EV Test Equipment Market by Vehicle Type (Passenger Car and Commercial Vehicle), Electric Vehicle Type (BEV, PHEV & HEV), Equipment Type, Application Type (EV Component, EV Charging, and Powertrain) and Region - Global Forecast to 2027

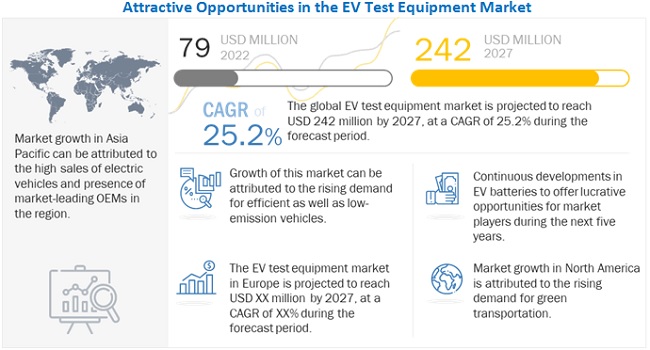

[271 Pages Report] The global EV test equipment market size was valued at USD 79 million in 2022 and it is expected to reach USD 242 million by 2027, at a CAGR of 25.2% during the forecast period 2022-2027. Factors such as increasing pollution and the threat of global warming have accentuated the need to replace petroleum-fuel vehicles with emission-free substitutes. The increasing demand for electric vehicles is expected to fuel the growth of the market for electric vehicle testing equipment and related components.

After decades of R&D, the industry has found electric vehicles to be the best suitable substitute for traditionally fueled vehicles, which has resulted in the growth of the market for electric vehicles. The increasing demand for zero-emission vehicles is also likely to boost electric vehicle sales. Automotive OEMs focus on the electrification of vehicles as consumers become increasingly aware of the impact of vehicular emissions on the environment.

To know about the assumptions considered for the study, Request for Free Sample Report

EV Test Equipment Market Dynamics:

How advancements in battery technology increase the growth of EV test Equipment market?

The battery is a major component in an electric vehicle. The majority of electric vehicles use either a lithium-ion family battery or a lead-acid battery. New developments in battery chemistry are expected to help increase the efficiency of lithium-ion batteries and test systems for these innovative battery packs. This is expected to boost the demand for EV test equipment.

Research is underway to increase the range of electric vehicles and reduce costs. Thus, various OEMs have started offering electric vehicles with a range of more than 300-350 km and long battery life. The research focuses on conventional lithium-ion, solid-state, advanced lithium-ion using an intermetallic anode (silicon alloy composite), and future advanced lithium-ion (lithium metal, including lithium-sulfur and lithium-cobalt) batteries with innovative designs and chemistries. Such rapid developments in battery technologies are expected to lead to the demand for new and advanced battery testing systems/platforms/software, thereby driving the EV test equipment market.

Why is decrease in subsidies for EVs in major Markets is a critical restraining factor that is holding back growth of market?

Purchase subsidies for EVs were reduced in key markets such as China and France. For example, the Chinese Ministry of Finance announced plans to reduce subsidies associated with electric cars by approximately 30% by 2022. However, vehicles for public transport and those costing below USD 42,000 are expected to continue to receive subsidies, with the new rules only affecting luxury car brands. As the Chinese Ministry of Finance only provides subsidies for cars with high battery capacities, EV battery manufacturers must provide electric vehicles with high-capacity batteries to ensure that the vehicles fall are in the subsidized range. This is expected to affect EV sales, as subsidies are the most important reason for customers from emerging economies to buy electric vehicles. The decline in sales is expected to affect the EV test equipment market.

What opportunities does increase in technological advancements of test equipment create?

Governments across the globe are promoting the adoption of hybrid and electric vehicles, as these are environment-friendly and fuel-efficient. Emission norms implemented by national and regional government authorities are driving research in fuel-efficient technologies. There has been a rapid increase in technological advancements in EV test equipment. This can be majorly attributed to the increased demand for fuel-efficient vehicles. Various EV test equipment manufacturers such as HORIBA (Japan) and Intertek (UK) are investing significantly in vehicle testing equipment and expanding their vehicle testing segments. Manufacturers are focusing on developing efficient and technologically advanced test equipment. The latest generation chassis dynamometers are characterized by modular designs. They offer enhanced performance, which helps reduce installation and maintenance costs. These dynamometers are also capable of testing vehicles according to Indian emission norms, the European Emission Standards (EEC), and the US Environmental Protection Agency (EPA) emission regulations. The advanced chassis dynamometer covers various applications for automotive testing such as emission testing, performance testing, and NVH (noise, vibration, and harshness) testing. Such innovations in testing equipment are expected to drive the growth of the market.

How challenge in maintaining balance between high cost and performance of test equipment impact market?

The dilemma faced by the automotive industry is between technological innovation and cost reduction. Technologies such as advanced EV test equipment used for electric, or hybrid vehicle testing are higher priced compared to conventional test equipment. New technologies require time for their adoption as manufacturers also require time in experiencing economies of scale. In emerging economies, entry-level passenger cars are in demand and automotive manufacturers need to provide their products at competitive prices. Thus, high-priced test equipment can be a hindrance. There is always a trade off between the cost incurred on product innovation and cost reduction in conventional products. The challenge, therefore, is to develop EV test equipment that is efficient and economical at the same time.

Canada is expected to witness significant growth in North America market during the forecast period

The country’s electric vehicle and infrastructure market is expected to grow at a significant rate due to subsidies and tax exemptions offered by the Canadian government. The Canadian government is investing significantly in building EV charging infrastructure. The government has offered rebates to EV buyers as well as subsidies to OEMs and EV manufacturers. It is also focused on promoting a zero-emission mode of travel.

