Aircraft Propeller System Market Size, Share, Trends & Growth Analysis By Type (Fixed Pitch, Variable Pitch), Component (Blade, Spinner, Hub), Engine (Conventional, Hybrid & Electric), Platform (Civil, Military), End Use (OEM, Aftermarket), & Region

Updated on : Oct 22, 2024

The Aircraft Propeller System Market is experiencing robust growth driven by increasing demand for fuel-efficient and high-performance aircraft. Technological advancements in propeller design and materials have enhanced efficiency, reduced noise levels, and improved overall performance, making modern aircraft more competitive in the market. Additionally, the rising focus on environmental sustainability is prompting manufacturers to innovate and develop advanced propeller systems that minimize emissions and optimize fuel consumption. As airlines and operators seek to enhance operational efficiency and passenger comfort, the demand for state-of-the-art aircraft propeller systems is expected to continue its upward trajectory.

Aircraft Propeller System Market Size & Share

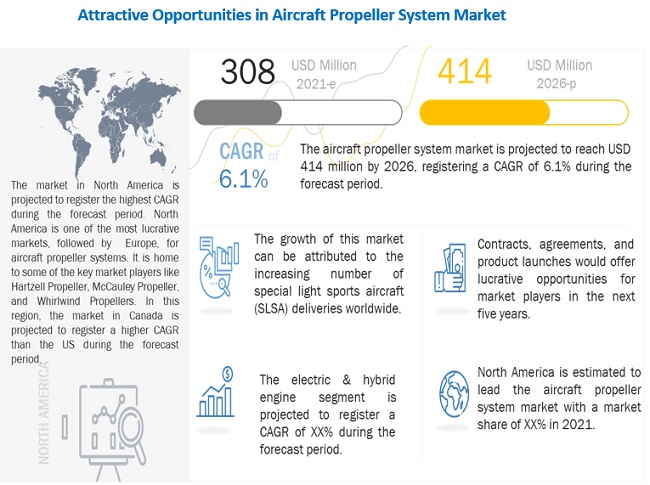

The aircraft propeller system market size is projected to reach USD 414 million by 2026, growing at a CAGR of 6.1% during the forecast period. The aircraft propeller system industry is going to be driven by the increasing number of special light-sport aircraft (SLSA) deliveries worldwide.

Aircraft propellers are devices that are used in different types of aircraft to create relative motion by forcing the environmental air axially backward for the movement of an aircraft. They provide the required thrust to an aircraft to fly by rotating fans/rotor blades. Aircraft propellers transform rotational motion generated by rotating fans/rotor blades into sweeping force with the help of an aircraft engine to ensure the flight of the aircraft. Propeller systems consist of blades, hubs, and digital electronic controls that incorporate advanced aerodynamics, structures, control dynamics, software, and de-icing components into modern aircraft propeller systems industry. Propeller blades are the prime components in aircraft propeller systems and are generally made of aluminum or composites.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Aircraft propeller system Market

The COVID-19 and resultant lockdowns have adversely impacted the aviation industry. According to the International Air Transport Association (IATA), every year, over 2 billion people take aircraft as their mode of transportation. Due to the outbreak of COVID-19, the year 2020 witnessed over 60% loss in global air traffic, which bought the aviation industry to a standstill.

Several companies have already implemented policies to restrict non-essential travel to protect their employees. Remote and flexible working arrangements have been considered, and supply chains have become highly sophisticated and vital to the competitiveness of many companies. But their interlinked, global nature also makes them increasingly vulnerable to a range of risks, with more potential points of failure and less margin of error for absorbing delays and disruptions. New supply chain technologies are emerging, which can significantly improve visibility across the end-to-end supply chain and support more supply chain agility and resiliency without the traditional overhead associated with risk management techniques.

The spread of COVID-19 has also compelled companies to implement remote work solutions and digital technologies for business continuation and fleet optimization. For example, aircraft companies and OEMs are using AI for predictive maintenance, intelligent scheduling, real-time analytics, and improving performance. Currently, companies like C3 AI (Redwood City, California) and Honeywell International Inc. offer software for the fleet of the US Air Force and commercial aircraft carrier companies to provide data for timely maintenance using AI.

Aircraft Propeller System Market Dynamics

Aircraft Propeller System Market Driver: Increasing number of special light-sport aircraft (SLSA) deliveries worldwide

There has been an increase in the number of deliveries of Special Light-Sport Aircraft (SLSA) across the globe due to the increasing popularity of aviation sports in the North American and European regions. The operational efficiency of an aircraft is determined by its design, navigation & flight routes taken by it, and its ability to withstand harsh weather conditions. Advancements in technologies employed in aircraft engines, along with improvements in flight operations, technical operations, and ground operations of different types of aircraft have enhanced their efficiency and performance.

These factors have led to an increase in the number of orders for SLSA across the globe, which is expected to fuel the growth of the aircraft propeller system market during the forecast period.

The growing popularity of the SLSA across the globe is expected to lead to an increase in the number of orders for these aircraft, which, in turn, is expected to fuel the demand for aircraft propeller systems during the forecast period

Aircraft Propeller System Market Opportunity: Increasing adoption of solar-powered aircraft

The growing popularity and adoption of clean energy sources such as solar power have grabbed the attention of several key aircraft manufacturers across the globe. Due to the high costs involved in aircraft operations, the need to develop aircraft that use renewable sources of energy such as solar power has gained significant importance in the past decade. The idea is to develop an aircraft that can be used to carry out weather monitoring and patrolling activities, among others at significantly low costs.

There are several prototype projects that have been undertaken by various key manufacturers of space vehicles and aircraft such as the National Aeronautics and Space Administration (NASA) (US), Airbus (France), and the Swiss Federal Institute of Technology (Switzerland) to develop aircraft that use solar energy or other renewable energy sources.

