Feed Anticoccidials Market by Livestock (Poultry, Ruminant, Swine), Type (Monensin, Salinomycin, Narasin, Diclazuril), Form (Dry, Liquid), Source (Chemical, Natural), Mode of Consumption (Oral, Injection) And Region - Global Forecast to 2025

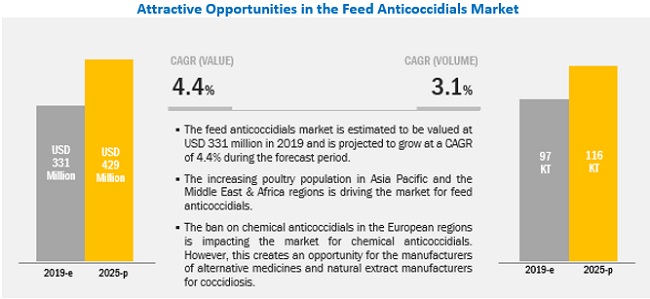

[164 Pages Report] The feed anticoccidials market size is expected to reach USD 429 million by 2025, at a CAGR of 4.4% during the forecast period. Lenient regulations about chemical anticoccidials and increasing livestock population in countries such as China, Japan, Thailand, and India are driving the Asia Pacific market growth. Stringent regulations on the usage of chemical anticoccidials in feed products are hindering the market growth for anticoccidials, mainly in the European region. Use of natural/ herbal extracts having anticoccidial property is generating opportunities for new entrants in the feed anticoccidials market due to minimal regulations.

Based on livestock, the poultry segment is projected to dominate during the forecast period.

One of the most common parasitic diseases prevalent in poultry, needing the usage of antibiotics, remains coccidiosis. It occurs because of the infestation of coccidia in the intestines. Coccidiosis is still a severe disease in poultry, also having the ability to disrupt the poultry industry economically. Therefore, proper control measures need to be followed for the complete prevention of its occurrence. Sound husbandry systems and the usage of anticoccidial drugs for both prophylaxis and treatment are the primary requirements to curb coccidiosis in poultry.

The usage of chemical anticoccidials is restricted in the European Union countries and is gradually losing favorability in other regions as well.

In 2006, the European Union (EU) banned the usage of antibiotics in the feed as growth promoters owing to the emergence of microbes, which are resistant to antibiotics that are used to treat human and animal infections. Following this ban by the EU, the use of antibiotics declined in many countries around the globe, especially in countries such as China, India, and the US, due to their overexploitation or misuse. As a result, the market for anticoccidials in the region has also been hindered to a substantial extent.

Based on type, the salinomycin segment is projected to see the highest growth in the feed anticoccidials market.

A monocarboxylic polyether antibiotic, salinomycin is derived from the fermentation of Streptomyces albus. The mode of action for salinomycin is mainly via ionophoric activity, via principally monovalent cations, such as potassium, sodium, rubidium, and lithium, which are bound in a complex manner and are then channelled into livestock cells. Cheaper cost as compared to other anticoccidials, and easy availability makes it the fastest growing segment globally.

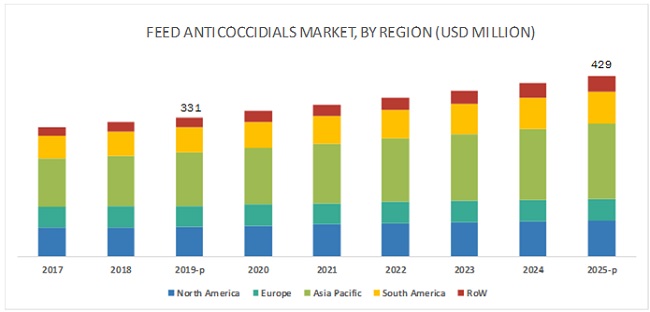

The Asia Pacific region is projected to account for the largest market share during the forecast period.

Asia Pacific region accounted for the highest share in the global feed anticoccidials market in 2017. The APAC market is the highest growth potential for animal antimicrobials and antibiotics during the forecast period. This can primarily be attributed to the presence of an enormous number of domesticated animals in the region. Over the past few years, the animal healthcare market in Asia Pacific has seen significant changes owing to factors such as increasing awareness about animal health and growing health expenditure, especially in India and China. China and India also saw significant increases in livestock breeding for meat and poultry products. To meet this growing demand for milk and meat products, livestock producers are increasingly focusing on animal healthcare, thereby excessively using livestock antibiotics, such as anticoccidials.

