Environmental Test Chambers Market by Type (Temperature and Humidity Chambers, Customized Chambers, Thermal Shock Chambers), Industry (Aerospace and Defense, Automotive, Telecommunications and Electronics), and Geography - Global Forecast to 2025-2036

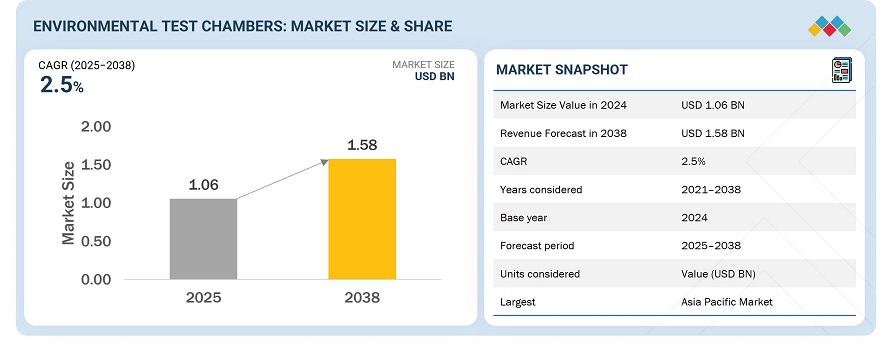

The global environmental test chambers market was valued at USD 1.10 billion in 2025 and is estimated to reach USD 1.58 billion by 2036, at a CAGR of 2.5% between 2025 and 2036.

The environmental test chamber market is witnessing strong growth driven by the rising demand for product reliability testing and regulatory compliance across industries such as automotive, aerospace, electronics, and pharmaceuticals. Additionally, the integration of IoT, automation, and AI is creating new opportunities by enabling real-time monitoring, data analysis, and predictive maintenance. Moreover, stringent government standards, rapid technological innovation, and the growth of sectors such as EV batteries and semiconductors are further fueling market expansion.

The rising stringency of regulatory frameworks in industries such as aerospace, defense, and automotive, combined with increased emphasis on product reliability testing, is driving steady growth in the environmental testing chambers market. These chambers also referred to as climatic or environmental test rooms simulate real-world conditions, including temperature, humidity, vibration, altitude, and light to evaluate product performance and material durability. Further, growing R&D investments and the need to ensure compliance with evolving global quality standards are reinforcing market expansion.

Market by Type

Temperature and Humidity Chambers

The card-based reader segment holds the largest share of the global environmental test chambers market, due to the dependence of various industries such as aerospace and defense, automotive, and electronics and telecommunications. A temperature and humidity chamber is essential for evaluating the potential success or failure of a product in the field. The chambers are available in various styles, sizes, and performance configurations. Various models of temperature and humidity chambers offered by manufacturers mainly include floor, benchtop, rack and stack, and walk-in chambers.

Thermal shock chambers

Thermal shock chambers grow at highest CAGR due to the rising miniaturization of electronic components, which increases their sensitivity to temperature variations, thereby driving the need for precise thermal testing. Thermal shock chambers are used for exposing products to a thermal shock test. These chambers perform environmental stress screening of components and board electronic assemblies. These chambers are largely used to study the impact of a rapid change of temperature on the test products. Such rapid change in temperature causes various effects such as cracking of the material, mechanical failures, and permanent change in electrical performance. It is thus important to study and analyze such failures to design a better product that can endure such changing environmental conditions. They are used in various applications in the aerospace and defense, automotive, and telecommunications and electronics sectors.

Market by Industry

Aerospace & Defense

The aerospace & defense industry is the largest adopter of environmental test chambers. The chambers ensure safety and security by testing various components, subsystems, and systems (such as tracking systems, communication systems, and detection systems) that are used under harsh conditions in this sector. The environmental test chambers employed in the aerospace and defense applications provide precise conditions that simulate airborne operations, and include altitude chambers, humidity chambers, low-temperature chambers, walk-in chambers, and others. With the emergence of new technologies in commercial and military applications, performance and testing are becoming critical to determine compliance to standards and specifications.

