Display Controller Market by Type (LCD Controller, Touchscreen Controller, Multi Display, Smart Display, Graphic LCD Controller), Application (Industrial Control, Medical Equipment, Automotive, Mobile Communication), and Geography - Global Forecast to 2022

[160 Pages Report] The display controller market was valued at USD 17.26 Billion in 2015 and is estimated to reach USD 32.24 Billion by 2022, at a CAGR of 9.68% during the forecast period. The base year used for this study is 2015, and the forecast period considered is between 2016 and 2022.

The objectives of the study are as follows:

- To define, describe, and forecast the display controller market segmented on the basis of type, application, and geography

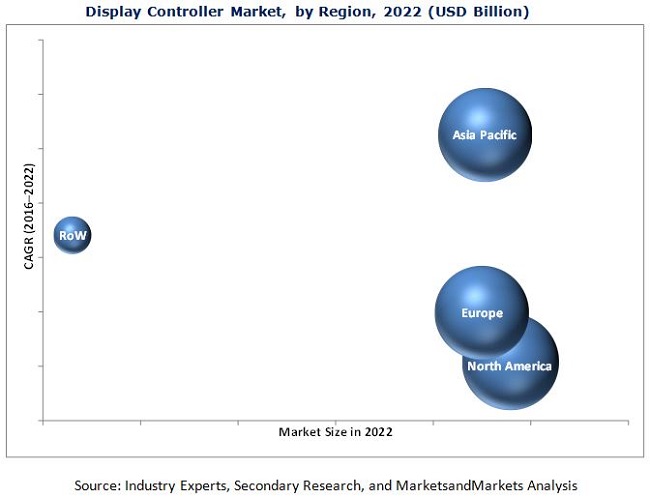

- To forecast the market size, in terms of value, for various segments with regard to four main regions—North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the market dynamics influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To study the complete value chain and allied industry segments and perform a value chain analysis of the global display controllers landscape

- To provide a detailed Porter’s analysis for the display controller market

- To analyze the strategic developments such as joint ventures, mergers and acquisitions, new product developments, and research and development (R&D) carried out in the market

The display controller market was valued at USD 17.26 Billion in 2015 and is expected to reach USD 32.24 Billion by 2022, at a CAGR of 9.68% during the forecast period. The growth of this market The growth of this market is driven by the factors such as high demand for mobile communication devices with advanced displays, increasing need for more sophisticated display controllers in teleconferencing applications, growing adoption of interactive displays in the retail sector for enhanced customer experience, and changing role of display controllers from generic devices to more holistic system controllers.

The scope of this report covers the market on the basis of type, application, and geography. LCD controllers are likely to hold the largest size of the display controller market by 2022, and the market for the same is expected to grow at the highest rate between 2016 and 2022. LCD controllers are used in several high-volume applications, including smartphones, home appliances, televisions, car infotainment systems, and flat-panel displays, among others.

Mobile communication devices applications accounted for the largest size of the overall display controller market in 2015. Smartphones and tablets are the key products in this segment, which account for an annual sale of over one billion units; this high volume is a major demand generator for display controllers. Moreover, the display resolution and pixel density is currently increasing in mobile communication devices, which necessitates the use of high-performance ICs with higher ASPs in these devices.

North America held the largest size of the display controller market in 2015. The demand in this region is high for major applications, including mobile communication and teleconferencing, e-learning, digital signage, advertising, and command and control. Factors such as availability of advanced technologies and abundant capital are contributing to the growth of the display controller market in North America.

One of the key restraining factors for the growth of the display controller market is the lack of skilled workforce to develop software programs for multi-touch and multi-display applications. This report describes the drivers, restraints, opportunities, and challenges for the market. In addition, it analyzes the current scenario and forecasts the market till 2022. The market in this research report has been segmented on the basis of type, application, and geography.

