Endpoint Detection and Response Market by Component (Solution and Service), Enforcement Point (Workstations, Mobile Devices, Servers, POS Terminals), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2021

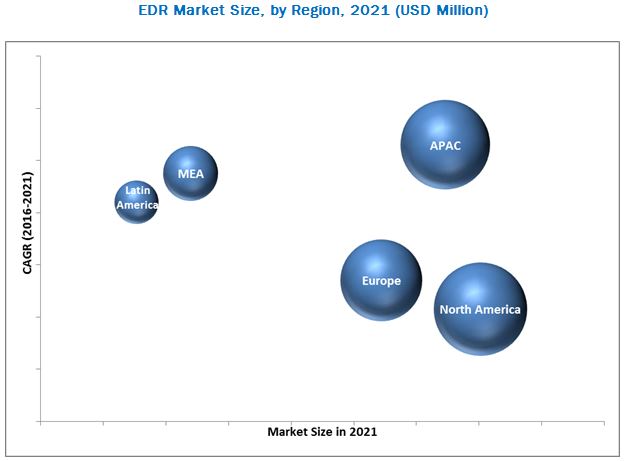

MarketsandMarkets expects, the endpoint detection and response market size to grow from $749.0 million in 2016 to $2,285.4 Million by 2021, at a Compound Annual Growth Rate (CAGR) of 25.0%. EDR solutions are required for various enforcement points, such as workstations, mobile devices, servers, point of sale terminals, and others. Increasing adoption of enterprise mobility and BYOD trends along with an overall rise in the number of enterprise-targeted cyber-attacks have led to growth of the endpoint detection and response (EDR) market. The growth of the Market is also propelled by the increasing integration of mobile and web applications and platforms across enterprises. The base year for the study is 2015 and the forecast period is considered to be 2016 to 2021.

Endpoint Detection and Response Market Dynamics

Drivers

- Need to mitigate IT security risks

- Increasing instances of enterprise endpoint targeted attacks

- Rising enterprise mobility trends across organizations

Restraints

- High cost of innovation and budget constraints

- Lack of awareness regarding internal and external threats

Opportunities

- Rise in the adoption of hosted Endpoint Detection and Response solutions

- Increasing demand for integrated and next-generation security solutions

Challenges

- Addressing the complexity of advanced threats

- Dynamicity of organizations and IT infrastructure

Need to mitigate IT security risks is driving the global Endpoint Detection and Response Market

The need to mitigate IT security risks is still the primary goal of enterprises. As businesses grow, new and sophisticated threats, for example zero-day malware, Trojans, and APTs, are created every day, putting c critical data at risk. This has encouraged enterprises to deploy EDR solutions to safeguard their endpoints and networks against potential cyber-attacks. The APAC and MEA are expected to witness a surge in deployment of such solutions, as these regions are going through industrialization, which has led to an increase in endpoint attacks. In order to mitigate IT security risks, enterprises can focus on training security staff in security policies and practices, managing access controls, encrypting data, and deploying security monitoring solutions. Focusing on training would help enterprises to significantly reduce the managed services cost; it would also help them develop their own cyber security team, eliminating the need to depend on a third party for their security needs.

The following are the major objectives of the study.

- To define, describe, and forecast the global Endpoint Detection and Response Market on the basis of component, enforcement point, deployment mode, organization size, vertical and region

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to the individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the EDR market

- To forecast the market size of the segments with respect to five main regions, namely North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players in the EDR market and comprehensively analyze their market size and core competencies2

- To track and analyze competitive developments, such as new product launches, mergers and acquisitions, and partnerships, agreements, and collaborations in the global Market

The research methodology used to estimate and forecast the EDR market begins with collection and analysis of data on key vendor revenues through secondary sources such as company website, press releases, annual reports, SC magazine, and SANS Institute studies. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global Endpoint Detection and Response Market from the revenue of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of the primary is depicted in the below figure:

The Endpoint Detection and Response Market comprises key vendors, such as McAfee, LLC (US), Cisco Systems, Inc. (US), RSA Security LLC. (US), FireEye, Inc. (US), Guidance Software, Inc. (US), Carbon Black, Inc. (US), Digital Guardian (US), Tripwire, Inc. (US), Symantec Corporation (US), and CrowdStrike, Inc. (US). These vendors sell EDR solutions to end-users to cater to their unique business requirements and security needs.

