Digitally Printed Wallpaper Market by Printing Technology (Inkjet, Electrophotography), Substrate (Nonwoven, Vinyl, Paper), End-Use Sector (Non-Residential, Residential, Automotive & Transportation) and Region - Global Forecast to 2027

Updated on : April 23, 2024

Digitally Printed Wallpaper Market

The digitally printed wallpaper market was valued at USD 4.7 billion in 2022 and is projected to reach USD 13.1 billion by 2027, growing at 22.4% cagr from 2022 to 2027. The increase in in urbanization and growing construction activities is driving the growth of the market. Moreover, the increasing growth in commercial and marketing sectors is also expected to drive the growth for digitally printed wallpaper in the near future.

Global Digitally Printed Wallpaper Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Digitally Printed Wallpaper Market Dynamics

DRIVERS: Growth of wallpapers with better durability and aesthetics

In comparison to interior paint, digitally printed wallpapers improve the aesthetic appeal of walls and are more reasonable. The demand for improved aesthetics has increased, particularly in residential construction. Digitally illustrated wallpapers promote the aesthetic allure of wall space along with protecting buildings from damage. Apart from this, the permanence of digitally printed wallpapers is much superior to that of conventional paintings. Wallpaper made from different substrates offers a wide range of benefits and properties.

RESTRAINT: Rivalry from paint & coating manufacturers

A rise in the availability of substitute products, such as paint & coating may hinder the growth of the market. Various paint & coating manufacturers are developing products that are environment-friendly, corrosion resistant, water resistant, heat resistant, and waterproof. Paints & coatings sold by companies, such as Asian Paints, PPG Industries, Sherwin-Williams, Berger Paints, and AkzoNobel, are promoted with a multi-year guarantee against corrosion, primarily as a result of improvements in the performance of coatings. In addition, to improve performance, manufacturers are continuously introducing new products in the market that are environmentally friendly. Hence, the introduction of new technologies has increased the performance of coatings, which has restricted the consumers’ shift from paint & coating products to digitally printed wallpaper.

OPPORTUNITIES: Growing use in commercial and marketing sectors

The application of digitally printed wallpapers is not limited to the residential sector. The demand for digital wallpapers is budding in the commercial sector, in malls, gyms, spas, showrooms, hospitals, and various other places. Through recent developments in digital printing, many businesses have started using customized wallpapers to create business interiors on behalf of the brand.

CHALLENGES: Rigorous legal regulations associated with the use of chemicals in wallpapers

Printing regulations, such as the ones in Europe—the European environmental legislative framework— safeguard that the emissions of hazardous organic compounds are under control. The European printing industry is devoted to decreasing carbon dioxide emissions and supporting reducing the carbon footprint. There are regulations from REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) related to the chemicals used in the manufacture of wallpapers.

Based on substrate, the vinyl segment is expected to lead the market during the projected period

The vinyl segment accounted for a major share of the digitally printed wallpaper market in terms of both value and volume. This growth can be ascribed to factors, such as elevated durability and easy maintenance, combined with lower cost, which boosts the demand for vinyl wallpaper, mainly in emerging economies.

Based on printing technology, the inkjet segment is projected to be the leading segment in the market

The inkjet segment overshadowed the global digitally printed wallpaper market, by technology and this development is projected to persist during the forecast period. The progress of this technology in the studied market is ascribed to the introduction of a high-speed, commercial color printing inkjet system.

Based on the end-use sector, the residential segment is likely to grow at the highest CAGR during the forecast period

Digital wallpapers are used in residential purposes for living rooms, dining rooms, and home interior decoration. The application of wallpapers in residential buildings complements the artistic appeal of the interiors. The budding urbanization and relocation of people from rural areas to metropolitan cities are key factors driving the residential sector.

