Edge Analytics Market by Component (Solutions and Services), Analytics Type, Business Application (Marketing, Sales, Operations, Finance, and Human Resources), Deployment, Vertical, and Region - Global Forecast to 2021

[145 Pages Report] The edge analytics market expected to grow from USD 1.94 billion in 2016 to USD 7.96 billion by 2021, at a CAGR of 32.6% from 2016 to 2021.

Edge analytics refers to the approach of capturing, monitoring, and analyzing the data at the edge of the network devices such as sensors, routers, gateways, switches, and others. The analytical computation is done at the edge of the devices without waiting for the data to be received back at centralized storage system and then imply analytical applications. This has not only decreased the latency in the decision-making process on connected devices but also provided scalability. The advent of Internet of Thing (IoT) and the growing demand for edge analytical solutions due to its effectiveness have increased the demand for edge analytics. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Edge Analytics Market Dynamics

Drivers

- Advent of IoT and proliferation of massive amount of data through connected devices

- Predictive and real-time intelligence on network devices acts as a catalyst to the growth of edge analytics

- Adoption of edge analytics increases scalability and cost optimization

Restraints

- Issues pertaining to safety and security

- Lack of universally accepted standards

Opportunities

- Increasing demand of more edge analytical solutions across industries

- Growing adoption of supported technologies (like IoT, machine learning, natural language processing, visualization, fog computing, cloudlet etc.)

- Use data ‘wholly’, reducing operation cost and boost performance through predictive maintenance etc.

- Growing demand of edge analytics in Business-to-Business (B2B) as compared to consumer applications

Challenges

- Restructuring organization’s data strategy in order to avoid siloes environment

- Reluctance of companies to invest in new technologies

- Infrastructural constraints

Predictive and real-time intelligence on network devices acts as a catalyst to the growth of edge analytics market

Predictive analytics has been a forefront driver of analytics and currently is being deployed in the edges of the network to

provide analytics at the edge (routers, switches, gateways) thereby reducing the cost of data transmission, storage, and processing which are significant during data analysis on centralized analytic hubs. Predictive analytics has been a key driver of growth for edge analytics that capitalizes on embedding pre-defined intelligence (algorithms) to the server, where it can take its decision based on the earlier patterns. Real time analytics on the edge are used by traffic department to act on the real time intelligence to reduce traffic jams, divert the traffic, and so on. Traffic lights are deployed with sensors with analytic capabilities to identify traffic jams, emergency vehicles (such as ambulances, police vehicles, and convoy), and take actions on the impulse. Similarly, oil and gas companies are using real-time predictive analytics on the edge of the devices to detect anomalies (rising temperatures and acoustic sensing) and can pre-warn officials by sending signals, whistles, initiating alarms to prevent catastrophe.

The following are the major objectives of the study.

- To describe and forecast the global edge analytics market on the basis of component, type, business application, deployment model, vertical, and region.

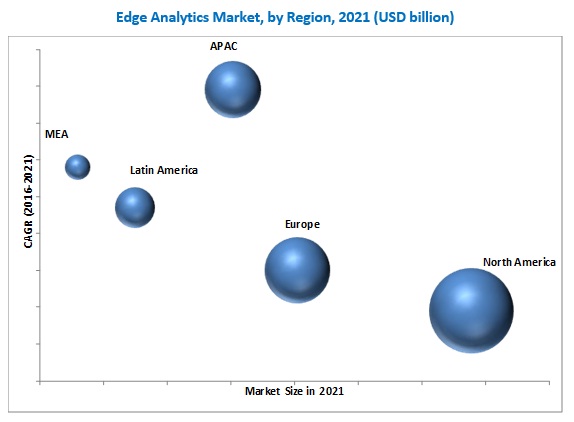

- To forecast the market size of the five main regional segments, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To strategically analyze sub-segments with respect to individual growth trends, future prospects, and contribution to the total market.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To analyze the opportunities in the market for stakeholders and to provide details of a competitive landscape for major players.

- To comprehensively analyze core competencies of key players.

- To track and analyze competitive developments such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market.

