TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

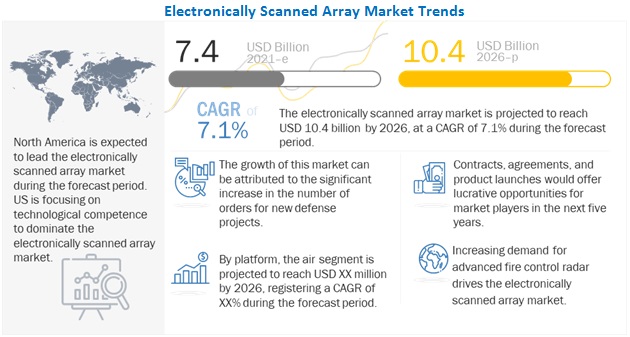

FIGURE 1 ELECTRONICALLY SCANNED ARRAY MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

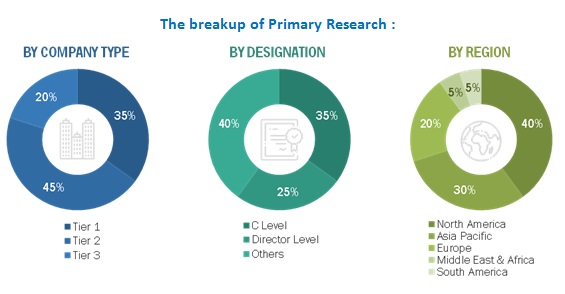

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION & REGION

2.1.3 DEMAND-SIDE INDICATORS

2.1.4 SUPPLY-SIDE ANALYSIS

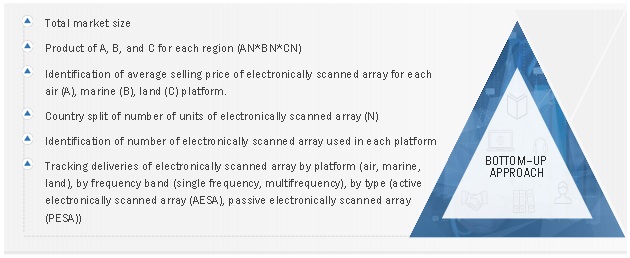

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

TABLE 1 ELECTRONICALLY SCANNED ARRAY MARKET ESTIMATION PROCEDURE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 8 AIR PLATFORM TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 SINGLE FREQUENCY TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 TRANSCEIVER MODULES TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 ACTIVE ELECTRONICALLY SCANNED ARRAY TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 12 FIRE CONTROL RADAR SEGMENT EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 13 LONG-RANGE RADAR TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 14 BY ARRAY GEOMETRY, LINEAR ARRAY SEGMENT EXPECTED TO DOMINATE MARKET

FIGURE 15 4D SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 16 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF ELECTRONICALLY SCANNED ARRAY MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN ELECTRONICALLY SCANNED ARRAY MARKET

FIGURE 17 INCREASED DELIVERIES OF MARINE VESSELS FUELS MARKET GROWTH

4.2 ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM

FIGURE 18 AIR SEGMENT TO COMMAND MARKET FROM 2017 TO 2026

4.3 ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND

FIGURE 19 SINGLE FREQUENCY EXPECTED TO DOMINATE MARKET FROM 2017 TO 2026

4.4 ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT

FIGURE 20 TRANSCEIVER MODULES TO DOMINATE MARKET FROM 2017 TO 2026

4.5 ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE

FIGURE 21 ACTIVE ELECTRONICALLY SCANNED ARRAY TO WITNESS UPWARD TREND FROM 2017 TO 2026

4.6 ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION

FIGURE 22 FIRE CONTROL RADAR TO LEAD MARKET FROM 2017 TO 2026

4.7 ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE

FIGURE 23 LONG-RANGE SEGMENT TO DOMINATE MARKET FROM 2017 TO 2026

4.8 ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY

FIGURE 24 LINEAR ARRAY SEGMENT TO LEAD MARKET FROM 2017 TO 2026

4.9 ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION

FIGURE 25 3D SEGMENT TO DOMINATE MARKET FROM 2017 TO 2026

4.10 ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY

FIGURE 26 FRANCE PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 ELECTRONICALLY SCANNED ARRAY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in deliveries of military vessels

