Extruded Plastics Market by Type (LDPE, HDPE, Polypropylene, Polystyrene, PVC), End User (Packaging, Building & Construction, Automotive, Consumer Goods, Electrical & Electronics), Region - Global Forecasts to 2026

The Extruded Plastics Market is projected to grow USD 291.74 Billion by 2026, at a CAGR of 4.7%.

The main objectives of this market study are:

- To define and segment the extruded plastics market on the basis of type, end user, and region

- To estimate and forecast the market, in terms of value and volume

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market

- To analyze significant region-specific trends in North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa

- To strategically identify and profile key players and analyze their shares in the extruded plastics market

- To analyze recent market developments and competitive strategies such as alliances, joint ventures, and mergers & acquisitions to draw the competitive landscape of the extruded plastics market

- To estimate market shares of key players in the extruded plastics market

The extruded plastics market has been segmented on the basis of type, end user, and region. The years considered for the report are:

- Base Year - 2015

- Estimated Year - 2016

- Projected Year - 2026

- Forecast Period - 2016-2026

The base year considered for company profiles is 2015; where the information was not available for the base year, the prior year was taken into consideration.

Research Methodology:

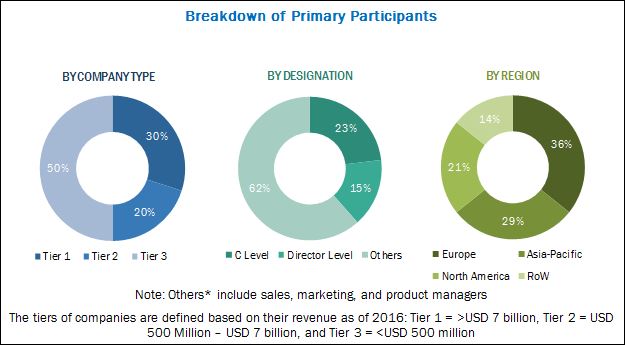

Secondary sources such as company websites, directories, and database such as Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, and other government and private websites have been used to identify and collect information that is useful for this extensive commercial study of the extruded plastics market. Primary sources, which include experts from related industries, have been interviewed to verify and collect critical information as well as to assess the prospects of the market. The top-down approach has been implemented to validate the market size. With data triangulation procedure and validation of data through primaries, exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study. The breakdown of primaries conducted is shown in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The ecosystem of the extruded plastics market consists of suppliers of key resin types such as low density polyethylene, polypropylene, polyvinyl chloride, high density polyethylene, and polystyrene, among others. Several companies such as The Dow Chemical Company (U.S.), SABIC (Saudi Arabia), and Dupont (U.S.) are involved in the production of feedstock materials. The demand side users include companies from packaging, building & construction, automotive, consumer goods, electrical & electronics, and other industries, which use plastic extrudates for various applications such as packaging and insulation, among others.

Target Audience of the Extruded Plastics Market Report :

The target audience of the report includes:

- Manufacturers of Extruded Plastics

- Traders, Distributors, and Suppliers of Extruded Plastics

- Companies Operational Across Various End Users of Extruded Plastics

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- National & Local Government Organizations/Agencies

- R&D Institutions

- Investment Banks and Private Equity Firms

Scope of the Extruded Plastics Market Report :

-

By Type:

- Low Density Polyethylene

- Polypropylene

- Polyvinyl Chloride

- High Density Polyethylene

- Polystyrene

- Others

-

By End User:

- Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Electrical & Electronics

- Others

-

By Region:

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- France

- Poland

- Netherlands

- U.K.

