Eco Fibers Market by Type (Regenerated fibers, Recycled fibers, Organic fibers), Application (Textile/Clothing, Household Furnishings, Industrial, Medical), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027

Updated on : August 28, 2025

Eco Fibers Market

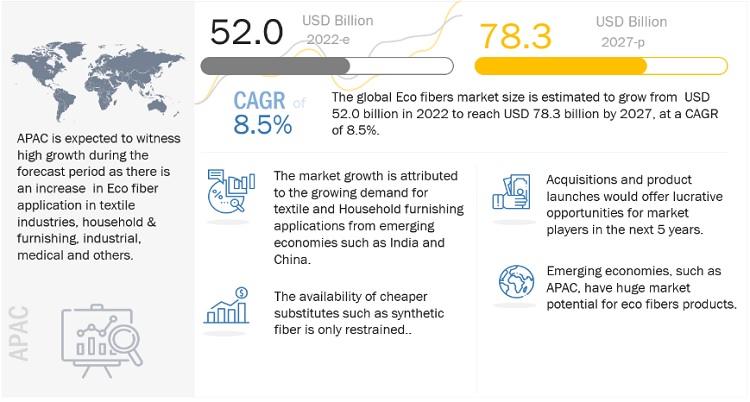

The global eco fibers market was valued at USD 52.0 billion in 2022 and is projected to reach USD 78.3 billion by 2027, growing at 8.5% cagr from 2022 to 2027. Eco Fibers are an invaluable part of the clothing/textile applications. They are also referred to as sustainable fibers that include natural, regenerated, and recycle fibers. These fiber materials are poses similar characteristics to synthetic fiber however, Eco Fibers are more environmentally friendly in manufacturing as well as usage.

Organic Fibers are those which are grown and produced in an eco-friendly method. In this method, the crop is grown without the use of chemical pesticides, insecticides or fertilizers and then spinning it into Fiber or yarn with efficient use of energy and minimal harm to the environment. Regenerated fibers are produced by using cellulose provided majorly by wood pulp. The market for Eco Fibers is being driven by the increase in demand for eco-friendly fibers from applications such as textile/clothing, household furnishings, and industrial.

Attractive Opportunities in the Eco Fibers Market

e- Estimated, p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 pandemic Impact

The COVID-19 pandemic caused supply chain disruption, a drop in demand from several applications, and a labour shortage that resulted in the suspension of operations, all of which had an impact on the market for Eco Fibers. However, during the COVID-19 pandemic, the market for Eco Fibers was supported by the growing demand for nutrition and medical supplies. Additionally, the market will expand throughout the projection period due to the quick recovery of various industries like the automotive, agricultural, and textile sectors.

Eco Fibers Market Dynamics

Driver: Increasing usage of synthetic cellulosic fiber in the apparel industry

Eco Fibers help stabilize the Earth’s climate by reducing co2 emission during product manufacturing. According to preferred Fibers and materials market report published by Textile Exchange 2021, cellulose fibers are among the majorly used fibers in MMCF’s category with a 6% share of recycled MMCF’S in 2020 as they release considerably less amount of pollutants and greenhouse gases (GHG’s) during the manufacturing process of fabrics in comparison of synthetic fibers. MMCF’s are used in different type of clothing such as protective clothing, home furnishing, and fashion clothing, to make them more breathable, textured shiny smooth and most importantly to prevent adverse effect on skin due to toxic chemical fiber, thus the rising demand from clothing industries likely to propel the growth of Eco Fibers.

The textile industry is one of the largest industries in the world, with ever growing global population, rapid urbanization, high disposable income, and increase adoption of western culture in developing countries such as China & India, As well as ASEAN countries. Due to environmental concern and stringent government regulations that force manufacturing firms to reduce GHG emission during manufacturing process, The textile and apparel industries in the world witnessed increase demand for cellulosic fiber.

Restrains: Availability of cheaper substitutes such as synthetic fibers.

The availability of low-cost substitutes such as Polyester, Nylon & Cotton produced by proven and low-cost techniques makes the end product affordable for the majority of

the end user and the local population. These fibers are having similar properties as the Eco Fibers and they are way more cheaper than Eco Fibers. These synthetic fibers are mass-produced mostly using oil by products. Synthetic fibers can withstand higher stress, possess higher strength, light weighted having more shine & durability compared to Eco Fibers.