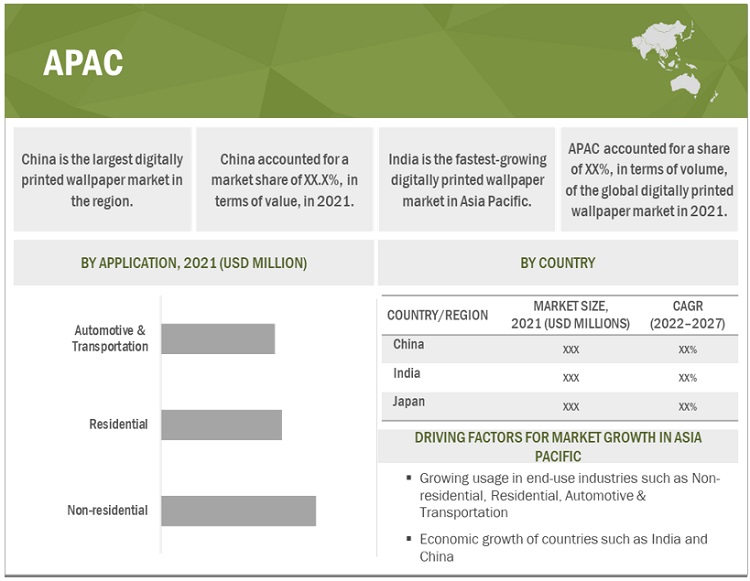

The Asia Pacific is likely to corroborate the highest growth in the digitally printed wallpaper market during the forecast period

The Asia Pacific is the fastest-growing market for digitally printed wallpaper globally. China account for a major share of the Asia Pacific market. The growing number of new housing units, boosting demand for cheaper interior decoration, along with an increase in populace and huge investments in the infrastructure sector are driving the requirement for digitally printed wallpaper in this region.

To know about the assumptions considered for the study, download the pdf brochure

Digitally Printed Wallpaper Market Players

The digitally printed wallpaper market is dominated by a few globally established players such as A.S. Création Tapeten AG (Germany), Muraspec Group (UK), Tapetenfabrik Gebr. Rasch GmbH & Co. KG (Germany), MX Display (UK), 4Walls (US) Flavor Paper (US), The Printed Wallpaper Company (UK), Hollywood Monster (UK), and Great Wall Custom Coverings (US), and among others, are key players in the digitally printed wallpaper market. These players have been focusing on developmental strategies, such as new product launches and investments which have helped them expand their businesses in untapped and potential markets.

Digitally Printed Wallpaper Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 4.7 billion |

|

Revenue Forecast in 2027 |

USD 13.1 billion |

|

CAGR |

22.4% |

|

Market size available for years |

2021–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Thousand square meter) |

|

Segments Covered |

Substrate, Printing Technology, End-Use Sector, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

A.S. Création Tapeten AG (Germany), Muraspec Group (UK), Tapetenfabrik Gebr. Rasch GmbH & Co. KG (Germany), MX Display (UK), 4Walls (US) Flavor Paper (US), The Printed Wallpaper Company (UK), Hollywood Monster (UK), and Great Wall Custom Coverings (US), and among others. Total 25 major players covered |

On the basis of substrate:

- Nonwoven

- Vinyl

- Paper

- Others (Glass Fiber, Canvas, and Grass Cloth)

On the basis of printing technology:

- Inkjet

- Electrophotography

On the basis of the end-use sector:

- Non-residential

- Residential

- Automotive & Transportation

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2019, Muraspec Wallcoverings launched three new wallcovering designs Tweed, Sorrento, and Novaro.

- In September 2019, Muraspec launched two new wallcovering designs Herringbone and Accor, made from specialty inks for the luxury segment

- In January 2019, the Meraspec Group launched new wallcovering collection Cantari. The company is adopting new product development as a growth strategy to strengthen its product portfolio and attract more customers

Frequently Asked Questions (FAQ):

What are digitally printed wallpaper?

Digitally printed wallpapers refer to wallpapers that are printed using digital printing processes, such as inkjet and electrophotography.

What is the major substrate of digitally printed wallpaper?

Vinyl is the most commonly used substrate in digitally printed wallpaper due to its high durability and easy maintenance, coupled with lower cost, which boosts the demand for vinyl wallpaper, mainly in emerging economies.

What are the major driving factors for digitally printed wallpaper?

The major drivers for the market include increasing use of digital technology, development of wallpapers with better durability and aesthetics and growing urbanization, and rising residential spending.

What is a major end-use sector that uses digitally printed wallpaper?

The non-residential segment contributed the largest share in the digitally printed wallpaper market. The demand for wallpapers for commercial applications is increasing as wallpaper manufacturers are coming up with wallpapers with new designs and patterns for non-residential buildings that are easier to install and remove, durable, environmentally friendly, and have an attractive finish.