To know about the assumptions considered for the study, download the pdf brochure

Major Endpoint Detection and Response Market Developments

- In August 2016, Symantec acquired Blue Coat Systems, an advanced web security solutions provider for approximately USD 4.65 billion. Symantec will enhance its capabilities in advanced network and cloud security solutions.

- In July 2016, Carbon Black acquired Confer, a leading antivirus company. This will enable Carbon Black to deliver enhanced endpoint detection solutions. Confers security solution has been renamed Cb Defense.

- In October 2016, Symantec Corporation entered into a strategic partnership with VMware, a global cloud and mobility leader, to collaborate on endpoint management and threat security. Symantec will also join hands with VMware Mobile Security Alliance to deliver integrated identity management and endpoint management solutions.

Key Target Audience

- Government agencies

- EDR vendors

- Independent software vendors

- Consulting firms

- System integrators

- Value-Added Resellers (VARs)

- Information Technology (IT) security agencies

- Managed Security Service Providers (MSSPs)

Scope of the report

The research report segments the EDR market into the following submarkets:

By Component:

- Solution

- Service

- Professional services

- Implementation

- Consulting services

- Training and education

- Support and maintenance

- Managed services

Endpoint Detection and Response Market By Enforcement Point:

- Workstations

- Mobile devices

- Servers

- Point of sale terminals

- Others

By Deployment Mode:

- On-premises

- Managed

- Hybrid

Endpoint Detection and Response Market By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and telecom

- Government and public utilities

- Aerospace and defense

- Manufacturing

- Healthcare

- Retail

- Others

Endpoint Detection and Response Market By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Critical questions which the report answers

- What are new enforcement points which the EDR companies are exploring?

- Which are the key players in the market and how intense is the competition?

- Where will all these developments take the industry in the mid to long term?

- What are the applications areas of Endpoint Detection and Response?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America EDR market

- Further breakdown of the Europe EDR market

- Further breakdown of the APAC EDR market

- Further breakdown of the MEA EDR market

- Further breakdown of the Latin America EDR market

Company Information

- Detailed analysis and profiling of additional market players

The major growth drivers of the Endpoint Detection and Response Market include the need to mitigate IT security risks and increasing instances of enterprise endpoint-targeted attacks, coupled with the surge in demand from Small and Medium-sized Enterprises (SMEs), owing to the rise in the adoption of hosted EDR solutions.

EDR is a next-generation enterprise endpoint security solution that makes use of a set of tools and solutions to detect, identify, monitor, and handle malware and other Advanced Persistent Threats (APTs), and provides an effective response and remediation. Modern EDR solutions integrate virtual learning and behavioral analytics and function beyond the detection of incidents and response to make threat predictions ahead of time. Advanced EDR systems help reduce the overall attack surface, minimize the impact of an attack, and use virtual intelligence and observation to predict cyber-attacks before their occurrence in the enterprise ecosystem. Vendors are offering hosted EDR solutions that effectively help organizations detect modern-day cyber threats in real time and respond accordingly. Major solution suppliers also offer supporting services such as integration and training, along with support and maintenance for seamless transition and implementation of EDR solutions.

The Endpoint Detection and Response Market by component has been segmented, on the basis of solution and services. The market for services segment is expected to grow at the highest CAGR between 2016 and 2021. The high adoption of EDR solutions and services by the global organizations contribute to the rapid growth of the market.

