Document Analysis Market by Solution (Product and Services), Deployment Type (On-premises and Cloud), Organization Size, Vertical (BFSI, Healthcare and Life Sciences, and Government), and Region - Global Forecast to 2024

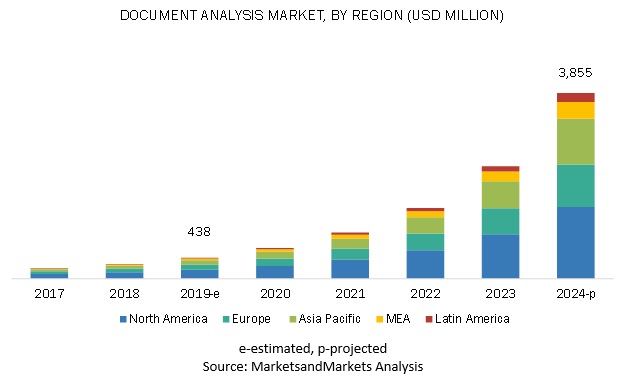

[143 Pages Report] MarketsandMarkets forecasts the global document analysis market size to grow from USD 438 million in 2019 to USD 3,855 million by 2024, at a CAGR of 54.5% from 2019 to 2024. Growing initiatives to digitalize content across enterprises and increasing adoption of cloud-based document analysis solutions are some of the major factors expected to drive the growth of this market.

The professional service segment is expected to hold a larger size during the forecast period within the document analysis market

Professional services include planning and consultingoffers a full set of planning and consulting services based on the service providers product portfolio, as well as third-party products. Covering all stages: expectation analyses, solution architecture definition, and design, C-level business case development, ROI and TCO evaluations, and post-production solution support. Operations and maintenance services cover all aspects of support, from routine activities to smooth fault handling and progressive product upgrade procedures, product development and systems integration. And training services offer comprehensive software training to ensure that organizations can operate, administer and maintain vendor products.

SMEs segment to grow at a higher rate during the forecast period

The need for document analysis is equally required in all organizations, irrespective of the size, to compete in the market. Cost-effectiveness is an essential need of the SMEs, as they are always constrained by limited budgets, which leaves them with limited ways to market themselves and gain visibility. SMEs usually opt for Software as a Service (SaaS)-based document analysis solution, due to cost constraints; additionally, the SaaS model minimizes the IT requirement.

The BFSI vertical is expected to hold the largest market size during the forecast period

The entry of FinTech companies in the market has caused a lot of disruption in this industry. As a result, many companies in this vertical are expected to adopt an document analysis solution. The companies in this vertical deals with complex documents such as invoices, receipts, legal contracts, emails, and financial statements. The extraction of these data available in different formats PDFs, images, excel sheets, and others is very difficult to do it manually. Thus, the adoption of document analysis solution helps BFSI companies to capture, classify, and extract relevant data for further processes. Moreover, document analysis ensures the seamless execution of transactions and fix bottlenecks in workflows. These solutions improve the accuracy and efficiency of various processes and assist in regulatory and compliance reporting by collating data from multiple sources.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global document analysis market, while Asia Pacific (APAC) is likely to grow at the highest CAGR during the forecast period. North America is expected to be the leading region in terms of adopting document analysis solutions and services. The developed economies of North America, such as the US and Canada, there is a high focus on innovations obtained from Research and Development (R&D) and technology. The APAC region is expected to be the fastest-growing region in the market, due to the growing need for advanced intelligent solution.

Key Market Players

Major vendors in the global document analysis market include ABBYY (US), WorkFusion (US), Kofax (US), IBM (US), AntWorks (Singapore), Parascript (US), Automation Anywhere (US), Datamatics (India), Hyland (US), Extract Systems (US), HyperScience (US), OpenText (Canada), Infrrd (US), Celaton (UK), HCL Technologies (India), Kodak Alaris (UK), Rossum (Czech Republic), InData Labs (Belarus), Ephesoft (US) , and IRIS (Belgium). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global market further.

