Encoder Market by Encoder Type (Linear, Rotary), Signal Type (Incremental, Absolute), Technology, Application (Industrial, HC, Consumer Electronics, Automotive, Power, FnB, Aerospace, Printing, Textile) Region - Global Forecast to 2028

Encoder Market

Encoder Market And Top Companies

DYNAPAR

Dynapar Corporation is a subsidiary of Fortive—an electrical and electronics manufacturing group. The parent company offers its products through three business segments, namely, Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions, wherein Dynapar Corporation is a part of the precision technologies business segment. Dynapar offers a wide range of products and solutions, such as rotary encoders, resolvers, encoder accessories, condition monitoring, and condition monitoring applications. It offers various encoders through brands such as Dynapar, NorthStar, Harowe, and Hengstler. The company is associated with some of the Brand Standard Associations—ANSI, ASME, CSA Group, ISO, and others; Brand Communication Protocols—BiSS Interface, DeviceNet, Inetrbus, and Profibus; and Band Recognized Distributor Partners—AHTD, Fortive, DDC, Marathon, and Technosoft.

SENSATA TECHNOLOGIES

Sensata Technologies is a global industrial technology company and a pioneer in mission-critical sensors and controls. The company has a diverse product portfolio and has been catering to a wide range of verticals, such as aerospace & defense, energy, industrial, material handling, medical, motors, and professional food equipment. In 2018, Sensata manufactured and provided more than 47,000 products to its customers. The company operates through two major business segments—Performance Sensing and Sensing Solutions, wherein the encoders are part of the Sensing Solutions segment. The position sensors and encoders are marketed through brands such as Kavlico, BEI Sensors, and Newall. The rotary and linear encoders prove to have high quality, durability, accuracy, repeatability, reliability in tough environments, and competitive pricing. The company has a large presence across the globe, with business centers and manufacturing and sales sites located in 13 countries.

HEIDENHAIN

HEIDENHAIN is a pioneer in measurement control and drive system technologies. Major offerings of the company include linear encoders, angle encoders, rotary encoders, CNC controls, and digital readouts. These products are mainly used in high-precision machine tools as well as electric component manufacturing and distribution plants. Further, the company’s expertise in encoders has enabled it to automate production machines and systems and attain a prime position in the market. HEIDENHAIN provides its diverse product portfolio under the brands AMO, ETEL, IMT, LTN, NUMERIK JENA, RENCO, and RSF to most of the industries and applications, such as machine tools, automation, semiconductors, electronics, metrology, robotics, drive systems, medical technology, elevators, printing machines, structural health monitoring, and telescopes. The company has its sales agencies, service agencies, subsidiaries, as well as a distribution network. It has a cumulative of 30 subsidiaries and 40 distributors located across the globe. Additionally, its high emphasis on research and development has aided the company to focus mainly on innovation and development of advanced technologies.

Encoder Market and Top Applications

Consumer Electronics

Consumer electronics is one of the fastest-growing markets for encoders. In this industry, encoders are widely used in office equipment such as PC-based scanning equipment, printers, copiers, answering machines, and scanners. For instance, many industrial inkjet printing systems are equipped with a rotary encoder to track the motion of the object to be printed. This enables the print head to apply the image to a precisely controlled location on the object. Furthermore, an evident surge has been noticed in the use of encoders in APAC and North America for consumer electronics applications owing to the rapid adoption of new technologies and the presence of many consumer electronics giants, such as Apple (US), Samsung Electronics (South Korea), Huawei (China), Sony Corporation (Japan), HP Inc. (US)

Healthcare

Healthcare applications require high precision, where encoders play a vital role by accurate positioning. Applications such as robotic surgery, oncological radiation treatment, and laboratory analysis are all benefiting due to the advancements in encoder technology. Surgery robots that are surgeon-assist-based are being more widely accepted in the healthcare sector. Some surgery robots are required to have redundancy for motion control components, while others can drill and measure distances at the same time, making accuracy especially important. Besides, some of the other applications of encoders in the healthcare sector are ophthalmic laser treatment, dialysis, artificial respiration, physical therapy, and orthopedic rehab. Encoders play a vital role in laboratory analysis due to the presence of multiple machines that perform critical tasks where precise and accurate measurements of the position, speed, and motion are important.

Encoder Market By Top Encoder Type

Rotary Encoder

The increasing demand for automated industrial machines and robotics is driving the growth of the rotary encoders market. Rotary encoders are electromechanical devices used to measure the number of rotations, rotational angle, and rotational position of equipment. They are used for position sensing across various applications, for example, on motors paired with drives and automated machinery in consumer electronics, elevators, conveyor speed monitors, industrial machines, and robotics. They track the turning of motor shafts to generate a digital position and motion information. Whether incremental or absolute, magnetic, or optical, rotary encoders track motor shaft rotation to generate a digital position and motion information. Rotary encoders are used in a wide range of applications that require monitoring or control, or both, of mechanical systems, including industrial controls, robotics, photographic lenses, computer input devices, and rotating radar platforms.