Automotive

In the automotive industry, growing production of automobiles across countries is likely to raise the demand for testing capabilities for a variety of components, including seat belts, electronics, airbags, engines, lithium-ion batteries, and so on. Testing of automotive components and automobiles is carried out in testing laboratories and manufacturing centers to help manufacturers improve the marketability of their products and reduce costs in the preproduction phase. Thus, the automotive industry is likely to witness increasing demand for environmental test chambers during the forecast period.

Market by Geography

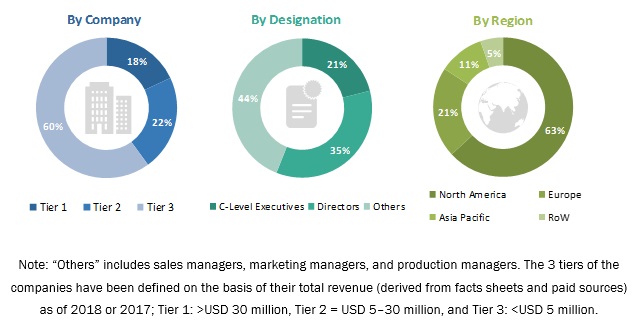

Geographically, the environmental test chambers market is experiencing widespread adoption across North America, Europe, Asia Pacific, and RoW. Asia Pacific is expected to contribute the highest to the environmental test chambers market during the forecast period. China is expected to be a major contributor to the environmental test chambers market in Asia Pacific. Furthermore, the governments of different countries are encouraging investments by private players in the technology sector, which would lead to an increased number of players engaged in the testing ecosystem.

Market Dynamics

Driver: Increase in number of regulations in industries such as aerospace and defense, and automotive

Environmental test chambers are used to ensure that the manufactured products or components meet the specific requirements. Governments across regions strive to enhance the quality and standards of products manufactured on their shores through the implementation of market-oriented measures and the adoption of a wider range of global standards to ensure that their products gain access to the overseas markets, especially in developed countries that impose stringent regulations on imported goods. For instance, the US alone mandates the compliance of consumer goods, retail, and electronics industries with standards set by bodies such as the American Association of Textile Chemists and Colorist (AATCC), ASTM International, National Institute of Standards and Technology (NIST), Consumer Product Safety Commission (CPSC) (including to new CPSIA regulations), among others.

Restraint: Shorter product life cycle and fast-changing testing requirements

Rapidly changing technologies and fluctuating customer requirements are resulting in shorter product lifecycles, which, in turn, compel organizations to shorten product development cycle times. Shorter lifecycles make forecasting much more difficult for both manufacturers and resellers. Further, with the expected increase in pressure to bring out new and better products, continuously changing testing requirements, as well as standardization, will act as a restraining factor for the environmental test chambers market during the forecast period.

Opportunity: Increasing innovations in connectivity and smart technologies

With the tremendous surge in Internet penetration in the past decade, the growth of connected and smart technologies is expected to increase, since the world is becoming connected. The emergence of the Internet of Things (IoT) and smart applications is among the important enablers of the overall growth. Almost one-third of the global population now uses the Internet at high bandwidths. loT involves expensive connected devices that are critical in the automobile, aerospace and defense, and telecommunications industries as they facilitate better connectivity between plants and operators to control the major functionalities within the plants. They also present significant opportunities for environmental test chamber companies due to their specific and strict requirements of accuracy, reliability, latency, and availability. The increasing investment by enterprises in smart cities, connected cars, and process automation in manufacturing companies is likely to create an opportunity for the studied market.

Challenge: High Costs and Regulatory Demands Limit Adoption

The high initial investment and maintenance costs remain key barriers to wider adoption of environmental test chambers, confining their use primarily to large enterprises and limiting accessibility for small and medium-sized manufacturers. Frequent technological upgrades and calibration requirements further escalate operational expenses and complicate long-term budgeting. Moreover, stringent regulatory compliance and testing standards increase system complexity and lengthen deployment timelines.

The market also faces challenges from the limited availability of advanced testing solutions and the presence of alternative testing methods, which together hinder broader market penetration. As a result, despite the growing need for precise and reliable environmental testing across industries, overall market growth remains gradual and cost-sensitive.

Future Outlook

Between 2025 and 2036, the environmental test chambers market is expected to grow rapidly as due to the increasing expansion of electric vehicle (EV) production, where battery modules and power electronics undergo rigorous thermal shock testing to ensure safety and durability. In addition, increasing R&D investments in material science and aerospace component testing necessitate chambers capable of simulating extreme thermal environments.

