Air and Missile Defense Radar (AMDR) Market by Range (Short, Medium, Long & Strategic System), Application (Ballistic Missile Defense, Conventional), Platform (Ground Based, Naval, Airborne) & by Region - Global Forecast to 2021

The AMDR market is estimated to be valued at USD 8.79 Billion in 2016 and is projected to reach USD 12.52 Billion by 2021, at a CAGR of 7.34% from 2016 to 2021. The report considers the following segments to define, describe, and forecast the AMDR market: By Platform (ground-based, naval-based, airborne), By Range (short range, medium range and long range strategic system), By Application (conventional and ballistic missile defense) and By Region (North America, Europe, Asia-Pacific, Middle East and Africa, Rest of the World).

Years considered for this study are 2014 as the base year and the projections are made up to 2021. Radars play a vital role in the defense industry. For instance, the United States has an elaborate ballistic missile early warning system (BMEWS) to detect incoming missiles. Multifunctional radars are the upcoming technological advancements in the surveillance industry that have huge potential to drive this market globally.

The global air and missile defence radar (AMDR) market was valued at USD 8.79 Billion in 2016 and is projected to reach USD 12.52 Billion by 2021, at a CAGR of 7.34% from 2016 to 2021. Increased concerns towards prevention from ballistic and stealth missiles, target racking and early warning, airborne fire control, surveillance, and ground mapping, among others, are driving the demand for AMDRs across the globe.

Ground-based AMDRs have the largest share in the global AMDR market in 2016. These systems are mostly used for military and homeland security application. X-band and S-band radars are widely used for ground-based AMDR application, whereas naval radars are used for naval surveillance and target detection, such as ballistic 7 stealth missile, and long range artilleries, among others. These systems are also used for monitoring drug trafficking, smuggling, piracy, illicit fishing, and terrorism. Airborne AMDR systems are widely used for air space surveillance, intrusion detection, early warning systems, and missile defence application.

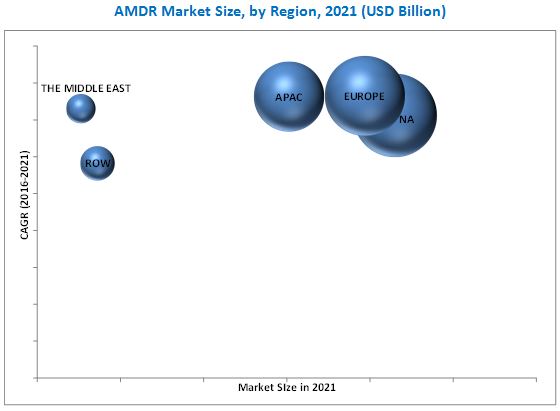

The global air and missile defense radar market, on the basis of region, is dominated by North American countries that include the U.S. and Canada. North America has the highest share in the global AMDR market. High demand for air surveillance systems, and air and missile defence radars in the U.S. is majorly driven by the AMDR program, the three dimensional expeditionary long range radar (3DELRR) program, space fence program, procurement of AN/TPS- 59, AN/TPS-63, And AN/TPS- 80 radar systems, and the acoustic rapid COTS Insertion (A - RCI) program.

New-age war tactics present numerous challenges for automation of AMDR systems. AMDR systems are not fool-proof. Cyber hacking of fully automated AMDRs may result in unrecoverable damage to critical infrastructure and country security. False signals may prevent from detection of actual targets, such as ballistic and stealth missiles adding to the challenge. Communication loss, scrambled pilot radios and information stealing are the probable outcomes of a cyberattack.

Basically, Lockheed Martin stands as one of the world's premier companies in aerospace, defence, security, and technologies industry. It is world's largest defence contractor. Lockheed Martin operates in five business segments namely, aeronautics, information systems and global solutions, missiles and fire control, mission systems and training, and space systems. Its space and defence solutions, including advanced missile defense systems, naval systems, radar systems, electronic warfare and unmanned system, among others, offer high-quality security capabilities to their customers across the globe. The major competitors of Lockheed Martin are Israel Aerospace Industries, Boeing, Raytheon, General Dynamics, Northrop Grumman Inc., Reutech Radar Ltd (South Africa), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Periodization

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increased Fatalities During the Active Conflicts

2.2.2.2 Air-SPAce Violation Incidents

2.2.2.3 Total Fleets Size

2.2.3 Supply-Side Indicators

2.2.3.1 Rise in Research and Development Activities

2.2.3.2 Advancements in Efficient Materials

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 37)

