Enteric Disease Testing Market by Technology (Traditional and Rapid), End Use (Food (Meat, Poultry, Seafood, Dairy, Processed Foods, and Fruits & Vegetables) and Water), Pathogen Tested, and Region - Global Forecast to 2026

Enteric Disease Testing Market Overview (2021-2026)

The enteric disease testing market, valued at USD 1.8 billion in 2021, is expected to grow at a compound annual growth rate (CAGR) of 6.0%, reaching USD 2.4 billion by 2026. The increasing food demand has compelled farmers, food manufacturers, and suppliers to increase the quantity and improve the quality of agricultural produce and food products. To meet the increasing food demand, global food production must be increased by 70% by 2050, according to the Food and Agriculture Organization of the United Nations (FAO). The increase in global food production impacts the growth of the enteric disease testing market with an increasing number of enteric disease controls in each step—from the raw material procurement till the product reaches consumers, who look out for accredited certification when they purchase food products to ensure the safety of food.

Enteric Disease Testing Market Dynamics

Driver: Increase in demand for convenience foods

Busy lifestyles have slowly shifted consumer focus from traditional buying of raw food products to convenience and packaged food products, such as frozen foods and ready-to-eat (RTE) meals. For higher marketability, additives are used to accentuate the organoleptic characteristics of food & beverages. Packaged products are also added with preservatives to improve their shelf life.

With the increase in preference for convenience foods, the need for enteric disease testing is growing.

Restraint: Lack of proper regulations governing pathogen testing in the developing economies

The food industry in developing countries remains highly fragmented and is predominated by small and unorganized players, who may have not necessarily adopted proper food testing practices, leading to a greater risk of contamination. The testing of food & beverage products, such as packaged foods, dairy products, beverages, and meat products, requires proper enforcement measures, coordination between market stakeholders, and supporting infrastructure. However, many countries that are classified in the cluster of developing economies lack these factors, acting as a restraint to the testing of pathogens in food and water in these regions.

Opportunity: Technological innovations in the enteric disease testing industry

Technological advancements and innovation across the supply chain have brought about a change in the way business is conducted. The focus is on reducing the lead time, sample utilization, the overall cost of testing services offered. Cheaper, faster, and efficient computing hardware coupled with improved software, network connectivity, and advanced sensors is gaining traction in the enteric disease industry.

Challenge: High cost associated with the testing of food and water

Automated testing instruments are equipped with advanced features and functionalities and are thus priced at a premium. For example, the price for spectroscopy-based systems ranges from USD 150,000 to USD 850,000. The estimated cost for the instrument, media, and labor is also very high for some end users.

"Testing laboratories require many such systems,

owing to which the entire capital cost investment increases significantly."

Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The food segment is estimated to account for the fastest growth in the by end use segment for the enteric disease testing market.

The increase in food trade has encouraged public health and government agencies to continuously monitor food quality and take prompt actions to identify, contain, and correct sources of outbreaks. For instance, the Enteric disease and Inspection Service (FSIS) has framed regulations to control the contamination of meat & poultry products in slaughterhouses and processing plants, based on the HACCP enteric disease control system.

By technology, the rapid technology segment is estimated to account for the largest market share in the enteric disease testing market.

Rapid technology in the food industry is used to monitor the count, type, and metabolites of microorganisms that lead to food spoilage, preservation, fermentation, food safety, and foodborne pathogens as the use of the Hazard Analysis & Critical Control Points (HACCP) model and other enteric disease systems have become firmly entrenched in quality assurance/quality control (QA/QC) programs, the industry’s need for “faster, better, cheaper” real-time test results has also increased.

The meat, poultry and seafood food sub-segment is estimated to account for the largest market share in the by food end use segment of enteric disease testing market over the forecast period.

The global consumption of meat and processed meat products is highly rising. Further, with expanding globalization, food products are traded, which provides scope for various processes ranging from packaging, handling, storing and transportation, leading to food infestation. All these factors lead to an increased chance of contamination of the food, due to which the meat and seafood products are estimated to account for the highest market share in the market.

The rising health awareness among consumers in the North American region and presence of key players is projected to account for the largest market size during the forecast period

The high level of awareness about healthy foods and nutrition is projected to drive the market growth for enteric disease testing market in North American region. Furthermore, the US and Canada combined have a high concentration of market players after Europe and are also high on technology adoption.

Top Companies in Enteric Disease Testing Market

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (US)

- SGS SA (Switzerland)

- Eurofins Scientific (Luxembourg)

- Bureau Veritas (France)

- Intertek (UK)

- Romer Labs (Austria)

- Mérieux NutriSciences (US)

- TÜV SÜD (Germany)

- PerkinElmer, Inc. (US)

- Becton Dickinson (US)

- Certified Laboratories (US)

- ALS Limited (Australia)

- Neogen Corporation (US)

- Hardy Diagnostics (US)

Scope of the report

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.8 billion |

|

Revenue forecast in 2026 |

USD 2.4 billion |

|

Growth Rate |

CAGR of 6.0% from 2021 to 2026 |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2021-2026 |

|

Historical Base Year |

2020 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

North America |

|

Key companies profiled |

|

This research report categorizes the enteric disease testing market based on pathogen, technology, end use and region.

On the basis of pathogen tested, the market has been segmented as follows:

- E. coli

- Salmonella

- Campylobacter

- Listeria

- Other pathogens (include Enterobacteriaceae; Shigella; Norovirus; Clostridium; Hepatitis A, B, and E; Rotavirus; and Vibrio)

On the basis of technology, the market has been segmented as follows:

- Traditional

- Rapid

- Convenience-based

- Polymerase chain reaction (PCR)

- Immunoassay

- Chromatography & spectrometry

On the basis of end use, the market has been segmented as follows:

- Water

-

Food

- Meat, poultry, and seafood

- Dairy products

- Processed food

- Fruits & vegetables

- Other food products (includes nuts, herbs & spices, and cereals & grain)

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW) (includes South Africa and the Middle East

Enteric Disease Testing Industry News

- In June 2021, SGS announced the official opening of Its new food testing laboratory in Papua New Guinea, which would offer internationally recognized quality testing to the food manufacturing, hospitality, and retail market segments.

