Electron Beam Machining Market by Application (Welding, Surface Treatment, and Drilling), Industry (Automotive and Aerospace & Defence), and Geography (North America, Europe, Asia Pacific, RoW) - Global Forecast to 2025-2033

The global Electron Beam Machining market was valued at USD 0.43 billion in 2024 and is estimated to reach USD 0.61 billion by 2033, at a CAGR of 4.1% between 2025 and 2033.

The Electron Beam Machining Market is growing steadily, driven by increasing demand for high-precision, efficient, and reliable manufacturing solutions. Electron beam machines are used for applications such as cutting, drilling, and surface modification in industries including aerospace, automotive, medical, and electronics. Advancements in beam technology, automation, and material processing are facilitating faster machining, higher accuracy, and reduced material waste. As industries focus on precision manufacturing and cost-effective production, electron beam machining is shifting from specialized applications to a more widespread industrial tool. With ongoing innovation and integration with advanced manufacturing systems, electron beam machining is expected to become a key technology for next-generation industrial processes.

The growing need for high-precision and efficient manufacturing solutions is further driving the growth of the Electron Beam Machining Market. Companies are investing heavily in research and development to create faster, more reliable, and energy-efficient systems. Simultaneously, the adoption of advanced material processing techniques and automation technologies is increasing the demand for electron beam machines in aerospace, automotive, medical, and electronics industries. Furthermore, the global emphasis on precision manufacturing, reduced material waste, and cost-effective production is creating strong opportunities for market expansion.

Market by Application

Welding

Welding is expected to hold the largest market share in the Electron Beam Machining Market due to its critical role in joining high-strength materials in aerospace, automotive, and defense industries. Electron beam welding offers precision, minimal thermal distortion, and the ability to join difficult-to-weld metals, making it highly preferred for industrial applications. The growing demand for lightweight structures and advanced manufacturing techniques further strengthens the dominance of this segment. As industries increasingly focus on high-quality and durable components, electron beam welding continues to drive substantial revenue for the market.

Drilling

Drilling is projected to witness significant CAGR in the Electron Beam Machining Market over the forecast period. The ability of electron beam drilling to achieve ultra-precise, deep, and small-diameter holes in metals and alloys is fueling demand in aerospace, electronics, and medical device manufacturing. Increasing adoption of miniaturized components and micro-machining applications is accelerating the growth of this segment. Technological advancements that improve speed, accuracy, and efficiency are further enhancing its appeal. As manufacturers continue to require precision drilling for complex components, this application segment is expected to grow at a faster rate than other uses.

Market by Industry

Aerospace & Defense

The aerospace & defense industry is expected to hold considerable market share in the Electron Beam Machining Market. The demand for lightweight, high-strength components and precision-engineered parts in aircraft, satellites, and defense equipment makes electron beam machining crucial for this industry. Its ability to perform high-precision cutting, welding, and drilling with minimal thermal distortion ensures superior quality and reliability. Growing investment in advanced aerospace technologies and defense modernization programs is further increasing the adoption of these solutions. The critical need for accuracy, safety, and performance in this sector continues to support its dominance in the market.

Automotive

The automotive industry is projected to witness significant growth rate during the forecast period. This growth is driven by increased demand for lightweight, high-performance vehicles, electric vehicles, and precision-engineered components is driving the adoption of electron beam machining. Advancements in material processing, miniaturization, and automation are accelerating the implementation of EBM in automotive manufacturing. Manufacturers are focusing on reducing production time and improving component quality, which further fuels growth in this segment. As automotive production increasingly relies on advanced machining technologies, this industry segment is expected to grow significantly.

Market by Geography

Geographically, the Electron Beam Machining market is experiencing widespread adoption across North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America. For the Electron Beam Machining Market, the Asia Pacific region is expected to grow prominently over the forecast period. Rapid industrialization, expanding automotive and aerospace manufacturing, and growing adoption of advanced manufacturing technologies are driving this growth. Countries such as China, Japan, South Korea, and India are investing heavily in precision manufacturing and high-tech industrial applications, which boosts demand for electron beam machining systems. The region’s focus on cost-effective production, rising electronics manufacturing, and increasing infrastructure development further accelerates adoption.