Key Market Players

Top Environmental test chambers companies are ESPEC (Japan), Thermotron Industries (US), Weiss Technik UK (Germany), Binder GmBHv (Germany), Climats (France).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Lucrative Opportunities in Environmental Test Chambers Market

4.2 Market, By Type

4.3 Market, By Industry

4.4 Market, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Number of Regulations in Industries Such as Aerospace and Defense, and Automotive

5.2.1.2 Increasing Requirement of Monitoring Effects of Various Stress Factors

5.2.1.3 Supportive Government Initiatives

5.2.2 Restraints

5.2.2.1 Shorter Product Life Cycle and Fast-Changing Testing Requirements

5.2.3 Opportunities

5.2.3.1 Increasing Innovations in Connectivity and Smart Technologies

5.2.4 Challenges

5.2.4.1 High Development Cost Associated With Environmental Test Chambers

6 Environmental Test Chambers Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Temperature and Humidity Chambers

6.2.1 Demand for Temperature and Humidity Chambers is Increasing Due to Growing Production Within High-End Industries

6.3 Customized Chambers

6.3.1 Growing Number of Electronic Components in High-End Industries Likely to Drive Demand for Customized Chambers

6.4 Thermal Shock Chambers

6.4.1 Aerospace and Defense, Automotive, and Telecommunications and Electronics Sectors are Among Major Industries Utilizing Thermal Shock Chambers

6.5 Other Chambers

6.5.1 Agree Chambers Offer Rapid Temperature Change Rates, Thereby Reducing Product Development Time and Improving Product Reliability

7 Environmental Test Chambers Market, By Industry (Page No. - 43)

7.1 Introduction

7.2 Aerospace and Defense

7.2.1 Environmental Test Chambers Employed in Aerospace and Defense Applications Provide Precise Simulation of Airborne Operations

7.3 Automotive

7.3.1 Vehicles Need to Be Tested for Higher System Environmental Temperatures Due to Challenges With Thermal Characteristics, Product Quality, and Reliability

7.4 Telecommunications and Electronics

7.4.1 Test Chambers for Telecommunications Industry are Designed to Ensure Compliance of Products With Variety of Test Specifications

7.5 Medical and Pharmaceuticals

7.5.1 Stability Testing Plays Significant Role in Advancement of Pharmaceuticals Through Drug Development Pipeline

7.6 Other Industries

7.6.1 Other Industries in APAC to Witness Maximum Demand for Environmental Test Chambers

8 Geographic Analysis (Page No. - 62)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 US Holds Largest Share of Environmental Test Chambers Market in North America

8.2.2 Canada

8.2.2.1 Sound Automotive and Telecom Sector Supporting Growth of Canadian Market

8.2.3 Mexico

8.2.3.1 Mexico is Among Top Ten Automobile Producing Countries Worldwide

8.3 Europe

8.3.1 Germany

8.3.1.1 Germany is Known for Smart Cities Such as Berlin, Munich, and Manheim With Well-Developed Mobility and Communication Network

8.3.2 UK

8.3.2.1 UK is Home to Major Conference Centers and Venues That Function as Invaluable Hub for Businesses of All Kinds

8.3.3 France

8.3.3.1 Significant Focus of French Aerospace and Defense Industry on Research and Development

8.3.4 Italy

8.3.4.1 Automotive Industry to Witness Maximum CAGR in Italian Environmental Test Chambers Market

8.3.5 Russia

8.3.5.1 Russia Country Ranks 11th Among the World’s Largest Economies By Nominal Gross Domestic Product (GDP)

8.3.6 Spain

8.3.6.1 Spain Shows Consolidated Performance in Digital Transformation

8.3.7 Turkey

8.3.7.1 Construction Sector is Key Contributor to Economic Growth of Turkey

8.3.8 Netherlands

8.3.8.1 The Netherlands Hosts Favorable Conditions for Business and Investments

8.3.9 Rest of Europe

8.3.9.1 Countries Such as Belgium, Poland, and Sweden to Be Major Contributors to Market in Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 China has High Demand for Testing Products Efficiently as It is Prominent Exporter of Most of Its Industrial Offerings