Updated on : October 22, 2024

Encoder Market Size & Growth

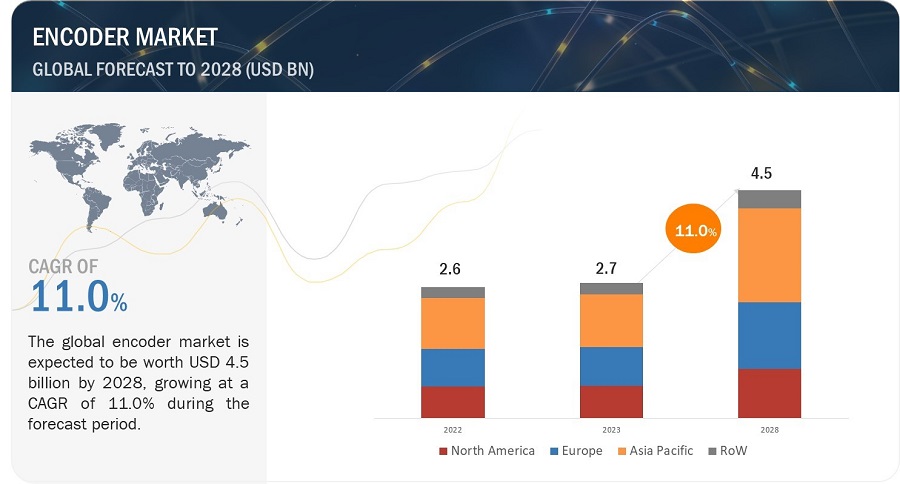

[210 Pages Report] The encoder market size is valued at USD 2.7 billion in 2023 and is projected to reach USD 4.5 billion by 2028, growing at a CAGR of 11.0% from 2023 to 2028. The rising need for high-end automation across industries, increasing adoption of Industry 4.0, and growing expansion of automotive markets worldwide are expected to propel the encoder Industry in the next five years. However, mechanical failure in harsh environments will likely pose challenges for the industry players.

The objective of the report is to define, describe, and forecast the encoder market share based on type, signal type, technology, application, and region.

Encoder Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Updated on : October 22, 2024

Encoder Market Trends

Drivers: The rising need for high-end automation across industries

The need for automation by manufacturers across industries has been the key demand driver for encoders. It is used in automation to provide precise speed and direction to ensure the motor runs safely and smoothly. As the adoption of automation is increasing worldwide, the usage of encoders is also increasing for various applications. For instance, encoders are used in web tensioning, registration mark timing, linear measurement, backstop gauging, filling, and conveying, among other applications. Similarly, in the manufacturing industry, electricity is used to power electric motors. Therefore, most of these electric motors use encoders to monitor or control the functions of motors.

Restraint: Accuracy-related errors

Encoders are at the heart of any closed-loop servo system and provide feedback to the controller, which uses this information to determine if the motor has reached the commanded position or velocity. The accuracy of encoders is affected by factors such as temperature, vibration, and wear and tear. Manufacturers are working towards developing new technologies and materials to improve the accuracy and reliability of encoders, but these improvements may add to the cost of production.

Opportunity: Rising government initiatives to boost industrial automation

Governments worldwide are supporting the adoption of various automation technologies for the structural development of manufacturing industries. As manufacturing industries are a vital segment of this development, governments worldwide focus on this segment. This is expected to boost the penetration of industrial robots and, consecutively, drive overall market growth.

Challenge: Mechanical failure in harsh environments

Encoders being used in harsh environments is one of the major challenges for the market. Environments that involve extreme temperatures like temperature variations, high humidity, dust, vibrations, and other adverse conditions may affect the accuracy and reliability of the encoder's measurements. In harsh environments, encoder failure is caused by liquid contamination or solid particulate, signal output failure, and mechanical bearing overload. As a result of any of these, the system operates erratically, or the encoder ceases to operate.

Encoder Map/Ecosystem:

Encoder Market Share

Market for incremental encoders is expected to have largest market share during the forecast period.

In 2022, incremental encoders held the largest share of the encoders market, and a similar trend is likely to be observed in the coming years. The simple design and economic nature have led to its high adoption in various applications such as factory automation, wind energy, motor feedback, and heavy-duty applications. HEIDENHAIN (Germany), Renishaw plc (UK), and Baumer (Switzerland) are a few of the key players offering incremental encoders.