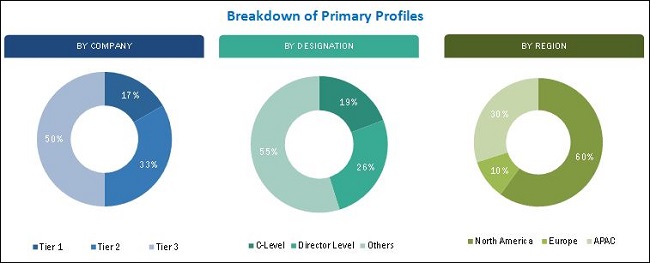

The research methodology used to estimate and forecast the edge analytics market begins with capturing data on key vendor’s revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global edge analytics market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The edge analytics ecosystem comprises vendors, such as, Cisco Corporation (US), Oracle Corporation (US), SAP SE (Germany), SAS Institute (US), Apigee Corporation (US), Predixion Software (US), AGT International Inc. (Switzerland), Foghorn Systems (US), CGI Group Inc. (Canada), Analytic Edge (India), and Prism Tech (UK). Major stakeholders of the edge analytics market include Independent Software Vendors (ISVs), cloud service providers, business analytics software providers, application design and software developers, system integrators and IT service providers.

Major Developments

- In July 2016, Cisco collaborated with IBM Watson IoT, to provide instant Internet of Things (IoT) insight at the edge of the network. This collaboration combines the power of IBM Watson IoT with Cisco edge analytics, which helps enterprises to make real-time informed decisions based on business-critical data.

- In April 2016, SAS Institute launched SAS Analytics for IoT that helps analyze enormous data generated from IoT sensors and devices. The analytics software is capable of analyzing moving data and draw insights in real-time that ensures smooth operations and increase profits of organizations.

- In November 2015, Cisco acquired ParStream, an analytics database company. The acquisition results into enhancing Cisco’s capabilities of providing deep analytics at the network edge, where maximum data is generated. The data would be analyzed in real time and would help organizations to take quick and actionable decisions.

Target Audience

- Edge analytics platform providers

- Cloud service providers

- Business analytics software providers

- Application design and software developers

- System integrators

- It service providers

Edge Analytics Market Report Scope

By Component

- Solution

- Services

By Type

- Descriptive analytics

- Predictive analytics

- Prescriptive analytics

- Diagnostic analytics

By Business Application

- Marketing

- Sales

- Operations

- Finance

- Human Resources

By Deployment Model

- On-premises

- On-cloud

By Vertical

- Healthcare and Life Sciences

- BFSI

- Manufacturing

- Retail and Consumer Goods

- IT and Telecommunication

- Transportation and Logistics

- Media and Entertainment

- Energy and Utility

- Government and Defence

- Travel and Hospitality

- Others

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Critical questions which the report answers

- What are new application areas which the edge analytics companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall edge analytics market is expected to grow from 1.94 billion in 2016 to USD 7.96 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 32.6 %. The key factors driving the growth rate in this market are advent of IoT and proliferation of massive amount of data through connected devices, predictive and real-time intelligence on network devices, and the increased scalability and cost reduction provided by edge analytics act as catalysts to the growth of edge analytics market.

Edge analytics refers to the approach of capturing, monitoring, and analyzing the data at the edge of the network devices such as sensors, routers, gateways, switches, and others. The analytical computation is done at the edge of the devices without waiting for the data to be received back at centralized storage system and then imply analytical applications. This has not only decreased the latency in the decision-making process on connected devices but also provided scalability.

The edge analytics market is segmented by component, such as solutions and services. Edge analytics Solutions are expected to account for a larger market share while services are expected grow at a higher CAGR during the forecast period. Proliferation of industrial IoT and smart cities is driving the growth of edge analytical solutions and services. Moreover, real-time analysis and reduction in costs due to less transfer of data to central analytical hubs is forcing enterprises to deploy solutions and services.

The edge analytics market in APAC is expected to grow at the highest CAGR during the forecast period. Edge analytics will see higher adoption in the market as the government is trying to push the markets for IoT and cloud technologies. In India, the new government is promoting Digital India Program with a vision to transform India into a digitally empowered society and knowledge economy. The companies operating in the APAC region will benefit from the flexible economic, industrialization motivated, globalization policies of the government as well as the expanding digital market that will have a huge impact on the business community.

