Docker Monitoring Market by Component (Solution and Services), Organization Size, Deployment Type, Industry Vertical (IT and Telecom, BFSI, eCommerce and Retail, Travel and Hospitality, Healthcare and Life Sciences), and Region - Global Forecast to 2024

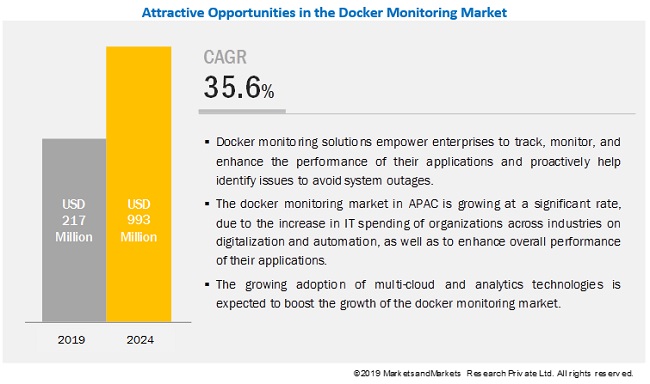

MarketsandMarkets estimates the global docker monitoring market size to grow from USD 217 million in 2019 to USD 993 million by 2024, at a Compound Annual Growth Rate (CAGR) of 35.6% during the forecast period. Factors expected to drive the growth of the docker monitoring market are the imminent need for monitoring health status of docker containers to avoid system outages and growing demand to optimize application performance across the dynamic container environment.

Factors, such as a rising trend of multi-cloud environment among enterprises and increasing infusion of analytics to enhance docker monitoring solution capabilities, are expected to create ample opportunities for docker monitoring solution vendors.

Software segment to hold a larger market size during the forecast period

The docker monitoring market by component covers, software and services. The software component is estimated to hold a larger market size during the forecast period. This is mainly due the advantages it offers, such as reduced monitoring complexity, complete docker visibility, and aggregated performance and health assessment. Furthermore, advanced capabilities of the docker monitoring software, such as actionable alerting and advanced analytics, fuel the demand for the docker monitoring solution.

On-premises segment to hold a larger market size during the forecast period in the docker monitoring market

The adoption of the on-premises docker monitoring solution is high as many companies across industry verticals, such as Banking, Financial Services and Insurance (BFSI), healthcare and life sciences, energy and utilities, and government still use bare metal servers to run legacy applications, due to several security risks associated with the cloud deployment mode. Therefore, to support their on-premises docker environment, these companies are increasingly adopting the on-premises docker monitoring solution for seamless integration, high data control, and self-configuration benefits.

Large enterprises to hold a majority of the market share during the forecast period

The adoption of docker monitoring solutions among large enterprises is high, due to the increasing adoption of trending technologies, such as Docker and Dockerized applications for improving speed and agility of services. To monitor such applications and containers, companies are increasingly adopting docker monitoring solutions. By automatically aggregating performance metrics, docker monitoring solution helps analyze change in docker services, clusters, hosts, containers, applications, and application codes that impact application performance for further optimizing docker performance.

