Emollient Esters Market by Product (Isopropyl Myristate, C12-15 Alkyl Benzoate, Caprylic/Capric Triglyceride, Cetyl Palmitate, Myristy l Myristate), by End-User (Skin Care, Hair Care, Cosmetics, Oral Care) & by Region - Global Forecast to 2020

The emollient esters market is projected to reach USD 420.3 Million by 2020, at a CAGR of 5.41% from 2015 to 2020.

Among end users, skin care segment is projected to lead the emollient esters market during the forecast period. New product developments and increasing investments in research and development of green emollients are expected to drive the growth of this market. Increasing demand for natural skin care products have triggered new research opportunities for green emollients. Moreover, rising disposable income and awareness for personal grooming will significantly contribute to the growth of emollients in the coming years

The objectives of this study are:

- To define, describe, and forecast the emollient esters market based on product, end user, and region

- To analyze the opportunities in the emollient esters for the stakeholders and draw a competitive landscape for market leaders

- To forecast size of the emollient esters market, in terms of value and volume with respect to four regions, namely, North America, Europe, Asia Pacific, Latin America and RoW, along with their key countries

- To strategically profile the key players operating in the emollient esters and comprehensively analyze their core competencies

- To analyze competitive developments such as expansions, mergers & acquisitions, new product launches, and research & development (R&D) activities in the emollient esters

Years considered for the study are:

- Base Year – 2014

- Estimated Year – 2015

- Projected Year – 2020

- Forecast Period – 2015 to 2020

For company profiles, 2014 has been considered as the base year. In cases, wherein information was unavailable for the base year, the years prior to it have been considered.

Research Methodology

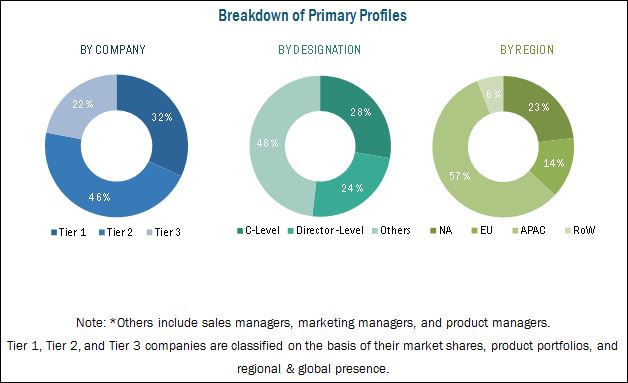

This study aims to estimate the size of the emollient esters for 2015 and projects the demand for emollient esters till 2020. It also provides a detailed qualitative and quantitative analysis of the emollient esters. Various secondary sources that include directories, industry journals, and various associations have been used to identify and collect information useful for this extensive commercial study of the emollient esters. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the emollient esters. The breakdown of profiles of primaries has been shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the emollient esters includes raw material suppliers and service providers. The leading players operating in the emollient esters includes Croda International Plc, Lonza Group Ltd, BASF SE, Evonik Industries AG, and others. The demand for emollient esters is largely due to growing personal care industry.

Key Target Audience

- Emollient Esters Manufacturers

- Emollient Esters Suppliers, Distributors, and Traders

- End-use Market Participants of Different Segments of Emollient Esters

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- Investment Banks and Private Equity Firms

- Environment Support Agencies

- Consulting Companies/Consultants in Chemical and Material Sectors

Scope of the Emollient Esters Market Report:

This research report categorizes the Emollient Esters based on product, end users, and region. The report forecasts revenue and analyzes trends in each of these submarkets.

Emollient Esters Market Based on Product

- Isopropyl Myristate

- C12-C15 Alkyl Benzoate

- Caprylic/Capric Triglyceride

- Cetyl Palmitate

- Myristyl Myristate

Emollient Esters Market Based on End User

- Skin Care

- Hair Care

- Cosmetics

- Oral Care

- Others

Emollient Esters Market Based on Region

- Asia-Pacific

- North America

- Europe

- Latin America

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to five)

- Information for two countries of client’s choice

- Product Matrix which gives a detailed comparison of new products and market trends in each industry

The global emollient esters market is projected to reach USD 226.1 Million by 2020, at a CAGR of 5.4% from 2015 to 2020. The growth is primarily driven by the growing end-user such as skin care, hair care, cosmetics, and oral care.