8.4.2 Japan

8.4.2.1 Japan Ranks Among Top 10 Vehicle Producing Countries in World

8.4.3 India

8.4.3.1 Increasing R&D Investments in Technology-Oriented Products Likely to Provide Growth Opportunities for Environmental Test Chambers Market in India

8.4.4 South Korea

8.4.4.1 Electronics and Automotive Industries are Main Contributors to South Korean Economy

8.4.5 Australia

8.4.5.1 Increasing Focus on Aerospace and Defense Likely to Drive Environmental Test Chambers Market in Australia

8.4.6 Indonesia

8.4.6.1 Expanding Market Opportunities Across Major Industries Likely to Drive Environmental Test Chambers Market in Indonesia

8.4.7 Singapore

8.4.7.1 Supportive Government Initiatives to Drive Market in Singapore

8.4.8 Thailand

8.4.8.1 Thailand is Among Major Exporting Countries in World

8.4.9 Rest of APAC (RoAPAC)

8.4.9.1 Vietnam, Taiwan, and Hong Kong to Play Major Role in Market in Rest of APAC

8.5 Rest of the World (RoW)

8.5.1 South America

8.5.1.1 Brazil and Argentina are Major Contributors to Growth of Market in South America

8.5.2 Central America

8.5.2.1 Costa Rica and Panama are Among Major Countries Contributing to Growth of Environmental Test Chambers Market in Central America

8.5.3 Middle East and Africa (MEA)

8.5.3.1 UAE and Saudi Arabia are Among Major Countries Contributing to Market Growth in the Middle East and Africa

9 Competitive Landscape (Page No. - 90)

9.1 Overview

9.2 Key Players in Environmental Test Chambers Market

9.3 Competitive Leadership Mapping, 2018

9.3.1 Visionary Leaders

9.3.2 Dynamic Differentiators

9.3.3 Innovators

9.3.4 Emerging Companies

9.4 Strength of Product Portfolio

9.5 Business Strategy Excellence

9.6 Competitive Situations and Trends

9.6.1 Product Launches

9.6.2 Mergers and Acquisitions

9.6.3 Partnerships and Collaborations

9.6.4 Expansions

10 Company Profiles (Page No. - 99)

10.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.2 Key Players

10.2.1 ESPEC

10.2.2 Thermotron Industries

10.2.3 Binder GmbH

10.2.4 Weiss Technik UK

10.2.5 Cincinnati Sub-Zero Products, Inc.

10.2.6 Angelantoni Test Technologies S.R.L.

10.2.7 Memmert GmbH + Co. Kg

10.2.8 Climats

10.2.9 Russells Technical Products

10.2.10 Thermal Product Solutions

10.2.11 Climatic Testing Systems, Inc.

10.2.12 Hastest Solutions Inc.

10.2.13 Hanse Environmental Inc.

10.2.14 CM Envirosystems Pvt. Ltd.

10.2.15 Envsin Instrument Equipment Co. Ltd

10.3 Other Companies

10.3.1 Scientific Climate Systems

10.3.2 Presto Group

10.3.3 Bahnson Environmental Specialties, LLC

10.3.4 Eckel Noise Control Technologies

10.3.5 Konrad Technologies GmbH

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 131)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (66 Tables)

Table 1 Assumptions for Study

Table 2 Limitations of Study

Table 3 Environmental Test Chambers Market, By Type, 2016–2024 (USD Million)

Table 4 Market, By Industry, 2016–2024 (USD Million)

Table 5 Market for Aerospace and Defense, By Region, 2016–2024 (USD Thousand)

Table 6 Market for Aerospace and Defense in North America, By Country, 2016–2024 (USD Thousand)

Table 7 Market for Aerospace and Defense in Europe, By Country, 2016–2024 (USD Thousand)

Table 8 Market for Aerospace and Defense in APAC, By Country, 2016–2024 (USD Thousand)

Table 9 Market for Aerospace and Defense in RoW, By Region, 2016–2024 (USD Thousand)

Table 10 Market for Automotive, By Region, 2016–2024 (USD Thousand)

Table 11 Market for Automotive in North America, By Country, 2016–2024 (USD Thousand)