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Indonesia

- Rest of Asia-Pacific

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Qatar

- Rest of the Middle East & Africa

-

North America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of product portfolio of each company

Country-Level Analysis

- Further breakdown of the Europe extruded plastics market into major countries, including Norway and Belgium, among others

- Further breakdown of the Asia-Pacific extruded plastics market into major countries, including Singapore and Malaysia, among others

Company Information

- Detailed analysis and profiling of additional market players

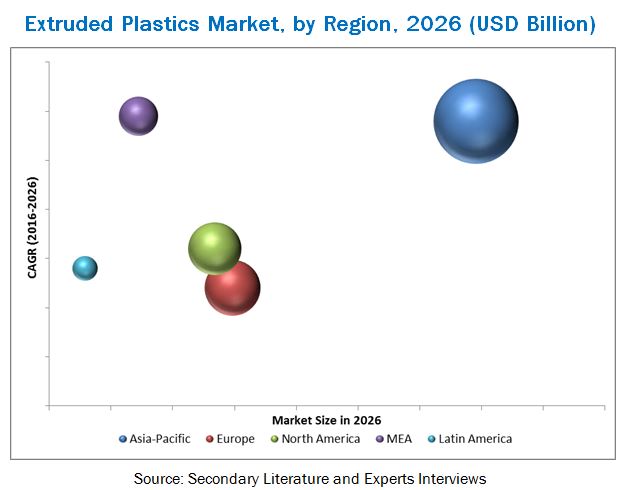

The extruded plastics market is projected to grow from USD 184.34 Billion in 2016 to USD 291.74 Billion by 2026, at a CAGR of 4.7% between 2016 and 2026. The growing demand for extrudates from the construction industry is expected to drive the extruded plastics market. Increasing demand from Asia-Pacific region from end-use industries such as packaging is also expected to fuel the demand for extruded plastics.

The extruded plastics market has been segmented on the basis of type, end user, and region. Based on type, the low density polyethylene segment dominated the extruded plastics market in 2015, owing to its increased demand for flexible food packaging as it a food grade material. Based on end user, the packaging segment dominated the extruded plastics market in 2015, due to rise in demand for packaging from food & beverage and consumer goods, especially for storage and protection of products during logistics. Cost efficiency with complex-shaped products and excellent mechanical properties is driving the demand for extruded plastics.

The Asia-Pacific region dominated the extruded plastics market in 2015. This market in Asia-Pacific is expected to grow at the highest rate during the forecast period, owing to increasing demand for extruded plastics from countries such as Japan, China, India, and Indonesia, among others. Improving economy of scale, and increasing manufacturing & construction activities in the region with growing investment in R&D and plastic production from key players is driving the Asia-Pacific extruded plastics market. Emergence of domestic manufacturers in the region has led to an increase in import of raw materials of extruded plastics.

The extruded plastics market lack product differentiation, owing to similar chemical & mechanical properties in raw material and extrudates, which create intense competition among their manufacturers. Eventually, inter-material and inter-polymer competition cause a major challenge to the growth of the extruded plastics market. In addition, there are various plastic processing methods such as injection molding, which pose a challenge to the growth of the extruded plastics market.

The DOW Chemical Company (U.S.), Sigma Plastics Group (U.S.), ExxonMobil Chemical Company (U.S.), Bemis Company Inc. (U.S.), SABIC (Saudi Arabia), Chevron Phillips Chemical Company LLC (U.S.), JM Eagle (U.S.), Berry Plastics Corporation (U.S.), Saint-Gobain S.A. (France), E.I. Dupont De Nemours and Company (U.S.), and Sealed Air Corporation (U.S.) are the major players in the extruded plastics market. These players have been focusing on developmental strategies of mergers & acquisitions, expansions, and new product launches that have helped them to expand their businesses in newer geographies.

Frequently Asked Questions (FAQ):

How big is the Extruded Plastics Market?

The Extruded Plastics Market is projected to grow USD 291.74 Billion by 2026, at a CAGR of 4.7%.

Who leading market players in Extruded Plastics Market ?