Who is the leading digitally printed wallpaper provider in the world?

A.S. Création Tapeten AG (Germany), Muraspec Group (UK), Tapetenfabrik Gebr. Rasch GmbH & Co. KG (Germany), MX Display (UK), 4Walls (US) Flavor Paper (US), The Printed Wallpaper Company (UK), Hollywood Monster (UK), and Great Wall Custom Coverings (US), and among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 MARKET DEFINITION AND SCOPE

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primary interviews

2.2.2.3 Key industry insights

2.3 BASE NUMBER CALCULATION

FIGURE 2 BASE NUMBER CALCULATION

2.4 FORECAST NUMBER CALCULATION

2.5 MARKET ENGINEERING PROCESS

2.5.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 5 ASIA PACIFIC TO DOMINATE MARKET

FIGURE 6 VINYL SUBSTRATE TO LEAD MARKET

FIGURE 7 NON-RESIDENTIAL END-USE SECTOR TO LEAD MARKET

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN DIGITALLY PRINTED WALLPAPER MARKET

FIGURE 8 VINYL SEGMENT OFFERS LUCRATIVE GROWTH OPPORTUNITIES

4.2 DIGITALLY PRINTED WALLPAPER MARKET, BY SUBSTRATE

FIGURE 9 NONWOVEN TO BE FASTEST-GROWING SEGMENT

4.3 DIGITALLY PRINTED WALLPAPER MARKET, BY END-USE SECTOR

FIGURE 10 NON-RESIDENTIAL SEGMENT TO LEAD MARKET

4.4 DIGITALLY PRINTED WALLPAPER MARKET, BY END-USE SECTOR AND REGION

FIGURE 11 NON-RESIDENTIAL AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARES IN 2021

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DIGITALLY PRINTED WALLPAPER MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing use of digital technology

5.2.1.2 Wallpapers with higher durability and esthetics

5.2.2 RESTRAINTS

5.2.2.1 Competition from paint & coating manufacturers

5.2.3 OPPORTUNITIES

5.2.3.1 Demand in commercial and marketing sectors

5.2.4 CHALLENGES

5.2.4.1 Stringent regulations on chemicals in wallpapers

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 13 DIGITALLY PRINTED WALLPAPER MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 2 AVERAGE PRICES OF SUBSTRATE, BY REGION (USD/SQUARE METER)

5.6 PATENT ANALYSIS

5.6.1 INTRODUCTION

5.6.2 METHODOLOGY

5.6.3 DOCUMENT TYPE

TABLE 3 GRANTED PATENTS 57% OF TOTAL COUNT IN LAST 10 YEARS

FIGURE 14 NUMBER OF PATENTS PUBLISHED FROM 2011 TO 2021

FIGURE 15 NUMBER OF PATENTS PUBLISHED YEAR-WISE (2011–2021)

5.6.4 INSIGHTS

5.6.5 JURISDICTION ANALYSIS

FIGURE 16 PATENT ANALYSIS, BY TOP JURISDICTION

5.6.6 TOP APPLICANTS

FIGURE 17 TOP 10 PATENT APPLICANTS

6 DIGITALLY PRINTED WALLPAPER MARKET, BY PRINTING TECHNOLOGY (Page No. - 50)

6.1 INTRODUCTION

FIGURE 18 INKJET PRINTING TECHNOLOGY TO GROW AT HIGHER RATE

TABLE 4 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY PRINTING TECHNOLOGY, 2021–2027 (USD MILLION)

TABLE 5 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY PRINTING TECHNOLOGY, 2021–2027 (THOUSAND SQUARE METER)

6.2 INKJET

6.2.1 DEMAND FOR BETTER QUALITY AND LOW COST FOR SHORT RUN

6.3 ELECTROPHOTOGRAPHY

6.3.1 HIGH-QUALITY PRINT AT A HIGH-SPEED

7 DIGITALLY PRINTED WALLPAPER MARKET, BY SUBSTRATE (Page No. - 53)

7.1 INTRODUCTION

FIGURE 19 NONWOVEN SEGMENT TO GROW AT HIGHEST CAGR

TABLE 6 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 7 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