Table 12 Market for Automotive in Europe, By Country, 2016–2024 (USD Thousand)

Table 13 Market for Automotive in APAC, By Country, 2016–2024 (USD Thousand)

Table 14 Market for Automotive in RoW, By Region, 2016–2024 (USD Thousand)

Table 15 Market for Telecommunications and Electronics, By Region, 2016–2024 (USD Thousand)

Table 16 Market for Telecommunications and Electronics in North America, By Country, 2016–2024 (USD Thousand)

Table 17 Market for Telecommunications and Electronics in Europe, By Country, 2016–2024 (USD Thousand)

Table 18 Market for Telecommunications and Electronics in APAC, By Country, 2016–2024 (USD Thousand)

Table 19 Market for Telecommunications and Electronics in RoW, By Region, 2016–2024 (USD Thousand)

Table 20 Market for Medical and Pharmaceutical, By Region, 2016–2024 (USD Thousand)

Table 21 Market for Medical and Pharmaceutical in North America, By Country, 2016–2024 (USD Thousand)

Table 22 Market for Medical and Pharmaceutical in Europe, By Country, 2016–2024 (USD Thousand)

Table 23 Market for Medical and Pharmaceutical in APAC, By Country, 2016–2024 (USD Thousand)

Table 24 Market for Medical and Pharmaceutical in RoW, By Region, 2016–2024 (USD Thousand)

Table 25 Market for Other Industries, By Region, 2016–2024 (USD Thousand)

Table 26 Market for Other Industries in North America, By Country, 2016–2024 (USD Thousand)

Table 27 Market for Other Industries in Europe, By Country, 2016–2024 (USD Thousand)

Table 28 Market for Other Industries in APAC, By Country, 2016–2024 (USD Thousand)

Table 29 Market for Other Industries in RoW, By Region, 2016–2024 (USD Thousand)

Table 30 Market, By Region, 2016–2024 (USD Million)

Table 31 Market in North America, By Country, 2016–2024 (USD Million)

Table 32 Market in North America, By Industry, 2016–2024 (USD Million)

Table 33 Market in US, By Industry, 2016–2024 (USD Million)

Table 34 Market in Canada, By Industry, 2016–2024 (USD Thousand)

Table 35 Market in Mexico, By Industry, 2016–2024 (USD Thousand)

Table 36 Market in Europe, By Country, 2016–2024 (USD Million)

Table 37 Market in Europe, By Industry, 2016–2024 (USD Thousand)

Table 38 Market in Germany, By Industry, 2016–2024 (USD Thousand)

Table 39 Market in UK, By Industry, 2016–2024 (USD Thousand)

Table 40 Market in France, By Industry, 2016–2024 (USD Thousand)

Table 41 Market in Italy, By Industry, 2016–2024 (USD Thousand)

Table 42 Market in Russia, By Industry, 2016–2024 (USD Thousand)

Table 43 Market in Spain, By Industry, 2016–2024 (USD Thousand)

Table 44 Market in Turkey, By Industry, 2016–2024 (USD Thousand)

Table 45 Market in Netherlands, By Industry, 2016–2024 (USD Thousand)

Table 46 Market in Rest of Europe, By Industry, 2016–2024 (USD Thousand)

Table 47 Market in APAC, By Country, 2016–2024 (USD Million)

Table 48 Market in APAC, By Industry, 2016–2024 (USD Million)

Table 49 Market in China, By Industry, 2016–2024 (USD Thousand)

Table 50 Market in Japan, By Industry, 2016–2024 (USD Thousand)

Table 51 Market in India, By Industry, 2016–2024 (USD Thousand)

Table 52 Market in South Korea, By Industry, 2016–2024 (USD Thousand)

Table 53 Market in Australia, By Industry, 2016–2024 (USD Thousand)

Table 54 Market in Indonesia, By Industry, 2016–2024 (USD Thousand)

Table 55 Market in Singapore, By Industry, 2016–2024 (USD Thousand)

Table 56 Market in Thailand, By Industry, 2016–2024 (USD Thousand)

Table 57 Market in Rest of APAC, By Industry, 2016–2024 (USD Thousand)

Table 58 Market in RoW, By Region, 2016–2024 (USD Thousand)

