Document Camera Market by Product Type (Portable and Non-portable), Connection Type (Wired and Wireless), End User (Education, Corporate, and Others), and Geography- Global Forecast to 2025

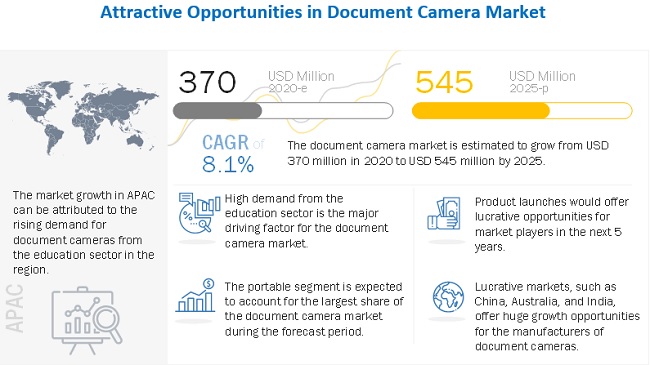

[142 Pages Report] The document camera market is expected to grow from USD 370 million in 2020 to USD 545 million by 2025; it is expected to grow at a CAGR of 8.1% during the forecast period.

The market had been witnessing growth in the past years, mainly owing to the high adoption of document cameras from the education sector.

Impact of COVID-19 on Document Camera Market:

The world is facing an economic crisis caused by COVID-19 pandemic. The pandemic like various other markets has also led to a decline in the growth rate of the market. This is because the educational institutions and corporate offices, which are the major demand generators of document cameras, are currently non-operational in various countries, thereby negatively impacting the demand for document cameras. Additionally, COVID-19 has also disrupted the supply chain of document cameras, which is hindering the manufacturing and distribution of document cameras.

However, the market is expected to witness rapid recovery in the near future. The manufacturers of document cameras are witnessing a surge in the demand for these products owing to more and more people resorting to remote working and teaching during the lockdown. Additionally, COVID-19 has led to a rise in the awareness of remote working and learning solutions, which is also expected to positively impact the demand for document cameras. On the other hand, many manufacturers are having difficulties in meeting this increased demand as they are facing several supply chain challenges. The growth of the market is expected to gain momentum as soon as the supply chain issues get resolved.

Market Dynamics:

Driver: Growing digitalization in education sector to boost demand for document cameras

The education sector is witnessing rapid digitalization. Studying involves more than just a textbook. Various digital devices, such as document cameras, interactive whiteboards, and projectors, are being used in classrooms to make learning more engaging and interactive. With growing digitalization, the demand for document cameras is also rising in the education sector. Currently, the education sector is the largest demand-generating segment for document cameras. Many educational institutions worldwide are using these cameras for various applications such as displaying textbooks and 3D objects and real-time video recordings for demonstrations.

Restraint: Unreliable infrastructure in developing countries

Several developing countries in APAC and Middle East and Africa still do not have reliable internet connection and electricity supply. This is one of the major factors which is restricting the penetration of digital technologies in developing nations. Document cameras, being ICT devices, require electricity and internet connection to operate; the absence of a stable internet connection and electricity supply restricts the adoption of document cameras. Moreover, the lack of a stable internet connection and electricity supply hinders the adoption of remote learning and working. This factor also negatively impacts the growth of the document camera market as these devices have proved to be beneficial for remote teaching and remote working.

Opportunity: Increasing penetration of wireless connectivity document cameras

The document camera market is currently being dominated by wired document cameras. However, the demand for wireless document cameras is expected to rise in the coming years. The rising popularity of wireless document cameras can be attributed to its ability to give its user the freedom to move and share data easily in a room. The wireless feature also allows the user to place and point the camera anywhere in a room. To reap the benefits of the increasing demand for wireless document cameras, a number of companies have introduced these devices in their product portfolio.

Challenge: Hindrance in document camera supply chain due to COVID-19

Many countries had imposed or are continuing to impose lockdowns to contain the spread of COVID-19. This has disrupted the supply chain of various markets, including the market. This hindrance in the supply chain is creating challenges for document camera manufacturers in manufacturing and supplying their products.