Market Dynamics

Driver: Rising Need for Electron Beam Welding

Electron beam welding offers high precision, minimal thermal distortion, and the ability to join difficult-to-weld metals, making it a critical driver of the market. These benefits enable manufacturers to produce complex and high-strength components efficiently. Industries such as aerospace, automotive, and defense rely on these capabilities for superior product quality. The consistent performance and reliability of electron beam welding continue to support market adoption.

Restraint: Generation of X-Rays During Electron Beam Welding Process

The generation of X-rays during the electron beam welding process poses safety and regulatory challenges for manufacturers. Proper shielding and compliance with safety standards are required, increasing operational complexity. This can result in slower adoption, especially in small-scale facilities or regions with strict radiation safety regulations. Managing X-ray exposure adds to both cost and procedural requirements.

Opportunity: Cost-Effective Welding for Large Scale Production

Electron beam welding presents opportunities for cost-effective manufacturing in large-scale production environments. The precision and speed of the process reduces material waste and rework, enhancing overall efficiency. Industries aiming to scale production of high-performance components can benefit from lower per-unit costs. Expanding applications in automotive and aerospace sectors further strengthens this growth potential.

Challenge: Requirement of Highly Trained Personnel

Operating electron beam machines require highly trained personnel to manage complex equipment and ensure precision. This skill requirement limits adoption in smaller manufacturing units and increases dependency on specialized workforce. Training programs and technical expertise are necessary to maintain consistent quality and efficiency. Workforce availability and retention are therefore key challenges for market expansion.

Future Outlook

Between 2025 and 2033 the Electron Beam Machining Market is expected to witness steady growth as demand for high-precision and efficient manufacturing solutions rises across industries globally. Advancements in beam technology, automation, and material processing will enable machines to achieve faster, more accurate, and energy-efficient machining. Increasing adoption in aerospace, automotive, medical, and electronics sectors will further accelerate market expansion. As systems become more cost-effective and versatile and awareness of precision manufacturing grows, the market is expected to experience broader deployment. Electron beam machining is expected to become an integral part of advanced industrial production, driving innovation and improving product quality worldwide.

Key Market Players

Top Electron Beam Machining companies: Mitsubishi Electric Corporation (Japan), Global Beam Technologies AG (Germany), pro-beam group (Germany), Sciaky Inc. (US), and Bodycote (UK).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

{ "@context": "https://schema.org", "@type": "Report", "name": "Electron Beam Machining Market – Global Forecast to 2024", "alternateName": "Electron Beam Machining Market by Application, Industry & Geography", "reportCode": "SE 7321", "url": "https://www.marketsandmarkets.com/Market-Reports/electron-beam-machining-market-162077061.html", "publisher": { "@type": "Organization", "name": "MarketsandMarkets", "url": "https://www.marketsandmarkets.com/" }, "datePublished": "2019-08-29", "about": { "@type": "Technology", "name": "Electron Beam Machining" }, "description": "This report provides a quantified B2B research on global Electron Beam Machining market, segmented by application (Welding, Surface Treatment, Drilling), industry (Automotive; Aerospace & Defense; Others) and geography (North America; Europe; Asia Pacific; Rest of the World) with forecasts up to 2024. The market is estimated at USD 181 million in 2019 and expected to grow to USD 212 million by 2024, at a CAGR of 3.2%.", "inLanguage": "en", "dateModified": "2019-08-29", "contentReferenceTime": "P1Y", "aboutLocation": [ { "@type": "Place", "name": "North America" }, { "@type": "Place", "name": "Europe" }, { "@type": "Place", "name": "Asia Pacific" }, { "@type": "Place", "name": "Rest of the World" } ], "estimatedRevenue": { "@type": "MonetaryAmount", "currency": "USD", "value": "181000000" }, "forecastRevenue": { "@type": "MonetaryAmount", "currency": "USD", "value": "212000000" }, "additionalProperty": [ { "@type": "PropertyValue", "name": "CAGR", "value": "3.2%", "unitText": "percent per annum" }, { "@type": "PropertyValue", "name": "ForecastPeriod", "value": "2019-2024", "unitText": "years" }, { "@type": "PropertyValue", "name": "ApplicationSegments", "value": "Welding, Surface Treatment, Drilling" }, { "@type": "PropertyValue", "name": "IndustrySegments", "value": "Automotive; Aerospace & Defence; Others" } ] }