Reed sensor applications in home appliances, HVAC, and smart meters drive the growth of reed sensor market

IT and Telecommunications

The IT and telecommunication industry is expected to have the highest growth rate in the edge analytics market during the forecast period. Telecommunication industry is aggressively deploying edge analytical solutions. Earlier, analytical information was limited to mobile packet core, however new analytical capabilities are needed to provide real-time information across the network that includes Radio Access Network (RAN). As telecommunication industry is reaching its saturation point, telecom vendors would have to find new opportunities to create revenue streams. Edge analytics will play an important part in processing the data and minimizing latencies. Analysis of data on the sensors and gateways would be effective in converting data into actionable insights and help in improving crop drops and other related networking issues.

Energy and Utilities

The energy and utility industry is looking for advanced solutions to get actionable insights. The industry is undergoing major transformation with the advent of smart sensors, smart meters, and IoT-based technologies. The industry generates huge chunks of data from oil wells, utility grids, gas grids, smart grids, and other sensors. Terabytes of data is generated from structured as well as unstructured sources, which need to be analyzed and get real-time insights. Such challenges are driving these industries to adopt analytics to gain insights and secure the market competitiveness, increase energy competitiveness, increase energy efficiency, manage risks, and lower operational cost.

Transport and Logistics

The implementation of edge analytics solutions in the transportation industry can create a rich and complete picture of insights gathered from the various touch points, such as smartphones, websites, booking counters, freight management system, ticketing system, toll booth systems, and traffic management systems. This is expected to eventually give an opportunity for the business analytics in the transportation and logistics sector to leverage big data tools and predictive analytics to help transportation agencies improve operations, reduce costs, and better serve customers

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for edge analytics?

Issues pertaining to safety and security, lack of universally accepted standards are some of the obstacles hindering in the growth of the edge analytics market. Enterprises are quick to adopt analytics to help them get real-time insights and improve decision making capabilities. However, there are serious concerns among the enterprises about security breaching and security lapses deploying edge analytics solution. Analytics on the network device can be a risky endeavor as it is exposed to third party solution for deploying sophisticated hardware and software. Further, analyzing data in the real-time raises the question of compliances and need of the hour for edge analytics solution providers, is to provide additional security features that beholds the trust of the stakeholders and the customers at the large in adopting edge analytics solution.

Key players in the market include Cisco Corporation (US), Oracle Corporation (US), SAP SE (Germany), SAS Institute (US), Apigee Corporation (US), Predixion Software (US), AGT International Inc. (Switzerland), Foghorn Systems (US), CGI Group Inc. (Canada), Analytic Edge (India), and Prism Tech (UK). These players have majorly adopted the strategy of partnerships, collaborations, and agreements to enhance their business footprints to cater to the market in a better way as compared to the competitors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the market

4.2 Market Share of Top Three Analytics Types and Regions

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

4.5 Top Three Verticals

5 Edge Analytics Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Business Application

5.2.3 By Type

5.2.4 By Deployment Model

5.2.5 By Vertical

5.2.6 By Region

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Advent of IoT and Proliferation of Massive Amount of Data Through Connected Devices

5.4.1.2 Predictive and Real-Time Intelligence on Network Devices Acts as A Catalyst to the Growth of Edge Analytics

5.4.1.3 Adoption of Edge Analytics Increases Scalability and Cost Optimization

5.4.2 Restraints

5.4.2.1 Issues Pertaining to Safety and Security

5.4.2.2 Lack of Universally Accepted Standards

5.4.3 Opportunities

5.4.3.1 Increasing Demand of More Edge Analytical Solutions Across Industries

5.4.3.2 Growing Adoption of Supported Technologies (Like IoT, Machine Learning, Natural Language Processing, Visualization, Fog Computing, Cloudlet Etc.)

