EV Cables Market by Type (BEV, HEV, PHEV), Voltage (Low, High), EV Application (Engine & Powertrain, Battery & Charging Management), High Voltage Application, Insulation, Shielding Type (Copper, Aluminium), Component and Region - Global Forecast to 2028

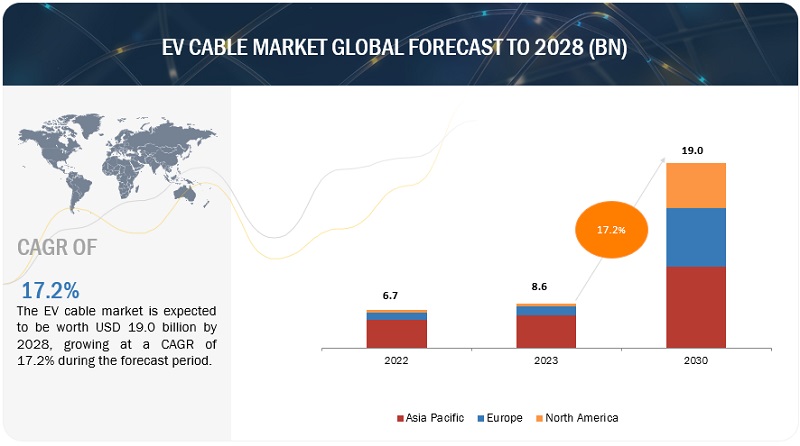

[221 Pages Report] The global EV cable market size was valued at USD 8.6 billion in 2023 and is expected to reach USD 19.0 billion by 2028 at a CAGR of 17.2% during the forecast period 2023-2028. EV cables perform different functions in electric vehicles as they aid in signal transmission and powering up of different electronic and electrical devices. EV cables have been the central function of transmitting electricity to power various devices equipped on a vehicle such as lighting, air conditioning units, steering servos, sensors, etc. LS Cable & System automobile cables consist of irradiation cables, general cables, battery cables, sensor cables, and others. They are assembled inside a rubber or plastic covering for insulation. They play a key role in transmitting information about the operation of the vehicle, sending & receiving sensor signals, and supplying power. The rise of advanced electronics in electric cars is a major factor driving the growth of the EV cable market forecast. These advanced electronics are used in a variety of ways to improve the performance, efficiency, and safety of electric cars.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Increasing growth of electric vehicles

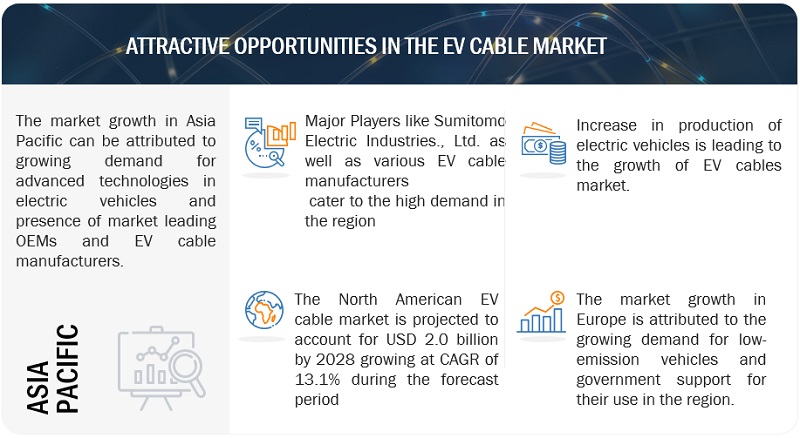

The market for EV cables is expected to grow with the increase in sales of electric vehicles. EV sales have surged with growth in all three top auto markets: China, the US, and Europe. Growing demand for zero emission commuting and governments subsidies and tax rebates have compelled automobile manufacturers to provide electric vehicles around the world. Electric passenger car is the fastest-growing segment in the EV market and will witness significant growth during the forecast period. Hence, the EV cable market will grow. Leading automotive markets for electric vehicles such as China, the US, and Germany are investing significantly in R & D activities for electric vehicles. Countries across North America, Asia Pacific and Europe, have adopted measures to reduce emissions in the coming years and replace their vehicle fleets for lower emissions by varying amounts by year 2050. This will increase the market for electric vehicles and hence EV cables market will increase.

Restraint: High initial cost of electric vehicles

The high manufacturing costs of EVs have been a major concern in their widespread adoption. The expected reduction in battery prices and reduced R&D costs are expected to lead to a reduction in the overall cost of purchasing electric hatchbacks, crossovers, or SUVs to reach the levels of ICE vehicles, leading to the rising demand for EVs. The cost of EVs is significantly higher than ICE vehicles due to the high price of rechargeable lithium-ion batteries required for these vehicles. Hence, it restrains the market growth for EV cables. The price of cathode affects the price of the batteries to a large extent. This is because materials such as cobalt, nickel, lithium, and magnesium used in these batteries are high-priced. The cost of production of EVs is also significantly higher than ICE vehicles due to the expensive process involved in developing these vehicles.