Opportunities: Rising adoption of Eco Fibers in several applications due to environmental concern

Eco Fibers have established recognition in many industries such as clothing/textile. However, these fibers are not widely adopted. The excessive amount of fabric waste generated by rising fashion has speed up the development of fiber technologies to make more environmentally friendly fibers, especially in the clothing industry. These developments will mitigate the impact of toxic waste produced from fiber production on the environment and open new market expansion opportunities. Additionally, there is a growing tendency in manufacturers to make efforts to find alternative material supplies that could be safer for the environment and more practical for customer use. However, to have a more sustainable impact on the fashion business, fashion manufacturers such as H&M are using eco-friendly fabrics and adjusting the supply chain. This sector has significant potential for growth opportunitiesto the emerging popularity of using less synthetic fiber.

Challenges: Developing low-cost production technique

With the ever-increasing demand for Eco Fibers, manufacturers are facing the challenge of producing Eco Fibers at a low cost. The low cost of production would help meet the bulging demand for Eco Fibers from the textile industry. Production cost is heavily dependent on the availability and cost of raw materials, which have been increasing in recent times. There is a need for a novel technology to minimize the production cost of Eco Fibers.

Eco Fibers Market Ecosystem Diagram

By Type, Regenerated Fibers segment accounted for the highest CAGR during the forecast period

Regenerated fibers are anticipated to see the fastest rate of growth throughout the anticipated period due to rising consumer demand for environmentally friendly goods that support sustainability. The regenerated cellulosic fiber has certain excellent qualities that make them an ideal substitute for synthetic fibers, including high wet tenacity, good absorbency, softness, lustre, ease of dyeing, biodegradability, and good drape.

By Application, Industrial accounted for the highest CAGR during the forecast period

Eco Fibers are used in industrial applications such as flame-resistant clothing, ropes, shoes, automotive parts, solar panels, and labels. Lyocell, recycled polyester, viscose, and organic cotton recycled are the principal Eco Fibers utilised in industrial applications. Due to the increased use of eco fibers in a variety of flame-retardant protective clothing that is further used in civilian and military applications such as fire-resistant suits, gloves, and other items, the Industrial applicationis the end use industry segment for organic cotton fibers that is growing at the fastest rate.

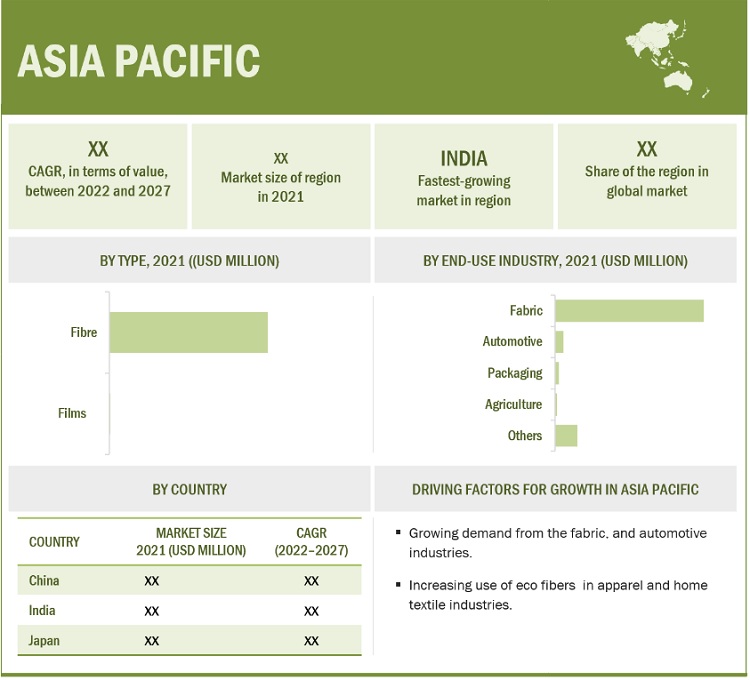

APAC is projected to account for the highest CAGR in the Eco Fibers market during the forecast period

During the forecasted period, the market for eco fibers is anticipated to grow at the fastest rate in APAC. Due to growing awareness of rising disposable income, sustainability, and increased use of environmentally friendly raw materials in a variety of applications, including clothing/textile, household furnishings, and industrial application, the market for eco fibers is expanding significantly in several emerging economies in the region, including India, China, and Japan. Rapid urbanisation and rising demand from the automotive and fabric industries are driving the expansion of eco fibers. Eco Fibers are highly used in the textile and apparel application to provide better finish and durability to a variety of fabrics. Therefore, the Textile and Apparel application dominates the demand for Eco Fibers in India followed by the automotive industry

To know about the assumptions considered for the study, download the pdf brochure

Eco Fibers Market Players

The prominent participants in the market for Eco Fibers include major producers such as Sateri Group (China), Lenzing AG (Austria), Grasim Industries Limited (India), Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd. (China), and US fibers (US). The main tactics used by the top players to develop the Eco Fibers Market include expansion, mergers, joint ventures, and the development of novel products.