The growth of the emollient esters market is primarily being driven by the growth in end-user industries like skin care, hair care, cosmetics, and oral care. Also, factors such as changing lifestyle, growing consciousness for personal hygiene and increase in purchasing power of people for cosmetics & personal care products in emerging countries are expected to drive the growth of emollient esters market during the forecast period.

In addition, the shift from use of oil based emollients to emollient esters is one of the reasons supporting the growth of this market. However, stringent labelling rules for cosmetic ingredients and availability of cheaper and greener substitutes of emollients are some of the challenges which may restrict the growth of the emollient esters market.

Based on end user, the skin care segment accounted for the largest market share of the global emollient esters market, followed by the hair care. Emollient esters are also used in other products like toiletries, fragrances, and different pharmaceutical applications.

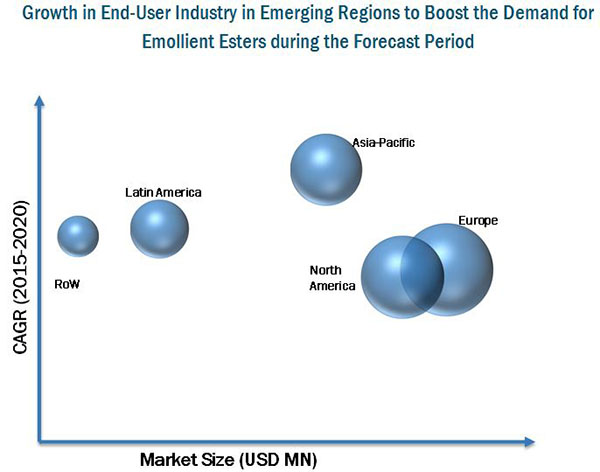

Europe is the leading manufacturer of emollient esters, followed by North America and Asia-Pacific. However, Asia-Pacific is one of the fastest-growing regions for the emollient esters market. Emollient esters in this region is likely to grow at highest CAGR during the period. Apart from Asia-Pacific, Latin America is also expected to be an important market in terms of growth. The strong growth for personal care industry in Brazil and Argentina will contribute to the growth of emollients esters in Latin America.

The emollient esters market in Asia-Pacific is expected to register the highest CAGR between 2015 and 2020. In the Asia-Pacific region, China and India provides a large customer base for personal care, cosmetic, and beauty products.

In Latin America, Brazil remains a key market due to emerging trends in beauty and personal care industry. Manufacturers assess that rising awareness for health and hygiene will significantly contribute to the growth of personal care and cosmetic industry, which will indirectly drive the consumption of emollient esters in this market.

The market of emollient esters is fragmented with few large players and a high number of smaller players. The organized players in emollient esters market have an edge over smaller players in terms of product offerings, innovations and distribution network. Leading manufactures for emollient esters are Lubrizol Corporation (U.S.), Stepan Company (U.S), Ashland Inc. (U.S.), Innospec Inc. (U.S.), Croda International Plc (U.K.), Lonza Group Ltd (Switzerland), BASF SE (Germany), Evonik Industries AG (Germany), and others.

Frequently Asked Questions (FAQ):

How big is the emollient esters market?

The emollient esters market is projected to reach USD 420.3 Million by 2020, at a CAGR of 5.41%.

Who leading market players in emollient esters market ?