The government is also investing significantly in R&D activities. In 2019, a USD 300 million fund was allocated to provide subsidies and additional rebates. In 2020, the Government of Quebec set up a USD 6.7 billion fund for the next six years to encourage the electrification of transportation and combat the climate crisis. In 2020, the British Columbia government committed USD 419 million towards EV purchase incentives, growth of EV charging infrastructure, and energy efficiency plans for new buildings. The EV test equipment market is expected to grow due to the rising demand for EVs in the country.

Brazil is estimated to witness significant growth for EV Test Equipment market during the forecast period

Brazil is estimated to account for the largest share of the RoW EV test equipment market during the forecast years. Several leading OEMs, including BMW, Volkswagen, Nissan, Ford, General Motors, Toyota, and Honda, have established manufacturing units in Brazil, making the country a major automobile hub in South America. The country has promoted the use of EVs with the implementation of various government policies, such as reduced taxes for EVs from time to time over the years, leading to increasing demand for EVs. It has also promoted the development of EV charging networks across its states. This is expected to lead to a higher demand for EV testing equipment in the country.

The Asia Pacific market is projected to hold the largest share by 2027

Governments in the Asia Pacific region are also focusing on the introduction of electric commercial vehicles. For instance, in India, the government announced the introduction of 10,000 electric buses and provided incentives for battery-operated cars and two-wheelers on Indian roads. In September 2020, the Indian government announced plans to offer incentives worth USD 4.6 billion to companies establishing advanced battery manufacturing facilities as part of its plans to reduce oil imports while switching to EVs. Similarly, in China undertook measures such as sales tax exemptions and providing preferential financing and traffic management policies for electric vehicles. Japan also plans to increase its share of EVs and plug-in hybrids between 20% and 30% by 2030 and has taken measures such as increasing subsidies for EV buyers. The South Korean government has been encouraging the usage of EVs through subsidies and tax rebates with the goal of having 430,000 EVs on the road by the end of 2022 and has invested in a program to improve charging infrastructure in the country. This has led to the high demand for EV testing equipment in the Asia Pacific region. The EV test equipment market in the region is led by various US, German, and Chinese companies which provide testing equipment and services to electric vehicle manufacturers. These factors are expected to drive the market in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global EV test equipment market is dominated by major players such as AVL (Austria), TUV Rheinland (Germany), Durr Group (Germany), Chroma ATE (Taiwan), and HORIBA (Japan). These companies offer extensive products and solutions for the EV test equipment industry; and have strong distribution networks at the global level, and they invest heavily in R&D to develop new products.

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$79 Million |

|

Estimated Revenue by 2027 |

$242 Million |

|

Revenue Rate |

Projected to grow at a CAGR of25.2% |

|

Market Driver |

Rising sales of electric, semi-autonomous, and autonomous vehicles |

|

Market Opportunity |

Advancements in EV charging solutions |

|

Key Market Players |

AVL (Austria), TUV Rheinland (Germany), Durr Group (Germany), Chroma ATE (Taiwan), and HORIBA (Japan). |

This research report categorizes the EV test equipment market based on vehicle type, electric vehicle, application, equipment, and region.

Based on the vehicle type:

- Passenger Car

- Commercial Vehicle

Based on the electric vehicle type:

- Battery Electric Vehicle

- Hybrid Electric Vehicle& Plug-in Hybrid Electric Vehicle

Based on the equipment type:

- AC/DC EVSE ATS

- Battery Test Equipment

- Motor Test Equipment

- Engine Dynamometer

- Chassis Dynamometer

- Transmission Dynamometer

- Fuel Injection Pump Tester

- Inverter Test

- On-Board Charger ATS

- EV Propulsion test System

- EV Axle Test

- Ev Drivetrain Test

- EV Component

- EV Charging

- Powertrain

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

-

Rest of the World

- Brazil

- Russia

Recent Developments

- In April 2022, Horiba launched the FTX-ONE-CL and FTX-ONE-RS which are two new products in the FTX-ONE exhaust gas analyzer

- In January 2022, FEV Group introduced FEV's Hybrid-BEV platform, that has a particularly compact integration of the energy conversion system including a generator and e-drive in the front of the vehicle.

- In October 2020, HORIBA introduced the all-new automatic driving system, ADS EVO, which works as a driving robot for testing vehicles.

- In October 2020, FEV Group launched a fully integrated turnkey solution for testing the latest generation high-voltage batteries.

- In July 2020, Chroma ATE launched a new Battery Pack Integrated Testbed, Chroma 8610, designed for the development and application of battery pack/modules and related parts. It integrates DC power supply, digital meter, battery charger/discharge system, and Hi-Pot equipment. The open architecture of 8610 provides a flexible and powerful UI (user interface).

- In July 2020, Arbin launched new 3-Electrode battery testing solution.

- In July 2020, T-Systems and KUKA partnered to develop digitized solutions for manufacturing industries.

- In 2021, Teledyne Technologies acquired FLIR Systems, a provider of thermal imaging and sensing solutions. Through this transaction, two businesses with complementary technologies and knowledge of the EV and automotive test markets were combined.

Frequently Asked Questions (FAQ):

How big is the EV test equipment market?

The global EV test equipment market was valued at USD 79 million in 2022, and it is expected to reach USD 242 million by 2027, at a CAGR of 25.2% during the forecast period 2022-2027.

Who is the market leader in EV Test Equipment Market?

Keysight Technologies, Chroma ATE, National Instruments, Teradyne, and AMETEK are among the leading companies. These companies provide a variety of test equipment solutions for electric vehicle components such as batteries, power electronics, motors, and chargers.

What are the new market trends impacting the growth of the EV test equipment market?

Autonomous vehicles, IoT in vehicles & charging infrastructure, regenerative braking, shared mobility, advanced E-Drive systems, Solid-State Battery (SSB), and smart charging systems are the key market trends or technologies which will have a major impact on the EV test equipment market in the future.