Opportunity: Rising popularity of hybrid electric vehicles

A plug-in hybrid electric vehicle (PHEV) is a type of electric vehicle where the battery can be recharged by plugging a charging cable into an external electric power source along with its onboard ICE-powered generator. PHEVs are witnessing high penetration into the passenger car segment, thus creating a market for EV cables. The growth of this segment is expected to offer lucrative opportunities for the growth of the electric vehicle charging cables market. China and the US have the highest sales of PHEVs. Major players such as Mitsubishi, BMW, Volkswagen, Toyota, and Daimler have launched several PHEVs that have had a successful run in the market. The growth in demand for PHEVs is also expected to increase the demand for EV cables that are required for power transmission systems in EVs. The sales of HEVs improved post-June 2022 as lockdown lifted in most countries has increased as manufacturers launched new models to attract customers. Major factors driving the growth of the market are growing environmental concerns, enactment of stringent emission and fuel economy norms, increasing government initiatives (in terms of subsidies, tax rebates, and benefits), and an increase in R&D efforts by major companies in HEVs, thus increasing the market for EV cables.

Challenge: Lack of EV charging infrasatructure in developing economies

To facilitate the widespread acceptance of EVs, an adequately developed infrastructure of charging stations is required. Barring a few countries such as the US, Germany, the UK, France, and Japan, the development of this infrastructure is in the initial stage across the world. This affects the market for electric vehicles, thus hampering the market for EV cables. Governments of various countries are offering subsidies and tax exemptions on infrastructure development to reduce the setup cost and promote sales of EVs, which will increase the market for EV cables. For instance, the Japanese government started investing in the development of charging stations across the country in association with electric vehicle manufacturers such as Nissan, Mitsubishi, and Honda. Due to this partnership, Japan today has more charging stations (40,000) than fuel stations (34,000). Although EV cable are extensively used in various aspects of EV charging infrastructure, the total network of EV charging infrastructure has been unable to expand as fast as the expansion on EV vehicles. This is due to lack of standardisation and lack of policy by governments. Hence, this situation pose a challenge to the expansion of EV cables sales.

The Thermoplastic Elastomer segment to be the largest segment during the forecast period

Thermoplastic elastomers (TPEs) are a class of materials that combine the properties of rubber and plastics. They are flexible, durable, and resistant to a variety of chemicals and solvents. TPEs are also recyclable, making them an environmentally friendly option. General Cable offers cables with three standard jacket types: EV All-Rubber Jacket, EVE Thermoplastic Elastomer (TPE) Jacket, and EVT Polyvinylchloride (PVC) Jacket. TPE is flexible and has significant low-temperature resistance and UV resistance, making it one of the most popular jacket materials for outdoor and heavy-duty indoor applications. TPE jackets can be processed to meet extreme industrial standards of various applications. A thermoplastic elastomer is light in weight and hence easier to handle in comparison to other jackets. It is commonly used in applications where conventional elastomers cannot provide the necessary range of physical properties. It can be molecularly bonded to connectors and caps for long-lasting strength, even in rough conditions/applications.

