Euro 7 Regulations Compliant Market by Vehicle Type & Country (Passenger Cars, LCVs, HCVs), Technology (DOC, DPF/GPF, SCR, ASC, EGR, EHC, & LNT), Sensors (Exhaust Gas Pressure & Temperature, PM, Oxygen/Lamba, NOx, & MAP/MAF Sensors) - Forecast to 2035

[173 Pages Report] The global Euro 7 regulations compliant market size was valued at 13.6 million units in 2026 and is expected to reach 14.1 million units by 2035, at a CAGR of 0.4%, during the forecast period 2026-2035. The market is driven by demand for zero-emission vehicles, reduction of brakes and tires emission in ICE and electric/hybrid vehicles, reduction in tailpipe emissions, and others.

The rise in the overall vehicle cost is mainly because of the increasing incorporation of technologies to comply with the Euro 7 regulations, which will restrain the growth Euro 7 regulations compliant market.

Euro 7 Regulations Compliant Market Market Dynamics

DRIVER: Zero emission targets by 2050

The Euro 7 regulations includes various real driving emissions (RDE), including the emissions from the brakes and tires of ICE and EVs. In-depth emission monitoring from different vehicular systems is required to achieve the agenda. Furthermore, the EU aims to be climate-neutral by 2050, with zero greenhouse gas emissions. Transitioning to this climate-neutral environment is not easy or quick; the Euro 7 norms can also be considered a step toward achieving the climate-neutral vision.

The Euro 7 targets to lower the emission of particles from the tailpipe by 13% from cars and vans and 39% from buses and lorries by 2035. Furthermore, the particles from cars' brakes will be lessened by 27%. To achieve such targets, many OEMs are developing advanced emission reduction technologies and powertrains to comply with the Euro 7. For instance, to meet the updated BS6 norms in India, TATA Motors (India) has upgraded its entire range of engines to be RDE compliant. Similarly, many European OEMs are equipping their powertrains to be Euro 7 compliant. These regulations have also compelled automotive OEMs to increase the use of lightweight materials such as light metals, composites, and plastics, which helps increase efficiency and reduce emissions.

Following several limitations on the usage of diesel vehicles in the Netherlands and Belgium, many countries have imposed restrictions on vehicles for their environmental protection. Germany is the only country worldwide that has banned diesel vehicles that are emission standard 4/IV or lower in its Stuttgart city. Many other cities in Germany are expected to implement diesel vehicle bans soon.

With increasingly stringent emission norms and restrictions, automotive OEMs focus more on electric and hybrid vehicles. For instance, Mercedes Benz (Germany) has many upcoming electric vehicles ranges in its EQ models, including the newer versions of its EQS, and EQE offerings. The other leading European carmakers, including Volvo (Sweden), Volkswagen (Germany), and others, are also developing electric vehicles.

RESTRAINT: Unfeasible period of implementation

The rise in the overall vehicle cost is mainly because of the increasing incorporation of technologies to comply with the Euro 7 regulations. This includes onboard monitoring, emission reduction technologies such as fuel particulate filters, selective catalytic reduction, and many associated sensors in these systems. Though these technologies aid in reducing emissions, they increase the vehicle's overall weight, adding load on the powertrain and enhancing emissions. However, the costs for these technologies can be relatively lower than the cost of developing an entirely new IC powertrain.

For these reasons, many leading automakers have concentrated more on the electric powertrain than the ICEs. For instance, according to the Europe head of Ford, the Model E division, investing in developing zero-emission technologies is better than concentrating on conventional internal combustion engines. In 2021, General Motors (US) announced that the company would discontinue all their ICEs vehicles by 2035 and only offer vehicles with zero tailgate emission in their product portfolio.

OPPORTUNITY: Increased periodic maintenance of vehicles

The Euro 7 regulation mandates emission from tires, brakes, onboard emission monitoring systems, etc. For these reasons, the automakers plan to incorporate an onboard monitoring (OBM) system that can monitor the real-time emissions of the vehicle. This will, in turn, drive the growth of the OBM system market. For instance, many leading companies, including Continental AG (Germany), Borgwarner Inc (US), Siemens (Germany), and others, are developing various onboard diagnostic tools and sensors for emission monitoring and reduction.