What is the popular equipment used in the EV test equipment market?

Based on equipment type, the Battery testing equipment segment is projected to lead the EV test equipment market during the forecast period, in terms of value. Continuous developments in battery technologies and rising demand for electric vehicles with significant range per charge are driving the battery test equipment segment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 PRODUCT DEFINITION

1.2.1 EV TEST EQUIPMENT MARKET DEFINITION AND INCLUSIONS, BY EQUIPMENT TYPE

TABLE 1 MARKET DEFINITION AND INCLUSIONS, BY EQUIPMENT TYPE

1.2.2 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION TYPE

TABLE 2 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION TYPE

1.2.3 MARKET DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

TABLE 3 MARKET DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

1.2.4 MARKET DEFINITION AND INCLUSIONS, BY ELECTRIC VEHICLE TYPE

TABLE 4 MARKET DEFINITION AND INCLUSIONS, BY ELECTRIC VEHICLE TYPE

1.2.5 INCLUSIONS & EXCLUSIONS

TABLE 5 INCLUSIONS & EXCLUSIONS FOR MARKET REPORT

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 6 USD EXCHANGE RATES

1.5 UNITS CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 EV TEST EQUIPMENT MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 PRIMARY PARTICIPANTS

2.4 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

FIGURE 8 MARKET: RESEARCH APPROACH

FIGURE 9 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF AVL’S REVENUE ESTIMATION

FIGURE 10 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF SUPPLY-SIDE REVENUE ESTIMATION

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION

2.7 FACTOR ANALYSIS

2.7.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.8 RESEARCH ASSUMPTIONS

TABLE 7 RESEARCH ASSUMPTIONS

2.9 RISK ASSESSMENT & RANGES

TABLE 8 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY (Page No. - 56)

FIGURE 12 EV TEST EQUIPMENT MARKET: MARKET OUTLOOK

FIGURE 13 MARKET: MARKET DYNAMICS

FIGURE 14 MARKET, BY REGION

FIGURE 15 BY APPLICATION TYPE, EV CHARGING SEGMENT TO REGISTER HIGHEST CAGR DUE TO INCREASED FOCUS ON CHARGING INFRASTRUCTURE GLOBALLY (2022–2027)

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES IN EV TEST EQUIPMENT MARKET

FIGURE 16 INCREASING DEMAND FOR EFFICIENT AND LOW-EMISSION COMMUTING TO DRIVE MARKET

4.2 MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 17 BEV SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET, BY VEHICLE TYPE

FIGURE 18 PASSENGER CAR SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.4 MARKET, BY EQUIPMENT TYPE

FIGURE 19 BATTERY TEST EQUIPMENT SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 MARKET, BY APPLICATION TYPE

FIGURE 20 EV CHARGING SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 EV TEST EQUIPMENT MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising sales of electric, semi-autonomous, and autonomous vehicles

FIGURE 22 GLOBAL EV SALES, 2017-2021 (THOUSAND UNITS)

TABLE 9 ROADMAP FOR TECHNOLOGY LEVEL AND IMPLEMENTATION OF SEMI-AUTONOMOUS AND AUTONOMOUS DRIVING SYSTEMS

5.2.1.2 Advancements in battery technology

TABLE 10 EV BATTERY IMPROVEMENTS/INNOVATIONS

TABLE 11 DAWN OF EUROPEAN GIGAFACTORIES: ANNOUNCED LITHIUM-ION BATTERY CELL PRODUCTION SITES

5.2.1.3 Increasing electronic architecture in modern vehicles

FIGURE 23 ELECTRIC ARCHITECTURE OF CARS IN 2020

FIGURE 24 ELECTRIC ARCHITECTURE OF CARS IN 1980

5.2.1.4 Declining EV battery prices

FIGURE 25 EXPECTED PRICE OF EV BATTERY PER KWH IN COMING YEARS

5.2.2 RESTRAINTS

5.2.2.1 High cost of advanced technology equipment

5.2.2.2 Reductions in subsidies for EVs in major markets

FIGURE 26 SUBSIDIES OFFERED FOR ELECTRIC VEHICLES IN CHINA

5.2.2.3 Lack of trained workforce for advanced test equipment

TABLE 12 LAYOFFS OF UNSKILLED WORKFORCE

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in EV charging solutions

TABLE 13 DIFFERENCE BETWEEN FAST, LEVEL 2, AND LEVEL 1 CHARGING

5.2.3.2 Technological advancements in test equipment

5.2.3.3 Evaluating real-time EV data and simulation testing

5.2.3.4 Increasing demand for onboard diagnostic tools

TABLE 14 BUDGET INDIAN CARS WITH TIRE PRESSURE MONITORING SYSTEM

5.2.4 CHALLENGES

5.2.4.1 Lack of compatibility and standardization

5.2.4.2 Maintaining balance between high cost and performance of test equipment

TABLE 15 IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

FIGURE 27 PORTER’S FIVE FORCES: MARKET

TABLE 16 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 INTENSITY OF COMPETITIVE RIVALRY

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 BARGAINING POWER OF SUPPLIERS

5.4 PATENT ANALYSIS

5.4.1 INTRODUCTION

FIGURE 28 PATENT PUBLICATION TRENDS FOR MARKET (2011-2022)

5.4.2 DOCUMENT TYPE

FIGURE 29 PATENTS REGISTERED FOR MARKET, 2011–2021

5.4.3 LEGAL STATUS OF PATENTS

FIGURE 30 LEGAL STATUS OF PATENTS FILED FOR MARKET

5.4.4 JURISDICTION WISE ANALYSIS

FIGURE 31 MARKET PATENTS, JURISDICTION WISE ANALYSIS

5.4.5 TOP PATENT HOLDERS

TABLE 17 MARKET: INNOVATION & PATENT REGISTRATIONS

5.5 KEY STAKEHOLDERS & BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.5.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 19 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.6 VALUE CHAIN ANALYSIS