- In February 2021, Thermo Fisher Scientific, Inc. acquired Mesa Biotech (US), which aims at expanding the benefits of molecular diagnostics at hospitals.

- In July 2021, Intertek acquired JLA Brazil, a market-leading independent provider of food, agri, and environmental testing solutions. The acquisition of JLA offered an opportunity to Intertek to enter the fast-growing food testing sector in Brazil, one of the largest markets globally in terms of agri-food & beverage production value.

Key Benefits of this report for you:

- Determining and projecting the size of the enteric disease testing market with respect to pathogen, end use, technology, and region, over five years ranging from 2021 to 2026.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling the key market players in the global market

- Determining the market share of key players operating in the enteric disease testing market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Service offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the enteric disease testing market?

Key players in this market include competitors such as SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), Bureau Veritas (France), ALS Limited (Australia), and TÜV SÜD (Germany).

What kind of stakeholders would be interested in this market?

The key stakeholders to enteric disease testing market would be

- Manufacturers, importers & exporters, traders, distributors, and suppliers of enteric disease testing kits, equipment, reagents, chemicals, and other related consumables

- Enteric disease testing laboratories

- Food raw material suppliers

- Food ingredient, intermediate, and end-product manufacturers and processors

- Government, research organizations, and institutions

- Food traders, trade associations, and industry bodies

- Regulatory bodies

-

Commercial research & development (R&D) institutions and financial institutions

- Regulatory bodies, including government agencies and NGOs

Which regions suffer more with enteric diseases in the world?

Enteric diseases are a major public health concern worldwide, particularly in developing countries. Some regions of the world have a higher burden of enteric diseases than others.

- Africa:Diarrhea is a major cause of death among children in Africa, and is often caused by a lack of clean water and adequate sanitation.

- South Asia: Enteric diseases are a major problem in South Asia, particularly in India, where poor sanitation and crowded living conditions contribute to the spread of illnesses such as cholera and typhoid fever.

- Southeast Asia: Diarrheal diseases are a major cause of death in Southeast Asia, particularly among children, and are often caused by contaminated water and food.

- Latin America and Caribbean: Diarrhea is one of the leading causes of death in children under the age of five in Latin America and the Caribbean.

- Eastern Mediterranean Region: In the Eastern Mediterranean Region countries like Afghanistan, Iraq, and Syria, the population has been affected by war, poverty and displacement which has made the people more vulnerable to infectious diseases, including enteric diseases.

It is important to note that enteric diseases can occur anywhere, and even in developed countries, outbreaks can occur due to lack of sanitation, food contamination and poor hygiene.

What are the key market trends in the enteric disease testing market?

The advancements in enteric disease testing technologies are trending in the global markets. All the major players are investing into research in order to improve their efficiency, coverage and parameters to be tested of each products to enhance their market share. .

What is the Enteric Disease Testing?

Enteric disease testing is the process of diagnosing and identifying infections or diseases that affect the gastrointestinal tract, specifically the small intestine and colon. These tests may include stool culture, PCR testing, serological testing, and microbiological tests to detect and identify specific pathogens such as bacteria, viruses, and parasites that cause enteric diseases. Enteric diseases can include conditions such as diarrhea, food poisoning, cholera, typhoid fever, and dysentery. These tests are often used in public health surveillance and outbreak investigations to identify the cause of a disease outbreak and to develop appropriate treatment and prevention strategies.

key factor affect the Enteric Disease Testing Market?

- Increase in the prevalence of enteric diseases

- Growing awareness about the importance of early diagnosis and treatment of enteric diseases

- Advancements in diagnostic technologies

- Increase in the number of diagnostic centers and laboratories

- Increase in funding for research and development in the field of enteric disease testing

- Increase in the number of government initiatives for the prevention and control of enteric diseases

- Increase in the number of partnerships and collaborations between industry players and research institutes

- Increase in the number of international travel and migration, leading to an increase in the risk of enteric diseases.

- Increase in demand for rapid and accurate diagnostic tests

- Increase in the number of mergers and acquisitions in the enteric disease testing market.

What is the reason for increase in enteric diseases?

There are several reasons why enteric diseases, which are infections of the intestinal tract, may increase. Some of the most common causes include:

- Poor sanitation and hygiene: When people do not have access to clean water and proper sanitation facilities, they are more likely to become infected with enteric pathogens.

- Contaminated food and water: Eating food or drinking water that is contaminated with bacteria, viruses, or parasites can lead to enteric infections.

- Overcrowding: When people live in close proximity to one another, it can be easier for enteric pathogens to spread from person to person.

- Climate change: Climate change has been observed to increase risk of waterborne and foodborne diseases.

- Travel: Enteric diseases can also be spread through travel, as people may be exposed to different types of pathogens in different parts of the world.

- Antimicrobial resistance: Some enteric pathogens have developed resistance to antibiotics which make it difficult to treat these infections

- Poor sanitation and hygiene in food processing facilities or grocery markets can also lead to contamination of food and water, leading to enteric infections.

