Environmental Technology Market by Component (Solutions, Services), Technological Solutions (Waste Valorization, Greentech, Nuclear Energy, Bioremediation), Application, Vertical (Municipal, Industrial), and Region - Global Forecast to 2026

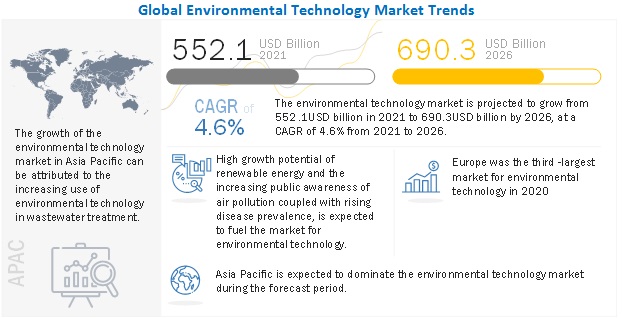

[312 Pages Report] The global environmental technology market in terms of revenue was estimated to be worth $552.1 billion in 2021 and is poised to reach $690.3 billion by 2026, growing at a CAGR of 4.6% from 2021 to 2026. The environmental technology market is on course for intense growth across different verticals such as power, energy & utilities, transportation & logistics, oil & gas, agriculture, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Environmental Technology Market Dynamics

Driver: Increased awareness of the global water crisis

Water is a natural resource, which covers 70% of the planet. However, only 2.5% represents the amount of available freshwater. This percentage of freshwater needs to cater to an estimated population of 9.7 billion by 2050. Over the last decade, the use of water has increased more than twice the rate of population increase globally and is steadily increasing in various sectors. According to the United Nations, a territory is considered water-stressed when it withdraws 25% or above its renewable freshwater resources.

Thus, there is a growing demand to treat water as a scarce resource, with a far stronger focus on managing demand. Countries experiencing water scarcity are adopting various strategies to deal with this challenge. For example, according to a report by UNU-INWEH, the adoption of Sustainable Development Goals (SDG) in 2015 by the UN member states attracted other countries such as Canada to focus on wastewater treatment processes, water recycling, and water efficiency. Hence, water is being treated with advanced technologies to supply clean drinking water. Many treatment designs are aimed at removing microbial contamination and suspended solids. There has been a development of technologies such as reverse osmosis (RO) and electrodialysis to use in the desalination process.

Opportunity: Development of advanced components to treat effluents in the oil & gas industry

The produced water (PW) is the largest wastewater stream (brine) released during oil and gas exploration and production activities. The treatment of oil and gas PW is required to meet the water requirement quality as per the regulatory bodies either for discharge/reuse and sustainability of the energy sector. The management of PW has been the focus of the oil and gas industry due to stringent legislation on the discharge of oil and gas PW into the environment. Various treatment methods are being used in the oil and gas industry to remove substantial amounts of pollutants from PW, which enhances the growth of the environmental technology market. Bioreactor-based methods have been found to be suitable for the treatment of industrial hydrocarbon-containing wastewater. There is a chemical treatment technology that uses chemical oxidants for the oxidation of organic contaminants in oil and gas PW to products like CO2 and H2O. However, it is challenging to decompose them due to the presence of recalcitrant pollutants such as BTEX.

Challenge: Inconsistencies in government regulations in many countries

Emerging countries are gradually focusing on environmental protection initiatives to address the growing concerns related to pollution control and rapid industrialization. This is leading to the development of new environment-related regulations. However, there is inconsistency in the regulations and policies in different emerging countries with respect to the adoption of environmental protection equipment and technologies. This acts as a key challenge for the growth of the market. Thus, regulations are modified down the line, which affects the implementation of environmental pollution control services.

In Russia, environmental policies and regulations are witnessing delays in their implementation. Though the government is taking actions to improve the environmental standards, many impracticable or unfeasible rules are still in place. In India, regulations to monitor water pollution have been ineffective and inconsistent largely due to the lack of concern for water pollution control by central government agencies such as the Ministry of Environment and Forestry (MoEF).

Solutions segment is expected to dominate the environmental technology market during 2021-2026

By component, the solutions segment is estimated to be USD 471.4 billion in 2021 and is projected to reach USD 586.7 billion by 2026, at a CAGR of 4.5% during the forecast period. The solutions segment dominated the global market in 2020 due to the rising awareness regarding the increased carbon footprint.

Power generation & fuel segment is expected to dominate the market during 2021-2026

The energy source for power generation and fuel segment is projected to lead the market during the forecast period due to the growing demand for renewable energy technologies. Also, electricity generation using renewable sources such as wind energy, solar energy, and geothermal energy is gaining momentum in all the sectors, including commercial and industrial, globally.

Greentech/renewable energy segment dominated the market in 2020

Based on technological solutions, the greentech/renewable energy segment dominated the market in 2020 and is expected to reach USD 213.3 billion by 2026, at a CAGR of 4.7% during the forecast period. The high demand for the greentech/renewable energy segment can be attributed to the increasing demand for carbon footprint management services.

Industrial segment is expected to dominate the environmental technology market during 2021-2026

The industrial segment is projected to grow from USD 547.1 USD billion in 2021 to USD 683.5 billion by 2026. Under industrial segment, the power, energy & utilities industry is the largest consumer of environmental technologies during the forecast period. The large market share of the power, energy & utilities industry is majorly due to the rising renewable energy sector.

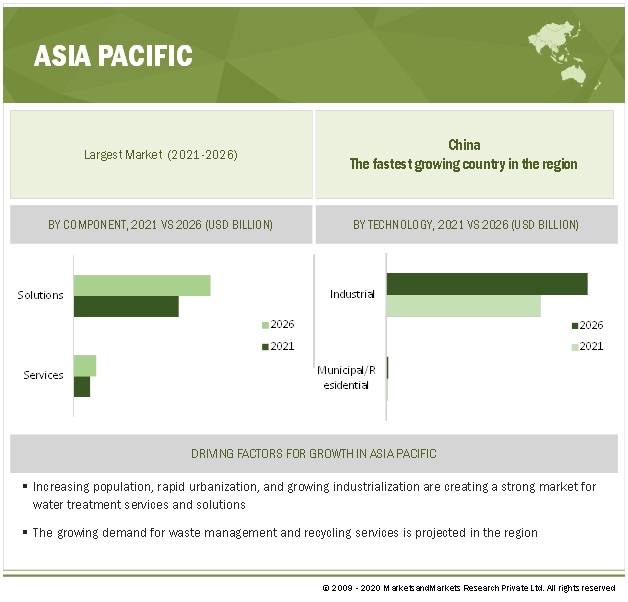

Asia Pacific is expected to dominate the environmental technology market during 2021-2026

