Feed Packaging Market by Pet (Dogs, Cats, Fish, and Birds), Livestock (Poultry, Ruminants, and Swine), Type (Flexible and Rigid), Feed Type (Dry, Wet, Pet Treats, and Chilled & Frozen), Material, and Region - Global Forecast to 2023

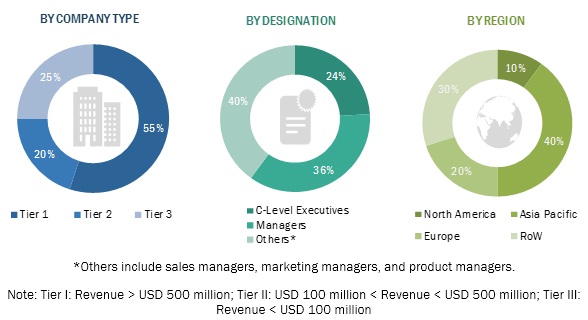

[208 Pages Report] Feed packaging market is projected to grow from USD 13.8 billion in 2018 to USD 17.8 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period. The study involved four major activities in estimating the current market size for the market. Exhaustive secondary research was done to collect information on the market as well as the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, so as to identify and collect information for this study. These secondary sources included reports from the American Feed Industry Association (AFIA), European Feed Manufacturers' Federation (FEFAC), and EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA); annual reports; press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors, packaging safety regulations, feed safety organizations, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain; the total pool of key players; market classification; and segmentation, according to industry trends to the bottom-most level; and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall feed packaging market comprises several stakeholders such as feed traders and distributors, pet food traders and distributors, animal feed and packaging regulatory bodies, manufacturers of feed packaging, manufacturers of pet food packaging, pet food packaging material distributors/suppliers, livestock feed packaging material distributors/suppliers, technology providers to feed packaging companies, environmental protection bodies, and regulatory bodies in the supply chain. The demand side of this market is characterized by the development of the feed industries, the rise in livestock population, and an increase in pet adoption and humanization. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the overall market were interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the livestock feed and pet food industries. The primary sources from the supply side include research institutions involved in R&D to introduce new feed packaging; key opinion leaders; distributors; and livestock feed & pet food packaging manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the global market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The feed packaging industry’s value chain and market size in terms of value were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market sizes-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and its subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the feed packaging industry. The market size was validated using the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the feed packaging market with respect to livestock, pet, type, material, feed type, and regional markets, over a five-year period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, future prospects, and their contribution to the total market

- Identifying and profiling key market players in the livestock feed and pet food packaging markets

- Providing a comparative analysis of the market leaders on the basis of:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the supply chain, products, and regulatory frameworks across regions and their impact on the prominent market players

- Providing insights on key innovations and investments in the feed packaging market

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Type, Pet, Livestock, Feed Type, Material, and Region |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

LC Packaging (Netherlands), El Dorado Packaging, Inc. (US), NPP Group Limited (Ireland), Plasteuropa Group (UK), NYP Corp. ( US), ABC Packaging Direct ( US), Shenzhen Longma Industrial Co., Limited (China), Amcor Limited (Australia), Mondi Group (Austria), ProAmpac ( US), Sonoco Products Company ( US), Winpak Ltd., (Canada), NNZ Group (the Netherlands), Constantia Flexible Group (Austria), and Huhtamäki Oyj (Finland) |

This research report categorizes the feed packaging market based on livestock, pet, material, type, feed type, and region.

On the basis of pet, the market has been segmented as follows:

- Dogs

- Cats

- Fish

- Birds

- Others (Tortoise and Reptiles)

On the basis of livestock, the market has been segmented as follows:

- Poultry

- Ruminants

- Swine

- Others (Aquatic animals and Equine)

On the basis of feed type, the market (for pets) has been segmented as follows:

- Dry

- Wet

- Pet Treats

- Chilled & frozen

On the basis of feed type, the market (for livestock) has been segmented as follows:

- Dry

- Wet

On the basis of material, the market (for pets) has been segmented as follows:

- Plastic

- Paper & paperboards

- Metal

- Others (Glass, Wood, and Cotton)

On the basis of material, the market (for livestock) has been segmented as follows:

- Plastic

- Paper

- Jute

- Others (Cotton and Polyesters)

On the basis of type, the market (for pets) has been segmented as follows:

- Flexible

- Rigid

On the basis of type, the market (for livestock) has been segmented as follows:

- Flexible

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (Brazil, Argentina, South Africa, and Others in RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of European feed packaging market into Spain, Belgium, the Netherlands, and Denmark.

