Electronic Design Automation Market by Product Category (CAE, Semiconductor IP, PCB & MCM), Deployment Mode(On-premises, Cloud-based), End-Use Application, End User (Consumer Electronics Industry, Automotive, Healthcare), Region - Global Forecast to 2028

Updated on : Sep 12, 2024

Electronic Design Automation Market Size, Share & Growth

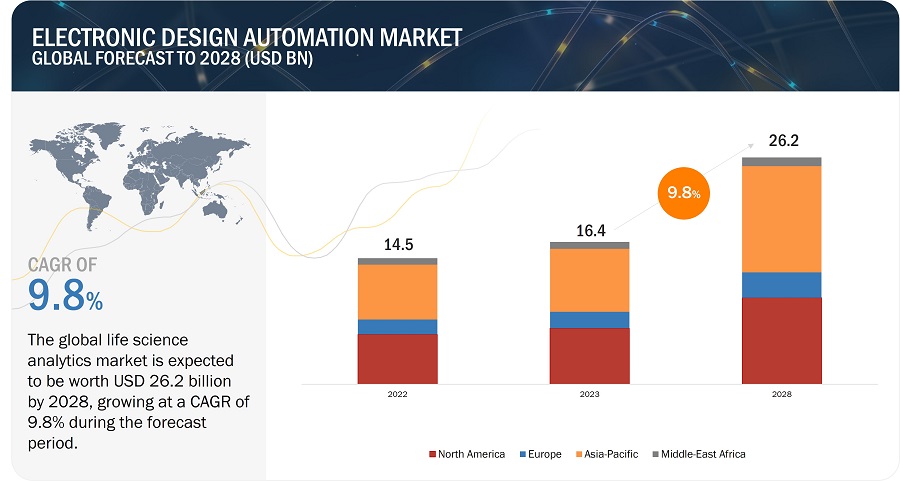

[263 Pages Report] The global electronic design automation was valued at USD 14.5 billion in 2022 and is estimated to reach

USD 26.2 billion by 2028, registering a CAGR of 9.8% during the forecast period. The increasing demand for complex integrated circuits (ICs) is driving the growth of the electronic design automation market. the advancement in technology has made it possible to produce smaller and more powerful electronic devices, such as smartphones, smartwatches, and laptops, which have become ubiquitous in our daily lives. Additionally, the increasing availability and affordability of high-speed internet connections have enabled the development of new applications and services that rely on these devices, such as streaming services, social media platforms.

Electronic Design Automation Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Electronic Design Automation Market Trends & Dynamics:

Driver: Growing miniaturization in various industries

In today's era of advanced electronics, the trend towards miniaturization has allowed companies in various industries including healthcare, consumer electronics, aerospace and defense, automotive and others to develop compact electronic devices. These devices integrate miniaturized semiconductor components, such as surgical devices and blood glucose monitors in healthcare, fitness watches in wearable devices, automotive subsystems in the automotive industry, and smart baggage tags. Miniaturization has several benefits, including freeing up space for additional features and more effective batteries. The growing awareness among consumers for fitness is driving the demand for compact fitness devices like smartwatches and fitness trackers. As a result, companies are encouraged to develop innovative products with enhanced features, while researchers are focusing on cost-effective and reliable product development using electronic design tools.

In addition, the use of portable devices has become increasingly popular among media professionals due to the growing need for live coverage of various events such as riots, accidents, sports, and political events. Due to the impracticality of using bulky TV production trucks to reach these events, the demand for portable handheld devices has increased. These devices can be easily carried in backpacks and transported to the event location quickly. As a result, the demand for compact devices in different industries has created opportunities for the semiconductor industry to produce miniaturized components, which is having a positive impact on the electronic design automation market.

Restraint: Constant technological changes

The semiconductor industry is constantly evolving and is characterized by ever-changing technology. With each leap, new technologies are introduced that disrupt the market equilibrium. This trend also applies to the integrated circuit (IC) industry where the process nodes of a semiconductor chip play a crucial role. The change in nodes affects the complexity of chip design, form factor, and IP core design architecture. As a result, system-on-chip (SoC) design faces technical challenges related to device integration and the development of new design methodologies. As technology nodes continuously evolve, their sizes change, necessitating changes in IP core design architecture. To keep up with the changing technology, most semiconductor companies are enhancing their electronic design automation solutions to match the evolving needs.

Opportunity: Increasing demand for electronic design automation solutions in aerospace & defense industry

The aerospace and defense industry requires semiconductor chips and circuits that can function in high temperatures and radiations. Therefore, these chips need to be integrated into small, less dense form factors using special materials. Due to their critical nature, chips and circuits are tested rigorously to ensure they are efficient and resistant to failure as non-performance could have severe consequences. To meet the requirements of avionics systems, programmable chip platforms are rapidly being incorporated into semiconductors using enhanced electronic design automation solutions. Consequently, there is high demand for technical manufacturing processes with special functionalities, as well as extended product accessibility and support. Leading companies in the electronic design automation market, such as Synopsys, Cadence, and Siemens EDA, offer solutions tailored for the aerospace and defense industry. For example, Cadence Design Systems is an integrated circuit design supplier for aerospace and defense industry with Defense Microelectronics Activity (DMEA) accreditation. These factors are expected to create lucrative opportunities for the growth of the electronic design automation market in the near future.

