Electrochemical Instruments Market by Product (Electrochemical Meters, Titrators, Ion Chromatographs), by Technology (Potentiometry, Coulometry, Voltammetry), by End User (Environmental Testing, Food & Agriculture) - Analysis & Global Forecast to 2019

The electrochemical instruments market is segmented on the basis of products, technologies, end user, and region. The global market was valued at $1,713.0 Million in 2014 and is poised to grow at a CAGR of 5.2% during the forecasted period.

Factors such as Growing demand for multiparameter test instruments, and awareness amongst the people about the safe water consumption are driving the growth of this market. Moreover, emerging Asian markets, rising R&D expenditure of pharmaceutical and biotechnology companies globally, and global alliances amongst leading research institutes to trigger drug discovery to create huge opportunities for this market in coming years. However, commoditization of electrochemical instruments and declining average selling prices of electrochemical instruments are hindering the growth of this market.

Some of the major players in the global electrochemical instruments include HANNA Instruments, Inc. (U.S.), Metrohm AG (Switzerland), Xylem Inc. (U.S.), METTLER-TOLEDO International, Inc. (U.S.), DKK TOA Corporation (Japan), Danaher Corporation (U.S.), Endress+Hauser AG (Switzerland), Thermo Fisher Scientific, Inc. (U.S.), Yokogawa Electric Corporation (Japan), and Horiba Ltd. (Japan), among others.

Electrochemical Instruments Market : Scope of the Report

This research report categorizes the market into the following segments and sub segments:

Electrochemical Instruments Market, by Product

- Electrochemical Meters

- Benchtop Meters

- Handheld Meters

- Titrators

- Ion Chromatographs

- Potentiostats/Galvanostats

- Others

Electrochemical Instruments Market, Technology

- Potentiometry

- Voltammetry

- Coulometry

- Others

Electrochemical Instruments Market, by End User

- Environmental Testing Industry

- Biotechnology and Pharmaceutical Industries

- Food and Agriculture Industries

- Academic Research Institutes

- Others

Antibody Production Market, by Region

- North America

- U.S.

- Canada

- Europe

- EU5 Countries

- Rest of Europe (RoE)

- Asia-Pacific

- Asia

- Pacific

- Rest of the World (RoW)

Electrochemical instruments are used to measure and monitor various parameters such as pH, dissolved oxygen, conductivity, and concentration of various ions in the sample solution. Electrochemical instruments form an integral part of research laboratories across the globe and routinely employed instruments to monitor processes in biotechnology and pharmaceutical, environmental testing, agriculture and food and academic institutions.

The global market is segmented on the basis of products, technologies, end users, and regions.

Based on products, this market is categorized into electrochemical meters, titrators, ion chromatographs, potentiostats/galvanostats, and others. In 2014, the electrochemical meters segment accounted for a major share of the electrochemical instruments market, by product. On the basis of type, the electrochemical meters market is further segmented into benchtop meters and portable meters. In 2014, the benchtop meters accounted for the largest share of the electrochemical meters market.

Based on technologies, the market is segmented into potentiometry, voltammetry, coulometry, and other technologies. Based on end users, this market is segmented into environmental testing industry, biotechnology and pharmaceutical industries, food and agriculture industries, academic and research institutes, and others. In 2014, the environmental testing industry segment accounted for the largest share of electrochemical instruments end user market.

The key factors that are expected to spur the growth of this market are growing demand for multi-parameter test instruments, and awareness about the safe water consumption. Moreover, emerging Asian markets, rising R&D expenditure of pharmaceutical and biotechnology companies globally, and global alliances amongst leading research institutes to trigger drug discovery to create huge opportunities for this market in coming years. However, factors such as commoditization of electrochemical instruments and declining average selling prices of electrochemical instruments are likely to pose as a deterrent for the growth of this market.

On the basis of regions, this market is classified into North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

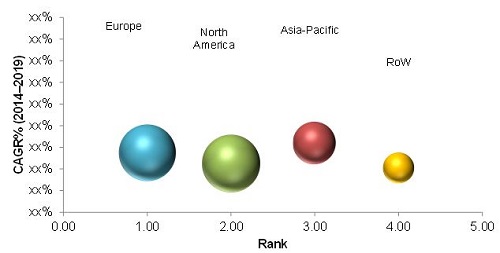

Global Electrochemical Instruments Market Size, by Region, 2014 - 2019

Note: The size of the bubble chart depicts the market size ($Million) in 2014.