- It is important to note that these factors may interact and contribute to the increase of enteric diseases. And also, Not all enteric diseases are caused by the same pathogens, so the specific reasons for an increase in a particular enteric disease will depend on the pathogen responsible for the infection.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 ENTERIC DISEASE TESTING MARKET SEGMENTATION

1.3.1 REGIONAL SEGMENTATION

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2015–2019

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 ENTERIC DISEASE TESTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

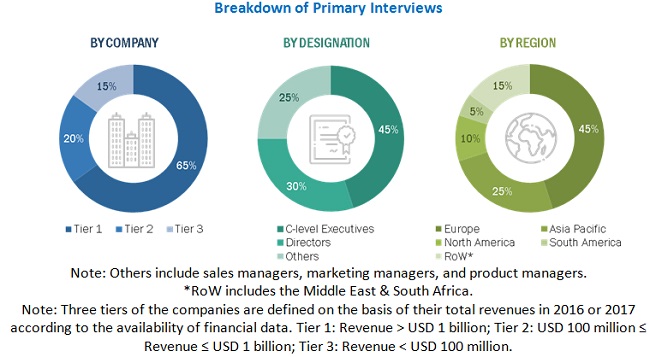

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.3.1 MARKET SIZE ESTIMATION: SUPPLY SIDE

FIGURE 6 MARKET SIZE ESTIMATION OF ENTERIC DISEASE TESTING MARKET, 2020

2.3.2 MARKET SIZE ESTIMATION: DEMAND SIDE

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.7 SCENARIO-BASED MODELLING

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 51)

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

4.2 NORTH AMERICA: ENTERIC DISEASE TESTING MARKET, BY END USE & COUNTRY

4.3 MARKET, BY PATHOGEN

FIGURE 18 SALMONELLA TO ACCOUNT FOR THE LARGEST SHARE FOR ENTERIC DISEASE TESTING IN 2020

4.4 MARKET, BY TECHNOLOGY

4.5 MARKET IN FOOD, BY REGION & SUBSEGMENT

4.6 MARKET: MAJOR REGIONAL SUBMARKETS

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASE IN FOODBORNE ILLNESSES

FIGURE 22 NUMBER OF FOODBORNE ILLNESSES ACROSS THE GLOBE, 2020 (MILLION)

FIGURE 23 US: TOP FIVE PATHOGENS CONTRIBUTING TO FOODBORNE ILLNESSES, 2020

5.3 MARKET DYNAMICS

FIGURE 24 ENTERIC DISEASE TESTING MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Increase in the number of food recalls

FIGURE 25 EU: NUMBER OF FOOD RECALLS, 2017–2020

FIGURE 26 US: REASONS FOR RECALL OF FOOD, 2020

5.3.1.2 Rise in demand for convenience foods

FIGURE 27 READY-TO-EAT FOODS MOST AFFECTED BY FOOD RECALLS, 2020

FIGURE 28 RISE IN GLOBAL MEAT EXPORTS, 2017–2020 (KT)

5.3.1.3 Increase in global trade owing to higher disposable income among consumers

FIGURE 29 GLOBAL AGRI-FOOD EXPORT VALUE, BY KEY COUNTRY, 2016–2018 (USD BILLION)

FIGURE 30 COUNTRY-WISE PREPARED FOODS TRADE SCENARIOS, BY KEY COUNTRY, 2019 (USD MILLION)

5.3.2 RESTRAINTS

5.3.2.1 Lack of proper regulations governing pathogen testing in the developing economies

5.3.3 OPPORTUNITIES

5.3.3.1 Technological innovations in the food safety testing industry

5.3.3.2 R&D investment directed toward the development of PCR technology for improved pathogen testing

TABLE 2 R&D INVESTMENT BY MAJOR COMPANIES

5.3.4 CHALLENGES

5.3.4.1 High cost associated with testing of food and water

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 REGULATORY FRAMEWORK

6.2.1 INTRODUCTION

6.2.2 INTERNATIONAL BODIES FOR FOOD SAFETY STANDARDS AND REGULATIONS

6.2.2.1 Codex Alimentarius Commission (CAC)

6.2.2.2 Global Food Safety Initiative (GFSI)

6.2.3 NORTH AMERICA

6.2.3.1 US regulations

6.2.3.2 Mexico

6.2.3.3 Canada

6.2.4 EUROPE

6.2.4.1 Microbiological criteria regulation

6.2.4.2 General food law for food safety

6.2.4.3 Germany

6.2.4.4 UK

6.2.4.5 France

6.2.4.6 Italy

6.2.4.7 Poland

6.2.5 ASIA PACIFIC

6.2.5.1 China

TABLE 3 PATHOGEN LIMITS FOR FOOD

6.2.5.2 India

6.2.5.3 Japan

6.2.5.4 Australia

6.2.5.5 New Zealand

6.2.6 SOUTH AMERICA

6.2.6.1 Brazil

6.2.6.2 Ministry of Agriculture, Livestock, and Food Supply (MAPA)

6.2.6.3 Ministry of Health (MS)

6.2.6.4 Argentina

6.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 ENTERIC DISEASE TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 DEGREE OF COMPETITION

6.4 MARKET ECOSYSTEM

FIGURE 31 ENTERIC DISEASE TESTING MARKET ECOSYSTEM MAP

6.4.1 UPSTREAM

6.4.2 DOWNSTREAM

TABLE 5 COMPANY MARKET ECOSYSTEM

6.5 SUPPLY CHAIN ANALYSIS

FIGURE 32 REGULATORY BODIES: ENTERIC DISEASE TESTING MARKET

6.5.1 R&D

6.5.2 PRODUCTION

6.5.3 PROCESSING & TRANSFORMING

6.5.4 TRANSPORTATION

6.5.5 FINAL PREPARATION

6.5.6 DISTRIBUTION

6.6 TECHNOLOGY ANALYSIS

6.7 PATENT ANALYSIS

FIGURE 33 PATENT ANALYSIS, 2017-2020

TABLE 6 KEY PATENTS FILED IN THE ENTERIC DISEASES TESTING MARKET, 2018- 2021

6.8 CASE STUDIES

TABLE 7 AUTOMATED PATHOGEN DETECTION USING VIDAS ADVANCED TESTING SOLUTION

6.9 DISRUPTIONS IMPACTING BUYERS IN THE MARKET

FIGURE 34 THE DEMAND FOR CONVENIENCE FOODS IS DRIVING THE MARKET FOR ENTERIC DISEASE TESTING IN FROZEN FRUITS & VEGETABLES