Document camera market for education sector to grow at highest CAGR during the forecast period

The education sector is expected to hold largest share as well as witness the highest CAGR in the market during the forecast period. The rapid digitalization in the education sector is one of the key factors that has led to the high penetration of document cameras in this market. Additionally, COVID-19 has resulted in a rise in the trend of online education and has boosted the demand for devices assisting online education. Document cameras have proven to be beneficial for online education, which is expected to positively impact the growth of the market.

Wired connectivity document cameras to account for largest market share during the forecast period

The document camera market, by connection type, is segmented into wired and wireless. Wired connectivity document cameras segment is expected to lead the market, in terms of size, during the forecast period. The wired connectivity document cameras offer high quality and speed of video/image streaming, which at times can be challenging for wireless connectivity document cameras. Additionally, the price of wired connectivity document cameras is usually lower than that of wireless connectivity document cameras. These factors have collectively led to the leading position of the wired connectivity segment in the market.

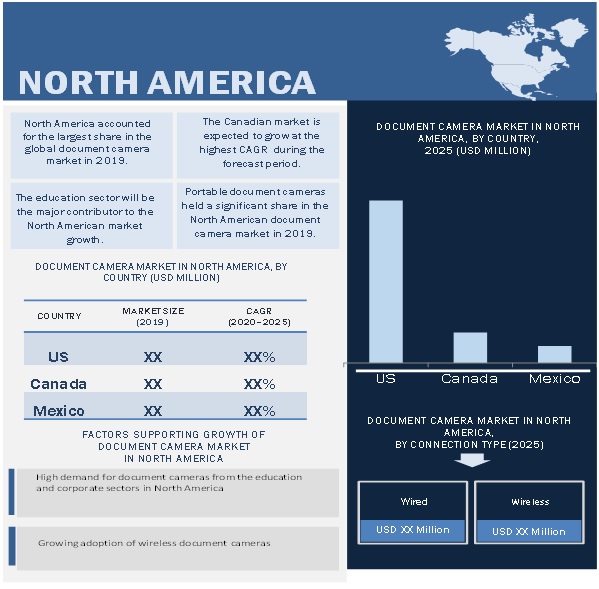

North America to account for largest market share during forecast period

North America is expected to account for the largest share of the document camera market during the forecast period. High demand from the education sector is one of the key factors that has led to the dominant position of this region in the market. North America has a strong education industry and is home to a number of renowned and technologically sound educational institutions. Additionally, several companies offering document cameras have their presence in this region, which further adds to the growth of the market in North America.

Key Market Players

AVer Information (Taiwan), WolfVision (Austria), ELMO Company (Japan), Seiko Epson (Japan), IPEVO (US), Lumens Digital Optics (Taiwan), Pathway Innovations and Technologies (US), QOMO (US), Hue (UK), and SMART Technologies (Canada) are among the key players operating in the document camera market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) and Volume (Thousand Units) |

|

Segments covered |

Product Type, Connection Type, End User and Region |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

AVer Information (Taiwan), WolfVision (Austria), ELMO Company (Japan), Seiko Epson (Japan), and IPEVO (US) among others (total 20 players are covered). |

This research report categorizes the market based on product type, connection type, end user, and region.

Document Camera Market, by Product Type

- Portable

- Non-portable

Market, by Connection Type

- Wired

- Wireless

Market, by End User

- Education

- Corporate

- Others

Market, by Geography

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, Italy, and Rest of Europe)

- APAC (China, Japan, Australia, India, and Rest of APAC)

- RoW (South America, and Middle East and Africa)

Recent Developments

- In January 2020, WolfVision (Austria), at ISE 2020, launched 2 new products—VZ-8.UHD, the company’s first 4K Visualizer system, and Cynap Pure Pro wireless presentation and collaboration system. Few of the features of the newly launched VZ-8.UHD visualizer includes newly designed optical and electronic systems, 4K UHD output resolution, touchscreen control and preview monitor, and simultaneous 4K recording and streaming capability.

- In December 2019, AVer Information (Taiwan) launched AVerVision M15-13M mechanical arm visualizer. This product is AVer’s smallest, most lightweight document camera to date. It weighs 0.68 kg and folds into a thin bar that effortlessly fits in a bag with textbooks or other devices, making it easy to carry.

