FDI Opportunities in the Indian Defense Sector – Policy Overview, Technological Capability Assessment (Airborne, Naval, and Land), Inventory Gap Assessment (Airborne, Naval, and Land), Key Indian Companies – Capabilities, Tie-ups and Profiles

The report explains the defense procurement policy followed by the Indian government along with inventory assessment of various weapons possessed by the Indian armed forces. It also maps the technological capability in addition to profiling the key players in the market. India is likely to be one of the largest spenders on defense equipment, thereby attracting the interest of various major defense players. The spending on purchase of equipment along with upgrading programs is likely to increase further over the next decade. This is expected to bolster the development of the domestic defense industry owing to offsets requirement on defense purchases from global players.

India’s high defense spending along with the government’s ‘Make in India’ initiative are expected to encourage the entry of domestic players in the country’s defense sector. The procurement of new equipment and technology in the coming years along with massive upgrade programs is likely to open up a huge market for all stakeholders including global original equipment manufacturers (OEMs), defense public sector units (DPSUs), ordnance factory boards (OFBs) and domestic private sector players.

The Indian government aims to build a domestic industrial base by encouraging procurement of indigenously manufactured or developed technology and weapons systems, under its Make in India initiative. It has also revised the Defense Procurement Procedure (DPP). Original equipment manufacturers and their suppliers are expected to fulfil offset obligations and take advantage of India’s competitive advantages in manufacturing and information technology by setting up manufacturing facilities in the country. A large number of Indian private companies and publicly funded research laboratories are looking to enter the Indian defense sector.

The Indian Ministry of Defense has been focusing on filling the gaps in the inventory held by Indian armed forces. It has also been focusing on encouraging procurement of defense equipment from indigenous manufacturers. It has initiated the process of signing various contracts with the private sector under the Buy-Make category of the DPP. This is also expected to lead to various partnerships between the Indian companies and global Original Equipment Manufacturers (OEMs) to meet this demand.

India’s high defense spending along with the government’s ‘Make in India’ initiative are expected to encourage the entry of domestic players in the country’s defense sector. The procurement of new equipment and technology in the coming years along with massive upgrade programs is likely to open up a huge market for all stakeholders including global original equipment manufacturers (OEMs), defense public sector units (DPSUs), ordnance factory boards (OFBs) and domestic private sector players.

Some of the key procurements by the Indian government include medium multi-role combat aircraft, artillery guns in the 155 mm category and light combat aircraft among others. The Indian Air Force is also aiming to increase its number of squadrons by procuring more fighter aircraft. The Indian navy aims to acquire indigenous capability in design, development and construction of ships and submarines as espoused in its long-term perspective program.

The offset requirements as stipulated by the Indian government for the foreign players could present a challenge for foreign players as domestic companies do not have the adequate manufacturing capabilities. However, various large players such as Mahindra & Mahindra and TATA group have been setting up manufacturing facilities in order to cater to the potential rise in demand for indigenous defense equipment.

Some of the major domestic private players in the Indian defense sector include Ashok Leyland, Bharat Forge, Larsen & Toubro, Mahindra & Mahindra, Reliance Industries, and TATA group among others.

Mahindra & Mahindra operates in the defense sector through its subsidiaries which include Defense Land Systems India (DLSI), Mahindra Defense Systems (MDS), Mahindra Defense Naval Systems (MDNL) and Mahindra Special Service Groups (MSSG). The company has been focusing on entering into joint ventures to expand its product portfolio of weapons systems.

The TATA group is a major player which also caters to the Indian defense sector through its various holding companies which include Tata Advanced System, Tata Power SED, Tata Motors, and Tata Advanced Materials (TAML) among others. These companies have been focusing on entering into joint ventures with various overseas equipment manufacturers, such as helicopter maker Sikorsky, Lockheed Martin, and Israel's Elta Systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Policy Overview (Page No. - 9)