Samsung Electronics Co., Ltd. (South Korea) held the leading position in the global display controller market in 2015. The company strongly focuses on product innovations and technological advancements to capture more shares in the market. The company’s broad product portfolio, comprising a variety of semiconductors and display technologies, allows it to offer integrated products to its customers. This also helps it in obtaining better product margins, thereby improving its annual earnings. Samsung’s strong position in the market for smartphones and TVs poses as a boon for revenue generation in the market. The company relies on both organic and inorganic strategies for growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Market

1.3.1 Markets Covered

1.3.2 Display Controller Market, By Geography

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up and Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.2.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.3 Top-Down Approach

2.2.3.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Lucrative Opportunities in the Display Controller Market

4.2 Market – Comparison of Growth Pattern of Display Controller Types

4.3 Market in APAC in 2015

4.4 Market Share of Major Countries and Regions, 2015

4.5 Market, By Application

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Display Type

5.2.2 Market, By Interfaces

5.2.3 Market, By Application

5.2.4 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Demand for Mobile Computation Devices With Advanced Display and Controller Technologies

5.3.1.2 Need for Sophisticated Display Controllers in Teleconferencing Applications

5.3.1.3 Growing Adoption of Interactive Displays in the Retail Sector for Enhanced Customer Experience

5.3.1.4 Changing Role of Display Controllers From Generic Devices to Holistic System Controllers

5.3.2 Restraints

5.3.2.1 Different Operating System in Displays From Different Manufacturers and Lack of Skilled Workforce to Develop Software Programs for Multi- Touch and Multi-Display Applications

5.3.3 Opportunities

5.3.3.1 Growth Opportunity in Automotive Applications

5.3.3.2 Increasing Trend of Using Displays in Trade Shows and Events

5.3.4 Challenges

5.3.4.1 Manufacturing Controllers for A Wide Range of Display Panel Sizes and Applications is Very Complex

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Display Market, By Display Type (Page No. - 52)

7.1 Introduction

7.2 LCD Controller

7.3 Touchscreen Controller

7.4 Multi-Display Controller

7.5 Smart Display Controller

7.6 Graphics Display Controller

8 Types of Video Interfaces for Display Controller (Page No. - 85)

8.1 Introduction

8.2 Types of Video Interfaces

8.2.1 VGA

8.2.2 WVGA

8.2.3 DVI

8.2.4 HDMI

8.2.5 VHDCI

8.2.6 Displayport

8.3 Classification of Display Controllers

8.3.1 Video Shifter

8.3.2 Video Interface Controller

8.3.3 Video Co-Processor

9 Market By Application (Page No. - 89)

9.1 Introduction

9.2 Appliances

9.3 Industrial Control

9.4 Medical Equipment

9.5 Office Automation

9.6 Automotive

9.7 Mobile Communication Devices

9.8 Entertainment & Gaming

9.9 Others

10 Geographic Analysis (Page No. - 101)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Korea

10.4.4 Rest of APAC

10.5 Rest of the World

10.5.1 Middle East

10.5.2 South America

10.5.3 Africa

11 Competitive Landscape (Page No. - 119)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Expansions

11.3.3 Agreements, Partnerships, and Contracts

11.3.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 125)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Samsung Electronics Co., Ltd.

12.3 LG Display Co., Ltd.

12.4 Toshiba Corporation

12.5 Texas Instruments, Inc.

12.6 Novatek Microelectronics Corporation

12.7 Intersil Corpration

12.8 Fujitsu Limited

12.9 Seiko Epson Corporation

12.10 Solomon Systech Limited.

12.11 Digital View Inc.

12.12 Raio Technology Inc.

12.13 Cyviz As

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 152)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (80 Tables)

Table 1 Display Controller Market, By Type, 2013–2022 (USD Million)

Table 2 LCD Controller Market, By Value and Volume, 2013–2022

Table 3 LCD Controller Market, By Application, 2013–2022 (USD Million)

Table 4 LCD Controller Market, By Region, 2013–2022 (USD Million)

Table 5 LCD Controller Market for Appliances, By Region, 2013–2022 (USD Million)

Table 6 LCD Controller Market for Industrial Controls, By Region, 2013–2022 (USD Million)

Table 7 LCD Controller Market for Medical Equipment, By Region, 2013–2022 (USD Million)

Table 8 LCD Controller Market Office Automation, By Region, 2013–2022 (USD Million)

Table 9 LCD Controller Market for Automotive, By Region, 2013–2022 (USD Million)

Table 10 LCD Controller Market for Mobile Communication Devices, By Region, 2013–2022 (USD Million)

Table 11 LCD Controller Market for Entertainment & Gaming, By Region, 2013–2022 (USD Million)

Table 12 LCD Controller Market for Other Applications, By Region, 2013–2022 (USD Million)

