong Contribution of Government in the Development of Industrial Sector

10.2.2 Canada

10.2.2.1 Increased Focus on Innovation By Players in Manufacturing Sector Enhances Growth

10.2.3 Mexico

10.2.3.1 Technology Advancements and Increase in Fdi Spur the Growth of Industrial Segment

10.3 Europe

10.3.1 Germany

10.3.1.1 Automotive Industry to Play Important Role in FDM Market Growth During Forecast Period

10.3.2 UK

10.3.2.1 Increasing Trends of IIoT and Industry 4.0 Drive Market Growth

10.3.3 France

10.3.3.1 Government Initiative to Adopt Advanced Industrial Manufacturing Practices Enhance Growth

10.3.4 Italy

10.3.4.1 Automotive Industry to Exhibit Sturdy Growth in FDM Market in Italy

10.3.5 Russia

10.3.5.1 Oil & Gas Industry to Witness Substantial Growth in FDM Market in Russia

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 China Would Be Fastest-Growing Country in FDM Market in APAC

10.4.2 Japan

10.4.2.1 Growth of Japanese Market Driven By Rapid Adoption of FDM Solutions in Discrete and Process Industries

10.4.3 India

10.4.3.1 Higher Adoption of FDM Tools in Discrete Industries Drive FDM Market Growth in India

10.4.4 South Korea

10.4.4.1 Consumer Industry and Government Support for Smart Manufacturing Create Significant Opportunities for FDM Market Growth

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East and Africa

10.5.1.1 Oil & Gas Industry Drives Growth of FDM Market in Middle East and Africa

10.5.2 South America

10.5.2.1 Metals, Chemicals, and Oil & Gas Industries Offer Growth Opportunities for FDM Market

11 Competitive Landscape (Page No. - 110)

11.1 Overview

11.2 Ranking Analysis of Key Players

11.2.1 Product Launches and Developments

11.2.2 Agreements, Partnerships, and Contracts

11.2.3 Mergers & Acquisitions

11.2.4 Expansions

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Players

12 Company Profiles (Page No. - 118)

12.1 Introduction

12.2 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

12.2.1 Siemens

12.2.2 Emerson Electric Co.

12.2.3 ABB

12.2.4 Schneider Electric

12.2.5 Honeywell

12.2.6 Rockwell Automation

12.2.7 Yokogawa

12.2.8 OMRON

12.2.9 Fanuc

12.2.10 Metso Automation

12.3 Other Key Players

12.3.1 Azbil Corporation

12.3.2 Endress+Hauser

12.3.3 Festo

12.3.4 Hach Company

12.3.5 Hamilton Company

12.3.6 Mitsubishi Electric

12.3.7 Omega Engineering

12.3.8 Phoenix Contact

12.3.9 Valmet

12.3.10 Weidmüller

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 151)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (67 Tables)

Table 1 Field Device Management Market, By Offering, 2015–2024 (USD Billion)

Table 2 List of Hardware Products Used in FDM Systems

Table 3 Market for Hardware, By Industry, 2015–2024 (USD Million)

Table 4 Market for Hardware, By Process Industry, 2015–2024 (USD Million)

Table 5 Market for Hardware, By Discrete Industry, 2015–2024 (USD Million)

Table 6 Market for Software, By Industry, 2015–2024 (USD Million)

Table 7 Market for Software, By Process Industry, 2015–2024 (USD Million)

Table 8 Market for Software, By Discrete Industry, 2015–2024 (USD Million)

Table 9 Field Device Management Market, By Communication Protocol, 2015–2024 (USD Million)

Table 10 Market for Foundation Fieldbus & Hart Protocol, By Region, 2015–2024 (USD Million)

Table 11 Market for Profibus Protocol, By Region, 2015–2024 (USD Million)

Table 12 Market for Profinet Protocol, By Region, 2015–2024 (USD Million)

Table 13 Market for Ethernet/IP Protocol, By Region, 2015–2024 (USD Million)

Table 14 Market for Modbus Protocol, By Region, 2015–2024 (USD Million)

Table 15 Market for Software, By Deployment, 2015–2024 (USD Million)

Table 16 Market, By Industry, 2015–2024 (USD Million)

Table 17 Market, By Process Industry, 2015–2024 (USD Million)

Table 18 Field Device Management Market for Process Industries, By Offering, 2015–2024 (USD Million)

Table 19 Market for Process Industries, By Region, 2015–2024 (USD Million)

Table 20 Market for Oil & Gas Industry, By Offering, 2015–2024 (USD Million)

Table 21 Market for Oil & Gas Industry, By Region, 2015–2024 (USD Million)