FIGURE 34 VALUE CHAIN ANALYSIS: MARKET

5.6.1 PLANNING AND REVISING FUNDS

5.6.2 EV TESTING EQUIPMENT SUPPLIERS

5.6.3 EV TESTING SOFTWARE DEVELOPMENT

5.6.4 OEM

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 35 MARKET: SUPPLY CHAIN ANALYSIS

5.8 MARKET ECOSYSTEM

FIGURE 36 MARKET: ECOSYSTEM ANALYSIS

5.8.1 EV OEMS

5.8.2 EV TIER-1 SUPPLIERS

5.8.3 EV CHARGING INFRASTRUCTURE PROVIDERS

5.8.4 EV TEST EQUIPMENT PROVIDERS

TABLE 20 MARKET: ECOSYSTEM

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO OF EV TEST EQUIPMENT

FIGURE 37 IMPORTS OF EV TEST EQUIPMENT, BY KEY COUNTRIES, 2017-2021 (USD MILLION)

TABLE 21 IMPORT TRADE DATA, BY KEY COUNTRIES, 2021 (USD MILLION)

5.9.2 EXPORT SCENARIO OF EV TEST EQUIPMENT

FIGURE 38 EXPORTS OF EV TEST EQUIPMENT, BY KEY COUNTRIES, 2017-2021 (USD MILLION)

TABLE 22 EXPORT TRADE DATA, BY KEY COUNTRIES, 2021(USD MILLION)

5.10 NOTABLE DEVELOPMENTS IN EV MARKET (2021)

FIGURE 39 NOTABLE EVENTS Q1 2021

FIGURE 40 NOTABLE EVENTS Q2 2021

FIGURE 41 NOTABLE EVENTS Q3 2021

FIGURE 42 NOTABLE EVENTS Q4 2021

5.11 CASE STUDY ANALYSIS

5.11.1 ION ENERGY’S BATTERY TESTING SOLUTION

5.11.2 STANFORD UNIVERSITY, TOYOTA RESEARCH INSTITUTE, AND MIT ON NEW BATTERY TESTING METHOD

5.11.3 SIZING OF ELECTRIC VEHICLE CHARGING STATIONS WITH SMART CHARGING CAPABILITIES AND QUALITY OF SERVICE REQUIREMENTS

5.11.4 CASE STUDY ON DEVELOPMENT OF LOAD BALANCING SOLUTION FOR EV CHARGING

5.12 TECHNOLOGY ANALYSIS

5.12.1 ECU AND E-AXLE TESTING

FIGURE 43 E-AXLE TEST BENCH FEV DESIGN

5.12.2 BATTERY PACK TESTING

FIGURE 44 BATTERY PACK TESTING SYSTEMS

5.12.3 SIMULATION TESTING

5.12.4 ADAS TESTING

FIGURE 45 ADAS TESTING BY DEWESOFT

5.12.5 SMART CHARGING SYSTEM

FIGURE 46 SMART EV CHARGING SYSTEM

5.13 REGULATORY ANALYSIS

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 25 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 26 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 NETHERLANDS

TABLE 27 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

TABLE 28 NETHERLANDS: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.13.3 GERMANY

TABLE 29 GERMANY: ELECTRIC VEHICLE INCENTIVES

TABLE 30 GERMANY: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.13.4 FRANCE

TABLE 31 FRANCE: ELECTRIC VEHICLE INCENTIVES

TABLE 32 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.13.5 UK

TABLE 33 UK: ELECTRIC VEHICLE INCENTIVES

TABLE 34 UK: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.13.6 CHINA

TABLE 35 CHINA: ELECTRIC VEHICLE INCENTIVES

TABLE 36 CHINA: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.13.7 US

TABLE 37 US: ELECTRIC VEHICLE INCENTIVES

TABLE 38 US: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.14 MARKET: CONFERENCES & EVENTS

TABLE 39 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 MARKET, SCENARIOS (2022–2027)

5.15.1 MOST LIKELY SCENARIO

TABLE 40 MOST LIKELY SCENARIO: MARKET SIZE, BY REGION, 2022–2027 (USD THOUSAND)

5.15.2 OPTIMISTIC SCENARIO

TABLE 41 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2022–2027 (USD THOUSAND)

5.15.3 PESSIMISTIC SCENARIO

TABLE 42 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2022–2027 (USD THOUSAND)

6 EV TEST EQUIPMENT MARKET, BY VEHICLE TYPE (Page No. - 117)

6.1 INTRODUCTION

FIGURE 47 COMMERCIAL VEHICLE SEGMENT PROJECTED TO GROW AT HIGHER RATE DURING FORECAST PERIOD

TABLE 43 MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 44 MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

6.1.1 OPERATIONAL DATA

TABLE 45 TESTING AND PRODUCTION FACILITIES OF LEADING OEMS

FIGURE 48 FOSSIL FUELS STILL MAJOR SOURCE OF GLOBAL ENERGY CONSUMPTION

FIGURE 49 COMPARISON OF OPERATING COST OF EVS AND ICE VEHICLES

6.1.2 ASSUMPTIONS

TABLE 46 ASSUMPTIONS: BY VEHICLE TYPE

6.1.3 RESEARCH METHODOLOGY

6.1.4 KEY PRIMARY INSIGHTS

6.2 PASSENGER CAR

6.2.1 HIGH ADOPTION OF ZERO-EMISSION PASSENGER VEHICLES TO BOOST PASSENGER CAR SEGMENT

TABLE 47 PASSENGER CAR: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 48 PASSENGER CAR: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