Leading manufactures for emollient esters are Lubrizol Corporation (U.S.), Stepan Company (U.S), Ashland Inc. (U.S.), Innospec Inc. (U.S.), Croda International Plc (U.K.), Lonza Group Ltd (Switzerland), BASF SE (Germany), Evonik Industries AG (Germany), and others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Scope

1.2.1 Market Definition

1.2.2 Markets Covered

1.2.3 Years Considered for the Study

1.3 Currency & Pricing

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Market Size Estimation

2.2 Market Breakdown & Data Triangulation

2.3 Research Data

2.3.1 Key Data From Secondary Sources

2.3.2 Key Data From Primary Sources

2.3.3 Key Industry Insights

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Significant Opportunities for Emollient Esters Market

4.2 Market: Key Regions

4.3 Market in Asia-Pacific

4.4 Market Attractiveness

4.5 Market Share, By End User

4.6 Market: Developing vs Developed Nations

4.7 Fastest-Growing Market: By End User

4.8 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Product

5.2.2 By Region

5.2.3 By End-User

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Involvement of Governments and Cosmetic Associations

5.3.1.2 Higher Growth in Asia-Pacific Market

5.3.1.3 Increasing Demand of Multifunctional Products

5.3.2 Restraints

5.3.2.1 Dependency on Personal Care Market

5.3.2.2 Usage of Strong Acids and Solvents

5.3.3 Opportunities

5.3.3.1 Improving Living Standards

5.3.3.2 Higher Growth in Asia-Pacific Market

5.3.4 Increasing Demand for Green Emollient Esters

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Materials

6.2.2 Research and Development

6.2.3 Manufacturing

6.2.4 Distribution Network

6.2.5 End User

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Strategic Benchmarking

6.4.1 New Product Launches

6.4.2 Expansions

6.4.3 Acquisitions

7 Emollient Esters Market, By Product (Page No. - 48)

7.1 Introduction

7.2 Market Size & Projection

7.3 Isopropyl Myristate

7.4 C12-15 Alkyl Benzoate

7.5 Caprylic/Capric Triglyceride

7.6 Cetyl Palmitate

7.7 Myristyl Myristate

8 Emollient Esters Market, By End-User (Page No. - 53)

8.1 Introduction

8.2 Market Size & Projection

8.3 Skin Care

8.4 Hair Care

8.5 Cosmetics

8.6 Oral Care

8.7 Others

9 Emollient Esters Market, By Region (Page No. - 59)

9.1 Introduction

9.2 Europe

9.3 North America

9.4 Asia-Pacific

9.5 Latin America

9.6 Rest of the World

10 Competitive Landscape (Page No. - 89)

10.1 Overview

10.1.1 New Product Launches and Acquisitions : the Most Adopted Growth Strategies

10.2 Maximum Developments in North America Between 2010-2015

10.3 Maximum Developments in 2014

10.4 Croda International PLC: Top Most Player

10.5 Competitive Situation & Trends

10.5.1 New Product Launches

10.5.2 New Technology

10.5.3 Acquisitions

10.5.4 Expansions

10.5.5 Other Developments

11 Company Profiles (Page No. - 97)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Introduction

11.2 Ashland Inc.

11.3 BASF SE

11.4 Evonik Industries AG

11.5 Lonza Group Ltd.

11.6 Stepan Company

11.7 Croda International PLC

11.8 Innospec Inc.

11.9 The Lubrizol Corporation

11.10 Solvay SA

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 126)

12.1 Discussion Guide

12.2 Introducing RT: Real Time Market Intelligence

12.3 Available Customizations

List of Tables (75 Tables)

Table 1 Emollient Esters Market Size: By Product, 2013–2020 (MT)

Table 2 Isopropyl Myristate Market, By Region, 2013–2020 (MT)

Table 3 C12-15 Alkyl Benzoate Market, By Region, 2013–2020 (MT)

Table 4 Caprylic/Capric Triglyceride Market Size, By Region, 2013–2020 (MT)

Table 5 Cetyl Palmitate Market, By Region, 2013–2020 (MT)

Table 6 Myristyl Myristate Market, By Region, 2013–2020 (MT)

Table 7 Emollient Esters Market, By End-User, 2013–2020 (MT)

Table 8 Skin Care Emollient Ester Market, By Region, 2013–2020 (MT)

Table 9 Hair Care Emollient EstersMarket Size, By Region, 2013–2020 (MT)

Table 10 Cosmetics Emollient Ester Market, By Region , 2013–2020 (MT)

Table 11 Oral Care Emollient Ester Market, By Region, 2013-2020 (MT)

Table 12 Others Emollient Esters Market, By Region, 2013–2020 (MT)

Table 13 Emollient Esters Market, By Region, 2013–2020 (MT)