Eco Fibers Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Billion), and Volume (Kilotons) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia-Pacific, North America, Europe, Middle East & Africa, South America |

|

Companies |

The major players are Sateri (China), Lenzing AG (Austria), Grasim Industries Ltd. (India), Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd.(China), US Fibers (US), Teijin Limited. (Japan), Polyfiber Industries Limited (India), David C Poole Company Inc. (US), and others are covered in the eco fibers market. |

This research report categorizes the global Eco Fiber market on the basis of Type, Region, and Application.

Eco Fibers Market, By Type

- Regenerated fibers

- Recycle fibers

- Organic fibers

- Others

Eco Fibers Market, By Application

- Clothing/ Textile

- Household Furnishing

- Industrial

- Medical

- Others

Eco Fibers Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In March 2022, an agreement was signed between Grasim Industries Limited Swedish textile-to-textile recycling innovator (Renewcell) for providing high-quality LIVA REVIVA fibers.

- In March 2022, the world’s largest lyocell production plant was opened by Lenzing AG in Thailand. The production capacity of this plant is 100,000 tons.

- In April 2022, The Teijin LTD.has created an excellent-performing eco-friendly staple polyester nanofiber to reinforce rubber used in products like vehicle tyres, hoses, and belts.

- In May 2022, a Belgium-based company i.e., UTEXBEL collaborated with Lenzing AG for producing uniforms for security personnel of the Belgian Federal Public Service for Justice (FPS Justice).

- In January 2022, GP Cellulose, LLC., invested USD 80 Million to expand its fluff pulp production capacity.

- In March 2021, Eastman Chemical Company planned to increase the production capacity of NAIA filament yarn by more than 50% by 2022.

- In November 2021, Grasim Industries Limited expanded its viscose production capacity by 300 tons per day.

- In February 2021, Lenzing AG introduced new zero-carbon lyocell fibers namely TENCEL and TENCEL REFIBRA, under the brand name of TENCEL.

- In March 2021, Sateri has planned to expand the production capacity by 500,000 tons by 2025.

- In February 2021, Sateri launched its recycled fiber namely FINEX.

- In July 2021, Sateri collaborated with Infinited Fiber Company to scale up the next-generation fiber technology.

Frequently Asked Questions (FAQ):

What are Eco Fibres?

Eco-friendly textiles are manufactured from fibres that don't need any chemicals or pesticides to flourish. They are free of illness and naturally resistant to mould and mildew. Eco-friendly fibres include ramie, hemp, linen, bamboo, and bamboo.

What are the major drivers driving the growth of the eco fibers market?

The major drivers influencing the growth of the eco fibers are increasing demand for fashionable fabrics, across the globe.

What are the major challenges in the eco fibers market?

The major challenge in the eco fibers market is manufacturing eco fibers at a low cost.

What are the restraining factors in eco fibers market?

The availability of cheaper substitutes such as synthetic fiber is the major restraining factors of eco fibers market.

What is the key opportunity in the eco fibers market?

Growing usage of eco-friendly materials in end-use sectors as a result of environmental concern is the key opportunity in the eco fibers market.

What is the impact of the COVID-19 pandemic on the eco fibers market?

There was a decline in the market of eco fibers across the globe due to the COVID-19 pandemic, however, there is no impact on the other industries which include the health industry. Owing to COVID-19, demand from the Medical & Healthcare industry has increased whereas, in transportation, Manufacturing plants (other than healthcare and packaging), and others, the demand for eco fibers declined. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 ECO FIBERS MARKET: INCLUSIONS & EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 ECO FIBERS MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNITS CONSIDERED

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 ECO FIBERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH: BASED ON GLOBAL PRODUCTION OF ECO FIBER TYPES

FIGURE 2 BOTTOM-UP APPROACH: BASED ON PRODUCTION OF VARIOUS ECO FIBER TYPES

2.2.2 SUPPLY-SIDE ESTIMATION: BASED ON MARKET

FIGURE 3 MARKET SIZE ESTIMATION: BASED ON MARKET

2.3 DATA TRIANGULATION

FIGURE 4 ECO FIBERS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS & STUDY LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 STUDY LIMITATIONS

2.4.3 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 5 RECYCLED FIBERS DOMINATED GLOBAL ECO FIBERS MARKET IN 2021 (USD MILLION)