4 Premium Insights (Page No. - 43)

4.1 Attractive Market Opportunities in AMDR Market

4.2 Air and Missile Defense Radar (AMDR) Market, By Range

4.3 North America AMDR Market, By Platform

4.4 Air and Missile Defense Radar Market, By Application

4.5 AMDR Market, By Region

4.6 Air and Missile Defense Radar Market, By Range

4.7 Air and Missile Defense Radar Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 50)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 AMDR Market, By Platform

5.3.2 Air and Missile Defense Radar Market, By Range

5.3.3 Air and Missile Defense Radar Market, By Application

5.3.4 Air and Missile Defense Radar Market, By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Replacement of Legacy Systems By Militaries Globally Due to Technological Evolution in Warfare

5.4.1.2 Territorial Conflicts and Geopolitical Instabilities in the Middle East and the Asia-Pacific Region

5.4.1.3 Miniaturization and Automation of Defense and Surveillance Systems

5.4.2 Restraints

5.4.2.1 Hindrance in Performance Due to Growing Cyber Warfare

5.4.3 Opportunities

5.4.3.1 Growing Deployment of Ballistic Missiles, and Air and Missile Defense Systems

5.4.4 Challenges

5.4.4.1 Electromagnetic Jamming and Noise Interruptions

5.4.5 Burning is sues

5.4.5.1 Incapability of AMDRs in Detecting Uavs, Stealth Aircrafts and Ballistic Missiles

6 Industry Trends (Page No. - 62)

6.1 Introduction

6.2 Patent Analysis

6.3 Technology Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 AMDR Market, By Platform (Page No. - 72)

7.1 Introduction

7.2 Ground-Based

7.3 Naval-Based

7.4 Airborne-Based

8 AMDR Market, By Range (Page No. - 80)

8.1 Introduction

8.2 Short Range

8.3 Medium Range

8.4 Long Range & Strategic System

9 AMDR Market, By Application (Page No. - 87)

9.1 Introduction

9.2 Ballistic Missile Defense

9.3 Conventional

10 AMDR Market, By Region (Page No. - 93)

10.1 Introduction

10.2 North America

10.2.1 By Platform

10.2.2 By Range

10.2.3 By Application

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Platform

10.2.4.1.2 By Range

10.2.4.2 Canada

10.2.4.2.1 By Platform

10.2.4.2.2 By Range

10.3 Asia-Pacific

10.3.1 By Platform

10.3.2 By Range

10.3.3 By Application

10.3.4 By Country

10.3.4.1 China

10.3.4.1.1 By Platform

10.3.4.1.2 By Range

10.3.4.2 India

10.3.4.2.1 By Platform

10.3.4.2.2 By Range

10.3.4.3 Japan

10.3.4.3.1 By Platform

10.3.4.3.2 By Range

10.3.4.4 South Korea

10.3.4.4.1 By Platform

10.3.4.4.2 By Range

10.3.4.5 Australia

10.3.4.5.1 By Platform

10.3.4.5.2 By Range

10.3.4.6 Others

10.3.4.6.1 By Platform

10.3.4.6.2 By Range

10.4 Europe

10.4.1 By Platform

10.4.2 By Range

10.4.3 By Application

10.4.4 By Country

10.4.4.1 Russia

10.4.4.1.1 By Platform

10.4.4.1.2 By Range

10.4.4.2 France

10.4.4.2.1 By Platform

10.4.4.2.2 By Range

10.4.4.3 U.K.

10.4.4.3.1 By Platform

10.4.4.3.2 By Range

10.4.4.4 Germany

10.4.4.4.1 By Platform

10.4.4.4.2 By Range

10.4.4.5 Italy

10.4.4.5.1 By Platform

10.4.4.5.2 By Range

10.4.4.6 Others

10.4.4.6.1 By Platform

10.4.4.6.2 By Range

10.5 The Middle East

10.5.1 By Platform

10.5.2 By Range

10.5.3 By Application

10.5.4 By Country

10.5.4.1 Saudi Arabia

10.5.4.1.1 By Platform

10.5.4.1.2 By Range

10.5.4.2 Israel

10.5.4.2.1 By Platform

10.5.4.2.2 By Range

10.5.4.3 Others

10.5.4.3.1 By Platform

10.5.4.3.2 By Range

10.6 Rest of the World

10.6.1 By Platform

10.6.2 By Range

10.6.3 By Application

10.6.4 By Country

10.6.4.1 Brazil

10.6.4.1.1 By Platform

10.6.4.1.2 By Range

10.6.4.2 Others

10.6.4.2.1 By Platform

10.6.4.2.2 By Range

11 Competitive Landscape (Page No. - 143)

11.1 Introduction

11.2 Platform-Based Ranking Matrix for Key Market Players

11.3 Supply Contracts Was the Key Strategy Between 2013 and 2015

11.3.1 Contract

11.3.2 New Product Launch

11.3.3 Other Developments

12 Company Profiles (Page No. - 153)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Lockheed Martin Corporation

12.3 Northrop Grumman Corporation

12.4 Raytheon Company

12.5 SAAB Group

12.6 Thales Group

12.7 Airbus Group

12.8 BAE Systems

12.9 General Dynamics

12.10 Israel Aerospace Industries Ltd.

12.11 Finmeccanica SPA

12.12 Almaz-Antey

12.13 Reutech Radar Systems

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 184)