- In June 2019, WolfVision (Austria) launched 3 new solutions to the US market at Infocomm 2019. These products are the Cynap Pure, a 4K-capable wireless presentation appliance, vSolution Meeting, an intuitive room-scheduling and meeting management tool, and the VZ-8.UHD visualizer, the company’s first native 4K UHD visualizer system.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the document camera market?

The product launch strategy has been and continues to be one of the major strategies adopted by the key players to grow in the document camera market. Expansions, collaborations, and partnerships are some of the other strategies adopted by the key companies operating in the document camera market.

What are the emerging end user segments of document cameras?

Education and corporate are the major end users of document cameras. Besides, healthcare, automotive, government, military & defense, and legal are some of the emerging end users of document cameras.

How are advancements in education sector influencing the document camera market?

The education sector is witnessing rapid digitalization. Studying involves more than just a textbook. Various digital devices, such as document cameras, interactive whiteboards, and projectors, are being used in classrooms to make learning more engaging and interactive. With growing digitalization, the demand for document cameras is also rising in the education sector.

Which type of document cameras is expected to penetrate significantly in the document camera market?

Portable document cameras are currently the most popular in the document camera market, and the same trend is expected to be witnessed in the near future. The portability feature allows easy storage, convenient placement on a table or other areas, and easier management of the equipment.

Who are the major companies in the document camera market?

AVer Information (Taiwan), WolfVision (Austria), ELMO Company (Japan), Seiko Epson (Japan), Lumens Digital Optics (Taiwan), and IPEVO (US) are among the major companies operating in the document camera market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DOCUMENT CAMERA MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW: DOCUMENT CAMERA MARKET SIZE ESTIMATION

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

3.1 DOCUMENT CAMERA MARKET: IMPACT OF COVID-19

3.1.1 REALISTIC SCENARIO

FIGURE 7 REALISTIC SCENARIO: MARKET, 2017–2025 (USD MILLION)

3.1.2 PESSIMISTIC SCENARIO

FIGURE 8 PESSIMISTIC SCENARIO: MARKET, 2017–2025 (USD MILLION)

3.1.3 OPTIMISTIC SCENARIO

FIGURE 9 OPTIMISTIC SCENARIO: MARKET, 2017–2025 (USD MILLION)

FIGURE 10 IMPACT OF COVID-19 ON MARKET

FIGURE 11 PORTABLE DOCUMENT CAMERAS TO ACCOUNT FOR SIGNIFICANT MARKET SIZE DURING FORECAST PERIOD

FIGURE 12 WIRED SEGMENT, BY CONNECTION TYPE, TO HOLD LARGER MARKET SIZE IN 2025

FIGURE 13 EDUCATION TO BE FASTEST-GROWING END-USER SEGMENT DURING FORECAST PERIOD

FIGURE 14 NORTH AMERICA CAPTURED LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 15 INCREASING ADOPTION OF DOCUMENT CAMERAS IN APAC DRIVING MARKET GROWTH

4.2 MARKET, BY PRODUCT TYPE

FIGURE 16 PORTABLE DOCUMENT CAMERA MARKET TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET IN NORTH AMERICA, BY COUNTRY AND END USER

FIGURE 17 EDUCATION SECTOR AND US TO BE LARGEST SHAREHOLDERS IN MARKET IN NORTH AMERICA IN 2025

4.4 MARKET, BY CONNECTIVITY TYPE

FIGURE 18 WIRELESS DOCUMENT CAMERA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY COUNTRY (2019)

FIGURE 19 US HELD LARGEST SHARE OF MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing digitalization in education sector to boost demand for document cameras

5.2.1.2 Increasing popularity of portable document cameras

FIGURE 21 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Unreliable infrastructure in developing countries

FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing penetration of wireless connectivity document cameras

5.2.3.2 Rising demand for document cameras from emerging countries

5.2.3.3 Growing trend of remote working and teaching due to COVID-19

FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about document cameras restricting market growth

5.2.4.2 Hindrance in document camera supply chain due to COVID-19

FIGURE 24 IMPACT ANALYSIS: CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MANUFACTURING AND ASSEMBLY PHASE CONTRIBUTES MAJOR VALUE