Table 13 Touchscreen Controller Market, By Value and Volume, 2013–2022

Table 14 Touchscreen Controller Market, By Application, 2013–2022 (USD Million)

Table 15 Touchscreen Controller Market, By Region, 2013–2022 (USD Million)

Table 16 Touchscreen Controller Market for Appliances, By Region, 2013–2022 (USD Million)

Table 17 Touchscreen Controller Market for Industrial Controls, By Region, 2013–2022 (USD Million)

Table 18 Touchscreen Controller Market for Medical Equipment, By Region, 2013–2022 (USD Million)

Table 19 Touchscreen Controller Market Office Automation, By Region, 2013–2022 (USD Million)

Table 20 Touchscreen Controller Market for Automotive, By Region, 2013–2022 (USD Million)

Table 21 Touchscreen Controller Market for Mobile Communication Devices, By Region, 2013–2022 (USD Million)

Table 22 Touchscreen Controller Market for Entertainment & Gaming, By Region, 2013–2022 (USD Million)

Table 23 Touchscreen Controller Market for Other Applications, By Region, 2013–2022 (USD Million)

Table 24 Multi-Display Controller Market, By Value and Volume, 2013–2022

Table 25 Multi-Display Controller Market, By Application, 2013–2022 (USD Thousand)

Table 26 Multi-Display Controller Market, By Region, 2013–2022 (USD Thousand)

Table 27 Multi-Display Controller Market for Industrial Controls, By Region, 2013–2022 (USD Thousand)

Table 28 Multi-Display Controller Market for Medical Equipment, By Region, 2013–2022 (USD Thousand)

Table 29 Multi-Display Controller Market Office Automation, By Region, 2013–2022 (USD Thousand)

Table 30 Multi-Display Controller Market for Entertainment & Gaming, By Region, 2013–2022 (USD Thousand)

Table 31 Multi-Display Controller Market for Other Applications, By Region, 2013–2022 (USD Thousand)

Table 32 Smart Display Controller Market, By Value and Volume, 2013–2022

Table 33 Smart Display Controller Market, By Application, 2013–2022 (USD Million)

Table 34 Smart Display Controller Market, By Region, 2013–2022 (USD Million)

Table 35 Smart Display Controller Market for Appliances, By Region, 2013–2022 (USD Million)

Table 36 Smart Display Controller Market for Industrial Controls, By Region, 2013–2022 (USD Million)

Table 37 Smart Display Controller Market for Medical Equipment, By Region, 2013–2022 (USD Million)

Table 38 Smart Display Controller Market Office Automation, By Region, 2013–2022 (USD Million)

Table 39 Smart Display Controller Market for Automotive, By Region, 2013–2022 (USD Million)

Table 40 Smart Display Controller Market for Mobile Communication Devices, By Region, 2013–2022 (USD Million)

Table 41 Smart Display Controller Market for Entertainment & Gaming, By Region, 2013–2022 (USD Million)

Table 42 Smart Display Controller Market for Other Applications, By Region, 2013–2022 (USD Million)

Table 43 Graphics Display Controller Market, By Value and Volume, 2013–2022

Table 44 Graphics Display Controller Market, By Application, 2013–2022 (USD Million)

Table 45 Graphics Display Controller Market, By Region, 2013–2022 (USD Million)

Table 46 Graphics Display Controller Market for Appliances, By Region, 2013–2022 (USD Million)

Table 47 Graphics Display Controller Market for Industrial Controls, By Region, 2013–2022 (USD Million)

Table 48 Graphics Display Controller Market for Medical Equipment, By Region, 2013–2022 (USD Million)

Table 49 Graphics Display Controller Market for Office Automation, By Region, 2013–2022 (USD Million)

Table 50 Graphics Display Controller Market for Automotive, By Region, 2013–2022 (USD Million)

Table 51 Graphics Display Controller Market for Mobile Communication Devices, By Region, 2013–2022 (USD Million)

Table 52 Graphics Display Controller Market for Entertainment & Gaming, By Region, 2013–2022 (USD Million)

Table 53 Graphics Display Controller Market for Other Applications, By Region, 2013–2022 (USD Million)

Table 54 Market, By Application, 2013–2022 (USD Million)

Table 55 Market for Appliances, By Region, 2013–2022 (USD Million)

Table 56 Market for Industrial Controls, By Region, 2013–2022 (USD Million)