FIGURE 6 CLOTHING & TEXTILE APPLICATIONS TO DOMINATE ECO FIBERS MARKET BETWEEN 2022 AND 2027

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 OPPORTUNITIES IN ECO FIBERS MARKET

FIGURE 8 HIGH DEMAND FOR ECO FIBERS IN TEXTILE INDUSTRY TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: ECO FIBERS MARKET, BY TYPE AND COUNTRY (2021)

FIGURE 9 RECYCLED FIBERS AND CHINA DOMINATED MARKET IN 2021

4.3 GEOGRAPHIC GROWTH OPPORTUNITIES IN ECO FIBERS MARKET

FIGURE 10 INDIA TO REGISTER HIGHEST CAGR OF MARKET IN FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ECO FIBERS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing use of man-made cellulosic fibers in clothing industry

5.2.1.2 Rising demand from emerging economies

5.2.1.3 Rising use of eco fibers in medical and hygiene products

5.2.1.4 Increasing adoption of eco fibers as substitutes for synthetic fibers

5.2.2 RESTRAINTS

5.2.2.1 High cost of eco fibers

5.2.2.2 Availability of cheaper substitutes such as synthetic fibers

5.2.3 OPPORTUNITIES

5.2.3.1 Rising adoption of eco fibers in end-use industries due to environmental sustainability

5.2.3.2 Adoption of new technologies to produce regenerated cellulose fibers

5.2.4 CHALLENGES

5.2.4.1 Obstacles in cotton textile industry

5.2.4.2 Developing low-cost production techniques

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 12 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT FROM NEW ENTRANTS

5.3.2 THREAT FROM SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 CASE ANALYSIS

5.4.1 ECO-FRIENDLY FIBERS PRODUCED THROUGH RECYCLED PULP TO REDUCE DEPENDENCY ON NATURAL RESOURCES

5.5 VALUE CHAIN ANALYSIS

FIGURE 13 OVERVIEW OF ECO FIBERS MARKET VALUE CHAIN

5.5.1 RAW MATERIALS AND SUPPLIERS

5.5.2 MANUFACTURERS

5.5.3 DISTRIBUTORS

5.5.4 END-USE INDUSTRIES

5.6 PRICING ANALYSIS

FIGURE 14 WEIGHTED AVERAGE PRICING ANALYSIS OF MARKET, BY REGION, 2021 (USD/TON)

TABLE 2 AVERAGE PRICE OF REGENERATED CELLULOSE, BY PRODUCT TYPE AND REGION, 2021 (USD/TON)

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 15 FOCUS ON SUSTAINABLE DEVELOPMENT TO BRING IN CHANGE IN FUTURE REVENUE MIX

5.8 KEY CONFERENCES & EVENTS, 2022–2023

5.9 MACROECONOMIC INDICATORS

5.9.1 GLOBAL GDP OUTLOOK

TABLE 3 WORLD GDP GROWTH PROJECTION, 2019–2026 (USD BILLION)

5.10 ADJACENT AND RELATED MARKETS

5.10.1 INTRODUCTION

5.10.2 LIMITATIONS

5.10.3 NONWOVEN FABRICS MARKET

5.10.3.1 Market definition

5.10.3.2 Nonwoven fabrics market, by application

TABLE 4 NONWOVEN FABRICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 5 NONWOVEN FABRICS MARKET, BY APPLICATION, 2018–2025 (KILOTON)

5.10.4 ECOSYSTEM MARKET MAP

5.10.5 TECHNOLOGY OVERVIEW

5.10.6 ORGANIC FIBERS

5.10.7 RECYCLED FIBERS

5.10.8 REGENERATED FIBERS

5.10.9 REGULATIONS

TABLE 6 CURRENT STANDARD CODES FOR ECO FIBERS

5.11 PATENT ANALYSIS

5.11.1 INTRODUCTION

5.11.2 REGENERATED CELLULOSE FIBERS

FIGURE 16 NUMBER OF GRANTED PATENTS, BY TYPE OF REGENERATED CELLULOSE FIBER, 2015–2021

FIGURE 17 JURISDICTION-WISE GRANTED PATENTS TO DATE, BY TYPE OF REGENERATED CELLULOSE FIBER

TABLE 7 NUMBER OF GRANTED, APPLIED, AND LIMITED PATENTS, BY FIBER TYPE (TILL 2020)