The DOW Chemical Company (U.S.), Sigma Plastics Group (U.S.), ExxonMobil Chemical Company (U.S.), Bemis Company Inc. (U.S.), SABIC (Saudi Arabia), Chevron Phillips Chemical Company LLC (U.S.), JM Eagle (U.S.), Berry Plastics Corporation (U.S.), Saint-Gobain S.A. (France), E.I. Dupont De Nemours and Company (U.S.), and Sealed Air Corporation (U.S.) are the major players in the extruded plastics market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Extruded Plastics Market

4.2 Market, By Region

4.3 Market: Major Segments

4.4 Market Growth

4.5 Market, By End User

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By End User

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Low Feedstock and Energy Prices

5.3.1.2 Growing Demand for Extruded Plastics From Construction Industry

5.3.2 Restraints

5.3.2.1 Lack of Product Differentiation

5.3.2.2 Volatile Crude Oil Prices Impacting Opec to Curb Production

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Extruded Plastics From Emerging Economies in Asia-Pacific

5.3.4 Challenges

5.3.4.1 Inter-Material and Inter-Polymer Competition

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Extrusion Technology and Different Types of Extrusions

6.3 Different Types of Dies Used in Plastic Extrusion

6.4 Value Chain Analysis

6.5 Revenue Pocket Matrix

6.5.1 Market, Revenue Pocket Matrix, By Type, 2015

6.5.2 Market, Revenue Pocket Matrix, By End User, 2015

6.6 Porter’s Five Forces Analysis

7 Extruded Plastics Market, By Type (Page No. - 48)

7.1 Introduction

7.2 Low Density Polyethylene

7.2.1 Films & Sheets

7.2.2 Others (Bottles, Tubes, and Bags)

7.3 Polypropylene

7.3.1 Films & Sheets

7.3.2 Others (Wires & Cables)

7.4 Polyvinyl Chloride

7.4.1 Pipes

7.4.1.1 Solid Wall Pipes

7.4.1.2 Structured Wall Pipes

7.4.1.3 Barrier Pipes

7.4.2 Doors & Windows

7.4.3 Sidings

7.4.4 Others (Molding, Fencing, and Decking)

7.5 High Density Polyethylene

7.5.1 Films & Sheets

7.5.2 Pipes

7.5.2.1 Solid Wall Pipes

7.5.2.2 Structured Wall Pipes

7.5.2.3 Barrier Pipes

7.5.3 Others (Bottles & Containers)

7.6 Polystyrene

7.6.1 Foams

7.6.2 Sheets

7.6.3 Films

7.6.4 Others

7.7 Others

8 Extruded Plastics Market, By End User (Page No. - 63)

8.1 Introduction

8.2 Packaging

8.2.1 Food & Beverages Packaging

8.2.2 Medical Packaging

8.2.3 Others

8.3 Building & Construction

8.3.1 Piping Systems

8.3.2 Sidings

8.3.3 Others

8.4 Automotive

8.4.1 Interior Parts

8.4.2 Exterior Parts

8.5 Consumer Goods

8.5.1 Bottles & Containers

8.5.2 Furniture

8.6 Electrical & Electronics

8.6.1 Wires & Cables

8.7 Others

9 Regional Analysis (Page No. - 78)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Taiwan

9.2.6 Indonesia

9.2.7 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Poland

9.3.4 Netherlands

9.3.5 U.K.

9.3.6 Italy

9.3.7 Spain

9.3.8 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 Egypt

9.5.4 Qatar

9.5.5 Rest of Middle East & Africa

9.6 Latin America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 123)

10.1 Overview

10.2 Mergers & Acquisitions: the Most Preferred Growth Strategy

10.3 Market: Growth Strategies, By Company, 2011-2016

10.4 Market Share, By Company, 2015

10.5 Maximum Developments in 2016

10.6 Mergers & Acquisitions

10.7 Expansions

10.8 New Product Launches

10.9 Agreements, Collaborations & Partnerships

10.10 Disinvestments

10.11 Investments

10.12 Joint Ventures

11 Company Profiles (Page No. - 133)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Formosa Plastics Group

11.2 SABIC (Saudi Arabia Basic Industries Corporation)

11.3 Sigma Plastics Group

11.4 JM Eagle

11.5 Sealed Air Corporation

11.6 Berry Plastics Corporation

11.7 E. I. Du Pont De Nemours and Company

11.8 AEP Industries Inc.

11.9 The DOW Chemical Company

11.10 Chevron Phillips Chemical Company LLC

11.11 Exxonmobil Chemical Company

11.12 Engineered Profiles LLC

11.13 Bemis Company, Inc.

11.14 Arkema S.A.

11.15 Saint-Gobain S.A.

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 177)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Developments