6.3 COMMERCIAL VEHICLE

6.3.1 PRESENCE OF LEADING ELECTRIC COMMERCIAL VEHICLE OEMS IN EUROPE AND ASIA PACIFIC TO DRIVE MARKET

TABLE 49 COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 50 COMMERCIAL VEHICLE: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7 EV TEST EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 126)

7.1 INTRODUCTION

FIGURE 50 BATTERY TEST EQUIPMENT SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 51 MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 52 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

7.1.1 OPERATIONAL DATA

TABLE 53 ELECTRIC CAR MODELS AND THEIR CORE COMPONENT MANUFACTURERS/SUPPLIERS

FIGURE 51 FUTURE ROAD MAP FOR ELECTRIC VEHICLES

TABLE 54 SOME OF THE RENOWNED EV TESTING EQUIPMENT PROVIDERS WORLDWIDE

7.1.2 ASSUMPTIONS

TABLE 55 ASSUMPTIONS: BY EQUIPMENT TYPE

7.1.3 RESEARCH METHODOLOGY

7.1.4 KEY PRIMARY INSIGHTS

7.2 BATTERY TEST EQUIPMENT

7.2.1 BATTERY IS INTEGRAL PART OF ELECTRIC VEHICLE WITH INCREASE IN DEMAND OF ELECTRIC VEHICLES DEMAND OF BATTERIES AND BATTERY TEST EQUIPMENT WILL ALSO INCREASE

TABLE 56 BATTERY TEST EQUIPMENT: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 57 BATTERY TEST EQUIPMENT: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.3 MOTOR TEST EQUIPMENT

7.3.1 GROWING DEMAND OF ELECTRIC VEHICLE WILL INCREASE DEMAND OF MOTORS AND MOTOR TEST EQUIPMENT’S

TABLE 58 MOTOR TEST EQUIPMENT: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 59 MOTOR TEST EQUIPMENT: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.4 ENGINE DYNAMOMETER

7.4.1 WITH CUSTOMERS FOCUSING ON PERFORMANCE OF CARS DEMAND FOR ENGINE DYNAMOMETER WILL INCREASE

TABLE 60 ENGINE DYNAMOMETER: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 61 ENGINE DYNAMOMETER: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.5 CHASSIS DYNAMOMETER

7.5.1 FOR CUSTOMERS PREFERENCE TOWARDS LUXURY AND COMFORT DEMAND FOR CHASSIS DYNAMOMETER WILL INCREASE

TABLE 62 CHASSIS DYNAMOMETER: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 63 CHASSIS DYNAMOMETER: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.6 TRANSMISSION DYNAMOMETER

7.6.1 RANGE IS THE MAJOR CONCERN IN ELECTRIC VEHICLES WHICH WILL INCREASE THE DEMAND OF TRANSMISSION DYNAMOMETER

TABLE 64 TRANSMISSION DYNAMOMETER: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 65 TRANSMISSION DYNAMOMETER: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.7 FUEL INJECTION PUMP TESTER

7.7.1 AS HYBRID VEHICLES KNOWN FOR ITS MILEAGE IT WILL INCREASE THE MARKET FOR FUEL INJECTION PUMP TESTER

TABLE 66 FUEL INJECTION PUMP TESTER: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 67 FUEL INJECTION PUMP TESTER: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.8 INVERTER TEST EQUIPMENT

7.8.1 AS ELECTRIC VEHICLES ARE LOADED WITH LOTS OF ELECTRONICS INVERTER TESTING IS PLAYS A MAJOR ROLE IN THEIR TESTING

TABLE 68 INVERTER TEST EQUIPMENT: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 69 INVERTER TEST EQUIPMENT: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.9 EV DRIVETRAIN TEST

7.9.1 AS DRIVETRAIN TEST ENSURES EV IS READY FOR EVERY TERRAIN, EV DRIVETRAIN TEST IS VERY POPULAR AMONG EVS

TABLE 70 EV DRIVETRAIN TEST: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 71 EV DRIVETRAIN TEST: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.10 ELECTRIC PROPULSION TEST SYSTEM

7.10.1 CHINA IS EXPECTED TO LEAD THE MARKET

TABLE 72 ELECTRIC PROPULSION TEST SYSTEM: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 73 ELECTRIC PROPULSION TEST SYSTEM: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.11 ELECTRIC AXLE TEST EQUIPMENT

7.11.1 GROWING DEMAND OF EVS IN COUNTRIES SUCH AS CHINA, THE US, AND GERMANY TO DRIVE THE MARKET

TABLE 74 ELECTRIC AXLE TEST EQUIPMENT: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 75 ELECTRIC AXLE TEST EQUIPMENT: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.12 ON-BOARD CHARGER ATS

7.12.1 ON BOARD CHARGERS ARE USED WIDELY FOR EV CHARGING, CHARGERS DEMAND ARE INCREASING WITH INCREASE IN DEMAND OF EV WHICH ALTOGETHER INCREASE THE DEMAND FOR ON BOARD CHARGER ATS

TABLE 76 ON-BOARD CHARGER ATS: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 77 ON-BOARD CHARGER ATS: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.13 AC/DC EVSE ATS

7.13.1 AS NEED OF BALANCE BETWEEN PERFORMANCE AND MILEAGE IS VERY NECESSARY FOR EVS DEMAND FOR AC/DC ATS WILL INCREASE

TABLE 78 AC/DC EVSE ATS: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 79 AC/DC EVSE ATS: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8 EV TEST EQUIPMENT MARKET, BY APPLICATION TYPE (Page No. - 145)

8.1 INTRODUCTION

FIGURE 52 BY APPLICATION TYPE, EV COMPONENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 80 MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 81 MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