Challenge: High complexity due to continuous technological changes and large volume of data

The ever-evolving nature of technology in the semiconductor industry leads to changes in chip sizes, necessitating alterations in IP core design infrastructure and resulting in design complexities and chip form factor. As a result, EDA providers frequently need to develop new design methodologies, creating challenges in the electronic design automation market. Furthermore, the increasing amount of data required for EDA solutions poses a challenge for vendors, who must keep up with the demand for faster processing due to accelerated development cycles in the semiconductor industry. Other hindrances to the growth of the electronic design automation market include increasing design complexity, on-demand compute requirements, the use of hybrid cloud for design workloads, and industry consolidation.

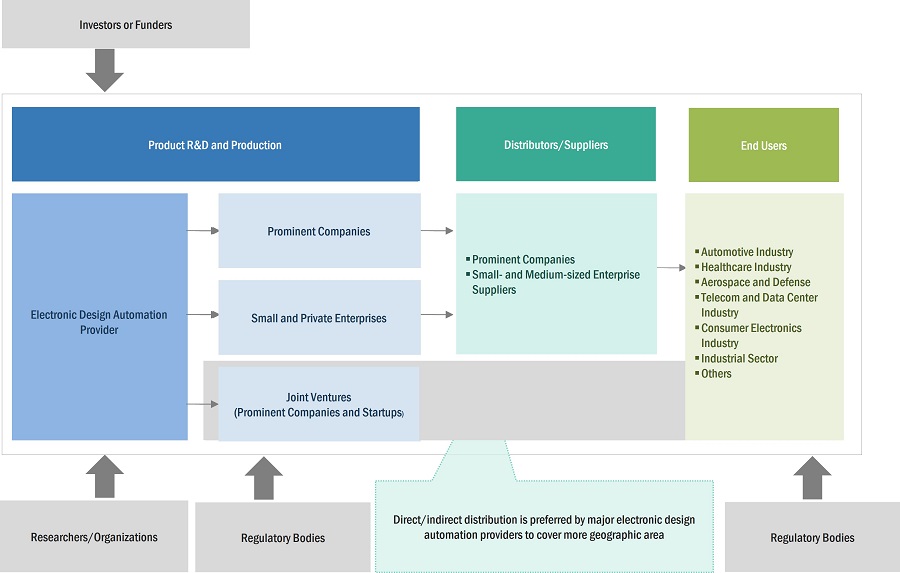

Electronic Design Automation Market Ecosystem

The electronic design automation market is consolidated, with major companies such as Cadence Design Systems, Inc., Siemens, Synopsys, Inc., ANSYS, Inc., and Keysight Technologies, Inc., and numerous small- and medium-sized enterprises. Almost all players offer a wide range of products, including computer-aided engineering (CAE), IC physical design & verification, PCB & MCM, semiconductor IPs, as well as services. These solutions are widely used in the automotive, healthcare, aerospace & defense, telecom and data center, consumer electronics industries, and the industrial sector.

Based on deployment on premise segment is expected to have highest market share during the forecast period.

The major share of the electronic design automation market is currently held by the on-premise segment, which is driven by the need to manage highly complex chip designs, vast datasets, and the low risk and complexity involved in migrating to new operational processes for chip design, manufacturing, and verification. Many semiconductor manufacturing companies are currently deploying on-premise electronic design automation solutions in their operational processes to improve their efficiency and productivity. Moreover, the on-premise segment provides better control over the entire design process, which is a critical factor in ensuring data security and intellectual property protection. Additionally, the on-premise solutions enable companies to customize the EDA tools based on their specific needs, which may not be possible with cloud-based solutions. However, the adoption of cloud-based solutions is also increasing rapidly due to the benefits it offers such as cost-effectiveness, flexibility, scalability, and ease of deployment.

Based on end use application, the memory management units segment is projected to record the highest CAGR during the forecast period.

Memory management unit is an essential component for efficient functioning of processors as it manages the memory accesses requested by the processor. With the increasing digitalization across various industries, there is a growing need for faster processors and efficient memory management tools. This has resulted in the memory management unit segment of the electronic design automation market expected to witness the highest CAGR during the forecast period.

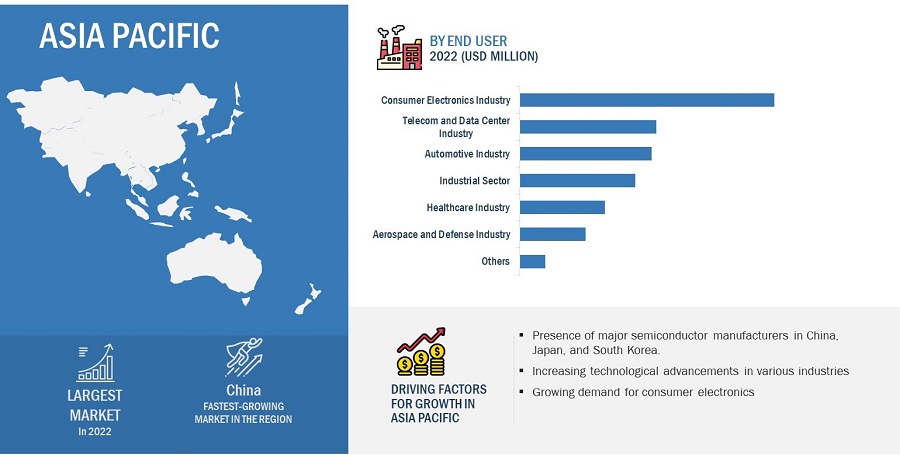

Based on end user, consumer electronics industry end user held the largest share which is expected to continue during the forecast period.

The consumer electronics segment has dominated the electronic design automation market in recent years due to the increasing sophistication of electronics and rising demand for advanced gadgets such as smart TVs and smartphones. The segment is expected to continue its rapid growth during the forecast period, fueled by advancements in technology and rising disposable incomes across the world.