FIGURE 28 MILITARY VESSELS DELIVERED FROM 2018 TO 2021

5.2.1.2 Emergence of modern warfare systems

TABLE 2 NETWORK-CENTRIC WARFARE SYSTEMS MARKET, BY REGION, 2016 VS. 2021 (USD MILLION)

TABLE 3 ELECTRONIC WARFARE SYSTEMS MARKET, BY REGION, 2016 VS. 2021 (USD MILLION)

5.2.1.3 Increasing defense expenditure of emerging economies

TABLE 4 DEFENSE BUDGET OF INDIA & CHINA, 2015-2020 (USD BILLION)

5.2.1.4 Increasing number of radar upgradation contracts

5.2.2 RESTRAINTS

5.2.2.1 Limited bandwidth for commercial applications

5.2.3 OPPORTUNITIES

5.2.3.1 Rise and adoption of unmanned aerial vehicles

TABLE 5 UAVS MARKET, BY REGION, 2015 VS. 2020 (USD MILLION)

5.2.3.2 Geopolitical instability

TABLE 6 LIST OF ONGOING GEOPOLITICAL ISSUES AND CONFLICTS

5.2.4 CHALLENGES

5.2.4.1 Stringent policies of cross-border trading

5.2.5 DEMAND-SIDE IMPACT

5.2.5.1 Key developments from January 2019 to January 2022

TABLE 7 KEY DEVELOPMENTS IN ELECTRONICALLY SCANNED ARRAY MARKET, 2020-2021

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 29 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.4 MARKET ECOSYSTEM

5.4.1 PROMINENT COMPANIES

5.4.2 PRIVATE AND SMALL ENTERPRISES

5.4.3 END USERS

TABLE 8 ELECTRONICALLY SCANNED ARRAY MARKET ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 9 AVERAGE SELLING PRICE ANALYSIS OF ELECTRONICALLY SCANNED ARRAYS IN 2020

FIGURE 30 AVERAGE SELLING PRICE OF ELECTRONICALLY SCANNED ARRAY (ESA) OFFERED BY TOP PLAYERS

5.6 TARIFF REGULATORY LANDSCAPE

5.6.1 NORTH AMERICA

5.6.2 EUROPE

5.6.3 ASIA PACIFIC

5.6.4 MIDDLE EAST

5.7 TRADE DATA

5.7.1 TRADE ANALYSIS

TABLE 10 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 11 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

5.8 PATENT ANALYSIS

FIGURE 31 LIST OF MAJOR PATENTS FOR ELECTRONICALLY SCANNED ARRAY

TABLE 12 LIST OF MAJOR PATENTS FOR ELECTRONICALLY SCANNED ARRAY

5.9 VALUE CHAIN ANALYSIS OF ELECTRONICALLY SCANNED ARRAY MARKET

FIGURE 32 VALUE CHAIN ANALYSIS

5.10 TECHNOLOGY ANALYSIS

5.10.1 KEY TECHNOLOGY

5.10.1.1 Modular building block approach in developing active electronically scanned array radar technology

5.10.2 COMPLIMENTARY TECHNOLOGY

5.10.2.1 Development of solid-state radar

5.11 PORTER’S FIVE FORCES MODEL

TABLE 13 ELECTRONICALLY SCANNED ARRAY MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 33 ELECTRONICALLY SCANNED ARRAY MARKET: PORTER'S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING ESA, BY INSTALLATION

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING ESA, BY INSTALLATION (%)

5.12.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA FOR ESA, BY DIMENSION

TABLE 15 KEY BUYING CRITERIA FOR ESA, BY DIMENSION

5.13 USE CASES

5.13.1 DEVELOPMENT OF 4D ACTIVE ELECTRONICALLY SCANNED ARRAY (AESA) RADAR SYSTEM (NS50) - THALES GROUP

5.14 KEY CONFERENCES & EVENTS, 2022-23

TABLE 16 ELECTRONICALLY SCANNED ARRAY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 OPERATIONAL DATA

TABLE 17 NEW COMMERCIAL SHIP DELIVERIES, BY TYPE, 2017-2020

TABLE 18 NEW AIRCRAFT DELIVERIES, BY AIRCRAFT TYPE, 2017-2020

6 INDUSTRY TRENDS (Page No. - 82)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 36 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