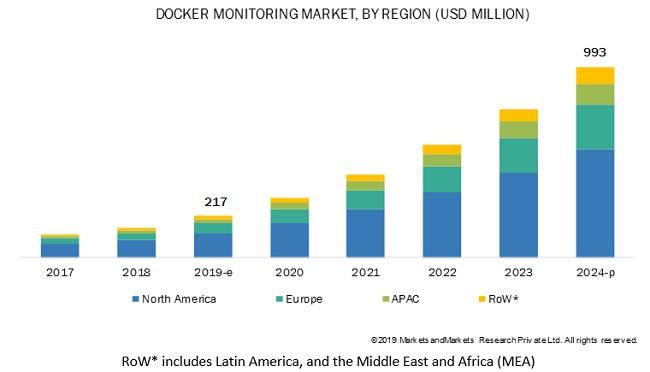

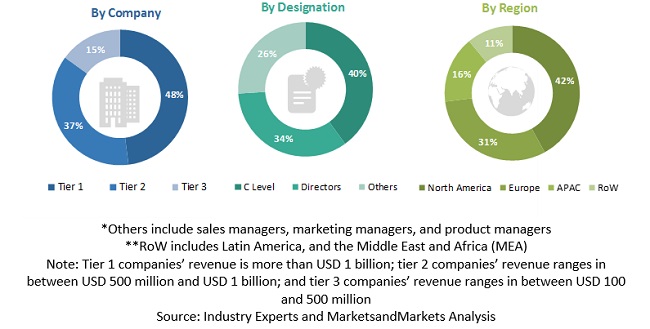

North America to account for the largest market size during the forecast period

The global docker monitoring market by region covers 4 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, and Rest of World (RoW). North America is expected to account for the largest market size during the forecast period due to the presence of large number of docker monitoring vendors and increasing adoption of cloud-native technologies, such as docker containerization and microservices among North American enterprises for overall improving business and system application performance.

Key Docker Monitoring Market Players

The major players in the market are Dynatrace (US), AppDynamics (US), New Relic (US), Broadcom (US), Microsoft (US), Datadog (US), Sysdig (US), Splunk (US), BMC Software (US), IBM (US), Riverbed Technology (US), Oracle (US), ScienceLogic (US), SolarWinds (US), Micro Focus (US), ManageEngine (US), Wavefront (US), Instana (US), Centreon (US), and Sumo Logic (US).

The study includes an in-depth competitive analysis of key players in the docker monitoring market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component, Deployment Type, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Dynatrace (US), AppDynamics (US), New Relic (US), Broadcom (US), Microsoft (US), Datadog (US), Sysdig (US), Splunk (US), BMC Software (US), IBM (US), Riverbed Technology (US), Oracle (US), ScienceLogic (US), SolarWinds (US), Micro Focus (US), ManageEngine (US), Wavefront (US), Instana (US), Centreon (US), and Sumo Logic (US) |

This research report categorizes the docker monitoring market based on component, deployment type, organization size, industry vertical, and region.

Based on Component:

- Solution

- Services

- Integration and Implementation

- Consulting

- Training and Support

Based on Deployment Type:

- On-premises

- Cloud

Based on Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on Industry Vertical:

- Information Technology (IT) and telecom

- Banking, Financial Services, and Insurance (BFSI)

- eCommerce and Retail

- Media and Entertainment

- Travel and Hospitality

- Healthcare and Life Sciences

- Others (Manufacturing, Government, and Energy and Utilities)

Based on Region:

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Rest of Europe

- APAC

- China

- Rest of APAC

- RoW (Latin America and MEA)

Recent Developments

- In January 2019, AppDynamics launched AppDynamics for Ciscos Application Centric Infrastructure (ACI), a monitoring solution with end-to-end transaction tracing and correlated data models that pinpoint constructs in a network that impact application performance.

- In October 2019, Datadog introduced the Cluster Agent a streamlined, centralized approach to collect cluster-level monitoring data, allowing users to auto scale applications using any metric collected by Datadog.

Key Questions Addressed by the Report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the docker monitoring market?

- Which are the major factors expected to drive the market?

- Which industry vertical would gain the largest market share in the market?

- Which region would offer high growth for vendors in the market?

Frequently Asked Questions (FAQ):

What is Docker Monitoring?

Docker monitoring refers to the activity of monitoring the performance of microservice containers in docker environments. It provides organizations time-series data for helping them fine-tune applications to enhance performance and robustness. Furthermore, it enables organizations to proactively identify issues to avoid system outages. Docker container monitoring tools are crucial for maintaining performance efficiency and detecting performance issues.

What are the top trends in docker monitoring market?

Trends impacting the docker monitoring include

- Need to monitor health status of docker containers to avoid system outages

- Demand for optimizing application performance across a dynamic container environment

Opportunities for the docker monitoring market include

- Growing trend of multi-cloud among enterprises

- Infusion of analytics and ML technologies to enhance the capabilities of the docker monitoring solution

What are the top companies providing docker monitoring solution?

Major vendors offering docker monitoring solution and services are Dynatrace, AppDynamics, New Relic, Broadcom, Microsoft, Datadog, Sysdig, Splunk, BMC Software, IBM, Riverbed Technology, and Oracle among others. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the docker monitoring market.