Source: USDA Foreign Agricultural Service (FAS), The Research Council of Norway, Association of the British Pharmaceutical Industry (ABPI), Central Electrochemical Research Institute (CECRI), International Society of Electrochemistry, Council of Scientific & Industrial Research, The Electrochemical Society (IES), International Electrotechnical Commission (IEC), Expert Interviews, and MarketsandMarkets Analysis

The global market is expected to reach $2,205.9 Million by 2019 from $1,713.0 Million in 2014, growing at a CAGR of 5.2% from 2014 to 2019. The market is dominated by Europe, followed by North America, Asia-Pacific, and the Rest of the World (RoW). Asia-Pacific region is expected to grow at the fastest rate during the forecast period.

Some of the major players in the global Electrochemical Instruments Market include HANNA Instruments, Inc. (U.S.), Metrohm AG (Switzerland), Xylem Inc. (U.S.), METTLER-TOLEDO International, Inc. (U.S.), DKK TOA Corporation (Japan), Danaher Corporation (U.S.), Endress+Hauser AG (Switzerland), Thermo Fisher Scientific, Inc. (U.S.), Yokogawa Electric Corporation (Japan), and Horiba Ltd. (Japan), among others.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Insights From Primary Sources

2.2 Market Size Estimation Methodology

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Market Forecast Methodology

2.3 Market Data Validation and Triangulation

2.3.1 Assumptions for the Study

3 Executive Summary (Page No. - 26)

3.1 Introduction

3.2 Current Scenario and Future Outlook

3.3 Growth Strategies

4 Premium Insights (Page No. - 30)

4.1 Global Electrochemical Instruments Market

4.2 Geographic Analysis: Market, By Technology

4.3 Geographical Snapshot of the Market (2014)

4.4 Market, By Product (2014 vs. 2019)

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.3 Application Market Potential Analysis

5.3.1 Introduction

5.3.2 Market Potential Analysis, By Application

5.3.2.1 Environmental Applications

5.3.2.2 Industrial Applications

5.3.2.3 Laboratory Applications

5.4 Market Dynamics

5.5 Drivers

5.5.1 Growing Demand for Multiparameter Testing Instruments

5.5.2 Increasing Awareness About Safe Water Consumption

5.5.3 Rising R&D Expenditure of Pharmaceutical and Biotechnology Companies

5.5.4 Global Alliances Among Leading Research Institutes

5.6 Restraints

5.6.1 Market Saturation

5.6.2 Declining Average Selling Prices

5.7 Challenges

5.7.1 Commoditization Challenges Manufacturers of Electrochemical Instruments

5.8 Opportunities

5.8.1 Online Water Testing

5.8.2 Asian Market Presents High Growth Opportunities

6 Industry Insights (Page No. - 42)

6.1 Introduction

6.2 Porters Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Buyers

6.2.4 Bargaining Power of Suppliers

6.2.5 Intensity of Competitive Rivalry

6.3 PEST Analysis

6.3.1 Political Factors

6.3.2 Economic Factors

6.3.3 Social Factors

6.3.4 Technological Factors

7 Electrochemical Instruments Market, By Product (Page No. - 46)

7.1 Introduction

7.2 Electrochemical Meters

7.2.1 Introduction

7.2.2 Benchtop Meters

7.2.3 Portable Meters

7.3 Titrators

7.4 Ion Chromatographs

7.5 Potentiostats and Galvanostats

7.6 Others

8 Electrochemical Instruments Market, By Technology (Page No. - 56)

8.1 Introduction

8.2 Potentiometry

8.3 Coulometry

8.4 Voltammetry

8.5 Others

9 Electrochemical Instruments Market, By End User (Page No. - 64)

9.1 Introduction

9.2 Environmental Testing Industry

9.3 Biotechnology and Pharmaceutical Industries

9.4 Food and Agriculture Industries

9.5 Academic Research Laboratories

9.6 Others

10 Global Electrochemical Instruments Market, By Region (Page No. - 72)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.1.1 Growing Funding for Water and Environment Testing