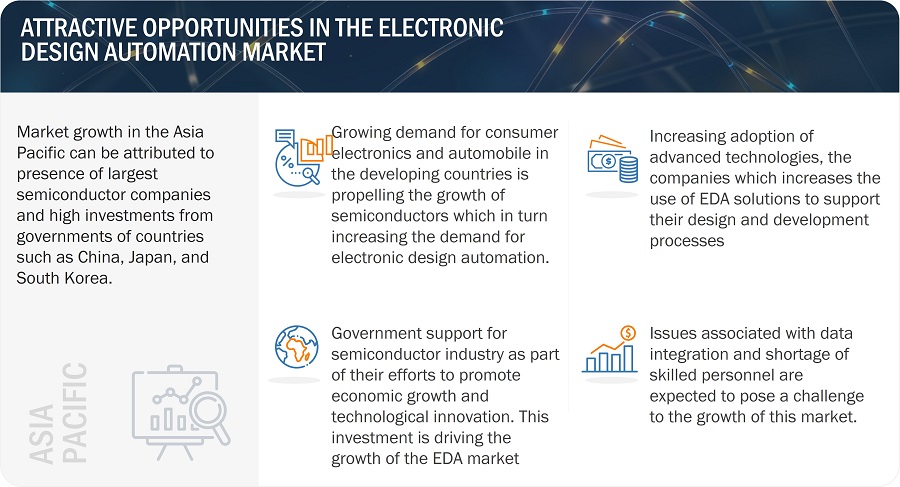

Based on region, Asia Pacific is projected to contribute the largest share for the electronic design automation market.

The Asia Pacific (APAC) region dominates the electronic design automation market, holding the largest share. This can be attributed to the strong foothold of the semiconductor industry in countries like China, Japan, South Korea, and Taiwan, which are major contributors to the growth of the EDA market. In addition, the presence of several semiconductor foundries, coupled with the rising demand for electronic devices and high-tech products, is expected to further fuel the growth of the EDA market in the APAC region.

Electronic Design Automation Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Electronic Design Automation Market

The electronic design automation market is dominated by a few globally established players such as Cadence Design Systems, Inc. (US), Synopsys, Inc. (US), Siemens (Germany), ANSYS, Inc. (US), Keysight Technologies, Inc. (US), Advance Micro Devices (US), eInfochips (US), Altium Limited (Australia), Zuken Inc. (Japan), Silvaco, Inc. (US).

Scope of the Report

|

Report Metric |

Details |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By product category, deployment mode, end-use application, and end user, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

Cadence Design Systems, Inc. (US), Synopsys, Inc. (US), Siemens (Germany), ANSYS, Inc. (US), Keysight Technologies, Inc. (US), Advance Micro Devices (US), eInfochips (US), Altium Limited (Australia), Zuken Inc. (Japan), Silvaco, Inc. (US). |

Electronic Design Automation Market Highlights

This research report categorizes the electronic design automation market based on product category, deployment mode, end-use application, and end user, and region

|

Aspect |

Details |

|

Based on product category: |

|

|

Based on deployment mode: |

|

|

Based on end-use application: |

|

|

Based on end user: |

|

|

Based on region: |

|

Recent Developments

- In February 2023, Ansys has expanded the collaboration with Microsoft to increase the availability of the simulation solutions on Microsoft Azure cloud-computing platform. This provides the customers browser-based location independent access. It also deepens the commitment of Ansys to provide cloud-based access to advanced simulation solutions.

- In January 2023, Siemens Digital Industries has launched Questa- a verification IQ software which helps the logic verification team to overcome the challenges in design complexity of ICs. Questa is powered by artificial intelligence and helps to accelerate verification closure, optimize the resources, and streamline traceability.

- In November 2022, eInfochips has partnered with Ambarella, Inc., an edge AI semiconductor company to expand the design and development services for AI camera products.

- In November 2022, Siemens has acquired Avery Design Systems, Inc. which is a simulation-independent verification IP supplier. The company has planned to add Avery to Siemens portfolio as a part of electronic design verification (EDA) integrated circuits verification offerings.

- In June 2022, Keysight Technologies Inc. has launched PathWave Advanced Design System (ADS) 2023, which addresses design complexity and higher frequency in the radio frequency (RF) and microwave industry

Frequently Asked Questions (FAQ):

Which are the major companies in the electronic design automation market? What are their major strategies to strengthen their market presence?

The major companies in the electronic design automation market are – Cadence Design Systems, Inc. (US), Synopsys, Inc. (US), Siemens (Germany), ANSYS, Inc. (US), and Keysight Technologies, Inc. (US). The strategies adopted by these players are product launches, collaborations, and partnerships.

Which is the potential market for the electronic design automation in terms of the region?

The APAC region is expected to dominate the electronic design automation market due to the presence of largest semiconductor companies in the countries like China, Japan, and South Korea.

What are the opportunities for new market entrants?

There are significant opportunities in the electronic design automation market for start-up companies. With the rising need for miniaturized components, the demand for electronic design automation is also rising.

What are the drivers and opportunities for the electronic design automation market?

Factors such as increasing demand for complex integrated circuits (ICs) and growing demand for technologically advanced consumer electronics are among the driving factors of the electronic design automation market. Moreover growing adoption of cloud-based services to create lucrative opportunities in the electronic design automation market.

Who are the major end users of the electronic design automation that are expected to drive the growth of the market in the next 5 years?