What are the top industry verticals contributing to the growth of docker monitoring market?

The top industry verticals contributing to the growth of docker monitoring market during the forecast period (2019-2024), include Information Technology (IT) and telecom, Banking, Financial Services, and Insurance (BFSI), and eCommerce and retail. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Docker Monitoring Market

4.2 North America: Market, By Industry Vertical and Country

4.3 Market: Major Countries

5 Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need to Monitor Health Status of Docker Containers to Avoid System Outages

5.2.1.2 Demand for Optimizing Application Performance Across A Dynamic Container Environment

5.2.2 Restraints

5.2.2.1 Complex Docker Container Security

5.2.3 Opportunities

5.2.3.1 Growing Trend of Multi-Cloud Among Enterprises

5.2.3.2 Infusion of Analytics and Ml Technologies to Enhance the Capabilities of the Docker Monitoring Solution

5.2.4 Challenges

5.2.4.1 Lack of Awareness and Scarcity of Skilled Professionals

5.2.4.2 Issue of Docker Container Sprawl

5.3 Industry Trends

5.3.1 Use Case 1: Dependency Mapping of Docker Container Components and Unified Analysis of Container Activity to Eliminate Container Issues

5.3.2 Use Case 2: Monitoring Servers and Services Contained in A Docker Architecture to Identify and Resolve Complex Production Issues

5.3.3 Use Case 3: Instrumenting and Monitoring Applications to Streamline Container and Application Efficiency

6 Docker Monitoring Market, By Component (Page No. - 41)

6.1 Introduction

6.2 Solution

6.2.1 Growing Need Among Enterprises to Monitor Application Performance and Avoid System Outages to Drive Adoption of Docker Monitoring Solution in Global Market

6.3 Services

6.3.1 Integration and Implementation

6.3.1.1 Need for Seamless Integration With Existing Docker Containers and Enclosed Microservices to Drive Demand for Integration and Implementation Services

6.3.2 Consulting

6.3.2.1 Assessing Business and IT Requirements for Selecting Right Docker Monitoring Solution to Drive Demand for Consulting Services

6.3.3 Training and Support

6.3.3.1 Need for Acquainting Users With Necessary Updates and Removing Knowledge Gaps to Drive Adoption of Training and Support Services

7 Docker Monitoring Market, By Organization Size (Page No. - 53)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Growing Need to Monitor and Improve Application Performance for Offering Enhanced Customer Experience to Fuel Growth of Market in Large Enterprises

7.3 Small and Medium-Sized Enterprises

7.3.1 Rising Awareness of Benefits of Docker Monitoring Solutions to Boost the Market Growth in Small and Medium-Sized Enterprises

8 Market, By Deployment Type (Page No. - 59)

8.1 Introduction

8.2 On-Premises

8.2.1 Need for Preserving Data Security and Control Driving Adoption of On-Premises Docker Monitoring Solutions

8.3 Cloud

8.3.1 Speed and Scalability Benefits to Boost Adoption of Cloud-Based Docker Monitoring Solutions

9 Docker Monitoring Market, By Industry Vertical (Page No. - 65)

9.1 Introduction

9.2 IT and Telecom

9.2.1 Distributed Processes and Abrupt Requirements to Drive Growth of Market in IT and Telecom Industry Vertical

9.3 Banking, Financial Services, and Insurance

9.3.1 Compliance and Regulatory Requirements to Drive Adoption of Docker Monitoring Solutions Among BFSI Organizations

9.4 eCommerce and Retail

9.4.1 Need for Real-Time Monitoring of Docker Containers to Improve Application Performance for Enhancing Customer Experience to Drive Growth of Market

9.5 Media and Entertainment

9.5.1 Ensuring Readiness of Docker Containers to Quickly Serve User Service Requests Driving Growth of Docker Monitoring Market in Media and Entertainment Industry Vertical

9.6 Travel and Hospitality

9.6.1 Monitoring Health Status of Docker Containers for Enhancing Customer Satisfaction With Fast Service Delivery to Boost the Market Growth in Travel and Hospitality Industry Vertical

9.7 Healthcare and Life Sciences

9.7.1 Improving Effectivity of Docker Containers to Ensure Quality Patient Care to Drive Adoption of Docker Monitoring Solutions Among Healthcare and Life Sciences Companies