Table 57 Market for Medical Equipment, By Region, 2013–2022 (USD Million)

Table 58 Market Office Automation, By Region, 2013–2022 (USD Million)

Table 59 Market for Automotive, By Region, 2013–2022 (USD Million)

Table 60 Market for Mobile Communication Devices, By Region, 2013–2022 (USD Million)

Table 61 Market for Entertainment & Gaming, By Region, 2013–2022 (USD Million)

Table 62 Market for Other Applications, By Region, 2013–2022 (USD Million)

Table 63 Display Controller Market, By Region, 2013–2022 (USD Million)

Table 64 Market for North America, By Type, 2013–2022 (USD Million)

Table 65 Market for North America, By Application, 2013–2022 (USD Million)

Table 66 Market for North America, By Country, 2013–2022 (USD Million)

Table 67 Market for Europe, By Type, 2013–2022 (USD Million)

Table 68 Market for Europe, By Application, 2013–2022 (USD Million)

Table 69 Market for Europe, By Country, 2013–2022 (USD Million)

Table 70 Market for APAC, By Type, 2013–2022 (USD Million)

Table 71 Market for APAC, By Application, 2013–2022 (USD Million)

Table 72 Market for APAC, By Country, 2013–2022 (USD Million)

Table 73 Market for RoW, By Type, 2013–2022 (USD Million)

Table 74 Market for RoW, By Application, 2013–2022 (USD Million)

Table 75 Market for RoW, By Geography, 2013–2022 (USD Million)

Table 76 Market Ranking of the Top 5 Players in the Display Controller Market, 2015

Table 77 New Product Launches, 2014–2016

Table 78 Expansions, 2014–2016

Table 79 Agreements, Contracts, Partnerships, and Collaborations, 2014–2016

Table 80 Mergers & Acquisitions, 2014–2016

List of Figures (60 Figures)

Figure 1 Display Controller Market: Process Flow of Market Size Estimation

Figure 2 Display Controller Market: Research Design

Figure 3 Market Size Estimation Meth0dology: Bottom-Up Approach

Figure 4 Market Size Estimation Meth0dology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Display Controller Market Snapshot (2016 vs 2022): LCD Controller to Hold the Largest Market Size By 2022

Figure 8 Automotive Application Segment to Exhibit Fastest Growth in Market Between 2016 and 2022

Figure 9 Mobile Communication Devices Expected to Hold the Largest Market for Display Controllers During the Forecast Period

Figure 10 North America Held the Largest Share of the Market in 2015

Figure 11 High Demand From Mobile Communication Devices Would Create Opportunities for the Market Between 2016 and 2022

Figure 12 LCD Controller Segment to Hold the Largest Market Size During the Forecast Period

Figure 13 China Held the Largest Share of the Display Controller Market in APAC in 2015

Figure 14 U.S. Held the Largest Market Share of Display Controllers Market in 2015

Figure 15 Automotive Applicaion Segment to Exhibit the Highest CAGR in Market During the Forecast Period

Figure 16 Major Markets for Display Controller Across Different Geographies

Figure 17 High Demand for Mobile Computation Devices Will Likely Drive the Market for Display Controllers Durig the Forecast Period

Figure 18 Value Chain Analysis: Display Controller Market

Figure 19 Porter’s Five Forces Analysis: Display Controller Market (2015)

Figure 20 Porter’s Five Forces: Impact Analysis

Figure 21 Market: Threat of New Entrants

Figure 22 Market: Threat of Substitutes

Figure 23 Market: Bargaining Power of Suppliers

Figure 24 Market: Bargaining Power of Buyers

Figure 25 Market: Intensity of Competitive Rivalry

Figure 26 Major Segments for Display Controller, By Type

Figure 27 LCD Controller to Be the Leading Market for Display Controllers During the Forecast Period

Figure 28 Mobile Communication Devices to Be the Largest Application for LCD Controllers During the Forecast Period

Figure 29 Touchscreen Controllers to Be in Highest Demand in North America During the Forecast Period

Figure 30 Market Share of North America in Multi-Display Controller Market is Expected to Be Largest During the Forecast Period

Figure 31 Smart Display Controllers to Be in Highest Demand for Mobile Communication Devices During the Forecast Period

Figure 32 Demand for Graphics Display Controllers to Be Largest From North American Region During the Forecast Period