Kofax (US) is one of the leading providers of document analysis solution. Kofax has a varied portfolio of products, such as Intelligent Automation, Robotic Process Automation, Cognitive Capture, Process Orchestration, Advanced Analytics, Mobility and Engagement, and Accounts Payable Automation. Kofax provides automation solutions to transform information-intensive business processes, reduce manual work and errors, minimize cost, and improve customer engagement. In the document analysis market, Kofax offers Cognitive Capture. Kofax recently acquired the Nuance Imaging Division. With closure of the acquisition, Kofaxs position will strengthen in the market as a solid market shareholder.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Solution (Product and Services), Deployment Type, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

It includes 20 major vendors, namely, ABBYY (US), WorkFusion (US), Kofax (US), IBM (US), AntWorks (Singapore), Parascript (US), Automation Anywhere (US), Datamatics (India), Hyland (US), Extract Systems (US), HyperScience (US), OpenText (Canada), Infrrd (US), Celaton (UK), HCL Technologies (India), Kodak Alaris (UK), Rossum (Czech Republic), InData Labs (Belarus), Ephesoft (US) , and IRIS (Belgium) |

This research report categorizes the document analysis market to forecast revenues and analyze trends in each of the following submarkets:

By Solution:

- Product

- Services

By Service:

- Professional Services

- Managed Services

By Deployment Type:

- On-premises

- Cloud

By Organization Size:

- SMEs

- Large Enterprises

By Vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail and eCommerce

- Manufacturing

- Transportation and Logistics

- Others (ITES, telecom, education, and energy and utilities

By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Middle East and North Africa

- Sub-Saharan Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In July 2019, IBM enhanced its Datacap version 9.1.6. With the new version, it updates OCR/A engine files, enhanced Datacap to support SQL Server AlwaysOn Availability Groups, and enhanced image ruleset for changing color depth of an image.

- In February 2019, Kofax acquired Nuance Document Imaging (NDI), a division of Nuance Communications for USD 400 million in cash. With this acquisition, Kofax drives customer value to its existing portfolio by adding technologies, such as cloud compatibility, scan-to-archive, scan-to-workflow, print management, and document security to its end-to-end Intelligent Automation platform.

- In October 2018, ABBYY expanded its FineReader 14 capabilities to support the latest Portable Document Format (PDF) International Standards Organization (ISO) standard. Moreover, it improved Optical Character Recognition (OCR) for Japanese and added Hanja symbols for documents in the Korean language.

Critical Questions the Report Answers

- What are new market segments to focus over the next 25 years for prioritizing the efforts and investments?

- What are the current trends that are driving the document analysis market?

- Who are the top vendors in the market and what is their competitive analysis?

- What are the innovations and developments done by the major market players?

- What are the regulatory implications that impact the market directly and indirectly?

- Which region is expected to lead the global market at the end of the forecast period?

Frequently Asked Questions (FAQ):

What is Intelligent Document Processing?

Intelligent Document Processing is the process of identifying and extracting critical information from incoming paper and electronic documents without extensive user interaction. It transforms the time-consuming and error-prone task of manually processing all types of documents into a fast, effective, and intelligent automated learning workflow. It combines automatic document classification, extraction, validation, routing, and approval, along with archiving and uploading, the data into Content Management System (CMS) or Enterprise Resource Planning (ERP) system.

What are the top trends in the Intelligent Document Processing market?

Following are the current market trends impacting the Intelligent Document Processing market:

Driving factors for the Intelligent Document Processing market:

- Growing initiatives to digitalize content across enterprises

- Increasing adoption of cloud-based intelligent document processing solution

Opportunities for the Intelligent Document Processing market:

- Integration of advanced technologies with intelligent document processing solution

- Increasing need to improve customer experience

What are the top companies providing Intelligent Document Processing solution and services?

ABBYY, Kofax, IBM, WorkFusion, Automation Anywhere, AntWorks, Parascript, Hyland, Datamatics, Extract Systems, HyperScience, OpenText, Infrrd, Celaton, HCL Technologies, Kodak Alaris, Rossum, InData Labs, Ephesoft, IRIS are some of the major companies providing Intelligent Document Processing solution and services.

What are the major industries adopting Intelligent Document Processing solution and services?

BFSI, government, retail and eCommerce, healthcare and life sciences, manufacturing, transportation and logistics, and others are some of the major industries adopting Intelligent Document Processing solution and services. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Document Analysis Market

4.2 North America: Market, By Vertical and Country

4.3 Market: Major Countries

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Initiatives to Digitalize Content Across Enterprises