5.4.3.3 Use Data ‘Wholly’, Reducing Operation Cost and Boost Performance Through Predictive Maintenance Etc.

5.4.3.4 Growing Demand of Edge Analytics in Business-To-Business (B2B) as Compared to Consumer Applications

5.4.4 Challenges

5.4.4.1 Restructuring Organization’s Data Strategy in Order to Avoid Siloes Environment

5.4.4.2 Reluctance of Companies to Invest in New Technologies

5.4.4.3 Infrastructural Constraints

6 Market Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Edge Analytics Standards

6.3.1 Global System for Mobile Communication Association (GSMA) IoT Security

6.3.2 Spring Singapore

6.3.3 International Telecommunication Union

6.4 Strategic Benchmarking

7 Edge Analytics Market Analysis, By Component (Page No. - 44)

7.1 Introduction

7.2 Solutions

7.3 Services

7.3.1 Professional Services

7.3.1.1 System Integration and Deployment

7.3.1.2 Training ,Support, and Maintenance Services

7.3.1.3 Consulting Services

7.3.2 Managed Services

8 Market Analysis, By Type (Page No. - 50)

8.1 Introduction

8.2 Descriptive Analytics

8.3 Predictive Analytics

8.4 Prescriptive Analytics

8.5 Diagnostic Analytics

9 Edge Analytics Market Analysis, By Business Applications (Page No. - 55)

9.1 Introduction

9.2 Marketing

9.3 Sales

9.4 Operations

9.5 Finance

9.6 Human Resources

10 Market Analysis, By Deployment Model (Page No. - 61)

10.1 Introduction

10.2 On-Premises

10.3 On-Cloud

11 Edge Analytics Market Analysis, By Vertical (Page No. - 64)

11.1 Introduction

11.2 Healthcare and Life Sciences

11.3 Banking, Financial Services, and Insurance

11.4 Manufacturing

11.5 Retail and Consumer Goods

11.6 IT and Telecommunication

11.7 Transportation and Logistics

11.8 Media and Entertainment

11.9 Energy and Utility

11.10 Government and Defense

11.11 Travel and Hospitality

11.12 Others

12 Geographic Analysis (Page No. - 76)

12.1 Introduction

12.2 North America

12.2.1 United States (U.S.)

12.2.2 Canada

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 Rest of Europe

12.4 Asia-Pacific (APAC)

12.4.1 China

12.4.2 India

12.4.3 Japan

12.4.4 Rest of Asia-Pacific

12.5 Middle East and Africa (MEA)

12.5.1 Middle East

12.5.2 Africa

12.6 Latin America

12.6.1 Mexico

12.6.2 Brazil

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 101)

13.1 Overview

13.2 Competitive Situations and Trends

13.2.1 Partnerships, Agreements, and Collaborations

13.2.2 New Product Launches

13.2.3 Mergers and Acquisitions

13.2.4 Expansion

13.2.5 VC Funding

14 Company Profiling (Page No. - 107)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 Cisco Systems, Inc.

14.3 Oracle Corporation

14.4 SAP SE

14.5 SAS Institute Inc.

14.6 Apigee Corporation

14.7 Predixion Software

14.8 AGT International Inc.

14.9 Foghorn Systems

14.10 CGI Group Inc.

14.11 Analytic Edge

14.12 Prism Tech

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 136)

15.1 Recent Developments

15.2 Key Insights

15.3 Discussion Guide

15.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.5 Available Customization

15.6 Related Reports

List of Tables (75 Tables)

Table 1 Edge Analytics Market Size and Growth Rate, 2014–2021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Component, 2014–2021 (USD Billion)

Table 3 Solution: Market Size, By Region, 2014–2021 (USD Million)

Table 4 Market Size, By Service, 2014–2021 (USD Billion)

Table 5 Professional Services: Market Size, By Region, 2014–2021 (USD Million)

Table 6 Managed Services: Market Size, By Region, 2014–2021 (USD Million)

Table 7 Edge Analytics Market Size, By Type, 2014–2021 (USD Billion)

Table 8 Descriptive Analytics: Market Size, By Region, 2014–2021 (USD Million)

Table 9 Predictive Analytics: Market Size, By Region, 2014–2021 (USD Million)

Table 10 Prescriptive Analytics: Market Size, By Region, 2014–2021 (USD Million)