For instance, the NASA Pathfinder and NASA Pathfinder Plus were the first two aircraft developed by AeroVironment, Inc. (US) under the Environmental Research Aircraft and Sensor Technology (ERAST) program at NASA. These long-term, high-altitude aircraft can be used in atmospheric research, communication platforms, and satellites. Airbus Zephyr is an ongoing project being carried out by QinetiQ (UK). This project was initiated in 2003 and aims at developing a lightweight solar-powered Unmanned Aerial Vehicle (UAV), which is presently a part of the Airbus High Altitude Pseudo-Satellite (HAPS) program being carried out by Airbus (France.

Aircraft Propeller System Market Challenge: High maintenance cost of turboprop

Different types of aircraft using turboprop engines have an extra gearbox and various moveable parts as compared to the aircraft using turbojet engines. These turboprop engines are more prone to loss of engine oil pressure causing oil leakages in aircraft than turbojet engines. Oil leakages are a common cause of catastrophic engine failure in an aircraft. As bleed air is sucked from the aircraft engine to pressurize the aircraft cabin, air entering the aircraft cabin is contaminated and can cause safety issues. Several initiatives are being undertaken by the manufacturers of aircraft engines to overcome these problems. For instance, General Electric (US) is developing a new GE93 advanced turboprop engine to overcome problems faced by conventional turboprop engines. Moreover, Hartzell Propellers (US) is developing aircraft propeller systems that do not need any overhauling after its installation in the aircraft.

Aircraft Propeller System Market Segmental Analysis

Based on Type

The aircraft propeller system market is segmented by type into fixed-pitch propellers and variable-pitch propellers. Fixed-pitch propellers are simpler and more cost-effective, making them suitable for light and general aviation aircraft. Variable-pitch propellers, on the other hand, offer better performance and efficiency by allowing pilots to adjust the blade pitch during flight, making them ideal for commercial and military aircraft. The increasing demand for fuel-efficient aircraft and advancements in propeller technology are driving the growth of variable-pitch propellers in the market?.

Based on Component

In terms of components, the aircraft propeller system market includes blades, hubs, spinners, and other essential parts. Propeller blades are crucial as they directly affect the performance and efficiency of the aircraft. Technological advancements have led to the development of composite materials for blades, which are lighter and more durable than traditional materials. Hubs and spinners also play significant roles in maintaining the balance and aerodynamic efficiency of the propeller system. The focus on reducing maintenance costs and improving the overall lifecycle of propeller components is a key driver in this market segment?.

Based on Engine

The conventional engine segment is anticipated to register a CAGR of 6.1% during the forecast period. This segment’s growth is mainly driven by the advantages of conventional engines, such as fuel efficiency, high compression ratio, high heat, and low fuel consumption.

Based on Platform

Based on the platform, the aircraft propeller system market is categorized into commercial, military, and general aviation. The commercial segment is experiencing substantial growth due to the rising demand for air travel and the expansion of airline fleets. Military aircraft propellers are also in demand as countries invest in advanced defense systems and modernize their fleets. General aviation, which includes private and business aircraft, continues to grow with increasing personal and corporate investments in aviation. The need for efficient, reliable, and high-performance propeller systems across these platforms fuels market expansion?.

Based on End Use

As the aviation industry grows, demand for aircraft parts, such as propellers, may increase in parallel with orders for new turboprop and piston engine aircraft. The demand produced by aircraft manufacturers is presently very substantial, resulting in higher OEM segment revenues in 2021. However, because propellers are vulnerable to wear, fatigue, corrosion, and erosion, they must be maintained, repaired, and refurbished on a regular basis to ensure that they last as long as possible. Thus, even though the revenues from the segment are low, the aftermarket services for existing aircraft are expected to boost the growth of the aftermarket segment during the forecast period.

Regional Analysis - Aircraft Propeller System Market

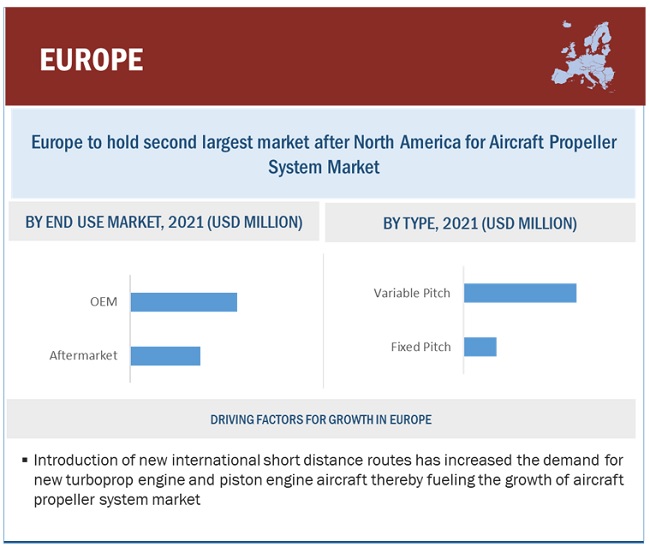

Europe is projected to grow at the CAGR of 5.7 %during the forecast period.

The aircraft propeller system market in the European region has been studied for France, the UK, Germany, Italy, and the Rest of Europe. The aircraft propeller systems market in the Rest of Europe has been studied for Russia, Finland, Sweden, Austria, Ukraine, and the Netherlands. The European region is estimated to account for a share of 24.1% of the aircraft propeller systems market in 2021.

The large fleet of existing aircraft, continuously ongoing aircraft modernization programs, consolidation of airlines, and growth in air traffic are the factors fueling the growth of the aircraft propeller system market in Europe. Dowty Propellers (UK), which is a key manufacturer of commercial and military turboprop engine and piston engine aircraft propellers, is estimated to contribute significantly to the growth of the aircraft propeller system market in Europe during the forecast period.