The major end users of the electronic design automation are consumer electronics, automotive industry, and aerospace and defense industry are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for complex integrated circuits (ICs)- Growing use of advanced technologies in consumer electronics- Rising demand for connected devices- Increasing miniaturization of devices in various industriesRESTRAINTS- Constant technological advancements in semiconductor industryOPPORTUNITIES- Growing adoption of cloud-based services- Increasing demand for electronic design automation solutions in aerospace & defense industry- Rising need for complex integrated circuits in automotive sectorCHALLENGES- Continuous technological advancements leading to design complexities

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 ELECTRONIC DESIGN AUTOMATION ECOSYSTEM

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 CASE STUDY ANALYSISONTEC USED CR-8000 OFFERED BY ZUKEN TO DEVELOP NEXT-GENERATION PRODUCTS IN LESS TIMEIDESIGNSPEC HELPED XINGTERA MINIMIZE OPERATIONAL COSTS AND REDUCE TIME TO MARKETSILVACO, INC. HELPED MOBILE SEMICONDUCTOR DELIVER NEXT-GENERATION, LOW-POWER MEMORY SYSTEMSTOSHIBA ACHIEVED SIGNIFICANT REDUCTION IN PRODUCT SIZE WITH ZUKEN’S CR-8000 DESIGN FORCE AND ANSYS’ ANALYSIS TOOLSSYNOPSYS’ SIMULATION SOLUTIONS HELPED JUNIPER NETWORKS ADDRESS OPTICAL CONNECTIVITY IN DATA CENTERS AND TELECOM NETWORKS

-

5.8 TECHNOLOGY ANALYSISCOMPLEMENTARY TECHNOLOGY- Printed electronicsADJACENT TECHNOLOGY- RISC–V processor

- 5.9 AVERAGE SELLING PRICE ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.11 PATENT ANALYSIS, 2018–2023

- 6.1 INTRODUCTION

-

6.2 COMPUTER-AIDED ENGINEERING (CAE)RISING ADOPTION OF COMPUTER-AIDED ENGINEERING IN VARIOUS INDUSTRIES TO BOOST MARKET GROWTH

-

6.3 INTEGRATED CIRCUIT (IC) PHYSICAL DESIGN & VERIFICATIONSHRINKING PROCESS GEOMETRIES TO INCREASE NEED FOR SOPHISTICATED IC PHYSICAL DESIGN AND VERIFICATION SOLUTIONS

-

6.4 PRINTED CIRCUIT BOARD (PCB) & MULTI-CHIP MODULE (MCM)GROWING USE OF PCBS AND MCMS IN AEROSPACE & DEFENSE, INDUSTRIAL, AND COMMERCIAL END-USER SEGMENTS TO DRIVE MARKET

-

6.5 SEMICONDUCTOR INTELLECTUAL PROPERTIES (IP)EASY REUSABILITY AND LICENSING TO DRIVE GROWTH OF SEMICONDUCTOR IP SEGMENT

-

6.6 SERVICESGROWING COMPLEXITY OF CHIP DESIGN TO DRIVE SERVICES SEGMENT

- 7.1 INTRODUCTION

-

7.2 ON-PREMISESON-PREMISES SEGMENT TO HOLD LARGER SHARE OF ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

-

7.3 CLOUD-BASEDTO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 8.1 INTRODUCTION

-

8.2 MICROPROCESSORS & MICROCONTROLLERSMICROPROCESSORS & MICROCONTROLLERS SEGMENT TO HOLD LARGEST SHARE OF ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

-

8.3 MEMORY MANAGEMENT UNITSHIGH PROCESSING SPEED REQUIREMENTS TO FUEL DEMAND FOR MEMORY MANAGEMENT UNITS

- 8.4 OTHERS

- 9.1 INTRODUCTION

-

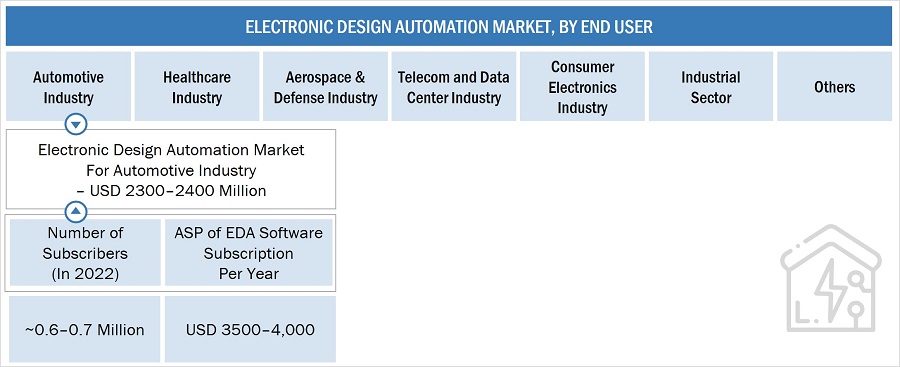

9.2 AUTOMOTIVEINCREASING INNOVATION IN AUTOMOTIVE INDUSTRY TO DRIVE ELECTRONIC DESIGN AUTOMATION MARKET

-

9.3 AEROSPACE & DEFENSETECHNOLOGICAL ADVANCEMENTS IN AEROSPACE & DEFENSE SECTOR TO FUEL DEMAND FOR ELECTRONIC DESIGN AUTOMATION SOLUTIONS

-

9.4 HEALTHCAREINCREASING LEVEL OF COMPLEXITY AND CUSTOMIZATION IN MEDICAL DEVICES TO FUEL DEMAND FOR ELECTRONIC DESIGN AUTOMATION