5.2.1.2 Increasing Adoption of Cloud-Based Document Analysis Solution

5.2.2 Restraints

5.2.2.1 Addressing Governance and Compliance Requirements

5.2.3 Opportunities

5.2.3.1 Integration of Advanced Technologies With Document Analysis Solution

5.2.3.2 Increasing Need to Improve Customer Experience

5.2.4 Challenges

5.2.4.1 High Implementation Costs

5.3 Use Cases

5.3.1 Use Case 1

5.3.2 Use Case 2

5.3.3 Use Case 3

6 Document Analysis Market, By Solution (Page No. - 37)

6.1 Introduction

6.2 Product

6.2.1 Growing Need to Automate the Documentation Process to Drive the Adoption Document Analysis Products

6.3 Services

6.3.1 Growing Need for Document Analysis Solutions to Fuel the Demand for Document Analysis Services Across Verticals

7 Market, By Service (Page No. - 41)

7.1 Introduction

7.2 Professional Services

7.2.1 Growing Focus of Organizations to Effectively Deploy Document Analysis Solutions to Fuel the Adoption of Professional Services

7.3 Managed Services

7.3.1 Need to Provide Enterprises With Best Practices and Deep-Rooted Transformation Expertise Without Impairing Internal Operations to Drive the Adoption of Managed Services

8 Market, By Deployment Type (Page No. - 45)

8.1 Introduction

8.2 On-Premises

8.2.1 Need for Data Security to Drive the Growth of the On-Premises Document Analysis Solution

8.3 Cloud

8.3.1 Scalability and Cost-Effectiveness to be the Major Factors Driving the Adoption of Cloud-Based Document Analysis Solutions

9 Market, By Organization Size (Page No. - 49)

9.1 Introduction

9.2 Large Enterprises

9.2.1 Rising Need for Operational Efficiency to Drive the Demand for Document Analysis Solutions in Large Enterprises

9.3 Small and Medium-Sized Enterprises

9.3.1 Need for a Cost-Effective and Comprehensive Solution to Drive the Growth of the Document Analysis Market Across Small and Medium-Sized Enterprises

10 Market, By Vertical (Page No. - 53)

10.1 Introduction

10.2 Banking, Financial Services and Insurance

10.2.1 Need to Ensure Seamless Execution of Transactions and Fix Bottlenecks in Workflow to Drive the Adoption of Document Analysis in the Banking, Financial Services and Insurance Vertical

10.3 Government

10.3.1 Growing Demand for Greater Flexibility, Enhanced Data Security, and Advanced Intelligence to Drive the Document Analysis Market in the Government Vertical

10.4 Healthcare and Life Sciences

10.4.1 Need to Enhance Productivity and Gradual Adoption of Intelligent Solutions to Drive the Adoption of Document Analysis Solutions in the Healthcare and Life Sciences Vertical

10.5 Retail and Ecommerce

10.5.1 Growing Need to Manage and Improve Large Invoices to Drive the Growth of Document Analysis Solutions in the Vertical

10.6 Manufacturing

10.6.1 Growing Need to Automate Business Processes to Drive the Adoption of Document Analysis Solutions in the Manufacturing Vertical

10.7 Transportation and Logistics

10.7.1 Need to Reduce Freight Costs, Optimize Service Levels, Increase Efficiency, and Streamline Business Processes to Spur the Adoption of Document Analysis in the Transportation and Logistics Vertical

10.8 Others

11 Document Analysis Market, By Region (Page No. - 62)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Prominent Document Analysis Vendors in the Region to Drive the Adoption of Document Analysis Solutions in the United States

11.2.2 Canada

11.2.2.1 Early Adoption of Automation-Based Technologies to Drive the Growth of the Market in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Safety Laws and Compliances to Fuel the Adoption of Document Analysis Solutions in the United Kingdom

11.3.2 Germany

11.3.2.1 New Government Regulations and Adoption of Advanced Technologies to Fuel the Growth of the Market in Germany

11.3.3 France

11.3.3.1 Rising Need for Providing Enhanced Customer Experience to Fuel the Adoption of Document Analysis Solutions in France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Technological Advancement Across the Manufacturing Sector to Drive the Growth of the Document Analysis Market in China

11.4.2 Japan

11.4.2.1 Increased Spending on the Intelligent Automation Industry and R&D to Drive the Market for Document Analysis

11.4.3 India

11.4.3.1 Rise in Digitalization Among the Enterprises Incidents to Drive the Adoption of Document Analysis Solutions in India

11.4.4 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Middle East and North Africa

11.5.1.1 Adoption of Document Analysis in the Oil and Gas Vertical to Drive the Growth of the Document Analysis Market in Middle East and Africa

11.5.2 Sub-Saharan Africa

11.5.2.1 Rising Industrialization and Inclination Toward the Adoption of Advanced Technologies in Sub-Saharan Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Increasing Investment for the Adoption of Advanced Technologies to Drive the Growth of the Market in Brazil