FIGURE 37 REGION-WISE DELIVERIES OF ELECTRONICALLY SCANNED ARRAYS IN 2020

6.3.1 SOFTWARE-DEFINED RADAR

6.3.2 ACTIVE ELECTRONICALLY SCANNED ARRAY (AESA)

6.3.3 DIGITAL BEAMFORMING TECHNIQUE IN RADAR

6.3.4 4D ELECTRONICALLY SCANNED ARRAY

6.3.5 SCALABLE AESA TRANSMITTER WITH PHASE-ONLY NULLING

6.4 IMPACT OF MEGATRENDS

6.4.1 DIGITALIZATION AND INTRODUCTION OF INTERNET OF THINGS (IOT) SYSTEMS IN ESA-BASED AIRBORNE RADAR

6.4.2 SHIFT IN GLOBAL ECONOMIC POWER

TABLE 19 INNOVATIONS AND PATENT REGISTRATIONS

7 ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM (Page No. - 87)

7.1 INTRODUCTION

FIGURE 38 AIR SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 21 ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.2 AIR

7.2.1 ESA RADAR USED IN AEW&C SYSTEMS FOR COMMAND & COORDINATION

FIGURE 39 FIXED-WING AIRCRAFT SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

TABLE 22 AIR: ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 23 AIR: ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.2.2 FIXED-WING AIRCRAFT

7.2.3 ROTARY-WING AIRCRAFT

7.2.4 UAV

7.3 MARINE

7.3.1 MARINE ELECTRONICALLY SCANNED ARRAY WIDELY USED FOR NAVIGATION AND COLLISION AVOIDANCE

FIGURE 40 DEFENSE VESSELS SEGMENT EXPECTED TO GROW AT HIGHER RATE DURING FORECAST PERIOD

TABLE 24 MARINE: ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2017–2020 (USD MILLION)

TABLE 25 MARINE: ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2021–2026 (USD MILLION)

7.3.2 COMMERCIAL VESSELS

7.3.3 DEFENSE VESSELS

7.4 LAND

7.4.1 INCREASED NEED FOR BORDER SURVEILLANCE DRIVES LAND SEGMENT

FIGURE 41 FIXED LAND RADAR SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 26 LAND: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 27 LAND: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

7.4.2 FIXED

7.4.3 PORTABLE

7.4.4 MOBILE

8 ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND (Page No. - 95)

8.1 INTRODUCTION

FIGURE 42 SINGLE FREQUENCY TO DOMINATE ELECTRONICALLY SCANNED ARRAY MARKET FROM 2021 TO 2026

TABLE 28 ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 29 ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

8.2 SINGLE FREQUENCY

8.2.1 S-BAND ELECTRONICALLY SCANNED ARRAY RADAR DOMINATES SINGLE FREQUENCY RADAR MARKET

FIGURE 43 X-BAND PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 30 SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 31 SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

8.2.2 VHF BAND

8.2.3 L-BAND

8.2.4 S-BAND

8.2.5 C-BAND

8.2.6 X-BAND

8.2.7 K-BAND

8.3 MULTIFREQUENCY

8.3.1 USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGET OBJECTS

9 ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT (Page No. - 101)

9.1 INTRODUCTION

FIGURE 44 TRANSCEIVER MODULE EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 32 ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 33 ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

9.2 TRANSCEIVER MODULES

9.2.1 TRANSCEIVER MODULES TRANSMIT AND RECEIVE RADIO WAVES OF FLUCTUATING FREQUENCIES

9.3 PHASE SHIFTERS

9.3.1 PHASE SHIFTERS CARRY DATA FROM ANTENNA SECTION TO SIGNAL PROCESSING SECTION OF ELECTRONICALLY SCANNED ARRAY

9.4 BEAMFORMING NETWORK

9.4.1 BEAMFORMING NETWORKS DESIGNED TO TRANSMIT AND RECEIVE DIRECTIONAL SIGNALS

9.5 SIGNAL PROCESSOR

9.5.1 SIGNAL PROCESSORS GATHER SIGNALS FROM SENSORS TO PROVIDE INSIGHTS

9.6 RADAR DATA PROCESSOR

9.6.1 USED IN ELECTRONICALLY SCANNED ARRAY TO SEPARATE TARGETS FROM CLUTTER

9.7 OTHERS

10 ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE (Page No. - 105)

10.1 INTRODUCTION

FIGURE 45 ACTIVE ELECTRONICALLY SCANNED ARRAY SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 34 ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 35 ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2 ACTIVE ELECTRONICALLY SCANNED ARRAY (AESA)