Table 59 Market in RoW, By Industry, 2016–2024 (USD Thousand)

Table 60 Market in South America, By Industry, 2016–2024 (USD Thousand)

Table 61 Market in Central America, By Industry, 2016–2024 (USD Thousand)

Table 62 Market in Middle East and Africa, By Industry, 2016–2024 (USD Thousand)

Table 63 Product Launches (2016–2018)

Table 64 Mergers and Acquisitions (2015–2018)

Table 65 Partnerships and Collaborations (2016 & 2017)

Table 66 Expansions (2018)

List of Figures (28 Figures)

Figure 1 Environmental Test Chambers Market Segmentation

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 Market: Research Design

Figure 4 Data Triangulation Methodology

Figure 5 Market Scenario (2016–2024)

Figure 6 Market, By Type, 2018 and 2024 (USD Million)

Figure 7 Market, By Industry, 2018 and 2024 (USD Million)

Figure 8 Environmental Test Chambers Market, By Region, 2018

Figure 9 Increasing Need for Monitoring Various Stress Factors Drives Growth of Environmental Test Chambers Market

Figure 10 Customized Chambers to Register Highest CAGR in Market During Forecast Period

Figure 11 Aerospace and Defense to Hold Largest Size of Environmental Test Chambers Market During Forecast Period

Figure 12 Emerging Markets Such as China and India to Grow at High CAGR During 2019–2024

Figure 13 Market Dynamics: Overview

Figure 14 Temperature and Humidity Chambers, and Customized Chambers to Dominate Environmental Test Chambers Markets, in Terms of Size, During Forecast Period

Figure 15 Aerospace and Defense to Hold Largest Size of Environmental Test Chambers Market During Forecast Period

Figure 16 APAC to Register Highest CAGR in Market for Automotive During Forecast Period

Figure 17 US to Register Highest CAGR in North American Environmental Test Chambers Market for Telecommunications and Electronics During Forecast Period

Figure 18 Germany Hold Largest Size of Environmental Test Chambers Market for Medical and Pharmaceutical in Europe During Forecast Period

Figure 19 Geographic Snapshot: Rapidly Growing Countries Such as India and China Emerging as Potentially New Markets

Figure 20 Snapshot of Environmental Test Chambers Market in North America

Figure 21 Snapshot of Market in Europe

Figure 22 Snapshot of Market in APAC

Figure 23 Snapshot of Environmental Test Chambers Market in RoW

Figure 24 Companies Adopted Product Launch as Key Growth Strategy During 2015–2018

Figure 25 Top 5 Players in Environmental Test Chambers Market, 2018

Figure 26 Environmental Test Chambers Market (Global) Competitive Leadership Mapping, 2018

Figure 27 Evaluation Framework: Environmental Test Chambers Market

Figure 28 ESPEC: Company Snapshot

This research study involves the use of extensive secondary sources—including directories and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource—to identify and collect information useful for this technical and commercial study of the environmental test chambers market. Primary sources were several experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of the key market players, and industry consultants have been conducted to obtain and verify critical qualitative and quantitative information as well as to assess the market prospects.

Secondary Research

Secondary sources referred to for this research study include corporate filings (investor presentations and financial statements); trade, business, and professional associations; white papers; certified publications; articles from recognized authors; directories; and databases such as International Confederation of Inspection and Certifications, European testing Inspection Certification System, and International Organization for Standardization. The secondary data have been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the environmental test chambers market scenario through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across 4 major regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the environmental test chambers market and various dependent submarkets. The key players in the market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research. This entire procedure involves the study of financial reports of the top players and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through the primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from, both, demand and supply sides. In addition to this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the environmental test chambers market based on type, industry, and geography

- To forecast the environmental test chambers market, in terms of value, for the concerned segments with regard to 4 main regions—North America, Europe, APAC, and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges for the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To study the complete value chain and allied industry segments, and perform value chain analysis of the environmental test chambers landscape

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the environmental test chambers market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as mergers and acquisitions, expansions, product and service launches, partnerships, contracts, and agreements in the environmental test chambers market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

Company Information

- Company Information: Detailed analysis and profiling of additional 5 market players

- Country-level break-up for the industry segment

Growth opportunities and latent adjacency in Environmental Test Chambers Market