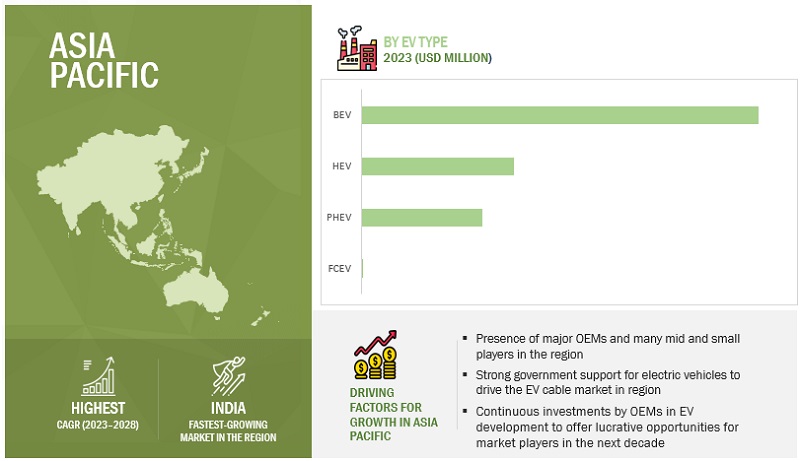

The Asia Pacific is projected to be the fastest market by 2028

The region is home to some of the fastest-developing economies of the world such as China and India. Furthermore, several European and American automobile manufacturers, such as Volkswagen (Germany), Mercedes Benz Group AG (Germany), and General Motors (US), have shifted their production plants to emerging economies. Necessary measures such as increasing subsidies for EV buyers are also undertaken in Japan to increase its share of EVs and plug-in hybrids from 20% to 30% by 2030. All the measures taken by the government to promote sales of electric vehicles will boost the demand for EV cables. In 2021, the Japanese government announced to invest USD 911 million to build EV Charger stations and stimulate the development of the electric vehicle market. As of 2021, Japan has a higher number of charging stations than fuel stations. In June-2022, the Indian government announced to offer subsidy of USD 135/kWh for purchase of electric vehicles. With the implementation of these schemes, the Indian electric vehicle market is expected to grow in the near future. South Korea is also making efforts to quickly develop EV infrastructure across the country. It plans to speed up the EV demand in the country driving the EV cable market trends.

Key Market Players

The major automotive EV cable market pump market players include Leoni AG (Germany), Huber +Suhner (Switzerland), Sumitomo Electric Industries., Ltd (Japan), Aptiv (Ireland), Nexans (France). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements. Some instances are provided below.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

BY EV type, by insulation material, by shielding type, by components, by Voltage, by high Voltage, by EV application |

|

Geographies covered |

Asia Pacific, Europe and North America |

|

Companies covered |

Leoni AG (Germany), Huber + Suhner (Switzerland), Sumitomo Electric Industries., Ltd (Japan), Aptiv (Ireland) and Nexans (France) |

This research report categorizes the market based on EV type, insulation material, shielding type, components, Voltage, high Voltage, EV application

Based on EV type:

- BEV

- HEV

- PHEV

- FCEV

Based on insulation material:

- Silicon Rubber Insulation

- Fluoro-polymers

- Thermoplastic Elastomer

- Others

Based on shielding type:

- Copper

- Aluminum

- Others

Based on components

- Wires

- Connectors/Terminals

- Fuses

- Others

Based on Voltage:

- Low

- Medium

- High

- Very high

Based on high voltage type:

- Engine & Powertrain

- Battery & Battery Management

- Charging Management

- Power Electronics

- Others

Based on EV application:

- Engine & Powertrain

- Battery & Battery Management

- Charging Management

- Power Electronics

- Others

Based on region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

Europe

- France

- Germany

- Norway

- Spain

- UK

-

North America

- US

- Canada

Recent Developments

- In May 2023, Sumitomo Electric Industries, Ltd. announced to establish the world’s largest factory for electric vehicle wiring harnesses in Egypt, with a USD 100 million investment and construction area of 150,000 square meters.

- In May 2023, Huber+Suhner launched Upgraded Radox EV-C High Voltage Flex Cable

- In September 2022, Ravicab Cables Private Limited announces acquisition of Leoni Cable Solution IndiaPrivate Limited(LCSI), Pune, a fully owned subsidiary of Leoni AG

- In July 2021, Nexans announced a cable manufacturing facility in Tianjin, China. The new plant covers a 3,000-meter square to produce a large range of cable products and solutions.

- In November 2020, Huber + Suhner launched its new flexible and robust Radox Screened Flex high voltage battery cable range for electric vehicles by combining Radox technology with a new type of semiconductor.

Frequently Asked Questions (FAQ):

Does this report cover various applications of EV cable?

Yes, EV cable applications such as engine & powertrain, battery & battery management, charging management, power electronics and others as a segment is provided in the report.

Which countries are considered in the Asian region?

The EV cable market report includes Asia Pacific countries such as:

- China

- India

- Japan

- South Korea

We are interested in regional EV cable market for electric vehicle types? Does this report cover electric vehicle types?

Yes, EV cable market for electric vehicle type are covered at global and regional level.

Does this report include impact of recession on EV cables?

Yes, the market includes qualitative insights for recession impact on the EV cables

Does this report provide insights on EV vehicle type?

Yes, EV Vehicle type is covered for BEV, PHEV, FCEV and HEV

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of EVs- Increase in fuel prices- Rising focus of automakers on emission-free vehiclesRESTRAINTS- High initial cost of EVs- Limited subsidies by governments and financial organizationsOPPORTUNITIES- Government initiatives pertaining to EV charging infrastructure- Rising popularity of HEVsCHALLENGES- Lack of EV charging infrastructure in emerging economies- Longer charging time than other fuelsIMPACT ANALYSIS OF MARKET DYNAMICS

-

5.3 ECOSYSTEM ANALYSISEV CABLE PROVIDERSTIER-I SUPPLIERSOEMSEND USERS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 TECHNOLOGY ANALYSISSELECTIVE METAL COATING TECHNOLOGYILLUMINATED EV CHARGING CABLEV2X TECHNOLOGY