The Europe-based airlines have an installed base of 4,400 aircraft. Out of these aircraft, approximately 25% are turboprop engine and piston engine aircraft that were replaced or refurbished by 2015. This has led to the growth of aircraft propeller system aftermarket in the European region. Apart from this, the introduction of new international short distance routes has also increased the demand for new turboprop engine and piston engine aircraft, thereby fueling the growth of the aircraft propeller system market in Europe.

To know about the assumptions considered for the study, download the pdf brochure

Top Aircraft Propeller System Companies - Key Market Players

Hartzell Propeller, Inc. (Hartzell Propeller) (US), MT-Propeller Entwicklung GmbH (MT-Propeller) (Germany), and Dowty Propellers (UK) are the largest providers of aircraft propeller systems in the North American and European regions.

Aircraft Propeller System Market Scope Analysis:

|

Report Metric |

Details |

| Estimated Market Size |

USD 308 Million by 2021 |

| Projected Market Size |

USD 414 Million by 2026 |

| CAGR |

6.1% |

|

Market size available for years |

2018-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Based on Type, Platform, End Use, Engine and Component |

|

Geographies covered |

North America, Asia Pacific, Europe, and ROW(Middle East, Africa, and Latin America) |

|

Companies covered |

Hartzell Propeller, Inc. (Hartzell Propeller) (US), MT-Propeller Entwicklung GmbH (MT-Propeller) (Germany), and Dowty Propellers (UK) are the largest providers of aircraft propeller systems. |

This research report categorizes the aircraft propeller system market based on industry, forecasting type, purpose, organization size, and region.

Aircraft Propeller System Market, By Type.

- Fixed Pitch

- Variable Pitch

By Platform

- Civil

- Military

By Component

- Blade

- Spinner

- Hub

- Others

By Engine

- Conventional

- Electric & Hybrid

By End Use

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- ROW

Recent Developments in Aircraft Propeller System Industry

- In July 2021, Hartzell Propeller acquired Tanis Aircraft Products' assets. With this acquisition, Hartzell Propeller's heated goods will now include systems for propeller de-ice, piston engine warmup, turbine engine preheat, helicopter preheat, battery, avionics, and cabin warming, as well as the Tanis brand.

- In July 2020, Dowty Propellers entered into an agreement with Haydale Graphene Industries plc (Haydale) in which Haydale will provide graphene and nanomaterial enhanced products for use in Dowty Propellers' products. Haydale will collaborate with Dowty Propellers to produce erosion-resistant coatings for propeller blades

- In July 2020, MT-Propeller received the FAA STC SA04450NY (Supplemental Type Certificate) for the installation of the MTV-27 Propeller on the Kodiak 10.es.

Frequently Asked Questions (FAQ):

What is the current size of the Aircraft Propeller System market?

The Aircraft Propeller System market size is forecasted to grow from an estimated USD 308 million in 2021 to USD 414 million by 2026, at a CAGR of 6.1% during the forecast period.

Who are the winners in the Aircraft Propeller System market?

Hartzell Propeller, Inc. (Hartzell Propeller) (US), MT-Propeller Entwicklung GmbH (MT-Propeller) (Germany), and Dowty Propellers (UK are some of the winners in the market.

What is the COVID-19 impact on Aircraft Propeller System market?

The COVID-19 and resultant lockdowns have adversely impacted the aviation industry. According to the International Air Transport Association (IATA), every year, over 2 billion people take aircraft as their mode of transportation. Due to the outbreak of COVID-19, the year 2020 witnessed over 60% loss in global air traffic, which bought the aviation industry to a standstill.

Several companies have already implemented policies to restrict non-essential travel to protect their employees. Remote and flexible working arrangements have been considered, and supply chains have become highly sophisticated and vital to the competitiveness of many companies. But their interlinked, global nature also makes them increasingly vulnerable to a range of risks, with more potential points of failure and less margin of error for absorbing delays and disruptions. New supply chain technologies are emerging, which can significantly improve visibility across the end-to-end supply chain and support more supply chain agility and resiliency without the traditional overhead associated with risk management techniques.

What are some of the technological advancements in the market?

One of the fastest-growing demands in the industry of aircraft propulsion systems is the demand for composite material. Composite components and materials are used specifically in aircraft propeller blades. They provide multiple advantages over traditional materials used in the manufacturing of aircraft propeller blades. One of the major advantages of composite components is that they can operate with more efficiency at higher temperatures, as they are lighter, which helps in reducing the weight of an aircraft to a significant level. As the weight reduces, the fuel efficiency of the aircraft increases. Such advantages would drive the demand for composite technology during the forecast period.

What are the factors driving the growth of the market?

Manufacturers of aircraft across the globe are focusing on developing different types of aircraft that are lightweight and fuel-efficient. Continuous technological advancements in the aerospace & defense industry and the increased need of airlines to ensure improved performance of their aircraft have resulted in the reduction of size, weight, and power (SWaP) specifications of different types of aircraft. This, in turn, has led manufacturers of aircraft propeller systems to develop solutions that lower the lifecycle costs of aircraft propeller systems, thereby reducing the time to market (TTM) of an aircraft. Thus, manufacturers of aircraft propeller systems are developing solutions to replace the point-to-point wiring and unidirectional buses in an aircraft with fast and efficient bi-directional buses .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 AIRCRAFT PROPELLER SYSTEM MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

FIGURE 2 REGIONAL SCOPE: AIRCRAFT PROPELLER SYSTEMS MARKET

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 INCLUSIONS & EXCLUSIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 AIRCRAFT PROPELLER SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 INTRODUCTION