Asia Pacific accounted for a share of 38.7% of the environmental technology market in 2020 and is projected to register a CAGR of 5.5%, during 2021 and 2026. The growing demand for wastewater treatment from municipal and industrial applications in Asia Pacific is expected to drive the market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key market players in the environmental technology market are AECOM (US), Lennox International (US), Teledyne Technologies Incorporated (US), Thermo Fisher Scientific Inc. (US), Abatement Technologies (US), Veolia (France), Waste Connections (US), Total SA (France), Covanta Holding Corporation (US), SUEZ (US), Biffa (England), Hitachi Zosen Corporation (Japan), Carbon Clean (UK), Cypher Environmental (Canada), Svante Inc. (Canada), CarbonCure Technologies Inc. (Nova Scotia), Sunfire GmbH (Germany), BacTech Inc. (Canada), TRC Companies, Inc. (US), and Arcadis N.V. (Netherlands). These players have adopted expansions, joint ventures, mergers, acquisitions, agreements, collaborations, product launches, and partnerships as their growth strategies to meet the growing demand for environmental technology.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million ) |

|

Segments Covered |

Component, Application, Technological solutions, Vertical, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

AECOM (US), Lennox International (US), Teledyne Technologies Incorporated (US), Thermo Fisher Scientific Inc. (US), Abatement Technologies (US), Veolia (France), Waste Connections (US), Total S.A. (France), Covanta Holding Corporation (US), SUEZ (US), Biffa (UK), Hitachi Zosen Corporation (Japan), Carbon Clean (UK), Cypher Environmental (Canada), Svante Inc. (Canada), CarbonCure Technologies Inc. (Canada), Sunfire GmbH (Germany), BacTech Inc. (Canada), TRC Companies, Inc. (US), Arcadis N.V. (Netherlands), C-Capture (UK), Tandem Technical (Canada), Intelex (Canada), REMONDIS SE & Co. KG (Germany), Climeworks (Switzerland), Pycno (UK), Thermax Ltd. (India), Xylem, Inc. (US), Carbon Engineering (Canada), Geo-Cleanse International, Inc. (US), Ivey International Inc. (Canada), EcoMed Services (US), Skrap (India), RecyGlo (Myanmar), Saahas Zero Waste (India), Recycle Track Systems (US), GEM Enviro Management Pvt. Ltd (India), Vital Waste (India), Recycling Technologies (UK), Rekosistem (Indonesia), UnBound Chemicals (Canada), ENGIE Impact (US), IsoMetrix (US), Trade Genomics (US) |

This research report categorizes the environmental technology market based on component, application, technological solutions, vertical, and region.

Based on Component, the market has been segmented as follows:

- Solutions

- Services (wastewater & water treatment, resource recovery, consulting & engineering, industrial remediation, water utility)

Based on Application, the market has been segmented as follows:

- Wastewater treatment

- Water purification management

- Sewage treatment

- Pollution monitoring

- Dust emissions

- Dry steaming

- Gas dissolution

- Precision cooling

- Solid waste treatment

- Energy source for power generation and fuel

- Others (crop monitoring, soil monitoring/ soil analysis, and fire detection)

Based on Technological Solutions, the market has been segmented as follows:

- Waste valorization/ recycling & composting

- Greentech/renewable energy (wind energy, photovoltaics, and geothermal energy)

- Desalination

- Bioremediation

- Green hydrogen

- Carbon capture, utilization & storage (ccus)

- Others (air pollution monitoring, otec, biofuels and ocean plastic)

Based on Vertical, the market has been segmented as follows:

- Residential/municipal

-

Industrial transportation & logistics

- Power, energy & utilities

- Manufacturing

- Retail & consumer goods

- Construction & building materials

- Government & defense

- Oil & gas

- Others (law enforcement, healthcare & life sciences)

Based on Region, market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In April 2021, Veolia and SUEZ announced that they have reached an agreement enabling the merger of the two groups. Its scope is expected to be the municipal water and solid waste activities of SUEZ in France, as well as the activities of SUEZ in particular in water in the following geographies: Italy, the Czech Republic, Africa (including Lydec), Central Asia, India, China, Australia, and the global digital and environmental activities (SES).

- In December 2020, AECOM partners with Los Angeles County Sanitation Districts to upgrade its Joint Water Pollution Control Plant (JWPCP) in Carson, California. This partnership reflects on AECOM’s commitment to lead in environmental, social, and governance (ESG) best practices.

Frequently Asked Questions (FAQ):

What is the current size of the global environmental technology market?

The environmental technology market is estimated at USD 552.1 billion in 2021 and is projected to reach USD 690.3 billion by 2026, at a CAGR of 4.6% from 2021 to2026.

Who are the leading players in the global environmental technology market?

The leading companies in the cosmetic pigments market include Sun Chemical (US), Sensient Cosmetic Technologies (France), Merck (Germany), ECKART (UK), Sudarshan (India), Kobo Products (US), Clariant (Switzerland), and Geotech (Netherlands). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.1.1 COMPETITIVE INTELLIGENCE

1.2 MARKET DEFINITION

1.3 ENVIRONMENTAL TECHNOLOGY MARKET, BY TECHNOLOGICAL SOLUTIONS: INCLUSIONS & EXCLUSIONS

1.4 MARKET, BY COMPONENT: INCLUSIONS & EXCLUSIONS

1.5 MARKET, BY VERTICAL: INCLUSIONS & EXCLUSIONS

1.6 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.6.1 GEOGRAPHIC SCOPE

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

1.8 STAKEHOLDERS

1.9 RESEARCH LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 ENVIRONMENTAL TECHNOLOGY MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 SCOPE

2.4 IMPACT OF COVID-19 ON MARKET

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.3 DEMAND-SIDE ANALYSIS

2.5.3.1 Main metrics considered while analyzing and assessing demand for environmental technologies

2.5.3.2 Demand-side calculation

2.5.3.3 Assumptions for demand-side

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 1 MARKET SNAPSHOT (2021 VS. 2026)

FIGURE 7 SOLUTIONS SEGMENT PROJECTED TO DOMINATE THE MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ENVIRONMENTAL TECHNOLOGY MARKET

FIGURE 9 INCREASING USE OF ENVIRONMENTAL TECHNOLOGY IN WASTEWATER TREATMENT EXPECTED TO DRIVE THE MARKET

4.2 MARKET, BY REGION

FIGURE 10 ASIA PACIFIC PROJECTED TO LEAD THE MARKET FROM 2021 TO 2026

4.3 MARKET, BY COMPONENT AND COUNTRY

FIGURE 11 SOLUTIONS SEGMENT AND CHINA ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET IN ASIA PACIFIC IN 2021

4.4 MARKET, BY COMPONENT

FIGURE 12 SOLUTIONS SEGMENT IS EXPECTED TO DOMINATE MARKET IN 2021

4.5 MARKET, BY APPLICATION

FIGURE 13 POWER GENERATION & FUEL SEGMENT IS EXPECTED TO DOMINATE THE MARKET FORM 2021-2026

4.6 MARKET, BY TECHNOLOGICAL SOLUTIONS

FIGURE 14 WASTE VALORIZATION/RECYCLING & COMPOSTING SEGMENT IS EXPECTED TO DOMINATE THE MARKET IN 2021

4.7 MARKET, BY VERTICAL

FIGURE 15 INDUSTRIAL SEGMENT EXPECTED TO DOMINATE THE MARKET FROM 2021-2026

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 ENVIRONMENTAL TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased awareness of the global water crisis