11.6.2 Mexico

11.6.2.1 Growing It Infrastructure to Fuel the Adoption of Document Analysis Solutions in Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 102)

12.1 Competitive Scenario

12.1.1 New Product Launches

12.1.2 Partnerships and Collaborations

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

13 Company Profiles (Page No. - 106)

13.1 Introduction

(Business Overview, Software, Platform, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 ABBYY

13.3 Kofax

13.4 IBM

13.5 WorkFusion

13.6 Automation Anywhere

13.7 AntWorks

13.8 Parascript

13.9 Hyland

13.10 Datamatics

13.11 Extract Systems

13.12 HyperScience

13.13 OpenText

13.14 Infrrd

13.15 Celaton

13.16 HCL Technologies

13.17 Kodak Alaris

13.18 Rossum

13.19 InData Labs

13.20 Ephesoft

13.21 IRIS

13.22 Right-to-Win

*Details on Business Overview, Software, Platform, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 136)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (120 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Document Analysis Market Size, By Solution, 20172024 (USD Million)

Table 4 Product: Market Size, By Region, 20172024 (USD Million)

Table 5 Services: Market Size, By Region, 20172024 (USD Million)

Table 6 Market Size, By Service, 20172024 (USD Million)

Table 7 Professional Services: Market Size, By Region, 20172024 (USD Million)

Table 8 Managed Services: Market Size, By Region, 20172024 (USD Million)

Table 9 Market Size, By Deployment Type, 20172024 (USD Million)

Table 10 On-Premises: Market Size, By Region, 20172024 (USD Million)

Table 11 Cloud: Market Size, By Region, 20172024 (USD Million)

Table 12 Market Size, By Organization Size, 20172024 (USD Million)

Table 13 Large Enterprises: Document Analysis Size, By Region, 20172024 (USD Million)

Table 14 Small and Medium-Sized Enterprises: Document Analysis Market Size, By Region, 20172024 (USD Million)

Table 15 Market Size, By Vertical, 20172024 (USD Million)

Table 16 Banking, Financial Services and Insurance: Market Size, By Region, 20172024 (USD Million)

Table 17 Government: Market Size, By Region, 20172024 (USD Million)

Table 18 Healthcare and Life Sciences: Market Size, By Region, 20172024 (USD Million)

Table 19 Retail and Ecommerce: Market Size, By Region, 20172024 (USD Million)

Table 20 Manufacturing: Market Size, By Region, 20172024 (USD Million)

Table 21 Transportation and Logistics: Market Size, By Region, 20172024 (USD Million)

Table 22 Others: Market Size, By Region, 20172024 (USD Million)

Table 23 Market Size, By Region, 20172024 (USD Million)

Table 24 North America: Document Analysis Market Size, By Solution, 20172024 (USD Million)

Table 25 North America: Market Size, By Service, 20172024 (USD Million)

Table 26 North America: Market Size, By Deployment Type, 20172024 (USD Million)

Table 27 North America: Market Size, By Organization Size, 20172024 (USD Million)

Table 28 North America: Market Size, By Vertical, 20172024 (USD Million)

Table 29 North America: Market Size, By Country, 20172024 (USD Million)

Table 30 North America: Solution Market Size, By Country, 20172024 (USD Million)

Table 31 North America: Services Market Size, By Country, 20172024 (USD Million)

Table 32 North America: Large Enterprises Market Size, By Country, 20172024 (USD Million)

Table 33 North America: Small and Medium-Sized Enterprises Market Size, By Country, 20172024 (USD Million)

Table 34 North America: On-Premises Market Size, By Country, 20172024 (USD Million)

Table 35 North America: Cloud Market Size, By Country, 20172024 (USD Million)

Table 36 North America: Banking, Financial Services and Insurance Market Size, By Country, 20172024 (USD Million)

Table 37 North America: Government Market Size, By Country, 20172024 (USD Million)

Table 38 North America: Healthcare and Life Sciences Market Size, By Country, 20172024 (USD Million)

Table 39 North America: Retail and Ecommerce Market Size, By Country, 20172024 (USD Million)

Table 40 North America: Manufacturing Market Size, By Country, 20172024 (USD Million)

Table 41 North America: Transportation and Logistics Market Size, By Country, 20172024 (USD Million)

Table 42 North America: Others Market Size, By Country, 20172024 (USD Million)

Table 43 United States: Document Analysis Market Size, By Solution, 20172024 (USD Million)