Table 22 Market for Chemicals Industry, By Offering, 2015–2024 (USD Million)

Table 23 Market for Chemicals Industry, By Region, 2015–2024 (USD Million)

Table 24 Market for Energy & Power Industry, By Offering, 2015–2024 (USD Million)

Table 25 Market for Energy & Power Industry, By Region, 2015–2024 (USD Million)

Table 26 Field Device Management Market for Food & Beverages Industry, By Offering, 2015–2024 (USD Million)

Table 27 Market for Food & Beverages Industry, By Region, 2015–2024 (USD Million)

Table 28 Market for Pharmaceuticals Industry, By Offering, 2015–2024 (USD Million)

Table 29 Market for Pharmaceuticals Industry, By Region, 2015–2024 (USD Million)

Table 30 Market for Metals & Mining Industry, By Offering, 2015–2024 (USD Million)

Table 31 Market for Metals & Mining Industry, By Region, 2015–2024 (USD Million)

Table 32 Market for Other Process Industries, By Offering, 2015–2024 (USD Million)

Table 33 Market for Other Process Industries, By Region, 2015–2024 (USD Million)

Table 34 Field Device Management Market, By Discrete Industry, 2015–2024 (USD Million)

Table 35 Market for Discrete Industries, By Offering, 2015–2024 (USD Million)

Table 36 Market for Discrete Industries, By Region, 2015–2024 (USD Million)

Table 37 Market for Automotive Industry, By Offering, 2015–2024 (USD Million)

Table 38 Market for Automotive Industry, By Region, 2015–2024 (USD Million)

Table 39 Field Device Management Market for Manufacturing Industry, By Offering, 2015–2024 (USD Million)

Table 40 Market for Manufacturing Industry, By Region, 2015–2024 (USD Million)

Table 41 Market for Aerospace & Defence Industry, By Offering, 2015–2024 (USD Million)

Table 42 Market for Aerospace & Defence Industry, By Region, 2015–2024 (USD Million)

Table 43 Market, By Region, 2015–2024 (USD Million)

Table 44 Market in North America, By Country, 2015–2024 (USD Million)

Table 45 Market in North America, By Industry, 2015–2024 (USD Million)

Table 46 Market in North America, By Process Industry, 2015–2024 (USD Million)

Table 47 Market in North America, By Discrete Industry, 2015–2024 (USD Million)

Table 48 Market in North America, By Communication Protocol, 2015–2024 (USD Million)

Table 49 Field Device Management Market in Europe, By Country, 2015–2024 (USD Million)

Table 50 Market in Europe, By Industry, 2015–2024 (USD Million)

Table 51 Market in Europe, By Process Industry, 2015–2024 (USD Million)

Table 52 Market in Europe, By Discrete Industry, 2015–2024 (USD Million)

Table 53 Market in Europe, By Communication Protocol, 2015–2024 (USD Million)

Table 54 Field Device Management Market in APAC, By Country, 2015–2024 (USD Million)

Table 55 Market in APAC, By Industry, 2015–2024 (USD Million)

Table 56 Market in APAC, By Process Industry, 2015–2024 (USD Million)

Table 57 Market in APAC, By Discrete Industry, 2015–2024 (USD Million)

Table 58 Market in APAC, By Communication Protocol, 2015–2024 (USD Million)

Table 59 Field Device Management Market in RoW, By Region, 2015–2024 (USD Million)

Table 60 Market in RoW, By Industry, 2015–2024 (USD Million)

Table 61 Market in RoW, By Process Industry, 2015–2024 (USD Million)

Table 62 Market in RoW, By Discrete Industry, 2015–2024 (USD Million)

Table 63 Market in RoW, By Communication Protocol, 2015–2024 (USD Million)

Table 64 Product Launches and Developments, 2017–2018

Table 65 Agreements, Partnerships, and Contracts, 2016–2018

Table 66 Mergers & Acquisitions, 2017–2018

Table 67 Expansions, 2018

List of Figures (57 Figures)

Figure 1 Field Device Management Market: Process Flow of Market Size Estimation

Figure 2 Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Process Industry to Account for Larger Size of Field Device Management Market By 2024

Figure 8 Energy & Power Industry Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Software FDM Products to Hold Larger Share of Market Than Hardware Products By 2024

Figure 10 APAC to Account for Largest Share of Global Market By 2024

Figure 11 Growing Adoption of Filed Device Management Solutions to Surge Market Growth During Forecast Period

Figure 12 Foundation Fieldbus and Hart Protocols Expected to Command Market During Forecast Period

Figure 13 Software Offerings to Account for Major Share of Field Device Management Market By 2024