EDR solution can be used for enforcement points such as workstations, mobile devices, servers, point of sale terminals, and others. The workstations segment is estimated to have the largest market size during the forecast period. The growth in the workstation segment is associated with the rise in the number of security breaches targeting workstations, where hackers try to gain access to sensitive data. With vulnerabilities becoming more complex and sophisticated, the demand for endpoint security products to counter the growing challenges posed by the threats is expected to increase. The mobile devices segment is estimated to grow at the highest CAGR during the forecast period, due to rise in malware, APTs, and phishing attacks.

Hybrid deployment is the fastest-growing deployment mode in the Endpoint Detection and Response Market, as it benefits organizations with increased scalability, speed, 24/7 services, and enhanced management capabilities. Small & Medium-sized Enterprises (SMEs), in particular, have opted for hybrid deployment, as it can help them avoid costs pertaining to hardware, software, storage, and technical staff.

Increasing instances of enterprise endpoint targeted attacks drive the growth of Endpoint Detection and Response Market

Banking Financial Services, and Insurance (BFSI)

BFSI and other financial institutions are upgrading physical and endpoint security solutions to protect the industrys employees, customers, assets, offices, branches and operations, and to optimize against internal and external threats. The critical data, database, applications and servers are under constant risk of being breached by attackers. The increase in smart banking, Internet banking, and mobile banking requires endpoint security to be embedded in every micro and macro component of information systems in the BFSI sector.Government

The growing number of breaches in the government and public utilities sector has increased the need for endpoint security to combat advanced threats. EDR solutions provide complete visibility at endpoints and make use of machine learning algorithms and big data behavioral analytics to provide signature-less detection. EDR solutions and services prevent APTs, ransomware, malware, viruses and phishing mails, and also monitor back entries. Governments around the world have initiated stringent cyber and IT laws and legal and regulatory compliances for protecting enterprises and consumers from advanced cyber-attacks.Retail

Retail organizations are now adopting new technologies, such as location-based marketing and internal work localization from one floor to another, to attract customers & and take full advantage of online business opportunities, which are vulnerable to threats. Retail organizations must secure network points that such as PoS terminals, e-commerce websites, third-party vendors, employees access points, and increasing IoT-based devices, such as printers & and security cameras. Various initiatives in the US, such as Retail Industry Leaders Association (RILA) and Retail Cyber Intelligence Sharing Centre (R-CISC), in America are also contributing significantly towards cyber security awareness.Healthcare

Healthcare data records are a very attractive target for attackers, as they contain valuable sensitive information. Stealing financial data has always been the primary target of cyber-attackers, but these days medical data is also becoming one of the major targets. Healthcare organizations face several challenges, such as maintaining the privacy of Electronic Health Record (EHR) and meeting various compliances set by the HIPAA. Due to highly proliferated digital medical devices, network and endpoint management and protection has become an essential need to save devices from malicious attacks.Budget constraints to implement new EDR technology infrastructure is a major challenge in the growth of the market. The cost of innovation is high for strong and advanced security, especially for SMEs which view budgetary constraints as a barrier to the growth of the EDR market. Undertaking IT security operations effectively without affecting adequate budgetary constraints is a huge challenge for SMEs. Since SMEs are facing budgetary issues, organizations need to understand which information assets are more important to control the increase in security threats.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Global Endpoint Detection and Response Market

4.2 Market, By Enforcement Point

4.3 Global Market

4.4 Lifecycle Analysis, By Region

5 Endpoint Detection and Response Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.2 By Enforcement Point

5.3.3 By Deployment Mode

5.3.4 By Organization Size

5.3.5 By Vertical

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need to Mitigate IT Security Risks