Market for the magnetic encoders to have largest market size during the forecast period.

In a magnetic encoder, sensors are used to identify changes in magnetic fields from a rotating magnetized wheel, and then it converts them into electrical signals. A magnetic encoder uses three components: a rotating wheel or ring, a sensing circuit, and a series of magnetic poles around the circumference of the ring or wheel. With a magnetic encoder, a large-magnetized wheel spins over a plate of magneto-resistive sensors.A magnetic encoder is designed in a way that it is capable of providing reliable digital feedback even in harsh environments. Applications for this technology usually require robust sealing, high shock and vibration resistance, broad temperature specs, and contaminant protection while focusing on easy installation, output signal reliability, and downtime reduction.

Healthcare application segment to hold the second largest share of the encoder market during the forecast period

In 2022, the healthcare segment held the second-largest market share in applications. The healthcare segment requires high precision where there is no room for error; encoders play a vital role in accurate positioning. Medical equipment designers are utilizing advanced technologies; motion control is one such area in the healthcare sector. Applications such as robotic surgery, dialysis, artificial respiration, physical therapy, oncological radiation treatment, and laboratory analysis (DNA sequencing) are expected to grow in the coming years, owing to advances in encoder technology. In certain applications, there is a growing need for exact positioning, whereas, in other instances, smooth motion control is required. An encoder provides compact solutions for these controls in various healthcare applications.

Encoder Market Regional Analysis

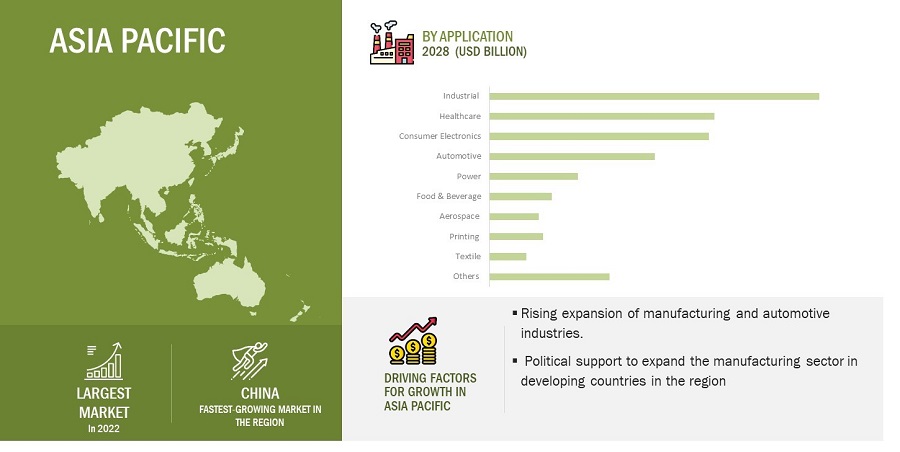

Encoder market in the Asia Pacific estimated to grow at the fastest rate during the forecast period.

The encoder market in the Asia Pacific has been studied for China, Japan, South Korea, India, and the Rest of Asia Pacific. The growth of the encoder market in the Asia Pacific is attributed to the active innovation in the electric and automotive industry, rapid urbanization and industrialization, increased GDP of emerging markets such as China and South Korea, and political support to expand the manufacturing sector in developing countries in the region.

Encoder Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Encoders Companies - Key Market Players:

Major vendors in the encoder companies include

- Sensata Technologies (US);

- HEIDENHAIN (Germany);

- Fortive (Dynapar) (US);

- Renishaw plc (UK);

- Mitutoyo Corporation (Japan);

- FRABA B.V. (Netherlands); ifm electronic (Germany);

- Pepperl+Fuchs (Germany);

- Maxon (Switzerland).

Encoders Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.7 billion in 2023 |

| Projected Market Size | USD 4.5 billion by 2028 |

| Growth Rate | At CAGR of 11.0% |

|

Encoder Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Forecast Units |

USD Million/USD Billion and Thousand Units |

|

Segments Covered |

|

|

Geographic regions covered |

|

|

Companies covered |

Sensata Technologies (US); HEIDENHAIN (Germany) Fortive (Dynapar) (US); Renishaw plc (UK); Mitutoyo Corporation (Japan); FRABA B.V. (Netherlands); ifm electronic (Germany); Pepperl+Fuchs (Germany); Maxon (Switzerland); Balluff Inc (Germany); Pilz GmbH & Co. KG (Germany); Tamagawa Seiki Co., Ltd (Japan), Faulhaber Group (Germany); Baumer (Switzerland); Koyo Electronics Industries Co., Ltd (Japan); Schneider Electric (France); Omron Corporation (Japan); Rockwell Automation (US); Sick AG (Germany); Kubler Group (Germany); Elap SRL (Italy); Sicko GmbH (Germany); Nemicon Corporation (Japan); Gurley Precision Instruments (Newyork); Lika Electronic SRL (Italy). |