5.2.1.2 Growing awareness on pollution monitoring

TABLE 2 WORLD'S MOST POLLUTED CITIES 2020 (PM2.5)

5.2.1.3 Stringent regulations on climate pollution control in major economies

TABLE 3 CONTAMINANTS’ CONCENTRATION IN SOIL, RUNOFF, AND GROUNDWATER

5.2.2 RESTRAINTS

5.2.2.1 High up-front costs of environmental technologies

5.2.2.2 Lack of skilled workforce for complex technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Growing significance of eco-friendly data center solutions

TABLE 4 PUE CONSUMPTION IN DIFFERENT DATACENTERS

5.2.3.2 Development of advanced components to treat effluents in the oil & gas industry

5.2.3.3 Growing demand for environmental technology solutions in emerging countries

5.2.4 CHALLENGE

5.2.4.1 Inconsistencies in government regulations in many countries

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 INTRODUCTION

FIGURE 17 DRIVERS AND CHALLENGE FOR THE ENVIRONMENT TECHNOLOGY MARKET

5.3.2 DRIVERS

5.3.2.1 Increased awareness regarding air pollution

5.3.2.2 Growing concerns related to water purification management

5.3.3 CHALLENGE

5.3.3.1 Short-term decline in demand from oil & gas industry

5.3.4 CUMULATIVE IMPACT OF COVID-19 ON MARKET

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS FOR ENVIRONMENTAL TECHNOLOGY MARKET

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF SUBSTITUTES

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 THREAT OF NEW ENTRANTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 TRENDS AND DISRUPTIONS IN TECHNOLOGY

5.5.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR ENVIRONMENTAL TECHNOLOGY PROVIDERS

FIGURE 19 REVENUE SHIFT FOR MARKET

FIGURE 20 ECOSYSTEM/MARKET MAP: ENVIRONMENTAL TECHNOLOGY MARKET

FIGURE 21 ECOSYSTEM/MARKET MAP: PHOTOVOLTAICS MARKET

5.6 TARIFF POLICIES & REGULATIONS

5.6.1 CARBON TAX

5.6.2 CARBON TAX IN EUROPEAN UNION

5.6.3 CARBON TAX IN IRELAND

5.6.4 CARBON TAX IN AUSTRALIA

5.6.5 CARBON TAX IN FINLAND AND SWEDEN

5.7 EU PLASTIC WASTE TAX

5.8 WATER TREATMENT POLICY AND REGULATIONS

5.8.1 CLEAN WATER ACT (CWA)

5.8.2 SAFE DRINKING WATER ACT (SDWA)

5.8.3 THE URBAN WASTEWATER TREATMENT DIRECTIVE (1991)

5.8.4 THE DRINKING WATER DIRECTIVE (1998)

5.8.5 THE WATER FRAMEWORK DIRECTIVE (2000)

5.8.6 ENVIRONMENTAL PROTECTION LAW (EPL)

5.8.7 THE WATER RESOURCES LAW

5.8.8 WATER POLLUTION PREVENTION & CONTROL LAW (WPL)

5.8.9 WATER PREVENTION AND CONTROL OF POLLUTION ACT, 1974

5.8.10 WATER POLLUTION CONTROL LAW, 1971

5.9 REGULATIONS FOR AIR POLLUTION MONITORING AND CONTROL

5.10 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS FOR PHOTOVOLTAICS MARKET

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY BY THERMAX GLOBAL

5.11.1.1 Fluoride Removal Using Tulsion TFR-93, February 2021

5.11.1.2 Tulsion Resins for Ultra-Pure Water in Solar Cell Manufacturing, February 2021

5.12 TRADE ANALYSIS

TABLE 6 CHEMICAL EXPORTS: BY COUNTRY, 2019 & 2020 (USD BILLION)

TABLE 7 CHEMICAL IMPORTS: BY COUNTRY, 2019 & 2020 (USD BILLION)

5.13 PATENT ANALYSIS

5.13.1 METHODOLOGY

FIGURE 23 NUMBER OF GRANTED VS. TOTAL PATENT APPLICATION ON ENVIRONMENTAL TECHNOLOGY

FIGURE 24 PUBLICATION TRENDS - LAST 10 YEARS

5.13.2 INSIGHTS

5.13.3 TOP COMPANIES/APPLICANTS

FIGURE 25 TOP 5 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

5.13.4 PATENTS PUBLISHED

6 ENVIRONMENTAL TECHNOLOGY MARKET, BY COMPONENT (Page No. - 83)

6.1 INTRODUCTION

FIGURE 26 SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 8 MARKET, BY COMPONENT, 2019–2026 (USD BILLION)

6.2 SOLUTIONS

6.2.1 RISING AWARENESS REGARDING THE CARBON FOOTPRINT MANAGEMENT EXPECTED TO DRIVE THIS SEGMENT

6.2.2 SOLUTIONS: COVID-19 IMPACT

TABLE 9 ENVIRONMENTAL TECHNOLOGY SOLUTIONS MARKET, BY REGION, 2019–2026 (USD BILLION)

6.3 SERVICES

6.3.1 RISING CHALLENGE OF RESOURCE SCARCITY IS DRIVING THE GROWTH OF THE ENVIRONMENTAL TECHNOLOGY SERVICES AROUND THE WORLD

TABLE 10 TYPE OF WATER AND SOIL CONTAMINANTS

6.3.2 SERVICES: COVID-19 IMPACT

TABLE 11 ENVIRONMENTAL TECHNOLOGY SERVICES MARKET, BY REGION, 2019–2026 (USD BILLION)

TABLE 12 ENVIRONMENTAL TECHNOLOGY SERVICES MARKET, BY TYPE, 2019–2026 (USD BILLION)

6.3.3 WATER & WASTEWATER MANAGEMENT SERVICES

6.3.3.1 Growing concerns regarding high wastewater discharge into waterways is expected to fuel the growth of this segment

TABLE 13 WATER & WASTEWATER MANAGEMENT SERVICES MARKET, BY REGION, 2019–2026 (USD BILLION)

6.3.4 RESOURCE RECOVERY

6.3.4.1 North America is expected to lead this segment during the forecast period

TABLE 14 RESOURCE RECOVERY SERVICES MARKET, BY REGION, 2019–2026 (USD BILLION)