TABLE 8 PATENT DETAILS

5.11.3 RECYCLED FIBERS

5.11.4 METHODOLOGY

5.11.5 DOCUMENT TYPE

TABLE 9 GRANTED PATENTS ARE 34% OF TOTAL COUNT DURING LAST 10 YEARS

FIGURE 18 NUMBER OF PATENTS FILED DURING LAST 10 YEARS

5.11.6 PUBLICATION TRENDS OVER LAST 10 YEARS

FIGURE 19 YEAR-WISE DATA FOR NUMBER OF PATENTS PUBLISHED, 2011–2022

5.11.7 LEGAL STATUS OF PATENTS

FIGURE 20 LEGAL STATUS

5.11.8 JURISDICTION ANALYSIS

FIGURE 21 PATENT ANALYSIS FOR TOP 10 JURISDICTIONS, BY DOCUMENT

5.11.9 TOP COMPANIES/APPLICANTS

FIGURE 22 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2011–2022

TABLE 10 LIST OF PATENTS, 2017–2021

6 ECO FIBERS MARKET, BY TYPE (Page No. - 69)

6.1 INTRODUCTION

FIGURE 23 RECYCLED FIBERS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 11 ECO FIBERS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 12 MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

6.2 ORGANIC FIBERS

6.2.1 ECO-FRIENDLY NATURE OF ORGANIC FIBERS TO FUEL DEMAND

TABLE 13 ORGANIC FIBERS MARKET SIZE, BY REGION, 2020–2027(KILOTON)

TABLE 14 ORGANIC FIBERS MARKET SIZE, BY REGION, 2020–2027(USD MILLION)

6.3 RECYCLED FIBERS

6.3.1 EASY AVAILABILITY OF RAW MATERIALS TO FOSTER DEMAND FOR RECYCLED FIBERS

TABLE 15 RECYCLED ECO FIBERS MARKET SIZE, BY REGION, 2020–2027(KILOTON)

TABLE 16 RECYCLED MARKET SIZE, BY REGION, 2020–2027(USD MILLION)

6.4 REGENERATED FIBERS

6.4.1 GROWING DEMAND FROM TEXTILE INDUSTRY TO SUPPORT GROWTH

TABLE 17 REGENERATED FIBERS MARKET SIZE, BY REGION, 2020–2027(KILOTON)

TABLE 18 REGENERATED FIBERS MARKET SIZE, BY REGION, 2020–2027(USD MILLION)

TABLE 19 REGENERATED FIBERS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 20 REGENERATED FIBERS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

6.5 OTHERS

TABLE 21 OTHER ECO FIBERS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 22 OTHER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

7 ECO FIBERS MARKET, BY APPLICATION (Page No. - 77)

7.1 INTRODUCTION

FIGURE 24 CLOTHING & TEXTILE SEGMENT TO DOMINATE ECO FIBERS MARKET DURING FORECAST PERIOD

TABLE 23 ECO FIBERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 24 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 CLOTHING & TEXTILE

7.2.1 INCREASING USE OF ECO FIBERS IN CLOTHING APPLICATIONS TO DRIVE MARKET

TABLE 25 CLOTHING & TEXTILES: ECO FIBERS MARKET, BY REGION, 2020–2027 (KILOTON)

TABLE 26 CLOTHING & TEXTILES: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 HOUSEHOLD & FURNISHINGS

7.3.1 INCREASING SUSTAINABLE HOME DECOR TRENDS TO DRIVE MARKET

TABLE 27 HOUSEHOLD & FURNISHINGS: ECO FIBERS MARKET, BY REGION, 2020–2027 (KILOTON)

TABLE 28 HOUSEHOLD & FURNISHINGS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 INDUSTRIAL

7.4.1 GROWING USE OF ECO FIBERS IN PROTECTIVE CLOTHING TO SUPPORT GROWTH

TABLE 29 INDUSTRIAL: ECO FIBERS MARKET, BY REGION, 2020–2027 (KILOTON)

TABLE 30 INDUSTRIAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 MEDICAL

7.5.1 ECO-FRIENDLY PRODUCTS USED IN MEDICAL APPLICATIONS TO DRIVE ECO FIBER DEMAND

TABLE 31 MEDICAL: ECO FIBERS MARKET, BY REGION, 2020–2027 (KILOTON)

TABLE 32 MEDICAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.6 OTHER APPLICATIONS

TABLE 33 OTHER APPLICATIONS: ECO FIBERS MARKET, BY REGION, 2020–2027 (KILOTON)

TABLE 34 OTHER APPLICATIONS: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 ECO FIBERS MARKET, BY REGION (Page No. - 85)

8.1 INTRODUCTION

FIGURE 25 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS EMERGING AS NEW HOTSPOTS

8.2 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: ECO FIBERS MARKET SNAPSHOT