Encoder Market Highlights

This research report categorizes the encoder market based on type, signal type, technology, application, and region

|

Segment |

Subsegment |

|

Based on Type: |

|

|

Based on Signal type |

|

|

Based on Technology |

Note: Other technologies include mechanical, laser, and visual sensing technologies. |

|

Based on Application |

Note: Other applications include marine, chemicals, oil & gas, and mining applications. |

|

Based on Region: |

|

Recent Developments in Encoder Industry

- For instance, in July 2022, Sensata Technologies (US) acquired Dynapower Company LLC (South Burlington, Vermont), a leading energy storage and power conversion system provider, by Pfingsten Partners, a private equity firm. The objective is to deliver highly engineered, mission-critical power conversion solutions to fast-growing renewable energy storage, electric vehicle charging, and industrial and defense.

- In July 2022, HEIDENHAIN (Germany) launched new encoders representing the newest inductive scanning technology: ECI 1122 and EQI 1134. These new encoders have EnDat 3 interface, because of which they benefit from low signal noise, low-speed ripple, operating-data collecting, and reduced cabling. These advantages were obtained by increasing the resolution of the single turn position to 22 bits, which also enhances motor control performance dramatically.

Frequently Asked Questions (FAQ):

Which are the major companies in the 5G from the Space market? What are their major strategies to strengthen their market presence

Some of the key players in the 5G from Space market are Oneweb (UK), Omnispace(US), Qualcomm (US), Ericsson (Sweden), and Rohde & Schwarz (Germany), among others, are the key manufacturers that secured 5G from Space contracts in the last few years. Contracts were the key strategies adopted by these companies to strengthen their 5G from Space market presence.

What are the drivers and opportunities for the 5G from Space market?

The demand for global connectivity, high-speed and low-latency connectivity, and ubiquitous coverage is increasing rapidly. Industries undergoing digital transformation seek advanced communication solutions, and 5G from space technology enables seamless integration and IoT connectivity. The market offers vast potential for innovation and collaboration, with governments investing in development and deployment. Emerging markets and industries present untapped opportunities, while enhanced user experiences drive the demand.

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for 5G from Space in the region. One of the key factors driving the market in Asia Pacific is the rising demand for launch & early orbit support, TT&C services, and data handling & processing services.

Which type of 5G from Space is expected to lead significantly in the coming years?

The EMBB segment of the 5G from Space market is projected to witness the highest CAGR due to IoT and the increasing need for the fastest, most secure, and widest coverage of international and intercontinental data networks for enterprise systems between 2023 to 2028.

Which are the key technology trends prevailing in the 5G from Space market?

5G from space is an integral part of Non-Terrestrial Networks (NTNs), which encompass various satellite communication systems. As part of NTN design, 5G technology is being adapted and extended to provide connectivity and advanced network capabilities beyond terrestrial boundaries. The integration of 5G from space in the industrial sector opens new opportunities for enhanced automation, improved operational efficiency, and enhanced safety measures. Real-time connectivity enables smooth coordination between robotic systems, machinery, and sensors, resulting in streamlined workflows, minimized downtime, and informed decision-making. The low-latency capabilities of 5G from space also facilitate the implementation of emerging technologies like edge computing and the Internet of Things (IoT), enabling real-time data processing and analysis for various industrial applications. As this technology continues to evolve and mature, the industrial sector can anticipate even more transformative changes, unlocking new possibilities for growth, efficiency, and innovation

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for high-end automation across industries- Growing adoption of Industry 4.0- Expansion of automotive market worldwideRESTRAINTS- Accuracy-related errors- Variations in international regulationsOPPORTUNITIES- Rising government initiatives to boost industrial automation- Increasing demand for machine learning and artificial intelligence-based systems- Innovative technologies in automotive and UAV industriesCHALLENGES- Mechanical failures in harsh environments- Growing need to continuously invest in research and development

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF ENCODER TYPES OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TREND

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISIMPACT OF IIOT ON ENCODER INDUSTRYRISE OF COLLABORATIVE & AGV ROBOTSMINIATURIZATION AND WIRELESS CONNECTIVITY OF ENCODERS