7.2 NONWOVEN

7.2.1 ECO-FRIENDLY, DURABLE, AND BREATHABLE WALLPAPERS

TABLE 8 NONWOVEN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 9 NONWOVEN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

7.3 VINYL

7.3.1 EASY MAINTENANCE AND LOWER COST

TABLE 10 VINYL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 11 VINYL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

7.4 PAPER

7.4.1 LOW COST OF PAPER-BASED DIGITALLY PRINTED WALLPAPER

TABLE 12 PAPER: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 13 PAPER: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

7.5 OTHERS

TABLE 14 OTHER SUBSTRATES: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 15 OTHER SUBSTRATES: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

8 DIGITALLY PRINTED WALLPAPER MARKET, BY END-USE SECTOR (Page No. - 60)

8.1 INTRODUCTION

FIGURE 20 NON-RESIDENTIAL SEGMENT TO LEAD DIGITALLY PRINTED WALLPAPER MARKET

TABLE 16 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 17 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

8.2 RESIDENTIAL

8.2.1 IMPROVING ESTHETIC APPEAL OF INTERIOR WALLS

TABLE 18 RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 19 RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

8.3 NON-RESIDENTIAL

8.3.1 NON-RESIDENTIAL SECTOR PROJECTED TO FUEL MARKET

TABLE 20 NON-RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 21 NON-RESIDENTIAL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

8.4 AUTOMOTIVE & TRANSPORTATION

8.4.1 DEMAND FOR COMMERCIAL PURPOSES

TABLE 22 AUTOMOTIVE & TRANSPORTATION: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 23 AUTOMOTIVE & TRANSPORTATION: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

9 DIGITALLY PRINTED WALLPAPER MARKET, BY REGION (Page No. - 66)

9.1 INTRODUCTION

FIGURE 21 ASIA PACIFIC TO LEAD DIGITALLY PRINTED WALLPAPER MARKET

TABLE 24 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 25 DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY REGION, 2021–2027 (THOUSAND SQUARE METER)

9.2 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SNAPSHOT

TABLE 26 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 27 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (THOUSAND SQUARE METER)

TABLE 28 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 29 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 30 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 31 ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.2.1 CHINA

9.2.1.1 Projected to lead market

TABLE 32 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 33 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 34 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 35 CHINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.2.2 JAPAN

9.2.2.1 Increasing residential and non-residential constructions

TABLE 36 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 37 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 38 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 39 JAPAN: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.2.3 INDIA

9.2.3.1 Availability of labor and growing disposable income

TABLE 40 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 41 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 42 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 43 INDIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.2.4 SOUTH KOREA

9.2.4.1 Rapid industrialization and urbanization

TABLE 44 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 45 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 46 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 47 SOUTH KOREA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.2.5 REST OF ASIA PACIFIC

9.2.5.1 Infrastructural developments in non-residential sector

TABLE 48 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 49 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 50 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 51 REST OF ASIA PACIFIC: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.3 EUROPE

FIGURE 23 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SNAPSHOT

TABLE 52 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 53 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (THOUSAND SQUARE METER)

TABLE 54 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 55 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 56 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 57 EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.3.1 GERMANY

9.3.1.1 Growth of end-use sectors

TABLE 58 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 59 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 60 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 61 GERMANY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.3.2 UK

9.3.2.1 Government investments in construction and infrastructure

TABLE 62 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 63 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 64 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 65 UK: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.3.3 FRANCE

9.3.3.1 Increase in new construction projects

TABLE 66 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 67 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 68 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 69 FRANCE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.3.4 RUSSIA

9.3.4.1 Growth of construction sector

TABLE 70 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 71 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 72 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 73 RUSSIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.3.5 ITALY

9.3.5.1 Increasing industrial construction

TABLE 74 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 75 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 76 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 77 ITALY: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.3.6 REST OF EUROPE

TABLE 78 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 79 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 80 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 81 REST OF EUROPE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.4 NORTH AMERICA

TABLE 82 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (THOUSAND SQUARE METER)

TABLE 84 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 86 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.4.1 US

9.4.1.1 Leading market in North America

TABLE 88 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 89 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 90 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 91 US: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.4.2 CANADA

9.4.2.1 Increasing construction activities

TABLE 92 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 93 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 94 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 95 CANADA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.4.3 MEXICO