Key Market Players

This study on feed anticoccidials covers both chemical and natural products; companies with both these product lines have been considered in the study. Key companies operating in the feed anticoccidials market include Elanco Animal Health (US), Huvepharma (Bulgaria), Phibro Animal Health (US), Ceva Animal Health (France), Zoetis (US), Impextraco (Belgium), Kemin Industries (US), Merck Animal Health (US), Virbac SA (France), Zydus Animal Health (India), Bioproperties Pty. Ltd. (Australia), and Qilu Animal Health Products Co. Ltd. (China).

Scope of Report

|

Report Metric |

Details |

|

Market Size Estimation |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period considered |

2019-2025 |

|

Forecast units considered |

Value (USD Million) and Volume (Ton) |

|

Segments covered |

Livestock, Type, Source, Form, Mode of Consumption, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies covered |

Elanco animal health (US), Huvepharma (Bulgaria), Phibro Animal Health (US), Ceva Animal Health (France), Zoetis (US), Impextraco (Belgium), Kemin Industries (US), Merck Animal Health (US), Virbac SA (France), Zydus animal health (India), Bioproperties Pty. Ltd. (Australia), and Qilu Animal Health Products Co. Ltd. (China) |

This research report categorizes the feed anticoccidials market based on livestock, type, source, form, mode of consumption, and region.

Based on type, the feed anticoccidials market has been segmented as follows:

- Monensin

- Lasalocid

- Salinomycin

- Nicarbazin

- Diclazuril

- Narasin

- DOT (Dinitro-o-toluamide)

- Others (clopidol, robenidine, and semduramicin)

Based on livestock, the feed anticoccidials market has been segmented as follows:

-

Poultry

- Broilers

- Layers

- Breeders

-

Swine

- Starter

- Grower

- Sows

-

Ruminant

- Calves

- Dairy cattle

- Beef cattle

- Others (sheep and goat)

- Others (equine, aquatic, and pets)

Based on form, the market has been segmented as follows:

- Dry

- Liquid

Based on the source, the market has been segmented as follows:

- Chemical

- Natural

Based on the mode of consumption, the market has been segmented as follows:

- Injection

- Oral

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Africa and the Middle East)

Recent Developments

- In January 2019, Elanco Animal Health and Performance Livestock Analysis Inc. (PLA), announced a partnership which would enable access between Elanco’s Benchmark service and PLA’s Performance Beef platform to enable better livestock monitoring and improve decision making in the case of potential outbreaks.

Key Questions Addressed by the Report:

- Who are the major market players in the feed anticoccidials market?

- What are the regional growth trends and the largest revenue-generating regions for feed anticoccidials?

- Which are the major regions that are projected to witness significant growth for feed anticoccidials?

- What are the major types of feed anticoccidials that are projected to gain maximum market revenue and share during the forecast period?

- Which is the major type of livestock where feed anticoccidials are used that will be accounting for the majority of the revenue over the forecast period?

Frequently Asked Questions (FAQ):

What is the leading livestock in the feed anticoccidials market?

The poultry segment was the highest revenue contributor to the market, with USD 141.1 million in 2018, and is estimated to reach USD 192.7 million by 2025, with a CAGR of 4.7%.

What is the estimated industry size of feed anticoccidials?

The global feed anticoccidials market was valued at USD 320.0 million in 2018, and is projected to reach USD 429.2 million by 2025, registering a CAGR of 4.4% from 2019 to 2025.

What is the leading form in the feed anticoccidials market?