Figure 33 Major Applications for Display Controllers

Figure 34 Mobile Communication Devices to Be the Largest Market for Display Controllers During the Forecast Period

Figure 35 North America and APAC to Be the Leading Markets for Industrial Controls Between 2016 and 2022

Figure 36 Market in Automotive Application is Expected to Be Dominated By APAC During the Forecast Period

Figure 37 North America Expected to Be the Leading Market for Display Controllers in Mobile Communication Devices Between 2016 and 2022

Figure 38 U.S Accounted for the Largest Share of the Display Controller Market in 2015

Figure 39 Attractive Growth Opportunities in APAC During the Forecast Period

Figure 40 North America Market Snapshot, 2015

Figure 41 Europe Market Snapshot, 2015

Figure 42 APAC Market Snapshot, 2015

Figure 43 RoW Market Snapshot, 2015

Figure 44 Leading Companies in the Market Mostly Adopted Organic Growth Strategies

Figure 45 Battle for Market Share: New Product Launches Was the Key Strategy Between 2014–2016

Figure 46 Geographic Revenue Mix of the Top Market Players

Figure 47 Samsung Electronics Co., Ltd.: Company Snapshot

Figure 48 Samsung Electronics Co., Ltd.: SWOT Analysis

Figure 49 LG Display Co., Ltd.: Company Snapshot

Figure 50 LG Display Co., Ltd.: SWOT Analysis

Figure 51 Toshiba Corporation: Company Snapshot

Figure 52 Toshiba Corporation: SWOT Analysis

Figure 53 Texas Instruments, Inc.: Company Snapshot

Figure 54 Novatek Microelectronics Corporation: Company Snapshot

Figure 55 Novatek Microelectronics Corporation: SWOT Analysis

Figure 56 Intersil Corporation: Company Snapshot

Figure 57 Intersil Corporation: SWOT Analysis

Figure 58 Fujitsu Limited: Company Snapshot

Figure 59 Seiko Epson Corporation: Company Snapshot

Figure 60 Solomon Systech Limited.: Company Snapshot

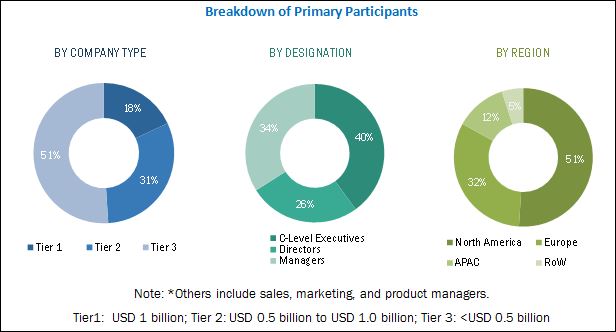

The research methodology used to estimate and forecast the display controller market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as IEEE journals, Factiva, Hoover’s, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global market from the revenues of some of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with people holding key positions in the industry such as CEOs, VPs, directors, and managers. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries has been depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The display controller market ecosystem includes manufacturers and solutions providers for display technologies such as Samsung Electronics Co., Ltd. (South Korea), LG Display Co., Ltd. (South Korea), Texas Instruments, Inc. (U.S.), Toshiba Corporation (Japan), Novatek Microelectronics Corporation (Taiwan), Intersil Corporation (U.S.), Fujitsu Limited (Japan), and Seiko Epson Corporation (Japan), among others.

Target Audience:

- Chip designers and fabricators

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users that want to know more about the technology and the latest technological developments in the industry

“The study answers several questions for the target audiences, primarily which market segments to focus on in next two to five years for prioritizing the efforts and investments.”

Report Scope:

In this report, the market has been segmented into the following categories.

Display controller market, by Type:

- LCD Controllers

- Touchscreen Controllers

- Multi-Display Controllers

- Smart Display Controllers

- Digital Display Controllers

Display controller market, by Application:

- Appliances

- Industrial Control

- Medical Equipment

- Office Automation

- Automotive

- Mobile Communication Devices

- Entertainment & Gaming

- Others

Display controller market, by Geography:

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France ,and Others)

- Asia-Pacific (China, Japan, South Korea, and Others)

- Rest of the World

Competitive Landscape: Market ranking analysis

Company Profiles: Detailed analysis of the major companies present in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Display Controller Market