10.2.1 DEVELOPMENT OF SOLID-STATE RADAR TO BOOST AESA SEGMENT

10.3 PASSIVE ELECTRONICALLY SCANNED ARRAY (PESA)

10.3.1 WIDE USE OF PESA IN STEALTH AND COVERT OPERATIONS DRIVE THIS SEGMENT

11 ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION (Page No. - 108)

11.1 INTRODUCTION

FIGURE 46 FIRE CONTROL RADAR SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 37 ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

11.2 FIRE CONTROL RADAR

11.2.1 INCREASED USE IN FIXED-WING AIRCRAFT TO FUEL GROWTH

11.3 TACTICAL DATA LINK RADAR

11.3.1 INCREASING USE IN UAVS FUELS SEGMENT

11.4 AIR TRAFFIC CONTROL RADAR

11.4.1 RISING DEMAND FOR ESA-BASED SECURITY & SURVEILLANCE APPLICATIONS DRIVES SEGMENT

11.5 OTHERS

12 ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE (Page No. - 112)

12.1 INTRODUCTION

FIGURE 47 LONG-RANGE RADAR SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 38 ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 39 ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

12.2 SHORT-RANGE RADAR

12.2.1 USED PRIMARILY IN COMMERCIAL APPLICATIONS OR MAN-PORTABLE RECONNAISSANCE MISSIONS

12.3 MEDIUM-RANGE RADAR

12.3.1 WIDELY USED ACROSS MILITARY APPLICATIONS

12.4 LONG-RANGE RADAR

12.4.1 USED FOR LONG-DISTANCE AND ACCURATE LOCATION TRACKING

13 ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY (Page No. - 115)

13.1 INTRODUCTION

FIGURE 48 LINEAR ARRAY SEGMENT EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 40 ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2017–2020 (USD MILLION)

TABLE 41 ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2021–2026 (USD MILLION)

13.2 LINEAR ARRAY

13.2.1 LINEAR ARRAY MINIMIZE NUMBER OF ELEMENTS NEEDED TO PERFORM RADAR OPERATIONS

13.3 PLANAR ARRAY

13.3.1 PLANAR ARRAY PROVIDES MUCH MORE FLEXIBILITY THAN LINEAR ARRAY

13.4 FREQUENCY SCANNING ARRAY

13.4.1 FREQUENCY SCANNING ARRAY USES MULTI-FREQUENCY MECHANISM FOR SCANNING

14 ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION (Page No. - 108)

14.1 INTRODUCTION

FIGURE 49 3D SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 42 ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 43 ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

14.2 2D

14.2.1 2D ELECTRONICALLY SCANNED ARRAY USED MAINLY FOR AIR TRAFFIC MANAGEMENT

14.3 3D

14.3.1 HIGH TARGET LOCATION ACCURACY AND AUTOMATIC OPERATION MODES DRIVE DEMAND FOR 3D ELECTRONICALLY SCANNED ARRAY

14.4 4D

14.4.1 4D ELECTRONICALLY SCANNED ARRAY USED IN AUTONOMOUS TACTICAL SURVEILLANCE VEHICLES FOR ACCURATE TARGET MAPPING

15 REGIONAL ANALYSIS (Page No. - 122)

15.1 INTRODUCTION

FIGURE 50 NORTH AMERICA HELD LARGEST SHARE OF ELECTRONICALLY SCANNED ARRAY MARKET IN 2021

15.2 IMPACT OF COVID-19

FIGURE 51 IMPACT OF COVID-19 ON ELECTRONICALLY SCANNED ARRAY MARKET

TABLE 44 ELECTRONICALLY SCANNED ARRAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 ELECTRONICALLY SCANNED ARRAY MARKET, BY REGION, 2021–2026 (USD MILLION)

15.3 NORTH AMERICA

FIGURE 52 NORTH AMERICA: COUNTRY-WISE MILITARY EXPENDITURE (2018–2021)

15.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 53 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET SNAPSHOT

TABLE 46 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2017–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2017–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2021–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.3.2 US

15.3.2.1 Increased investment in new prototypes and foreign military equipment sales will drive market

TABLE 72 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 73 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 74 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 75 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 76 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 77 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 78 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 79 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 80 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 81 US: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.3.3 CANADA

15.3.3.1 Government support to enhance military capabilities drive market in Canada

TABLE 82 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 83 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 84 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 85 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 86 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 87 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 88 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 89 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 90 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 91 CANADA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4 EUROPE