The dry segment was the highest revenue contributor to the market, with USD 241 million in 2018, and is estimated to reach USD 332.6 million by 2025, with a CAGR of 4.8%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Segmentation

1.4 Periodization Considered

1.5 Currency Considered

1.6 Units Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Opportunities in the Feed Anticoccidials Market

4.2 Feed Anticoccidials Market, By Type (USD Million)

4.3 Asia Pacific: Feed Anticoccidials Market, By Livestock & Country, By Value

4.4 Feed Anticoccidials Market, By Mode of Consumption

4.5 Feed Anticoccidials Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Threat of Coccidiosis in Livestock

5.2.1.1.1 Strong Demand for Anticoccidials From the Regions of Asia Pacific, South America, the Middle East, and Africa

5.2.2 Restraints

5.2.2.1 Stringent Regulations and Ban on Anticoccidials in Different Countries

5.2.2.2 Potent Residue Levels of Medicated Feed Ingredients Posing A Health Risk to Consumers

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Natural Feed Anticoccidials, Due to Rising Consumer Awareness

5.2.4 Challenges

5.2.4.1 Increasing Focus on Prevention Strategies, Restricting the Usage of Anticoccidials

5.2.4.2 Sustainability of Feed and Livestock Chain

5.3 Supply Chain for Feed

5.4 Regulatory Framework

5.4.1 Feed Additives Regulatory Approval From the European Union

5.4.2 Time Duration for A Feed Additive in the Register

5.4.3 Registration of Feed Additives

5.4.4 Packaging of Feed Additives

5.4.5 Labeling of Feed Additives

5.4.6 Manufacture and Sale of Feed Additives

5.4.7 Import of Feed Additives

5.4.8 Re-Evaluation of Feed Additives

5.5 Regulatory Framework, By Country

5.5.1 Brazil

5.5.2 China

5.5.3 The European Union

5.5.4 Japan

5.5.5 South Africa

6 Feed Anticoccidials Market, By Type (Page No. - 48)

6.1 Introduction

6.2 Monensin

6.2.1 Monensin Intoxications in Livestock Could Hinder Growth

6.3 Lasalocid

6.3.1 Improper Formulation of Lasalocid With Other Anticoccidials Could Hinder Market Growth

6.4 Salinomycin

6.4.1 Toxicity of Salinomycins in Livestock Make Proper Feed Inclusion Rates Essential to Driving Growth

6.5 Nicarbazin

6.5.1 Prevention Benefits and Climate Change to Drive Demand for Nicarbazin

6.6 Diclazuril

6.6.1 Proper Dosage of Diclazuril Could Help Reducing Oocyst Count, thereby Driving Growth

6.7 Narasin

6.7.1 Narasin’s Effectiveness Against A Number of Pathogens Drives Market Growth

6.8 DOT (Dinitro-O-Toluamide)

6.8.1 The Ability of the Drug to Induce Natural Immunity Drives Market Growth

6.9 Others

6.9.1 Effectiveness of these Anticoccidials Aiding Market Growth

7 Market for Feed Anticoccidials, By Livestock (Page No. - 60)

7.1 Introduction

7.2 Poultry

7.2.1 High Incidences of Coccidiosis in Poultry Expected to Drive Market Growth

7.3 Swine

7.3.1 High Susceptibility of Coccidiosis in Piglets Expected to Drive Market Growth

7.4 Ruminants

7.4.1 Calves Being Vulnerable to Coccidiosis Further Drives the Market for the Usage of Anticoccidials

7.5 Others

7.5.1 Rise in the Demand for Healthy Livestock Drives the Market for Anticoccidials

8 Market for Feed Anticoccidials, By Form (Page No. - 70)

8.1 Introduction

8.2 Dry

8.2.1 Powdered Form of Anticoccidials are Majorly Preferred By the Consumers

8.3 Liquid

8.3.1 Higher Reactivity Due to Direct Consumption is Driving the Market for Liquid Segment

9 Feed Anticoccidials Market, By Source (Page No. - 74)

9.1 Introduction

9.2 Chemical

9.2.1 Ban on Some of the Chemical Anticoccidials From Developed Countries is Restraining the Chemical Anticoccidials Market

9.3 Natural

9.3.1 Minimal Regulations on the Usage of Natural Sources are Driving the Market for Natural Anticoccidials

10 Market for Feed Anticoccidials, By Mode of Consumption (Page No. - 78)

10.1 Introduction

10.2 Oral

10.2.1 Inclusion of Anticoccidials in Feed as Additives is Driving the Growth for the Oral Segment

10.3 Injection

10.3.1 Mixing of Anticoccidials in the Bloodstream Directly Helps in Fast Cure of Coccidiosis

11 Market for Feed Anticoccidials, By Region (Page No. - 82)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Difference in Regulations for Various Anticoccidials Hinders Market Growth