2.1.4 DEMAND-SIDE INDICATORS

2.1.4.1 Growth of military expenditure on autonomous defense systems

2.1.5 SUPPLY-SIDE INDICATORS

2.1.5.1 Major US defense contractors’ financial trends

2.1.5.2 Need for minimizing limitations

2.2 MARKET SIZE ESTIMATION

2.3 SCOPE

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.2.1 COVID-19 impact on aircraft propeller system market

2.5 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 NORTH AMERICA REGION PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 9 BY END USE, AFTERMARKET SEGMENT PROJECTED TO REGISTER HIGHER CAGR THAN OEM SEGMENT FROM 2021 TO 2026

FIGURE 10 BY COMPONENT, HUB SEGMENT PROJECTED TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 11 BY TYPE, VARIABLE PITCH SEGMENT PROJECTED TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN AIRCRAFT PROPELLER SYSTEM MARKET, 2021–2026

FIGURE 12 INCREASING OPERATIONS IN COMMERCIAL AIRCRAFT INDUSTRY TO DRIVE MARKET GROWTH

4.2 AIRCRAFT PROPELLER SYSTEMS MARKET, BY ENGINE

FIGURE 13 TURBOPROP ENGINE AIRCRAFT TO BE IN GREATER DEMAND IN UPCOMING YEARS

4.3 AIRCRAFT PROPELLER SYSTEMS MARKET, BY COUNTRY

FIGURE 14 MARKET IN CANADA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 AIRCRAFT PROPELLER SYSTEMS MARKET, BY VARIABLE PITCH TYPE

FIGURE 15 CONTROLLABLE PITCH TYPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 AIRCRAFT PROPELLER SYSTEM MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand for lightweight and fuel-efficient aircraft globally

5.2.1.2 Increasing number of special light-sport aircraft (SLSA) deliveries worldwide

5.2.1.3 Increasing operations in commercial aircraft industry

5.2.2 RESTRAINTS

5.2.2.1 Lack of efficiency of aircraft using turboprop engines at high altitudes

5.2.2.2 Stringent regulatory norms to ensure safe aircraft operations

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of solar-powered aircraft worldwide

5.2.3.2 Technological advancements being carried out in passenger drones

5.2.3.3 Increasing testing operations of UAVs

5.2.4 CHALLENGES

5.2.4.1 High costs involved in manufacturing aircraft propeller systems

5.2.4.2 High maintenance cost of turboprop engines

5.3 RANGES AND SCENARIOS

FIGURE 17 IMPACT OF COVID-19 ON THE MARKET: GLOBAL SCENARIOS

5.4 IMPACT OF COVID-19 ON AIRCRAFT PROPELLER SYSTEM MARKET

FIGURE 18 IMPACT OF COVID-19 ON AIRCRAFT PROPELLER SYSTEMS MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to June 2021

TABLE 1 KEY DEVELOPMENTS IN AIRCRAFT PROPELLER SYSTEMS MARKET 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.4.2.1 Key developments from January 2020 to June 2021

TABLE 2 KEY DEVELOPMENTS IN AIRCRAFT PROPELLER SYSTEMS MARKET 2020-2021

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT PROPELLER SYSTEM MANUFACTURERS

FIGURE 19 REVENUE SHIFT IN AIRCRAFT PROPELLER SYSTEMS MARKET

5.6 AVERAGE SELLING PRICE ANALYSIS OF AIRCRAFT PROPELLER SYSTEM, 2020

TABLE 3 AVERAGE SELLING PRICE ANALYSIS OF AIRCRAFT PROPELLER SYSTEMS AND COMPONENTS IN 2020

5.7 AIRCRAFT PROPELLER SYSTEM MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 20 AIRCRAFT PROPELLER SYSTEMS MARKET ECOSYSTEM MAP

TABLE 4 AIRCRAFT PROPELLER SYSTEMS MARKET ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 ADVANCED HIGH-SPEED TURBOPROP

5.8.2 PREDICTIVE MAINTENANCE

5.8.3 COMPOSITE TECHNOLOGY

5.8.4 TECHNOLOGY ADVANCEMENTS AND CONTINUOUS IMPROVEMENTS

5.9 USE CASE ANALYSIS

5.9.1 USE CASE: ELECTRIC HYBRID PROPULSION SYSTEM

5.9.2 USE CASE: VECTOR THRUST PROPELLER SYSTEM

5.9.3 USE CASE: LIFT PLUS CRUISE

5.10 VALUE CHAIN ANALYSIS OF AIRCRAFT PROPELLER SYSTEM MARKET

FIGURE 21 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 AIRCRAFT PROPELLER SYSTEMS MARKET: PORTER’S FIVE FORCES

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 DEGREE OF COMPETITION

5.12 TRADE ANALYSIS

TABLE 6 COUNTRY-WISE EXPORT, AIRCRAFT, SPACECRAFT, AND PARTS THEREOF, 2019-2020 (USD THOUSAND)

TABLE 7 COUNTRY-WISE IMPORTS, AIRCRAFT, SPACECRAFT, AND PARTS THEREOF, 2019-2020 (USD THOUSAND)

5.13 VOLUME DATA

TABLE 8 PISTON AND TURBOPROP ENGINE AIRCRFATS DELIVERIES (19970-2019)