-

9.5 CONSUMER ELECTRONICSCONSUMER ELECTRONICS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

-

9.6 TELECOM & DATA CENTERADVANCEMENTS IN TELECOM AND DATA CENTER INDUSTRIES TO FUEL DEMAND FOR ELECTRONIC DESIGN AUTOMATION SOLUTIONS

-

9.7 INDUSTRIALADVENT OF INDUSTRY 4.0 TO FUEL DEMAND FOR ELECTRONIC DESIGN AUTOMATION SOLUTIONS

- 9.8 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- US to lead electronic design automation market in North America during forecast periodCANADA- Booming semiconductor industry to fuel market growthMEXICO- Substantial increase in foreign investments to propel market growth

-

10.3 EUROPEEUROPE: IMPACT OF RECESSIONUK- Demand from aerospace & defense industry to support market growthGERMANY- Growing adoption of smart home systems and connected cars to boost demand for electronic design automationFRANCE- Expanding aerospace & defense sector to fuel market growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- China to witness fastest growth in electronic design automation market in Asia Pacific during forecast periodJAPAN- Increasing demand for vehicles and consumer electronics to boost market growthSOUTH KOREA- Government initiatives and investments related to semiconductor industry to drive marketINDIA- Rapid digitalization through government-led initiatives to drive marketTAIWAN- Presence of large chip-making companies to fuel market growthREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDREST OF THE WORLD: IMPACT OF RECESSIONSOUTH AMERICA- Expanding consumer electronics and automotive industries to generate demand for electronic design automation solutionsMIDDLE EAST & AFRICA (MEA)- Adoption of advanced technologies and digital transformation to boost demand for electronic design automation

- 11.1 OVERVIEW

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSSOLUTION OFFERINGSORGANIC/INORGANIC STRATEGIES

- 11.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

11.4 MARKET SHARE ANALYSIS, 2022ELECTRONIC DESIGN AUTOMATION MARKET: DEGREE OF COMPETITION

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUPS/SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPANY FOOTPRINT

-

11.8 STARTUPS EVALUATION QUADRANTLIST OF STARTUPS: ELECTRONIC DESIGN AUTOMATION MARKETSTARTUPS MATRIX: DETAILED LIST OF KEY STARTUPS

-

11.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSCADENCE DESIGN SYSTEMS, INC.- Business overview- Solutions/Services offered- Recent developments- MnM viewSYNOPSYS, INC.- Business overview- Solutions/Services offered- Recent developments- MnM viewSIEMENS- Business overview- Solutions/Services offered- Recent developments- MnM viewANSYS, INC.- Business overview- Solutions/Services offered- Recent developments- MnM viewKEYSIGHT TECHNOLOGIES, INC.- Business overview- Solutions/Services offered- Recent developments- MnM viewADVANCED MICRO DEVICES, INC.- Business overview- Solutions/Services offered- Recent developmentsEINFOCHIPS- Business overview- Solutions/Services offered- Recent developmentsALTIUM LIMITED- Business overview- Solutions/Services offered- Recent developmentsZUKEN INC.- Business overview- Solutions/Services offered- Recent developmentsSILVACO, INC.- Business overview- Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSALDEC, INC.OPEN-SILICON, INC. (OPENFIVE)ENSILICAAGNISYS, INC.UCAMCOLABCENTER ELECTRONICSELECTROMAGNETICWORKS, INC.MIRABILIS DESIGN INC.EREMEX, LTD.SCHINDLER & SCHILL GMBHVENNSA TECHNOLOGIESPROTEANTECSPRIMARIUS TECHNOLOGIESALTAIR ENGINEERING INC.WESTDEV

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 ASSUMPTIONS: RECESSION

- TABLE 3 LIST OF ORIGINAL EQUIPMENT MANUFACTURERS, SUPPLIERS, AND DISTRIBUTORS OF ELECTRONIC DESIGN AUTOMATION SOLUTIONS

- TABLE 4 ELECTRONIC DESIGN AUTOMATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF ELECTRONIC DESIGN AUTOMATION SOFTWARE SUBSCRIPTION

- TABLE 6 IMPORT DATA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 7 EXPORT DATA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 8 TOP 20 PATENT OWNERS IN US FROM 2013 TO 2023

- TABLE 9 ELECTRONIC DESIGN AUTOMATION MARKET, BY PRODUCT CATEGORY, 2019–2022 (USD MILLION)

- TABLE 10 ELECTRONIC DESIGN AUTOMATION MARKET, BY PRODUCT CATEGORY, 2023–2028 (USD MILLION)

- TABLE 11 ELECTRONIC DESIGN AUTOMATION MARKET, BY DEPLOYMENT MODE, 2019–2022 (USD MILLION)

- TABLE 12 ELECTRONIC DESIGN AUTOMATION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 13 ELECTRONIC DESIGN AUTOMATION MARKET, BY END-USE APPLICATION, 2019–2022 (USD MILLION)

- TABLE 14 ELECTRONIC DESIGN AUTOMATION MARKET, BY END-USE APPLICATION, 2023–2028 (USD MILLION)

- TABLE 15 ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 16 ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 17 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 20 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 21 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 22 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 23 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 24 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 25 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 AUTOMOTIVE: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028, (USD MILLION)