According to MarketsandMarkets analysis, the global automotive tire market is projected to grow to USD 113.1 billion by 2025. The Euro 7 mandates the real driving emissions produced from these tires, including the tire and road wear particles (TRWP) created due to the friction between the tires and the road. To minimize these emissions from the tires, many leading tire makers are developing their products with various advanced materials that reduce overall tire emissions. For instance, since 2015, Michelin (France) has lowered around 5% of particle emissions from their tires. Furthermore, Michelin and its partners aim to achieve their objective of 100% sustainable materials by 2050.

Another mandated form of emission in the Euro 7 regulation is the braking system emission of vehicles. When the brake is applied, the frictional force produces heat, emitting small airborne particulate matter from the brake disc and pads. These particles are considered a form of emission, and many leading braking system manufacturers are developing less-emitting products. For instance, in 2020, Brembo (Italy) developed its Greentive brake disc with high-velocity-oxy-fuel (HVOF) technology to reduce the environmental impact by reducing CO2 emission. Similarly, the Euro 7 regulation is expected to drive the growth of emission reduction technologies, sensors, and other associated systems.

CHALLENGE: Additional parameters under Euro 7 regulations

The increasing number of emission reduction technologies, emission-free tires, braking systems, and other associated technologies for the Euro 7 regulations increase the overall vehicle cost and the periodic maintenance and operational costs. For instance, brake dust filters are expected to significantly reduce pollution caused by fine brake dust particles. These brake dust filters are installed primarily on trucks as trucks have bigger brake drums/discs and emit more particles during vehicle braking than other vehicle types. The filters need cleaning and replacing over the recommended intervals. Such operational costs have a more significant impact on the commercial vehicle segment. This is mainly because the initial and operational costs are crucial in transporting goods and commodities. Furthermore, commercial vehicles run relatively run more than passenger vehicles.

For these reasons, some commercial operators must change their fleets to electric vehicles. For instance, Girteka (Lithuania), one of the largest logistic companies in Europe, collaborated with Scania (Sweden) to deliver 600 battery electric vehicles within four years for sustainable transportation. However, this transition involves enormous investment and the need to be equipped with various other challenges, including rerouting according to the charging infrastructure, revision of their service charges, etc. For instance, according to the MarketsandMarkets Analysis, the global e-Commerce platform will grow at a CAGR of 12.8% from 2022 to 2027. A significant share of this e-commerce logistics is by road, which demands commercial vehicle usage. Therefore, companies with larger fleets of ICE vehicles will be affected because of the emission norms. Some small-scale commercial vehicle operators who cannot afford such investment will opt for pre-owned/refurbished ICE commercial vehicles. However, this will hamper the net-zero emission goals.

LCVs segment is projected to grow at the highest growth rate during the forecast period

The LCV production in Europe is expected to grow from 1,786.5 thousand units in 2026 to 1,881.5 million units by 2035 at a CAGR of 0.6% during the forecast period. According to European Commission, NOx emissions will be reduced by 35-56%; tailpipe particles will be reduced by 13% in passenger cars and vans and by 39% in the buses and trucks segment. In brakes and tires, the particles will be reduced by 27% in the LCV segment. The penetration of diesel in Europe is around 80-85% for the year 2022, and gasoline engines are expected to increase in the LCV segment. Hence, technologies such as SCR combined with EGR are used in the LCV segment to cater to NOx emissions. Thus, the OEMs and Tier-1 companies focus on developing powertrain and after-treatment technologies in LCVs.

Spain is the second largest market in the Euro 7 regulations complaint market

The Euro 7 regulations compliant market is expected to grow from 1.6 million units in 2026 to 1.8 million by 2035 at a CAGR of 0.8% from 2026 to 2035. Spain is the second largest SUV manufacturer in Europe after Germany. It has higher production of mid-size and full-size SUVs. With the growing demand for SUVs, the market for after-treatment devices used in SUVs is also increasing. Gasoline-based SUVs are the most demanding variants preferred by Spanish customers, with Peugeot 2008, Renault Captur, Volkswagen T-Cross, SEAT Arona, Citroen C3 Aircross, Ford Kuga, and Opel Crossland X top-selling SUV models. With the growing demand for gasoline-powered SUVs, the demand for lean NOx traps in SUVs is increasing.