- Further breakdown of the Rest of Asia Pacific feed packaging market into Indonesia, Thailand, South Korea, Singapore, and Malaysia.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

For this study, the feed packaging market is further bifurcated into pet food and livestock feed packaging. The market for feed packaging is projected to grow from USD 13.8 billion in 2018 to USD 17.8 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period. This is attributed to the feeding of traditional dry farms leftover to the livestock in the developing regions. However, with the growing demand for quality livestock products and the increasing production of feed and feed additives, this market is expected to grow at a higher rate in the coming years.

By livestock type, the poultry segment is projected to be the largest contributor to the feed packaging market (for livestock) during the forecast period.

The estimated largest market share of poultry feed is attributed to the large-scale production of poultry feed. The large-scale production of poultry feed is a result of its large-scale consumption, as, unlike beef and pork, it is devoid of religious concerns. Thus, the production of poultry for meat is projected to dominate and account for more than half the growth of all the additional meat produced by 2025. Such rapid growth in poultry meat production is expected to further fuel the demand for superior-quality feed and feed additives, thereby propelling the market for livestock feed packaging.

The dry feed type segment is projected to account for a larger market share during the forecast period.

Feed packaging (for livestock) is widely used for dry feed type. Dry feed is available in the form of pellets, powder, crumbles, cubes, and cakes. It is a largely produced and consumed, globally. Most feed manufacturers in the market offer their products in the dry form due to its ease of usage, storage, and transportation. Moreover, dry feed is widely used in animal diets, as it is affordable in comparison with wet feed. Due to these factors, the segment is estimated to acquire a larger market share in 2018. On the other hand, feed packaging market (for pets), by feed type, is estimated to be dominated by the dry segment, in 2018, due to factors such as economical prices and product durability of dry pet feed as compared to other pet feed type.

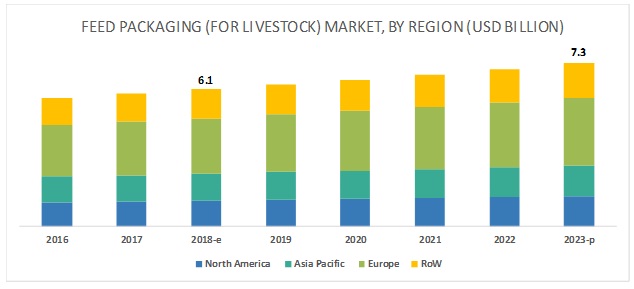

Asia Pacific is projected to account for the largest market share during the forecast period.

Asia Pacific is the major revenue generating region, in the feed packaging market (for livestock).

The region is experiencing maximum developments in the feed production and packaging. With the rapid economic growth in the region, the demand for meat and dairy products is projected to increase, particularly in countries such as China, India, Japan, and Thailand for both domestic consumption as well as exports. This growing demand for meat and dairy products has led to an increase in feed production in the region. Due to these factors, the application of packaging has increased, and the livestock feed packaging market is projected to witness a healthy growth from 2018 to 2023.

In addition, unlike developed countries, the livestock farm size in developing countries of Asia, including India, Thailand, and Vietnam, is quite small and the infrastructure for feed storage is poor. Due to these factors, farmers prefer buying feed in woven bags (25 to 50 kgs), as it prevents spoilage. Further, the growing animal husbandry practices, increasing awareness about the clean label products, and the growing demand for livestock products has encouraged the livestock rearers to buy well-packaged feed. These factors are expected to drive the growth of the livestock feed packaging market in the region.

For the feed packaging market (for pets), Asia Pacific is projected to witness the fastest growth in the pet food packaging market during the forecast period. Pet food manufacturers in Asia Pacific are developing and launching new and innovative products that comprise various ingredients to cater to the diverse health requirements of pets. In addition, packaging is gaining significance due to marketing, labeling of contents, and packaging size. Moreover, packaging solutions such as small pouches are witnessing an increasing preference, which is encouraging customers to purchase new products.

Key Market Players

The major vendors in the global market are LC Packaging (Netherlands); El Dorado Packaging Inc., (US); NPP Group Limited (Ireland); Plasteuropa Group (UK); NYP Corp. (US); ABC Packaging Direct (US); Shenzhen Longma Industrial Co., Limited (China); Amcor Limited (Australia); Mondi Group (Austria); ProAmpac (US); Sonoco Products Company (US); Winpak Ltd., (Canada); NNZ Group (the Netherlands); Constantia Flexible Group (Austria); and Huhtamäki Oyj (Finland). These players have broad industry coverage and strong operational and financial strength; they have grown organically and inorganically in the recent past. The industry players, such as Amcor Ltd., among other feed packaging manufacturers, are focusing on producing sustainable and environment-friendly packaging solutions. Moreover, key industry players such as Mondi, ProAmpac, LC packaging, Amcor Ltd., are adopting acquisitions as the key strategy to grow in the market. Acquisitions have helped companies to expand their product portfolios and extend their geographical presence in developing markets.