11.2.2 Canada

11.2.2.1 Proper Dosages and Cycles for the Usage of Anticoccidials Drives Market Growth

11.2.3 Mexico

11.2.3.1 Lack of Regulations Propel Market Growth for Anticoccidials in the Country

11.3 Europe

11.3.1 UK

11.3.1.1 High Local Poultry Production Drives the Market for Anticoccidials

11.3.2 Germany

11.3.2.1 High Resistance to Antibiotics Drives the Market for Injected Anticoccidials

11.3.3 France

11.3.3.1 Reduction in the Usage of Feed Antibiotics Hindering the Market for Anticoccidials

11.3.4 Italy

11.3.4.1 Usage of Vaccinated Anticoccidials Driving the Market in the Country

11.3.5 Spain

11.3.5.1 Gradual Movement Toward Vaccinated Anticoccidials Drives the Market

11.3.6 Russia

11.3.6.1 Anticoccidial Usage Pertaining to Residue Levels Driving the Market

11.3.7 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Different Modes of Usage of Anticoccidials Drives Growth

11.4.2 Japan

11.4.2.1 Probiotics Used as A Substitute for Anticoccidials Hinders Market Growth

11.4.3 Thailand

11.4.3.1 Better Regulations Reducing the Usage of Antibiotics to Hinder Market Growth

11.4.4 India

11.4.4.1 Gradual Phasing Out of Antibiotics Hindering Growth

11.4.5 Vietnam

11.4.5.1 Gradual Phasing Out of the Usage of Antibiotics to Prevent Market Growth

11.4.6 Rest of Asia Pacific

11.4.6.1 Increase in Demand for Meat and Meat Products to Drive Market Growth for Anticoccidials

11.5 South America

11.5.1 Brazil

11.5.1.1 High Rates of Production and Import Bans Drives the Market for Anticoccidials in Brazil

11.5.2 Argentina

11.5.2.1 Modernization of the Meat Industry and Incidences of Avian Diseases Drives the Growth of the Feed Anticoccidials Market in Argentina

11.5.3 Rest of South America

11.6 Rest of the World

11.6.1 South Africa

11.6.1.1 Increasing Government Regulations on Livestock Health to Supplement Anticoccidial Demand in South Africa

11.6.2 Middle East

11.6.2.1 Investments and Modernisation Widen the Growth Prospects for Feed Anticoccidials Manufacturers in the Middle East

12 Competitive Landscape (Page No. - 125)

12.1 Overview

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.2.5 Competitive Benchmarking

12.2.5.1 Strength of Product Portfolio

12.2.5.2 Business Strategy Excellence

12.3 Ranking of Key Players, 2018

12.4 Competitive Scenario

12.4.1 New Product Launches

12.4.2 Expansions & Investments

12.4.3 Acquisitions

12.4.4 Agreements

13 Company Profiles (Page No. - 135)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 Elanco Animal Health

13.2 Huvepharma

13.3 Phibro Animal Health

13.4 Ceva Animal Health

13.5 Zoetis

13.6 Impextraco

13.7 Kemin Industries

13.8 Merck Animal Health

13.9 Virbac S.A

13.10 Zydus Animal Health

13.11 Bioproperties Pty Ltd

13.12 Qilu Animal Health Products Co. Ltd.

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 157)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (109 Tables)

Table 1 USD Exchange Rate, 2014–2018

Table 2 Deadlines for the Submission of Application of Re-Evaluation

Table 3 Feed Anticoccidials Market Size, By Type, 2017–2025 (USD Thousand)

Table 4 Feed Anticoccidials Market Size, By Type, 2017–2025 (Ton)

Table 5 Monensin: Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 6 Monensin: By Market Size, By Region, 2017–2025 (Ton)

Table 7 Lasalocid: By Market Size, By Region, 2017–2025 (USD Thousand)

Table 8 Lasalocid: By Market Size, By Region, 2017–2025 (Ton)

Table 9 Salinomycin: By Market Size, By Region, 2017–2025 (USD Million)

Table 10 Salinomycin: By Market Size, By Region, 2017–2025 (Ton)

Table 11 Nicarbazin: By Market Size, By Region, 2017–2025 (USD Thousand)

Table 12 Nicarbazin: By Market Size, By Region, 2017–2025 (Ton)