6 DOCUMENT CAMERA MARKET, BY PRODUCT TYPE (Page No. - 47)

6.1 INTRODUCTION

FIGURE 26 MARKET SEGMENTATION, BY PRODUCT TYPE

TABLE 1 MARKET, BY VALUE AND VOLUME, 2017–2025

FIGURE 27 PORTABLE SEGMENT TO HOLD LARGER MARKET SIZE IN 2025

TABLE 2 MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

6.2 PORTABLE

6.2.1 EASY STORAGE AND CONVENIENT PLACEMENT KEY BENEFITS OF PORTABLE DOCUMENT CAMERAS

TABLE 3 PORTABLE DOCUMENT CAMERA MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 4 PORTABLE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 5 NORTH AMERICA: PORTABLE DOCUMENT CAMERA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 6 EUROPE: PORTABLE MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 7 APAC: PORTABLE MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 8 ROW: PORTABLE DOCUMENT CAMERA , BY REGION, 2017–2025 (USD MILLION)

6.3 NON-PORTABLE

6.3.1 NORTH AMERICA TO CONTINUE TO DOMINATE NON-PORTABLE DOCUMENT CAMERA DURING FORECAST PERIOD

FIGURE 28 EDUCATION SECTOR TO WITNESS HIGHEST GROWTH RATE IN NON-PORTABLE MARKET DURING FORECAST PERIOD

TABLE 9 NON-PORTABLE MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 10 NON-PORTABLE DOCUMENT CAMERA MARKET, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 11 NORTH AMERICA: NON-PORTABLE MARKET, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 12 EUROPE: NON-PORTABLE DOCUMENT CAMERA, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 13 APAC: NON-PORTABLE MARKET, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 14 ROW: NON-PORTABLE MARKET, BY REGION, 2017–2025 (USD THOUSAND)

7 DOCUMENT CAMERA MARKET, BY CONNECTION TYPE (Page No. - 55)

7.1 INTRODUCTION

FIGURE 29 MARKET SEGMENTATION, BY CONNECTION TYPE

FIGURE 30 WIRED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 15 MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

7.2 WIRED

7.2.1 HDMI, USB, AND VGA COMMONLY USED WIRED CONNECTION TYPES

TABLE 16 WIRED DOCUMENT CAMERA MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 17 WIRED MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 18 NORTH AMERICA: WIRED DOCUMENT CAMERA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 19 EUROPE: WIRED DOCUMENT CAMERA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 20 APAC: WIRED MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 21 ROW: WIRED DOCUMENT CAMERA, BY REGION, 2017–2025 (USD MILLION)

7.3 WIRELESS

7.3.1 WIFI MOST COMMONLY USED TECHNOLOGY IN WIRELESS DOCUMENT CAMERAS

FIGURE 31 EDUCATION SECTOR TO WITNESS HIGHEST GROWTH IN WIRELESS DOCUMENT CAMERA MARKET DURING FORECAST PERIOD

TABLE 22 WIRELESS MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 23 WIRELESS DOCUMENT CAMERA, BY REGION, 2017–2025 (USD MILLION)

TABLE 24 NORTH AMERICA: WIRELESS DOCUMENT CAMERA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 25 EUROPE: WIRELESS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 26 APAC: WIRELESS DOCUMENT CAMERA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 27 ROW: WIRELESS MARKET, BY REGION, 2017–2025 (USD MILLION)

8 DOCUMENT CAMERA MARKET, BY END USER (Page No. - 63)

8.1 INTRODUCTION

FIGURE 32 MARKET SEGMENTATION, BY END USER

FIGURE 33 EDUCATION SECTOR TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 28 MARKET, BY END USER, 2017–2025 (USD MILLION)

8.2 EDUCATION

8.2.1 RAPID DIGITALIZATION IN EDUCATION SECTOR TO BOOST DEMAND FOR DOCUMENT CAMERAS

TABLE 29 MARKET FOR EDUCATION SECTOR, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 30 MARKET FOR EDUCATION SECTOR, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 31 MARKET FOR EDUCATION SECTOR, BY REGION, 2017–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET FOR EDUCATION SECTOR, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 33 EUROPE: MARKET FOR EDUCATION SECTOR, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 34 APAC: MARKET FOR EDUCATION SECTOR, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 35 ROW: MARKET FOR EDUCATION SECTOR, BY REGION, 2017–2025 (USD MILLION)