Recent Developments:

- In August 2018, ProAmpac was awarded a Level-2 Food Safety Management Certification by the Safe Quality Food (SQF) Institute for its facility in Auburn, Washington, US.

- In June 2018, ProAmpac announced a launch of the no.2 Quadflex Pouch. This new pouch will provide synergies to its sustainable packaging solution for pet foods such as cereals and pet treats.

- In January 2018, Huhtamaki expanded its paper bag manufacturing operations in Poland by establishing a joint venture with Smith Anderson Group Limited (UK). Smith Anderson Group Limited is one of Europe's leading paper bag suppliers.

Key Questions addressed by the report:

- Who are the major market players in the global market?

- What are the regional growth trends and the largest revenue-generating regions for feed packaging?

- Which are the major regions that are expected to witness the majority of the growth for feed packaging?

- What are the major types of feed packaging that are expected to gain maximum market revenue and share during the forecast period?

- Which is the major packaging material that will be accounting for the majority of the revenue over the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Segmentation

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 27)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Research Assumptions

2.4.2 Research Limitations

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 40)

4.1 Attractive Opportunities in the Feed Packaging (For Livestock) Market

4.2 Attractive Opportunities in the Feed Packaging (For Pets) Market

4.3 Feed Packaging (For Pets) Market, By Key Country

4.4 Asia Pacific: Feed Packaging (For Livestock ) Market, By Livestock & Key Country

4.5 Feed Packaging (For Livestock) Market, By Feed Type & Region

4.6 Feed Packaging (For Pets) Market, By Pet & Region

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Competition: Product Differentiation Through Packaging Products

5.2.1.2 Innovations in Pet Food Packaging Products

5.2.1.3 Growth of the Parent Industry

5.2.1.4 Increase in Pet Population and Pet Care Expenditure

5.2.1.4.1 Pet Humanization: Health of Pets and Shift Toward Premium Food

5.2.1.5 Shelf-Life Extension of Feed Stimulating the Demand for Feed Packaging

5.2.1.6 Eco-Sustainability of Raw Materials Used in Packaging

5.2.1.7 Growth in Feed Production and Consumption

5.2.2 Restraints

5.2.2.1 Need for Greater Technological Understanding Than Required for Other Packaging Forms

5.2.3 Opportunities

5.2.3.1 Aseptic Packaging in the Feed Industry

5.2.3.2 Seaweed: A Sustainable Material to Replace Plastic Packaging

5.2.4 Challenges

5.2.4.1 Addressing Packaging Issues

6 Feed Packaging Market, By Type (Page No. - 55)

6.1 Introduction

6.2 Flexible

6.2.1 Growing Demand Polybags and Single Serve Food are Driving This Market

6.3 Rigid

6.3.1 Convenience in Gettig Desired Packaging Shape Supports the Growth of Rigid Packaging

7 Feed Packaging Market (For Livestock), By Feed Type (Page No. - 60)

7.1 Introduction

7.2 Dry

7.2.1 the Production and Cosnumption of Dry Feed in Large Volume is the Key Driver

7.3 Wet

7.3.1 Increasing Consumption of Feed Additives and Wet Feed Supplements to Drive the Market

8 Feed Packaging Market (For Pets), By Feed Type (Page No. - 64)

8.1 Introduction

8.2 Dry

8.2.1 Benefits Such as Convenient Packaging Solutions and High Shelf-Life to Drive the Dry Pet Food Packaging

8.3 Wet

8.3.1 Growing Investment in Premium Pet Food By Pet Owners and Increase in Cosnumption of Wet Pet Food to Drive Wet Form of Pet Food Packaging

8.4 Pet Treats

8.4.1 Increasing Snacking Trend Due to Pet Food Premiumization to Drive This Market

8.5 Chilled & Frozen Foods

8.5.1 Increase in Refrigerator Shelf Space in Parallel to the Growing Trend of Feeding Frozen Pet Food With Longer Shelf-Life to Drive the ChiMarket

9 Feed Packaging Market, By Livestock (Page No. - 70)

9.1 Introduction

9.2 Poultry

9.2.1 Relatively Large Production of Poultry Feed in Developing Countries to Drive the Market

9.3 Swine

9.3.1 Benefits of Packaging Such as Retain Feed Quality and Lowering the Incidences of Clinical and Environmental Infections Drives the Market

9.4 Ruminants

9.4.1 Continous Growth in the Feed Production for Ruminants and Necessity of Feed Preservation to Drive the Market

9.5 Others

9.5.1 High Requirement of Feed Shelf Life Extension Without Any Chemicals By Small and Middle-Sclae Livetsock Rears to Drive This Market