12.4 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Introducing RT: Real Time Market Intelligence

12.6 Available Customizations

12.7 Related Reports

12.8 Author Details

List of Tables (72 Tables)

Table 1 Market Snapshot

Table 2 Market, By Type, 2014–2026 (MT)

Table 3 Market, By Type, 2014–2026 (USD Billion)

Table 4 Low Density Polyethylene: Market, By Region, 2014–2026 (MT)

Table 5 Low Density Polyethylene: Market, By Region, 2014–2026 (USD Billion)

Table 6 Polypropylene: Market, By Region, 2014–2026 (MT)

Table 7 Polypropylene: Market, By Region, 2014–2026 (USD Billion)

Table 8 Polyvinyl Chloride: Market, By Region, 2014–2026 (MT)

Table 9 Polyvinyl Chloride: Market, By Region, 2014–2026 (USD Billion)

Table 10 High Density Polyethylene: Market, By Region, 2014–2026 (MT)

Table 11 High Density Polyethylene Market, By Region, 2014–2026 (USD Billion)

Table 12 Polystyrene: Market, By Region, 2014–2026 (MT)

Table 13 Polystyrene: Market, By Region, 2014–2026 (USD Billion)

Table 14 Others : Market, By Region, 2014–2026 (MT)

Table 15 Others; Market, By Region, 2014–2026 (USD Billion)

Table 16 Market, By End User, 2014–2026 (MT)

Table 17 Market, By End User, 2014–2026 (USD Billion)

Table 18 Packaging: Market, By Region, 2014–2026 (MT)

Table 19 Packaging: Market, By Region, 2014–2026 (USD Billion)

Table 20 Building & Construction: Market, By Region, 2014–2026 (MT)

Table 21 Building & Construction: Market, By Region, 2014–2026 (USD Billion)

Table 22 Automotive: Market, By Region, 2014–2026 (MT)

Table 23 Automotive: Market, By Region, 2014–2026 (USD Billion)

Table 24 Consumer Goods: Market, By Region, 2014–2026 (MT)

Table 25 Consumer Goods: Market, By Region, 2014–2026 (USD Billion)

Table 26 Electrical & Electronics: Market, By Region, 2014–2026 (MT)

Table 27 Electrical & Electronics: Market, By Region, 2014–2026 (USD Billion)

Table 28 Others: Market, By Region, 2014–2026 (MT)

Table 29 Others: Market, By Region, 2014–2026 (USD Billion)

Table 30 Market, By Region, 2014–2026 (MT)

Table 31 Market, By Region, 2014–2026 (USD Billion)

Table 32 Market, By Type, 2014–2026 (MT)

Table 33 Market, By Type, 2014–2026 (USD Billion)

Table 34 Market, By End User, 2014–2026 (MT)

Table 35 Market, By End User, 2014–2026 (USD Billion)

Table 36 Asia-Pacific: Market, By Country, 2014-2026 (MT)

Table 37 Asia-Pacific: Market, By Country, 2014-2026 (USD Billion)

Table 38 Asia-Pacific: Market, By Type, 2014-2026 (MT)

Table 39 Asia-Pacific: Market, By Type, 2014-2026 (USD Billion)

Table 40 Asia-Pacific: Market, By End User, 2014-2026 (MT)

Table 41 Asia-Pacific: Market, By End User, 2014-2026 (USD Billion)

Table 42 Europe: Market, By Country, 2014–2026 (MT)

Table 43 Europe: Market, By Country, 2014–2026 (USD Billion)

Table 44 Europe: Market, By Type, 2014–2026 (MT)

Table 45 Europe: Market, By Type, 2014–2026 (USD Billion)

Table 46 Europe: Market, By End User, 2014–2026 (MT)