9.8 Others

10 Docker Monitoring Market, By Region (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 High Technology Assimilation and Presence of Large Number of Players to Drive Adoption of Docker Monitoring Solution in the Us

10.2.2 Canada

10.2.2.1 Government Priorities for Achieving Workplace Modernization Through Technology Infusion Drive Demand for Docker Monitoring Solution in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Early Adoption of Cloud-Native Applications to Achieve Continuous Deployment and Testing Fuels Demand for Docker Monitoring Solution in the Uk

10.3.2 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Imminent Need for Standardizing Service Discovery Mechanism to Boost Growth of Market in China

10.4.2 Rest of Asia Pacific

10.5 Rest of World

10.5.1 Technological Diffusion, Concurrent Improvements in Container Technology, and Awareness of Benefits of Cloud-Native Applications to Drive Growth of Docker Monitoring Market in Rest of World

11 Competitive Landscape (Page No. - 100)

11.1 Introduction

11.2 Competitive Scenario

11.2.1 New Product/Solution Launches and Product Enhancements

11.2.2 Business Expansions

11.2.3 Partnerships

11.2.4 Acquisitions

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

12 Company Profiles (Page No. - 107)

12.1 Introduction

(Business Overview, Solutions, Platforms, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Dynatrace

12.3 Appdynamics

12.4 New Relic

12.5 Broadcom

12.6 Microsoft

12.7 Splunk

12.8 Datadog

12.9 BMC Software

12.10 IBM

12.11 Sysdig

12.12 Riverbed Technology

12.13 Oracle

12.14 Sciencelogic

12.15 Solarwinds

12.16 Micro Focus

12.17 Manageengine

12.18 Wavefront (By Vmware)

12.19 Instana

12.20 Centreon

12.21 Sumo Logic

12.22 Right to Win

*Details on Business Overview, Solutions, Platforms, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 140)

13.1 Knowledge Store: Marketsandmarkets Subscription Portal

13.2 Available Customizations

13.3 Related Reports

13.4 Author Details

List of Tables (103 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Docker Monitoring Market Size, By Component, 20172024 (USD Thousand)

Table 4 Solution: Market Size, By Region, 20172024 (USD Thousand)

Table 5 North America: Solution Market Size, By Country, 20172024 (USD Thousand)

Table 6 Europe: Solution Market Size, By Country, 20172024 (USD Thousand)

Table 7 Asia Pacific: Solution Market Size, By Country, 20172024 (USD Thousand)

Table 8 Services: Market Size, By Type, 20172024 (USD Thousand)

Table 9 Services: Docker Monitoring Market Size, By Region, 20172024 (USD Thousand)

Table 10 North America: Services Market Size, By Country, 20172024 (USD Thousand)

Table 11 Europe: Services Market Size, By Country, 20172024 (USD Thousand)

Table 12 Asia Pacific: Services Market Size, By Country, 20172024 (USD Thousand)

Table 13 Integration and Implementation Market Size, By Region, 20172024 (USD Thousand)

Table 14 North America: Integration and Implementation Market Size, By Country, 20172024 (USD Thousand)

Table 15 Europe: Integration and Implementation Market Size, By Country, 20172024 (USD Thousand)

Table 16 Asia Pacific: Integration and Implementation Market Size, By Country, 20172024 (USD Thousand)

Table 17 Consulting Market Size, By Region, 20172024 (USD Thousand)

Table 18 North America: Consulting Market Size, By Country, 20172024 (USD Thousand)

Table 19 Europe: Consulting Market Size, By Country, 20172024 (USD Thousand)

Table 20 Asia Pacific: Consulting Market Size, By Country, 20172024 (USD Thousand)

Table 21 Training and Support Market Size, By Region, 20172024 (USD Thousand)

Table 22 North America: Training and Support Market Size, By Country, 20172024 (USD Thousand)

Table 23 Europe: Training and Support Market Size, By Country, 20172024 (USD Thousand)

Table 24 Asia Pacific: Training and Support Market Size, By Country, 20172024 (USD Thousand)

Table 25 Docker Monitoring Market Size, By Organization Size, 20172024 (USD Thousand)