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.9 CASE STUDIES ANALYSIS

-

5.10 TRADE ANALYSISTARIFF ANALYSIS

-

5.11 PATENT ANALYSIS

- 5.12 PORTER’S FIVE FORCES ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS RELATED TO ENCODER MARKET

- 6.1 INTRODUCTION

-

6.2 ROTARYINCREASED DEMAND IN AUTOMATION INDUSTRY TO BOOST MARKET

-

6.3 LINEARINCREASING DEMAND FOR HIGH-PRECISION MACHINING TOOLS TO BENEFIT MARKET

- 7.1 INTRODUCTION

-

7.2 INCREMENTALSIMPLIFIED HARDWARE AND FLEXIBLE FUNCTIONALITY TO DRIVE MARKET

-

7.3 ABSOLUTERELIABLE MEASUREMENT PERFORMANCE TO STRENGTHEN MARKET

- 8.1 INTRODUCTION

-

8.2 MAGNETIC TECHNOLOGYRELIABLE DIGITAL FEEDBACK IN HARSH ENVIRONMENTS TO DRIVE MARKET

-

8.3 OPTICAL TECHNOLOGYABILITY TO MONITOR AND CONTROL MECHANICAL SYSTEMS TO DRIVE MARKET

-

8.4 INDUCTIVE TECHNOLOGYCOMPACT DESIGN WITH HIGH ACCURACY TO DRIVE DEMAND

- 8.5 OTHER TECHNOLOGIES

- 9.1 INTRODUCTION

-

9.2 INDUSTRIALINCREASING UTILIZATION OF ENCODERS IN ROBOTICS AND FACTORY AUTOMATION TO DRIVE MARKET

-

9.3 HEALTHCAREUTILIZATION OF SURGICAL ROBOTS IN HEALTHCARE APPLICATIONS TO DRIVE MARKET

-

9.4 CONSUMER ELECTRONICSSURGE OF LINEAR MOTOR ENCODERS IN ELECTRICAL APPLIANCES TO DRIVE MARKET

-

9.5 AUTOMOTIVERISING INTEGRATION OF AUTOMATION IN AUTOMOBILES TO PROPEL GROWTH

-

9.6 POWERINCREASING COMPLEXITIES IN SOLAR & WIND ENERGY APPLICATIONS TO DRIVE MARKET

-

9.7 FOOD & BEVERAGEINTEGRATION OF IO-LINK TECHNOLOGY INTO ENCODERS TO DRIVE MARKET

-

9.8 AEROSPACEPRECISION CONTROL TECHNOLOGY OF ENCODERS IN AIRBORNE PLANES TO PROPEL GROWTH

-

9.9 PRINTINGUSE OF ROTARY ENCODERS IN PRINTING APPLICATIONS AND OFFICE EQUIPMENT TO DRIVE MARKET

-

9.10 TEXTILEGROWING UTILIZATION OF ENCODERS IN WEAVING & KNITTING PROCESSES TO DRIVE MARKET

- 9.11 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Large industrial base for consumer electronics and automotive manufacturing to drive marketCANADA- Rising adoption of advanced technologies in aerospace industry to drive marketMEXICO- Expanding consumer electronics industry to support market growthRECESSION IMPACT ON ENCODER MARKET IN NORTH AMERICA

-

10.3 EUROPEUK- Expanding manufacturing sector to drive uptake of encodersGERMANY- Growing use of robotics in automobiles to drive marketFRANCE- Growing manufacturing & textile industries to drive demand for encodersREST OF EUROPERECESSION IMPACT ON ENCODER MARKET IN EUROPE

-

10.4 ASIA PACIFICCHINA- Rising expansion of manufacturing & mining industries to drive marketJAPAN- Rising demand for electric & hybrid vehicles in automotive industry to drive marketSOUTH KOREA- Increasing technological advancements in consumer electronics to drive demandINDIA- Developing textile industry to boost marketREST OF ASIA PACIFICRECESSION IMPACT ON ENCODER MARKET IN ASIA PACIFIC

-

10.5 ROWSOUTH AMERICA- Growing mining industry to fuel market growthMIDDLE EAST- Growing government investment in manufacturing to drive demand for encodersAFRICA- Growth of region as manufacturing hub to drive marketRECESSION IMPACT ON ENCODER MARKET IN ROW

- 11.1 INTRODUCTION

- 11.2 COMPANY REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS, 2022

-

11.4 COMPETITIVE EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY TYPE FOOTPRINT

-

11.5 SMALL AND MEDIUM ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUPS/SMES EVALUATION MATRIX

-

11.6 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCH & DEVELOPMENTDEALSOTHERS