Table 11 Diagnostic Analytics: Market Size, By Region, 2014–2021 (USD Million)

Table 12 Edge Analytics Market Size, By Business Application, 2014–2021 (USD Billion)

Table 13 Marketing: Market Size, By Region, 2014–2021 (USD Million)

Table 14 Sales: Market Size, By Region, 2014–2021 (USD Million)

Table 15 Operations: Market Size, By Region, 2014–2021 (USD Million)

Table 16 Finance : Market Size, By Region, 2014–2021 (USD Million)

Table 17 Human Resources: Market Size, By Region, 2014–2021 (USD Million)

Table 18 Market Size, By Deployment Model, 2014–2021 (USD Billion)

Table 19 On-Premises: Market Size, By Region, 2014–2021 (USD Million)

Table 20 On-Cloud: Market Size, By Region, 2014–2021 (USD Million)

Table 21 Edge Analytics Market Size, By Vertical, 2014–2021 (USD Million)

Table 22 Healthcare and Life Sciences: Market Size, By Region, 2014–2021 (USD Million)

Table 23 Banking, Financial Services, and Insurance: Market Size, By Region, 2014–2021 (USD Million)

Table 24 Manufacturing: Market Size, By Region, 2014–2021 (USD Million)

Table 25 Retail and Consumer Goods: Market Size, By Region, 2014–2021 (USD Million)

Table 26 IT and Telecommunication: Market Size, By Region, 2014–2021 (USD Million)

Table 27 Transportation and Logistics: Market Size, By Region, 2014–2021 (USD Million)

Table 28 Media and Entertainment: Market Size, By Region, 2014–2021 (USD Million)

Table 29 Energy and Utility: Market Size, By Region, 2014–2021 (USD Million)

Table 30 Government and Defense: Market Size, By Region, 2014–2021 (USD Million)

Table 31 Travel and Hospitality: Market Size, By Region, 2014–2021 (USD Million)

Table 32 Others: Market Size, By Region, 2014–2021 (USD Million)

Table 33 Edge Analytics Market Size, By Region, 2014-2021 (USD Million)

Table 34 North America: Market Size, By Country, 2014-2021 (USD Billion)

Table 35 North America: Market Size, By Component, 2014-2021 (USD Billion)

Table 36 North America: Market Size, By Service, 2014-2021 (USD Million)

Table 37 North America: Market Size, By Type, 2014-2021 (USD Million)

Table 38 North America: Market Size, By Business Application, 2014-2021 (USD Million)

Table 39 North America: Market Size, By Deployment Model, 2014-2021 (USD Billion)

Table 40 North America: Market Size, By Vertical, 2014-2021 (USD Million)

Table 41 Europe: Edge Analytics Market Size, By Country, 2014-2021 (USD Million)

Table 42 Europe: Market Size, By Component, 2014-2021 (USD Billion)

Table 43 Europe: Market Size, By Service, 2014-2021 (USD Million)

Table 44 Europe: Market Size, By Type, 2014-2021 (USD Million)

Table 45 Europe: Market Size, By Business Application, 2014-2021 (USD Million)

Table 46 Europe: Market Size, By Deployment Model, 2014-2021 (USD Billion)

Table 47 Europe: Market Size, By Vertical, 2014-2021 (USD Million)

Table 48 APAC: Market Size, By Country, 2014-2021 (USD Million)

Table 49 APAC: Market Size, By Component, 2014-2021 (USD Million)

Table 50 APAC: Market Size, By Services, 2014-2021 (USD Million)

Table 51 APAC: Market Size, By Type, 2014-2021 (USD Million)

Table 52 APAC: Market Size, By Business Application, 2014-2021 (USD Million)

Table 53 APAC: Market Size, By Deployment Model, 2014-2021 (USD Million)

Table 54 APAC: Market Size, By Vertical, 2014-2021 (USD Million)

Table 55 Middle East and Africa: Edge Analytics Market Size, By Country, 2014-2021 (USD Billion)

Table 56 Middle East and Africa : Market Size, By Component, 2014-2021 (USD Million)