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From the Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data Points From Primary Sources

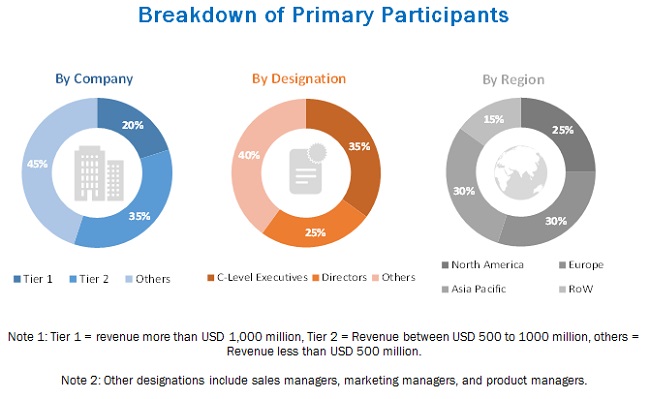

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in Market

4.2 Market in Welding, By Industry

4.3 Market, By Industry

4.4 Market, By Region

4.5 Europe Market, By Industry & Application

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Benefits of Electron Beam Welding

5.2.1.2 Demand for Welding in Aerospace and Automotive Industries

5.2.2 Restraints

5.2.2.1 Availability of Alternative Micromachining Technologies

5.2.2.2 Generation of X-Rays During Electron Beam Welding Process

5.2.3 Opportunities

5.2.3.1 Cost-Effective Welding for Large Scale Production

5.2.4 Challenges

5.2.4.1 Limitation on the Workpiece Size Due to Vacuum Chamber Size

5.2.4.2 Requirement of Highly Trained Personnel

5.2.4.3 High Capital/Set Up Cost of Electron Beam Machines

5.3 Electron Beam Machining System Components

5.4 Factors Affecting the Electron Beam Machining Performance

6 Analysis of Materials Processed Using Electron Beam Machining (Page No. - 35)

6.1 Introduction

6.2 Stainless Steel

6.2.1 Stainless Steel is Most Widely Used for Electron Beam Machining

6.3 Titanium

6.3.1 Increased Use of Titanium in Aerospace & Defense Industry for Developing Various Aircraft Components

6.4 Nickel

6.4.1 Nickel-Based Alloys Playing A Prominent Role in Power Industry

6.5 Others

6.5.1 Increased Porosity of Copper Due to Its Electron Beam Welding

7 Market, By Application (Page No. - 38)

7.1 Introduction

7.2 Welding

7.2.1 Advantages of Electron Beam Welding

7.3 Drilling

7.3.1 Pulse Modulation Plays an Important Role in Drilling Process

7.4 Surface Treatment

7.4.1 Use of Electron Beam Surface Treatment Technology as A Surface Hardening Tool

8 Market, By Industry (Page No. - 45)

8.1 Introduction

8.2 Automotive

8.2.1 Growth Scope for Turbocharger Welders in Automotive Industry

8.3 Aerospace & Defense

8.3.1 Nadcap Accreditation Ensures Quality of Welders

8.4 Others

8.4.1 Reduced Pressure Electron Beam Welding Enables High-Quality On-Site Welding and Single Pass Thick Section Welding

9 Market, By Geography (Page No. - 54)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Key Suppliers of Electron Beam Welding Services in the US Market