6.10 IMPACT OF COVID-19 ON MARKET DYNAMICS

6.10.1 COVID-19 INCREASED THE DEMAND FOR FOOD SAFETY AND ASSESSMENT

6.10.2 COVID-19 HAS SHIFTED THE FOCUS TOWARDS GENERAL HYGIENE SERVICES FROM FOOD SAFETY

7 ENTERIC DISEASE TESTING MARKET, BY PATHOGEN (Page No. - 88)

7.1 INTRODUCTION

FIGURE 35 MARKET SIZE, BY PATHOGEN, 2021 VS. 2026 (USD MILLION)

TABLE 8 PATHOGENESIS OF COMMON PATHOGENS

FIGURE 36 US: FOODBORNE DISEASE OUTBREAKS, OUTBREAK-ASSOCIATED ILLNESSES, AND HOSPITALIZATIONS, 2019

TABLE 9 US: INCIDENCE OF BACTERIAL AND PARASITIC INFECTIONS, 2019

TABLE 10 MARKET SIZE, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 11 MARKET SIZE, BY PATHOGEN, 2021–2026 (USD MILLION)

7.1.1 COVID-19 IMPACT ON THE ENTERIC DISEASE TESTING MARKET, BY PATHOGEN

7.1.1.1 Realistic Scenario

TABLE 12 REALISTIC SCENARIO: MARKET SIZE, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 13 REALISTIC SCENARIO: MARKET SIZE, BY PATHOGEN, 2021–2026 (USD MILLION)

7.1.1.2 Optimistic Scenario

TABLE 14 OPTIMISTIC SCENARIO: MARKET SIZE, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 15 OPTIMISTIC SCENARIO: MARKET SIZE, BY PATHOGEN, 2021–2026 (USD MILLION)

7.1.1.3 Pessimistic Scenario

TABLE 16 PESSIMISTIC SCENARIO: MARKET SIZE, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 17 PESSIMISTIC SCENARIO: MARKET SIZE, BY PATHOGEN, 2021–2026 (USD MILLION)

7.1.2 E. COLI

7.1.2.1 Proper food safety testing can limit the incidences of E. coli food poisoning

FIGURE 37 US: ANNUAL NUMBER OF E. COLI OUTBREAKS, 2009–2018

FIGURE 38 TRANSMISSION CYCLE OF ETEC (ENTEROTOXIGENIC E. COLI)

TABLE 18 E. COLI TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 19 E. COLI TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

7.1.3 SALMONELLA

7.1.3.1 Salmonella foodborne infection is found to be severe during summer than in winter

FIGURE 39 US: SALMONELLA OUTBREAKS, BY NUMBER AND CAUSE, 2009–2018

TABLE 20 SALMONELLA TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 21 SALMONELLA TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

7.1.4 CAMPYLOBACTER

7.1.4.1 WHO is strengthening disease surveillance to prevent foodborne illness

FIGURE 40 US: ANNUAL CAMPYLOBACTER OUTBREAKS, 2009–2018

TABLE 22 CAMPYLOBACTER TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 23 CAMPYLOBACTER TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

7.1.5 LISTERIA

7.1.5.1 L. monocytogenes causes high hospitalization rate than any other foodborne pathogen

TABLE 24 LISTERIA TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 25 LISTERIA TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

7.1.6 OTHER PATHOGENS

TABLE 26 OTHER PATHOGENS TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 27 OTHER PATHOGENS TESTING MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

8 ENTERIC DISEASE TESTING MARKET, BY END USE (Page No. - 103)

8.1 INTRODUCTION

FIGURE 41 EU: FREQUENCY DISTRIBUTION OF FOODBORNE OUTBREAKS THROUGH FOODS OF NON-ANIMAL ORIGIN, 2019

FIGURE 42 MARKET SIZE, BY END USE, 2021 VS. 2026 (USD MILLION)

TABLE 28 MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 29 MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 30 MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 31 MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE ENTERIC DISEASE TESTING MARKET, BY END USE

8.1.1.1 Realistic scenario

TABLE 32 REALISTIC SCENARIO: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 33 REALISTIC SCENARIO: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

8.1.1.2 Optimistic scenario

TABLE 34 OPTIMISTIC SCENARIO: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 35 OPTIMISTIC SCENARIO: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

8.1.1.3 Pessimistic scenario

TABLE 36 PESSIMISTIC SCENARIO: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 37 PESSIMISTIC SCENARIO: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

8.2 FOOD

8.2.1 MEAT & POULTRY PRODUCTS TO PROVIDE MORE SCOPE FOR FOOD TESTING

TABLE 38 ENTERIC DISEASE TESTING MARKET FOR FOOD SOURCE, BY FOODBORNE PATHOGENS

FIGURE 43 EU: FOODBORNE DISEASE OUTBREAKS, 2017

TABLE 39 EU: OCCURRENCE OF CAMPYLOBACTER IN MAJOR FOOD CATEGORIES

TABLE 40 US: FOOD RECALLS, 2020

TABLE 41 MARKET SIZE IN FOOD, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 MARKET SIZE IN FOOD, BY REGION, 2021–2026 (USD MILLION)

TABLE 43 MARKET SIZE IN FOOD, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 44 MARKET SIZE IN FOOD, BY PATHOGEN, 2021–2026 (USD MILLION)

8.2.2 MEAT, POULTRY, AND SEAFOOD

8.2.2.1 Unclean slaughterhouses and processing plants are the key contributors to bacterial contamination

FIGURE 44 EU: FREQUENCY DISTRIBUTION OF FOODBORNE OUTBREAKS THROUGH FOODS OF ANIMAL ORIGIN, 2019

TABLE 45 MARKET SIZE IN MEAT, POULTRY, AND SEAFOOD, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 MARKET SIZE IN MEAT, POULTRY, AND SEAFOOD, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 MARKET SIZE IN MEAT, POULTRY, & SEAFOOD, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 48 MARKET SIZE IN MEAT, POULTRY, & SEAFOOD, BY PATHOGEN, 2021–2026 (USD MILLION)

