Double-sided Tape Market by Resin Type (Acrylic, Rubber, Silicone), Technology (Solvent borne, Waterborne, Hot-melt-based), Tape-Backing Material (Foam-backed, Film-backed, Paper-/Tissue-backed), End-Use Industry, & Region - Global Forecast to 2028

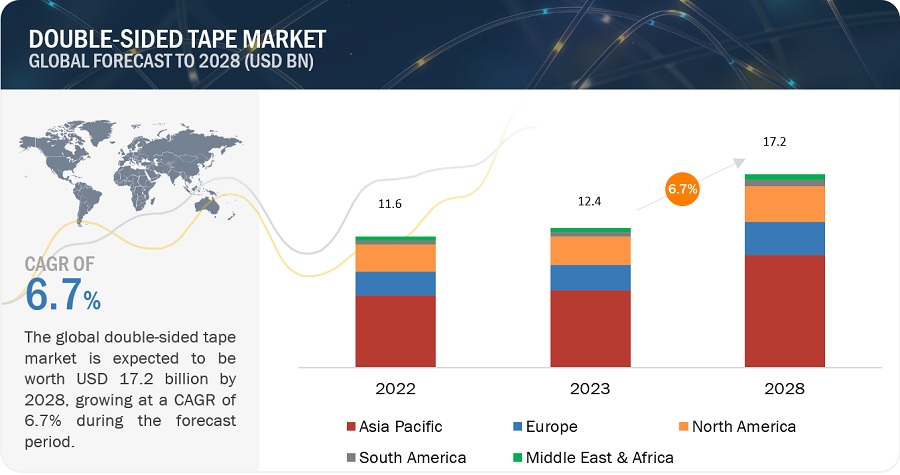

The double-sided tape market is projected to grow from USD 11.6 billion in 2022 to USD 17.2 billion by 2028, at a CAGR of 6.7% between 2023 and 2028. Growing demand from packaging industry is a major factor behind the growth of the market.

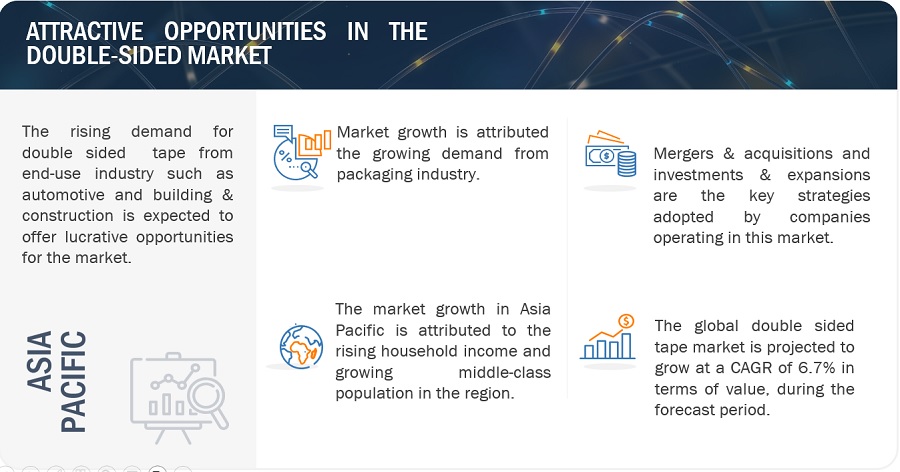

Attractive Opportunities in the Double-Sided Tape Market

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Double-Sided Tape Market Dynamics

Drivers: Growing demand from packaging industry

The growing presence in less developed countries is one of the key factors driving the packaging sector. There has been an increase in demand for packaged goods as a result of more people moving to metropolitan areas and adopting westernised culturesand lifestyles. The expanding e-commerce market has helped to further accelerate this trend on a worldwide level.

The modern consumer's preference for consuming goods like food, beverages, and pharmaceuticals while on the go has raised the demand for packaging solutions that are practical and safe. In this context, a key beneficiary is the flexible plastics industry, which offers solutions in line with changing consumer lifestyles.

Restraints: Increase in raw material price

Increased raw material costs have a big impact on the double-sided tape market. The primary obstacle is the steadily rising cost of raw materials. This increase is caused by supply chain disruption, geopolitical unrest, and changes in energy prices, all of which have a noticeable effect on the manufacturing costs experienced by double-sided tape producers. Therefore, the regulations present a formidable short-term restraint for the growth of the anti-corrosion coating market.

Opportunities: Potential substitutes to traditional fastening systems

While traditional techniques like screws and bolts are efficient, they come with complexity, weight, and aesthetic problems. It reduces vibrations, addressing numerous business difficulties. In high-temperature industries, double-sided tape is a flexible and long-lasting adhesive. It successfully binds tiny parts, fostering innovation in electronics and healthcare. Sustainability is vital, and eco-friendly formulations follow current trends in the green movement. Customization prospers, effectively providing individualized choices. The integration of sustainability, industry partnerships, market diversification, and R&D investment are all strategic imperatives.