FIGURE 54 EUROPE: COUNTRY-WISE MILITARY EXPENDITURE (2018–2021)

15.4.1 PESTLE ANALYSIS: EUROPE

FIGURE 55 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET SNAPSHOT

TABLE 92 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 93 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 94 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 95 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 96 EUROPE: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 97 EUROPE: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 98 EUROPE: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2017–2020 (USD MILLION)

TABLE 99 EUROPE: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2021–2026 (USD MILLION)

TABLE 100 EUROPE: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 101 EUROPE: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 102 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 103 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 104 EUROPE: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 105 EUROPE: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 106 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 107 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 108 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 111 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2017–2020 (USD MILLION)

TABLE 115 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2021–2026 (USD MILLION)

TABLE 116 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.2 UK

15.4.2.1 Radar modernization programs boost market

TABLE 118 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 119 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 120 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 121 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 122 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 123 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 124 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 125 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 126 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 127 UK: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.3 FRANCE

15.4.3.1 Enhancement of internal security drive demand for ESA radar in the country

TABLE 128 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 129 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 130 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 131 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 132 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 133 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 134 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 135 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 136 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 137 FRANCE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.4 GERMANY

15.4.4.1 Increased need for improved interoperability of armed forces and continuous monitoring of borders boost market

TABLE 138 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 139 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 140 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 141 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 142 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 143 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 144 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 145 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 146 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 147 GERMANY: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.5 NETHERLANDS

15.4.5.1 Geopolitical shifts and digital information revolution – key market drivers

TABLE 148 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 149 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 150 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 151 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 152 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 153 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 154 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 155 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 156 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 157 NETHERLANDS: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.6 RUSSIA

15.4.6.1 Modernization of air defense systems boost market

TABLE 158 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 159 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 160 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 161 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 162 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 163 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 164 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 165 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 166 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 167 RUSSIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.4.7 REST OF EUROPE

15.4.7.1 Increasing insecurity in post-Brexit scenarios will drive market

TABLE 168 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 169 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 170 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 171 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 172 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 173 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 174 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 175 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 176 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 177 REST OF EUROPE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5 ASIA PACIFIC

FIGURE 56 ASIA PACIFIC: COUNTRY-WISE MILITARY EXPENDITURE (2018–2021)

15.5.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET SNAPSHOT

TABLE 178 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 179 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 180 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 181 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 182 ASIA PACIFIC: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 183 ASIA PACIFIC: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2017–2020 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2021–2026 (USD MILLION)

TABLE 186 ASIA PACIFIC: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 187 ASIA PACIFIC: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 188 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 189 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 190 ASIA PACIFIC: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 191 ASIA PACIFIC: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 192 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 193 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 194 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 195 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 196 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 197 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 198 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 199 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 200 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2017–2020 (USD MILLION)

TABLE 201 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2021–2026 (USD MILLION)

TABLE 202 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 203 ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.2 CHINA

15.5.2.1 Instability across neighboring countries drives demand for electronically scanned array

TABLE 204 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 205 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 206 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 207 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 208 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 209 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 210 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 211 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 212 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 213 CHINA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.3 INDIA

15.5.3.1 Ongoing military modernization, self-reliant India campaign, and infrastructural revolution to fuel market growth

TABLE 214 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 215 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 216 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 217 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 218 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 219 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 220 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 221 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 222 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 223 INDIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.4 JAPAN

15.5.4.1 Development and procurement of new electronically scanned array drive market

TABLE 224 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 225 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 226 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 227 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 228 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 229 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 230 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 231 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 232 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 233 JAPAN: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.5 SOUTH KOREA

15.5.5.1 Increasing focus to safeguard national territory boosts market

TABLE 234 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 235 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 236 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 237 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 238 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 239 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 240 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 241 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 242 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 243 SOUTH KOREA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.6 AUSTRALIA

15.5.6.1 Government keen on developing TADRS for self-reliance

TABLE 244 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 245 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 246 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 247 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 248 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 249 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 250 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 251 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 252 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 253 AUSTRALIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.5.7 REST OF ASIA PACIFIC

15.5.7.1 Instability in region creates demand for electronically scanned arrays

TABLE 254 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 255 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 256 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 257 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 258 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 259 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 260 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 261 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 262 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 263 REST OF ASIA PACIFIC: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6 MIDDLE EAST & AFRICA