-

5.6 PATENT ANALYSIS

- 5.7 TRENDS AND DISRUPTIONS IN EV CABLES MARKET

-

5.8 CASE STUDY ANALYSISFUEL CASE STUDY ON ELECTRICAL CONNECTION FOR ALUMINUM CONDUCTORS IN AUTOMOTIVE APPLICATIONSTESTING CHARGEPOINT CABLE PAVEMENT GULLIES IN OXFORDSHIRE

-

5.9 REGULATORY FRAMEWORKCOUNTRY-WISE REGULATIONS- Netherlands- Germany- France- UK- China- USREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.10 EV CABLES MARKET SCENARIO ANALYSIS, 2023–2028MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

- 6.1 INTRODUCTION

-

6.2 ENGINE & POWERTRAINGROWING DEMAND FOR POWERTRAINS TO DRIVE MARKET

-

6.3 BATTERY & BATTERY MANAGEMENTADOPTION OF ADVANCED INTEGRATED TECHNOLOGIES TO DRIVE MARKET

-

6.4 CHARGING MANAGEMENTINCREASE IN DEMAND FOR EVS TO DRIVE MARKET

-

6.5 POWER ELECTRONICSSHIFT TO HIGH VOLTAGE ARCHITECTURE FOR EVS TO DRIVE MARKET

- 6.6 OTHERS (MOTOR & INVERTER)

- 6.7 KEY INDUSTRY INSIGHTS

- 7.1 INTRODUCTION

-

7.2 LOW VOLTAGE (UPTO 100V)INSTALLATION OF LOW VOLTAGE CABLES FOR APPLICATIONS SUCH AS POWER ELECTRONICS TO DRIVE MARKET

-

7.3 MEDIUM VOLTAGE (100V–300V)RISING ADOPTION OF NEW EV TECHNOLOGIES TO DRIVE MARKET

-

7.4 HIGH VOLTAGE (300V–1,000V)INCREASE IN CHARGING MANAGEMENT FOR EVS IN EMERGING ECONOMIES TO DRIVE MARKET

-

7.5 VERY HIGH VOLTAGE (ABOVE 1,000V)SHIFT TO VERY HIGH VOLTAGE ARCHITECTURE FOR EVS TO DRIVE MARKET

- 7.6 KEY INDUSTRY INSIGHTS

- 8.1 INTRODUCTION

-

8.2 ENGINE & POWERTRAININCREASING PENETRATION OF EVS IN EMERGING ECONOMIES TO DRIVE MARKET

-

8.3 BATTERY & BATTERY MANAGEMENTDEMAND FOR EV BATTERIES TO DRIVE MARKET

-

8.4 CHARGING MANAGEMENTDEVELOPMENT OF CHARGING INFRASTRUCTURE TO DRIVE MARKET

-

8.5 POWER ELECTRONICSGROWING PREFERENCE OF CUSTOMERS FOR ADVANCED TECHNOLOGIES TO DRIVE MARKET

- 8.6 OTHERS (MOTOR & INVERTER)

- 8.7 KEY INDUSTRY INSIGHTS

- 9.1 INTRODUCTION

-

9.2 BATTERY ELECTRIC VEHICLE (BEV)INCREASE IN ADOPTION OF INTEGRATED COMPONENTS BY OEMS TO DRIVE MARKET

-

9.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)EXTENDED DRIVING RANGE DUE TO LIQUID FUEL TANK AND INTERNAL COMBUSTION ENGINE TO DRIVE MARKET