10 Feed Packaging Market, By Pets (Page No. - 77)

10.1 Introduction

10.2 Dogs

10.2.1 Growing Dog Population, Largely in Key Growth Regions Such as Asia Pacific to Drive This Market

10.3 Cats

10.3.1 Increase in Number of Cats Over Dogs in the Developed Countries Such as the US and the UK to Drive the Market

10.4 Birds

10.4.1 Low Quantity Food Conumption Compared to Other Pets and Relatively Less Spending on Bird Food to Influence the Growth of the Market

10.5 Fish

10.5.1 Lack of Premiumization and Humanization Trends as Comapared to Dogs and Cats Segment is Expected to Be the Key Reason for Segment’s Steady Growth82

10.6 Others

10.6.1 Lack of Adoption as Pet and Minimal Humanization Trend in the Segment is Expected to Be the Key Reason for Segment’s Slow Growth Rate

11 Feed Packaging Market (For Livestock), By Material (Page No. - 84)

11.1 Introduction

11.2 Plastic

11.2.1 Polyethylene

11.2.1.1 Low Cost in Polyethylene Production Coupled With Its Availability in Wide Variety to Drive the Market

11.2.1.1.1 Low-Density Polyethylene (LDPE)

11.2.1.1.2 High-Density Polyethylene (HDPE)

11.2.2 Polypropylene (PP)

11.2.2.1 Its Properties Such as Glossy Film With High Strength and Puncture Resistance to Drive the Market

11.2.3 Others

11.3 Paper

11.3.1 Growing Wet Feed Cosnumption Due to Its Health Beenfits May Slow Down the Growth of This Market

11.4 Jute

11.4.1 Factors Such as the Material’s Susceptibility to Leakage, Its Heavy Weight, and Low Resistance to Temperature Have Reduced the Demand for JMarket88

11.5 Others

11.5.1 Relatively High Cot of Packaging Using these Materials has Lead to the Decline in the Demnd for these Materials

12 Feed Packaging Market (For Pets), By Material (Page No. - 90)

12.1 Introduction

12.2 Plastic

12.2.1 Increasing Demand for Flexible and Rigid Plastic Bags Coupled With Increasing Sales of See Through Packaging to Drive the Market

12.2.1.1 Bags

12.2.1.2 Pouches

12.3 Paper & Paperboards

12.3.1 Growing Environment Concerns Along With the Growing Awareness of Consumers About the Harmful Effects of Plastic to Drive the Market

12.3.1.1 Bags

12.3.1.2 Boxes & Cartons

12.4 Metal

12.4.1 High Production Costs and Difficulties in Handling and Transporting Products Have Negatively Influenced the Growth of the Market

12.5 Others

12.5.1 Low Production Cost and Convinentice of Flexible Palstic Packaging is Expected to Hamper the Growth of This Market

13 Feed Packaging Market (For Livestock), By Region (Page No. - 96)

13.1 Introduction

13.2 North America

13.2.1 US

13.2.1.1 The Application of Strict Regulatory Norms for Feed Safety By the US Governments is Expected to Drive the Market US

13.2.2 Canada

13.2.2.1 Increasing Feed Production Along With the Rise in Demand for Convenient and Safe Packaging for Livestock to Boost the Feed Packag101

13.2.3 Mexico

13.2.3.1 Rising Mexican Feed Industry and Increase in Spending on Livestock is Expected to Drive the Global Market in Mexico

13.3 Europe

13.3.1 Spain

13.3.1.1 Highly Efficient Livestock Rearing and Growing Feed Industry has Been Driving the Market in Spain

13.3.2 Germany

13.3.2.1 Modernization of the Livestock Industry and Rising Feed Safety Concern has Driven the Market in Germany

13.3.3 France

13.3.3.1 Rising Domestic Production of Compound Feed and Growing Innovation in Packaging Industry has Driven this Market in France

13.3.4 UK

13.3.4.1 High Commercialization Standards and Availability of Infrastructure for Feed Storage is the Key Reason for in this Market

13.3.5 Italy

13.3.5.1 Evolving Livestock Farming Coupled With Increasing Production of Feed and Feed Additives to Drive the Global Market in Italy

13.3.6 Rest of Europe

13.3.6.1 Introduction of Environment Friendly Packaging Solution in the Country to Drive the Feed Packaging Market

13.4 Asia Pacific

13.4.1 China

13.4.1.1 Growing Animal Husbandry and Rising Demand for Feed Shelf-Life Extension to Drive the to Drive the Feed Packaging Market in the Country