Challenges: Impact of supply chain disruptions

In the adhesive market, the recent increase in the price of double-sided tape has become a strategic concern, prompting a closer investigation of the underlying causes of this price increase. Variations in the cost of these raw materials have an immediate impact on production costs, which affect pricing dynamics. Global supply chains have been subject to significant interruptions as a result of the COVID-19 pandemic, geopolitical unrest, natural calamities, and logistical challenges. These disruptions have resulted in delays, shortages, and increased transportation costs.

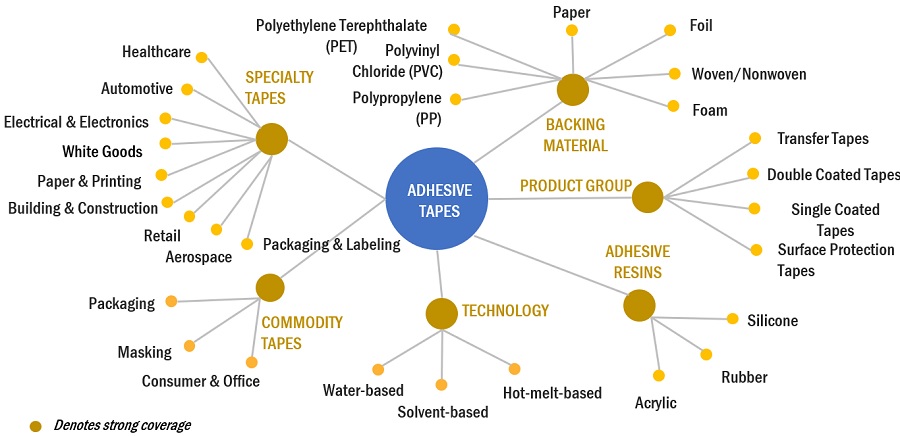

Double-sided Tape Market Ecosystem

The diagram below indicates MnM coverage of the adhesive tape ecosystem. KnowledgeStore provides strategic insights on each of the nodes in this ecosystem through a cloud-based , highly interactive market intelligence platform.

Acrylic by resin type accounted for the largest segment of double-sided tape market

Acrylic resin is the largest resin type segment in the overall double-sided tape market during forecasted period. These tapesstand out in a competitive market due toshort curing time, great resistance to oxidation, a wide temperature range, and the capacity to withstand UV rays. They also have exceptional anti-aging qualities and retain color consistency over time. Notably, they achieve an ideal level of water resistance and a high level of peel, tack, and shear strength by carefully balancing adhesion and cohesion.

To know about the assumptions considered for the study, download the pdf brochure

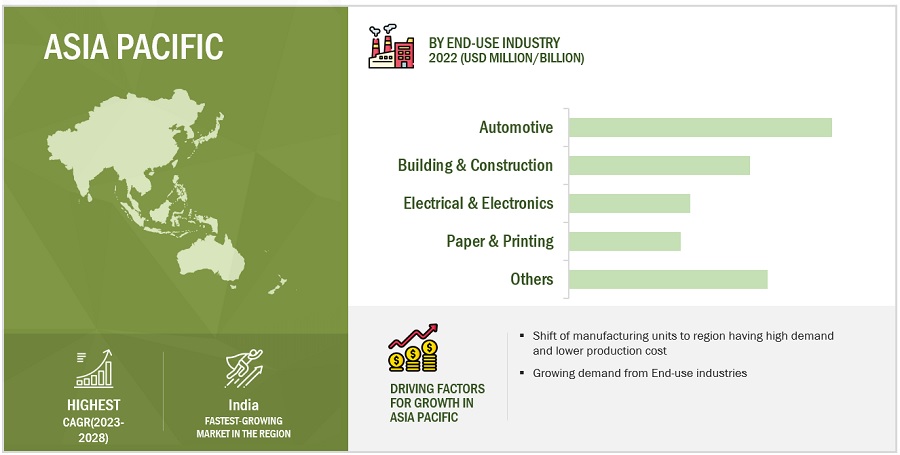

Asia Pacific is the largest growing double-sided tape market.

The Asia Pacific is the largest double-sided tape market, in terms of both, value and volume, and is projected to be the fastest-growing market during the forecast period. Rising household income and fast growing middle class population are the major drivers of double-sided tapes in Asia Pacific region. Asia Pacific is the most promising market and will remain such in the foreseeable future.

Key Market Players

3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Lintec Corporation (Japan), Avery Dennison Corporation (US) are the key players in the global double-sided tape market.