Table 57 Middle East and Africa: Market Size, By Services, 2014-2021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Type, 2014-2021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Business Application, 2014-2021 (USD Million)

Table 60 Middle East and Africa : Market Size, By Deployment Model, 2014-2021 (USD Million)

Table 61 Middle East and Africa: Market Size, By Vertical, 2014-2021 (USD Million)

Table 62 Latin America: Edge Analytics Market Size, By Country, 2014-2021 (USD Billion)

Table 63 Latin America: Market Size, By Component, 2014-2021 (USD Million)

Table 64 Latin America: Market Size, By Service, 2014-2021 (USD Million)

Table 65 Latin America: Market Size, By Type, 2014-2021 (USD Million)

Table 66 Latin America: Market Size, By Business Application, 2014-2021 (USD Million)

Table 67 Latin America: Market Size, By Deployment Model, 2014-2021 (USD Million)

Table 68 Latin America: Market Size, By Vertical, 2014-2021 (USD Million)

Table 69 Partnerships, Agreements, and Collaborations, 2013 – 2016

Table 70 New Product Launches, 2013–2016

Table 71 Mergers and Acquisitions, 2013–2016

Table 72 Mergers and Acquisitions, 2013–2016

Table 73 VC Funding, 2014–2016

Table 74 Partnerships, Collaborations, and Agreements , 2014 – 2015

Table 75 New Product Launches and Product Upgradation, 2014 & 2015

List of Figures (46 Figures)

Figure 1 Edge Analytics Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Edge Analytics Market: Assumptions

Figure 8 Top Three Largest Revenue Segments of Market, 2016–2021

Figure 9 North America is Estimated to Hold the Largest Market Share in Market

Figure 10 Growth Trends in the Market (2016–2021)

Figure 11 Geographic Lifecycle Analysis (2016): Asia-Pacific is Increasing at the Highest Growth Rate

Figure 12 Market Investment Scenario: Asia-Pacific is the Best Market to Invest in the Next Five Years

Figure 13 Healthcare and Life Sciences is Estimated to Have the Largest Market

Figure 14 Edge Analytics Market: Component

Figure 15 Market Analysis: By Business Application

Figure 16 Market Analysis: By Type

Figure 17 Market By Deployment Model

Figure 18 Market By Vertical

Figure 19 Market By Region

Figure 20 Market Evolution

Figure 21 Edge Analytics: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Market Value Chain Analysis

Figure 23 Market Strategic Benchmarking

Figure 24 Solutions Component is Expected to Have the Largest Market Size

Figure 25 Descriptive Analytics Type is Estimated to Have the Largest Market Size

Figure 26 Finance Business Application is Estimated to Have the Largest Market Size

Figure 27 On-Premises Deployment Model is Estimated to Have the Largest Market Size

Figure 28 Healthcare and Life Sciences Vertical is Estimated to Have the Largest Market Size

Figure 29 North America is Expected to Have the Largest Market Size in Edge Analytics Market

Figure 30 North America Market Snapshot

Figure 31 Asia-Pacific Market Snapshot

Figure 32 Companies Adopted Partnership, Agreement, and Collaboration as the Key Growth Strategy From 2013-2016

Figure 33 Market Evaluation Framework

Figure 34 Battle for Market Share: Partnership, Collaboration, and Agreement Was the Key Strategy in the Edge Analytics Market

Figure 35 Geographic Revenue Mix of Top Five Market Players

Figure 36 Cisco Systems, Inc.: Company Snapshot

Figure 37 Cisco System, Inc.: SWOT Analysis

Figure 38 Oracle Corporation: Company Snapshot

Figure 39 Oracle Corporation : SWOT Analysis

Figure 40 SAP SE: Company Snapshot

Figure 41 SAP SE: SWOT Analysis

Figure 42 SAS Institute Inc.: Company Snapshot

Figure 43 SAS Corporation: SWOT Analysis

Figure 44 Apigee Corporation: Company Snapshot

Figure 45 Apigee Corporation : SWOT Analysis

Figure 46 CGI Group Inc.: Company Snapshot

Growth opportunities and latent adjacency in Edge Analytics Market