13.4.2 India

13.4.2.1 Increase Feed Production and Consumption Along With the Growing Awareness Towards Feed Safety Among Livestock Rearers’ to Drive the 116

13.4.3 Japan

13.4.3.1 Growing Preference Towards Well-Packaged Feed Among Livestock Rears Due to Its Several Benefits is Expected to Drive the Market in 117

13.4.4 Thailand

13.4.4.1 Packaging Being the Economical Option for Small and Middle-Scale Livestock Rearers is Expected to Drive the Global Market

13.4.5 Rest of Asia Pacific

13.4.5.1 Increasing Demand for Feed Preservations and Shelf-Life Extension Coupled With Growing Consumption of Feed and Feed Additives to Market

13.5 Rest of the World (RoW)

13.5.1 Brazil

13.5.1.1 Growing Feed Production, Coupled With Rise in Demand for Feed Preservations and Shelf-Life Extension to Drive the Drive the Feed Market

13.5.2 Argentina

13.5.2.1 Growing Preference Towards Well-Packaged Feed Among Livestock Rears Due to Its Several Benefits is Expected to Drive the Market in 123

13.5.3 South Africa

13.5.3.1 Increase in Investment in Feed Industry From the Various Key Players and Rise in Spending on Feed Along With Growing Awareness Country

13.5.4 Others in RoW

13.5.4.1 Increasing Demand for Feed Preservations and Shelf-Life Extension Coupled With Growing Consumption of Feed and Feed Additives to Market

14 Feed Packaging Market (For Pets), By Region (Page No. - 126)

14.1 Introduction

14.2 North America

14.2.1 US

14.2.1.1 Growing Pet Humanization and Pet Food Premiumization Trend in the Country to Drive the Global Market

14.2.2 Canada

14.2.2.1 Growing Consumption of Single Serve Pet Food to Drive Country to Drive the Feed Packaging Market in the Country

14.2.3 Mexico

14.2.3.1 Rising Pet Population Coupled With Growing Investment in Pet Care Industry and Online Pet Food Shopping to Drive the Feed Packaging 134

14.3 Europe

14.3.1 UK

14.3.1.1 Increasing Demand for Premium Pet Food Coupled With Increasing Investment on Fancy But Safe Pet Food Packaging is Driving This Market in 138

14.3.2 France

14.3.2.1 Increase in Number Pet Per Household and Growing Pet Care Industry is Driving Market in France

14.3.3 Germany

14.3.3.1 Increasing Demand for Puncture- and Moisture-Resistant, Contamination-Free, and Safe Packaging Options Driving the Feed Packaging Country139

14.3.4 Italy

14.3.4.1 Increasing Pet Owner’s Interest in Small Formats (From Medium to Single-Serve) and Greater Awareness Towards Feed Waste Prevention 140

14.3.5 Russia

14.3.5.1 Growing Sales of Prepared Pet Foods Replacing Scraps and Leftovers of Human Food That Was Traditionally Given to Pets in theExpecte Russia141

14.3.6 Rest of Europe

14.3.6.1 Growing Pet Population and Increasing Pet Care Spending to Drive the Market

14.4 Asia Pacific

14.4.1 China

14.4.1.1 Growing Pet Population Coupled With Rising Pet Care Industry and Significant Growth in Online Pet Food Shopping Driving the Market in 145

14.4.2 Japan

14.4.2.1 High Pet Food and Pet Care Standards By the Pet Owners in the Country to Drive the Market in the Country

14.4.3 India

14.4.3.1 Growing Sales of Prepared Pet Foods Replacing Scraps and Leftovers of Human Food That Was Traditionally Given to Pets InIsPackaIndia

14.4.4 Australia

14.4.4.1 Presence on Nuclear Family and Growth of Pet Premiumization Trend Driving the Feed Packaging Market in Australia

14.4.5 Rest of Asia Pacific

14.4.5.1 Growing Average Pet Population Per Household and Treating Pets as Companion in these Countries to Drive the Global Market

14.5 RoW

14.5.1 Brazil

14.5.1.1 Growing Demand for Convenient and Hygienic Packaging With Regards to Pet Food Safety to Drive the Feed Packaging Market in Brazil

14.5.2 Argentina

14.5.2.1 Growing Pet Food Industry Along With Increasing Pet Food Safety Concerns Among Pet Owners to Drive the Feed Packaging in Argentina