1.1 Introduction

1.2 Indian Defense Supply Chain

1.3 Defense Procurement Policy (DPP)-2016

1.4 DPP: Procurement Categorization and Sanctioning Authorities

1.5 Current Defense Procurement Process

1.6 Process of Issuance of Request for Proposal (RFP)

1.7 Defense Equipment Procurement: Timeline and Bidding Process

1.8 Defense Offset Policy Obligations

1.9 Regulatory Mechanism: Taxation Policy, Protection of Intellectual Property, and Industrial Licensing

1.9.1 Industrial Licensing Policy

2 Technological Capability Assessment, By Platform (Page No. - 21)

2.1 Airborne Systems

2.1.1 Current Capability

2.1.2 Capability Roadmap: Technology Focus of the Indian Government and Key RFIs/RFPS Issued

2.2 Naval Systems

2.2.1 Current Capability

2.2.2 Capability Roadmap: Technology Focus of the Indian Government and Key RFIs/RFPS Issued

2.3 Land Systems

2.3.1 Capability Roadmap

2.3.2 Capability Roadmap: Technology Focus of the Indian Government and Key RFIs/RFPS Issued

3 Inventory Gap Assessment, By Platform (Page No. - 28)

3.1 Airborne Systems: Inventory Gap Assessment

3.1.1 Combat & Trainer

3.1.1.1 Current Scenario

3.1.1.2 Key Focus Areas

3.1.2 Rotary

3.1.2.1 Current Scenario

3.1.2.2 Key Focus Area

3.1.3 Support Platforms

3.1.3.1 Current Scenario

3.1.3.2 Key Focus Areas

3.1.4 Key Developments (2015)

3.2 Naval Systems

3.2.1 Submarines

3.2.1.1 Current Scenario

3.2.1.2 Key Focus Areas

3.2.2 Surface Combatants

3.2.2.1 Current Scenario

3.2.2.2 Key Focus Areas

3.2.3 Support Platforms

3.2.3.1 Current Scenario

3.2.3.2 Key Focus Areas

3.2.4 Key Developments (2015)

3.3 Land Systems

3.3.1 Artillery

3.3.1.1 Current Scenario

3.3.1.2 Key Focus Areas

3.3.2 Missiles

3.3.2.1 Current Scenario

3.3.2.2 Key Focus Areas

3.3.3 Fighting Vehicles

3.3.3.1 Current Scenario

3.3.3.2 Key Focus Areas

3.3.4 Infantry Systems

3.3.4.1 Current Scenario

3.3.4.2 Key Focus Areas

3.3.5 Key Developments (2015)

4 Key Indian Companies: Capabilities & Tie-Ups (Page No. - 40)

5 Company Profiles (Page No. - 44)

5.1 Key Private Defense Equipment Manufacturers

5.1.1 Ashok Leyland

5.1.2 Astra Microwave Products Limited

5.1.3 Bharat Forge Limited

5.1.4 Larsen&Toubro Limited

5.1.5 Mahindra&Mahindra Limited

5.1.6 Pipavav Defence and Offshore Engineering Company Limited

5.1.7 Reliance Infrastructure Limited

5.1.8 Reliance Industries Limited

5.1.9 Rolta India Limited

5.1.10 Solar Industries India Limited

5.1.11 Tata Group

5.1.12 Walchandnagar Industries

5.2 Key Government Owned Defense Equipment Manufacturers

5.2.1 Bharat Dynamics Limited

5.2.2 Bharat Earth Movers Limited

5.2.3 Bharat Electronics Limited

5.2.4 Cochin Shipyard Limited

5.2.5 Garden Reach Shipbuilding & Engineers Limited

5.2.6 Hindustan Aeronautics Limited

5.2.7 Hindustan Shipyard Limited

5.2.8 Mazagon Dock Shipbuilders Limited

5.3 Micro Small and Medium Enterprises (MSME)

5.3.1 Alpha Design Technologies Private Limited

5.3.2 Precision Electronics Limited

5.3.3 Zen Technologies Limited

6 Appendix (Page No. - 76)

6.1 Questionnaire for Primary Interviews

6.2 Available Customizations

6.2.1 Defense Procurement Policy (DPP)-2016 Analysis

6.2.2 Company Information

6.2.2.1 Detailed Analysis and Profiling of Additional Players (Up to 5).

6.3 Related Reports

List of Tables (23 Tables)

Table 1 Tax Regime

Table 2 Fighter Aircraft: Current Capability

Table 3 Support Platforms: Current Capability

Table 4 Rotary Aircraft: Current Capability

Table 5 Key Technologies Identified for Capability Enhancement By the Indian Government