- TABLE 29 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 30 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 31 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 32 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 34 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 35 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 AEROSPACE & DEFENSE: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 40 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 41 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 42 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 43 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 44 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 HEALTHCARE: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 50 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 51 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 55 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 CONSUMER ELECTRONICS: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 60 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 61 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 62 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 TELECOM & DATA CENTER: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 70 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 72 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 74 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 INDUSTRIAL: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 84 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 OTHERS: ELECTRONIC DESIGN AUTOMATION MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 US: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 94 US: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 95 CANADA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 96 CANADA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 97 MEXICO: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 98 MEXICO: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 100 EUROPE: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: ELECTRONIC DESIGN AUTOMATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: ELECTRONIC DESIGN AUTOMATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 UK: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 104 UK: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 105 GERMANY: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 106 GERMANY: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 107 FRANCE: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 108 FRANCE: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ELECTRONIC DESIGN AUTOMATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ELECTRONIC DESIGN AUTOMATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 CHINA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 116 CHINA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 117 JAPAN: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 118 JAPAN: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 120 SOUTH KOREA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 121 INDIA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 122 INDIA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 123 TAIWAN: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 124 TAIWAN: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 127 REST OF THE WORLD: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 128 REST OF THE WORLD: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 129 REST OF THE WORLD: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 130 REST OF THE WORLD: ELECTRONIC DESIGN AUTOMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 131 SOUTH AMERICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 132 SOUTH AMERICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 135 OVERVIEW OF STRATEGIES ADOPTED BY KEY ELECTRONIC DESIGN AUTOMATION COMPANIES

- TABLE 136 ELECTRONIC DESIGN AUTOMATION MARKET: MARKET SHARE ANALYSIS (2020)

- TABLE 137 COMPANY FOOTPRINT

- TABLE 138 COMPANY-WISE PRODUCT CATEGORY FOOTPRINT

- TABLE 139 COMPANY-WISE END-USER FOOTPRINT

- TABLE 140 COMPANY-WISE REGION FOOTPRINT

- TABLE 141 LIST OF STARTUPS: ELECTRONIC DESIGN AUTOMATION MARKET

- TABLE 142 STARTUPS MATRIX: DETAILED LIST OF KEY STARTUPS

- TABLE 143 ELECTRONIC DESIGN AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY PRODUCT CATEGORY

- TABLE 144 ELECTRONIC DESIGN AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY REGION

- TABLE 145 PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2023

- TABLE 146 DEALS, JANUARY 2018–JANUARY 2023

- TABLE 147 OTHERS, JANUARY 2018–JANUARY 2023

- TABLE 148 CADENCE DESIGN SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 149 CADENCE DESIGN SYSTEMS, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 150 CADENCE DESIGN SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 151 CADENCE DESIGN SYSTEMS, INC.: DEALS

- TABLE 152 SYNOPSYS, INC.: BUSINESS OVERVIEW

- TABLE 153 SYNOPSYS, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 154 SYNOPSYS, INC.: PRODUCT LAUNCHES

- TABLE 155 SYNOPSYS, INC.: DEALS

- TABLE 156 SIEMENS: BUSINESS OVERVIEW

- TABLE 157 SIEMENS: SOLUTIONS/SERVICES OFFERED

- TABLE 158 SIEMENS: PRODUCT LAUNCHES

- TABLE 159 SIEMENS: DEALS

- TABLE 160 ANSYS, INC.: BUSINESS OVERVIEW

- TABLE 161 ANSYS, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 162 ANSYS, INC.: DEALS

- TABLE 163 KEYSIGHT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 164 KEYSIGHT TECHNOLOGIES, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 165 KEYSIGHT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 166 ADVANCED MICRO DEVICES, INC.: BUSINESS OVERVIEW

- TABLE 167 ADVANCED MICRO DEVICES, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 168 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 169 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 170 EINFOCHIPS: BUSINESS OVERVIEW

- TABLE 171 EINFOCHIPS: SOLUTIONS/SERVICES OFFERED

- TABLE 172 EINFOCHIPS: DEALS

- TABLE 173 ALTIUM LIMITED: BUSINESS OVERVIEW

- TABLE 174 ALTIUM LIMITED: SOLUTIONS/SERVICES OFFERED

- TABLE 175 ALTIUM LIMITED: PRODUCT LAUNCHES

- TABLE 176 ALTIUM LIMITED: DEALS

- TABLE 177 ZUKEN INC.: BUSINESS OVERVIEW

- TABLE 178 ZUKEN INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 179 ZUKEN INC.: PRODUCT LAUNCHES