8.2.3 DAIRY PRODUCTS

8.2.3.1 Unhygienic storage conditions lead to contamination of dairy products

FIGURE 45 EU: FREQUENCY DISTRIBUTION OF ILLNESSES IN DAIRY PRODUCTS, 2019

TABLE 49 MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 MARKET SIZE IN DAIRY PRODUCTS, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 52 MARKET SIZE IN DAIRY PRODUCTS, BY PATHOGEN, 2021–2026 (USD MILLION)

8.2.4 PROCESSED FOOD

8.2.4.1 Ready-To-Eat foods are gaining more traction among consumers

TABLE 53 MARKET SIZE IN PROCESSED FOOD, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 MARKET SIZE FOR PROCESSED FOOD, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 MARKET IN PROCESSED FOODS, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 56 MARKET SIZE IN PROCESSED FOODS, BY PATHOGEN, 2021–2026 (USD MILLION)

8.2.5 FRUITS & VEGETABLES

8.2.5.1 Good handling practices can help in the safe production of fresh produce

TABLE 57 MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2016–2020 (USD MILLION)

TABLE 58 MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 MARKET SIZE IN FRUITS & VEGETABLES, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 60 ENTERIC DISEASE TESTING MARKET SIZE IN FRUITS & VEGETABLES, BY PATHOGEN, 2021–2026 (USD MILLION)

8.2.6 OTHER FOOD APPLICATIONS

TABLE 61 MARKET SIZE IN OTHER FOOD APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 MARKET SIZE IN OTHER FOOD APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 63 MARKET SIZE IN OTHER FOOD APPLICATIONS, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 64 MARKET SIZE IN OTHER FOOD APPLICATIONS, BY PATHOGEN, 2021–2026 (USD MILLION)

8.3 WATER

8.3.1 POOR HYGIENIC CONDITIONS LEAD TO WATERBORNE DISEASES IN DEVELOPING REGIONS

TABLE 65 MARKET SIZE IN WATER, BY REGION, 2016–2020 (USD MILLION)

TABLE 66 MARKET SIZE IN WATER, BY REGION, 2021–2026 (USD MILLION)

TABLE 67 MARKET SIZE IN WATER, BY PATHOGEN, 2016–2020 (USD MILLION)

TABLE 68 MARKET SIZE IN WATER, BY PATHOGEN, 2021–2026 (USD MILLION)

9 ENTERIC DISEASE TESTING MARKET, BY TECHNOLOGY (Page No. - 126)

9.1 INTRODUCTION

FIGURE 46 MARKET SIZE, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

TABLE 69 MARKET SIZE, BY TECHNOLOGY, 2016–2020 (USD MILLION)

TABLE 70 MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE GLOBAL MARKET, BY TECHNOLOGY

9.1.1.1 Realistic scenario

TABLE 71 REALISTIC SCENARIO: MARKET SIZE, BY TECHNOLOGY, 2016–2020 (USD MILLION)

TABLE 72 REALISTIC SCENARIO: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.1.1.2 Optimistic scenario

TABLE 73 OPTIMISTIC SCENARIO: MARKET SIZE, BY TECHNOLOGY, 2016–2020 (USD MILLION)

TABLE 74 OPTIMISTIC SCENARIO: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.1.1.3 Pessimistic scenario

TABLE 75 PESSIMISTIC SCENARIO: MARKET SIZE, BY TECHNOLOGY, 2016–2020 (USD MILLION)

TABLE 76 PESSIMISTIC SCENARIO: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.2 TRADITIONAL

9.2.1 CULTURAL TECHNIQUES HAVE BEEN PREFERRED FOR BOTH READY-TO-EAT FOODS AND FRESH PRODUCE

TABLE 77 TRADITIONAL ENTERIC DISEASE TESTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 78 MARKET SIZE FOR TRADITIONAL ENTERIC DISEASE TESTING, BY REGION, 2021–2026 (USD MILLION)

9.3 RAPID

TABLE 79 ENTERIC DISEASE TESTING MARKET SIZE FOR RAPID TECHNOLOGY, BY REGION, 2016–2020 (USD MILLION)

TABLE 80 RAPID MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 RAPID MARKET SIZE, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 82 RAPID MARKET SIZE, BY SUBSEGMENT, 2021–2026 (USD MILLION)

9.3.1 CONVENIENCE-BASED

9.3.1.1 Helps detect microorganisms based on their biochemical reactions under standard growth conditions

9.3.2 POLYMERASE CHAIN REACTION (PCR)

9.3.2.1 Real-time PCR involves fluorescent ethidium bromide monoazide dye that prevent the detection of dead organisms

9.3.3 IMMUNOASSAY

9.3.3.1 ELISA is based on the protein’s characteristic of binding to specific enzyme-labeled antibodies

9.3.4 CHROMATOGRAPHY & SPECTROMETRY

9.3.4.1 Inductively Coupled Plasma (ICP) is one of the major advancements of mass spectrometry

10 ENTERIC DISEASE TESTING MARKET, BY REGION (Page No. - 136)

10.1 INTRODUCTION

FIGURE 47 REGION-WISE FOOD SAFETY EVENTS, 2020

FIGURE 48 US ESTIMATED TO GROW AT THE HIGHEST GROWTH RATE IN THE GLOBAL MARKET, 2021–2026

TABLE 83 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 84 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE ENTERIC DISEASE TESTING MARKET, BY REGION

10.1.1.1 Realistic scenario

TABLE 85 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 86 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.1.1.2 Optimistic scenario

TABLE 87 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 88 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.1.1.3 Pessimistic scenario

TABLE 89 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 90 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 49 NORTH AMERICA: ENTERIC DISEASE TESTING MARKET SNAPSHOT, 2020

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 FSIS is the regulating body that enforces food safety regulations