TABLE 35 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 36 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 38 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 39 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 40 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Healthy growth of textile and automotive manufacturing industries to support growth

TABLE 41 CHINA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 42 CHINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 43 CHINA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 44 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.2 JAPAN

8.2.2.1 Growth of textile and apparel market to govern demand for eco fibers

TABLE 45 JAPAN: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 46 JAPAN: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 47 JAPAN: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 48 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.3 INDIA

8.2.3.1 FDI initiatives to support market growth

FIGURE 27 AUTOMOTIVE PRODUCTION IN INDIA, 2019–2021 (MILLION UNITS)

TABLE 49 INDIA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 50 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 INDIA: MARKET, BY APPLICATION INDUSTRY, 2020–2027 (KILOTON)

TABLE 52 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.4 INDONESIA

8.2.4.1 Investments in textile sector to fuel growth

TABLE 53 INDONESIA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 54 INDONESIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 INDONESIA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 56 INDONESIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2.5 REST OF ASIA PACIFIC

TABLE 57 REST OF ASIA PACIFIC: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 58 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 59 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 60 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA: ECO FIBERS MARKET SNAPSHOT

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 NORTH AMERICA MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 64 NORTH AMERICA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 66 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.1 US

8.3.1.1 Thriving clothing & textile and household & furnishings industries to drive demand

TABLE 67 US: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 68 US: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 US: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 70 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.2 CANADA

8.3.2.1 Increasing investments in fabrics industry to foster adoption

TABLE 71 CANADA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 72 CANADA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 CANADA: MARKET, BY ECO FIBERS, 2020–2027 (KILOTON)

TABLE 74 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.3.3 MEXICO

8.3.3.1 Growing adoption of high-fashion clothes to drive market

TABLE 75 MEXICO: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 76 MEXICO: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 MEXICO: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 78 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4 EUROPE

TABLE 79 EUROPE: ECO FIBERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 80 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 81 EUROPE MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 82 EUROPE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 EUROPE:MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 84 EUROPE:MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Growing textile market to fuel demand

FIGURE 29 GERMANY: AUTOMOTIVE PRODUCTION & SALES, 2019–2021 (MILLION UNITS)

TABLE 85 GERMANY: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 86 GERMANY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 GERMANY: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 88 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.2 UK

8.4.2.1 Growing EV penetration to meet vehicle emission targets to drive growth

TABLE 89 UK: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 90 UK: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 UK: MARKET, BY APPLICATION INDUSTRY, 2020–2027 (KILOTON)

TABLE 92 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.3 FRANCE

8.4.3.1 Growing consumption of eco fibers in textile industry to foster growth

TABLE 93 FRANCE: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 94 FRANCE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 96 FRANCE: MARKET, BY APPLICATION INDUSTRY, 2020–2027 (USD MILLION)

8.4.4 ITALY

8.4.4.1 Significant economic recovery and growing textile industry to spur growth

TABLE 97 ITALY: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 98 ITALY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 ITALY: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 100 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.4.5 RUSSIA

8.4.5.1 Growing textile production to increase demand

TABLE 101 RUSSIA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 102 RUSSIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 RUSSIA: MARKET, BY APPLICATION INDUSTRY, 2020–2027 (KILOTON)

TABLE 104 RUSSIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

8.4.6 REST OF EUROPE

TABLE 105 REST OF EUROPE: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 106 REST OF EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET, BY REGENERATED INDUSTRY, 2020–2027 (KILOTON)

TABLE 108 REST OF EUROPE: MARKET, BY APPLICATION INDUSTRY, 2020–2027 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 109 MIDDLE EAST & AFRICA: ECO FIBERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 112 MIDDLE EAST & AFRICA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.1 UAE

8.5.1.1 Government investments in textile industry to propel demand

TABLE 115 UAE: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 116 UAE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 UAE: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 118 UAE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.2 SAUDI ARABIA

8.5.2.1 Increasing textile and automotive production to spur demand for eco fibers

TABLE 119 SAUDI ARABIA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 120 SAUDI ARABIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 122 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 123 REST OF MIDDLE EAST & AFRICA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 124 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 126 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 127 SOUTH AMERICA: ECO FIBERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 128 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 129 SOUTH AMERICA MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 130 SOUTH AMERICA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 132 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Fabrics industry to contribute highest to market growth

TABLE 133 BRAZIL: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 134 BRAZIL: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 136 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Clothing & textile applications to drive market growth

TABLE 137 ARGENTINA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 138 ARGENTINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 ARGENTINA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 140 ARGENTINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 141 REST OF SOUTH AMERICA: ECO FIBERS MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 142 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 REST OF SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (KILOTON)