8.3 CORPORATE

8.3.1 PORTABLE DOCUMENT CAMERAS IN HIGH DEMAND IN CORPORATE SECTOR

FIGURE 34 PORTABLE SEGMENT TO WITNESS HIGHER GROWTH IN MARKET FOR CORPORATE SECTOR DURING FORECAST PERIOD

TABLE 36 MARKET FOR CORPORATE SECTOR, BY PRODUCT TYPE, 2017–2025 (USD THOUSAND)

TABLE 37 MARKET FOR CORPORATE SECTOR, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 38 MARKET FOR CORPORATE SECTOR, BY REGION, 2017–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET FOR CORPORATE SECTOR, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 40 EUROPE: MARKET FOR CORPORATE SECTOR, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 41 APAC: MARKET FOR CORPORATE SECTOR, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 42 ROW: MARKET FOR CORPORATE SECTOR, BY REGION, 2017–2025 (USD MILLION)

8.4 OTHERS

TABLE 43 MARKET FOR OTHERS, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 44 MARKET FOR OTHERS, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 45 MARKET FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

FIGURE 35 US TO LEAD IN NORTH AMERICAN DOCUMENT CAMERA MARKET FOR OTHERS DURING FORECAST PERIOD

TABLE 46 NORTH AMERICA: MARKET FOR OTHERS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 47 EUROPE: MARKET FOR OTHERS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 48 APAC: MARKET FOR OTHERS, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 49 ROW: MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

9 GEOGRAPHIC ANALYSIS (Page No. - 74)

9.1 INTRODUCTION

FIGURE 36 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

TABLE 50 MARKET, BY REGION, 2017–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 37 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 51 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Online teaching to help education sector dominate market

TABLE 55 US: DOCUMENT CAMERA MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 56 US: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 57 US: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rise in adoption of digital technologies to drive market

TABLE 58 CANADA: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 59 CANADA: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 60 CANADA: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.2.2.2 forecast period

TABLE 61 MEXICO: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 62 MEXICO: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 63 MEXICO: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.3 EUROPE

FIGURE 38 SNAPSHOT OF DOCUMENT CAMERA MARKET IN EUROPE

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.3.1 UK

9.3.1.1 High penetration of digital technologies in education sector boosting market growth

TABLE 68 UK: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 69 UK: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 70 UK: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Adoption of document cameras in automotive industry to positively impact market

TABLE 71 GERMANY: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 72 GERMANY: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.3.3 ITALY

9.3.3.1 Wired document cameras dominating market

TABLE 74 ITALY: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 75 ITALY: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 76 ITALY: MARKET, BY END USER, 2017–2025 (USD THOUSAND)

9.3.4 FRANCE

9.3.4.1 Education and corporate sectors to boost market

TABLE 77 FRANCE: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 78 FRANCE: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 79 FRANCE: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.3.5 REST OF EUROPE

TABLE 80 REST OF EUROPE: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 81 REST OF EUROPE: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 82 REST OF EUROPE: MARKET, BY END USER, 2017–2025 (USD THOUSAND)

9.4 APAC

FIGURE 39 SNAPSHOT OF DOCUMENT CAMERA MARKET IN APAC

TABLE 83 APAC: MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 84 APAC: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 85 APAC: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 86 AAPC: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Presence of document camera manufacturers to boost market

TABLE 87 CHINA: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 88 CHINA: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 89 CHINA: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Presence of various prominent document camera manufacturers to propel market growth

TABLE 90 JAPAN: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 91 JAPAN: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 92 JAPAN: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.4.3 AUSTRALIA

9.4.3.1 Rise in trend of remote learning due to COVID-19 to grow market

TABLE 93 AUSTRALIA: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 94 AUSTRALIA: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 95 AUSTRALIA: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.4.4 INDIA

9.4.4.1 Education sector to dominate market during forecast period

TABLE 96 INDIA: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 97 INDIA: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 98 INDIA: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.4.5 REST OF APAC