-

12.1 KEY PLAYERSSENSATA TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEIDENHAIN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORTIVE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRENISHAW PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITUTOYO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFRABA B.V.- Business overview- Products/Solutions/Services offered- Recent developmentsIFM ELECTRONIC GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsPEPPERL+FUCHS SE- Business overview- Products/Solutions/Services offered- Recent developmentsMAXON- Business overview- Products/Solutions/Services offered- Recent developmentsBALLUFF INC.- Business overview- Products/Solutions/Services offered- Recent developmentsPILZ GMBH & CO. KG- Business overview- Products/Solutions/Services offeredTAMAGAWA SEIKI CO., LTD.- Business overview- Products/Solutions/Services offeredFAULHABER GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsBAUMER- Business overview- Products/Solutions/Services offered- Recent developmentsJTEKT ELECTRONICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSSCHNEIDER ELECTRICOMRON CORPORATIONROCKWELL AUTOMATIONSICK AGKÜBLER GROUPELAP SRLSIKO GMBHNEMICON CORPORATIONGURLEY PRECISION INSTRUMENTSLIKA ELECTRONIC SRL

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INVESTMENTS IN INDUSTRIAL AUTOMATION PROVIDED THROUGH GOVERNMENT INITIATIVES

- TABLE 2 ENCODER MARKET ECOSYSTEM

- TABLE 3 INDICATIVE PRICES OF ENCODERS

- TABLE 4 AVERAGE SELLING PRICE OF SIGNAL TYPE ENCODERS OFFERED BY KEY PLAYERS (USD)

- TABLE 5 AVERAGE SELLING PRICE OF ENCODER TYPES OFFERED BY KEY PLAYERS (USD)

- TABLE 6 ENCODER MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 SAM-JEONG AUTOMATION INCORPORATES RENISHAW’S INCREMENTAL ENCODER TO ACHIEVE ACCURACY

- TABLE 9 PAL ROBOTICS INTEGRATES ENCODERS INTO ROBOTIC TECHNOLOGY

- TABLE 10 SCODIX ULTRA CHOOSES RENISHAW’S TONIC INCREMENTAL ENCODER SYSTEM TO ACHIEVE HIGH-QUALITY PRINTING

- TABLE 11 TARIFF FOR ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS OR FOR MAKING CONNECTIONS, EXPORTED BY CHINA 2021

- TABLE 12 TARIFF FOR ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS OR FOR MAKING CONNECTION EXPORTED BY GERMANY, 2021

- TABLE 13 TARIFF FOR ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS OR FOR MAKING CONNECTIONS EXPORTED BY US, 2021

- TABLE 14 TARIFF FOR ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS OR FOR MAKING CONNECTIONS, EXPORTED BY JAPAN 2021

- TABLE 15 TARIFF FOR ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS OR FOR MAKING CONNECTIONS, EXPORTED BY FRANCE 2021

- TABLE 16 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

- TABLE 17 ENCODER MARKET: KEY PATENTS, 2020–2022

- TABLE 18 ENCODER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 19 ENCODER MARKET: KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 STANDARDS FOR ENCODER MARKET

- TABLE 25 ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 ENCODER MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 28 ENCODER MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 29 ROTARY: ENCODER MARKET, BY SIGNAL TYPE, 2019–2022 (USD MILLION)

- TABLE 30 ROTARY: ENCODER MARKET, BY SIGNAL TYPE, 2023–2028 (USD MILLION)

- TABLE 31 ROTARY: ENCODER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 32 ROTARY: ENCODER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 33 ROTARY: ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 ROTARY: ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 LINEAR: ENCODER MARKET, BY SIGNAL TYPE, 2019–2022 (USD MILLION)

- TABLE 36 LINEAR: ENCODER MARKET, BY SIGNAL TYPE, 2023–2028 (USD MILLION)

- TABLE 37 LINEAR: ENCODER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 38 LINEAR: ENCODER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 39 LINEAR: ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 40 LINEAR: ENCODER MARKET, BY APPLICATION, 2023–2028(USD MILLION)

- TABLE 41 ENCODER MARKET, BY SIGNAL TYPE, 2019–2022 (USD MILLION)

- TABLE 42 ENCODER MARKET, BY SIGNAL TYPE, 2023–2028 (USD MILLION)

- TABLE 43 INCREMENTAL: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 INCREMENTAL: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 ABSOLUTE: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 ABSOLUTE: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 ENCODER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 48 ENCODER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 49 MAGNETIC TECHNOLOGY: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 MAGNETIC TECHNOLOGY: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 OPTICAL TECHNOLOGY: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 52 OPTICAL TECHNOLOGY: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 INDUCTIVE TECHNOLOGY: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 INDUCTIVE TECHNOLOGY: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 OTHER TECHNOLOGIES: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 OTHER TECHNOLOGIES: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 INDUSTRIAL APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 60 INDUSTRIAL APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 INDUSTRIAL APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 INDUSTRIAL APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 HEALTHCARE APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 64 HEALTHCARE APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 HEALTHCARE APPLICATION: ENCODER MARKET, BY REGION, 2019–2022(USD MILLION)