5.4.1.2 Increasing Instances of Enterprise Endpoint Targeted Attacks

5.4.1.3 Rising Enterprise Mobility Trends Across Organizations

5.4.2 Restraints

5.4.2.1 High Cost of Innovation and Budget Constraints

5.4.2.2 Lack of Awareness Regarding Internal and External Threats

5.4.3 Opportunities

5.4.3.1 Rise in the Adoption of Hosted Edr Solutions

5.4.3.2 Increasing Demand for Integrated and Next-Generation Security Solutions

5.4.4 Challenges

5.4.4.1 Addressing the Complexity of Advanced Threats

5.4.4.2 Dynamicity of Organizations and IT Infrastructure

5.5 Regulatory Implications

5.6 Innovation Spotlight

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

6.3.1 Strategic Benchmarking: Product Launch and Enhancement

7 Endpoint Detection and Response Market Analysis, By Component (Page No. - 47)

7.1 Introduction

7.2 Solutions

7.3 Services

7.3.1 Professional Services

7.3.1.1 Implementation

7.3.1.2 Consulting

7.3.1.3 Training and Education

7.3.1.4 Support and Maintenance

7.3.2 Managed Services

8 Market Analysis, By Enforcement Point (Page No. - 57)

8.1 Introduction

8.2 Workstations

8.3 Mobile Devices

8.4 Servers

8.5 Point of Sale Terminals

8.6 Others

9 Endpoint Detection and Response Market Analysis, By Deployment Mode (Page No. - 64)

9.1 Introduction

9.2 On-Premises

9.3 Managed/Hosted

9.4 Hybrid

10 Market Analysis, By Organization Size (Page No. - 69)

10.1 Introduction

10.2 Small and Medium Enterprises

10.3 Large Enterprises

11 Endpoint Detection and Response Market Analysis, By Vertical (Page No. - 73)

11.1 Introduction

11.2 Banking, Financial Services and Insurance (BFSI)

11.3 IT and Telecom

11.4 Government and Public Utilities

11.5 Aerospace and Defense

11.6 Manufacturing

11.7 Healthcare

11.8 Retail

11.9 Others

12 Endpoint Detection and Response Market Analysis, By Region (Page No. - 84)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 108)

13.1 Overview

13.2 Competitive Situations and Trends

13.3 Endpoint Detection and Response: Vendor Analysis

13.3.1 Agreements, Partnerships and Collaborations

13.3.2 Mergers & Acquisitions

13.3.3 New Product Launches

13.3.4 Business Expansions

14 Company Profiles (Page No. - 116)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 Intel Security McAfee

14.3 Cisco Systems, Inc.

14.4 RSA Security, LLC (EMC)

14.5 Fireeye, Inc.

14.6 Guidance Software, Inc.

14.7 Carbon Black, Inc.

14.8 Digital Guardian

14.9 Tripwire, Inc.

14.10 Symantec Corporation

14.11 Crowdstrike, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

15 Key Innovators (Page No. - 148)

15.1 Deep Instinct

15.2 Sentinelone

15.3 Cybereason Inc.

15.4 Tanium Inc.

15.5 Romad Cyber Systems

15.6 Cyberbit

16 Appendix (Page No. - 155)

16.1 Other Developments

16.1.1 Other Developments: Partnerships, Agreements and Collaborations

16.1.2 Other Developments: Mergers & Acquisitions

16.1.3 Other Developments: New Product Launches

16.2 Industry Experts

16.3 Discussion Guide

16.4 Knowledge Store: Marketsandmarkets Subscription Portal

16.5 Introduction RT: Real-Time Market Intelligence

16.6 Available Customizations

16.7 Related Reports

16.8 Author Details

List of Tables (78 Tables)

Table 1 Endpoint Detection and Response Market Size and Growth, 20142021(USD Million, Y-O-Y %)

Table 2 Innovation Spotlight: Latest Endpoint Detection and Response Innovations

Table 3 Market Size, By Component, 20142021 (USD Million)

Table 4 Solutions: Market Size, By Region, 20142021 (USD Million)

Table 5 Services: Market Size, By Region, 20142021 (USD Million)

Table 6 Endpoint Detection and Response Market Size, By Service, 20142021 (USD Million)

Table 7 Professional Services: Market Size, By Region, 20142021 (USD Million)

Table 8 Professional Services: Market Size, By Type, 20142021 (USD Million)