9.4.3.1 Increasing investments in construction

TABLE 96 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 97 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 98 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 99 MEXICO: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.5 MIDDLE EAST & AFRICA

TABLE 100 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (THOUSAND SQUARE METER)

TABLE 102 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 104 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.5.1 SAUDI ARABIA

9.5.1.1 Increased car sales locally

TABLE 106 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 107 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 108 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 109 SAUDI ARABIA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.5.2 UAE

9.5.2.1 Significant growth of construction industry

TABLE 110 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 111 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 112 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 113 UAE: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 114 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 116 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 117 REST OF MIDDLE EAST & AFRICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.6 SOUTH AMERICA

TABLE 118 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 119 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY COUNTRY, 2021–2027 (THOUSAND SQUARE METER)

TABLE 120 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 121 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 122 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 123 SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.6.1 BRAZIL

9.6.1.1 Growing demand from residential sector fueling market

TABLE 124 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 125 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 126 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 127 BRAZIL: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.6.2 ARGENTINA

9.6.2.1 Growing commercial infrastructure

TABLE 128 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 129 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 130 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 131 ARGENTINA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

9.6.3 REST OF SOUTH AMERICA

9.6.3.1 Economic growth of countries

TABLE 132 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (USD MILLION)

TABLE 133 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY SUBSTRATE, 2021–2027 (THOUSAND SQUARE METER)

TABLE 134 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (USD MILLION)

TABLE 135 REST OF SOUTH AMERICA: DIGITALLY PRINTED WALLPAPER MARKET SIZE, BY END-USE SECTOR, 2021–2027 (THOUSAND SQUARE METER)

10 COMPETITIVE LANDSCAPE (Page No. - 115)

10.1 OVERVIEW

10.2 MARKET RANKING

FIGURE 24 MARKET RANK ANALYSIS OF TOP PLAYERS

10.3 PRODUCT FOOTPRINT

FIGURE 25 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

10.4 COMPANY EVALUATION MATRIX

10.4.1 STARS

10.4.2 PARTICIPANTS

10.4.3 PERVASIVE PLAYERS

FIGURE 26 DIGITALLY PRINTED WALLPAPER MARKET: COMPANY EVALUATION MATRIX, 2021

10.5 SME EVALUATION MATRIX, 2021

FIGURE 27 DIGITALLY PRINTED WALLPAPER MARKET: SME COMPANY EVALUATION MATRIX, 2019

10.6 COMPETITIVE SCENARIOS AND TRENDS

10.6.1 NEW PRODUCT LAUNCHES

10.6.2 PRODUCT LAUNCHES

TABLE 136 PRODUCT LAUNCHES, 2019

11 COMPANY PROFILES (Page No. - 121)

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weakness/competitive threats) *