Scope of the Report

|

Report Attribute |

Details |

|

Base year for estimation |

2026 |

|

Forecast period |

2026 - 2035 |

|

Market Growth forecast |

14,077.8 thousand units by 2035 at 0.4% CAGR |

|

Top Players |

Forvia (Germany), Tenneco Inc. (US), Eberspächer (Germany), Johnson Matthey (UK), and Umicore (Belgium) |

|

Segments covered |

|

|

By Vehicle Type |

Passenger cars, LCVs, trucks, and buses |

|

By Technology |

Diesel oxidation catalysts (DOCs), diesel particulate filters (DPFs), gasoline particulate filters (GPFs), selective catalytic reduction (SCR), ammonia slip catalysts, electrically heated catalyst, exhaust gas recirculation (EGR), and lean NOx traps |

|

By Sensors |

Exhaust gas pressure sensors, exhaust gas temperature sensors, particulate matter sensors, oxygen/lambda sensors, NOx sensors, engine coolant temperature sensors, MAP/MAF sensors |

The study categorizes the Euro 7 based on vehicle type, technology and sensors at regional and global levels.

By Vehicle Type

- Passenger Vehicles

- LCVs

- Trucks

- Buses

Technology

- Diesel Oxidation Catalysts (DOCs)

- Diesel Particulate Filters (DPFs)

- Gasoline Particulate Filters (GPFs)

- Selective Catalytic Reduction (SCR)

- Ammonia Slip Catalysts

- Electrically Heated Catalyst

- Exhaust Gas Recirculation (EGR)

- Lean NOx Traps

Sensors

- Exhaust gas pressure sensors

- Exhaust gas temperature sensors

- Particulate matter sensors

- Oxygen/lambda sensors

- NOx sensors

- Engine coolant temperature sensors

- MAP/MAF sensors

Key Market Players

The key players in the Euro 7 regulations compliant market are Eberspächer (Germany), FORVIA (Germany), Tenneco (US), and Johnson Matthey (UK). The key strategies adopted by major companies to sustain their position in the market are expansions, contracts and agreements, and partnerships.

Recent Developments

- In September 2022, Forvia showcased its heated doser in the IAA Transport exhibition held in Germany. The company claimed it could reduce NOx emission by 90% at low-temperature engines obeying all the norms of Euro 7 and EPA2027. It would be available for aftermarket architectures.

- In October 2022, Eberspächer and AAPICO (Thailand) signed a joint venture agreement named "JV company Purem AAPICO Co., Ltd." to manufacture exhaust system control systems and components used in commercial and passenger car segments sold in Thailand and ASEAN markets. Eberspächer will have 51% of the holding in the joint venture.

- In January 2022, Forvia (formerly Faurecia) acquired Hella (Germany) to expand its lighting and sensor product portfolio. Both companies will sell their products in their respective brands but will communicate under the new brand, Forvia.

- In April 2022, Johnson Matthey invested USD 54.24 million to build a new plant in Poland to manufacture small batches of spare parts of catalyst products for the automotive sector, which will help reduce the harmful emission more efficiently. This project will take 18 months to complete.

Frequently Asked Questions (FAQ):

What is the actual date of implementation of Euro 7 in Europan countries?

The actual year of Euro 7 implementation for cars and vans is 2025 and for buses and lorries it is 2027 as per European Union.

What is the impact of Euro 7 on electric and hybrid vehicles?

For the first time, under Euro norms, electric and hybrid vehicles have been included. Euro 7 set standards for battery durability, as well as establishing limits on non-exhaust emissions, such as particle emissions from brakes and microplastic emissions tyres.

What is the impact of Euro 7 on adjacent markets such as lubricants and fuels market?

Enhanced fuel economy will be required without any compromise of the protection of complex engines and aftertreatment devices, and this will require higher performance fuel and lubricant technology in Euro 7 complaint vehicles. Engine oils have always played a key role in enabling clean, efficient engine operation and this role will increase in importance with the arrival of Euro 7.

What is the cost of increment of Euro 7 technologies in passenger cars & heavy duty vehicles?

The cost of vehicle is going to increase with the upcoming Euro 7 regulations, as to achieve the emission targets huge R&D cost will incur, advancements of the existing Euro 6 technologies will require additional cost. On an avarage, for passenger car the additional cost is upto USD 300-320 per car and for heavy duty vehicles it is upto USD 2,860-3,000 per vehicle

Many companies are operating in the market space across the globe. Do you know who are the front manufacturers of the aftertreatment devices ?

The market is dominated by Eberspächer (Germany), FORVIA (Germany), Tenneco (US), and Johnson Matthey (UK). The key strategies adopted by major companies to sustain their position in the market are expansions, contracts and agreements, and partnerships.