The 3M Company offers a broad range of products including adhesives, bonding materials, coatings, and specialty materials. The company operates through four business segments: Safety & Industrial, Transportation & Electronics, Healthcare, and Consumer. Through the electronics & energy segment, 3M supplies PSA tapes, electrical insulation, and fiber optic and copper-based telecommunications systems for the rapid deployment of rapidly deployed fixed and wireless networks. The company has production sites in 65 countries around the world. and offers products and solutions to customers in about 200 countries in the Americas, APAC, Europe, and the Middle East & Africa.

Read More: Double-Sided Tape Companies

Scope of the report

|

Report Metric |

Details |

|

Years Considered for the study |

2020-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments |

By Resin Type |

|

Regions covered |

Asia Pacific, Europe, North America, South America, Middle East & Africa |

|

Companies profiled |

3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Lintec Corporation (Japan), Avery Dennison Corporation (US). A total of 25 players have been covered. |

This research report categorizes the double-sided tape market based on Resin Type, Technology, Backing Material, End-use Industry, and Region.

By Resin Type:

- Acrylic

- Rubber

- Silicone

- Others

By Technology:

- Solvent-based

- Waterbased

- Hot-melt-based

By Tape-Backing Material:

- Foam-backed

- Film-backed

- Paper-/Tissue-backed

- Unsupported-/Transfer-backed

- Others

By End-use Industry:

- Automotive

- Building & Construction

- Electrical & Electronics

- Paper & Printing

- thers

By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Development

- In October 2019, 3M acquired Acelity Inc. (US) in October 2019. Acelity is a recognized leading provider of advanced wound care technologies and solutions and received USD 1.5 billion revenue in 2018. This acquisition is an excellent complement to 3M's Healthcare business and bolsters the company's medical solutions business and supports its growth by offering comprehensive, advanced, and surgical wound care solutions.

Frequently Asked Questions (FAQ):

What are the growth driving factors of double-sided tape?

High demand from the packaging industry is the major factor for driving double-sided tape market.

What are the major end-use for double-sided tape?

The major end-use industries of double-sided tape are automotive, building & construction, and electrical & electronics.

Who are the major manufacturers?

3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Lintec Corporation (Japan), Avery Dennison Corporation (US) are some of the leading players operating in the global double-sided tape market.

What are the reasons behind double-sided tape gaining market share?

Double-sided tape are gaining market share due to high demand from the packaging industry.

Which is the largest region in the double-sided tape coating market?

Asia Pacific is the largest region in double-sided tape market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand from packaging industry- Strategic use in electrical & electronics industryRESTRAINTS- Increase in raw material priceOPPORTUNITIES- Potential substitutes to traditional fastening productsCHALLENGES- Impact of supply chain disruptions

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRYTRENDS IN CONSUMER ELECTRONICS INDUSTRYTRENDS IN AUTOMOTIVE INDUSTRY