Table 47 Europe: Market, By End User, 2014–2026 (USD Billion)

Table 48 North America: Market, By Country, 2014–2026 (MT)

Table 49 North America: Market, By Country, 2014–2026 (USD Billion)

Table 50 North America: Market, By Type, 2014–2026 (MT)

Table 51 North America: Market, By Type, 2014–2026 (USD Billion)

Table 52 North America: Market, By End User, 2014–2026 (MT)

Table 53 North America: Market, By End User, 2014–2026 (USD Billion)

Table 54 Middle East & Africa: Market, By Country, 2014–2026 (MT)

Table 55 Middle East & Africa: Market, By Country, 2014–2026 (USD Billion)

Table 56 Middle East & Africa: Market, By Type, 2014–2026 (MT)

Table 57 Middle East & Africa: Market, By Type, 2014–2026 (USD Billion)

Table 58 Middle East & Africa: Market, By End User, 2014–2026 (MT)

Table 59 Middle East & Africa: Market, By End User, 2014–2026 (USD Billion)

Table 60 Latin America: Market, By Country, 2014–2026 (MT)

Table 61 Latin America: Market, By Country, 2014–2026 (USD Billion)

Table 62 Latin America: Market, By Type, 2014–2026 (MT)

Table 63 Latin America: Market, By Type, 2014–2026 (USD Billion)

Table 64 Latin America: Market, By End User, 2014–2026 (MT)

Table 65 Latin America: Market, By End User, 2014–2026 (USD Billion)

Table 66 Mergers & Acquisitions, 2016

Table 67 Expansions, 2015–2016

Table 68 New Product Launches, 2012–2014

Table 69 Agreements, Collaborations & Partnerships, 2012–2016

Table 70 Disinvestments, 2014–2016

Table 71 Investments, 2014

Table 72 Joint Ventures, 2016

List of Figures (89 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Key Industry Insights

Figure 7 Breakdown of Primary Interviews

Figure 8 Market, By Type, 2016 & 2021 (USD Billion)

Figure 9 The Packaging Segment is Estimated to Lead the Extruded Plastics Market in 2016

Figure 10 Asia-Pacific Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 11 Increasing Demand From Various End Users is Projected to Fuel the Growth of the Extruded Plastics Market From 2016 to 2021

Figure 12 Asia-Pacific Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 13 Packaging and Low Density Polyethylene Segments Accounted for Large Shares of the Extruded Plastics Market in 2015

Figure 14 China Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 15 Asia-Pacific Dominated the Extruded Plastics Market in 2015

Figure 16 Market, By Type

Figure 17 Market, By End User

Figure 18 Market, By Region

Figure 19 Drivers, Restraints, Opportunities, and Challenges for Growth of the Extruded Plastics Market

Figure 20 Overview of Extruded Plastics Value Chain

Figure 21 Porter’s Five Forces Analysis

Figure 22 The Low Density Polyethylene Type Segment is Projected to Drive the Extruded Plastics Market Between 2016 and 2021

Figure 23 The Low Density Polyethylene Segment of the Asia-Pacific Extruded Plastics Market is Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 24 The Asia-Pacific Region to Lead the Polypropylene Segment of the Extruded Plastics Market Between 2016 and 2021

Figure 25 The Asia-Pacific Region to Lead the Polyvinyl Chloride Segment of the Extruded Plastics Market From 2016 to 2021

Figure 26 The Asia-Pacific Region to Lead the High Density Polyethylene Segment of the Extruded Plastics Market From 2016 to 2021

Figure 27 The Middle-East Region is Projected to Lead the Polystyrene Segment of the Extruded Plastics Market From 2016 to 2021

Figure 28 The Asia-Pacific Region is Projected to Lead the Others Segment of the Extruded Plastics Market Between 2016 and 2021

Figure 29 The Packaging End User Segment is Projected to Drive the Extruded Plastics Market Between 2016 and 2021

Figure 30 The Middle-East & Africa Extruded Plastics Market in Packaging is Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 31 The Asia-Pacific Region is Projected to Be the Largest Market for Extruded Plastics in Building & Construction Between 2016 and 2021