-

9.4 FUEL CELL ELECTRIC VEHICLE (FCEV)ADVANCEMENTS IN FUEL CELL TECHNOLOGY TO DRIVE MARKET

-

9.5 HYBRID ELECTRIC VEHICLE (HEV)IMPROVED FUEL EFFICIENCY AND REDUCED EMISSIONS TO DRIVE MARKET

- 9.6 KEY INDUSTRY INSIGHTS

- 10.1 INTRODUCTION

-

10.2 WIREGROWING DEMAND FOR EVS TO DRIVE MARKET

-

10.3 CONNECTOR/TERMINALGROWING DEMAND FOR ELECTRIC DRIVETRAINS TO DRIVE MARKET

-

10.4 FUSEDEMAND FOR SAFETY FOR EV DRIVETRAIN COMPONENTS TO DRIVE MARKET

- 10.5 OTHERS

- 10.6 KEY PRIMARY INSIGHTS

- 11.1 INTRODUCTION

-

11.2 SILICON RUBBER INSULATIONGROWING EV DEMAND TO DRIVE MARKET

-

11.3 THERMOPLASTIC ELASTOMERGROWING DEMAND FOR EVS IN MODERATELY LOW-TEMPERATURE REGIONS TO DRIVE MARKET

-

11.4 FLUOROPOLYMERGROWING DEMAND FOR HIGHLY ADAPTABLE EV CABLES TO DRIVE MARKET

- 11.5 OTHERS

- 11.6 KEY PRIMARY INSIGHTS

- 12.1 INTRODUCTION

-

12.2 COPPERGROWING DEMAND FOR LONG-LASTING EV CABLES TO DRIVE MARKET

-

12.3 ALUMINUMGROWING DEMAND FOR HIGHLY EFFICIENT EV CABLES TO DRIVE MARKET

- 12.4 OTHERS

- 12.5 KEY PRIMARY INSIGHTS

- 13.1 INTRODUCTION

-

13.2 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Increase in sales of EVs to drive marketINDIA- Active participation of OEMs to drive marketJAPAN- EV charging management facilities to drive marketSOUTH KOREA- Adoption of advanced technologies in EVs to drive market

-

13.3 EUROPERECESSION IMPACT ANALYSISFRANCE- Government incentive policies for EV adoption to drive marketGERMANY- Presence of leading EV cable manufacturers to drive marketNORWAY- Rising popularity of PHEVs to drive marketSPAIN- Scrappage policy by government to drive marketUK- Growing battery market for EVs to drive market

-

13.4 NORTH AMERICARECESSION IMPACT ANALYSISUS- Presence of leading EV manufacturers to drive marketCANADA- Growth of FCEVs to drive market

- 14.1 OVERVIEW

-

14.2 MARKET SHARE ANALYSISLEONI AGHUBER+SUHNERSUMITOMO ELECTRIC INDUSTRIES, LTD.APTIVNEXANS

- 14.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

-

14.4 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

-

14.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

14.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

15.1 KEY PLAYERSLEONI AG- Business overview- Products offered- Recent developments- MnM viewHUBER+SUHNER- Business overview- Products offered- Recent developments- MNM viewSUMITOMO ELECTRIC INDUSTRIES, LTD.- Business overview- Products offered- Recent developments- MNM viewAPTIV- Business overview- Products offered- Recent developments- MnM viewNEXANS- Business overview- Products offered- Recent developments- MnM viewTE CONNECTIVITY- Business overview- Products offeredELAND CABLES- Business overview- Products offeredACOME- Business overview- Products offered- Recent developmentsELKEM- Business overview- Products offered- Recent developmentsCOROPLAST- Business overview- Products offeredCHAMPLAIN CABLE CORPORATION- Business overview- Products offered- Recent developmentsSINBON ELECTRONICS- Business overview- Products offered- Recent developmentsPHILATRON WIRE & CABLE- Business overview- Products offered- Recent developments

-

15.2 OTHER KEY PLAYERSFURUKAWA ELECTRIC CO., LTDHENGFEI CABLE CO., LTDDYDEN CORPORATIONRIYING ELECTRONICS CO., LTDTHB GROUPYURA CORPORATIONYAZAKI CORPORATIONFUJIKURA LTDOMG EV CABLEDRAXLMAIER GROUPBESEN INTERNATIONAL GROUPGENERAL CABLE (PRYSMIAN GROUP)

- 16.1 ASIA PACIFIC IS KEY FOCUS MARKET FOR EV CABLES

- 16.2 TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET FOR EV CABLES

- 16.3 RISING ADOPTION OF HIGH VOLTAGE CABLES

- 16.4 CONCLUSION

- 17.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN EV CABLES MARKET

- TABLE 2 CURRENCY EXCHANGE RATES

- TABLE 3 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021–2022

- TABLE 4 EUROPE: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 5 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 6 AMERICAS: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 7 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024–2027 (% GROWTH)

- TABLE 8 OEMS’ TARGET TO SHIFT TOWARD EV

- TABLE 9 AVERAGE VEHICLE COST, BY PROPULSION, 2023

- TABLE 10 GOVERNMENT PROGRAMS FOR PROMOTION OF EV SALES

- TABLE 11 COUNTRY-WISE COMPARISON OF EV CHARGER DENSITY

- TABLE 12 EV CABLES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 13 NETHERLANDS: EV INCENTIVES

- TABLE 14 GERMANY: EV INCENTIVES

- TABLE 15 FRANCE: EV INCENTIVES

- TABLE 16 UK: EV INCENTIVES

- TABLE 17 CHINA: EV INCENTIVES

- TABLE 18 US: EV INCENTIVES

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EV CABLES MARKET (MOST LIKELY SCENARIO), BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 EV CABLES MARKET (OPTIMISTIC), BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MARKET (PESSIMISTIC), BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY HIGH VOLTAGE TYPE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 MARKET, BY HIGH VOLTAGE TYPE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 ENGINE & POWERTRAIN: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 ENGINE & POWERTRAIN: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 BATTERY & BATTERY MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 BATTERY & BATTERY MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 CHARGING MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 CHARGING MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 POWER ELECTRONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 POWER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 MARKET, BY VOLTAGE, 2019–2022 (USD MILLION)