10.2.1.2 Government Initiatives to Boost Research Activities in the U.S.

10.2.1.3 Increased Food Safety Activities in the U.S.

10.2.1.4 Funding for the Worlds First Calibration-Free Ph Meter

10.2.2 Canada

10.2.2.1 Dedicated Research Bodies to Increase Focus on Drug Discovery

10.2.2.2 Increasing Environmental Testing in Canada

10.3 Europe

10.3.1 EU 5

10.3.1.1 Increasing Funding From the European Union

10.3.1.2 Advances in Biotechnology Likely to Fuel Market Growth in Germany

10.3.1.3 Increasing Crop Research in EU5 a Positive Sign for the Market

10.3.2 Rest of Europe

10.3.2.1 Investments and Funding for Life Sciences

10.4 Asia-Pacific

10.4.1 Asia

10.4.1.1 Extensive Crop Research in the Asian Region

10.4.1.2 Growing Pharmaceutical Industry in India and China

10.4.1.3 Increasing Government Investments on the Life Sciences Sector in China

10.4.1.4 Rising Pharmaceutical and Biotechnology R&D Activities in Korea

10.4.2 Pacific Countries

10.4.2.1 Government Funding for the Development of Next-Generation Electrochemical Devices

10.5 RoW

10.5.1 Flourishing Biotechnology & Pharmaceutical Markets in Brazil

10.5.2 Mexico: A Production Hub for Global Pharmaceutical Companies

10.5.3 Favorable Business Environment for Pharmaceutical and Biotechnology Industries in Saudi Arabia and UAE

11 Competitive Landscape (Page No. - 104)

11.1 Competitive Situation and Trends

11.2 New Product Launches

11.3 Mergers and Expansion

11.4 Partnerships and Collaborations

11.5 Other Developments

12 Company Profiles (Page No. - 111)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 Hanna Instruments, Inc.

12.2 Metrohm AG

12.3 DKK-TOA Corporation

12.4 Danaher Corporation

12.5 Endress+Hauser AG

12.6 Yokogawa Electric Corporation

12.7 Thermo Fisher Scientific, Inc.

12.8 Xylem Inc.

12.9 Mettler-Toledo International, Inc.

12.10 Horiba, Ltd.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 146)

13.1 Discussion Guide

13.2 Company Developments (2012-2015)

13.2.1 Hanna Instruments, Inc.

13.2.2 Metrohm AG

13.2.3 Mettler-Toledo International, Inc.

13.2.4 Thermo Fisher Scientific, Inc.

13.2.5 Xylem, Inc.

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (70 Tables)

Table 1 Sampling Frame: Primary Research

Table 2 Electrochemical Instruments Market Size, By Application, 20122019 ($Million)

Table 3 Increasing Demand for Multi-Parameter Testing Instruments is Propelling Growth of the Market

Table 4 Market Saturation Coupled With Declining Average Selling Price Restricting the Growth of the Global Market

Table 5 Market Size for Electrochemical Meters, By Region, 20122019 ($Million)

Table 7 Market Size for Electrochemical Meters, By Type, 2012-2019 ($Million)

Table 8 Market Size for Benchtop Meters, By Region, 2012-2019 ($Million)

Table 9 Electrochemical Instruments Market Size for Portable Meters, By Region, 20122019 ($Million)

Table 10 Market Size for Titrators, By Region, 20122019 ($Million)

Table 11 Market Size for Ion Chromatographs, By Region, 20122019 ($Million)

Table 12 Market Size for Potentiostats and Galvanostats, By Region, 20122019 ($Million)

Table 13 Market Size for Others, By Region, 20122019 ($Million)

Table 14 Specifications of Various Electrochemical Methods

Table 15 Electrochemical Instruments Market Size, By Technology, 20122019 ($Million)

Table 16 Market Size for Potentiometry, By Region, 20122019 ($Million)

Table 17 Market Size for Coulometry, By Region, 20122019 ($Million)

Table 18 Market Size for Voltammetry, By Region, 20122019 ($Million)

Table 19 Market Size for Other Technologies, By Region, 20122019 ($Million)

Table 20 Market Size, By End User, 20122019 ($Million)

Table 21 Market Size for Environmental Testing Industry, By Region, 20122019 ($Million)

Table 22 Market Size for Biotechnology and Pharmaceutical Industries, By Region, 2012-2019 ($Million)

Table 23 Market Size for Food and Agricultural Industries, By Region, 2012-2019 ($Million)

Table 24 Electrochemical Instruments Market Size for Academic Research Laboratories, By Region, 2012-2019 ($Million)

Table 25 Market Size for Others, By Region, 20122019 ($Million)

Table 26 Market Size, By Region, 20122019 ($Million)

Table 27 North America: Market Size, By Product, 20122019 ($Million)

Table 28 North America: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 29 North America: Market Size, By Technology, 20122019 ($Million)

Table 30 North America: Market Size, By End User, 20122019 ($Million)

Table 31 U.S.: Market Size, By Product, 20122019 ($Million)

Table 32 U.S.: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 33 U.S.: Electrochemical Instruments Market Size, By Technology, 20122019 ($Million)

Table 34 U.S.: Market Size, By End User, 20122019 ($Million)

Table 35 Canada: Market Size, By Product, 20122019 ($Million)

Table 36 Canada: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 37 Canada: Market Size, By Technology, 20122019 ($Million)

Table 38 Canada: Electrochemical Instruments Market Size, By End User, 20122019 ($Million)

Table 39 Europe: ruments Market Size, By Product, 20122019 ($Million)

Table 40 Europe: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 41 Europe: Market Size, By Technology, 20122019 ($Million)