Figure 14 Process Industry and China Expected to Account for Largest Share of Market in APAC By 2024

Figure 15 Field Device Management Market in China to Grow at Highest CAGR During Forecast Period

Figure 16 Market Dynamics

Figure 17 FDM Market, By Offering

Figure 18 Software Offerings to Dominate Filed Device Management Market During Forecast Period

Figure 19 Working of Hardware Components Used in FDM Systems Based on Hart Communication Protocol

Figure 20 Process Industries Expected to Hold Larger Size of Filed Device Management Market for Hardware By 2024

Figure 21 Process Industries Expected to Account for Largest Size of Filed Device Management Market for Software By 2024

Figure 22 Power & Energy Industry Expected to Witness Highest CAGR in Filed Device Management Market for Software for Process Industries By 2024

Figure 23 Foundation Fieldbus & Hart Protocols to Command Filed Device Management Market During Forecast Period

Figure 24 Working Principle of Hart

Figure 25 Comparison of Foundation Fieldbus Model and Osi Model

Figure 26 Comparison of Profibus and Osi Layer

Figure 27 FDM Market, By Deployment

Figure 28 Cloud-Based Deployment Expected to Witness Higher CAGR in Field Device Management Market During Forecast Period

Figure 29 Discrete Industries Expected to Witness Highest CAGR in Market During Forecast Period

Figure 30 Energy & Power Industry to Lead Market, By Process Industry, During Forecast Period

Figure 31 APAC to Dominate Market for Process Industries During Forecast Period

Figure 32 APAC to Dominate Field Device Management Market for Oil & Gas Industry During Forecast Period

Figure 33 APAC to Lead Market for Chemicals Industry During Forecast Period

Figure 34 Software Offerings to Command Market for Energy & Power Industry During Forecast Period

Figure 35 APAC to Account for Largest Size of Market for Food & Beverages Industry During Forecast Period

Figure 36 APAC to Exhibit Highest CAGR in Field Device Management Market for Pharmaceuticals Industry During Forecast Period

Figure 37 Manufacturing Industry to Exhibit Highest CAGR in Market for Discrete Industries During Forecast Period

Figure 38 APAC is Expected to Dominate Market During Forecast Period

Figure 39 North America: Snapshot of Field-Device Management Market

Figure 40 US to Dominate Field-Device Management Market in North America During Forecast Period

Figure 41 Europe: Snapshot of Field Device Management Market

Figure 42 Germany to Command Market in Europe During 2019–2024

Figure 43 APAC: Snapshot of Field Device Management Market

Figure 44 China to Hold Commanding Position in Market in APAC During Forecast Period

Figure 45 Organic and Inorganic Strategies Adopted By Companies Operating in Market

Figure 46 Market Player Ranking, 2018

Figure 47 Field Device Management Market (Global) Competitive Leadership Mapping (2018)

Figure 48 Siemens: Company Snapshot

Figure 49 Emerson: Company Snapshot

Figure 50 ABB: Company Snapshot

Figure 51 Schneider Electric: Company Snapshot

Figure 52 Honeywell: Company Snapshot

Figure 53 Rockwell Automation: Company Snapshot

Figure 54 Yokogawa: Company Snapshot

Figure 55 OMRON: Company Snapshot

Figure 56 Fanuc: Company Snapshot

Figure 57 Metso Automation: Company Snapshot

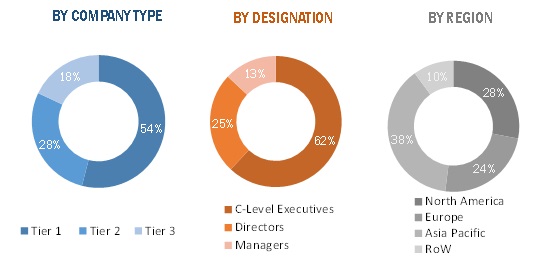

The study has involved 4 major activities to estimate the size of the field device management market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The field device management market comprises several stakeholders, such as industrial software providers and automation and FDM solution providers in the supply chain. The demand side of this market includes various process industries, such as oil & gas, chemicals, energy & power, food & beverages, pharmaceuticals, mining & metals, while discrete industries such as automotive, manufacturing, and aerospace & defence. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the field device management market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in various discrete and process industries.

Report Objectives

- To describe and forecast the field device management market, in terms of value, by offering, industry, and communication protocol

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding factors such as drivers, restraints, opportunities, and challenges that influence the growth of the field device management market

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches and developments, acquisitions, contracts, agreements, and partnerships in the field device management market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players/

Growth opportunities and latent adjacency in Field Device Management Market