Table 9 Implementation: Market Size, By Region, 20142021 (USD Million)

Table 10 Consulting: Market Size, By Region, 20142021 (USD Million)

Table 11 Training and Education: Market Size, By Region, 20142021 (USD Million)

Table 12 Support and Maintenance: Market Size, By Region, 20142021 (USD Million)

Table 13 Managed Services: Market Size, By Region, 20142021 (USD Million)

Table 14 Market Size, By Enforcement Point, 20142021 (USD Million)

Table 15 Workstations: Market Size, By Region, 20142021 (USD Million)

Table 16 Mobile Devices: Market Size, By Region, 20142021 (USD Million)

Table 17 Servers: Market Size, By Region, 20142021 (USD Million)

Table 18 Pos Terminals: Market Size, By Region, 20142021 (USD Million)

Table 19 Others: Market Size, By Region, 20142021 (USD Million)

Table 20 Endpoint Detection and Response Market Size, By Deployment Mode, 20142021 (USD Million)

Table 21 On-Premises: Market Size, By Region, 20142021 (USD Million)

Table 22 Managed/Hosted: Market Size, By Region, 20142021 (USD Million)

Table 23 Hybrid:Market Size, By Region, 20142021 (USD Million)

Table 24 Endpoint Detection and Response Market Size, By Organization Size, 20142021 (USD Million)

Table 25 Small and Medium Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 26 Large Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 27 Market Size, By Vertical, 20142021 (USD Million)

Table 28 Banking, Financial Services and Insurance: Market Size, By Region, 20142021 (USD Million)

Table 29 IT and Telecom: Market Size, By Region, 20142021 (USD Million)

Table 30 Government and Public Utilities: Market Size, By Region, 20142021 (USD Million)

Table 31 Aerospace and Defense: Market Size, By Region, 20142021 (USD Million)

Table 32 Manufacturing: Market Size, By Region, 20142021 (USD Million)

Table 33 Healthcare: Market Size, By Region, 20142021 (USD Million)

Table 34 Retail: Market Size, By Region, 20142021 (USD Million)

Table 35 Others: Market Size, By Region, 20142021 (USD Million)

Table 36 Marketsize, By Region, 20142021 (USD Million)

Table 37 North America: Endpoint Detection and Response Market Size, By Component, 20142021 (USD Million)

Table 38 North America: Market Size, By Service, 20142021 (USD Million)

Table 39 North America: Market Size, By Professional Service, 20142021 (USD Million)

Table 40 North America: Market Size, By Enforcement Point, 20142021 (USD Million)

Table 41 North America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 42 North America: Market Size, By Organization Size, 20142021 (USD Million)

Table 43 North America: Market Size, By Vertical, 20142021 (USD Million)

Table 44 Europe: Market Size, By Component, 20142021 (USD Million)

Table 45 Europe: Market Size, By Service, 20142021 (USD Million)

Table 46 Europe: Market Size, By Professional Service, 20142021 (USD Million)

Table 47 Europe: Market Size, By Enforcement Point, 20142021 (USD Million)

Table 48 Europe: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 49 Europe: Market Size, By Organization Size, 20142021 (USD Million)

Table 50 Europe: Market Size, By Vertical, 20142021 (USD Million)

Table 51 Asia-Pacific: Endpoint Detection and Response Market Size, By Component, 20142021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Professional Service, 20142021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Enforcement Point, 20142021 (USD Million)

Table 55 Asia-Pacific: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 56 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Million)

Table 57 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Million)

Table 58 Middle East and Africa: Endpoint Detection and Response Market Size, By Component, 20142021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 60 Middle East and Africa: Market Size, By Professional Service, 20142021 (USD Million)

Table 61 Middle East and Africa: Market Size, By Enforcement Point, 20142021 (USD Million)

Table 62 Middle East and Africa: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 63 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Million)

Table 64 Middle East and Africa: Market Size, By Vertical, 20142021 (USD Million)

Table 65 Latin America: Market Size, By Component, 20142021 (USD Million)