Table 13 Diclazuril: By Market Size, By Region, 2017–2025 (USD Thousand)

Table 14 Diclazuril: By Market Size, By Region, 2017–2025 (Ton)

Table 15 Narasin: By Market Size, By Region, 2017–2025 (USD Thousand)

Table 16 Narasin: By Market Size, By Region, 2017–2025 (Ton)

Table 17 DOT (Dinitro-O-Toluamide): Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Thousand)

Table 18 DOT (Dinitro-O-Toluamide): By Market Size, By Region, 2017–2025 (Ton)

Table 19 Others: By Market Size, By Region, 2017–2025 (USD Thousand)

Table 20 Others: By Market Size, By Region, 2017–2025 (Ton)

Table 21 Feed Anticoccidials Market Size, By Livestock, 2017–2025 (USD Million)

Table 22 Feed Anticoccidials Market Size, By Livestock, 2017–2025 (Ton)

Table 23 Anticoccidials Market Size in Poultry Feed, By Region, 2017–2025 (USD Thousand)

Table 24 Anticoccidials Market Size in Poultry Feed, By Region, 2017–2025 (Kt)

Table 25 Anticoccidials Market Size in Poultry Feed, By Poultry Type, 2017-2025 (USD Million)

Table 26 Anticoccidials Market Size in Swine Feed, By Region, 2017–2025 (USD Thousand)

Table 27 Anticoccidials Market Size in Swine Feed, By Region, 2017–2025 (Ton)

Table 28 Anticoccidials Market Size in Swine Feed, By Swine Type, 2017-2025 (USD Million)

Table 29 Anticoccidials Market Size in Ruminant Feed, By Region, 2017–2025 (USD Thousand)

Table 30 Anticoccidials Market Size in Ruminant Feed, By Region, 2017–2025 (Ton)

Table 31 Anticoccidials Market Size in Ruminant Feed, By Ruminant Type, 2017-2025 (USD Thousand)

Table 32 Anticoccidials Market Size in Other Livestock Feed, By Region, 2017–2025 (USD Thousand)

Table 33 Anticoccidials Market Size in Other Livestock Feed, By Region, 2017–2025 (Ton)

Table 34 By Market Size, By Form, 2017–2025 (USD Million)

Table 35 Dry Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 36 Liquid Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 37 By Market Size, By Source, 2017–2025 (USD Million)

Table 38 Chemical: Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 39 Natural: Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 40 By Market Size, By Mode of Consumption, 2017–2025 (USD Million)

Table 41 Oral: Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 42 Injection: Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 43 Global Feed Anticoccidials Market Size, By Region, 2017–2025 (USD Million)

Table 44 Global Feed Anticoccidials Market Size, By Region, 2017–2025 (Kt)

Table 45 North America: Feed Anticoccidials Market Size, By Country, 2017–2025 (Ton)

Table 46 North America: By Market Size, By Country, 2017–2025 (USD Thousand)

Table 47 North America: By Market Size, By Type, 2017–2025 (USD Thousand)

Table 48 North America: By Market Size, By Livestock, 2017–2025 (Ton)

Table 49 North America: By Market Size, By Livestock, 2017–2025 (USD Million)

Table 50 North America: By Market Size, By Form, 2017–2025 (USD Million)

Table 51 North America: By Market Size, By Mode of Consumption, 2017–2025 (USD Million)

Table 52 North America: Feed Anticoccidials Market, Source, 2017–2025 (USD Thousand)

Table 53 US: By Market Size, By Livestock, 2017–2025 (USD Thosand)

Table 54 Canada: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 55 Mexico: By Market Size, By Livestock, 2017–2025 (USD Million)

Table 56 Europe: By Market, By Country, 2017–2025 (Ton)

Table 57 Europe: By Market, By Country, 2017–2025 (USD Thousand)

Table 58 Europe: Feed Anticoccidials Market, By Type, 2017–2025 (USD Thousand)

Table 59 Europe: By Market, By Livestock, 2017–2025 (Ton)

Table 60 Europe: By Market, By Livestock, 2017–2025 (USD Thousand)

Table 61 Europe: By Market, By Form, 2017–2025 (USD Thousand)

Table 62 Europe: By Market, By Mode of Consumption, 2017–2025 (USD Thousand)