6.3.5 CONSULTING & ENGINEERING

6.3.5.1 Growing urbanization and rising industrialization is driving the growth

TABLE 15 CONSULTING & ENGINEERING SERVICES MARKET, BY REGION, 2019–2026 (USD BILLION)

6.3.6 INDUSTRIAL REMEDIATION SERVICES

6.3.6.1 High demand for clean waste oil and other refinery chemicals is driving this segment

TABLE 16 INDUSTRIAL REMEDIATION SERVICES MARKET, BY REGION, 2019–2026 (USD BILLION)

6.3.7 WATER UTILITY SERVICES

6.3.7.1 High demand from areas experiencing stressed water supplies/water scarcity drive this segment

TABLE 17 WATER UTILITY SERVICES MARKET, BY REGION, 2019–2026 (USD BILLION)

7 ENVIRONMENTAL TECHNOLOGY MARKET, BY APPLICATION (Page No. - 93)

7.1 INTRODUCTION

FIGURE 27 POWER GENERATION & FUEL SEGMENT EXPECTED TO DOMINATE THE MARKET DURING FORECAST PERIOD

TABLE 18 ENVIRONMENTAL TECHNOLOGY MARKET SIZE, BY APPLICATION, 2019-2026 (USD BILLION)

7.2 POWER GENERATION & FUEL

7.2.1 NORTH AMERICA IS THE LEADING MARKET FOR ENVIRONMENTAL TECHNOLOGIES IN THIS SEGMENT

TABLE 19 MARKET IN POWER GENERATION & FUEL, BY REGION, 2019-2026 (USD BILLION)

7.2.2 POWER GENERATION & FUEL: COVID-19 IMPACT

7.3 SOLID WASTE TREATMENT

7.3.1 INCREASING URBAN POPULATION AND RAPID INDUSTRIALIZATION IS CREATING OPPORTUNITY FOR THE GROWTH OF THIS APPLICATION

TABLE 20 MARKET IN SOLID WASTE TREATMENT, BY REGION, 2019–2026 (USD BILLION)

7.3.2 SOLID WASTE TREATMENT: COVID-19 IMPACT

7.4 POLLUTION MONITORING

7.4.1 SUPPORTIVE GOVERNMENT REGULATIONS FOR AIR POLLUTION MONITORING IS DRIVING THIS SEGMENT

TABLE 21 MARKET IN POLLUTION MONITORING, BY REGION, 2019-2026 (USD BILLION)

7.4.2 POLLUTION MONITORING: COVID-19 IMPACT

7.5 WASTEWATER TREATMENT

7.5.1 STRINGENT POLICIES REGARDING THE SAFE DISCHARGE OF WASTEWATER IS EXPECTED TO BOOST THE SEGMENT

TABLE 22 MARKET IN WASTEWATER TREATMENT, BY REGION, 2019-2026 (USD BILLION)

7.5.2 WASTEWATER TREATMENT: COVID-19 IMPACT

7.6 WATER PURIFICATION MANAGEMENT

7.6.1 THE DEVELOPMENT OF WATER PURIFICATION TECHNOLOGY IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 23 MARKET IN WATER PURIFICATION MANAGEMENT, BY REGION, 2019-2026 (USD BILLION)

7.6.2 WATER PURIFICATION MANAGEMENT: COVID-19 IMPACT

7.7 SEWAGE TREATMENT

7.7.1 RISING AWARENESS REGARDING BIOENERGY PRODUCTION FROM SLUDGE IS FUELLING THE GROWTH OF THIS SEGMENT

TABLE 24 MARKET IN SEWAGE TREATMENT, BY REGION, 2019-2026 (USD BILLION)

7.7.2 SEWAGE TREATMENT: COVID-19 IMPACT

7.8 PRECISION COOLING

7.8.1 INNOVATIVE COOLING SOLUTIONS IN HYPER-SCALE DATA CENTERS (HDCS) PROJECTED TO FUEL THE GROWTH OF THIS APPLICATION

TABLE 25 MARKET IN PRECISION COOLING, BY REGION, 2019-2026 (USD BILLION)

7.8.2 PRECISION COOLING: COVID-19 IMPACT

7.9 DUST EMISSIONS

7.9.1 GROWING APPLICATION FROM THE INDUSTRIAL SECTOR IS DRIVING SEGMENT

TABLE 26 MARKET IN DUST EMISSIONS, BY REGION, 2019–2026 (USD BILLION)

7.9.2 DUST EMISSIONS: COVID-19 IMPACT

7.10 DRY STREAMING

7.10.1 DRY STREAMING TECHNOLOGY IS USED TO PRODUCE GEOTHERMAL ENERGY

TABLE 27 MARKET IN DRY STREAMING, BY REGION, 2019–2026 (USD BILLION)

7.10.2 DRY STREAMING: COVID-19 IMPACT

7.11 GAS DISSOLUTION

7.11.1 GROWING WATER TREATMENT INDUSTRY IS PROPELLING THIS SEGMENT

TABLE 28 MARKET IN GAS DISSOLUTION, BY REGION, 2019–2026 (USD BILLION)

7.11.2 GAS DISSOLUTION: COVID-19 IMPACT

7.12 OTHERS

TABLE 29 MARKET IN OTHER APPLICATIONS, BY REGION, 2019-2026 (USD BILLION)

8 ENVIRONMENTAL TECHNOLOGY MARKET, BY TECHNOLOGICAL SOLUTIONS (Page No. - 108)

8.1 INTRODUCTION

FIGURE 28 WASTE VALORIZATION/RECYCLING & COMPOSTING LEAD THE MARKET IN 2021

TABLE 30 MARKET, BY TECHNOLOGICAL SOLUTIONS, 2019-2026 (USD BILLION)

TABLE 31 GREENTECH/RENEWABLE ENERGY MARKET, BY TYPE, 2019-2026 (USD BILLION)

TABLE 32 WASTE VALORIZATION/RECYCLING & COMPOSTING MARKET, BY TYPE, 2019-2026 (USD BILLION)

8.2 WASTE VALORIZATION/RECYCLING & COMPOSTING

8.2.1 AN INCREASE IN WASTE GENERATION AND ITS GROWING ROLE IN THE FIELDS OF ELECTRICITY AND HEAT GENERATION IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 33 WASTE VALORIZATION/RECYCLING & COMPOSTING MARKET, BY REGION, 2019-2026 (USD BILLION)

TABLE 34 RECYCLING & UPCYCLING MARKET, BY REGION, 2019-2026 (USD BILLION)

TABLE 35 COMPOSTING MARKET, BY REGION, 2019-2026 (USD BILLION)

8.2.2 WASTE VALORIZATION/RECYCLING & COMPOSTING: COVID-19 IMPACT

8.3 NUCLEAR ENERGY

8.3.1 THE RISING DEMAND TO REACH NET-ZERO CO2 EMISSIONS IS EXPECTED TO FUEL THIS SEGMENT

TABLE 36 NUCLEAR ENERGY MARKET, BY REGION, 2019-2026 (USD BILLION)