- TABLE 39 MARKET, BY VOLTAGE, 2023–2028 (USD MILLION)

- TABLE 40 LOW VOLTAGE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 LOW VOLTAGE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 MEDIUM VOLTAGE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 MEDIUM VOLTAGE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 HIGH VOLTAGE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 HIGH VOLTAGE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 VERY HIGH VOLTAGE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 VERY HIGH VOLTAGE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET, BY EV APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 MARKET, BY EV APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 ENGINE & POWERTRAIN: EV CABLES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 ENGINE & POWERTRAIN: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 BATTERY & BATTERY MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 BATTERY & BATTERY MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 CHARGING MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 CHARGING MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 POWER ELECTRONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 POWER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 OTHERS (MOTOR & INVERTER): MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 OTHERS (MOTOR & INVERTER): MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 61 MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 62 BEV: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 BEV: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 PHEV: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 PHEV: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 FCEV: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 FCEV: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 HEV: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 HEV: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 71 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 72 WIRE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 WIRE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 CONNECTOR/TERMINAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 CONNECTOR/TERMINAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 FUSE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 FUSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 OTHER EV POWER TRANSMISSION COMPONENTS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 OTHER EV POWER TRANSMISSION COMPONENTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 MARKET, BY INSULATION MATERIAL, 2019–2022 (USD MILLION)

- TABLE 81 MARKET, BY INSULATION MATERIAL, 2023–2028 (USD MILLION)

- TABLE 82 SILICON RUBBER INSULATION: EV CABLES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 SILICON RUBBER INSULATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 THERMOPLASTIC ELASTOMER: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 THERMOPLASTIC ELASTOMER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 FLUOROPOLYMER: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 FLUOROPOLYMER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 OTHER INSULATION MATERIALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 OTHER INSULATION MATERIALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 MARKET, BY SHIELDING TYPE, 2019–2022 (USD MILLION)

- TABLE 91 MARKET, BY SHIELDING TYPE, 2023–2028 (USD MILLION)

- TABLE 92 COPPER: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 COPPER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 ALUMINUM: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 95 ALUMINUM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 OTHER SHIELDING TYPES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 97 OTHER SHIELDING TYPES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 CHINA: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 104 INDIA: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 105 INDIA: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 106 JAPAN: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 107 JAPAN: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 108 SOUTH KOREA: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 109 SOUTH KOREA: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 FRANCE: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 113 FRANCE: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 114 GERMANY: EV CABLES MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 115 GERMANY: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 116 NORWAY: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 117 NORWAY: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 118 SPAIN: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 119 SPAIN: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 120 UK: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 121 UK: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 123 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 US: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 125 US: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 126 CANADA: MARKET, BY EV TYPE, 2019–2022 (USD MILLION)

- TABLE 127 CANADA: MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- TABLE 128 DEGREE OF COMPETITION, 2022

- TABLE 129 MARKET: PRODUCT LAUNCHES, OCTOBER 2020–MAY 2023

- TABLE 130 MARKET: DEALS, MAY 2022–DECEMBER 2022

- TABLE 131 MARKET: EXPANSIONS, JULY 2021–JUNE 2023

- TABLE 132 MARKET: COMPANY FOOTPRINT, 2023

- TABLE 133 MARKET: PRODUCT FOOTPRINT, 2023

- TABLE 134 MARKET: REGIONAL FOOTPRINT, 2023

- TABLE 135 LEONI AG: COMPANY OVERVIEW

- TABLE 136 LEONI AG: PRODUCTS OFFERED

- TABLE 137 LEONI AG: DEALS

- TABLE 138 LEONI AG: OTHERS

- TABLE 139 HUBER+SUHNER: COMPANY OVERVIEW

- TABLE 140 HUBER+SUHNER: PRODUCTS OFFERED

- TABLE 141 HUBER+SUHNER: PRODUCT DEVELOPMENTS

- TABLE 142 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 143 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 144 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCT DEVELOPMENTS

- TABLE 145 SUMITOMO ELECTRIC INDUSTRIES, LTD.: OTHERS

- TABLE 146 APTIV: COMPANY OVERVIEW

- TABLE 147 APTIV: PRODUCTS OFFERED

- TABLE 148 APTIV: DEALS

- TABLE 149 APTIV: OTHERS

- TABLE 150 NEXANS: COMPANY OVERVIEW

- TABLE 151 NEXANS: PRODUCTS OFFERED

- TABLE 152 NEXANS: OTHERS

- TABLE 153 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 154 TE CONNECTIVITY: PRODUCTS OFFERED