TABLE 144 REST OF SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 132)

9.1 INTRODUCTION

FIGURE 30 EXPANSION IS KEY STRATEGY ADOPTED BY MARKET PLAYERS BETWEEN 2018 AND 2021

9.2 MARKET SHARE ANALYSIS

TABLE 145 ECO FIBERS MARKET: DEGREE OF COMPETITION

9.3 KEY PLAYER STRATEGIES

TABLE 146 STRATEGIC POSITIONING OF KEY PLAYERS

9.4 COMPANY EVALUATION QUADRANT

9.4.1 STARS

9.4.2 PERVASIVE COMPANIES

9.4.3 PARTICIPANT PLAYERS

9.4.4 EMERGING LEADERS

FIGURE 32 ECO FIBERS MARKET: COMPANY EVALUATION MATRIX, 2021

9.5 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES EVALUATION QUADRANT

9.5.1 RESPONSIVE COMPANIES

9.5.2 DYNAMIC COMPANIES

9.5.3 STARTING BLOCKS

FIGURE 33 STARTUPS AND SMES EVALUATION MATRIX, 2021

9.6 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 34 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FOUR YEARS

9.7 COMPETITIVE BENCHMARKING

TABLE 147 ECO FIBERS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 148 ECO FIBERS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

9.8 COMPETITIVE SCENARIOS AND TRENDS

9.8.1 PRODUCT LAUNCHES

TABLE 149 ECO FIBERS MARKET: PRODUCT LAUNCHES, 2018–2022

9.8.2 DEALS

TABLE 150 ECO FIBERS MARKET: DEALS, 2018–2022

9.8.3 OTHER DEVELOPMENTS

TABLE 151 ECO FIBERS MARKET: OTHER DEVELOPMENTS, 2018–2022

10 COMPANY PROFILES (Page No. - 144)

10.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

10.1.1 GRASIM INDUSTRIES LIMITED

TABLE 152 GRASIM INDUSTRIES LIMITED: BUSINESS OVERVIEW

FIGURE 35 GRASIM INDUSTRIES LIMITED: COMPANY SNAPSHOT

TABLE 153 GRASIM INDUSTRIES LIMITED: DEALS

TABLE 154 GRASIM INDUSTRIES LIMITED: OTHERS

FIGURE 36 GRASIM INDUSTRIES’ PERFORMANCE IN ECO FIBERS MARKET

10.1.2 LENZING AG

TABLE 155 LENZING AG: BUSINESS OVERVIEW

FIGURE 37 LENZING AG: COMPANY SNAPSHOT

TABLE 156 LENZING AG: PRODUCT LAUNCHES

TABLE 157 LENZING AG: DEALS

TABLE 158 LENZING AG: OTHERS

FIGURE 38 LENZING’S PERFORMANCE IN ECO FIBERS MARKET

10.1.3 SATERI GROUP

TABLE 160 SATERI: PRODUCT LAUNCHES

TABLE 161 SATERI: DEALS

TABLE 162 SATERI: OTHERS

FIGURE 39 SATERI’S PERFORMANCE IN ECO FIBERS MARKET

10.1.4 TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO., LTD.

TABLE 163 TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO., LTD.: BUSINESS OVERVIEW

TABLE 164 TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO., LTD.: PRODUCT LAUNCHES