14.5.3 South Africa

14.5.3.1 Growing Investment on Commercial Pet Food Products to Drive the Global Market in South Africa

14.5.4 Others in Row

14.5.4.1 Increasing Adoption of Pets and Rising Sales of Pet Food Products Drive the Global Market

15 Competitive Landscape (Page No. - 155)

15.1 Overview

15.2 Competitive Scenario

15.3 Market Ranking Analysis

15.4 Acquisitions

15.5 Expansions and Investments

15.6 Joint Ventures, Partnerships, & Agreements

15.7 Accreditation, Award/Recognition, and Certification

15.8 New Product Launches

16 Company Profiles (Page No. - 163)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

16.1 LC Packaging

16.2 EL Dorado Packaging, Inc.

16.3 NPP Group Limited

16.4 Plasteuropa Group

16.5 NYP Corp.

16.6 ABC Packaging Direct

16.7 Shenzhen Longma Industrial Co., Limited

16.8 Amcor Limited

16.9 Mondi Group

16.10 Proampac

16.11 Sonoco Products Company

16.12 Winpack Ltd.

16.13 MNZ Group

16.14 Constantia Flexibles Group

16.15 Huhtamäki OYJ

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

17 Appendix (Page No. - 198)

17.1 Discussion Guide

17.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

17.3 Available Customizations

17.4 Related Reports

17.5 Author Details

List of Tables (120 Tables)

Table 1 US Dollar Exchange Rate Considered for the Study, 2013–2017

Table 2 Feed Packaging Market (For Pet) Snapshot, 2018 vs. 2023

Table 3 Market (For Livestock) Snapshot, 2018 vs. 2023

Table 4 Market (For Livestock) Size, By Type, 2016–2023 (USD Million)

Table 5 Market (For Pet) Size, By Type, 2016–2023 (USD Million)

Table 6 Flexible: Feed Packaging Market (For Pet) Size, By Region, 2016–2023 (USD Million)

Table 7 Rigid: Feed Packaging Market (For Pet) Size, By Region, 2016–2023 (USD Million)

Table 8 Feed Packaging Market (For Livestock) Size, By Feed Type, 2016–2023 (USD Million)

Table 9 Dry: Market (For Livestock) Size, By Region, 2016–2023 (USD Million)

Table 10 Wet: Market (For Livestock) Size, By Region, 2016–2023 (USD Million)

Table 11 Feed Packaging Market (For Pet) Share, By Feed Type, 2016–2023 (USD Million)

Table 12 Dry: Market (For Pet) Share, By Region, 2016–2023 (USD Million)

Table 13 Wet: Market (For Pet) Size, By Region, 2016–2023 (USD Million)

Table 14 Pet Treats: Feed Packaging Market (For Pet) Size, By Region, 2016–2023 (USD Million)

Table 15 Chilled & Frozen: Feed Packaging Market (For Pet) Size, By Region, 2016–2023 (USD Million)

Table 16 Livestock Feed Packaging Market Size, By Livestock, 2016–2023 (USD Million)

Table 17 Poultry: Market Size, By Region, 2016–2023 (USD Million)

Table 18 Swine: Market Size, By Region, 2016–2023 (USD Million)

Table 19 Ruminants: Market Size, By Region, 2016–2023 (USD Million)

Table 20 Other: Livestock Feed Packaging Market Size, By Region, 2016–2023 (USD Million)

Table 21 Feed Packaging Market Size, By Pet, 2016–2023 (USD Million)

Table 22 Dogs: Market Size, By Region, 2016–2023 (USD Million)

Table 23 Cats: Market Size, By Region, 2016–2023 (USD Million)

Table 24 Birds: Market Size, By Region, 2016–2023 (USD Million)

Table 25 Fish: Market Size, By Region, 2016–2023 (USD Million)

Table 26 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 27 Feed Packaging Market (For Livestock) Size, By Material, 2016–2023 (USD Million)

Table 28 Plastic: Market (For Livestock) Size, By Sub-Type, 2016–2023 (USD Million)

Table 29 Plastic: Market (For Livestock) Size, By Region, 2016–2023 (USD Million)

Table 30 Paper: Market (For Livestock) Size, By Region, 2016–2023 (USD Million)

Table 31 Jute: Market (For Livestock) Size, By Region, 2016–2023 (USD Million)

Table 32 Others: Market (For Livestock) Size, By Region, 2016–2023 (USD Million)

Table 33 Feed Packaging (For Pet) Market Size, By Material, 2016–2023 (USD Million)

Table 34 Plastic: Feed Packaging (For Pet) Market Size, By Sub-Type, 2016–2023 (USD Million)

Table 35 Plastic: Feed Packaging (For Pet) Market Size, By Region, 2016–2023 (USD Million)

Table 36 Paper & Paperboards: Feed Packaging (For Pet) Market Size, By Sub-Type, 2016–2023 (USD Million)

Table 37 Paper & Paperboards: Feed Packaging (For Pet) Market Size, By Region, 2016–2023 (USD Million)

Table 38 Metal: Feed Packaging (For Pet) Market Size, By Region, 2016–2023 (USD Million)