5.14 TARIFF AND REGULATORY LANDSCAPE

6 INDUSTRY TRENDS (Page No. - 72)

6.1 INTRODUCTION

FIGURE 22 EMERGING TECHNOLOGY TREND IN THE AIRCRAFT PROPELLER SYSTEM MARKET

6.2 TECHNOLOGY TRENDS

6.3 EMERGING TRENDS IN THE AIRCRAFT PROPELLER SYSTEMS MARKET

6.3.1 DIGITAL PROPELLER VIBRATION TREND MONITORING SYSTEMS

6.3.2 3D PRINTING PROCESS

6.3.3 ADVANCEMENTS IN PROPELLER TECHNOLOGIES

6.3.4 ADVANCED MATERIALS USED TO MANUFACTURE PROPELLER SYSTEMS FOR UNMANNED AERIAL VEHICLES

6.3.5 ASYNCHRONOUS PROPELLER TECHNOLOGY

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS

6.5 IMPACT OF MEGATRENDS

6.5.1 DIGITAL PROPELLER VIBRATION TREND MONITORING SYSTEMS

6.5.2 3D PRINTING PROCESS

6.5.3 ADVANCEMENTS IN PROPELLER TECHNOLOGIES

6.6 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 9 INNOVATION & PATENT REGISTRATIONS (2018-2021)

7 AIRCRAFT PROPELLER SYSTEM MARKET, BY COMPONENT (Page No. - 80)

7.1 INTRODUCTION

FIGURE 24 BLADE SEGMENT ESTIMATED TO LEAD AIRCRAFT PROPELLER SYSTEMS MARKET IN 2021

TABLE 10 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 11 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

7.2 BLADE

7.2.1 PRESENCE OF LIGHT AND ULTRALIGHT AIRCRAFT MANUFACTURERS TO DRIVE MARKET

7.3 HUB

7.3.1 INCREASING OPERATIONS OF COMMERCIAL AIRCRAFT TO DRIVE MARKET FOR HUB

7.4 SPINNER

7.4.1 INCREASING DELIVERIES OF TURBOPROP ENGINE AIRCRAFT TO DRIVE MARKET

7.5 OTHERS

8 AIRCRAFT PROPELLER SYSTEM MARKET, BY END USE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 25 OEM SEGMENT PROJECTED TO REGISTER HIGHER CAGR THAN AFTERMARKET SEGMENT FROM 2021 TO 2026

TABLE 12 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY END USE, 2017–2020 (USD MILLION)

TABLE 13 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

8.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

8.2.1 INCREASING AUTOMATION OF FLIGHT OPERATIONS, CONTINUING TECHNOLOGICAL ADVANCEMENTS IN AIRCRAFT PROPULSION TECHNOLOGIES, AND RISING ADOPTION OF UNMANNED AIR VEHICLES TO FUEL MARKET GROWTH

8.3 AFTERMARKET

8.3.1 VULNERABILITY OF PROPELLER TO WEAR, FATIGUE, AND CORROSION TO DRIVE AFTERMARKET

9 AIRCRAFT PROPELLER SYSTEM MARKET, BY ENGINE (Page No. - 87)

9.1 INTRODUCTION

FIGURE 26 CONVENTIONAL SEGMENT ESTIMATED TO LEAD AIRCRAFT PROPELLER SYSTEM MARKET IN 2021

TABLE 14 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY ENGINE, 2017–2020 (USD MILLION)

TABLE 15 MARKET SIZE, BY ENGINE, 2021–2026 (USD MILLION)

9.2 CONVENTIONAL

TABLE 16 MARKET SIZE, BY CONVENTIONAL TYPE, 2017–2020 (USD MILLION)

TABLE 17 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY CONVENTIONAL TYPE, 2021–2026 (USD MILLION)

9.2.1 TURBOPROP ENGINE

9.2.1.1 Rising demand for commercial and military aircraft to drive market for Turboprop engine

9.2.2 PISTON ENGINE

9.2.2.1 Increase in procurement of training aircraft to fuel this segment’s market

9.3 HYBRID & ELECTRIC

9.3.1 REDUCED EMISSIONS PRODUCED BY HYBRID & ELECTRIC AIRCRAFT TO FUEL THIS SEGMENT’S MARKET

10 AIRCRAFT PROPELLER SYSTEM MARKET, BY TYPE (Page No. - 91)

10.1 INTRODUCTION

FIGURE 27 VARIABLE PITCH SEGMENT PROJECTED TO REGISTER HIGHEST CAGR THAN FIXED PITCH SEGMENT FROM 2021 TO 2026

TABLE 18 MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 19 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.2 FIXED PITCH

10.2.1 INCREASING USE OF UAVS BY DEFENSE FORCES TO FUEL SEGMENT’S GROWTH

10.3 VARIABLE PITCH

TABLE 20 VARIABLE PITCH SEGMENT SIZE, BY PROPELLER TYPE, 2017–2020 (USD MILLION)

TABLE 21 VARIABLE PITCH SEGMENT SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.3.1 CONTROLLABLE PITCH PROPELLER

10.3.1.1 Increased fuel efficiency to drive segment’s growth

10.3.2 CONSTANT SPEED PROPELLER

10.3.2.1 Better suitability to modern engine and reduced strain on engine to drive segment

10.3.3 FULL FEATHERING PROPELLER

10.3.3.1 Increased deliveries of military transport aircraft to drive segment

10.3.4 OTHER PROPELLERS

10.3.4.1 Easy replacement and adjustment options for aircraft propeller to fuel market growth

11 AIRCRAFT PROPELLER SYSTEM MARKET, BY PLATFORM (Page No. - 95)

11.1 INTRODUCTION

FIGURE 28 BY PLATFORM, CIVIL SEGMENT ESTIMATED TO LEAD AIRCRAFT PROPELLER SYSTEMS MARKET IN 2021

TABLE 22 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 23 MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

11.2 CIVIL

TABLE 24 MARKET SIZE, BY CIVIL, 2017–2020 (USD MILLION)

TABLE 25 MARKET SIZE, BY CIVIL, 2021–2026 (USD MILLION)