To know about the assumptions considered for the study, download the pdf brochure

- 5.1 VOLKSWAGEN AG

- 5.2 STELLANTIS

- 5.3 RENAULT

- 5.4 HYUNDAI

- 5.5 MERCEDES - BENZ

- 5.6 BMW

- 5.7 NISSAN

- 5.8 VOLVO

- 5.9 JAGUAR LAND ROVER (JLR)

- 5.10 PEUGEOT

- 5.11 FORD

-

6.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS

- 6.2 PASSENGER CARS

- 6.3 LIGHT COMMERCIAL VEHICLES (LCVS)

- 6.4 TRUCKS

- 6.5 BUSES

-

7.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS

- 7.2 DIESEL OXIDATION CATALYSTS

- 7.3 DIESEL/GASOLINE PARTICULATE FILTERS

- 7.4 SELECTIVE CATALYTIC REDUCTION

- 7.5 AMMONIA SLIP CATALYSTS

- 7.6 ELECTRICALLY HEATED CATALYSTS

- 7.7 EXHAUST GAS RECIRCULATION SYSTEMS

- 7.8 LEAN NOX TRAPS

- 8.1 INTRODUCTION

-

8.2 RESEARCH METHODOLOGYASSUMPTIONS

- 8.3 EXHAUST GAS PRESSURE SENSORS

- 8.4 EXHAUST GAS TEMPERATURE SENSORS

- 8.5 PARTICULATE MATTER SENSORS

- 8.6 OXYGEN/LAMBDA SENSORS

- 8.7 NOX SENSORS

- 8.8 ENGINE COOLANT TEMPERATURE SENSORS

- 8.9 MAP/MAF SENSORS

- 9.1 OVERVIEW

- 9.2 EURO 7 MARKET RANKING ANALYSIS, 2021

-

9.3 COMPANY EVALUATION QUADRANT (AFTERTREATMENT DEVICE SUPPLIERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.4 COMPETITIVE SCENARIOPRODUCT LAUNCHESPRODUCT LAUNCHES, 2019–2022DEALSEXPANSIONS, 2019–2022RIGHT TO WIN

- 9.5 COMPETITIVE BENCHMARKING

- 10.1 KEY PLAYERS

-

10.2 AFTERTREATMENT DEVICE MANUFACTURERSEBERSPÄCHER- Business overview- Products offered- Recent developments- MnM viewFORVIA- Business overview- Products offered- Recent developments- MnM viewTENNECO INC.- Business overview- Products offered- Recent developmentsJOHNSON MATTHEY- Business overview- Products offeredUMICORE- Business overview- Products offered

-

10.3 TECHNOLOGY SUPPLIERS/SENSORS MANUFACTURERSROBERT BOSCH GMBH- Business overview- Products offered- Recent developments- MnM ViewSIEMENS- Business overview- Products offered- Recent developments- MnM ViewBORGWARNER INC.- Business overview- Products offered- Recent developments- MnM viewCONTINENTAL AG- Business overview- Products offered- Recent developmentsDENSO- Business overview- Products offered- Recent developmentsSNAP-ON- Business overview- Products offered- Recent developmentsSENSATA TECHNOLOGIES- Business overview- Products offered- Recent developments- Recent developments

-

10.4 SOFTWARE PROVIDERSKPITCRYPTON TECHNOLOGYAVLHORIBAAPPLIED SYSTEMS LTD.

- 11.1 INSIGHTS OF INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 TIMELINE OF EURO REGULATIONS FOR HEAVY-DUTY ENGINES AND PASSENGER VEHICLES

- TABLE 2 HISTORIC OVERVIEW OF ON-ROAD VEHICLE EMISSION REGULATIONS FOR PASSENGER CARS, 2016–2021

- TABLE 3 POLLUTANT LIMIT REDUCTION FROM EURO 3 TO 6

- TABLE 4 EMISSION REGULATION OUTLOOK OF CHINA, 2021–2023

- TABLE 5 POLLUTANT LIMIT REDUCTION FROM CHINA 3 TO 6B

- TABLE 6 PASSENGER CAR AND LCV CO EMISSIONS IN JAPAN

- TABLE 7 BS6 CO EMISSIONS IN INDIA, 2020

- TABLE 8 POLLUTANT LIMIT REDUCTION FROM BS IV TO VI

- TABLE 9 PASSENGER CAR AND LCV CO EMISSIONS IN US, 2022–2026

- TABLE 10 POLLUTANT LIMITS REDUCTION FROM TIER 2 TO 3

- TABLE 11 PROPOSED EURO 7 EMISSION LIMITS FOR CATEGORY M1 AND N2 VEHICLES WITH ICE

- TABLE 12 PROPOSED CONDITIONS FOR REAL DRIVING EMISSIONS TESTING: CATEGORY M1 AND N1 VEHICLES

- TABLE 13 COST OF EURO 7 EMISSION REDUCTION TECHNOLOGIES FOR HEAVY-DUTY VEHICLES, 2021 VS. 2025 VS. 2030 (EUR)