Table 39 Others: Feed Packaging (For Pet) Market Size, By Region, 2016–2023 (USD Million)

Table 40 Feed Packaging (For Livestock) Market (For Livestock) Size, By Region, 2016–2023 (USD Million)

Table 41 North America: Feed Packaging Market (For Livestock) Size, By Country, 2016–2023 (USD Million)

Table 42 North America: Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 43 North America: Market (For Livestock) Size, By Feed Type, 2016–2023 (USD Million)

Table 44 North America: Livestock Feed Packaging Market Size, By Material, 2016–2023 (USD Million)

Table 45 US: Feed Packaging (For Livestock) Market Size, By Livestock, 2016–2023 (USD Million)

Table 46 Canada: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 47 Mexico: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 48 Europe: Feed Packaging Market (For Livestock) Size, By Country, 2016–2023 (USD Million)

Table 49 Europe: Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 50 Europe: Market (For Livestock) Size, By Feed Type, 2016–2023 (USD Million)

Table 51 Europe: Market (For Livestock) Size, By Material, 2016–2023 (USD Million)

Table 52 Spain: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 53 Germany: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 54 France: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 55 UK: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 56 Italy: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 57 Rest of Europe: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 58 Asia Pacific: Feed Packaging Market (For Livestock) Size, By Country, 2016–2023 (USD Million)

Table 59 Asia Pacific: Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 60 Asia Pacific: Market (For Livestock) Size, By Feed Type, 2016–2023 (USD Million)

Table 61 Asia Pacific: Market (For Livestock) Size, By Material, 2016–2023 (USD Million)

Table 62 China: Feed Packaging Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 63 India: Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 64 Japan: Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 65 Thailand: Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 66 Rest of Asia Pacific: Feed Packaging (For Livestock) Market Size, By Livestock, 2016–2023 (USD Million)

Table 67 RoW: Feed Packaging Market (For Livestock) Size, By Country, 2016–2023 (USD Million)

Table 68 RoW: Market (For Livestock) Size, By Livestock, 2016–2023 (USD Million)

Table 69 RoW: Market (For Livestock) Size, By Feed Type, 2016–2023 (USD Million)

Table 70 RoW: Market (For Livestock) Size, By Material, 2016–2023 (USD Million)

Table 71 Brazil: Feed Packaging (For Livestock) Market Size, By Livestock, 2016–2023 (USD Million)

Table 72 Argentina: Feed Packaging (For Livestock) Market Size, By Livestock, 2016–2023 (USD Million)

Table 73 South Africa: Feed Packaging (For Livestock) Market Size, By Livestock, 2016–2023 (USD Million)

Table 74 Others in RoW: Feed Packaging (For Livestock) Market Size, By Livestock, 2016–2023 (USD Million)

Table 75 Feed Packaging (For Pets) Market Size, By Region, 2016–2023 (USD Million)

Table 76 North America: Feed Packaging Market (For Pet) Size, By Country, 2016–2023 (USD Million)

Table 77 North America: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 78 North America: Market (For Pet) Size, By Packaging Type, 2016–2023 (USD Million)

Table 79 North America: Market (For Pet) Size, By Feed Type, 2016–2023 (USD Million)

Table 80 North America: Market (For Pet) Size, By Material, 2016–2023 (USD Million)

Table 81 Number of Pets Owned in the Us, 2016

Table 82 US: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023 (USD Million)

Table 83 Canada: Feed Packaging Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 84 Mexico: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 85 Europe: Feed Packaging Market (For Pet) Size, By Country, 2016–2023 (USD Million)

Table 86 Europe: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 87 Europe: Market (For Pet) Size, By Type, 2016–2023 (USD Million)

Table 88 Europe: Market (For Pet) Size, By Feed Type, 2016–2023 (USD Million)

Table 89 Europe: Market (For Pet) Size, By Material, 2016–2023 (USD Million)

Table 90 UK: Feed Packaging Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 91 France: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 92 Germany: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 93 Italy: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 94 Russia: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 95 Rest of Europe: Feed Packaging Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 96 Asia Pacific: Market (For Pet) Size, By Country, 2016–2023 (USD Million)

Table 97 Asia Pacific: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 98 Asia Pacific: Market (For Pet) Size, By Type, 2016–2023 (USD Million)

Table 99 Asia Pacific: Market (For Pet) Size, By Feed Type, 2016–2023 (USD Million)

Table 100 Asia Pacific: Market (For Pet) Size, By Material, 2016–2023 (USD Million)

Table 101 China: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023

Table 102 Japan: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023 (USD Million)

Table 103 India: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023

Table 104 Australia: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023

Table 105 Rest of Asia Pacific: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023