Table 6 List of Key Request for Information (RFI) Issued

Table 7 List of Key Request for Proposals (RFPS) Issued

Table 8 Surface Combatants: Current Capability

Table 9 Submarines: Current Capability

Table 10 Support Platforms: Current Capability

Table 11 Key Technologies Identified for Capability Enhancement By the Indian Government

Table 12 List of Key Request for Information (RFI) Issued

Table 13 List of Key Request for Proposals (RFPS) Issued

Table 14 Artillery: Current Capability

Table 15 Missiles: Current Capability

Table 16 Fighting Vehicles: Current Capability

Table 17 Infantry Systems: Current Capability

Table 18 Key Technologies Identified for Capability Enhancement By the Indian Government

Table 19 List of Key Request for Information (RFI) Issued

Table 20 List of Key Request for Proposals (RFPS) Issued

Table 21 Key Private Sector Players : Capability

Table 22 Key Public Sector Players: Capability

Table 23 Key Industry Participants, By Platform

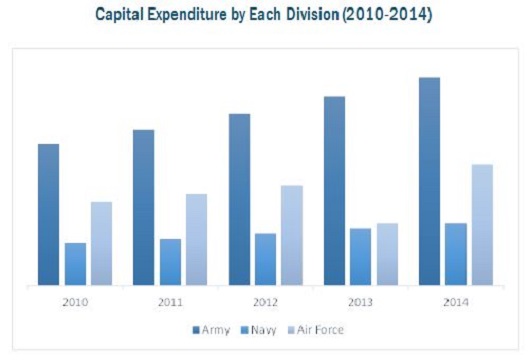

List of Figures (71 Figures)

Figure 1 State of Inventory Held By India (2015)

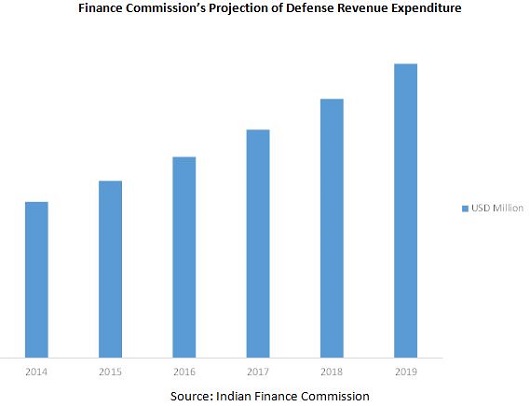

Figure 2 Finance Commission’s Projection for Defense Revenue Expenditure (2014-2019)

Figure 3 Defense Supply Chain

Figure 4 DPP 2016- Interim Guidelines

Figure 5 Evolution of DPP (2002-2013)

Figure 6 Procurement Categorization

Figure 7 Process for Procurement Under ‘Buy’, ‘Buy and Make With Tot’, and Buy & Make (Indian) Categories

Figure 8 Acquisition Process Under ‘Make’ Category

Figure 9 Key Decision Makers in the Procurement Process

Figure 10 RFPS are Issued By the Indian Mod

Figure 11 Overview of the Defense Equipment Procurement Process

Figure 12 Evaluation and Selection of Bids During DPP

Figure 13 Registration Guidelines for Vendors

Figure 14 Avenues to Discharge Offset Obligations

Figure 15 Protection of Intellectual Property

Figure 16 Projected Airforce Capital Expenditure Outlay (2014-2024)

Figure 17 Combat/Trainer Aircraft: Inventory Assessment (2015)

Figure 18 Rotary Aircraft: Inventory Assessment (2015)

Figure 19 Support Platforms: Inventory Assessment (2015)

Figure 20 Projected Navy Capital Expenditure Outlay (2014-2024)

Figure 21 Submarines: Inventory Assessment (2015)

Figure 22 Surface Combatants: Inventory Assessment (2015)

Figure 23 Support Platforms: Inventory Assessment (2015)

Figure 24 Projected Land Systems Capital Expenditure Outlay (2014-2024)

Figure 25 Land Systems: Inventory Assessment (2015)

Figure 26 Artillery: Inventory Assessment (2015)