- TABLE 180 ZUKEN INC.: DEALS

- TABLE 181 SILVACO, INC.: BUSINESS OVERVIEW

- TABLE 182 SILVACO, INC.: SOLUTIONS/SERVICES OFFERED

- TABLE 183 SILVACO, INC.: PRODUCT LAUNCHES

- TABLE 184 SILVACO, INC.: DEALS

- TABLE 185 ALDEC, INC.: COMPANY OVERVIEW

- TABLE 186 OPEN-SILICON, INC. (OPENFIVE): COMPANY OVERVIEW

- TABLE 187 ENSILICA: COMPANY OVERVIEW

- TABLE 188 AGNISYS, INC.: COMPANY OVERVIEW

- TABLE 189 UCAMCO: COMPANY OVERVIEW

- TABLE 190 LABCENTER ELECTRONICS: COMPANY OVERVIEW

- TABLE 191 ELECTROMAGNETICWORKS, INC.: COMPANY OVERVIEW

- TABLE 192 MIRABILIS DESIGN INC.: COMPANY OVERVIEW

- TABLE 193 EREMEX, LTD.: COMPANY OVERVIEW

- TABLE 194 SCHINDLER & SCHILL GMBH: COMPANY OVERVIEW

- TABLE 195 VENNSA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 196 PROTEANTECS: COMPANY OVERVIEW

- TABLE 197 PRIMARIUS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 198 ALTAIR ENGINEERING INC.: COMPANY OVERVIEW

- TABLE 199 WESTDEV: COMPANY OVERVIEW

- FIGURE 1 ELECTRONIC DESIGN AUTOMATION MARKET SEGMENTATION

- FIGURE 2 GROWTH PROJECTIONS FOR ELECTRONIC DESIGN AUTOMATION MARKET

- FIGURE 3 ELECTRONIC DESIGN AUTOMATION MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALE OF ELECTRONIC DESIGN AUTOMATION SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN ELECTRONIC DESIGN AUTOMATION MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – BOTTOM-UP (DEMAND SIDE): DEMAND FOR ELECTRONIC DESIGN AUTOMATION SOLUTIONS AMONG DIFFERENT END USERS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 IC PHYSICAL DESIGN & VERIFICATION SEGMENT TO EXHIBIT HIGHEST CAGR IN ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 11 CLOUD-BASED SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 12 MICROPROCESSORS & MICROCONTROLLERS SEGMENT TO DOMINATE ELECTRONIC DESIGN AUTOMATION MARKET IN 2023

- FIGURE 13 AUTOMOTIVE SEGMENT TO EXHIBIT HIGHEST CAGR IN ELECTRONIC DESIGN AUTOMATION MARKET FROM 2023 TO 2028

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 15 GROWING DEMAND FOR TECHNOLOGICALLY ADVANCED CONSUMER ELECTRONICS TO FUEL ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 16 SEMICONDUCTOR IP & MICROPROCESSORS & MICROCONTROLLERS SEGMENTS TO HOLD LARGEST SHARES OF ELECTRONIC DESIGN AUTOMATION MARKET BY 2028

- FIGURE 17 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF ELECTRONIC DESIGN AUTOMATION MARKET BY 2028

- FIGURE 18 CHINA TO RECORD HIGHEST CAGR IN ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO HOLD LARGEST SHARE OF ELECTRONIC DESIGN AUTOMATION MARKET IN 2028

- FIGURE 20 ELECTRONIC DESIGN AUTOMATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ELECTRONIC DESIGN AUTOMATION MARKET DRIVERS AND THEIR IMPACT

- FIGURE 22 ELECTRONIC DESIGN AUTOMATION MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 23 ELECTRONIC DESIGN AUTOMATION MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 24 ELECTRONIC DESIGN AUTOMATION MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 25 SUPPLY CHAIN OF ELECTRONIC DESIGN AUTOMATION MARKET

- FIGURE 26 REVENUE SHIFTS IN ELECTRONIC DESIGN AUTOMATION MARKET

- FIGURE 27 ECOSYSTEM OF ELECTRONIC DESIGN AUTOMATION

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 PATENTS GRANTED WORLDWIDE FROM 2013 TO 2023

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2013 TO 2023

- FIGURE 31 ELECTRONIC DESIGN AUTOMATION MARKET, BY PRODUCT CATEGORY

- FIGURE 32 IC PHYSICAL DESIGN & VERIFICATION SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 33 ELECTRONIC DESIGN AUTOMATION MARKET, BY DEPLOYMENT MODE

- FIGURE 34 CLOUD-BASED SEGMENT TO EXHIBIT HIGHER CAGR IN ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 35 ELECTRONIC DESIGN AUTOMATION MARKET, BY END-USE APPLICATION

- FIGURE 36 MEMORY MANAGEMENT UNITS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ELECTRONIC DESIGN AUTOMATION MARKET, BY END USER

- FIGURE 38 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR IN ELECTRONIC DESIGN AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC ELECTRONIC DESIGN AUTOMATION MARKET TO CAPTURE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: ELECTRONIC DESIGN AUTOMATION MARKET SNAPSHOT

- FIGURE 41 EUROPE: ELECTRONIC DESIGN AUTOMATION MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: ELECTRONIC DESIGN AUTOMATION MARKET SNAPSHOT

- FIGURE 43 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN ELECTRONIC DESIGN AUTOMATION MARKET, 2018 TO 2022

- FIGURE 44 SHARE OF MAJOR PLAYERS IN ELECTRONIC DESIGN AUTOMATION MARKET, 2022

- FIGURE 45 ELECTRONIC DESIGN AUTOMATION MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 46 ELECTRONIC DESIGN AUTOMATION MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 47 CADENCE DESIGN SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 48 SYNOPSYS, INC.: COMPANY SNAPSHOT

- FIGURE 49 SIEMENS: COMPANY SNAPSHOT

- FIGURE 50 ANSYS, INC.: COMPANY SNAPSHOT

- FIGURE 51 KEYSIGHT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 52 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 53 ALTIUM LIMITED: COMPANY SNAPSHOT

- FIGURE 54 ZUKEN INC.: COMPANY SNAPSHOT

To estimate the size of the electronic design automation market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the electronic design automation market. Secondary sources considered for this research study include included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE NAME |