- TABLE 14 COST OF EURO 7 EMISSION REDUCTION SYSTEMS FOR HEAVY- DUTY VEHICLES (EUR)

- TABLE 15 WHO SUPPLIES WHOM, GASOLINE PARTICULATE FILTERS

- TABLE 16 WHO SUPPLIES WHOM, DIESEL PARTICULATE FILTERS

- TABLE 17 WHO SUPPLIES WHOM, SELECTIVE CATALYTIC REDUCTION

- TABLE 18 WHO SUPPLIES WHOM, DIESEL OXIDATION CATALYSTS

- TABLE 19 WHO SUPPLIES WHOM, OXYGEN SENSORS

- TABLE 20 WHO SUPPLIES WHOM, PRESSURE SENSORS

- TABLE 21 WHO SUPPLIES WHOM, TEMPERATURE SENSORS

- TABLE 22 MERCEDES BENZ VEHICLE MODELS THAT COMPLY WITH EURO 6D STANDARDS

- TABLE 23 EURO 7: VEHICLE COST INCREMENT IN COMPARISON WITH EURO 6

- TABLE 24 EURO 7 COMPLIANT VEHICLES MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 25 EURO 7 COMPLIANT PASSENGER CARS MARKET, BY COUNTRY, 2026–2035 (THOUSAND UNITS)

- TABLE 26 EURO 7 COMPLIANT LIGHT COMMERCIAL VEHICLES MARKET, BY COUNTRY, 2026–2035 (THOUSAND UNITS)

- TABLE 27 EURO 7 COMPLIANT TRUCKS MARKET, BY COUNTRY, 2026–2035 (THOUSAND UNITS)

- TABLE 28 EURO 7 COMPLIANT BUSES MARKET, BY COUNTRY, 2026–2035 (THOUSAND UNITS)

- TABLE 29 POLLUTANT LIMIT REDUCTION UNDER EURO 6 & PROPOSED EURO 7 REGULATIONS

- TABLE 30 ASP ANALYSIS, BY TECHNOLOGY, 2021 VS. 2030 (USD)

- TABLE 31 DIESEL OXIDATION CATALYST MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 32 DIESEL PARTICULATE FILTER MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 33 GASOLINE PARTICULATE FILTER MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 34 SELECTIVE CATALYTIC REDUCTION MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 35 AMMONIA SLIP CATALYST MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 36 ELECTRICALLY HEATED CATALYST MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 37 EXHAUST GAS RECIRCULATION SYSTEM MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 38 LEAN NOX TRAP MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 39 EURO 7 COMPLIANT EMISSION SENSORS MARKET, BY SENSOR TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 40 ASP ANALYSIS, BY SENSORS, 2021 (USD)

- TABLE 41 EXHAUST GAS PRESSURE SENSORS MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 42 EXHAUST GAS TEMPERATURE SENSORS MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 43 PARTICULATE MATTER SENSORS MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 44 OXYGEN/LAMBDA SENSORS MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 45 NOX SENSORS MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 46 ENGINE COOLANT TEMPERATURE SENSORS MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 47 MAP/MAF SENSORS MARKET, BY VEHICLE TYPE, 2026–2035 (THOUSAND UNITS)

- TABLE 48 EURO 7 MARKET: PRODUCT LAUNCHES, APRIL 2019–SEPTEMBER 2022

- TABLE 49 EURO 7 MARKET: DEALS, MARCH 2019–OCTOBER 2022

- TABLE 50 EURO 7 MARKET: EXPANSIONS, JANUARY 2020–APRIL 2022

- TABLE 51 COMPANIES ADOPTED PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2019–2022

- TABLE 52 AFTERTREATMENT DEVICE MANUFACTURERS: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 53 COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY APPLICATION AND REGION