Table 26 Large Enterprises: Market Size, By Region, 20172024 (USD Thousand)

Table 27 North America: Large Enterprises Market Size, By Country, 20172024 (USD Thousand)

Table 28 Europe: Large Enterprises Market Size, By Country, 20172024 (USD Thousand)

Table 29 Asia Pacific: Large Enterprises Market Size, By Country, 20172024 (USD Thousand)

Table 30 Small and Medium-Sized Enterprises: Market Size, By Region, 20172024 (USD Thousand)

Table 31 North America: Small and Medium-Sized Enterprises Market Size, By Country, 20172024 (USD Thousand)

Table 32 Europe: Small and Medium-Sized Enterprises Market Size, By Country, 20172024 (USD Thousand)

Table 33 Asia Pacific: Small and Medium-Sized Enterprises Market Size, By Country, 20172024 (USD Thousand)

Table 34 Docker Monitoring Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 35 On-Premises: Market Size, By Region, 20172024 (USD Thousand)

Table 36 North America: On-Premises Market Size, By Country, 20172024 (USD Thousand)

Table 37 Europe: On-Premises Market Size, By Country, 20172024 (USD Thousand)

Table 38 Asia Pacific: On-Premises Market Size, By Country, 20172024 (USD Thousand)

Table 39 Cloud: Market Size, By Region, 20172024 (USD Thousand)

Table 40 North America: Cloud Market Size, By Country, 20172024 (USD Thousand)

Table 41 Europe: Cloud Market Size, By Country, 20172024 (USD Thousand)

Table 42 Asia Pacific: Cloud Market Size, By Country, 20172024 (USD Thousand)

Table 43 Market Size, By Industry Vertical, 20172024 (USD Thousand)

Table 44 IT and Telecom: Docker Monitoring Market Size, By Region, 20172024 (USD Thousand)

Table 45 Banking, Financial Services, and Insurance: Market Size, By Region, 20172024 (USD Thousand)

Table 46 eCommerce and Retail: Market Size, By Region, 20172024 (USD Thousand)

Table 47 Media and Entertainment: Market Size, By Region, 20172024 (USD Thousand)

Table 48 Travel and Hospitality: Market Size, By Region, 20172024 (USD Thousand)

Table 49 Healthcare and Life Sciences: Market Size, By Region, 20172024 (USD Thousand)

Table 50 Others: Market Size, By Region, 20172024 (USD Thousand)

Table 51 Market Size, By Region, 20172024 (USD Thousand)

Table 52 North America: Docker Monitoring Market Size, By Component, 20172024 (USD Thousand)

Table 53 North America: Market Size, By Service, 20172024 (USD Thousand)

Table 54 North America: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 55 North America: Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 56 North America: Market Size, By Industry Vertical, 20172024 (USD Thousand)

Table 57 North America: Market Size, By Country, 20172024 (USD Thousand)

Table 58 United States: Market Size, By Component, 20172024 (USD Thousand)

Table 59 United States: Docker Monitoring Market Size, By Service, 20172024 (USD Thousand)

Table 60 United States: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 61 United States: Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 62 Canada: Market Size, By Component, 20172024 (USD Thousand)

Table 63 Canada: Market Size, By Service, 20172024 (USD Thousand)

Table 64 Canada: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 65 Canada: Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 66 Europe: Market Size, By Component, 20172024 (USD Thousand)

Table 67 Europe: Docker Monitoring Market Size, By Service, 20172024 (USD Thousand)

Table 68 Europe: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 69 Europe: Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 70 Europe: Market Size, By Industry Vertical, 20172024 (USD Thousand)

Table 71 Europe: Market Size, By Country, 20172024 (USD Thousand)

Table 72 United Kingdom: Market Size, By Component, 20172024 (USD Thousand)

Table 73 United Kingdom: Market Size, By Service, 20172024 (USD Thousand)

Table 74 United Kingdom: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 75 United Kingdom: Docker Monitoring Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 76 Rest of Europe: Market Size, By Component, 20172024 (USD Thousand)

Table 77 Rest of Europe: Market Size, By Service, 20172024 (USD Thousand)