FIGURE 58 MIDDLE EAST & AFRICA: COUNTRY-WISE MILITARY EXPENDITURE (2018–2021)

15.6.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 59 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET SNAPSHOT

TABLE 264 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 265 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 266 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 267 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 268 MIDDLE EAST & AFRICA: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 269 MIDDLE EAST & AFRICA: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 270 MIDDLE EAST & AFRICA: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2017–2020 (USD MILLION)

TABLE 271 MIDDLE EAST & AFRICA: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2021–2026 (USD MILLION)

TABLE 272 MIDDLE EAST & AFRICA: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 273 MIDDLE EAST & AFRICA: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 274 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 275 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 276 MIDDLE EAST & AFRICA: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 277 MIDDLE EAST & AFRICA: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 278 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 279 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 280 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 281 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 282 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 283 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 284 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 285 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 286 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2017–2020 (USD MILLION)

TABLE 287 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2021–2026 (USD MILLION)

TABLE 288 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 289 MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.2 TURKEY

15.6.2.1 Increasing focus on procuring low-altitude airborne surveillance AESA radar drives market

TABLE 290 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 291 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 292 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 293 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 294 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 295 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 296 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 297 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 298 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 299 TURKEY: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.3 SAUDI ARABIA

15.6.3.1 Demand for fighter aircraft with airborne warning and control system capabilities fuels market

TABLE 300 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 301 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 302 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 303 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 304 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 305 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 306 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 307 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 308 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 309 SAUDI ARABIA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.4 UAE

15.6.4.1 Aim to achieve self-reliance in military-industrial capabilities – key driver of market

TABLE 310 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 311 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 312 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 313 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 314 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 315 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 316 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 317 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 318 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 319 UAE: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.5 ISRAEL

15.6.5.1 Market in Israel driven by presence of major radar manufacturers

TABLE 320 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 321 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 322 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 323 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 324 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 325 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 326 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 327 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 328 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 329 ISRAEL: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.6 SOUTH AFRICA

15.6.6.1 Increased geopolitical instability expected to boost market

TABLE 330 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 331 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 332 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 333 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 334 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 335 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 336 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 337 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 338 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 339 SOUTH AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.6.7 REST OF MIDDLE EAST & AFRICA

TABLE 340 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 341 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 342 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 343 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 344 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 345 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 346 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 347 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 348 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 349 REST OF MIDDLE EAST & AFRICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7 LATIN AMERICA

FIGURE 60 LATIN AMERICA: COUNTRY-WISE MILITARY EXPENDITURE (2018–2021)

15.7.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 61 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET SNAPSHOT

TABLE 350 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 351 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 352 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 353 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 354 LATIN AMERICA: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 355 LATIN AMERICA: AIR ELECTRONICALLY SCANNED ARRAY MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 356 LATIN AMERICA: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2017–2020 (USD MILLION)

TABLE 357 LATIN AMERICA: MARINE ELECTRONICALLY SCANNED ARRAY MARKET, BY SHIP TYPE, 2021–2026 (USD MILLION)

TABLE 358 LATIN AMERICA: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 359 LATIN AMERICA: LAND ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 360 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 361 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 362 LATIN AMERICA: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 363 LATIN AMERICA: SINGLE FREQUENCY ELECTRONICALLY SCANNED ARRAY MARKET, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 364 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 365 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 366 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 367 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 368 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 369 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 370 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 371 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 372 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2017–2020 (USD MILLION)

TABLE 373 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY ARRAY GEOMETRY, 2021–2026 (USD MILLION)

TABLE 374 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 375 LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.2 MEXICO

15.7.2.1 Market fueled by demand for advanced fighter aircraft with airborne warning and control system capabilities

TABLE 376 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 377 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 378 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 379 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 380 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 381 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 382 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 383 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 384 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 385 MEXICO: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.3 BRAZIL

15.7.3.1 Ongoing military modernization propels market in Brazil

TABLE 386 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 387 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 388 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 389 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 390 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 391 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 392 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 393 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 394 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 395 BRAZIL: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

15.7.4 REST OF LATIN AMERICA

TABLE 396 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 397 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 398 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 399 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 400 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2017–2020 (USD MILLION)

TABLE 401 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY INSTALLATION, 2021–2026 (USD MILLION)