8.3.2 NUCLEAR ENERGY: COVID-19 IMPACT

8.4 DATA CENTER COOLING

8.4.1 THE GROWING IMPORTANCE OF ECO-FRIENDLY DATA CENTER SOLUTIONS IS EXPECTED TO BOOST THE SEGMENT

TABLE 37 DATA CENTER COOLING MARKET, BY REGION, 2019-2026 (USD BILLION)

8.4.2 DATA CENTER COOLING: COVID-19 IMPACT

8.5 DESALINATION

8.5.1 LACK OF ACCESS TO FRESH WATER IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 38 DESALINATION MARKET, BY REGION, 2019-2026 (USD BILLION)

8.5.2 DESALINATION: COVID-19 IMPACT

8.6 GREENTECH/RENEWABLE ENERGY

8.6.1 THE INCREASING DEMAND FOR A CARBON-FREE ECONOMY IS EXPECTED TO BOOST THIS SEGMENT

TABLE 39 GREENTECH/RENEWABLE ENERGY MARKET, BY TYPE, 2019-2026 (USD BILLION)

TABLE 40 GREENTECH/RENEWABLE ENERGY MARKET, BY REGION, 2019-2026 (USD BILLION)

8.6.2 GREENTECH/RENEWABLE ENERGY: COVID-19 IMPACT

8.7 PHOTOVOLTAICS

8.7.1 THE INCREASING DEMAND FOR RENEWABLE ENERGY SOURCES DUE TO THE RISE IN POPULATION IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 41 PHOTOVOLTAICS MARKET, BY REGION, 2019-2026 (USD BILLION)

8.7.2 PHOTOVOLTAICS: COVID-19 IMPACT

8.8 WIND ENERGY

8.8.1 THE INCREASING DEMAND FOR SUSTAINABLE ENERGY SOURCES IS EXPECTED TO BOOST THE SEGMENT

TABLE 42 WIND ENERGY MARKET, BY REGION, 2019-2026 (USD BILLION)

8.8.2 COVID-19 IMPACT ON WIND ENERGY

8.9 GEOTHERMAL POWER

8.9.1 THE INCREASING DEMAND FOR SUSTAINABLE ENERGY SOURCES IS EXPECTED TO DRIVE THE SEGMENT

TABLE 43 GEOTHERMAL POWER MARKET, BY REGION, 2019-2026 (USD BILLION)

8.9.2 COVID-19 IMPACT ON GEOTHERMAL ENERGY

8.10 CARBON CAPTURE, UTILIZATION & STORAGE (CCUS)

8.10.1 THE RISING DEMAND TO REACH NET-ZERO CO2 EMISSIONS IS EXPECTED TO FUEL THIS SEGMENT

TABLE 44 CCUS MARKET, BY REGION, 2019-2026 (USD BILLION)

8.10.2 CCUS: COVID-19 IMPACT

8.11 BIOREMEDIATION

8.11.1 LIMITED AVAILABILITY OF LANDFILLS DUE TO INCREASING POPULATION IS EXPECTED TO FUEL THIS SEGMENT

TABLE 45 BIOREMEDIATION MARKET, BY REGION, 2019-2026 (USD BILLION)

8.11.2 BIOREMEDIATION: COVID-19 IMPACT

8.12 GREEN HYDROGEN

8.12.1 THE USE OF GREEN HYDROGEN AS A MULTI-FUNCTIONAL GAS IS EXPECTED TO BOOST THIS SEGMENT

TABLE 46 GREEN HYDROGEN MARKET, BY REGION, 2019-2026 (USD BILLION)

8.12.2 GREEN HYDROGEN: COVID-19 IMPACT

8.13 OTHERS

TABLE 47 OTHERS MARKET, BY REGION, 2019-2026 (USD BILLION)

9 ENVIRONMENTAL TECHNOLOGY MARKET, BY VERTICAL (Page No. - 123)

9.1 INTRODUCTION

FIGURE 29 THE INDUSTRIAL SEGMENT IS EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 48 MARKET, BY VERTICAL, 2019–2026 (USD BILLION)

9.2 RESIDENTIAL/MUNICIPAL

9.2.1 RAPID URBANIZATION AND POPULATION GROWTH HAVE INCREASED THE DEMAND FOR WASTE AND WASTEWATER TREATMENT IN THIS SEGMENT

TABLE 49 MARKET FOR RESIDENTIAL/MUNICIPAL, BY REGION, 2019–2026 (USD BILLION)

9.2.2 RESIDENTIAL: COVID-19 IMPACT

9.3 INDUSTRIAL

9.3.1 INDUSTRIAL AND ECONOMIC GROWTH IN EMERGING COUNTRIES IS EXPECTED TO FUEL THIS SEGMENT

TABLE 50 MARKET FOR INDUSTRIAL, BY REGION, 2019–2026 (USD BILLION)

TABLE 51 MARKET FOR INDUSTRIAL, BY TYPE, 2019–2026 (USD BILLION)

9.3.2 INDUSTRIAL: COVID-19 IMPACT

9.3.3 POWER, ENERGY & UTILITIES

9.3.3.1 Need for water treatment and air treatment solutions & services driving this segment

TABLE 52 MARKET FOR POWER, ENERGY & UTILITIES INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.3.2 Power, Energy & Utilities: Covid-19 Impact

9.3.4 TRANSPORTATION & LOGISTICS

9.3.4.1 The outbreak of the COVID-19 pandemic adversely affected this segment

TABLE 53 MARKET IN TRANSPORTATION & LOGISTICS INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.4.2 Transportation & Logistics: Covid-19 Impact

9.3.5 OIL & GAS

9.3.5.1 Growing demand for Remediation technologies in the oil & gas industry is driving the market growth

TABLE 54 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.5.2 Oil & Gas: Covid-19 Impact

9.3.6 AGRICULTURE

9.3.6.1 Rising need to remove pollutants create lucrative growth opportunities for the environmental technology market

TABLE 55 MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.6.2 Agriculture Industry: Covid-19 Impact

9.3.7 MANUFACTURING

9.3.7.1 Demand for eco-friendly industrialization expected to drive market growth

TABLE 56 MARKET FOR MANUFACTURING INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.7.2 Manufacturing Industry: Covid-19 Impact

9.3.8 CONSTRUCTION & BUILDING MATERIALS

9.3.8.1 Need for environmental assessment expected to drive market growth

TABLE 57 MARKET FOR CONSTRUCTION & BUILDING MATERIALS INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.8.2 Construction & Building Materials Industry: Covid-19 Impact

9.3.9 RETAIL & CONSUMER GOODS

9.3.9.1 The use of renewable energy is projected to drive this segment

TABLE 58 MARKET FOR RETAIL & CONSUMER GOODS INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.9.2 Retail & Consumer Goods Industry: Covid-19 Impact