9.2.2 Rest of North America

9.2.2.1 Growing Need for Electron Beam Welding in Aerospace Industry is Expected to Offer Opportunities for Market in Mexico

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany is One of the Key Markets for Electron Beam Machining for Automotive Industry in Europe

9.3.2 France

9.3.2.1 Presence of Leading Aerospace Companies to Drive Demand for Electron Beam Welding in France

9.3.3 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Presence of Key Suppliers of Electron Beam Machines in the Country is Driving the Chinese Market

9.4.2 Japan

9.4.2.1 Nuclear Industry is A Prominent Market for Electron Beam Machining in Japan

9.4.3 Rest of APAC

9.5 Rest of the World (RoW)

9.5.1 South America

9.5.1.1 Future Growth Opportunities for Market in Brazil

9.5.2 Middle East & Africa

9.5.2.1 Significant Growth Expected for Market in Middle East

10 Competitive Landscape (Page No. - 68)

10.1 Overview

10.2 Competitive Analysis

10.3 Key Players and Their Offerings

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Dynamic Differentiators

10.4.3 Innovators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 72)

11.1 Key Players

(Business Overview, Products Offered, SWOT Analysis, and MnM View)*

11.1.1 Mitsubishi Electric

11.1.2 Global Beam Technologies

11.1.3 Pro-Beam

11.1.4 Cambridge Vacuum Engineering

11.1.5 Sciaky

11.1.6 Bodycote

11.1.7 Beijing Zhong Ke Electric Co. Ltd.

11.1.8 Sodick

11.1.9 Teta

11.1.10 Focus GmbH

11.2 Other Key Players

11.2.1 Evobeam

11.2.2 AVIC

11.3 Key Electron Beam Service Providers

11.3.1 Ravenscourt Engineering

11.3.2 Josch Strahlschweißtechnik GmbH

11.3.3 EB Industries

11.3.4 EBWA Industries

11.3.5 Acceleron Inc.

11.3.6 Creative Instrumentation

11.3.7 Joining Technologies

11.3.8 B.C. Instruments

11.3.9 KFMI

*Details on Business Overview, Products Offered, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 94)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (36 Tables)

Table 1 Electron Beam Machining Market, By Application, 2016–2024 (USD Million)

Table 2 Market in Welding, By Region, 2016–2024 (USD Million)

Table 3 Market in Welding, By Industry, 2016–2024 (USD Million)

Table 4 Market in Drilling, By Region, 2016–2024 (USD Million)

Table 5 Market in Drilling, By Industry, 2016–2024 (USD Million)

Table 6 Market in Surface Treatment, By Region, 2016–2024 (USD Million)

Table 7 Market in Surface Treatment, By Industry, 2016–2024 (USD Million)

Table 8 Market, By Industry, 2016–2024 (USD Million)

Table 9 Market for Automotive, By Region, 2016–2024 (USD Million)

Table 10 Market for Automotive, By Application, 2016–2024 (USD Million)

Table 11 North America Market for Automotive, By Application, 2016–2024 (USD Million)

Table 12 Europe Market for Automotive, By Application, 2016–2024 (USD Million)

Table 13 APAC Market for Automotive, By Application, 2016–2024 (USD Million)

Table 14 Market for Aerospace & Defense, By Region, 2016–2024 (USD Million)

Table 15 Market for Aerospace & Defense, By Application, 2016–2024 (USD Million)

Table 16 North America Market for Aerospace & Defense, By Application, 2016–2024 (USD Million)

Table 17 Europe Market for Aerospace & Defense, By Application, 2016–2024 (USD Million)

Table 18 APAC Market for Aerospace & Defense, By Application, 2016–2024 (USD Million)

Table 19 Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 20 Market for Other Industries, By Application, 2016–2024 (USD Million)

Table 21 North America Market for Other Industries, By Application, 2016–2024 (USD Million)

Table 22 Europe Market for Other Industries, By Application, 2016–2024 (USD Million)