11.2.1 BUSINESS JET

11.2.1.1 Increase in corporate activities globally to drive demand

11.2.2 LIGHT & ULTRALIGHT AIRCRAFT

11.2.2.1 Increase in corporate activities globally to drive demand

11.2.3 REGIONAL TRANSPORT

11.2.3.1 Rising demand for regional transport aircraft in US and Asia Pacific

11.2.4 UAV

11.2.4.1 Investments in air taxis to drive UAV segment

11.3 MILITARY

TABLE 26 AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY MILITARY, 2017–2020 (USD MILLION)

TABLE 27 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY MILITARY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.1 TRANSPORT

11.3.1.1 Increasing use of transport aircraft in military operations to drive demand

11.3.2 SPECIAL MISSION

11.3.2.1 Growing defense spending and territorial disputes to drive demand

11.3.3 TRAINER

11.3.3.1 Advancements in training missions lead to growth in aircraft propeller systems market

11.3.4 UAV

11.3.4.1 Increased usability and applications of UAVs in defense sector to drive market

12 REGIONAL ANALYSIS (Page No. - 101)

12.1 INTRODUCTION

FIGURE 29 AIRCRAFT PROPELLER SYSTEM MARKET SNAPSHOT

TABLE 28 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS

FIGURE 30 NORTH AMERICA MARKET SNAPSHOT

TABLE 30 NORTH AMERICA: MARKET SIZE, BY END USE, 2017–2020 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY AFTERMARKET, 2017–2020 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY AFTERMARKET, 2021–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY VARIABLE PITCH TYPE, 2017–2020 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY VARIABLE PITCH TYPE, 2021–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY ENGINE, 2017–2020 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY ENGINE, 2021–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.1.1 US

12.2.1.1.1 Presence of various leading manufacturers of aircraft propeller systems to drive market growth in US

TABLE 46 US: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 47 US: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.2.1.2 Canada

12.2.1.2.1 Increased demand for lightweight and fuel-efficient aircraft to drive market in Canada

TABLE 50 CANADA: MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 51 CANADA: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 52 CANADA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 53 CANADA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3 EUROPE

12.3.1 PESTEL ANALYSIS: EUROPE

FIGURE 31 EUROPE AIRCRAFT PROPELLER SYSTEM MARKET SNAPSHOT

TABLE 54 EUROPE: MARKET SIZE, BY END USE, 2017–2020 (USD MILLION)

TABLE 55 EUROPE: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY AFTERMARKET, 2017–2020 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY AFTERMARKET, 2021–2026 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY VARIABLE PITCH TYPE, 2017–2020 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY VARIABLE PITCH TYPE, 2021–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY ENGINE, 2017–2020 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY ENGINE, 2021–2026 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 EUROPE: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.1.1 France

12.3.1.1.1 Increasing competition between various airlines to drive market growth in France

TABLE 70 FRANCE: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 71 FRANCE: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 72 FRANCE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 73 FRANCE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.1.2 Germany

12.3.1.2.1 Aftermarket growth to drive aircraft propeller systems market in Germany

TABLE 74 GERMANY: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 75 GERMANY: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 76 GERMANY: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 77 GERMANY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.1.3 UK

12.3.1.3.1 Replacement of existing fleet with fuel-efficient aircraft to lead to growth of aircraft propeller system market in UK

TABLE 78 UK: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 79 UK: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 80 UK: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 81 UK: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.1.4 Italy

12.3.1.4.1 Presence of MRO service providers to support market growth in Italy

TABLE 82 ITALY: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 83 ITALY: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 84 ITALY: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 85 ITALY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.1.5 Rest of Europe

12.3.1.5.1 Development of commercial airlines to drive market for aircraft propeller systems

TABLE 86 REST OF EUROPE: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 87 REST OF EUROPE: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 88 REST OF EUROPE ALY: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 89 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 32 ASIA PACIFIC AIRCRAFT PROPELLER SYSTEM MARKET SNAPSHOT

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY END USE, 2017–2020 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY AFTERMARKET, 2017–2020 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY AFTERMARKET, 2021–2026 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY VARIABLE PITCH TYPE, 2017–2020 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY VARIABLE PITCH TYPE, 2021–2026 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY ENGINE, 2017–2020 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY ENGINE, 2021–2026 (USD MILLION)

TABLE 104 ASIA PACIFIC: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.1.1 China

12.4.1.1.1 Demand for aircraft equipped with advanced propeller systems expected to fuel market growth in China

TABLE 106 CHINA: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 107 CHINA: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 108 CHINA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 CHINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.1.2 Japan

12.4.1.2.1 Increasing number of new aircraft orders expected to drive market growth in Japan

TABLE 110 JAPAN: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 111 JAPAN: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 112 JAPAN: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 JAPAN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.1.3 India

12.4.1.3.1 Increasing procurement for military aircraft equipped with turboprop and piston engines to drive market growth in India

TABLE 114 INDIA: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 115 INDIA: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 116 INDIA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 INDIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.1.4 Australia

12.4.1.4.1 With growing aviation industry, demands for aircraft deliveries increasing in Australia

TABLE 118 AUSTRALIA: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 119 AUSTRALIA: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 120 AUSTRALIA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 AUSTRALIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.1.5 Rest of Asia Pacific

12.4.1.5.1 Replacement of old, matured aircraft with advanced next-generation aircraft will boost market for aircraft propeller systems

TABLE 122 REST OF ASIA PACIFIC: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 124 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 125 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 126 ROW: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY END USE, 2017–2020 (USD MILLION)

TABLE 127 ROW: MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

TABLE 128 ROW: MARKET SIZE, BY AFTERMARKET, 2017–2020 (USD MILLION)

TABLE 129 ROW: MARKET SIZE, BY AFTERMARKET, 2021–2026 (USD MILLION)