Table 78 Rest of Europe: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 79 Rest of Europe: Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 80 Asia Pacific: Market Size, By Component, 20172024 (USD Thousand)

Table 81 Asia Pacific: Market Size, By Service, 20172024 (USD Thousand)

Table 82 Asia Pacific: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 83 Asia Pacific: Docker Monitoring Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 84 Asia Pacific: Market Size, By Industry Vertical, 20172024 (USD Thousand)

Table 85 Asia Pacific: Market Size, By Country, 20172024 (USD Thousand)

Table 86 China: Market Size, By Component, 20172024 (USD Thousand)

Table 87 China: Market Size, By Service, 20172024 (USD Thousand)

Table 88 China: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 89 China: Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 90 Rest of Asia Pacific: Docker Monitoring Market Size, By Component, 20172024 (USD Thousand)

Table 91 Rest of Asia Pacific: Market Size, By Service, 20172024 (USD Thousand)

Table 92 Rest of Asia Pacific: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 93 Rest of Asia Pacific: Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 94 Rest of World: Market Size, By Component, 20172024 (USD Thousand)

Table 95 Rest of World: Market Size, By Service, 20172024 (USD Thousand)

Table 96 Rest of World: Market Size, By Organization Size, 20172024 (USD Thousand)

Table 97 Rest of World: Docker Monitoring Market Size, By Deployment Type, 20172024 (USD Thousand)

Table 98 Rest of World: Market Size, By Industry Vertical, 20172024 (USD Thousand)

Table 99 New Product/Solution Launches and Product Enhancements, 2019

Table 100 Business Expansions, 2018

Table 101 Partnerships , 20182019

Table 102 Acquisitions, 20182019

Table 103 Evaluation Criteria

List of Figures (33 Figures)

Figure 1 Docker Monitoring Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Market to Witness High Growth During the Forecast Period

Figure 4 Segments With High Market Shares in the Market in 2019

Figure 5 North America to Account for the Highest Market Share in 2019

Figure 6 Growing Need to Adopt Docker Monitoring Solutions to Enhance Application Performance and Avoid System Outages Driving Growth of Docker Monitoring Market

Figure 7 IT and Telecom Industry Vertical and the United States Expected to Account for High Market Shares in 2019

Figure 8 Asia Pacific to Grow at the Highest Growth Rate During the Forecast Period

Figure 9 Drivers, Restraints, Opportunities, and Challenges: Docker Monitoring Market

Figure 10 Growing Demand for Analytics Among Companies to Drive the Adoption of Docker Monitoring Solutions

Figure 11 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Integration and Implementation Segment to Grow at the Highest CAGR During the Forecast Period

Figure 13 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 14 Cloud Segment to Grow at A Higher CAGR During the Forecast Period

Figure 15 eCommerce and Retail Industry Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 16 Asia Pacific to Witness Significant Growth During the Forecast Period

Figure 17 North America: Market Snapshot

Figure 18 Asia Pacific: Market Snapshot

Figure 19 Key Developments By the Leading Players in the Docker Monitoring Market, 20172019

Figure 20 Market (Global) Competitive Leadership Mapping, 2019

Figure 21 Dynatrace: Company Snapshot

Figure 22 Dynatrace: SWOT Analysis

Figure 23 Appdynamics: SWOT Analysis

Figure 24 New Relic: Company Snapshot

Figure 25 New Relic: SWOT Analysis

Figure 26 Broadcom: Company Snapshot

Figure 27 Broadcom: SWOT Analysis

Figure 28 Microsoft: Company Snapshot

Figure 29 Microsoft: SWOT Analysis

Figure 30 Splunk: Company Snapshot

Figure 31 Splunk: SWOT Analysis

Figure 32 Datadog: Company Snapshot

Figure 33 IBM: Company Snapshot

The study involved 4 major activities in estimating the current size of the global docker monitoring market. An exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total docker monitoring market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred for, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the docker monitoring market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents,

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the docker monitoring market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global docker monitoring market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the docker monitoring market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the docker monitoring market by component (solution and services), deployment type, organization size, industry vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the docker monitoring market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the docker monitoring market

- To forecast the market size of 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of World (RoW)

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as new product launches and product enhancements, partnerships, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Docker Monitoring Market