- 5.5 VALUE CHAIN ANALYSIS

- 6.1 INTRODUCTION

-

6.2 ACRYLICGOOD SHELF-LIFE AND FLEXIBILITY TO DRIVE MARKET

-

6.3 RUBBERHIGH DEMAND FROM BUILDING & CONSTRUCTION SECTOR TO DRIVE MARKET

-

6.4 SILICONEINCREASING DEMAND FROM AUTOMOTIVE AND ELECTRONICS INDUSTRY TO DRIVE MARKET

- 6.5 OTHER TYPES

- 7.1 INTRODUCTION

-

7.2 WATER-BASED TECHNOLOGYLOW TOXICITY AND VERSATILITY TO DRIVE MARKET

-

7.3 SOLVENT-BASED TECHNOLOGYEXCEPTIONAL PEEL AND SHEAR STRENGTH TO FUEL MARKET

-

7.4 HOT-MELT TECHNOLOGYEFFECTIVE BOND FORMATION AND HIGH PRODUCTION EFFICIENCY TO BOOST MARKET

- 8.1 INTRODUCTION

-

8.2 FOAM-BACKED TAPESLOAD-CARRYING CAPACITY AND SHOCK RESISTANCE TO DRIVE MARKET

-

8.3 FILM-BACKED TAPESLONG SHELF LIFE AND DURABILITY TO BOOST MARKET

-

8.4 PAPER/TISSUE-BACKED TAPESVERSATILE BONDING AND TEMPERATURE RESISTANCE TO FUEL MARKET

-

8.5 UNSUPPORTED/TRANSFER-BACKED TAPESLOW PRODUCT COST AND PREMIUM QUALITY FINISH TO DRIVE MARKET

- 8.6 OTHER BACKING MATERIAL

- 9.1 INTRODUCTION

-

9.2 AUTOMOTIVEENERGY EFFICIENCY AND LOWER MAINTENANCE COSTS TO DRIVE MARKET

-

9.3 BUILDING & CONSTRUCTIONRISE IN PRIVATE SECTOR INVESTMENTS AND INCREASING COMMERCIAL SPACES TO DRIVE DEMAND

-

9.4 ELECTRICAL & ELECTRONICSRESURGENCE IN ELECTRICAL & ELECTRONICS SECTOR TO DRIVE MARKET

-

9.5 PAPER & PRINTINGEASE OF USE AND HIGH VERSATILITY TO DRIVE MARKET

- 9.6 OTHER END-USE INDUSTRIES

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICCHINA- High demand for adhesive tapes to drive marketINDIA- Rapid growth of chemical and automotive sectors to drive marketJAPAN- Use of solvent-based technology in automotive sector to drive marketSOUTH KOREA- Stringent environmental regulations to drive marketTAIWAN- High rate of exports to boost marketINDONESIA- Availability of cheap labor and raw materials to propel marketVIETNAM- High economic growth to drive marketREST OF ASIA PACIFIC

-

10.3 NORTH AMERICAUS- Increase in demand from aerospace and electronics sectors to drive marketCANADA- Technological advancements to drive marketMEXICO- Rising demand from healthcare and automotive sectors to drive market

-

10.4 EUROPEGERMANY- Presence of major automotive companies to drive marketFRANCE- Growth of building & construction sector to fuel marketRUSSIA- Growing automotive sector to drive marketITALY- Strong demand from automotive industry to drive marketSPAIN- Growth of transportation sector to drive marketUK- Advanced technological infrastructure and increased R&D to attract foreign investmentsTURKEY- Growth of construction industry to drive marketNETHERLANDS- Rise in demand for adhesives in various industries to drive marketREST OF EUROPE

-

10.5 SOUTH AMERICABRAZIL- Growth of automotive and building & construction industries to drive marketARGENTINA- Rising population and improved economic conditions to increase demand for adhesive tapesCOLOMBIA- Increasing investments in healthcare and construction sector to drive marketREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICASOUTH AFRICA- Low production costs to fuel demand for double-sided tapesSAUDI ARABIA- Development of real estate sector to fuel demand for adhesive tapesREST OF MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

-

11.2 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.3 COMPANY FOOTPRINT

-

11.4 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 11.5 MARKET RANKING ANALYSIS

- 11.6 REVENUE ANALYSIS

- 11.7 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERS3M- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNITTO DENKO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTESA SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLINTEC CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewAVERY DENNISON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIPG- Business overview- Products/Solutions/Services offered- Recent developmentsSHURTAPE TECHNOLOGIES, LLC- Business overview- Products/Solutions/Services offeredSCAPA GROUP LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsLOHMANN GMBH & CO. KG- Business overview- Products/Solutions/Services offered- Recent developmentsNICHIBAN CO., LTD.- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSMACTACADCHEM CORPORATION (BERRY GLOBAL INC.)COROPLAST FRITZ MÜLLER GMBH & CO. KGCCT (COATING & CONVERTING TECHNOLOGIES, LLC) - AN ATP GROUP COMPANYGERGONNEECHOTAPEADVANCE TAPES INTERNATIONALAJIT INDUSTRIES PVT. LTD.ATP ADHESIVE SYSTEMS AGTOYOCHEM CO. LTD.ARKEMA (BOSTIK)ADERE PRODUTOS AUTO ADESIVO LTDAGUANGZHOU BROADYA ADHESIVE PRODUCTS CO., LTD.INDUSTRIAS TUK, S.A. DE C.V.SAINT-GOBAIN

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 MARKET INCLUSION

- TABLE 2 MARKET EXCLUSION

- TABLE 3 DOUBLE-SIDED TAPE MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 KEY PLAYERS IN DOUBLE-SIDED TAPE MARKET

- TABLE 5 DOUBLE-SIDED TAPE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE (2020–2027)

- TABLE 7 AUTOMOTIVE INDUSTRY PRODUCTION (2021–2022)

- TABLE 8 DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 9 DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 10 DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 11 DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 12 ACRYLIC: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 13 ACRYLIC: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 ACRYLIC: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 15 ACRYLIC: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 16 RUBBER: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 17 RUBBER: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 RUBBER: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 19 RUBBER: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 20 SILICONE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 21 SILICONE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 SILICONE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 23 SILICONE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 24 OTHER TYPES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 25 OTHER TYPES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 OTHER TYPES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER )

- TABLE 27 OTHER TYPES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER )

- TABLE 28 DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 29 DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 30 DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 31 DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 32 WATER-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 33 WATER-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 WATER-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 35 WATER-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 36 SOLVENT-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 37 SOLVENT-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SOLVENT-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 39 SOLVENT-BASED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 40 HOT-MELT: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 41 HOT-MELT: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 HOT-MELT: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 43 HOT-MELT: BY TECHNOLOGY MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 44 DOUBLE-SIDED TAPE MARKET, BY TAPE-BACKING MATERIAL, 2020–2022 (USD MILLION)

- TABLE 45 DOUBLE-SIDED TAPE MARKET, BY TAPE-BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 46 DOUBLE-SIDED TAPE MARKET, BY TAPE-BACKING MATERIAL, 2020–2022 (MILLION SQUARE METER)

- TABLE 47 DOUBLE-SIDED TAPE MARKET, BY TAPE-BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 48 FOAM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 49 FOAM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 FOAM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 51 FOAM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 52 FILM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 53 FILM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 FILM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 55 FILM-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 56 PAPER/TISSUE-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 57 PAPER/TISSUE-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 PAPER/TISSUE-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 59 PAPER/TISSUE-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 60 UNSUPPORTED/TRANSFER-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 61 UNSUPPORTED/TRANSFER-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 UNSUPPORTED/TRANSFER-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 63 UNSUPPORTED/TRANSFER-BACKED: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 64 OTHER BACKING MATERIAL: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 65 OTHER BACKING MATERIAL: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 OTHER BACKING MATERIAL: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 67 OTHER BACKING MATERIAL: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 68 DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 69 DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 70 DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 71 DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 72 AUTOMOTIVE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 73 AUTOMOTIVE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 AUTOMOTIVE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 75 AUTOMOTIVE: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 76 BUILDING & CONSTRUCTION: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 77 BUILDING & CONSTRUCTION: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 BUILDING & CONSTRUCTION: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 79 BUILDING & CONSTRUCTION: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 80 ELECTRICAL & ELECTRONICS: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 81 ELECTRICAL & ELECTRONICS: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 ELECTRICAL & ELECTRONICS: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 83 ELECTRICAL & ELECTRONICS: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 84 PAPER & PRINTING: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 85 PAPER & PRINTING: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 PAPER & PRINTING: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 87 PAPER & PRINTING: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 88 OTHER END-USE INDUSTRIES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 89 OTHER END-USE INDUSTRIES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 OTHER END-USE INDUSTRIES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 91 OTHER END-USE INDUSTRIES: DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 92 DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 93 DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 DOUBLE-SIDED TAPE MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 95 DOUBLE-SIDED TAPE MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 96 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 99 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 100 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 103 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 104 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 107 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 108 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (MILLION SQUARE METER)

- TABLE 111 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 112 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 115 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 116 CHINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 117 CHINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 118 CHINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 119 CHINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 120 INDIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 121 INDIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 122 INDIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 123 INDIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 124 JAPAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 125 JAPAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 126 JAPAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 127 JAPAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 128 SOUTH KOREA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 129 SOUTH KOREA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 130 SOUTH KOREA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 131 SOUTH KOREA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 132 TAIWAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 133 TAIWAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 134 TAIWAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 135 TAIWAN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 136 INDONESIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 137 INDONESIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 138 INDONESIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 139 INDONESIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 140 VIETNAM: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 141 VIETNAM: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 142 VIETNAM: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 143 VIETNAM: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 144 REST OF ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 147 REST OF ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 148 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 151 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 152 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 155 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 156 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 157 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 158 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 159 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 160 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (USD MILLION)

- TABLE 161 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 162 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (MILLION SQUARE METER)

- TABLE 163 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 164 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 165 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 166 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 167 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 168 US: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 169 US: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 170 US: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 171 US: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 172 CANADA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 173 CANADA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 174 CANADA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 175 CANADA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 176 MEXICO: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 177 MEXICO: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 178 MEXICO: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 179 MEXICO: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 180 EUROPE: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 181 EUROPE: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 182 EUROPE: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 183 EUROPE: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 184 EUROPE: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 185 EUROPE: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 186 EUROPE: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 187 EUROPE: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 188 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 189 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 190 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 191 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 192 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (USD MILLION)

- TABLE 193 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 194 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (MILLION SQUARE METER)

- TABLE 195 EUROPE: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 196 EUROPE: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 197 EUROPE: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 198 EUROPE: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 199 EUROPE: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 200 GERMANY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 201 GERMANY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 202 GERMANY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 203 GERMANY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 204 FRANCE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 205 FRANCE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 206 FRANCE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 207 FRANCE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 208 RUSSIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 209 RUSSIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 210 RUSSIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 211 RUSSIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 212 ITALY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 213 ITALY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 214 ITALY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 215 ITALY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 216 SPAIN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 217 SPAIN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 218 SPAIN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 219 SPAIN: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 220 UK: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 221 UK: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 222 UK: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 223 UK: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 224 TURKEY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 225 TURKEY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 226 TURKEY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 227 TURKEY: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 228 NETHERLANDS: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 229 NETHERLANDS: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 230 NETHERLANDS: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 231 NETHERLANDS: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 232 REST OF EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 233 REST OF EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 234 REST OF EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 235 REST OF EUROPE: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 236 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 237 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 238 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 239 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 240 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 241 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 242 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 243 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 244 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 245 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 246 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 247 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 248 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (USD MILLION)