- TABLE 54 EBERSPÄCHER: BUSINESS OVERVIEW

- TABLE 55 EBERSPÄCHER: PRODUCTS OFFERED

- TABLE 56 EBERSPÄCHER: PRODUCT DEVELOPMENTS

- TABLE 57 EBERSPÄCHER: DEALS

- TABLE 58 EBERSPÄCHER: OTHER DEVELOPMENTS

- TABLE 59 FORVIA: BUSINESS OVERVIEW

- TABLE 60 FORVIA: PRODUCTS OFFERED

- TABLE 61 FORVIA: PRODUCT DEVELOPMENTS

- TABLE 62 FORVIA: DEALS

- TABLE 63 FORVIA: OTHER DEVELOPMENTS

- TABLE 64 TENNECO INC.: BUSINESS OVERVIEW

- TABLE 65 TENNECO INC.: PRODUCT DEVELOPMENTS

- TABLE 66 TENNECO INC.: DEALS

- TABLE 67 TENNECO INC.: OTHER DEVELOPMENTS

- TABLE 68 JOHNSON MATTHEY: BUSINESS OVERVIEW

- TABLE 69 JOHNSON MATTHEY: PRODUCTS OFFERED

- TABLE 70 JOHNSON MATTHEY: OTHER DEVELOPMENTS

- TABLE 71 UMICORE: BUSINESS OVERVIEW

- TABLE 72 UMICORE: PRODUCTS OFFERED

- TABLE 73 UMICORE: DEALS

- TABLE 74 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- TABLE 75 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 76 ROBERT BOSCH GMBH: PRODUCT DEVELOPMENTS

- TABLE 77 ROBERT BOSCH GMBH: DEALS

- TABLE 78 ROBERT BOSCH GMBH: OTHER DEVELOPMENTS

- TABLE 79 SIEMENS: BUSINESS OVERVIEW

- TABLE 80 SIEMENS: PRODUCTS OFFERED

- TABLE 81 SIEMENS: PRODUCT DEVELOPMENTS

- TABLE 82 SIEMENS: DEALS

- TABLE 83 BORGWARNER INC.: BUSINESS OVERVIEW

- TABLE 84 BORGWARNER INC.: PRODUCTS OFFERED

- TABLE 85 BORGWARNER INC.: DEALS

- TABLE 86 BORGWARNER INC.: OTHER DEVELOPMENTS

- TABLE 87 CONTINENTAL AG: BUSINESS OVERVIEW

- TABLE 88 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 89 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- TABLE 90 CONTINENTAL AG: DEALS

- TABLE 91 DENSO: BUSINESS OVERVIEW

- TABLE 92 DENSO: PRODUCTS OFFERED

- TABLE 93 DENSO: PRODUCT DEVELOPMENTS

- TABLE 94 DENSO: DEALS

- TABLE 95 DENSO: OTHER DEVELOPMENTS

- TABLE 96 SNAP-ON: BUSINESS OVERVIEW

- TABLE 97 SNAP-ON: PRODUCTS OFFERED

- TABLE 98 SNAP-ON: PRODUCT DEVELOPMENTS

- TABLE 99 SNAP-ON: DEALS

- TABLE 100 SNAP-ON: OTHER DEVELOPMENTS

- TABLE 101 SENSATA TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 102 SENSATA TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 103 SENSATA TECHNOLOGIES: PRODUCT DEVELOPMENTS

- TABLE 104 SENSATA TECHNOLOGIES: DEALS

- TABLE 105 KPIT: COMPANY OVERVIEW

- TABLE 106 CRYPTON TECHNOLOGY: COMPANY OVERVIEW

- TABLE 107 AVL: COMPANY OVERVIEW

- TABLE 108 HORIBA: COMPANY OVERVIEW

- TABLE 109 APPLIED SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 1 EURO 7 MARKET SEGMENTATION

- FIGURE 2 RESEARCH METHODOLOGY MODEL

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 RESEARCH DESIGN AND METHODOLOGY

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 ROADMAP OF KEY POWERTRAIN TECHNOLOGIES

- FIGURE 9 CARBON REDUCTION PATHWAY OF PARIS CLIMATE AGREEMENT

- FIGURE 10 COUNTRY-WISE ELECTRIFICATION TARGETS, 2025–2050

- FIGURE 11 PASSENGER CARS: EURO 6 VS EURO 7 NOX & PM EMISSION REDUCTION

- FIGURE 12 HEAVY-DUTY VEHICLES: EURO 6 VS EURO 7 NOX & PM EMISSION REDUCTION

- FIGURE 13 EURO 7 COMPLIANT VEHICLES MARKET, BY VEHICLE TYPE (THOUSAND UNITS)