- TABLE 155 TE CONNECTIVITY: OTHERS

- TABLE 156 ELAND CABLES: COMPANY OVERVIEW

- TABLE 157 ELAND CABLES: PRODUCTS OFFERED

- TABLE 158 ACOME: COMPANY OVERVIEW

- TABLE 159 ACOME: PRODUCTS OFFERED

- TABLE 160 ACOME: PRODUCT DEVELOPMENTS

- TABLE 161 ELKEM: COMPANY OVERVIEW

- TABLE 162 ELKEM: PRODUCTS OFFERED

- TABLE 163 ELKEM: OTHERS

- TABLE 164 COROPLAST: COMPANY OVERVIEW

- TABLE 165 COROPLAST: PRODUCTS OFFERED

- TABLE 166 CHAMPLAIN CABLE CORPORATION: COMPANY OVERVIEW

- TABLE 167 CHAMPLAIN CABLE CORPORATION: PRODUCTS OFFERED

- TABLE 168 CHAMPLAIN CABLE CORPORATION: OTHERS

- TABLE 169 SINBON ELECTRONICS: COMPANY OVERVIEW

- TABLE 170 SINBON ELECTRONICS: PRODUCTS OFFERED

- TABLE 171 SINBON ELECTRONICS: DEALS

- TABLE 172 PHILATRON WIRE & CABLE: COMPANY OVERVIEW

- TABLE 173 PHILATRON WIRE & CABLE: PRODUCTS OFFERED

- TABLE 174 PHILATRON WIRE & CABLE: PRODUCT DEVELOPMENTS

- FIGURE 1 MARKETS COVERED

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 EV CABLES MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET: MARKET OVERVIEW

- FIGURE 8 MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 MARKET, BY EV TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 INCREASING DEMAND FOR EVS TO DRIVE MARKET

- FIGURE 11 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 12 BEV TO HAVE LARGEST MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 13 THERMOPLASTIC ELASTOMER TO HOLD MAJORITY MARKET SHARE (2023–2028) (USD MILLION)

- FIGURE 14 COPPER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 WIRE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 HIGH VOLTAGE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 BATTERY & BATTERY MANAGEMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 CHARGING MANAGEMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GLOBAL SALES OF ELECTRIC PASSENGER CARS, 2018–2022 (THOUSAND UNITS)

- FIGURE 21 AVERAGE PETROL PRICES PER GALLON IN US (1994–2022)

- FIGURE 22 GLOBAL PHEV SALES, BY VOLUME (THOUSAND UNITS)

- FIGURE 23 EV CHARGING DEMAND, 2020–2030

- FIGURE 24 AVERAGE INITIAL INVESTMENT COMPARISON FOR DIFFERENT TYPES OF FUEL STATIONS

- FIGURE 25 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 TRENDS AND DISRUPTIONS IN MARKET

- FIGURE 28 MARKET, BY HIGH VOLTAGE TYPE, BY APPLICATION 2023–2028 (USD MILLION)

- FIGURE 29 MARKET, BY VOLTAGE, 2023–2028 (USD MILLION)

- FIGURE 30 MARKET, BY EV APPLICATION, 2023–2028 (USD MILLION)

- FIGURE 31 MARKET, BY EV TYPE, 2023–2028 (USD MILLION)

- FIGURE 32 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- FIGURE 33 MARKET, BY INSULATION MATERIAL, 2023–2028 (USD MILLION)

- FIGURE 34 MARKET, BY SHIELDING TYPE, 2023–2028 (USD MILLION)

- FIGURE 35 MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: EV CABLES MARKET SNAPSHOT

- FIGURE 38 MARKET SHARE ANALYSIS, 2022

- FIGURE 39 TOP PUBLIC/LISTED PLAYERS DOMINATING EV CABLES MARKET DURING LAST FIVE YEARS

- FIGURE 40 EV CABLES MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 41 EV CABLES MARKET: START-UP/SME EVALUATION MATRIX, 2023

- FIGURE 42 LEONI AG: COMPANY SNAPSHOT

- FIGURE 43 HUBER+SUHNER: COMPANY SNAPSHOT

- FIGURE 44 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 45 APTIV: COMPANY SNAPSHOT

- FIGURE 46 NEXANS: COMPANY SNAPSHOT

- FIGURE 47 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 48 ACOME: COMPANY SNAPSHOT

- FIGURE 49 ELKEM: COMPANY SNAPSHOT

The study involved 4 major activities in estimating the market size for EV cables. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive commercial study of the global market. Secondary sources include company annual reports/presentations, press releases, industry association publications, India Electronics & Semiconductor Association, ARTEMIS Industry Association, European Automotive Research Partners Association (EARPA), European Alternate Fuels Observatory (EAFO), International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), China Association Of Automoblie Manufacturers (CAAM), automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (Marklines and Factiva).