9.3.10 GOVERNMENT & DEFENSE

9.3.10.1 Stringent regulations imposed by governments is driving the market

TABLE 59 MARKET FOR GOVERNMENT & DEFENSE INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.10.2 Government & Defense Industry: Covid-19 Impact

9.3.11 EDUCATION

TABLE 60 MARKET IN EDUCATION INDUSTRY, BY REGION, 2019–2026 (USD BILLION)

9.3.11.1 Education: Covid-19 Impact

9.3.12 OTHERS

TABLE 61 MARKET FOR OTHER INDUSTRIES, BY REGION, 2019–2026 (USD BILLION)

10 ENVIRONMENTAL TECHNOLOGY MARKET, BY REGION (Page No. - 139)

10.1 INTRODUCTION

TABLE 62 ENVIRONMENTAL TECHNOLOGY MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

10.2 ASIA PACIFIC

10.2.1 ASIA PACIFIC MARKET DRIVERS

10.2.2 ASIA PACIFIC: COVID-19 IMPACT

10.2.3 ASIA PACIFIC: REGULATIONS

10.2.3.1 Regulations on wastewater treatment & purification and solid waste treatment

FIGURE 30 ASIA PACIFIC ENVIRONMENTAL TECHNOLOGY MARKET SNAPSHOT

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

TABLE 64 ASIA PACIFIC: ENVIRONMENTAL TECHNOLOGY SERVICES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGICAL SOLUTIONS, 2019–2026 (USD BILLION)

TABLE 66 ASIA PACIFIC: GREENTECH/RENEWABLE ENERGY TECHNOLOGICAL SOLUTIONS MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2026 (USD BILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL, BY TYPE, 2019–2026 (USD BILLION)

TABLE 70 ASIA PACIFIC: ENVIRONMETAL TECHNOLOGY MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

10.2.4 CHINA

10.2.4.1 Rising awareness regarding high CO2 emissions in China drive the market

TABLE 71 CHINA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.2.4.2 China: Covid-19 Impact

10.2.5 JAPAN

10.2.5.1 Growth of automotive, electronics, and renewable energy sectors drive the market

TABLE 72 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.2.5.2 Japan: Covid-19 Impact

10.2.6 AUSTRALIA AND NEW ZEALAND

10.2.6.1 Water scarcity is propelling the need for water treatment and reuse, and thereby environmental technologies

TABLE 73 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.2.6.2 Australia & New Zealand: Covid-19 Impact

10.2.7 SINGAPORE

10.2.7.1 The rising awareness regarding waste-to-energy plants to spur market growth

TABLE 74 SINGAPORE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.2.7.2 Singapore: Covid-19 Impact

10.2.8 REST OF ASIA PACIFIC

TABLE 75 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.3 NORTH AMERICA

10.3.1 NORTH AMERICA MARKET DRIVERS

10.3.2 NORTH AMERICA: COVID-19 IMPACT

10.3.3 NORTH AMERICA: REGULATIONS

10.3.3.1 US: Laws & regulations on wastewater treatment and waste management

10.3.3.2 Canada: laws & regulations on air pollution management

10.3.3.3 Mexico: general climate change law (LGCC)in Mexico

FIGURE 31 NORTH AMERICA ENVIRONMENTAL TECHNOLOGY MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

TABLE 77 NORTH AMERICA: ENVIRONMENTAL TECHNOLOGY SERVICES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGICAL SOLUTIONS, 2019–2026 (USD BILLION)

TABLE 79 NORTH AMERICA: GREENTECH/RENEWABLE ENERGY TECHNOLOGICAL SOLUTIONS MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD BILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL VERTICAL, BY TYPE, 2019–2026 (USD BILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

10.3.4 US

10.3.4.1 High demand for wastewater treatment and waste management is driving the market

TABLE 84 US: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.3.4.2 US: Covid 19 Impact

10.3.5 CANADA

10.3.5.1 Government initiatives for the water treatment sector expected to drive the market

TABLE 85 CANADA: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.3.5.2 Canada: Covid-19 Impact

10.3.6 MEXICO

10.3.6.1 Rising demand for clean energy is expected to drive the market

TABLE 86 MEXICO: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.3.6.2 Mexico: Covid-19 Impact

10.4 EUROPE

10.4.1 EUROPE MARKET DRIVERS

10.4.2 EUROPE: COVID-19 IMPACT

10.4.3 EUROPE: REGULATIONS

10.4.3.1 Regulation on wastewater treatment

10.4.3.1.1 Urban wastewater treatment directive (1991)

10.4.3.1.2 The drinking water directive (1998)

10.4.3.1.3 The water framework directive (2000)

10.4.3.2 Regulation on waste management

FIGURE 32 EUROPE ENVIRONMENTAL TECHNOLOGY MARKET SNAPSHOT

TABLE 87 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

TABLE 88 EUROPE: ENVIRONMENTAL TECHNOLOGY SERVICES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 89 EUROPE: MARKET SIZE, BY TECHNOLOGICAL SOLUTIONS, 2019–2026 (USD BILLION)

TABLE 90 EUROPE: GREENTECH/RENEWABLE ENERGY TECHNOLOGICAL SOLUTIONS MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 91 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 92 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2026 (USD BILLION)

TABLE 93 EUROPE: MARKET FOR INDUSTRIAL, BY TYPE, 2019–2026 (USD BILLION)

TABLE 94 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD BILLION)

10.4.4 UK

10.4.4.1 High levels of air and water pollution coupled with the rising prevalence of disease drive the market in the UK

TABLE 95 UK: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.4.4.2 UK: Covid-19 impact

10.4.5 GERMANY

10.4.5.1 High demand for waste and wastewater treatment services driving the market

TABLE 96 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.4.5.2 Germany: Covid-19 Impact

10.4.6 FRANCE

10.4.6.1 High demand from the industrial sector is driving the market

TABLE 97 FRANCE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.4.6.2 France: Covid-19 Impact

10.4.7 REST OF EUROPE

TABLE 98 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST & AFRICA: REGULATIONS

10.5.3.1 General environmental regulations

10.5.3.2 Government investments in Saudi Arabia

10.5.3.3 Air pollution regulation in UAE

10.5.3.4 Waste regulations in UAE

10.5.3.5 Plastic waste regulations in UAE

10.5.3.6 Environmental protection in UAE

10.5.3.7 Environmental protection laws of South Africa

TABLE 99 MIDDLE EAST & AFRICA: ENVIRONMENTAL TECHNOLOGY MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

TABLE 100 MIDDLE EAST & AFRICA: ENVIRONMENTAL TECHNOLOGY SERVICES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 101 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGICAL SOLUTIONS, 2019–2026 (USD BILLION)