TABLE 130 ROW: MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 131 ROW: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 132 ROW: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 133 ROW: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 134 ROW: MARKET SIZE, BY VARIABLE PITCH TYPE, 2017–2020 (USD MILLION)

TABLE 135 ROW: MARKET SIZE, BY VARIABLE PITCH TYPE, 2021–2026 (USD MILLION)

TABLE 136 ROW: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 137 ROW: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 138 ROW: MARKET SIZE, BY ENGINE, 2017–2020 (USD MILLION)

TABLE 139 ROW: MARKET SIZE, BY ENGINE, 2021–2026 (USD MILLION)

TABLE 140 ROW: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 141 ROW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.5.1 PESTLE ANALYSIS: REST OF THE WORL

12.5.1.1 Latin America

12.5.1.1.1 Large number of aerospace firms in Mexico and Brazil drives market growth in Latin America

TABLE 142 LATIN AMERICA: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.5.1.2 Middle East

12.5.1.2.1 Popularity of aircraft using propeller systems for short to mid-range trips to drive market growth in Middle East

TABLE 146 MIDDLE EAST: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 147 MIDDLE EAST: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 148 MIDDLE EAST: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 149 MIDDLE EAST: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.5.1.3 AFRICA

12.5.1.3.1 Development of new and advanced UAVs to aid defense forces will boost market for aircraft propeller systems in Africa

TABLE 150 AFRICA: AIRCRAFT PROPELLER SYSTEM MARKET SIZE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 151 AFRICA: MARKET SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 152 AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 153 AFRICA: AIRCRAFT PROPELLER SYSTEMS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 146)

13.1 INTRODUCTION

TABLE 154 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRCRAFT PROPELLER SYSTEM MARKET BETWEEN 2017 AND 2021

13.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

FIGURE 33 REVENUE ANALYSIS OF LEADING PLAYERS IN AIRCRAFT PROPELLER SYSTEMS MARKET, 2020

13.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

FIGURE 34 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN AIRCRAFT PROPELLER SYSTEMS MARKET, 2020

TABLE 155 AIRCRAFT PROPELLER SYSTEM MARKET: DEGREE OF COMPETITION

13.4 COMPANY EVALUATION QUADRANT

13.4.1 AIRCRAFT PROPELLER SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING

13.4.1.1 Star

13.4.1.2 Emerging Leaders

13.4.1.3 Pervasive

13.4.1.4 Participant

FIGURE 35 AIRCRAFT PROPELLER SYSTEMS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

13.4.2 AIRCRAFT PROPELLER SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

13.4.2.1 Progressive companies

13.4.2.2 Responsive companies

13.4.2.3 Starting blocks

13.4.2.4 Dynamic companies

FIGURE 36 AIRCRAFT PROPELLER SYSTEMS MARKET (SME) COMPETITIVE LEADERSHIP MAPPING, 2020

13.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 156 COMPANY FOOTPRINT

TABLE 157 COMPANY PRODUCT FOOTPRINT

TABLE 158 COMPANY REGION FOOTPRINT

13.6 COMPETITIVE SCENARIO AND TRENDS

13.6.1 DEALS

TABLE 159 AIRCRAFT PROPELLER SYSTEM MARKET, DEALS, 2017–2021

13.6.2 PRODUCT LAUNCHES

TABLE 160 AIRCRAFT PROPELLER SYSTEMS MARKET, PRODUCT LAUNCHES, 2017–2021

14 COMPANY PROFILES (Page No. - 160)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 RAYTHEON TECHNOLOGIES

TABLE 161 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 37 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 162 RAYTHEON TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.2 HARTZELL PROPELLER

TABLE 163 HARTZELL PROPELLER: BUSINESS OVERVIEW

TABLE 164 HARTZELL PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 165 HARTZELL PROPELLER: PRODUCT DEVELOPMENTS

TABLE 166 HARTZELL PROPELLER: DEALS

14.2.3 MT-PROPELLER

TABLE 167 MT-PROPELLER: BUSINESS OVERVIEWS

TABLE 168 MT-PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 169 MT-PROPELLER: DEALS

14.2.4 DOWTY PROPELLERS

TABLE 170 DOWTY PROPELLERS: BUSINESS OVERVIEW

TABLE 171 DOWTY PROPELLERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 DOWTY PROPELLERS: DEALS

14.2.5 MCCAULEY PROPELLER

TABLE 173 MCCAULEY PROPELLER: BUSINESS OVERVIEW

TABLE 174 MCCAULEY PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 175 MCCAULEY PROPELLER: DEAL

14.2.6 AIRMASTER PROPELLERS

TABLE 176 AIRMASTER PROPELLERS: BUSINESS OVERVIEW

TABLE 177 AIRMASTER PROPELLERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.7 HÉLICES PROPS

TABLE 178 HELICES PROPS: BUSINESS OVERVIEW

TABLE 179 HELICES PROPS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.8 FP PROPELLER

TABLE 180 FP PROPELLER: BUSINESS OVERVIEW

TABLE 181 FP PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.9 WHIRLWIND PROPELLER

TABLE 182 WHIRLWIND PROPELLER: BUSINESS OVERVIEW

TABLE 183 WHIRLWIND PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.10 SENSENICH PROPELLER

TABLE 184 SENSENICH PROPELLER: BUSINESS OVERVIEW

TABLE 185 SENSENICH PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.11 HERCULES PROPELLER

TABLE 186 HERCULES PROPELLER: BUSINESS OVERVIEW

TABLE 187 HERCULES PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.12 AEROSILA

TABLE 188 AEROSILA: BUSINESS OVERVIEW

TABLE 189 AEROSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.13 GSC SYSTEMS

TABLE 190 GSC SYSTEMS: BUSINESS OVERVIEW

TABLE 191 GSC SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.14 JABIRU AIRCRAFT