Table 66 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 67 Latin America: Market Size, By Professional Service, 20142021 (USD Million)

Table 68 Latin America: Market Size, By Enforcement Point, 20142021 (USD Million)

Table 69 Latin America: Market Size, By Deployment Mode, 20142021 (USD Million)

Table 70 Latin America: Market Size, By Organization Size, 20142021 (USD Million)

Table 71 Latin America: Endpoint Detection and Response Market Size, By Vertical, 20142021 (USD Million)

Table 72 Agreements, Partnerships and Collaborations, 20142016

Table 73 Mergers & Acquisitions, 20152016

Table 74 New Product Launches, 2016

Table 75 Business Expansions, 20142016

Table 76 Other Developments: Partnerships, Agreements, and Collaborations, 20142016

Table 77 Other Developments: Mergers & Acquisitions, 2014

Table 78 Other Developments: New Product Launches, 20142016

List of Figures (52 Figures)

Figure 1 Global Endpoint Detection and Response Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 7 Mobile Device Enforcement Point is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 9 Hybrid Deployment Mode is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 10 BFSI Vertical Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 North America Estimated to Hold the Largest Share of the Endpoint Detection and Response Market in 2016

Figure 12 Need to Mitigate IT Security Risks Across Industry Verticals Expected to Drive theMarket

Figure 13 Mobile Devices Enforcement Point Segment is Expected to Grow at the Highest CAGR Over the Forecast Period

Figure 14 BFSI Industry Vertical and North America to Hold the Largest Share of the Market in 2016

Figure 15 Asia-Pacific Followed By Middle East and Africa Exhibits the Highest Growth Potential During 2016-2021

Figure 16 Evolution of the Endpoint Detection and Response

Figure 17 Endpoint Detection and Response Market Segmentation: By Component

Figure 18 Market Segmentation: By Enforcement Point

Figure 19 Market Segmentation: By Deployment Mode

Figure 20 Market Segmentation: By Organization Size

Figure 21 Market Segmentation: By Vertical

Figure 22 Market Segmentation: By Region

Figure 23 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 24 Endpoint Detection and Response Market: Value Chain

Figure 25 Strategic Benchmarking: Product Launch and Enhancement

Figure 26 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 27 Managed Services Segment is Expected to Grow at A High CAGR During the Forecast Period

Figure 28 Mobile Devices Enforcement Point Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Hybrid Deployment Mode is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Small and Medium Enterprises (SMES) Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 31 Banking, Financial Services and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Asia-Pacific Region is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Regional Snapshot: Asia-Pacific is the Emerging Region in the Endpoint Detection and Response Market

Figure 34 North America Market Snapshot

Figure 35 Asia-Pacific Market Snapshot

Figure 36 Companies Adopted New Product Launches as the Key Growth Strategy During the Period of 20142016

Figure 37 Battle for Market Share: New Product Launches is the Key Strategy Adopted By Leading Market Players

Figure 38 Market Evaluation Framework: Significant Number of New Product Launches Have Fueled the Growth of the Market From 20142016

Figure 39 Product Offerings Comparison

Figure 40 Business Strategies Comparison

Figure 41 Geographic Revenue Mix of Top Players

Figure 42 Intel Security - McAfee: Company Snapshot

Figure 43 Intel Security - McAfee: SWOT Analysis

Figure 44 Cisco Systems, Inc.: Company Snapshot

Figure 45 Cisco Systems, Inc.: SWOT Analysis

Figure 46 RSA Security: Company Snapshot

Figure 47 RSA Security: SWOT Analysis

Figure 48 Fireeye, Inc.: Company Snapshot

Figure 49 Fireeye, Inc.: SWOT Analysis

Figure 50 Guidance Software, Inc.: Company Snapshot

Figure 51 Guidance Software, Inc.: SWOT Analysis

Figure 52 Symantec Corporation: Company Snapshot

Growth opportunities and latent adjacency in Endpoint Detection and Response Market