- TABLE 249 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 250 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (MILLION SQUARE METER)

- TABLE 251 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 252 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 253 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 254 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 255 SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 256 BRAZIL: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 257 BRAZIL: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 258 BRAZIL: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 259 BRAZIL: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 260 ARGENTINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 261 ARGENTINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 262 ARGENTINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 263 ARGENTINA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 264 COLOMBIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 265 COLOMBIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 266 COLOMBIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 267 COLOMBIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 268 REST OF SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 269 REST OF SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 270 REST OF SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 271 REST OF SOUTH AMERICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 272 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 275 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 276 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 279 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 280 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 283 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 284 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2020–2022 (MILLION SQUARE METER)

- TABLE 287 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TAPE BACKING MATERIAL, 2023–2028 (MILLION SQUARE METER)

- TABLE 288 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 290 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 291 MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 292 SOUTH AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 293 SOUTH AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 294 SOUTH AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 295 SOUTH AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 296 SAUDI ARABIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 297 SAUDI ARABIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 298 SAUDI ARABIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 299 SAUDI ARABIA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 300 REST OF MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 301 REST OF MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 302 REST OF MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 303 REST OF MIDDLE EAST & AFRICA: DOUBLE-SIDED TAPE MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 304 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS (2017–2023)

- TABLE 305 DOUBLE-SIDED TAPE MARKET: PRODUCT LAUNCHES, 2017–2023

- TABLE 306 DOUBLE-SIDED TAPE MARKET: DEALS, 2017–2023

- TABLE 307 DOUBLE-SIDED TAPE MARKET: OTHER DEVELOPMENTS, 2017–2023

- TABLE 308 3M: COMPANY OVERVIEW

- TABLE 309 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 3M: DEALS

- TABLE 311 NITTO DENKO CORPORATION: COMPANY OVERVIEW

- TABLE 312 NITTO DENKO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 NITTO DENKO CORPORATION: DEALS

- TABLE 314 NITTO DENKO CORPORATION: OTHER DEVELOPMENTS

- TABLE 315 TESA SE: COMPANY OVERVIEW

- TABLE 316 TESA SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 TESA SE: DEALS

- TABLE 318 TESA SE: OTHER DEVELOPMENTS

- TABLE 319 LINTEC CORPORATION: COMPANY OVERVIEW

- TABLE 320 LINTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 322 AVERY DENNISON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 AVERY DENNISON CORPORATION: DEALS

- TABLE 324 IPG: COMPANY OVERVIEW

- TABLE 325 IPG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 IPG: DEALS

- TABLE 327 SHURTAPE TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 328 SHURTAPE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 SCAPA GROUP LTD.: COMPANY OVERVIEW

- TABLE 330 SCAPA GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 SCAPA GROUP LTD.: DEALS

- TABLE 332 LOHMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 333 LOHMANN GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 LOHMANN GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 335 NICHIBAN CO., LTD.: COMPANY OVERVIEW

- TABLE 336 NICHIBAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 MACTAC: COMPANY OVERVIEW

- TABLE 338 MACTAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 ADCHEM CORPORATION (BERRY GLOBAL INC.): COMPANY OVERVIEW

- TABLE 340 ADCHEM CORPORATION (BERRY GLOBAL INC.): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 341 COROPLAST FRITZ MÜLLER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 342 COROPLAST FRITZ MÜLLER GMBH & CO. KG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 343 CCT (COATING & CONVERTING TECHNOLOGIES, LLC) - AN ATP GROUP COMPANY: COMPANY OVERVIEW

- TABLE 344 CCT (COATING & CONVERTING TECHNOLOGIES, LLC) - AN ATP GROUP COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 GERGONNE: COMPANY OVERVIEW

- TABLE 346 GERGONNE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 ECHOTAPE: COMPANY OVERVIEW

- TABLE 348 ECHOTAPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 ADVANCE TAPES INTERNATIONAL: COMPANY OVERVIEW

- TABLE 350 ADVANCED TAPES INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 351 AJIT INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 352 AJIT INDUSTRIES PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 353 ATP ADHESIVE SYSTEMS AG: COMPANY OVERVIEW

- TABLE 354 ATP ADHESIVE SYSTEMS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 TOYOCHEM CO. LTD.: COMPANY OVERVIEW