WEBLINK |

|

Chinese American Semiconductor Professional Association |

https://www.caspa.com/ |

|

GaN Consortium |

https://www.gan-conso.jp/index.html |

|

Global Semiconductor Alliance |

https://www.gsaglobal.org/ |

|

MIPI Alliance |

https://www.mipi.org/ |

|

Silicon Integration Initiative |

https://si2.org/ |

|

SEMI ESDA |

https://www.semi.org/en/communities/esda |

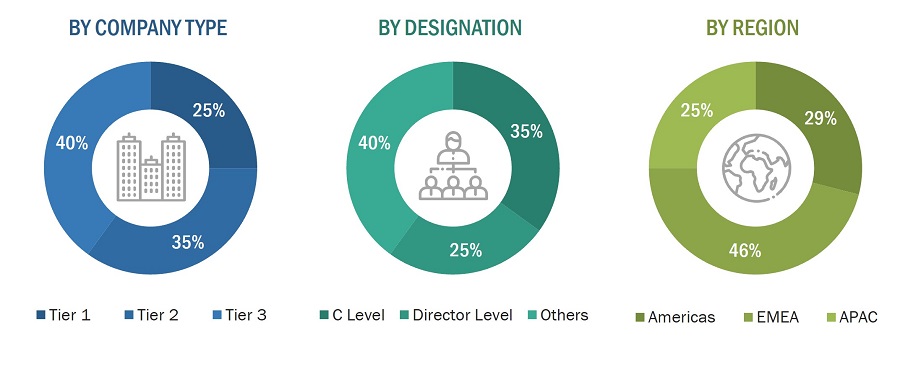

Primary Research

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end user installation teams using electronic design automation solutions, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of electronic design automation, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

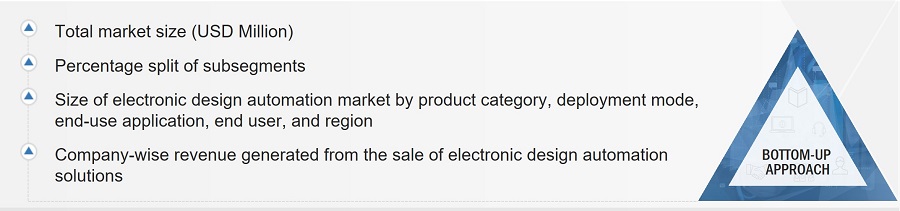

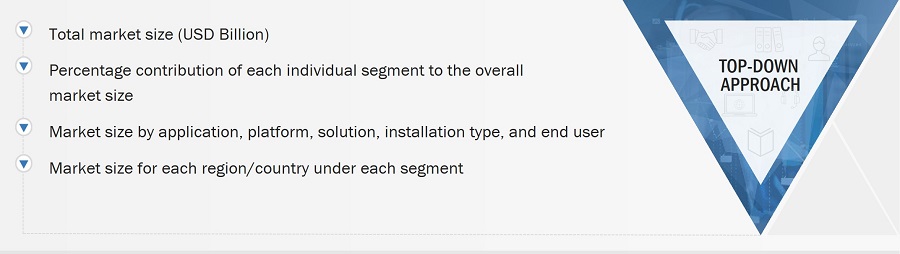

To estimate and validate the size of the electronic design automation market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

- Identification of the revenue generated by each company from electronic design automation solutions.

- Determination of the average selling prices of electronic design automation solutions globally.

- Conducting multiple discussion sessions with key opinion leaders to understand the various product categories in the electronic design automation market, their usage in different applications, and analyzing the work breakdown carried out by each key company.

- Verification and crosschecking of estimates at every level with key opinion leaders such as CEOs, directors, operation managers, and domain experts from MarketsandMarkets.

- Study of various paid and unpaid sources of information, including annual reports, press releases, white papers, and databases, to track the company and region-specific developments in the electronic design automation market.

The top-down approach has been used to estimate and validate the total size of the electronic design automation market.

- Initially, the focus was on top-line investments and expenditures within the electronic design automation ecosystem.

- The market was then divided based on product category, deployment mode, end-use application, and end user, and key developments in each area were listed.

- Major players in the electronic design automation market were identified through secondary research based on their product category, deployment mode, end-use application, and penetration in various end-user segments. The information was then verified with industry experts.

- Revenues, product mix, geographic presence, and key applications offered by all identified players were analyzed to estimate the percentage splits for all key segments.

- The splits were then discussed with industry experts to validate the information and identify key growth areas within all key segments.

- Breaking down the global market based on verified splits and key growth pockets across all segments

Data Triangulation

Once the overall size of the electronic design automation market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Electronic design automation (EDA) solutions are utilized in the creation and development of electronic systems like integrated circuits (ICs) and printed circuit boards (PCBs). The domain of EDA solutions encompasses hardware, software, and services with the shared objective of aiding in the planning, definition, design, implementation, verification, and manufacture of semiconductor devices or chips. Although EDA solutions are not directly used in the production of chips, they play a crucial role in three ways. Firstly, electronic design automation tools are employed in designing and assessing the semiconductor manufacturing process to ensure that they offer the necessary performance and density. Secondly, they are utilized to verify that a design fulfills all prerequisites. The third aspect is still in its early stages, whereby monitoring of the device's performance from post-manufacturing testing to deployment in manufacturing process fields is required.

Key Stakeholders

- Component Manufacturers

- Government and Research Organizations

- HVAC Contractors

- HVAC System Providers

- HVAC Software and Service Providers

- Maintenance and Service Providers

- Original Equipment Manufacturers (OEMs)

- Professional Services/Solution Providers

- Research Institutions and Organizations

- System Integrators

Report Objectives

- To describe and forecast the size of the electronic design automation market in terms of value.

- To describe and forecast the size of the electronic design automation market based on product category, deployment mode, end-use application, and end user.

- To describe and forecast the market size for 4 key regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (ROW) in terms of value.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the electronic design automation market.

- To provide a detailed overview of the supply chain pertaining to the electronic design automation ecosystem, along with the average selling prices of electronic design automation software subscriptions

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market

- To describe the detailed impact of the recession on the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the electronic design automation market

- To strategically profile the key players in the electronic design automation market and comprehensively analyze their market ranking and core competencies.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the electronic design automation market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the electronic design automation market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electronic Design Automation Market