TABLE 402 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2017–2020 (USD MILLION)

TABLE 403 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY RANGE, 2021–2026 (USD MILLION)

TABLE 404 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 405 REST OF LATIN AMERICA: ELECTRONICALLY SCANNED ARRAY MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 249)

16.1 INTRODUCTION

TABLE 406 KEY DEVELOPMENTS BY LEADING PLAYERS IN ELECTRONICALLY SCANNED ARRAY MARKET BETWEEN JANUARY 2019 AND JANUARY 2022

16.2 MARKET SHARE ANALYSIS

TABLE 407 DEGREE OF COMPETITION

FIGURE 62 REVENUE ANALYSIS OF TOP 5 PLAYERS

16.3 MARKET RANKING ANALYSIS

FIGURE 63 RANKING OF MAJOR PLAYERS IN ELECTRONICALLY SCANNED ARRAY MARKET, 2020

16.4 COMPANY EVALUATION MATRIX

16.4.1 STARS

16.4.2 EMERGING LEADERS

16.4.3 PERVASIVE PLAYERS

16.4.4 PARTICIPANTS

FIGURE 64 ELECTRONICALLY SCANNED ARRAY MARKET: COMPANY EVALUATION MATRIX, 2021

16.4.5 COMPANY FOOTPRINT

TABLE 408 COMPANY REGION FOOTPRINT

TABLE 409 COMPANY PLATFORM FOOTPRINT

TABLE 410 COMPANY INSTALLATION FOOTPRINT

16.5 STARTUP/SME EVALUATION MATRIX

16.5.1 PROGRESSIVE COMPANIES

16.5.2 RESPONSIVE COMPANIES

16.5.3 STARTING BLOCKS

16.5.4 DYNAMIC COMPANIES

FIGURE 65 ELECTRONICALLY SCANNED ARRAY MARKET: STARTUP/SME EVALUATION MATRIX, 2021

16.5.5 COMPETITIVE BENCHMARKING

TABLE 411 ELECTRONICALLY SCANNED ARRAY MARKET: LIST OF KEY STARTUP/SMES

TABLE 412 ELECTRONICALLY SCANNED ARRAY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

16.6 COMPETITIVE SCENARIO

16.6.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 413 ELECTRONICALLY SCANNED ARRAY MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2019–JANUARY 2022

16.6.2 DEALS

TABLE 414 ELECTRONICALLY SCANNED ARRAY MARKET: DEALS, JANUARY 2019– JANUARY 2022

16.6.3 OTHER DEALS/DEVELOPMENTS

TABLE 415 ELECTRONICALLY SCANNED ARRAY MARKET: OTHER DEALS/DEVELOPMENTS, JANUARY 2019– JANUARY 2022

17 COMPANY PROFILES (Page No. - 265)

17.1 INTRODUCTION

17.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)*

17.2.1 NORTHROP GRUMMAN CORPORATION

TABLE 416 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 66 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 417 NORTHROP GRUMMAN CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 418 NORTHROP GRUMMAN CORPORATION: DEALS

17.2.2 ASELSAN A.S.

TABLE 419 ASELSAN A.S.: BUSINESS OVERVIEW

FIGURE 67 ASELSAN A.S.: COMPANY SNAPSHOT

TABLE 420 ASELSAN A.S.: DEALS

17.2.3 LOCKHEED MARTIN

TABLE 421 LOCKHEED MARTIN: BUSINESS OVERVIEW

FIGURE 68 LOCKHEED MARTIN: COMPANY SNAPSHOT

TABLE 422 LOCKHEED MARTIN: NEW PRODUCT DEVELOPMENT

TABLE 423 LOCKHEED MARTIN: DEALS

17.2.4 RAYTHEON TECHNOLOGIES

TABLE 424 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 69 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 425 RAYTHEON TECHNOLOGIES COMPANY: DEALS

17.2.5 GENERAL DYNAMICS

TABLE 426 GENERAL DYNAMICS: BUSINESS OVERVIEW

FIGURE 70 GENERAL DYNAMICS: COMPANY SNAPSHOT

TABLE 427 GENERAL DYNAMICS: DEALS

17.2.6 L3HARRIS TECHNOLOGIES

TABLE 428 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 71 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 429 L3HARRIS TECHNOLOGIES: DEALS

17.2.7 TELEDYNE TECHNOLOGIES

TABLE 430 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 72 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