Table 44 United States: Market Size, By Service, 20172024 (USD Million)

Table 45 United States: Market Size, By Deployment Type, 20172024 (USD Million)

Table 46 United States: Market Size, By Organization Size, 20172024 (USD Million)

Table 47 United States: Market Size, By Vertical, 20172024 (USD Million)

Table 48 United States: Product Market Size, By Vertical, 20172024 (USD Million)

Table 49 United States: Services Market Size, By Vertical, 20172024 (USD Million)

Table 50 United States: On-Premises Market Size, By Vertical, 20172024 (USD Million)

Table 51 United States: Cloud Market Size, By Vertical, 20172024 (USD Million)

Table 52 United States: Small and Medium-Sized Enterprises Market Size, By Vertical, 20172024 (USD Million)

Table 53 United States: Large Enterprises Market Size, By Vertical, 20172024 (USD Million)

Table 54 Canada: Document Analysis Market Size, By Solution, 20172024 (USD Million)

Table 55 Canada: Market Size, By Service, 20172024 (USD Million)

Table 56 Canada: Market Size, By Deployment Type, 20172024 (USD Million)

Table 57 Canada: Market Size, By Organization Size, 20172024 (USD Million)

Table 58 Canada: Market Size, By Vertical, 20172024 (USD Million)

Table 59 Europe: Market Size, By Solution, 20172024 (USD Million)

Table 60 Europe: Market Size, By Service, 20172024 (USD Million)

Table 61 Europe: Document Analysis Market Size, By Deployment Type, 20172024 (USD Million)

Table 62 Europe: Market Size, By Organization Size, 20172024 (USD Million)

Table 63 Europe: Market Size, By Vertical, 20172024 (USD Million)

Table 64 Europe: Market Size, By Country, 20172024 (USD Million)

Table 65 United Kingdom: Market Size, By Solution, 20172024 (USD Million)

Table 66 United Kingdom: Market Size, By Service, 20172024 (USD Million)

Table 67 United Kingdom: Document Analysis Market Size, By Deployment Type, 20172024 (USD Million)

Table 68 United Kingdom: Market Size, By Organization Size, 20172024 (USD Million)

Table 69 United Kingdom: Market Size, By Vertical, 20172024 (USD Million)

Table 70 United Kingdom: Product Market Size, By Vertical, 20172024 (USD Million)

Table 71 United Kingdom: Services Market Size, By Vertical, 20172024 (USD Million)

Table 72 United Kingdom: On-Premises Market Size, By Vertical, 20172024 (USD Million)

Table 73 United Kingdom: Cloud Market Size, By Vertical, 20172024 (USD Million)

Table 74 United Kingdom: Small and Medium-Sized Enterprises Market Size, By Vertical, 20172024 (USD Million)

Table 75 United Kingdom: Large Enterprises Market Size, By Vertical, 20172024 (USD Million)

Table 76 Asia Pacific: Market Size, By Solution, 20172024 (USD Million)

Table 77 Asia Pacific: Document Analysis Market Size, By Service, 20172024 (USD Million)

Table 78 Asia Pacific: Market Size, By Deployment Type, 20172024 (USD Million)

Table 79 Asia Pacific: Market Size, By Organization Size, 20172024 (USD Million)

Table 80 Asia Pacific: Market Size, By Vertical, 20172024 (USD Million)

Table 81 Asia Pacific: Market Size, By Country, 20172024 (USD Million)

Table 82 China:Market Size, By Solution, 20172024 (USD Million)

Table 83 China: Market Size, By Service, 20172024 (USD Million)

Table 84 China: Market Size, By Deployment Type, 20172024 (USD Million)

Table 85 China: Document Analysis Market Size, By Organization Size, 20172024 (USD Million)

Table 86 China: Market Size, By Vertical, 20172024 (USD Million)

Table 87 Middle East and Africa: Market Size, By Solution, 20172024 (USD Million)

Table 88 Middle East and Africa: Market Size, By Service, 20172024 (USD Million)

Table 89 Middle East and Africa: Market Size, By Deployment Type, 20172024 (USD Million)

Table 90 Middle East and Africa: Market Size, By Organization Size, 20172024 (USD Million)

Table 91 Middle East and Africa: Document Analysis Market Size, By Vertical, 20172024 (USD Million)

Table 92 Middle East and Africa: Market Size, By Country, 20172024 (USD Million)

Table 93 Middle East and North Africa: Market Size, By Solution, 20172024 (USD Million)