- TABLE 66 HEALTHCARE APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 AUTOMOTIVE APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 72 AUTOMOTIVE APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 AUTOMOTIVE APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 AUTOMOTIVE APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 POWER APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 76 POWER APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 POWER APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 POWER APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 80 FOOD & BEVERAGE APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 FOOD & BEVERAGE APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 FOOD & BEVERAGE APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 AEROSPACE APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 84 AEROSPACE APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 AEROSPACE APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 AEROSPACE APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 PRINTING APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 PRINTING APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 PRINTING APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 PRINTING APPLICATION: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 TEXTILE APPLICATION: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 TEXTILE APPLICATION: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 TEXTILE APPLICATION: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 TEXTILE APPLICATION: ENCODER MARKET, BY REGION, 2023–2028(USD MILLION)

- TABLE 95 OTHER APPLICATIONS: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 96 OTHER APPLICATIONS: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 97 OTHER APPLICATIONS: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 OTHER APPLICATIONS: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: ENCODER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: ENCODER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: ENCODER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: ENCODER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 EUROPE: ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ENCODER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ENCODER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 ROW: ENCODER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 ROW: ENCODER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 ROW: ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 116 ROW: ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- TABLE 118 COMPANY TYPE FOOTPRINT

- TABLE 119 COMPANY APPLICATION FOOTPRINT

- TABLE 120 COMPANY REGION FOOTPRINT

- TABLE 121 COMPANY FOOTPRINT

- TABLE 122 ENCODER MARKET: KEY STARTUPS/SMES

- TABLE 123 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 124 PRODUCT LAUNCHES & DEVELOPMENT, 2019–2022

- TABLE 125 DEALS, 2019–2022

- TABLE 126 OTHERS, 2019–2022

- TABLE 127 SENSATA TECHNOLOGIES, INC: BUSINESS OVERVIEW

- TABLE 128 SENSATA TECHNOLOGIES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HEIDENHAIN: COMPANY OVERVIEW

- TABLE 130 HEIDENHAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 FORTIVE: BUSINESS OVERVIEW

- TABLE 132 FORTIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 RENISHAW PLC: COMPANY OVERVIEW

- TABLE 134 RENISHAW PLC: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 135 MITUTOYO CORPORATION: COMPANY OVERVIEW

- TABLE 136 MITUTOYO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 FRABA B.V.: COMPANY OVERVIEW

- TABLE 138 FRABA B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 IFM ELECTRONIC GMBH: BUSINESS OVERVIEW

- TABLE 140 IFM ELECTRONIC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 PEPPERL+FUCHS SE: BUSINESS OVERVIEW

- TABLE 142 PEPPERL+FUCHS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 MAXON: BUSINESS OVERVIEW

- TABLE 144 MAXON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 BALLUFF INC: BUSINESS OVERVIEW

- TABLE 146 BALLUFF INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 PILZ GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 148 PILZ GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 TAMAGAWA SEIKI CO., LTD.: BUSINESS OVERVIEW

- TABLE 150 TAMAGAWA SEIKI CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 FAULHABER GROUP: BUSINESS OVERVIEW

- TABLE 152 FAULHABER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 BAUMER: BUSINESS OVERVIEW

- TABLE 154 BAUMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 JTEKT ELECTRONICS CORPORATION: BUSINESS OVERVIEW

- TABLE 156 JTEKT ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 ENCODER MARKET SEGMENTATION

- FIGURE 2 ENCODER MARKET: REGIONAL SCOPE

- FIGURE 3 ENCODER MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES IN ENCODER MARKET

- FIGURE 5 ENCODER MARKET: BOTTOM-UP APPROACH

- FIGURE 6 ENCODER MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 ROTARY TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 9 ENCODER MARKET, BY SIGNAL TYPE, 2023 VS. 2028

- FIGURE 10 MAGNETIC ENCODERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 INDUSTRIAL VERTICAL TO CLAIM LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ENCODER MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 INCREASING ADOPTION OF INDUSTRY 4.0 TO BOOST MARKET GROWTH

- FIGURE 14 ROTARY ENCODERS TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 15 BY APPLICATION, INDUSTRIAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 16 MAGNETIC ENCODERS TO HOLD LARGEST SHARE IN 2028