TABLE 165 TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO., LTD.: DEALS

FIGURE 40 TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO., LTD.’S PERFORMANCE IN ECO FIBERS MARKET

10.1.5 US FIBERS

TABLE 166 US FIBERS: BUSINESS OVERVIEW

FIGURE 41 US FIBERS’ PERFORMANCE IN ECO FIBERS MARKET

10.1.6 TEIJIN LIMITED

TABLE 167 TEIJIN LIMITED: BUSINESS OVERVIEW

FIGURE 42 TEIJIN LIMITED: COMPANY SNAPSHOT

TABLE 168 TEIJIN LIMITED: PRODUCT LAUNCHES

TABLE 169 TEIJIN LIMITED: DEALS

FIGURE 43 TEIJIN LIMITED’S PERFORMANCE IN ECO FIBERS MARKET

10.1.7 POLYFIBRE INDUSTRIES PVT. LTD.

TABLE 170 POLYFIBRE INDUSTRIES PVT. LTD.: BUSINESS OVERVIEW

10.1.8 DAVID C. POOLE COMPANY, INC.

TABLE 171 DAVID C. POOLE COMPANY, INC.: BUSINESS OVERVIEW

10.1.9 WELLMAN PLASTICS RECYCLING, LLC

TABLE 172 WELLMAN PLASTICS RECYCLING, LLC: BUSINESS OVERVIEW

10.1.10 FOSS MANUFACTURING COMPANY, LLC.

TABLE 173 FOSS MANUFACTURING COMPANY, LLC.: BUSINESS OVERVIEW

TABLE 174 FOSS MANUFACTURING COMPANY, LLC.: DEALS

10.1.11 SHANGHAI TENBRO BAMBOO TEXTILE CO., LTD.

TABLE 175 SHANGHAI TENBRO BAMBOO TEXTILE CO., LTD.: BUSINESS OVERVIEW

10.2 OTHER PLAYERS

10.2.1 UNIFI, INC.

TABLE 176 UNIFI, INC.: COMPANY OVERVIEW

10.2.2 KOMAL FIBRES

TABLE 177 KOMAL FIBRES: COMPANY OVERVIEW

10.2.3 CHINA BAMBRO TEXTILE CO., LTD.

TABLE 178 CHINA BAMBRO TEXTILE CO., LTD. COMPANY OVERVIEW

10.2.4 PILIPINAS ECOFIBER CORPORATION

TABLE 179 PILIPINAS ECOFIBER CORPORATION: COMPANY OVERVIEW

10.2.5 VISHAL POLY FIBERS PVT. LTD.

TABLE 180 VISHAL POLY FIBERS PVT. LTD.: COMPANY OVERVIEW

10.2.6 SHYAM FIBERS PRIVATE LIMITED

TABLE 181 SHYAM FIBERS PRIVATE LIMITED: COMPANY OVERVIEW

10.2.7 JB ECOTEX LIMITED

TABLE 182 JB ECOTEX LIMITED: COMPANY OVERVIEW

10.2.8 PROMA INDUSTRIES LTD.

TABLE 183 PROMA INDUSTRIES LTD.: COMPANY OVERVIEW

10.2.9 GANESHA ECOSPHERE LTD.

TABLE 184 GANESHA ECOSPHERE LTD.: COMPANY OVERVIEW

10.2.10 BLS ECOTECH

TABLE 185 BLS ECOTECH: COMPANY OVERVIEW

10.2.11 AGL POLYFIL PRIVATE LIMITED

TABLE 186 AGL POLYFIL PRIVATE LIMITED: COMPANY OVERVIEW

10.2.12 JIANGSU AOYANG TECHNOLOGY CORPORATION LIMITED

TABLE 187 JIANGSU AOYANG TECHNOLOGY CORPORATION LIMITED: COMPANY OVERVIEW

10.2.13 BARNET INTELLIGENT MATERIALS

TABLE 188 BARNET INTELLIGENT MATERIALS: COMPANY OVERVIEW

10.2.14 SNIACE, S.A.

TABLE 189 SNIACE, S.A.: COMPANY OVERVIEW

10.2.15 COMPOSITION MATERIALS CO., INC.

TABLE 190 COMPOSITION MATERIALS CO., INC.: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 184)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Eco fibers market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

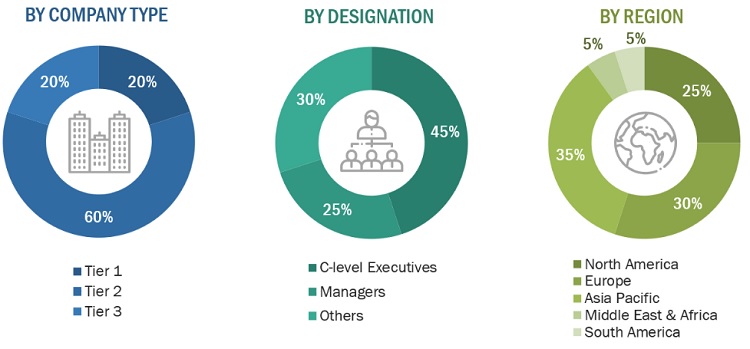

The Eco Fibers market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Eco Fibers market. Primary sources from the supply side include associations and institutions involved in the eco fiber industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

Notes: Others include sales, marketing, engineers, and product managers.

Tier 1= USD 1 Billion; Tier 2 = below USD 1 Billion to USD 500 Million; and Tier 3 = Below USD 500 Million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Eco Fibers market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global eco fibers market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, region and end-use application.

- To forecast the market size, in terms of value, with respect to four main regions: North America, Europe, Asia Pacific, Middle East & Africa and South America.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Eco fibers market

- Further breakdown of the Rest of Europe’s Eco fibers market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Eco Fibers Market