- FIGURE 14 AFTERTREATMENT TECHNOLOGY MARKET, 2026 VS. 2035 (THOUSAND UNITS)

- FIGURE 15 DIESEL OXIDATION CATALYST TECHNOLOGY MARKET INSIGHTS

- FIGURE 16 DIESEL/GASOLINE PARTICULATE FILTER TECHNOLOGY MARKET INSIGHTS

- FIGURE 17 SELECTIVE CATALYTIC REDUCTION TECHNOLOGY MARKET INSIGHTS

- FIGURE 18 AMMONIA SLIP CATALYST TECHNOLOGY MARKET INSIGHTS

- FIGURE 19 ELECTRICALLY HEATED CATALYST MARKET INSIGHTS

- FIGURE 20 EXHAUST GAS RECIRCULATION SYSTEM MARKET INSIGHTS

- FIGURE 21 LEAN NOX TRAP MARKET INSIGHTS

- FIGURE 22 EURO 7 COMPLIANT EMISSION SENSORS MARKET, BY SENSOR TYPE (THOUSAND UNITS)

- FIGURE 23 EURO 7 MARKET RANKING ANALYSIS, 2021

- FIGURE 24 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS (AFTERTREATMENT DEVICE SUPPLIERS), 2021

- FIGURE 25 COMPETITIVE EVALUATION MATRIX (AFTERTREATMENT DEVICE SUPPLIERS), 2021

- FIGURE 26 COMPETITIVE EVALUATION MATRIX (CATALYTIC CONVERTER SUPPLIERS), 2021

- FIGURE 27 COMPANIES ADOPTED PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019–2022

- FIGURE 28 EBERSPÄCHER: COMPANY SNAPSHOT

- FIGURE 29 FORVIA: COMPANY SNAPSHOT

- FIGURE 30 TENNECO INC.: COMPANY SNAPSHOT

- FIGURE 31 JOHNSON MATTHEY: COMPANY SNAPSHOT

- FIGURE 32 UMICORE: COMPANY SNAPSHOT

- FIGURE 33 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 34 SIEMENS: COMPANY SNAPSHOT

- FIGURE 35 BORGWARNER INC.: COMPANY SNAPSHOT

- FIGURE 36 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 37 DENSO: COMPANY SNAPSHOT

- FIGURE 38 SNAP-ON: COMPANY SNAPSHOT

- FIGURE 39 SENSATA TECHNOLOGY: COMPANY SNAPSHOT

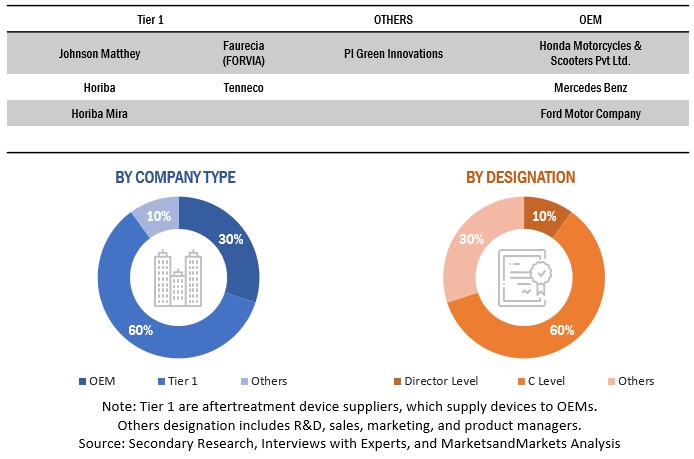

The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, automotive powertrain magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the Euro 7 regulations. Primary sources—experts from related industries, after treatment devices suppliers, technology suppliers, sensor manufacturers and software providers—were interviewed to obtain and verify critical information, as well as to assess the growth prospects and Euro 7 regulations compliant market estimations.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall Euro 7 regulations compliant market size, which was further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the Euro 7 regulations compliant market. Primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors of business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as Euro 7 regulations compliant market and market forecast, future technology trends, and upcoming technologies. Data triangulation of all these points was done with the information gathered from secondary research and company revenues. Stakeholders from the demand and supply sides were interviewed to understand their views on the aforementioned points.