FIGURE 50 NUMBER OF DEATHS RELATED TO CONFIRMED INFECTIONS, BY PATHOGEN, 2010–2018

FIGURE 51 US: FOODBORNE PATHOGEN INCIDENCE RATE PER 100,000 PERSONS, 2010–2016

TABLE 97 US: ESTIMATED EFFECTS OF FOODBORNE AGENTS (2016)

FIGURE 52 US: INCIDENCES RELATED TO THE TOP FIVE FOODBORNE PATHOGENS, 2016

TABLE 98 US: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 99 US: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 100 US: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 101 US: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Canadian government imposed stringent regulations on exports to ensure food safety

TABLE 102 CANADA: ENTERIC DISEASE TESTING MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 103 CANADA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Rise in the number of foodborne disease cases has increased focus on food safety in the country

TABLE 106 MEXICO: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 107 MEXICO: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 108 MEXICO: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 109 MEXICO: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 53 EU/EEA: DISTRIBUTION OF CONFIRMED CAMPYLOBACTERIOSIS CASES AND RATES PER 100 000 POPULATION BY YEAR AND COUNTRY, 2013–2017

FIGURE 54 EUROPE: ENTERIC DISEASE TESTING MARKET SNAPSHOT, 2020

TABLE 110 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 International food trade has increased food safety risks

FIGURE 55 GERMANY: ACTIVE FOOD TESTING CARRIED OUT FOR VARIOUS FOOD PATHOGENS IN MULTIPLE FOOD PRODUCTS, 2019

TABLE 116 GERMANY: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 117 GERMANY: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 118 GERMANY: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 119 GERMANY: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Large number of foodborne outbreaks in meat-based food encouraging the growth of enteric disease testing

TABLE 120 FRANCE: MARKET SIZE FOR ENTERIC DISEASE TESTING, BY END USE, 2016–2020 (USD MILLION)

TABLE 121 FRANCE: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 122 FRANCE: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 123 FRANCE: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3.3 SPAIN

10.3.3.1 Outbreak of listeriosis will have serious implications on the Spanish meat industry

TABLE 124 SPAIN: ENTERIC DISEASE TESTING MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 125 SPAIN: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 126 SPAIN: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 127 SPAIN: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Products of animal origin products are found to be more problematic in this region

TABLE 128 ITALY: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 129 ITALY: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 130 ITALY: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 131 ITALY: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3.5 POLAND

10.3.5.1 Increase in incidences of Salmonella outbreaks drives awareness about food safety

TABLE 132 POLAND: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 133 POLAND: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 134 POLAND: MARKET SIZE IN FOOD, BY SUBSEGMENTS, 2016–2020 (USD MILLION)

TABLE 135 POLAND: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3.6 UK

10.3.6.1 Norovirus infection is estimated to occur every year in the UK

TABLE 136 UK: MARKET SIZE FOR ENTERIC DISEASE TESTING, BY END USE, 2016–2020 (USD MILLION)

TABLE 137 UK: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 138 UK: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 139 UK: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 140 REST OF EUROPE: ENTERIC DISEASE TESTING MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 143 REST OF EUROPE: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

TABLE 144 ASIA PACIFIC: MARKET SIZE FOR ENTERIC DISEASE TESTING, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 E. coli to be the major pathogen found to affect people

TABLE 150 JAPAN: ENTERIC DISEASE TESTING MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 151 JAPAN: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 152 JAPAN: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 153 JAPAN: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Microbial contamination is reported to be the biggest food safety risk

TABLE 154 CHINA: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 155 CHINA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 156 CHINA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 157 CHINA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 FSSAI to safeguard the quality of food produced

TABLE 158 INDIA: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 159 INDIA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 160 INDIA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 161 INDIA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.4.1 Gastroenteritis occurs every year, affecting several people

TABLE 162 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR ENTERIC DISEASE TESTING, BY END USE, 2016–2020 (USD MILLION)

TABLE 163 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 164 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 165 AUSTRALIA & NEW ZEALAND: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.4.5 THAILAND

10.4.5.1 Demand for food exports to boost the growth of the market

TABLE 166 THAILAND: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 167 THAILAND: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 168 THAILAND: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 169 THAILAND: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 170 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 174 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 175 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 176 SOUTH AMERICA: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 177 SOUTH AMERICA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 178 SOUTH AMERICA: MARKET FOR FOOD END USE, BY SUBSEGMENT,2016–2020 (USD MILLION)

TABLE 179 SOUTH AMERICA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Export of agricultural produce to boost the demand for enteric disease testing

TABLE 180 BRAZIL: ENTERIC DISEASE TESTING MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 181 BRAZIL: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 182 BRAZIL: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 183 BRAZIL: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Food companies are taking preventive measures for pathogen infections

TABLE 184 ARGENTINA: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 185 ARGENTINA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 186 ARGENTINA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 187 ARGENTINA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 188 REST OF SOUTH AMERICA: ENTERIC DISEASE TESTING MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 189 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 190 REST OF SOUTH AMERICA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 191 REST OF SOUTH AMERICA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.6 REST OF THE WORLD (ROW)

TABLE 192 ROW: MARKET SIZE FOR ENTERIC DISEASE TESTING, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 193 ROW: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 194 ROW: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 195 ROW: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 196 ROW: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 197 ROW: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.6.1 SOUTH AFRICA

10.6.1.1 Growth in the demand to follow international standards is encouraging enteric disease testing

TABLE 198 SOUTH AFRICA: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 199 SOUTH AFRICA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 201 SOUTH AFRICA: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

10.6.2 MIDDLE EAST

10.6.2.1 Food safety services are driven by food imports from other countries

TABLE 202 MIDDLEAST: MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 203 MIDDLEAST: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 204 MIDDLEAST: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2016–2020 (USD MILLION)

TABLE 205 MIDDLEAST: MARKET SIZE IN FOOD, BY SUBSEGMENT, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 195)

11.1 OVERVIEW

11.2 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE ENTERIC DISEASES TESTING MARKET