TABLE 102 MIDDLE EAST & AFRICA: GREENTECH/RENEWABLE ENERGY TECHNOLOGICAL SOLUTIONS MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 103 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 104 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2019–2026 (USD BILLION)

TABLE 105 MIDDLE EAST & AFRICA: MARKET FOR INDUSTRIAL, BY TYPE, 2019–2026 (USD BILLION)

TABLE 106 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2026 (USD BILLION)

10.5.4 SAUDI ARABIA

10.5.4.1 High demand for water in Saudi Arabia is driving the market

TABLE 107 SAUDI ARABIA: MARKET, BY COMPONENT, 2019–2026 (USD BILLION)

10.5.4.2 Saudi Arabia: Covid-19 Impact

10.5.5 UAE

10.5.5.1 High oil production in the UAE is driving the market

TABLE 108 UAE: MARKET, BY COMPONENT, 2019–2026 (USD BILLION)

10.5.5.2 UAE: Covid-19 impact

10.5.6 SOUTH AFRICA

10.5.6.1 Rising demand for renewable energy in South Africa is driving the market

TABLE 109 SOUTH AFRICA: ENVIRONMENTAL TECHNOLOGY MARKET, BY COMPONENT, 2019–2026 (USD BILLION)

10.5.6.2 South Africa: Covid-19 Impact

10.5.7 REST OF MIDDLE EAST & AFRICA

TABLE 110 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2019–2026 (USD BILLION)

10.6 SOUTH AMERICA

10.6.1 SOUTH AMERICA MARKET DRIVERS

10.6.2 SOUTH AMERICA: COVID-19 IMPACT

10.6.3 SOUTH AMERICA: REGULATIONS

10.6.3.1 Brazil - LAW No. 6,938, OF AUGUST 31, 1981

10.6.3.2 Waste disposal regulations in Brazil

10.6.3.3 Updated legal framework for basic sanitation in Brazil

10.6.3.4 Regulation on waste management

TABLE 111 SOUTH AMERICA: ENVIRONMENTAL TECHNOLOGY MARKET SIZE, BY COMPONENT, 2019–2026 (USD BILLION)

TABLE 112 SOUTH AMERICA: ENVIRONMENTAL TECHNOLOGY SERVICES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 113 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGICAL SOLUTIONS, 2019–2026 (USD BILLION)

TABLE 114 SOUTH AMERICA: ENVIRONMENTAL GREENTECH/RENEWABLE ENERGY TECHNOLOGICAL SOLUTIONS MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 115 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD BILLION)

TABLE 116 SOUTH AMERICA: ENVIRONMETAL TECHNOLOGY MARKET SIZE , BY VERTICAL, 2019–2026 (USD BILLION)

TABLE 117 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL VERTICAL, BY TYPE, 2019–2026 (USD BILLION)

TABLE 118 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD BILLION)

10.6.4 BRAZIL

10.6.4.1 High production of clean energy in Brazil is driving the market

TABLE 119 BRAZIL: MARKET, BY COMPONENT, 2019–2026 (USD BILLION)

10.6.4.2 Brazil: Covid-19 Impact

10.6.5 REST OF SOUTH AMERICA

TABLE 120 REST OF SOUTH AMERICA: MARKET, BY COMPONENT, 2019–2026 (USD BILLION)

10.6.5.1 Argentina: Laws & regulations

11 COMPETITIVE LANDSCAPE (Page No. - 190)

11.1 KEY PLAYERS’ STRATEGIES

TABLE 121 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2020

11.2 MARKET EVALUATION FRAMEWORK

TABLE 122 MARKET EVALUATION FRAMEWORK FOR ALL PLAYERS, 2018-2020

TABLE 123 ENVIRONMENTAL TECHNOLOGY MARKET: COMPONENT FOOTPRINT

TABLE 124 MARKET: APPLICATION FOOTPRINT

TABLE 125 MARKET: COMPANY REGION FOOTPRINT

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STAR

11.3.2 PERVASIVE

11.3.3 EMERGING LEADER

11.3.4 PARTICIPANT

FIGURE 33 ENVIRONMENTAL TECHNOLOGY MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

11.4 TOP PLAYERS BY TECHNOLOGICAL SOLUTIONS

TABLE 126 CARBON CAPTURE, UTILIZATION & STORAGE (CCUS): TOP 5 PLAYERS, 2020

TABLE 127 WASTEWATER TREATMENT SERVICES: TOP 5 PLAYERS, 2020

TABLE 128 AIR QUALITY MONITORING: TOP 5 PLAYERS, 2020

TABLE 129 PHOTOVOLTAICS: TOP 5 PLAYERS, 2020

TABLE 130 WASTE MANAGEMENT: TOP 5 PLAYERS, 2020

11.5 COMPETITIVE SCENARIO

TABLE 131 MARKET: PRODUCT LAUNCHES, FEBRUARY 2019–OCTOBER 2020

TABLE 132 MARKET: DEALS, JANUARY 2018 – MAY 2021

TABLE 133 MARKET: OTHER DEVELOPMENTS, JUNE 2018- MARCH 2021

12 COMPANY PROFILES (Page No. - 218)

12.1 MAJOR COMPANIES

(Business overview, Products/solutions/services offered, Recent Developments, Impact of COVID-19, MNM view)*