Figure 32 The Asia-Pacific Region is Projected to Lead the Automotive Segment of the Extruded Plastics From 2016 to 2021

Figure 33 The Asia-Pacific Region is Projected to Be the Largest Market for Extruded Plastics in Consumer Goods Between 2016 and 2021

Figure 34 The Asia-Pacific Region is Projected to Lead the Electrical & Electronics Segment of the Extruded Plastics Market From 2016 to 2021

Figure 35 The Asia-Pacific Region is Projected to Lead the Others Segment of the Extruded Plastics From 2016 to 2021

Figure 36 Market, By Region, 2015

Figure 37 Asia-Pacific Market Snapshot

Figure 38 China Market, 2016 & 2021

Figure 39 Japan Market, 2016 & 2021

Figure 40 India Market, 2016 & 2021

Figure 41 South Korea Market, 2016 & 2021

Figure 42 Taiwan Market, 2016 & 2021

Figure 43 Indonesia Market, 2016 & 2021

Figure 44 Rest of Asia-Pacific Market, 2016 & 2021

Figure 45 Europe Market Snapshot

Figure 46 Germany Market, 2016 & 2021

Figure 47 France Market, 2016 & 2021

Figure 48 Poland Market, 2016 & 2021

Figure 49 Netherlands Market, 2016 & 2021

Figure 50 The U.K. Market, 2016 & 2021

Figure 51 Italy Market, 2016 & 2021

Figure 52 Spain Market, 2016 & 2021

Figure 53 Rest of Europe Market, 2016 & 2021

Figure 54 North America Market Snapshot

Figure 55 U.S. Market, 2016 & 2021

Figure 56 Canada Market, 2016 & 2021

Figure 57 Mexico Market, 2016 & 2021

Figure 58 Middle East & Africa Market Snapshot

Figure 59 Saudi Arabia Market, 2016 & 2021

Figure 60 UAE Market, 2016 & 2021

Figure 61 Egypt Market, 2016 & 2021

Figure 62 Qatar Market, 2016 & 2021

Figure 63 Rest of Middle East & Africa Market, 2016 & 2021

Figure 64 Latin America Market Snapshot

Figure 65 Brazil Market, 2016 & 2021

Figure 66 Argentina Market, 2016 & 2021

Figure 67 Rest of Latin America Market, 2016 & 2021

Figure 68 Mergers & Acquisitions is One of the Key Growth Strategies Adopted By Leading Players in the Extruded Plastics Market Between 2011 and 2016

Figure 69 Key Growth Strategies in the Extruded Plastics Market, 2011–2016

Figure 70 The DOW Chemical Company Reported Maximum Number of Developments Between 2011 and 2016

Figure 71 Formosa Plastics Corporation and SABIC: Leaders in the Extruded Plastics Market (2015)

Figure 72 Extruded Plastics Market Developments, 2011–2016

Figure 73 Formosa Plastics Group: Company Snapshot

Figure 74 Formosa Plastics Group: SWOT Analysis

Figure 75 SABIC: Company Snapshot

Figure 76 Sealed Air Corporation: Company Snapshot

Figure 77 Sealed Air Corporation: SWOT Analysis

Figure 78 Berry Plastics Corporation: Company Snapshot

Figure 79 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 80 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 81 AEP Industries Inc.: Company Snapshot

Figure 82 AEP Industries Inc.: SWOT Analysis

Figure 83 The DOW Chemical Company: Company Snapshot

Figure 84 The DOW Chemical Company: SWOT Analysis

Figure 85 Chevron Phillips Chemical Company LLC: Company Snapshot

Figure 86 Exxonmobil Chemical Company: Company Snapshot

Figure 87 Bemis Company, Inc.: Company Snapshot

Figure 88 Arkema S.A.: Company Snapshot

Figure 89 Saint-Gobain S.A.: Company Snapshot

Growth opportunities and latent adjacency in Extruded Plastics Market