Table 63 Europe: Feed Anticoccidials Market, Source, 2017–2025 (USD Thousand)

Table 64 UK: By Market, By Livestock, 2017–2025 (USD Thousand)

Table 65 Germany: By Market, By Livestock, 2017–2025 (USD Thousand)

Table 66 France: By Market, By Livestock, 2017–2025 (USD Thousand)

Table 67 Italy: By Market, By Livestock, 2017–2025 (USD Thousand)

Table 68 Spain: Feed Anticoccidials Market, By Livestock, 2017–2025 (USD Thousand)

Table 69 Russia: By Market, By Livestock, 2017–2025 (USD Thousand)

Table 70 Rest of Europe: Feed Anticoccidials Market, By Livestock, 2017–2025 (USD Thousand)

Table 71 Asia Pacific: By Market Size, By Country, 2017–2025 (USD Million)

Table 72 Asia Pacific: By Market Size, By Country, 2017–2025 (Ton)

Table 73 Asia Pacific: By Market, By Type, 2017–2025 (USD Thousand)

Table 74 Asia Pacific: By Market Size, By Livestock, 2017–2025 (USD Million)

Table 75 Asia Pacific: By Market Size, By Livestock, 2017–2025 (Kt)

Table 76 Asia Pacific: Feed Anticoccidials Market, By Form, 2017–2025 (USD Million)

Table 77 Asia Pacific: By Market Size, By Mode of Consumption, 2017–2025 (USD Million)

Table 78 Asia Pacific: Feed Anticoccidials Market Size, Source, 2017–2025 (USD Million)

Table 79 China: By Market Size, By Livestock, 2017–2025 (USD Million)

Table 80 Japan: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 81 Thailand: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 82 India: Feed Anticoccidials Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 83 Vietnam: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 84 Rest of Asia Pacific: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 85 South America: Feed Anticoccidials Market Size, By Country, 2017–2025 (Ton)

Table 86 South America: By Market Size, By Country, 2017–2025 (USD Thousand)

Table 87 South America: By Market Size, By Type, 2017–2025 (USD Thousand)

Table 88 South America: By Market Size, By Livestock, 2017–2025 (Ton)

Table 89 South America: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 90 South America: By Market Size, By Form,2017–2025 (USD Million)

Table 91 South America: Feed Anticoccidials Market Size, By Mode of Consumption, 2017–2025 (USD Million)

Table 92 South America: By Market Size, By Source, 2017–2025 (USD Million)

Table 93 Brazil: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 94 Argentina: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 95 Rest of South America: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 96 RoW: By Market Size, By Region, 2017–2025 (Kt)

Table 97 RoW: By Market Size, By Region, 2017–2025 (USD Million)

Table 98 RoW: By Market Size, By Type, 2017–2025 (USD Thousand)

Table 99 RoW: By Market Size, By Livestock, 2017–2025 (Ton)

Table 100 RoW: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 101 RoW: Feed Anticoccidials Market Size, By Form, 2017–2025 (USD Million)

Table 102 RoW: By Market Size, By Mode of Consumption, 2017–2025 (USD Million)

Table 103 RoW: By Market Size, By Source, 2017–2025 (USD Million)

Table 104 South Africa: Feed Anticoccidials Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 105 Middle East: By Market Size, By Livestock, 2017–2025 (USD Thousand)

Table 106 New Product Launches

Table 107 Expansions & Investments

Table 108 Acquisitions

Table 109 Agreements

List of Figures (39 Figures)

Figure 1 Feed Anticoccidials Market Segmentation

Figure 2 Feed Anticoccidials Market: Research Design

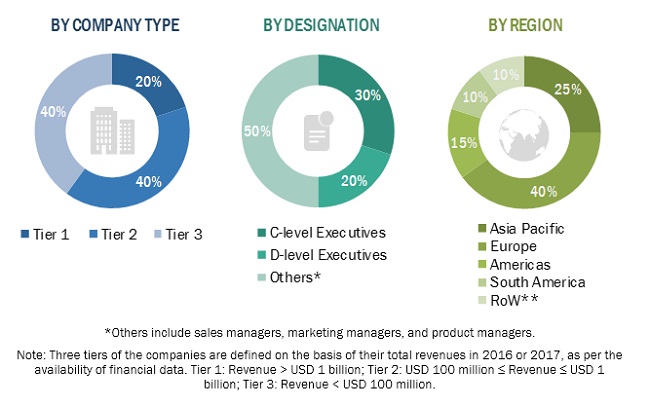

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Feed Anticoccidials Market Share (Value), By Livestock, 2018