13.1 Discussion Guide

13.2 Introducing RT: Real Time Market Intelligence

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

List of Tables (89 Tables)

Table 1 Number of Active Conflicts

Table 2 Fatalities in the Active Conflicts, 2008 to 2014

Table 3 High Risk Incidents Involving Russia and Nato in 2014

Table 4 Total Fleets Size, 2012-2013

Table 5 Number of Active Conflicts and Death Casualties Due to Missile Attacks Across the Globe Between 2008 and 2014

Table 6 Military Expenditure By Developed Economies as Percentage of GDP, 2005-2014

Table 7 Patent Analysis, 2003-2013

Table 8 Bargaining Power of Buyers is Expected to Have High Influence on the Market

Table 9 Threat of New Entrants

Table 10 Threat of Substitutes

Table 11 Bargaining Power of Suppliers

Table 12 Bargaining Power of Buyers

Table 13 Global Air and Missile Defense Radar Market Size 2016-2021 (USD Million)

Table 14 Ground-Based AMDR Market Size, By Region, 2016-2021 (USD Million)

Table 15 The Asia-Pacific Region is Expected to Register the Highest CAGR for Naval-Based AMDR Between 2016 and 2021

Table 16 Naval-Based AMDR Market Size, By Region 2016-2021 (USD Million)

Table 17 Airborne AMDR Market Size, By Region, 2016-2021 (USD Million)

Table 18 Air and Missile Defense Radar (AMDR) Market Size, By Range, 2014-2021 (USD Billion)

Table 19 Short Range AMDR Market Size, By Region, 2014-2021 (USD Million)

Table 20 Medium Range AMDR Market Size, 2014-2021 (USD Million)

Table 21 Market Size of Long Range and Strategic System AMDR, 2014-2021 (USD Million)

Table 22 AMDR Market Size, By Application, 2014-2021 (USD Billion)

Table 23 Market Size of Ballistic Missile Defense Radar, By Region, 2014-2021 (USD Million)

Table 24 Market Size of Conventional AMDR, By Region, 2014-2021 (USD Million)

Table 25 Global AMAir and Missile Defense Radar (AMDR) Market Size, By Region, 2014-2021 (USD Mllion)

Table 26 Global Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 27 Global Air and Missile Defense Radar (AMDR) Market Size, By Range, 2014-2021 (USD Million)

Table 28 Global Air and Missile Defense Radar Market Size, By Application, 2014-2021 (USD Million)

Table 29 North America: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 30 North America: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 31 North America: AMDR Market Size, By Application, 2014-2021 (USD Million)

Table 32 North America: AMDR Market Size, By Country, 2014-2021 (USD Million)

Table 33 U.S. : Air and Missile Defense Radar (AMDR) Market Size, By Platform, 2014-2021 (USD Million)

Table 34 U.S. : AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 35 Canada : AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 36 Canada : Air and Missile Defense Radar (AMDR) Market Size, By Range, 2014-2021 (USD Million)

Table 37 Asia-Pacific: Air and Missile Defense Radar (AMDR) Market Size, By Platform, 2014-2021 (USD Million)

Table 38 Asia-Pacific: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 39 Asia-Pacific: AMDR Market Size, By Application, 2014-2021 (USD Million)

Table 40 Asia-Pacific: AMDR Market Size, By Country, 2014-2021 (USD Million)

Table 41 China: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 42 China: Air and Missile Defense Radar (AMDR) Market Size, By Range, 2014-2021 (USD Million)

Table 43 India: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 44 India: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 45 Japan: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 46 Japan: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 47 South Korea: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 48 South Korea: Air and Missile Defense Radar (AMDR) Market Size, By Range, 2014-2021 (USD Million)

Table 49 Australia: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 50 Australia: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 51 Others: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 52 Others: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 53 Europe: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 54 Europe: Air and Missile Defense Radar (AMDR) Market Size, By Range, 2014-2021 (USD Million)