Table 94 Middle East and North Africa: Market Size, By Service, 20172024 (USD Million)

Table 95 Middle East and North Africa: Market Size, By Deployment Type, 20172024 (USD Million)

Table 96 Middle East and North Africa: Market Size, By Organization Size, 20172024 (USD Million)

Table 97 Middle East and North Africa: Document Analysis Market Size, By Vertical, 20172024 (USD Million)

Table 98 Latin America: Market Size, By Solution, 20172024 (USD Million)

Table 99 Latin America: Market Size, By Service, 20172024 (USD Million)

Table 100 Latin America: Market Size, By Deployment Type, 20172024 (USD Million)

Table 101 Latin America: Market Size, By Organization Size, 20172024 (USD Million)

Table 102 Latin America: Market Size, By Vertical, 20172024 (USD Million)

Table 103 Latin America: Document Analysis Market Size, By Country, 20172024 (USD Million)

Table 104 New Product Launches, 20172019

Table 105 Partnerships and Collaborations, 20172019

Table 106 ABBYY: Organic Growth Strategies

Table 107 ABBYY: Inorganic Growth Strategies

Table 108 Kofax: Organic Growth Strategies

Table 109 Kofax: Inorganic Growth Strategies

Table 110 IBM: Organic Growth Strategies

Table 111 IBM: Inorganic Growth Strategies

Table 112 WorkFusion: Organic Growth Strategies

Table 113 WorkFusion: Inorganic Growth Strategies

Table 114 Automation Anywhere: Organic Growth Strategies

Table 115 AntWorks: Organic Growth Strategies

Table 116 AntWorks: Inorganic Growth Strategies

Table 117 Parascript: Organic Growth Strategies

Table 118 Parascript: Inorganic Growth Strategies

Table 119 Hyland: Organic Growth Strategies

Table 120 Hyland: Inorganic Growth Strategies

List of Figures (25 Figures)

Figure 1 Document Analysis Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Segments With High Market Shares in the Market in 2019

Figure 4 North America to Account for the Highest Market Share in 2019

Figure 5 Growing Initiatives to Digitalize Content Across Enterprises to Drive the Growth of the Market

Figure 6 Banking, Financial Services and Insurance and United States to Account for High Market Shares Respectively in the North American Market in 2019

Figure 7 India to Grow at the Highest Growth Rate During the Forecast Period

Figure 8 Document Analysis Market: Drivers, Restraints, Opportunities, and Challenges

Figure 9 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 10 Managed Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 11 Cloud Deployment Segment to Grow at a Higher CAGR During the Forecast Period

Figure 12 Small and Medium-Sized Enterprises to Grow at a Higher CAGR During the Forecast Period

Figure 13 Government Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 15 North America: Market Snapshot

Figure 16 Asia Pacific: Market Snapshot

Figure 17 Key Developments in the Market During 20172019

Figure 18 Document Analysis Market (Global), Competitive Leadership Mapping, 2019

Figure 19 ABBYY: SWOT Analysis

Figure 20 Kofax: SWOT Analysis

Figure 21 IBM: Company Snapshot

Figure 22 IBM: SWOT Analysis

Figure 23 WorkFusion: SWOT Analysis

Figure 24 Automation Anywhere: SWOT Analysis

Figure 25 Datamatics: Company Snapshot

The study involved four major activities in estimating the current market size for the document analysis market. Exhaustive secondary research was done to collect information on the document analysis industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications, and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for making this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the document analysis market.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types; the competitive landscape of document analysis solution and service providers; and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key players strategies

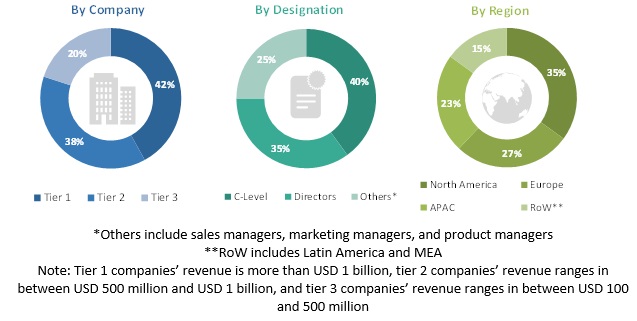

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the document analysis market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares split, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the document analysis market by solution (product and services), deployment type, organization size, vertical, and region

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments for five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players of the market and comprehensively analyze their market share and core competencies2

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations, in the document analysis market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the European document analysis market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Document Analysis Market