TABLE 99 REST OF APAC: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 100 REST OF APAC: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 101 REST OF APAC: MARKET, BY END USER, 2017–2025 (USD MILLION)

9.5 ROW

TABLE 102 ROW: MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 103 ROW: MARKET, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

TABLE 104 ROW: MARKET, BY CONNECTION TYPE, 2017–2025 (USD MILLION)

TABLE 105 ROW: MARKET, BY END USER, 2017–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 101)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS: DOCUMENT CAMERA MARKET

FIGURE 40 MARKET SHARE OF KEY PLAYERS IN MARKET, 2019

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 VISIONARY LEADERS

10.3.2 INNOVATORS

10.3.3 DYNAMIC DIFFERENTIATORS

10.3.4 EMERGING COMPANIES

FIGURE 41 DOCUMENT CAMERA MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

10.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

10.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

10.6 COMPETITIVE SITUATIONS AND TRENDS

10.6.1 PRODUCT LAUNCHES

TABLE 106 PRODUCT LAUNCHES, 2018–2020

10.6.2 EXPANSIONS, PARTNERSHIPS, AND COLLABORATIONS

TABLE 107 EXPANSIONS, PARTNERSHIPS, AND COLLABORATIONS, 2018–2020

11 COMPANY PROFILES (Page No. - 109)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 INTRODUCTION

11.2 KEY PLAYERS

11.2.1 AVER INFORMATION

FIGURE 44 AVER INFORMATION: COMPANY SNAPSHOT

11.2.2 ELMO COMPANY

11.2.3 WOLFVISION

11.2.4 SEIKO EPSON

FIGURE 45 SEIKO EPSON: COMPANY SNAPSHOT

11.2.5 IPEVO

11.2.6 LUMENS DIGITAL OPTICS

11.2.7 PATHWAY INNOVATIONS & TECHNOLOGIES (HOVERCAM)

11.2.8 QOMO

11.2.9 HUE

11.2.10 SMART TECHNOLOGIES

11.3 RIGHT-TO-WIN

11.4 OTHER COMPANIES

11.4.1 HONG KONG CODIS ELECTRONIC CO.

11.4.2 BOXLIGHT

11.4.3 TTS GROUP

11.4.4 EASTMAN KODAK

11.4.5 ACCO BRANDS

11.4.6 VIEWSONIC

11.4.7 SHENZHEN ELOAM TECHNOLOGY CO.

11.4.8 LONGJOY TECHNOLOGY

11.4.9 DUKANE

11.4.10 SHENZHEN DIGITAL-LEADER TECHNOLOGY CO.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 136)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

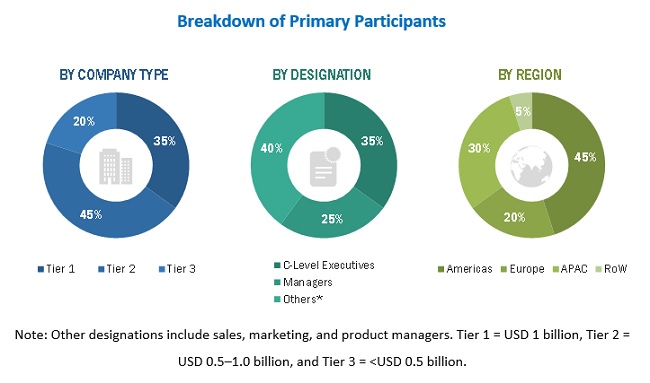

The study involved four major activities in estimating the current size of the document camera market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include document camera journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the document camera market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the document camera market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides in education and corporate sectors among others.

Report Objectives

The following are the primary objectives of the study.

- To describe and forecast the document camera market by product type, connection type, and end user, in terms of value

- To analyze and forecast the document camera market size, in terms of volume

- To describe and forecast the document camera market by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the market growth

- To provide a detailed overview of the document camera value chain and the impact of COVID-19 on the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their share based on their revenues and core competencies, along with detailed competitive landscape for the market leaders

- To analyze competitive developments such as product launches, expansions, collaborations, partnerships, and research and development (R&D) in the document camera market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Document Camera Market