Primary interviews were conducted with market experts from both the demand (OEM) and supply-side players across major regions including Europe, and the Asia Pacific. Approximately 30% and 70% of primary interviews were conducted with the demand and supply sides. The primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales and operations, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the opinions of the in-house subject matter experts, has led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

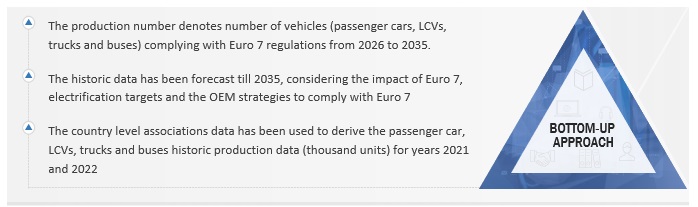

Bottom-Up Approach: Euro 7 Regulations Compliant Market

The bottom-up approach has been used to estimate and validate the size of the vehicles complying with Euro 7 regulations. The Euro 7 regulations compliant market size, by volume, by vehicle type – passenger cars, light commercial vehicles, and heavy commercial vehicles has been derived by identifying the demand for vehicles and electrification targets across the countries. The vehicles produced and complied with Euro 7 regulations from 2026 to 2035 have been forecasted based on electrification targets across the countries and technological adoption across the OEMs verified through industry experts.

In terms of volume, this country-level market size for each vehicle type. The summation of the country-level market gives the regional market, and a further overview of the regional market provides the market for vehicles complying with Euro 7 regulations.

While estimating the regional segmentation of the aftertreatment technologies, the regional shares of these technologies have been identified and applied to the regional market size in terms of volume. To calculate the demand for technologies, the factors such as NOx emission limits, PM limits, and other factors have been considered. Additionally, we have considered an increase in electric vehicle sales over ICE vehicles and the impact of the same on Euro 7 technologies. The same has been verified with industry experts.

To know about the assumptions considered for the study, Request for Free Sample Report

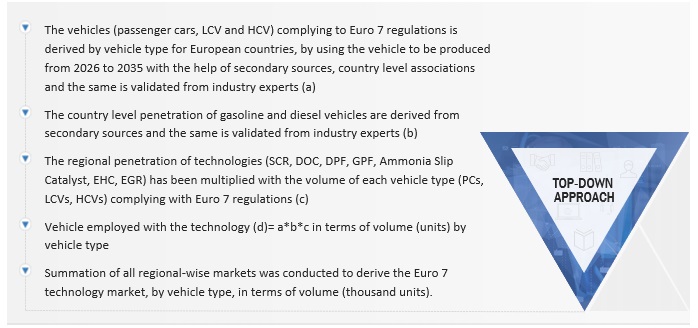

Top-Down Approach – Euro 7 Regulations Compliant Market

The top-down approach has been used to derive the technology segment. The penetrations of technologies adopted across the vehicle segments have been derived by studying the particulate limits such as NOx, PM emission limits, technological developments, development cost, and other factors. Industry experts have verified the same at the regional level.

All percentage shares, splits, and breakdowns have been determined using secondary paid and unpaid sources and verified through primary research. All parameters that affect the Euro 7 regulations compliant market covered in this research study have been accounted for, reviewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the Euro 7 regulations compliant markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and forecast the Euro 7 regulations compliant market in terms and volume (thousand units) based on the following segments:

- By vehicle type (passenger cars, LCVs, trucks, and buses)

- By technology (diesel oxidation catalysts (DOCs), diesel particulate filters (DPFs), gasoline particulate filters (GPFs), selective catalytic reduction (SCR), ammonia slip catalysts, electrically heated catalyst, exhaust gas recirculation (EGR), and lean NOx traps).

- By sensors (exhaust gas pressure sensors, exhaust gas temperature sensors, particulate matter sensors, oxygen/lambda sensors, NOx sensors, engine coolant temperature sensors, MAP/MAF sensors)

- To provide detailed information regarding the major factors influencing the growth of the market

- To strategically analyze the market with value chain analysis, revenue analysis, cost of implementation of emission control technologies in Euro 7, and regulatory analysis

- To evaluate the market share of leading after treatment device manufacturers and study competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue

- To examine the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide an analysis of recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the market

- In-depth analysis of the responses of OEM to Euro 7 and their developments to comply with the Euro 7 regulations

- Detailed company profiles of aftertreatment device manufacturers, technology and sensor suppliers, and software providers

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Euro 7 Regulations Compliant Market