11.1 MAJOR PLAYERS

11.1.1 A.S. CRÉATION TAPETEN AG

TABLE 137 A.S. CRÉATION TAPETEN AG: COMPANY OVERVIEW

FIGURE 28 A.S. CRÉATION TAPETEN AG: COMPANY SNAPSHOT

11.1.2 MURASPEC GROUP

TABLE 138 MURASPEC GROUP: COMPANY OVERVIEW

TABLE 139 MURASPEC GROUP: PRODUCT LAUNCHES

11.1.3 TAPETENFABRIK GEBR. RASCH GMBH & CO. KG

TABLE 140 TAPETENFABRIK GEBR. RASCH GMBH & CO. KG: COMPANY OVERVIEW

11.1.4 MX DISPLAY

TABLE 141 MX DISPLAY: COMPANY OVERVIEW

11.1.5 4WALLS

TABLE 142 4WALLS: COMPANY OVERVIEW

11.1.6 GRAHAM & BROWN

TABLE 143 GRAHAM & BROWN: COMPANY OVERVIEW

11.1.7 FLAVOR PAPER

TABLE 144 FLAVOR PAPER: COMPANY OVERVIEW

11.1.8 MCROBB DISPLAY LTD.

TABLE 145 MCROBB DISPLAY LTD.: COMPANY OVERVIEW

11.1.9 ASTEK WALLPAPERS

TABLE 146 ASTEK WALLPAPERS: COMPANY OVERVIEW

11.1.10 EFFECTIVE VISUAL MARKETING LIMITED

TABLE 147 EFFECTIVE VISUAL MARKETING LIMITED: COMPANY OVERVIEW

11.2 ADDITIONAL PLAYERS

11.2.1 PEGGY-BETTY DESIGNS

TABLE 148 PEGGY-BETTY DESIGNS: COMPANY OVERVIEW

11.2.2 THE PRINTED WALLPAPER COMPANY

TABLE 149 THE PRINTED WALLPAPER COMPANY: COMPANY OVERVIEW

11.2.3 HOLLYWOOD MONSTER

TABLE 150 HOLLYWOOD MONSTER: COMPANY OVERVIEW

11.2.4 GREAT WALL CUSTOM COVERINGS

TABLE 151 GREAT WALL CUSTOM COVERINGS: COMPANY OVERVIEW

11.2.5 MOONAVOOR SISUSTUS

TABLE 152 MOONAVOOR SISUSTUS: COMPANY OVERVIEW

11.2.6 OCTINK

TABLE 153 OCTINK: COMPANY OVERVIEW

11.2.7 CASPAR GMBH

TABLE 154 CASPAR GMBH: COMPANY OVERVIEW

11.2.8 JOHN MARK LTD.

TABLE 155 JOHN MARK LTD: COMPANY OVERVIEW

11.2.9 COLOR X

TABLE 156 COLOR X: COMPANY OVERVIEW

11.2.10 MARSHALLS

TABLE 157 MARSHALLS: COMPANY OVERVIEW

11.2.11 ECOSSE SIGNS

TABLE 158 ECOSSE SIGNS: COMPANY OVERVIEW

11.2.12 VISION SIGN AND DIGITAL

TABLE 159 VISION SIGN AND DIGITAL: COMPANY OVERVIEW

11.2.13 SURFACE PRINT

TABLE 160 SURFACE PRINT: COMPANY OVERVIEW

11.2.14 MEGAPRINT INC.

TABLE 161 MEGAPRINT INC.: COMPANY OVERVIEW

11.2.15 SENTEC INTERNATIONAL BV

TABLE 162 SENTEC INTERNATIONAL BV: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 145)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the digitally printed wallpaper market size. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary data includes company information acquired from annual reports, press releases, investor presentations; white papers; and articles from recognized authors. In the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to obtain, verify, and validate the market revenues arrived at. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

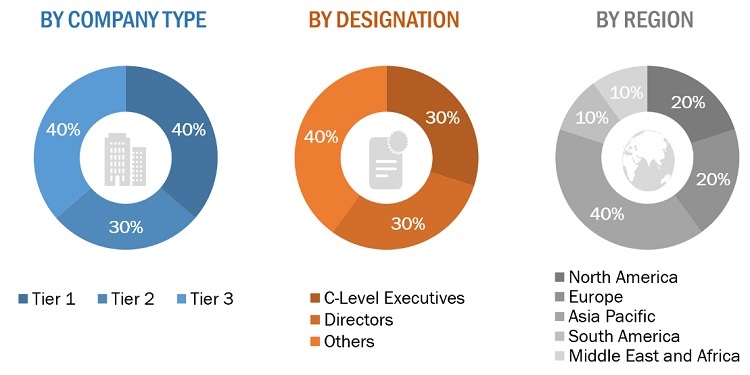

Primary Research

The digitally printed wallpaper market comprises stakeholders such as producers, suppliers, distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in end-use sectors such as residential, non-residential, and automotive & transportation. The supply side is characterized by market consolidation activities undertaken by digitally printed wallpaper manufacturers. Several primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

Breakdown of Primary Participants

Note: Companies are classified based on their revenues, product portfolios, and geographical presence.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the digitally printed wallpaper market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the market size for digitally printed wallpaper, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To estimate and forecast the digitally printed wallpaper market size based on substrate, printing technology, end-use sector, and region

- To analyze and forecast the digitally printed wallpaper market based on region – Asia Pacific, North America, Europe, Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Printing Technology Analysis

- A further breakdown of the printing technology segments of the digitally printed wallpaper market with respect to a particular country

End–Use Sector Analysis

- A further breakdown of the end-use sector segments of the digitally printed wallpaper market with respect to a particular substrate

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digitally Printed Wallpaper Market