Table 42 Europe: Electrochemical Instruments Market Size, By End User, 20122019 ($Million)

Table 43 EU5: Market Size, By Product, 20122019 ($Million)

Table 44 EU5: Meters Market Size, By Type, 20122019 ($Million)

Table 45 EU5: Market Size, By Technology, 20122019 ($Million)

Table 46 EU5: Market Size, By End User, 20122019 ($Million)

Table 47 RoE: Electrochemical Instruments Market Size, By Product, 20122019 ($Million)

Table 48 EU5: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 49 EU5: Market Size, By Technology, 20122019 ($Million)

Table 50 EU5: Market Size, By End User, 20122019 ($Million)

Table 51 Asia-Pacific: Market Size, By Product, 20122019 ($Million)

Table 52 Asia-Pacific: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 53 Asia-Pacific: Market Size, By Technology, 20122019 ($Million)

Table 54 Asia-Pacific: Electrochemical Instruments Market Size, By End User, 20122019 ($Million)

Table 55 Asia: Market Size, By Product, 20122019 ($Million)

Table 56 Asia: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 57 Asia: Market Size, By Technology, 20122019 ($Million)

Table 58 Asia: Market Size, By End User, 20122019 ($Million)

Table 59 Pacific Countries: Electrochemical Instruments Market Size, By Product, 20122019 ($Million)

Table 60 Pacific Countries: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 61 Pacific Countries: Market Size, By Technology, 20122019 ($Million)

Table 62 Pacific Countries: Market Size, By End User, 20122019 ($Million)

Table 63 RoW: Electrochemical Instruments Market Size, By Product, 20122019 ($Million)

Table 64 RoW: Electrochemical Meters Market Size, By Type, 20122019 ($Million)

Table 65 RoW: Market Size, By Technology, 20122019 ($Million)

Table 66 RoW: Market Size, By End User, 20122019 ($Million)

Table 67 New Product Launches, 20122015

Table 68 Mergers and Expansions, 20122014

Table 69 Partnerships and Collaborations, 20122014

Table 70 Other Developments, 20122015

List of Figures (41 Figures)

Figure 1 Electrochemical Instruments Market Segmentation

Figure 2 Global Market: Research Methodology Steps

Figure 3 Break Down of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach (1/3)

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach (2/3)

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach (3/3)

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Research Design

Figure 9 Data Triangulation

Figure 10 Electrochemical Meters Segment to Grow at the Highest CAGR From 20142019

Figure 11 Potentiometry Technology Segment to Grow at the Highest CAGR From 20142019

Figure 12 Asia-Pacific Region Slated to Witness the Highest Growth in the Electrochemical Instruments Market

Figure 13 Electrochemical Instruments: Market Overview

Figure 14 North America Dominated the Market in 2014

Figure 15 Asia to Witness the Highest Growth Rate During the Forecast Period

Figure 16 Electrochemical Meters Commanded the Largest Share

Figure 17 Electrochemical Instruments Market Segmentation

Figure 18 Industrial Applications Was the Most Lucrative Market Segment in 2014

Figure 19 Drivers, Restraints, Challenges, & Opportunities

Figure 20 Porters Five Forces Analysis

Figure 21 The Electrochemical Meters Segment to Grow at the Fastest Rate During the Forecast Period

Figure 22 Electrochemical Instruments Market: Technology Segmentation

Figure 23 Potentiometry Technology to Grow at the Highest Rate During the Forecast Period

Figure 24 Environmental Testing Industries End-User Segment to Grow at the Fastest Rate During the Forecast Period

Figure 25 Europe Commanded the Largest Share of the Global Market in 2014

Figure 26 The U.S. to Witness the Highest Growth in the North American Market

Figure 27 EU5 to Witness the Highest Growth in the Electrochemical Instruments Market in Europe

Figure 28 Asia is the Fastest-Growing Market in Asia-Pacific

Figure 29 Key Growth Strategies in the Global Market, 20122015

Figure 30 Key Players Focusing on New Product Launches, 20122015

Figure 31 Key Players Focusing on Expansion, 20122014

Figure 32 Key Players Focusing on Partnerships and Collaborations, 20122014

Figure 33 Key Players Focusing on Other Developments, 20122014

Figure 34 DKK-TOA Corporation: Company Snapshot

Figure 35 Danaher Corporation: Company Snapshot

Figure 36 Endress+Hauser AG: Company Snapshot

Figure 37 Yokogawa Electric Corporation: Company Snapshot

Figure 38 Thermo Fisher Scientific, Inc.: Company Snapshot

Figure 39 Xylem Inc.: Company Snapshot

Figure 40 Mettler-Toledo International, Inc.: Company Snapshot

Figure 41 Horiba, Ltd.: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electrochemical Instruments Market