Table 14 Europe: Market, By Country, 2013–2020 (MT)

Table 15 Europe: Market, By Product, 2013–2020 (MT)

Table 16 Europe: Market, By End User, 2013–2020 (MT)

Table 17 Germany Market, By End User, 2013–2020 (MT)

Table 18 Germany Market, By Product, 2013–2020 (MT)

Table 19 U.K. Market, By End User , 2013–2020 (MT)

Table 20 U.K. Market, By Product, 2013–2020 (MT)

Table 21 France Market, By End User, 2013–2020 (MT)

Table 22 France Market, By Product, 2013–2020 (MT)

Table 23 Others Emollient Esters Market, By End User, 2013–2020 (MT)

Table 24 Others Market, By Product, 2013–2020 (MT)

Table 25 North America Market, By Country, 2013-2020 (MT)

Table 26 North America Market, By Product, 2013–2020 (MT)

Table 27 North America Market, By End User, 2013–2020 (MT)

Table 28 U.S. Market, By End User, 2013–2020 (MT)

Table 29 U.S. Market, By Product, 2013–2020 (MT)

Table 30 Canada Market, By End User , 2013–2020 (MT)

Table 31 Canada Market, By Product, 2013–2020 (MT)

Table 32 Others Emollient Esters Market, By End User, 2013–2020 (MT)

Table 33 Others Market, By Product, 2013–2020 (MT)

Table 34 Asia-Pacific Market, By Country, 2013–2020 (MT)

Table 35 Asia-Pacific Market, By End User , 2013–2020 (MT)

Table 36 Asia-Pacific Market, By Product, 2013–2020 (MT)

Table 37 China Market, By End User, 2013–2020 (MT)

Table 38 China Market, By Product, 2013–2020 (MT)

Table 39 Japan Market, By End User , 2013–2020 (MT)

Table 40 Japan Market, By Product, 2013–2020 (MT)

Table 41 India Market, By End User , 2013–2020 (MT)

Table 42 India Market, By Product, 2013–2020 (MT)

Table 43 Others Emollient Esters Market, By End User, 2013–2020 (MT)

Table 44 Others Market, By Product, 2013–2020 (MT)

Table 45 Latin America Market, By Country, 2013–2020 (MT)

Table 46 Latin America Market, By End User , 2013–2020 (MT)

Table 47 Latin America Market, By Product, 2013–2020 (MT)

Table 48 Brazil Market, By End User , 2013–2020 (MT)

Table 49 Brazil Market, By Product, 2013–2020 (MT)

Table 50 Argentina Market, By End User, 2013–2020 (MT)

Table 51 Argentina Market, By Product, 2013–2020 (MT)

Table 52 Others Emollient Esters Market, By End User , 2013–2020 (MT)

Table 53 Others Market, By Product, 2013–2020 (MT)

Table 54 RoW Market, By Country, 2013–2020 (MT)

Table 55 RoW Market, By Product, 2013–2020 (MT)

Table 56 RoW Market, By End User, 2013–2020 (MT)

Table 57 South Africa Market, By Product, 2013–2020 (MT)

Table 58 South Africa Market, By End User, 2013–2020 (MT)

Table 59 Turkey Market, By Product, 2013–2020 (MT)

Table 60 Turkey Market, By End User, 2013–2020 (MT)

Table 61 Others Emollient Esters Market, By Product, 2013–2020 (MT)

Table 62 Others Market, By End User, 2013–2020 (MT)

Table 63 New Product Launch, 2010–2015

Table 64 New Technology, 2010–2015

Table 65 Mergers & Acquisition, 2010–2015

Table 66 Expansions, 2010–2015

Table 67 Other Developments, 2010–2015

Table 68 Ashland Inc.: Products & Their Description

Table 69 BASF SE: Products & Their Description

Table 70 Evonik Industries AG: Products & Their Descriptions

Table 71 Lonza Group Ltd: Products & Their Descriptions

Table 72 Stepan Company: Products & Their Descriptions

Table 73 Croda International PLC: Products & Their Descriptions

Table 74 Innospec Inc: Products & Their Description

Table 75 Solvay SA: Products & Their Description

List of Figures (51 Figures)