11.3 MARKET SHARE ANALYSIS, 2020

FIGURE 56 MARKET SHARE OBTAINED BY DOMINANT AND OTHER PLAYERS

11.4 COVID-19-SPECIFIC COMPANY RESPONSE

11.4.1 SGS SA

11.4.2 MERCK KGAA

11.4.3 EUROFINS SCIENTIFIC

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 57 ENTERIC DISEASE TESTING MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

11.6 PRODUCT FOOTPRINT

TABLE 206 COMPANY FOOTPRINT, BY TECHNOLOGY

TABLE 207 COMPANY FOOTPRINT, BY END-USE

TABLE 208 COMPANY FOOTPRINT, BY REGION

11.7 COMPANY EVALUATION QUADRANT (START-UP/SME)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 58 ENTERIC DISEASE TESTING MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UPS/SME)

11.8 COMPETITIVE SCENARIO

11.8.1 NEW PRODUCTS LAUNCHES

TABLE 209 MARKET FOR ENTERIC DISEASE TESTING: NEW PRODUCT LAUNCHES, JULY 2019

11.8.2 DEALS

TABLE 210 MARKET FOR ENTERIC DISEASE TESTING: DEALS, MAY 2017- JULY 2021

11.8.3 OTHER DEVELOPMENTS

TABLE 211 MARKET FOR ENTERIC DISEASE TESTING: OTHER DEVELOPMENTS, MAY 2018- JUNE 2021

12 COMPANY PROFILES (Page No. - 208)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 KEY COMPANIES

12.1.1 SGS SA

TABLE 212 SGS SA: BUSINESS OVERVIEW

FIGURE 59 SGS SA: COMPANY SNAPSHOT

TABLE 213 SGS SA: PRODUCT OFFERINGS

TABLE 214 SGA SA: DEALS

TABLE 215 SGS SA: OTHERS

12.1.2 MERCK KGAA

TABLE 216 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 60 MERCK KGAA: COMPANY SNAPSHOT

TABLE 217 MERCK KGAA: PRODUCT OFFERINGS

12.1.3 THERMO FISHER SCIENTIFIC INC.

TABLE 218 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 61 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

TABLE 219 THERMO FISHER SCIENTIFIC INC.: PRODUCT OFFERINGS

TABLE 220 THERMO FISHER SCIENTIFIC INC.: DEALS

12.1.4 EUROFINS SCIENTIFIC

TABLE 221 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 62 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 222 EUROFINS SCIENTIFIC: PRODUCT OFFERINGS

TABLE 223 EUROFINS SCIENTIFIC: DEALS

TABLE 224 EUROFINS SCIENTIFIC: OTHER DEVELOPMENTS

12.1.5 ALS LIMITED

TABLE 225 ALS LIMITED: BUSINESS OVERVIEW

FIGURE 63 ALS LIMITED: COMPANY SNAPSHOT

TABLE 226 ALS LIMITED: PRODUCT OFFERINGS

TABLE 227 ALS LIMITED: DEALS

TABLE 228 ALS LIMITED: OTHER DEVELOPMENTS

12.1.6 ASURE QUALITY

TABLE 229 ASURE QUALITY: BUSINESS OVERVIEW

FIGURE 64 ASURE QUALITY: COMPANY SNAPSHOT

TABLE 230 ASURE QUALITY: PRODUCT OFFERINGS

12.1.7 BUREAU VERITAS

TABLE 231 BUREAU VERITAS: BUSINESS OVERVIEW

FIGURE 65 BUREAU VERITAS: COMPANY SNAPSHOT

TABLE 232 BUREAU VERITAS: PRODUCT OFFERINGS

12.1.8 INTERTEK

TABLE 233 INTERTEK: BUSINESS OVERVIEW

FIGURE 66 INTERTEK: COMPANY SNAPSHOT

TABLE 234 INTERTEK: PRODUCT OFFERINGS

TABLE 235 INTERTEK: DEALS

12.1.9 BIO-RAD LABORATORIES, INC.

TABLE 236 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 67 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