Figure 27 Product Offerings

Figure 28 Ashok Leyland: SWOT Analysis

Figure 29 Product Offerings

Figure 30 Astra Microwave Products Limited: SWOT Analysis

Figure 31 Product Offerings

Figure 32 Bharat Forge Limited: SWOT Analysis

Figure 33 Product Offerings

Figure 34 Larsen&Toubro Limited: SWOT Analysis

Figure 35 Product Offerings

Figure 36 Mahindra & Mahindra: SWOT Analysis

Figure 37 Product Offerings

Figure 38 Pipavav Defence and Offshore Engineering Company Limited: SWOT Analysis:

Figure 39 Product Offerings

Figure 40 Reliance Infrastructure Limited: SWOT Analysis

Figure 41 Reliance Industries Limited: SWOT Analysis

Figure 42 Product Offerings

Figure 43 Rolta India Limited: SWOT Analysis:

Figure 44 Product Offerings

Figure 45 Solar Industries India Limited: SWOT Analysis

Figure 46 Product Offerings

Figure 47 Tata Group: SWOT Analysis

Figure 48 Product Offerings

Figure 49 Walchandnagar Industries: SWOT Analysis

Figure 50 Product Offerings

Figure 51 Bharat Dynamics Limited: SWOT Analysis

Figure 52 Product Offerings

Figure 53 Bharat Earth Movers Limited: SWOT Analysis

Figure 54 Product Offerings

Figure 55 Bharat Electronics Limited: SWOT Analysis

Figure 56 Product Offerings

Figure 57 Cochin Shipyard Limited: SWOT Analysis

Figure 58 Product Offerings

Figure 59 Garden Reach Shipbuilding & Engineers Limited: SWOT Analysis

Figure 60 Product Offerings

Figure 61 Hindustan Aeronautics Limited: SWOT Anlaysis

Figure 62 Product Offerings

Figure 63 Hindustan Shipyard Limited: SWOT Analysis

Figure 64 Product Offerings

Figure 65 Mazagon Dock Shipbuilders Limted: SWOT Analysis

Figure 66 Product Offerings

Figure 67 Alpha Design Technologies Private Limited: SWOT Analysis

Figure 68 Product Offerings

Figure 69 Precision Electronics Limited: SWOT Analysis:

Figure 70 Product Offerings

Figure 71 Zen Technologies Limited: SWOT Analysis

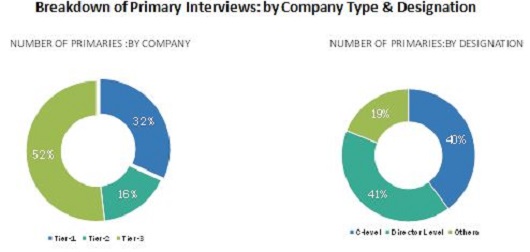

The status of the inventory held by the Indian armed forces was assessed through extensive secondary research and corroboration with primaries. Furthermore, secondary research has been mainly used to obtain key information about the defense sector’s supply chain, market dynamics, key players, and industry trends as well as the impact of government policy on the procurement of defense equipment.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the Indian defense sector comprises the Indian government, Indian armed forces, defense public sector undertakings (DSPUs), Ordnance Factory Boards (OFBs), private companies, and medium, small, and micro enterprises (MSMEs). This report would help equipment manufacturers, suppliers, and sub-component manufacturers to identify opportunities for investment in the Indian defense sector.Furthermore, this study answers several questions for the stakeholders; primarily which segments to focus over the next five years for prioritizing efforts and investments.

The various companies profiled in this report include Ashok Leyland, Astra Microwave Products, Bharat Forge, Larsen&Toubro, Mahindra & Mahindra, Reliance Infrastructure, Reliance Industries, Rolta India, Solar Industries, TATA Group, Walchandnagar Industries, Bharat Dynamics, Bharat Earth Movers, Bharat Electronics, Cochin Shipyard, Garden Reach Shipbuilding & Engineers, Hindustan Aeronautics, Hindustan Shipyard, Mazagaon Dock Shipyard, and Zen Technologies.

Target Audience

- Global defense players

- Original Equipment Manufacturers

- Sub-component Manufacturers

- Technology Support Providers

Scope of the Report

Inventory Gap Assessment

- Airborne

- Naval

- Land

Technological Capability Roadmap

- Airborne

- Naval

- Land

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs.

The following customization options are available for the report:

- Defense Procurement Policy (DPP 2016) Analysis

- Detailed company profiling

Growth opportunities and latent adjacency in FDI Opportunities in the Indian Defense Sector