17.2.8 THALES GROUP

TABLE 431 THALES GROUP: BUSINESS OVERVIEW

FIGURE 73 THALES GROUP: COMPANY SNAPSHOT

TABLE 432 THALES: NEW PRODUCT DEVELOPMENT

TABLE 433 THALES GROUP: DEALS

17.2.9 HANWHA SYSTEMS

TABLE 434 HANWHA SYSTEMS: BUSINESS OVERVIEW

FIGURE 74 HANWHA SYSTEMS: COMPANY SNAPSHOT

TABLE 435 HANWHA SYSTEMS: NEW PRODUCT DEVELOPMENT

TABLE 436 HANWHA SYSTEMS: DEALS

17.2.10 SAAB AB

TABLE 437 SAAB AB: BUSINESS OVERVIEW

FIGURE 75 SAAB AB: COMPANY SNAPSHOT

TABLE 438 SAAB AB: DEALS

17.2.11 BAE SYSTEMS

TABLE 439 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 76 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 440 BAE SYSTEMS: DEALS

17.2.12 LEONARDO S.P.A.

TABLE 441 LEONARDO S.P.A.: BUSINESS OVERVIEW

FIGURE 77 LEONARDO S.P.A.: COMPANY SNAPSHOT

TABLE 442 LEONARDO S.P.A.: DEALS

17.2.13 ISRAEL AEROSPACE INDUSTRIES

TABLE 443 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

FIGURE 78 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

TABLE 444 ISRAEL AEROSPACE INDUSTRIES: NEW PRODUCT DEVELOPMENT

TABLE 445 ISRAEL AEROSPACE INDUSTRIES: DEALS

17.2.14 INDRA COMPANY

TABLE 446 INDRA COMPANY: BUSINESS OVERVIEW

FIGURE 79 INDRA COMPANY: COMPANY SNAPSHOT

TABLE 447 INDRA COMPANY: DEALS

17.2.15 BHARAT ELECTRONICS LTD

TABLE 448 BHARAT ELECTRONICS LTD (BEL): BUSINESS OVERVIEW

FIGURE 80 BHARAT ELECTRONICS LTD (BEL): COMPANY SNAPSHOT

TABLE 449 BHARAT ELECTRONICS LTD (BEL): NEW PRODUCT DEVELOPMENT

17.2.16 AIRBUS GROUP

TABLE 450 AIRBUS GROUP: BUSINESS OVERVIEW

FIGURE 81 AIRBUS GROUP: COMPANY SNAPSHOT

TABLE 451 AIRBUS GROUP: DEALS

17.2.17 MITSUBISHI ELECTRIC

TABLE 452 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 82 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

17.2.18 LIG NEX 1

TABLE 453 LIG NEX 1: BUSINESS OVERVIEW

FIGURE 83 LIG NEX 1: COMPANY SNAPSHOT

TABLE 454 LIG NEX 1: DEALS

17.2.19 API TECHNOLOGIES CORP.

TABLE 455 API TECHNOLOGIES CORP.: BUSINESS OVERVIEW

FIGURE 84 API TECHNOLOGIES CORP.: COMPANY SNAPSHOT

17.3 OTHER KEY PLAYERS

17.3.1 HENSOLDT AG

TABLE 456 HENSOLDT AG: BUSINESS OVERVIEW

TABLE 457 HENSOLDT AG: DEALS

17.3.2 SRC, INC.

TABLE 458 SRC, INC.; BUSINESS OVERVIEW

TABLE 459 SRC, INC.: DEALS

17.3.3 TELEPHONICS CORPORATION

TABLE 460 TELEPHONICS CORPORATION: BUSINESS OVERVIEW

TABLE 461 TELEPHONICS CORPORATION: NEW PRODUCT DEVELOPMENT

TABLE 462 TELEPHONICS CORPORATION: DEALS

17.3.4 VEGA RADIO ENGINEERING CORPORATION

TABLE 463 VEGA RADIO ENGINEERING CORPORATION: BUSINESS OVERVIEW

17.3.5 JEM ENGINEERING LLC

TABLE 464 JEM ENGINEERING LLC: BUSINESS OVERVIEW

17.3.6 CEA TECHNOLOGIES

TABLE 465 CEA TECHNOLOGIES: BUSINESS OVERVIEW

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 322)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATION

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electronically Scanned Array Market