8.1.1 OPERATIONAL DATA

TABLE 82 RENOWNED OEMS AND SOME OF THEIR PRODUCTION AND TESTING FACILITIES

FIGURE 53 CHARGING COST COMPARISON

FIGURE 54 EV SHIFT AND TARGETS OF COUNTRIES AROUND THE WORLD

FIGURE 55 INTERESTING FACTS ON EV CHARGING

8.1.2 ASSUMPTIONS

TABLE 83 ASSUMPTIONS, BY APPLICATION TYPE

8.1.3 RESEARCH METHODOLOGY

8.1.4 KEY PRIMARY INSIGHTS

8.2 EV COMPONENT

8.2.1 INCREASING DEMAND FOR ELECTRIC VEHICLES TO BOOST MARKET

TABLE 84 EV COMPONENT: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 85 EV COMPONENT: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.3 EV CHARGING

8.3.1 INCREASING DEMAND FOR ON-BOARD CHARGER TESTERS AND EVSE ATS TO DRIVE TEST EQUIPMENT MARKET FOR EV CHARGING

TABLE 86 EV CHARGING: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 87 EV CHARGING: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.4 POWERTRAIN

8.4.1 MODERN POWERTRAIN TECHNOLOGIES IN HEVS TO BOOST TEST EQUIPMENT MARKET

TABLE 88 POWERTRAIN: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 89 POWERTRAIN: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

9 EV TEST EQUIPMENT MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 154)

9.1 INTRODUCTION

FIGURE 56 BEV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 90 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 91 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (USD THOUSAND)

9.1.1 OPERATIONAL DATA

TABLE 92 SOME TESTS REQUIRED FOR BEVS AND HEVS

FIGURE 57 TOP 10 EUROPEAN BRANDS REGISTRATION, BY FUEL TYPE, 2021

TABLE 93 PRICING OF POPULAR BEVS (US)

TABLE 94 PRICING OF POPULAR PHEVS (US)

9.1.2 ASSUMPTIONS

TABLE 95 ASSUMPTIONS: BY ELECTRIC VEHICLE TYPE

9.1.3 RESEARCH METHODOLOGY

9.1.4 KEY PRIMARY INSIGHTS

9.2 BATTERY ELECTRIC VEHICLE (BEV)

9.2.1 RISING DEMAND FOR EMISSION-FREE VEHICLES TO BOOST BEV SEGMENT

TABLE 96 BEV: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 97 BEV: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

9.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) & HYBRID ELECTRIC VEHICLE (HEV)

9.3.1 HIGH DEMAND FOR HEVS IN ASIA PACIFIC TO DRIVE MARKET

TABLE 98 PHEV & HEV: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 99 PHEV & HEV: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

10 EV TEST EQUIPMENT MARKET, BY REGION (Page No. - 165)

10.1 INTRODUCTION

FIGURE 58 ASIA PACIFIC PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 100 MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 101 MARKET, BY REGION, 2022–2027 (USD THOUSAND)

10.2 ASIA PACIFIC

FIGURE 59 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

10.2.1 CHINA

10.2.1.1 Government policies leading to market growth

TABLE 104 CHINA: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 105 CHINA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.2.2 INDIA

10.2.2.1 Indian government plans to provide charging infrastructure and encourage EV adoption

TABLE 106 INDIA: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 107 INDIA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.2.3 JAPAN

10.2.3.1 Technological advancements in Japan to lead to growth of EV component segment

TABLE 108 JAPAN: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 109 JAPAN: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.2.4 SOUTH KOREA

10.2.4.1 OEMs to work with government to promote EV sales

TABLE 110 SOUTH KOREA: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 111 SOUTH KOREA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.3 EUROPE

FIGURE 60 EUROPE: MARKET SNAPSHOT

TABLE 112 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 113 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

10.3.1 FRANCE

10.3.1.1 Electrification of public transport expected to boost demand for EV testing

TABLE 114 FRANCE: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 115 FRANCE: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.3.2 GERMANY

10.3.2.1 Major OEMs to increase use of EV testing equipment for their vehicles

TABLE 116 GERMANY: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 117 GERMANY: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.3.3 UK

10.3.3.1 Developed charging infrastructure and EV battery technology to lead to market growth

TABLE 118 UK: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 119 UK: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.3.4 SPAIN

10.3.4.1 Government incentives to promote electric vehicles to boost demand

TABLE 120 SPAIN: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 121 SPAIN: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.3.5 ITALY

10.3.5.1 Government’s offers of subsidies to build charging facilities to boost demand

TABLE 122 ITALY: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 123 ITALY: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.4 NORTH AMERICA

FIGURE 61 NORTH AMERICA: MARKET SNAPSHOT

TABLE 124 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 125 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

10.4.1 CANADA

10.4.1.1 Government support for charging infrastructure to boost demand

TABLE 126 CANADA: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 127 CANADA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.4.2 US

10.4.2.1 Focus on innovation, technology, and development of safe and comfortable automobiles to boost demand

TABLE 128 US: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 129 US: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.4.3 MEXICO

10.4.3.1 Increase in vehicle manufacturing facilities and development of infrastructure for EVs can lead to EV sales growth in coming years

TABLE 130 MEXICO: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 131 MEXICO: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.5 ROW

FIGURE 62 ROW: MARKET, BY COUNTRY, 2022 TO 2027 (USD THOUSAND)

TABLE 132 ROW: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 133 ROW: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

10.5.1 BRAZIL

10.5.1.1 Presence of manufacturing units to increase demand for EVs in RoW

TABLE 134 BRAZIL: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 135 BRAZIL:MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

10.5.2 RUSSIA

TABLE 136 RUSSIA: MARKET, BY APPLICATION TYPE, 2018–2021 (USD THOUSAND)

TABLE 137 RUSSIA: MARKET, BY APPLICATION TYPE, 2022–2027 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 192)

11.1 OVERVIEW

FIGURE 63 KEY DEVELOPMENTS BY LEADING PLAYERS (2019-2022)