Table 106 RoW: Feed Packaging Market (For Pet) Size, By Country, 2016–2023 (USD Million)

Table 107 RoW: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 108 RoW: Market (For Pet) Size, By Type, 2016–2023 (USD Million)

Table 109 RoW: Market (For Pet) Size, By Feed Type, 2016–2023 (USD Million)

Table 110 RoW: Market (For Pet) Size, By Material, 2016–2023 (USD Million)

Table 111 Brazil: Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 112 Argentina: Feed Packaging Market (For Pet) Size, By Pet, 2016–2023 (USD Million)

Table 113 South Africa: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023 (USD Million)

Table 114 Others in RoW: Feed Packaging (For Pet) Market Size, By Pet, 2016–2023 (USD Million)

Table 115 Market Ranking of Players in the Feed Packaging (For Livestock) Market

Table 116 Acquisitions, 2018

Table 117 Expansions and Investments, 2016–2018

Table 118 Joint Ventures, Partnerships, Andagreements, 2015–2018

Table 119 Accreditation, Award/Recognition, and Certifications, 2017–2018

Table 120 New Product Launches, 2015–2018

List of Figures (49 Figures)

Figure 1 Livestock Feed Packaging Market Snapshot

Figure 2 Pet Food Packaging Market Snapshot

Figure 3 Livestock Feed Packaging Market, By Region

Figure 4 Pet Food Packaging Market, By Region

Figure 5 Research Design

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Market Size, By Livestock, 2018 vs. 2023 (USD Million)

Figure 10 Market Size, By Pet, 2018 vs. 2023 (USD Million)

Figure 11 Feed Packaging (For Livestock) Market Share, By Region, 2017

Figure 12 Growth in Feed Production and Consumption to Drive the Demand for Feed Packaging ( for Livestock) Market

Figure 13 Rise in Competition and Innovation in Pet Food Packaging to Drive the Demand

Figure 14 India is Projected to Be the Fastest-Growing Market for Pet Food Packaging Between 2018 & 2023

Figure 15 Poultry Accounted for the Largest Share in the Asia Pacific Livestock Feed Packaging Market

Figure 16 Asia Pacific to Dominate the Feed Packaging (For Livestock) Market Across All Forms Through 2023

Figure 17 The Market for Dog is Projected to Be The Fastest-Growing Segment During the Forecast Period

Figure 19 Total Number of Pets Owned in the Us

Figure 20 Number of US Households That Own A Pet

Figure 21 Feed Production, 2013–2017 (Million Tons)

Figure 22 Regional Feed Production Status, 2012 vs. 2017 (Million Tons)

Figure 23 Aseptic Packaging: Process Flow

Figure 24 Feed Packaging (For Pet) Market Share, By Type, 2018 vs. 2023

Figure 25 Feed Packaging (For Livestock) Market Share, By Feed Type, 2018 vs. 2023

Figure 26 Feed Packaging (For Pet) Market Share, By Feed Type, 2018 vs. 2023

Figure 27 Livestock Feed Production, 2012–2017 (Mmt)

Figure 28 Feed Packaging Market Share, By Livestock, 2018 vs. 2023

Figure 29 Pet Food Production, 2013–2016

Figure 30 Market For Feed Packaging, By Pet, 2018 vs. 2023

Figure 31 Feed Packaging (For Livestock) Market Share, By Material, 2018 vs. 2023 (Value)

Figure 32 Rising Consumption of Livestock Feed has Stimulated the Livestock Feed Packaging Market in Brazil and India

Figure 33 Asia Pacific: Feed Packaging (For Livestock) Market Snapshot

Figure 34 Rising Demand for Pet Food Products has Stimulated the Pet Food Packaging Market in China and India

Figure 35 North America: Feed Packaging (For Pet) Market Snapshot

Figure 36 Key Developments By Leading Players in the Market, 2013–2018

Figure 37 Number of Developments Between 2015 & 2018

Figure 38 Market Ranking of Players in the Feed Packaging (For Pets) Market

Figure 39 LC Packaging: SWOT Analysis

Figure 40 Amcor Limited: Company Snapshot

Figure 41 Amcor Limited: SWOT Analysis

Figure 42 Mondi Group: Company Snapshot

Figure 43 Mondi Group: SWOT Analysis

Figure 44 Sonocos Products Company: Company Snapshot

Figure 45 Winpack Ltd.: Company Snapshot

Figure 46 Constantia Flexibles Group: Company Snapshot

Figure 47 Constantia Flexibles Groups: SWOT Analysis

Figure 48 Huhtamäki OYJ: Company Snapshot

Figure 49 Huhtamäki OYJ: SWOT Analysis

Growth opportunities and latent adjacency in Feed Packaging Market