Table 23 APAC Market for Other Industries, By Application, 2016–2024 (USD Million)

Table 24 Market, By Region, 2016–2024 (USD Million)

Table 25 Market in North America, By Country, 2016–2024 (USD Million)

Table 26 Market in North America, By Industry, 2016–2024 (USD Million)

Table 27 Market in North America, By Application, 2016–2024 (USD Million)

Table 28 Market in Europe, By Country, 2016–2024 (USD Million)

Table 29 Market in Europe, By Industry, 2016–2024 (USD Million)

Table 30 Market in Europe, By Application, 2016–2024 (USD Million)

Table 31 Market in APAC, By Country, 2016–2024 (USD Million)

Table 32 Market in APAC, By Industry, 2016–2024 (USD Million)

Table 33 Market in APAC, By Application, 2016–2024 (USD Million)

Table 34 Market in RoW, By Industry, 2016–2024 (USD Million)

Table 35 Market in RoW, By Application, 2016–2024 (USD Million)

Table 36 Key Companies and Their Offerings in the Market

List of Figures (41 Figures)

Figure 1 Markets Covered

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Limitations of the Research Study

Figure 8 Market Segmentation

Figure 9 Market Snapshot

Figure 10 Welding Application Expected to Lead Market During Forecast Period

Figure 11 Automotive Industry Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Market in Asia Pacific Expected to Grow at the Highest Growth Rate Between 2019 & 2024

Figure 13 Benefits of Electron Beam Machines Make Them Preferable Across Various Industries

Figure 14 Automotive Industry Estimated to Lead Market in Welding in 2019

Figure 15 Automotive Industry Expected to Grow at the Highest CAGR During Forecast Period

Figure 16 Europe is Estimated to Account for the Largest Share of the Market for Electron Beam Machining in 2019

Figure 17 Automotive Industry Accounted for Largest Share of the Europe Market in 2018

Figure 18 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Key Benefits of Electron Beam Welding

Figure 20 Global Vehicle Production (Million Units)

Figure 21 Components of an Electron Beam Machine

Figure 22 Parameters Affecting the Performance of Electron Beam Machine

Figure 23 Classification of Materials Used for Electron Beam Machining

Figure 24 Types of Stainless Steel Used for Electron Beam Welding

Figure 25 Parameters Responsible for Increased Porosity of Copper Metal Due to Electron Beam Welding

Figure 26 Market, By Application

Figure 27 Types of Electron Beam Welding Machines

Figure 28 Market, By Industry

Figure 29 China to Dominate the Market From 2019 to 2024

Figure 30 North America Market (USD Million)

Figure 31 Snapshot of Market in Europe

Figure 32 Passenger Car Production in Europe, 2018 (Million Units)

Figure 33 France’s Share in Nuclear Power Generation in 2018: Europe vs Global

Figure 34 Snapshot of Market in APAC

Figure 35 Present State of Automotive Industry in China

Figure 36 Japan’s Nuclear Energy Generation Increased Multifold in 2018

Figure 37 Market Ranking of the Top 3 Players in the Market, 2018

Figure 38 Market (Global) Competitive Leadership Mapping, 2018

Figure 39 Mitsubishi Electric: Company Snapshot

Figure 40 Bodycote: Company Snapshot

Figure 41 Sodick: Company Snapshot

The study involved four major activities in estimating the current market size for the electron beam machining market. Exhaustive secondary research has been done to collect information on the current market, the peer market, and the parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the overall market size. After that, the market breakdown and data triangulation approaches have been used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories and databases; among others.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, product users, and related executives from major companies and organizations operating in the electron beam machining market. Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the electron beam machining market, as well as that of the other dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the following:

- The study of annual and financial reports of top players, as well as interviews with experts for key insights

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through the primary research

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the global electron beam machining market by application, industry, and geography in terms of value

- To describe and forecast the market size for various segments by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking in terms of revenue and core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Electron Beam Machining Market