- TABLE 356 TOYOCHEM CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 357 ARKEMA (BOSTIK): COMPANY OVERVIEW

- TABLE 358 ARKEMA (BOSTIK): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 ADERE PRODUTOS AUTO ADESIVO LTDA.: COMPANY OVERVIEW

- TABLE 360 ADERE PRODUTOS AUTO ADESIVO LTDA.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 361 GUANGZHOU BROADYA ADHESIVE PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 362 GUANGZHOU BROADYA ADHESIVE PRODUCTS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 363 INDUSTRIAS TUK, S.A. DE C.V.: COMPANY OVERVIEW

- TABLE 364 INDUSTRIAS TUK, S.A. DE C.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 366 SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 DOUBLE-SIDED TAPE STRUCTURE

- FIGURE 2 DOUBLE-SIDED TAPE: MARKET SEGMENTATION

- FIGURE 3 DOUBLE-SIDED TAPE MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 FACTOR ANALYSIS OF DOUBLE-SIDED TAPE MARKET

- FIGURE 7 DOUBLE-SIDED TAPE MARKET: DATA TRIANGULATION

- FIGURE 8 SILICONE TAPES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 FOAM TAPES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 HOT-MELT TECHNOLOGY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 AUTOMOTIVE APPLICATION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 DOUBLE-SIDED TAPE MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- FIGURE 14 SILICONE RESIN TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 15 HOT-MELT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 PAPER/TISSUE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 PAPER & PRINTING TO BE FASTEST GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 18 EMERGING ECONOMIES TO GROW FASTER THAN DEVELOPED NATIONS DURING FORECAST PERIOD

- FIGURE 19 INDIA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DOUBLE-SIDED TAPE MARKET

- FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: DOUBLE-SIDED TAPE MARKET

- FIGURE 22 CONSUMER ELECTRONICS INDUSTRY REVENUE, BY SEGMENT (2018–2028)

- FIGURE 23 DOUBLE-SIDED TAPE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 ACRYLIC RESIN TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 25 SOLVENT-BASED TECHNOLOGY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 26 FOAM-BACKED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 27 AUTOMOTIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 28 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC: DOUBLE-SIDED TAPE MARKET SNAPSHOT

- FIGURE 30 NORTH AMERICA: DOUBLE-SIDED TAPE MARKET SNAPSHOT

- FIGURE 31 EUROPE: DOUBLE-SIDED TAPE MARKET SNAPSHOT

- FIGURE 32 INCREASING DEMAND FROM AUTOMOTIVE INDUSTRY TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 33 AUTOMOTIVE SECTOR TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 COMPANY EVALUATION MATRIX, 2022

- FIGURE 35 PRODUCT FOOTPRINT (25 COMPANIES)

- FIGURE 36 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 37 MARKET RANKING ANALYSIS, 2022

- FIGURE 38 3M: COMPANY SNAPSHOT

- FIGURE 39 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 TESA SE: COMPANY SNAPSHOT

- FIGURE 41 LINTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 IPG: COMPANY SNAPSHOT

- FIGURE 44 SCAPA GROUP LTD.: COMPANY SNAPSHOT

- FIGURE 45 NICHIBAN CO., LTD.: COMPANY SNAPSHOT

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global double-sided tape market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases & investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the double-sided tape market. Primary sources from the demand side include experts and key persons from the application segment. Extensive primary research has been conducted after understanding and analyzing the current scenario of the double-sided tape market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