Figure 1 Emollient Esters Market : Research Design

Figure 2 Market Size Estimation: Bottom Up Approach

Figure 3 Market Size Estimation : Top Down Approach

Figure 4 Breakdown of Primary Interviews, By Company Type, Designation & Region

Figure 5 Emollient Esters Market: Data Triangulation

Figure 6 Emollient Esters End User Snapshot ( 2015 vs 2020)

Figure 7 Myristyl Myristate to Register the Highest CAGR Between 2015 & 2020

Figure 8 Asia-Pacific & Latin America to Register Higher CAGR Between 2015-2020

Figure 9 High Growth in the Emollient Esters Market Between 2015 & 2020

Figure 10 Asia-Pacific Expected to Be the Key Market for Emollient Esters Between 2015 & 2020

Figure 11 China Accounted for the Largest Share in the Asia-Pacific Region in 2015

Figure 12 Growth of Emollient Esters Market in Different Regions (2015-2020)

Figure 13 The Skin Care Segment Dominates the Emollient Esters Market in 2015

Figure 14 China to Emerge as A Lucrative Market Between 2015 & 2020

Figure 15 Emollient Esters has High Growth Potential in Skin Care Industry

Figure 16 Asia-Pacific to Experience High Growth During the Forecast Period

Figure 17 Emollient Esters Market Segmentation

Figure 18 Drivers, Restraints, Opportunities, & Challenges in the Emollient Esters Market

Figure 19 Value Chain Analysis for Emollient Esters: Raw Material Accounts for Major Value Addition

Figure 20 Porter’s Five Forces Analysis

Figure 21 Strategic Benchmarking: Croda Introduced A New Product for Multicultural Conditioning and Damage Repair

Figure 22 Strategic Benchmarking: BASF SE Focused on Expansion in Capacity for Emollients

Figure 23 Strategic Benchmarking: Ashland Inc & Clariant Selling Ask Chemicals Joint Venture

Figure 24 Myristyl Myristate to Register the Highest CAGR During the Forecast Period

Figure 25 Hair Care to Register the Highest CAGR During the Forecast Period

Figure 26 Regional Snapshot (2015-2020): China & India Emerging as the New Strategic Locations

Figure 27 Asia-Pacific Likely to Be the Fastest-Growing Market for Emollient Esters Between 2015 & 2020

Figure 28 Germany & France to Be the Driving Engines in the European Emollients Market During the Forecast Period

Figure 29 Canada Expected to Register the Highest CAGR During the Forecast Period

Figure 30 China & India Anticipated to Contribute the Maximum Share to the Asia-Pacific Emollient Esters Market During the Forecast Period

Figure 31 Brazil Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 South Africa Anticipated to Be the Major Contributor During the Forecast Period

Figure 33 Companies Adopted Both Organic and Inorganic Growth Strategies Between 2010-2015

Figure 34 Major Growth Strategies Adopted By the Major Players, 2010–2015

Figure 35 Expansions & New Product Development in North America Made It the Most Active Region During 2010-2015

Figure 36 Emollient Ester Market Developmental Share, 2010–2015

Figure 37 Emollient Ester Market: Growth Strategies, By Company, 2010–2015

Figure 38 Geographical Revenue Mix of Top Five Market Players

Figure 39 Ashland Inc. Company Snapshot

Figure 40 Ashland Inc.: SWOT Analysis

Figure 41 BASF SE: Company Snapshot

Figure 42 BASF SE: SWOT Analysis

Figure 43 Evonik Industries AG: Company Snapshot

Figure 44 Evonik Industries AG: SWOT Analysis

Figure 45 Lonza Group Ltd: Company Snapshot

Figure 46 Lonza Group AG: SWOT Analysis

Figure 47 Stepan Company: Company Snapshot

Figure 48 Stepan Company: SWOT Analysis

Figure 49 Croda International PLC: Company Snapshot

Figure 50 AAK AB: Company Snapshot

Figure 51 Innospec Inc: Company Snapshot

Growth opportunities and latent adjacency in Emollient Esters Market