Table 55 Europe: AMDR Market Size, By Application, 2014-2021 (USD Million)

Table 56 Europe: AMDR Market Size, By Country, 2014-2021 (USD Million)

Table 57 Russia: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 58 Russia: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 59 France: Air and Missile Defense Radar (AMDR) Market Size, By Platform, 2014-2021 (USD Million)

Table 60 France: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 61 U.K.: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 62 U.K.: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 63 Germany: Air and Missile Defense Radar (AMDR) Market Size, By Platform, 2014-2021 (USD Million)

Table 64 Germany: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 65 Italy: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 66 Italy: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 67 Others: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 68 Others: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 69 The Middle East: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 70 The Middle East: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 71 The Middle East: AMDR Market Size, By Application, 2014-2021 (USD Million)

Table 72 The Middle East: AMDR Market Size, By Country, 2014-2021 (USD Million)

Table 73 Saudi Arabia: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 74 Saudi Arabia: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 75 Israel: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 76 Israel: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 77 Others: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 78 Others: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 79 Rest of the World: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 80 Rest of the World: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 81 RoW : AMDR Market Size, By Application, 2014-2021 (USD Million)

Table 82 Rest of the World: AMDR Market Size, By Country, 2014-2021 (USD Million)

Table 83 Brazil: Air and Missile Defense Radar Market Size, By Platform, 2014-2021 (USD Million)

Table 84 Brazil: Air and Missile Defense Radar Market Size, By Range, 2014-2021 (USD Million)

Table 85 Others: AMDR Market Size, By Platform, 2014-2021 (USD Million)

Table 86 Others: AMDR Market Size, By Range, 2014-2021 (USD Million)

Table 87 Contract, 2015

Table 88 New Product Launch, 2015

Table 89 Other Developments, 2015

List of Figures (75 Figures)

Figure 1 Study Scope : AMDR Market

Figure 2 Report Flow

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Number of Active Conflicts, 2008-2014

Figure 6 Fatalities in the Active Conflicts, 2008 to 2014

Figure 7 Total Fleets Size, 2012-2013

Figure 8 Market Size Estimation Methodology : Bottom-Up Approach

Figure 9 Market Size Estimation Methodology : Top-Down Approach

Figure 10 Data Triangulation

Figure 11 Global AMDR Market Snapshot (2016 vs 2021): Market for Naval-Based AMDR Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 12 Long Range and Strategic Systems to Lead the AMDR Market, 2014-2021

Figure 13 Europe Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 14 China Projected to Be the Most Lucrative Market to Invest During 2016 to 2021

Figure 15 Supply Contracts is the Key Growth Strategy in 2016

Figure 16 Attractive Market Opportunities in the AMDR Market, 2016-2021

Figure 17 Long Range & Strategic System are the Most Lucarative in the Range Segment, 2014-2021

Figure 18 Naval Based Platform to Hold the Largest Market Share in Platform Segment, 2016-2021

Figure 19 Ballisitc Missile Defense Segment is Expected to Hold the Largest Market Share

Figure 20 North America is Expected to Lead in the Air and Missile Defense Radar Market During the Forecast Period

Figure 21 Long Range and Strategic System is Expected to Dominate the AMDR Market During the Forecast Period

Figure 22 Europe Market is Expected to Grow at the Highest Rate

Figure 23 Military Spending as A Percentage of GDP: 2014

Figure 24 Air and Missile Defense Radar Market : Technological Evolution

Figure 25 AMDR Market, By Platform

Figure 26 AMDR Market, By Range

Figure 27 AMDR Market, By Application

Figure 28 AMDR Market, By Region

Figure 29 Increased Territorial Conflicts are Driving the AMDR Market

Figure 30 Military Expenditure of Brics Economy, 2010 to 2014

Figure 31 Share of Military Expenditure is Falling in Developed Economies: 2005-2014

Figure 32 Technological Development is A Growing Trend in Air and Missile Defense Radar Market

Figure 33 Porter’s Five Forces Analysis (2015)

Figure 34 Porter’s Five Forces Analysis - 2015

Figure 35 Threat of New Entrants

Figure 36 Threat of Substitutes

Figure 37 Bargaining Power of Suppliers

Figure 38 Bargaining Power of Buyers

Figure 39 Naval-Based AMDR Segment is Expected to Grow at the Highest Rate During the Forecast Period

Figure 40 North America Estimated to Dominate the Ground-Based AMDR Market in 2016

Figure 41 North America to Capture the Largest Share of Airborne AMDR Market During the Forecast Period

Figure 42 Long Range Strategic System AMDR Market is Expected to Grow at the Highest Rate During the Forecast Period