- FIGURE 17 INDUSTRIAL VERTICAL AND US WERE LARGEST SHAREHOLDERS IN NORTH AMERICAN ENCODER MARKET IN 2022

- FIGURE 18 ENCODER MARKET TO DISPLAY HIGHEST CAGR IN CHINA DURING FORECAST PERIOD

- FIGURE 19 ENCODER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 ANNUAL INSTALLATION OF INDUSTRIAL ROBOTS 2021

- FIGURE 21 ENCODER MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 ENCODER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 ENCODER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 ENCODER MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 ENCODER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 ENCODER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE OF ENCODER TYPES OFFERED BY KEY PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE OF ENCODER TYPE

- FIGURE 29 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN ENCODER MARKET

- FIGURE 30 ENCODER MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 31 ENCODER MARKET: KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 33 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 35 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- FIGURE 36 ENCODER MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 37 ROTARY ENCODER SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 38 INCREMENTAL ENCODER SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 39 MAGNETIC TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 40 INDUSTRIAL APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: ENCODER MARKET SNAPSHOT

- FIGURE 43 EUROPE: ENCODER MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: ENCODER MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF TOP THREE PLAYERS, 2020–2022

- FIGURE 46 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 47 ENCODER MARKET: SME EVALUATION MATRIX, 2022

- FIGURE 48 SENSATA TECHNOLOGIES, INC: COMPANY SNAPSHOT

- FIGURE 49 FORTIVE: COMPANY SNAPSHOT

- FIGURE 50 RENISHAW PLC: COMPANY SNAPSHOT

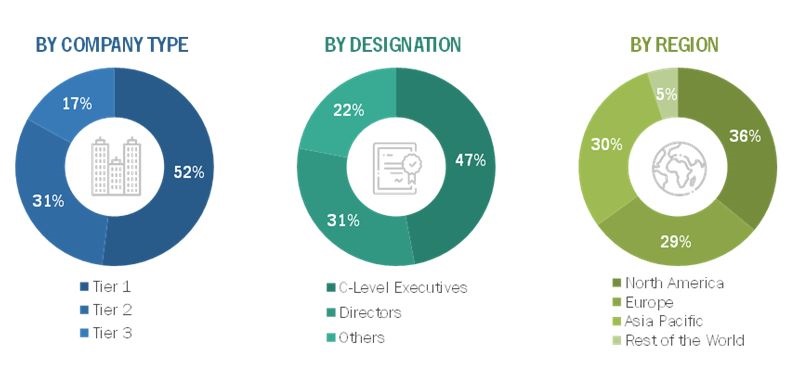

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the encoder industry . This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the encoder market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the encoder market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the encoder industry . Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the encoder market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (encoder providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

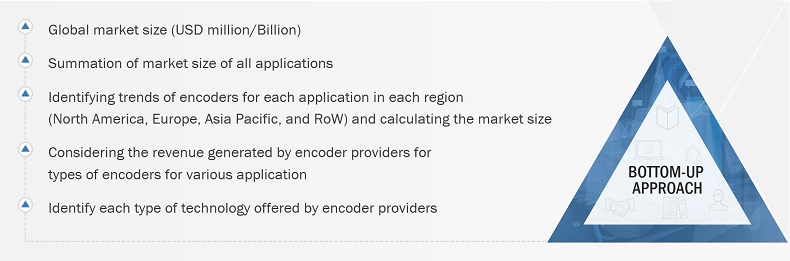

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the encoders market and various other dependent submarkets. Key players in the market were identified through secondary research, and their industry share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Encoders Market: Bottom-Up Approach

Encoders Market: Top-down approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

Encoders are defined as sensors that generate digital feedback signals in response to a change in the mechanical position of a tool or workpiece and convert it into a measurable electrical signal. They are classified into linear encoders (incremental and absolute) and rotary encoders (incremental and absolute). These Sensors that detect the mechanical displacement of straight lines are called linear encoders, while rotary encoders detect position and speed by converting rotational mechanical displacements into electrical signals.

Key Stakeholders

- Raw Material and Manufacturing Equipment Suppliers

- Encoder Manufacturers

- Original Equipment Manufacturers (OEMs)

- System Integrators

- Distributors and Traders

- Industry associations

- Organizations, Forums, Alliances, and Associations

Report Objectives

- To describe, segment, and forecast the encoder industry based on type, signal type, technology, and application, in terms of value.

- To describe and forecast the encoders market, by type, in terms of value and volume.

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To describe elements with varied types and application modes of encoders.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the encoders industry

- To provide a detailed overview of the supply chain and ecosystem pertaining to the encoders, along with the average selling prices of encoders.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the encoders market

- To strategically profile the key players in the encoder market and comprehensively analyze their market ranking and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Encoder Market