12.1.1 VEOLIA

FIGURE 34 VEOLIA: COMPANY SNAPSHOT

TABLE 134 VEOLIA: BUSINESS OVERVIEW

12.1.2 SUEZ

FIGURE 35 SUEZ: COMPANY SNAPSHOT

TABLE 135 SUEZ: BUSINESS OVERVIEW

12.1.3 AECOM

FIGURE 36 AECOM: COMPANY SNAPSHOT

TABLE 136 AECOM: BUSINESS OVERVIEW

12.1.4 LENNOX INTERNATIONAL

FIGURE 37 LENNOX INTERNATIONAL: COMPANY SNAPSHOT

TABLE 137 LENNOX INTERNATIONAL: BUSINESS OVERVIEW

12.1.5 TELEDYNE TECHNOLOGIES INCORPORATED

FIGURE 38 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

TABLE 138 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

12.1.6 THERMO FISHER SCIENTIFIC INC.

FIGURE 39 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

TABLE 139 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

12.1.7 CARBON CLEAN

TABLE 140 CARBON CLEAN: BUSINESS OVERVIEW

12.1.8 ARCADIS N.V.

FIGURE 40 ARCADIS N.V.: COMPANY SNAPSHOT

TABLE 141 ARCADIS N.V.: BUSINESS OVERVIEW

12.1.9 WASTE CONNECTIONS

FIGURE 41 WASTE CONNECTIONS: COMPANY SNAPSHOT

TABLE 142 WASTE CONNECTIONS: BUSINESS OVERVIEW

12.1.10 TOTAL S.A.

FIGURE 42 TOTAL S.A.: COMPANY SNAPSHOT

TABLE 143 TOTAL S.A.: BUSINESS OVERVIEW

12.1.11 COVANTA HOLDING CORPORATION

FIGURE 43 COVANTA HOLDING CORPORATION: COMPANY SNAPSHOT

TABLE 144 COVANTA HOLDING CORPORATION: BUSINESS OVERVIEW

12.1.12 HITACHI ZOSEN CORPORATION

FIGURE 44 HITACHI ZOSEN CORPORATION: COMPANY SNAPSHOT

TABLE 145 HITACHI ZOSEN CORPORATION: BUSINESS OVERVIEW

12.1.13 BIFFA

FIGURE 45 BIFFA: COMPANY SNAPSHOT

TABLE 146 BIFFA: BUSINESS OVERVIEW

12.1.14 ABATEMENT TECHNOLOGIES

TABLE 147 ABATEMENT TECHNOLOGIES: BUSINESS OVERVIEW

12.1.15 CYPHER ENVIRONMENTAL

TABLE 148 CYPHER ENVIRONMENTAL: BUSINESS OVERVIEW

12.1.16 GEO-CLEANSE INTERNATIONAL, INC.

TABLE 149 GEO-CLEANSE INTERNATIONAL, INC.: BUSINESS OVERVIEW

12.1.17 SVANTE INC.

TABLE 150 SVANTE INC.: BUSINESS OVERVIEW

12.1.18 CARBONCURE TECHNOLOGIES INC.

TABLE 151 CARBONCURE TECHNOLOGIES INC.: BUSINESS OVERVIEW

12.1.19 TRC COMPANIES, INC.

TABLE 152 TRC COMPANIES, INC.: BUSINESS OVERVIEW

12.1.20 SUNFIRE GMBH

TABLE 153 SUNFIRE GMBH: BUSINESS OVERVIEW

12.1.21 BACTECH INC.

TABLE 154 BACTECH INC.: BUSINESS OVERVIEW

12.1.22 IVEY INTERNATIONAL INC.

TABLE 155 IVEY INTERNATIONAL INC.: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 C-CAPTURE

TABLE 156 C-CAPTURE: BUSINESS OVERVIEW

12.2.2 TANDEM TECHNICAL

TABLE 157 TANDEM TECHNICAL: BUSINESS OVERVIEW

12.2.3 CARBON ENGINEERING (CE)

TABLE 158 CARBON ENGINEERING (CE): BUSINESS OVERVIEW

12.2.4 ENGIE IMPACT

TABLE 159 ENGIE IMPACT: BUSINESS OVERVIEW

12.2.5 INTELEX

TABLE 160 INTELEX: BUSINESS OVERVIEW

12.2.6 ISOMETRIX

TABLE 161 ISOMETRIX: BUSINESS OVERVIEW

12.2.7 TARANIS

TABLE 162 TARANIS: BUSINESS OVERVIEW

12.2.8 TRACE GENOMICS

TABLE 163 TRACE GENOMICS: BUSINESS OVERVIEW

12.2.9 PYCNO

TABLE 164 PYCNO: BUSINESS OVERVIEW

12.2.10 REMONDIS SE & CO. KG

TABLE 165 REMONDIS SE & CO. KG: BUSINESS OVERVIEW

12.2.11 CLIMEWORKS

TABLE 166 CLIMEWORKS: BUSINESS OVERVIEW

12.2.12 THERMAX LTD.

TABLE 167 THERMAX LTD.: BUSINESS OVERVIEW

12.2.13 XYLEM, INC.

TABLE 168 XYLEM, INC: BUSINESS OVERVIEW

12.2.14 ECOMED SERVICES

12.2.15 SKRAP

12.2.16 RECYGLO

12.2.17 SAAHAS ZERO WASTE

12.2.18 RECYCLE TRACK SYSTEMS

12.2.19 GEM ENVIRO MANAGEMENT PVT. LTD

12.2.20 RECYCLING TECHNOLOGIES

12.2.21 VITAL WASTE

12.2.22 REKOSISTEM

12.2.23 UNBOUND CHEMICALS

*Details on Business overview, Products/solutions/services offered, Recent Developments, Impact of COVID-19, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 307)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

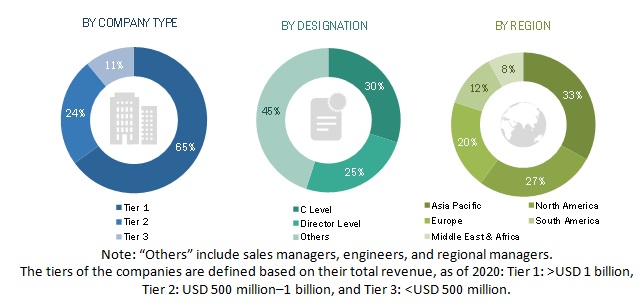

The study involved four major activities in estimating the current size of the environmental technology market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the environmental technology value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases of various companies and associations. The secondary research was mainly used to obtain key information about the industry’s supply chain, to identify the key players of various solutions and services, market classification and segmentation according to offerings of the major players, industry trends to the bottom-most level, regional markets, and key developments from both market and technology oriented perspectives.

Primary Research

The environmental technology market comprises several stakeholders, such as environmental technology solution providers, chemical suppliers for various technology and solutions, environmental technology providers, government and research organizations, industry associations, r&d institutions, and environmental support agencies.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEO), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

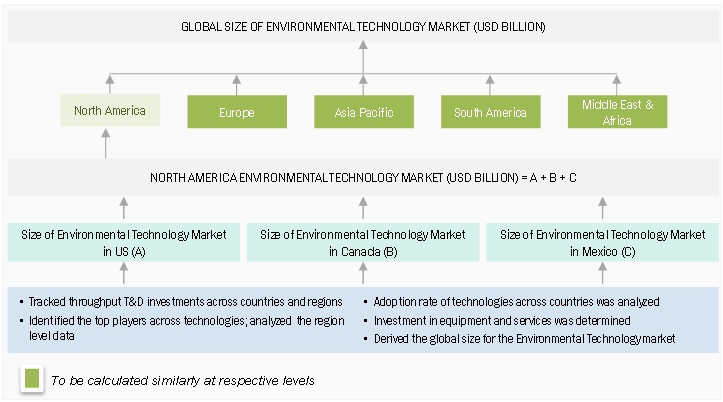

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the environmental technology market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global environmental technology market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

MARKET INTELLIGENCE

- To analyze and forecast the size of the environmental technology market in terms of value

- To define, describe, and forecast the market size by component, technological solutions, application, vertical, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, joint ventures, mergers, acquisitions, agreements, collaborations, product launches, and partnerships as in the market

COMPETITIVE INTELLIGENCE

- To identify and profile the key players in the environmental technology market

- To determine the top players offering various technologies (solutions and services) in the market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Environmental Technology Market