TABLE 192 JABIRU AIRCRAFT: BUSINESS OVERVIEW

TABLE 193 JABIRU AIRCRAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.15 PETER DE NECKER

TABLE 194 PETER DE NECKER: BUSINESS OVERVIEW

TABLE 195 PETER DE NECKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.16 DUC HELICE

TABLE 196 DUC HELICE: BUSINESS OVERVIEW

TABLE 197 DUC HELICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.17 HOFFMANN PROPELLER

TABLE 198 HOFFMANN PROPELLER: BUSINESS OVERVIEW

TABLE 199 HOFFMANN PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.18 WINDSOR PROPELLER

TABLE 200 WINDSOR PROPELLER: BUSINESS OVERVIEW

TABLE 201 WINDSOR PROPELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.19 CULVER PROPS

TABLE 202 CULVER PROPS: BUSINESS OVERVIEW

TABLE 203 CULVER PROPS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.20 IVO ZDARSKY

TABLE 204 IVO ZDARSKY: BUSINESS OVERVIEW

TABLE 205 IVO ZDARSKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3 OTHER PLAYERS

14.3.1 CATTO PROPELLERS

TABLE 206 CATTO PROPELLERS: BUSINESS OVERVIEW

TABLE 207 CATTO PROPELLERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.2 POWERFIN PROPELLERS

TABLE 208 POWERFIN PROPELLERS: BUSINESS OVERVIEW

TABLE 209 POWERFIN PROPELLERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.3 E-PROPS

TABLE 210 E-PROPS: BUSINESS OVERVIEW

TABLE 211 E-PROPS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.4 AERO COMPANY

TABLE 212 AERO COMPANY: BUSINESS OVERVIEW

TABLE 213 AERO COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.5 GEIGER ENGINEERING GMBH

TABLE 214 GEIGER ENGINEERING GMBH: BUSINESS OVERVIEW

TABLE 215 GEIGER ENGINEERING GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 195)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 RELATED REPORTS

15.4 AUTHOR DETAILS

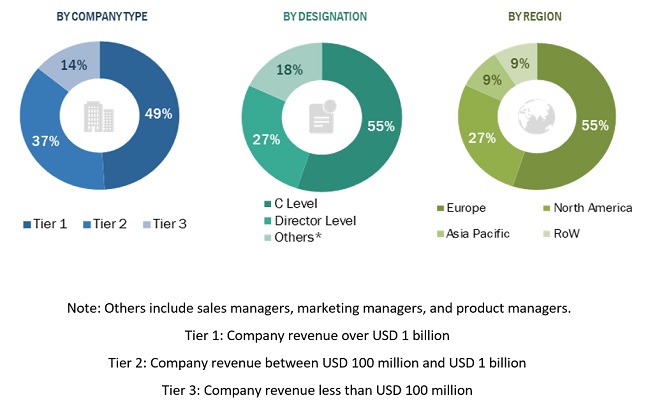

The research study conducted on the Aircraft Propeller System market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the Aircraft Propeller Systems market. The primary sources considered included industry experts from the Aircraft Propeller System market consisting of Aircraft Propeller System service providers, government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the Aircraft Propeller System as well as to assess the growth prospects of the market.

Secondary Research

Secondary sources referred for this research study included Boeing and Airbus Market Outlook 2019, General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications; Flight Global World Airforce Fleet; Stockholm International Peace Research Institute, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

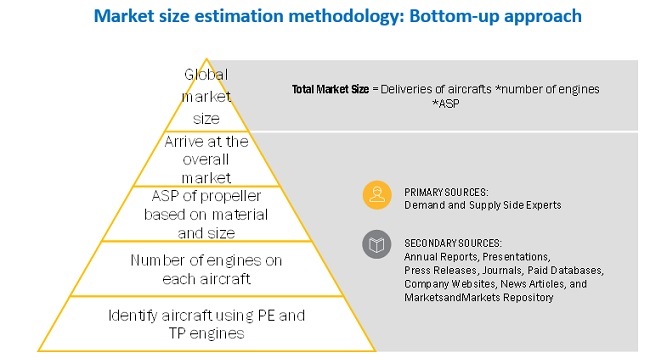

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Aircraft Propeller System market. The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews with industry experts with knowledge on Aircraft Propeller System

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data triangulation

The bottom-up approach was employed to arrive at the overall size of the aircraft propeller system market by determining the revenues of key players and their share in the market. Calculations based on the revenues of the key players identified in the market have led to the estimation of the overall size of the aircraft propeller systems market.

The bottom-up approach was also implemented for the data extracted from secondary research to validate the revenues obtained for different segments of the aircraft propeller system market. The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the overall size of the parent market and each individual market was determined and confirmed in this study.

Report Objectives

- To analyze the aircraft propeller system market and provide forecast from 2021 to 2026

- To define, describe, and forecast the size of the market based on end use, platform, component, engine, and type along with a regional analysis

- To understand the market structure by identifying its various subsegments

- To provide in-depth market intelligence regarding the dynamics (drivers, restraints, opportunities, and challenges) and major factors that influence the growth of the market

- To analyze opportunities in the market for stakeholders by identifying key trends

- To forecast the size of various segments of the market with respect to major countries, such as the US, China, the UK, Germany, France, Russia, India, Japan, South Korea, and Israel, among others

- To strategically analyze micro markets with respect to individual growth trends, prospects, and their contribution to the aircraft propeller system market

- To provide a detailed competitive landscape of the market, along with an analysis of the business and corporate strategies adopted by key market players

- To analyze competitive developments of key players in the market, such as contracts, acquisitions, partnerships, expansions, and new product developments

- To strategically profile key market players and comprehensively analyze their core competencies

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Propeller System Market