Figure 8 Feed Anticoccidials Market Share (Value), By Source, 2019 vs. 2025

Figure 9 Feed Anticoccidials Market, By Type, 2018

Figure 10 Feed Anticoccidials Market: Regional Snapshot

Figure 11 Increasing Demand for Anticoccidials From Asia Pacific, the Middle East, and Africa Driving the Market

Figure 12 The Monensin Segment to Dominate the Global Feed Anticoccidials Market, By Type

Figure 13 The Poultry Segment Dominates the Asia Pacific Region, By Livestock

Figure 14 Oral Consumption of Feed Anticoccidials Preferred By Livestock Growers in 2018

Figure 15 Asia Pacific is Projected to Account for the Largest Market Share During the Forecast Period

Figure 16 Feed Anticoccidials Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Compound Feed Production, 2012–2018

Figure 18 Feed Anticoccidials Market: Supply Chain

Figure 19 Feed Anticoccidials Market Share, By Type, 2019 vs. 2025 (USD Million)

Figure 20 Feed Anticoccidials Market Share (Value), By Livestock, 2019 vs. 2025

Figure 21 Feed Anticoccidials Market Size, By Form, 2019 vs. 2025 (USD Million)

Figure 22 Feed Anticoccidials Market Size, By Source, 2019 vs. 2025 (USD Million)

Figure 23 Feed Anticoccidials Market Share, By Mode of Consumption, 2019 vs. 2025 (USD Million)

Figure 24 India and Africa to Witness Significant Market Growth in the Feed Anticoccidials Market (2019–2025)

Figure 25 Asia Pacific: Feed Anticoccidials Market

Figure 26 Global Feed Anticoccidials Market Competitive Leadership Mapping, 2019 (Top 25)

Figure 27 Key Developments of the Leading Players in the Feed Anticoccidials Market, 2014–2019

Figure 28 Zoetis Led the Feed Anticoccidials Market in 2018

Figure 29 Elanco Animal Health: Company Snapshot

Figure 30 Elanco Animal Health: SWOT Analysis

Figure 31 Huvepharma: SWOT Analysis

Figure 32 Phibro Animal Health: Company Snapshot

Figure 33 Phibro Animal Health: SWOT Analysis

Figure 34 Ceva Animal Health: Company Snapshot

Figure 35 Ceva Animal Health: SWOT Analysis

Figure 36 Zoetis: Company Snapshot

Figure 37 Zoetis: SWOT Analysis

Figure 38 Merck Animal Health: Company Snapshot

Figure 39 Virbac S.A: Company Snapshot

The study includes four major activities to estimate the current market size for feed anticoccidials. Exhaustive secondary research was done to collect information on the overall market and the peer market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the complete market size. After that, data triangulation was used, and the market breakdown was done to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and geographic markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders, which include feed manufacturers, additive manufacturers & suppliers, animal nutritionists, and poultry farmers in the supply chain. Various primary sources from both the supply and demand sides of feed anticoccidial manufacturers were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include research institutions, feed formulators and suppliers, government agencies, animal nutrition associations, and cooperative farm societies. The primary sources from the supply side include anticoccidial manufacturers, plant-based extract manufacturers, chemical manufacturers, and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market in all three sections. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. After the market was validated using both the top-down and bottom-up approaches, the data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- Determining and projecting the size of the feed anticoccidials market, by livestock, type, source, form, mode of consumption, and region, over six years ranging from 2019 to 2025

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across the regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

-

Identifying and profiling key market players in the feed yeast market based on the following:

- Product/service offering

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by the players across the key regions.

- Providing insights on the key investments in product innovations and patent registrations

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market into the UK, Germany, Greece, and Belgium

- Further breakdown of the Rest of Asia Pacific market into Vietnam, Malaysia, Singapore, and Thailand

- Further breakdown of the RoW market into Israel, Egypt, Argentina, and Morocco

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Feed Anticoccidials Market