11.2 EV TEST EQUIPMENT MARKET SHARE ANALYSIS

TABLE 138 MARKET SHARE ANALYSIS, 2021

11.3 MARKET EVALUATION FRAMEWORK: REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 64 TOP PUBLIC/LISTED PLAYERS DOMINATING MARKET IN LAST 5 YEARS

11.4 COMPETITIVE SCENARIO

11.4.1 NEW PRODUCT DEVELOPMENTS

TABLE 139 NEW PRODUCT DEVELOPMENTS, 2019–2022

11.4.2 DEALS

TABLE 140 DEALS, 2019–2022

11.4.3 EXPANSIONS, 2018–2020

TABLE 141 EXPANSIONS, 2019–2022

11.5 COMPETITIVE LEADERSHIP MAPPING FOR MARKET

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 PARTICIPANTS

FIGURE 65 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 COMPANY PRODUCT FOOTPRINT

TABLE 142 MARKET: COMPANY PRODUCT FOOTPRINT, 2022

11.7 COMPANY APPLICATION FOOTPRINT

TABLE 143 MARKET: COMPANY APPLICATION FOOTPRINT, 2022

11.8 COMPANY REGIONAL FOOTPRINT

TABLE 144 MARKET: COMPANY REGIONAL FOOTPRINT, 2022

11.9 STARTUP/SME EVALUATION MATRIX, 2021

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 66 MARKET: START-UP MATRIX, 2021

11.10 DETAILED LIST AND BENCHMARKING OF KEY STARTUPS

TABLE 145 MARKET: DETAILED LIST OF KEY STARTUPS

TABLE 146 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS]