Figure 43 North America Expected to Dominate the Short Range AMDR Market Over the Next Five Years

Figure 44 Asia-Pacific Region Expected to Register Highest CAGR for Medium Range AMDR From 2016 to 2021

Figure 45 Asia-Pacific Region Expected to Register Highest CAGR for Long Range and Strategic Range AMDR From 2016 to 2021

Figure 46 Ballistic Missile Defence Application of AMDR is Expected to Grow at the Highest Rate During the Forecast Period

Figure 47 North America Region is Expected to Hold the Largest Share in the AMDR Market

Figure 48 Asia-Pacific Region is Expected to Register the Highest CAGR for Conventional Application of AMDR From 2016 to 2021

Figure 49 North America Estimated to Capture the Largest Share of the AMDR Market in 2016

Figure 50 North America Snapshot: the U.S Projected to Have Highest Growth Potential During the Forecast Period

Figure 51 Asia-Pacific Snapshot: China Projected to Have Highest Growth Potential During the Forecast Period

Figure 52 Europe Snapshot: Russia is Projected to Have Highest Growth Potential During the Forecast Period

Figure 53 The Middle East Snapshot: Israel is Projected to Have Highest Growth Potential During the Forecast Period

Figure 54 Rest of the World Snapshot: Brazil is Projected to Have Highest Growth Potential During the Forecast Period

Figure 55 Companies Adopted Contracts & New Product Launches as Key Growth Strategies From 2014 to 2016

Figure 56 Key Players in Airborne Segment in AMDR Market, 2014

Figure 57 Key Players in Naval Segment in the AMDR Market, 2014

Figure 58 Key Players in Land-Based Segment in AMDR Market, 2014

Figure 59 Competitive Situation and Trends: 2013-2015

Figure 60 Regional Revenue Mix of Top Five Market Players

Figure 61 Lockheed Martin Corporation: Company Snapshot

Figure 62 Lockheed Martin Corporation: SWOT Analysis

Figure 63 Northrop Grumman Corporation: Company Snapshot

Figure 64 Northrop Grumman Corporation: SWOT Analysis

Figure 65 Raytheon Company: Company Snapshot

Figure 66 Raytheon Company: SWOT Analysis

Figure 67 SAAB Group: Company Snapshot

Figure 68 SAAB Group: SWOT Analysis

Figure 69 Thales Group: Company Snapshot

Figure 70 Thales Group: SWOT Analysis

Figure 71 Airbus Group: Company Snapshot

Figure 72 BAE Systems: Company Snapshot

Figure 73 General Dynamics: Company Snapshot

Figure 74 Israel Aerospace Indutries Ltd.: Company Snapshot

Figure 75 Finmeccanica SPA: Company Snapshot

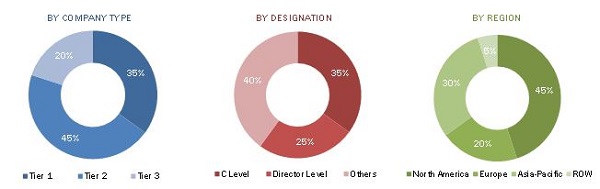

The research methodology used to estimate and forecast the AMDR market begins with capturing data on key AMDR equipment revenues through secondary research. The AMDR system offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global AMDR market from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments that are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the AMDR market comprises defense establishments, aerospace industry, and AMDR radar manufacturers’ facilities, among other. This report would help the AMDR system suppliers, army, navy, air force, government and regulatory authorities to identify hot revenue pockets in this market.

Target Audience for this Report:

- All departments pertaining to AMDR

- Armed services

- Defense system manufacturers

- Defense software providers

- Sub-component manufacturers

- Original equipment manufacturers (OEM’s)

- Component suppliers

- Aerospace and defense industry

- Aircraft, drone and UAV manufacturers

“Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments”.

Scope of the Report

This research report categorizes the AMDR market into the following segments and subsegments:

Global AMDR Market, By Range

- Short range

- Medium range

- Long range strategic system

Global AMDR Market, By Platform

- Ground-based

- Naval-based

- Airborne

Global AMDR Market, By Application

- Conventional

- Ballistic missile defense

Global AMDR Market, By Geography

-

North America

- U.S.

- Canada

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

-

Europe

- Russia

- France

- U.K.

- Germany

-

Middle East & Africa

- Saudi Arabia

- UAE

- Israel

-

RoW

- Brazil

- Other

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

-

Geographic Analysis

- Further breakdown of the Rest of the World market

-

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Air and Missile Defense Radar (AMDR) Market