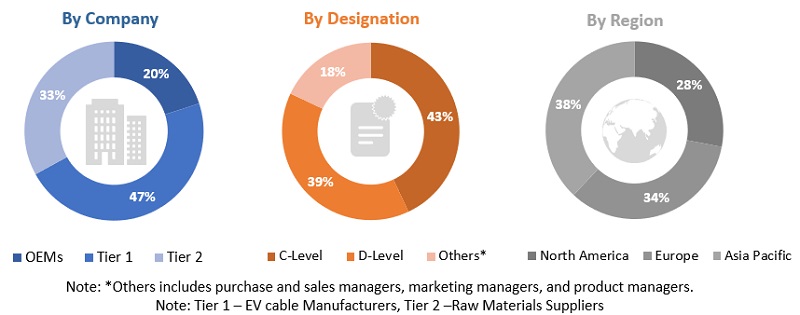

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs [(in terms of component supply), country-level government associations, and trade associations] and component manufacturers across 3 major regions, namely, Asia Pacific, Europe and North America. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

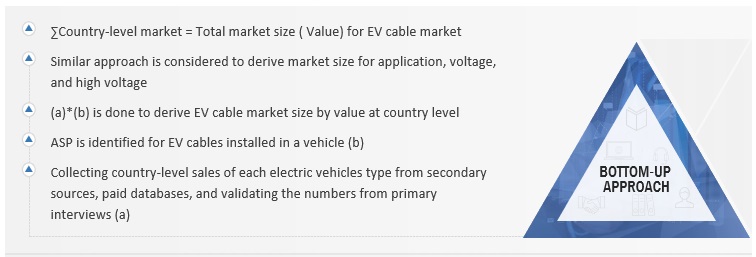

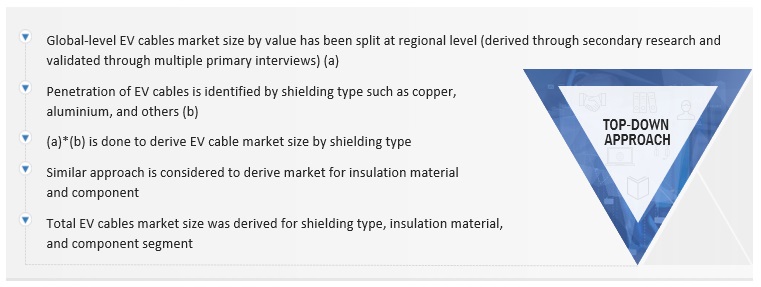

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The key players in the industry and markets have been identified through extensive secondary research. The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global EV Cable Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the size of the EV cable market by shielding type, insulation material and component segment in terms of value.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Market Definition

Modern electric vehicles require automotive wiring and cables that can carry low and high voltages – and these cables need to integrate seamlessly into the automotive assembly line for safety, low weight impact, and neatness. Lower voltage cables are preferably used for battery technology due to lower costs. High voltage cables in electric vehicles move power to and from the battery and various systems throughout the electric vehicle.

Key Stakeholders

- Automobile OEMs

- Battery Distributors

- Battery Manufacturers

- Charging Infrastructure Providers

- Charging Services Providers

- Component Manufacturers

- Environmental Protection Agency (EPA)

- EV Charging Poles Manufacturers

- EV Charging Station Service Providers

- EV Components Manufacturers

- EV Cable Distributors and Retailers

- EV Cable Manufacturers

- EV Cable System/Component Suppliers

- EV Cable Technology Integrators

- Regulatory Authorities

- Raw Material Suppliers

Report Objectives

-

To analyze the EV cables market and forecast (2023–2028) its size in terms of value

(USD million). - To provide detailed information regarding major factors influencing the growth of the market (drivers, restraintsa, opportunities, and industry challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment the market and forecast its size, by value, based on region (Asia Pacific, Europe, and North America)

- To segment and forecast the market size, by value, based on EV type (BEV, PHEV, FCEV, and HEV)

- To segment the market for EV cable and forecast the market size, by value, based on insulation materials (thermoplastic elastomer, fluoro-polymers, silicon rubber insulation, and others)

- To segment the market for EV cable and forecast the market size, by value, based on shielding type (copper, aluminum, and others)

- To segment the market for EV cable and forecast the market size, by value, based on components (wires, connectors/ terminals, fuses, and others)

- To segment the market for EV cable and forecast the market size, by value, based on Voltage (low, medium, high, and very high)

- To segment and forecast the market size, by value, based on high voltage application type (engine & powertrain, battery & battery management, charging management, power electronics, and others)

-

To segment and forecast the market size, by value, based on EV application

(engine & powertrain, battery & battery management, charging management, power electronics, and others) - To showcase technological developments impacting the EV cables market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as, new product launches, deals, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- EV cables market, By component at the regional level

Company Information

- Profiling of Additional Market Players (Up to 3)

- Additional countries for ME Region (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Cables Market