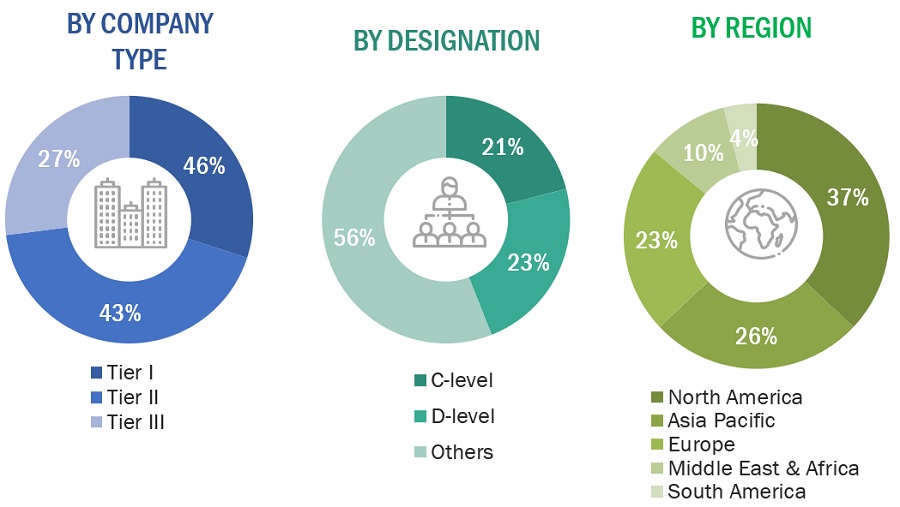

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

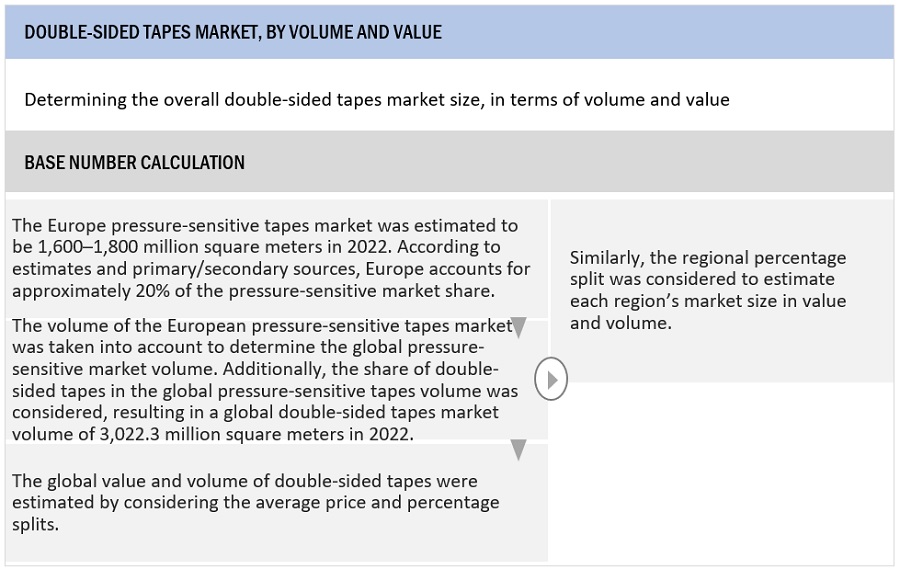

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the double-sided tape market on the basis of different end-use industries and types in each of the regions. The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that can affect the market have been accounted for in this research study, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

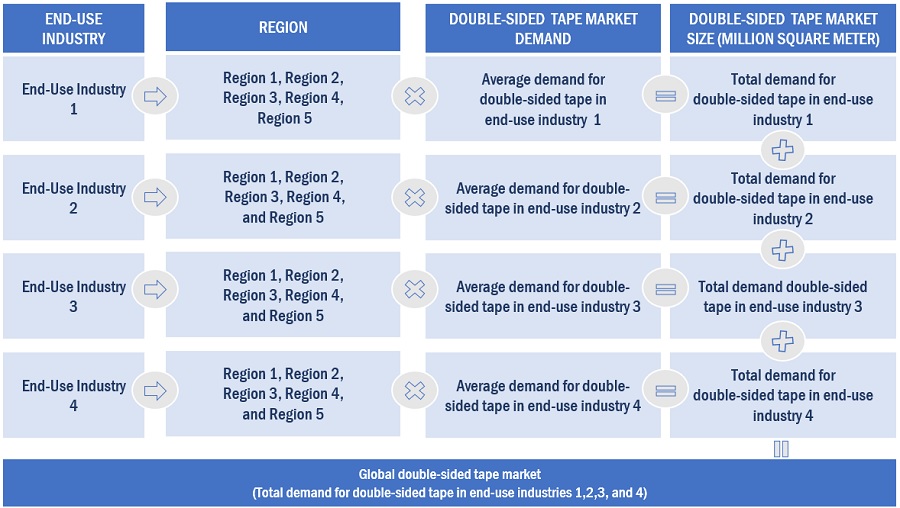

Global Double-Sided Tape Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Double-Sided Tape Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches. Then, it has been verified through primary interviews. Hence, for every data segment, there are three sources, one from the top-down approach, second from the bottom-up approach, and third from expert interviews. Only when the values arrived at from the three points match, the data have been assumed correct.

Market Definition.

Double-sided tape is a pressure-sensitive tape that is coated with adhesive on both sides. These tapes are created by applying a thin layer of adhesive to each side of a substrate material. Double-sided tapes are designed to stick two surfaces together; these tapes are widely used by industries such as automotive, building & construction, and electrical & electronics for bonding, holding, mounting, splicing, and other purposes.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, forecast, and analyze double-sided tape market based on resin type, technology, backing material, and end-use industry in terms of value

- To describe and forecast the size of the market based on five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective countries in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide Porter’s five forces analysis of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments such as product launches, acquisitions, agreements, and partnerships in the market

Note: 1. Micromarkets are defined as the subsegments of the double-sided tape market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the double-sided tape market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Double-sided Tape Market