TABLE 237 BIO-RAD LABORATORIES, INC.: PRODUCT OFFERINGS

12.1.10 BECTON DICKINSON

TABLE 238 BECTON DICKINSON: BUSINESS OVERVIEW

FIGURE 68 BECTON DICKINSON: COMPANY SNAPSHOT

TABLE 239 BECTON DICKINSON: PRODUCT OFFERINGS

12.1.11 3M

TABLE 240 3M: BUSINESS OVERVIEW

FIGURE 69 3M: COMPANY SNAPSHOT

TABLE 241 3M: PRODUCT OFFERINGS

12.1.12 PERKINELMER, INC.

TABLE 242 PERKINELMER, INC.: BUSINESS OVERVIEW

FIGURE 70 PERKINELMER, INC.: COMPANY SNAPSHOT

TABLE 243 PERKINELMER, INC.: PRODUCT OFFERINGS

12.1.13 NEOGEN CORPORATION

TABLE 244 NEOGEN CORPORATION: BUSINESS OVERVIEW

FIGURE 71 NEOGEN CORPORATION: COMPANY SNAPSHOT

TABLE 245 NEOGEN CORPORATION: PRODUCT OFFERINGS

12.1.14 MÉRIEUX NUTRISCIENCES

TABLE 246 MÉRIEUX NUTRISCIENCES: BUSINESS OVERVIEW

TABLE 247 MÉRIEUX NUTRISCIENCES: PRODUCT OFFERINGS

TABLE 248 MÉRIEUX NUTRISCIENCES: DEALS

12.1.15 TÜV SÜD

TABLE 249 TÜV SÜD: BUSINESS OVERVIEW

TABLE 250 TÜV SÜD: PRODUCT OFFERINGS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 HARDY DIAGNOSTICS

TABLE 251 HARDY DIAGNOSTICS: BUSINESS OVERVIEW

TABLE 252 HARDY DIAGNOSTICS: PRODUCT OFFERINGS

TABLE 253 HARDY DIAGNOSTICS: NEW PRODUCT LAUNCH

12.2.2 ROMER LABS

TABLE 254 ROMER LABS: BUSINESS OVERVIEW

TABLE 255 ROMER LABS: PRODUCT OFFERINGS

12.2.3 NOVA BIOLOGICALS

TABLE 256 NOVA BIOLOGICALS: BUSINESS OVERVIEW

TABLE 257 NOVA BIOLOGICALS: PRODUCT OFFERINGS

12.2.4 SYMBIO LABORATORIES

TABLE 258 SYMBIO LABORATORIES: BUSINESS OVERVIEW

TABLE 259 SYMBIO LABORATORIES: PRODUCT OFFERINGS

12.2.5 CERTIFIED LABORATORIES

13 ADJACENT AND RELATED MARKETS (Page No. - 257)

13.1 INTRODUCTION

TABLE 260 ADJACENT MARKETS TO ENTERIC DISEASE TESTING MARKET

13.2 LIMITATIONS

13.3 FOOD PATHOGEN TESTING MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 261 E. COLI MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 262 SALMONELLA MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 263 CAMPYLOBACTER MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

TABLE 264 LISTERIA MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

13.4 FOOD TESTING KITS MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 265 FOOD TESTING KITS MARKET SIZE IN MEAT, POULTRY, AND SEAFOOD PRODUCTS, BY REGION, 2015–2022 (USD MILLION)

TABLE 266 FOOD TESTING KITS MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2015–2022 (USD MILLION)

TABLE 267 FOOD TESTING KITS MARKET SIZE IN PROCESSED FOOD, BY REGION, 2015–2022 (USD MILLION)

TABLE 268 FOOD TESTING KITS MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2015–2022 (USD MILLION)

13.5 MICROBIAL WATER TESTING MARKET

13.5.1 MARKET DEFINITION

13.5.2 MARKET OVERVIEW

TABLE 269 MICROBIAL WATER TESTING SOLUTIONS MARKET SIZE, BY WATER TYPE, 2015–2022 (USD MILLION)

TABLE 270 MICROBIAL WATER TESTING SOLUTIONS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 271 DRINKING & BOTTLED MICROBIAL WATER TESTING SOLUTIONS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 272 INDUSTRIAL MICROBIAL WATER TESTING SOLUTIONS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

14 APPENDIX (Page No. - 265)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

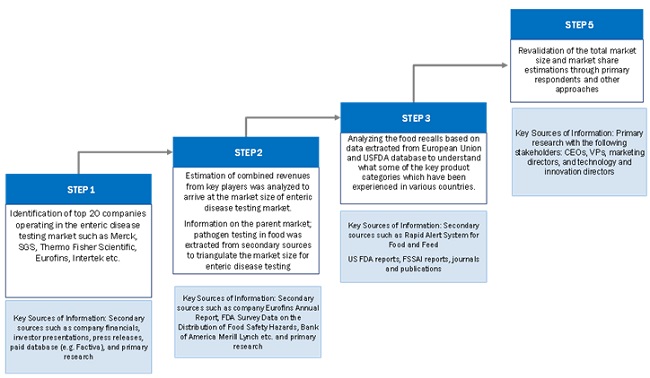

The study involved four major activities in estimating the enteric disease testing market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as the Food and Agriculture Organization (FAO), Enteric disease Council (FSC), The European Federation of National Associations of Measurement, Testing, and Analytical Laboratories (EUROLAB), European Enteric disease Authority (EFSA), Food Standards Australia New Zealand (FSANZ), and Canadian Food Inspection Agency (CFIA) were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as CEOs, vice presidents, service providers, technology and innovation directors, and related key executives from various key companies and organizations operating in the enteric disease testing market.

Post completion of market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research conducted aided in identifying and ratifying the segmentation types, industry trends, key players, competitive landscape of enteric disease testing services supplied by different types of market players, and key market dynamics, such as drivers, restraints, opportunities, industry trends, and key player strategies.

To know about the assumptions considered for the study, download the pdf brochure

Enteric Disease Testing Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

Top-Down

- Calculations for the market size have been based on the revenues of key companies identified in the market, which dominated the overall market size. This overall market size has been used in the top-down procedure to estimate the size of other individual markets (mentioned in the market segmentation) via percentage splits derived using secondary and primary sources.

- All macroeconomic and microeconomic factors such as the number of food recall, cases of contaminations, growth in the number of infectious diseases through enteric disease-causing pathogens that affect the growth of the enteric disease testing market were considered while estimating the market size.

- Further analysis of the revenue from each of the product categories was analyzed to understand the share of enteric disease testing in the food and water industries.

- The market size, regional, and segmental market shares so obtained were validated with key primary respondents in the enteric disease testing market.

Bottom-Up

- The bottom-up approach was implemented for the data extracted from secondary research to validate the share of the market segments obtained.

- The approach aided in understanding the trend of food applications for which enteric disease testing was adopted at a country level. This was done by analyzing the data on food recalls within different food categories such as meat, poultry, dairy products, and processed foods in each country due to microbial contamination. These were individually added up for each country to arrive at the global and regional market size and CAGR.

- By at a country level

- The bottom-up procedure has been employed to arrive at the overall size of the enteric disease testing market from the revenues of key players (companies) and their product share in the market at a country level.

Global Enteric disease testing Market Size: Methodology

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the enteric disease testing market in Rest of Europe, which includes countries such as Belgium, Russia, Denmark, Hungary, and Sweden

- Further breakdown of the enteric disease testing market in Rest of Asia Pacific, which includes countries such as Indonesia, South Korea, Malaysia, the Philippines, and Vietnam

- Further breakdown of the enteric disease testing market in Rest of South America, which includes countries such as Peru and Uruguay

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enteric Disease Testing Market

What is the strategic role of technologies? The results coming from this study could be relevant from several point of view and potentially interesting