11.11 WINNERS VS. TAIL-ENDERS

TABLE 147 WINNERS VS. TAIL-ENDERS

12 COMPANY PROFILES (Page No. - 209)

12.1 KEY PLAYERS

(Business overview, Products/services offered, Recent Developments, MNM view)*

12.1.1 TUV RHEINLAND

TABLE 148 TUV RHEINLAND: BUSINESS OVERVIEW

FIGURE 67 TUV RHEINLAND: COMPANY SNAPSHOT

TABLE 149 TUV RHEINLAND: PRODUCTS/SERVICES OFFERED

TABLE 150 TUV RHEINLAND: DEALS

TABLE 151 TUV RHEINLAND: OTHERS

12.1.2 DURR GROUP

TABLE 152 DURR GROUP: BUSINESS OVERVIEW

FIGURE 68 DURR GROUP: COMPANY SNAPSHOT

TABLE 153 DURR GROUP: PRODUCTS/SERVICES OFFERED

TABLE 154 DÜRR GROUP: DEALS

12.1.3 CHROMA ATE

TABLE 155 CHROMA ATE: BUSINESS OVERVIEW

FIGURE 69 CHROME ATE: COMPANY SNAPSHOT

TABLE 156 CHROMA ATE: PRODUCTS/SERVICES OFFERED

TABLE 157 CHROME ATE: NEW PRODUCT LAUNCHES

TABLE 158 CHROME ATE: DEALS

12.1.4 AVL

TABLE 159 AVL: BUSINESS OVERVIEW

TABLE 160 AVL: PRODUCTS/SERVICES OFFERED

TABLE 161 AVL: NEW PRODUCT LAUNCHES

TABLE 162 AVL: DEALS

TABLE 163 AVL: OTHERS

12.1.5 HORIBA LTD.

TABLE 164 HORIBA LTD.: BUSINESS OVERVIEW

FIGURE 70 HORIBA LTD.: COMPANY SNAPSHOT

TABLE 165 HORIBA LTD.: PRODUCTS/SERVICES OFFERED

TABLE 166 HORIBA LTD.: NEW PRODUCT LAUNCHES

TABLE 167 HORIBA LTD.: OTHERS

TABLE 168 HORIBA LTD.: DEALS

12.1.6 KUKA AG

TABLE 169 KUKA AG: BUSINESS OVERVIEW

FIGURE 71 KUKA AG: COMPANY SNAPSHOT

TABLE 170 KUKA AG: PRODUCTS/SERVICES OFFERED

TABLE 171 KUKA AG: DEALS

12.1.7 FEV GROUP GMBH

TABLE 172 FEV GROUP: BUSINESS OVERVIEW

TABLE 173 FEV GROUP: PRODUCTS/SERVICES OFFERED

TABLE 174 FEV GROUP: NEW PRODUCT DEVELOPMENT

TABLE 175 FEV GROUP: OTHERS

TABLE 176 FEV GROUP: DEALS

12.1.8 BURKE PORTER GROUP

TABLE 177 BURKE PORTER GROUP: BUSINESS OVERVIEW

TABLE 178 BURKE PORTER GROUP: PRODUCTS/SERVICES OFFERED

TABLE 179 BURKE PORTER GROUP: OTHERS

TABLE 180 BURKE PORTER GROUP: DEALS

12.1.9 BLUM-NOVOTEST GMBH

TABLE 181 BLUM-NOVOTEST GMBH: BUSINESS OVERVIEW

TABLE 182 BLUM-NOVOTEST GMBH: PRODUCTS/SERVICES OFFERED

12.1.10 INTERTEK

TABLE 183 INTERTEK: BUSINESS OVERVIEW

FIGURE 72 INTERTEK: COMPANY SNAPSHOT

TABLE 184 INTERTEK: PRODUCTS/SERVICES OFFERED

TABLE 185 INTERTEK: OTHERS

TABLE 186 INTERTEK: DEALS

12.1.11 ARBIN INSTRUMENTS

TABLE 187 ARBIN INSTRUMENTS: BUSINESS OVERVIEW

TABLE 188 ARBIN INSTRUMENTS: PRODUCTS & SERVICES OFFERED

TABLE 189 ARBIN INSTRUMENTS: NEW PRODUCT LAUNCHES

TABLE 190 ARBIN INSTRUMENTS: DEALS

12.1.12 ZF FRIEDRICHSHAFEN

TABLE 191 ZF FRIEDRICHSHAFEN: KEY CUSTOMERS

TABLE 192 ZF FRIEDRICHSHAFEN: KEY SHAREHOLDERS

TABLE 193 ZF FRIEDRICHSHAFEN: BUSINESS OVERVIEW

FIGURE 73 ZF FRIEDRICHSHAFEN: COMPANY SNAPSHOT

TABLE 194 ZF FRIEDRICHSHAFEN: PRODUCTS/SERVICES OFFERED

TABLE 195 ZF FRIEDRICHSHAFEN: EXPANSIONS

TABLE 196 ZF FRIEDRICHSHAFEN: DEALS

12.1.13 SOFTING AG

TABLE 197 SOFTING AG: BUSINESS OVERVIEW

FIGURE 74 SOFTING AG: COMPANY SNAPSHOT

TABLE 198 SOFTING: PRODUCTS OFFERED

TABLE 199 SOFTING AG: NEW PRODUCT LAUNCHES

TABLE 200 SOFTING AG: DEALS

12.1.14 SGS SA

TABLE 201 SGS SA: BUSINESS OVERVIEW

FIGURE 75 SGS SA: COMPANY SNAPSHOT

TABLE 202 SGS SA: PRODUCTS OFFERED

TABLE 203 SGS SA: DEALS

*Details on Business overview, Products/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER KEY PLAYERS

12.2.1 SIERRA INSTRUMENTS

TABLE 204 SIERRA INSTRUMENTS: BUSINESS OVERVIEW

12.2.2 UL LLC

TABLE 205 UL LLC: BUSINESS OVERVIEW

12.2.3 KEYSIGHT TECHNOLOGIES

TABLE 206 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

12.2.4 TASI GROUP

TABLE 207 TASI GROUP: BUSINESS OVERVIEW

12.2.5 NH RESEARCH

TABLE 208 NH RESEARCH: BUSINESS OVERVIEW

12.2.6 LINK ENGINEERING

TABLE 209 LINK ENGINEERING: BUSINESS OVERVIEW

12.2.7 NATIONAL INSTRUMENTS

TABLE 210 NATIONAL INSTRUMENTS: BUSINESS OVERVIEW

12.2.8 VECTOR INFORMATIK

TABLE 211 VECTOR INFORMATIK: BUSINESS OVERVIEW

12.2.9 DEWESOFT

TABLE 212 DEWESOFT: BUSINESS OVERVIEW

12.2.10 ELEMENTS MATERIALS TECHNOLOGY

TABLE 213 ELEMENTS MATERIALS TECHNOLOGY: BUSINESS OVERVIEW

12.2.11 ATESTEO GMBH

TABLE 214 ATESTEO GMBH: BUSINESS OVERVIEW

12.2.12 SINFONIA TECHNOLOGY

TABLE 215 SINFONIA TECHNOLOGY: BUSINESS OVERVIEW

13 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 264)

13.1 NEED TO FOCUS ON TESTING EQUIPMENT FOR EV COMPONENTS AND BATTERY TECHNOLOGIES

13.2 INDUSTRIES FROM JAPAN, SOUTH KOREA, AND INDIA EMERGING AS PROMISING ALTERNATIVES TO CHINA FOR COMPONENTS SUPPLY

13.3 CONCLUSION

14 APPENDIX (Page No. - 265)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the EV test equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of electric vehicle manufacturers, International Energy Agency (IEA), Federal Transit Administration (FTA), Regional Transportation Authority (RTA), country-level vehicle associations and trade organizations, and the US Department of Transportation (DOT)], test equipment magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global EV test equipment market.

Primary Research

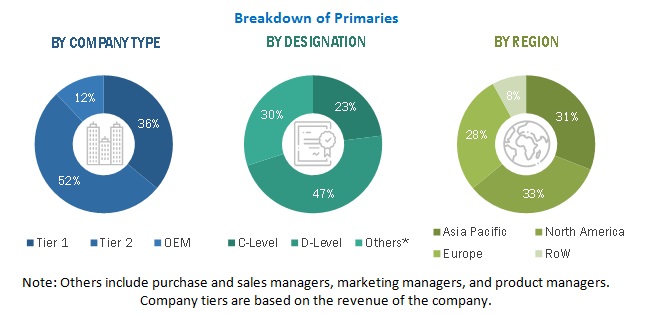

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across three major regions, namely, Asia Pacific, Europe, North America. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the size of the EV test equipment market in terms of value USD Million), from 2018 to 2027

- To define, describe, and forecast the market based on vehicle type, equipment type, electric vehicle type, application type, and region

- To segment and forecast the market by equipment type (AC/DC EVSE ATS, battery test equipment, motor test equipment, engine dynamometer, chassis dynamometer, transmission dynamometer, fuel injection pump tester, inverter test, on-board charger ATS, Electric Propulsion Test System, Exlectric Axle Test and EV drivetrain test)

- To segment and forecast the market by vehicle type (passenger car and commercial vehicle)

- To segment and forecast the market by electric vehicle type (battery electric vehicle, hybrid electric vehicle& Plug-in hybrid electric vehicle)

- To segment and forecast the market by application type (EV component, EV charging, and powertrain)

- To forecast the market size with respect to key regions, namely, Asia Pacific, Europe, North America, and Rest of the World.

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, and expansions, carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- EV Test Equipment Market, By vehicle type at country level (For countries covered in the report)

- EV Test Equipment Market, By electric vehicle type at country level (For countries covered in the report)

-

Company Information

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Test Equipment Market

Who are the top vendors in the EV Test Equipment Market? How is the competitive scenario among them?