Digital Vault Market by Component (Solutions and Services), Services (Consulting, Design and Implementation, Support and Maintenance, and Managed Services), Organization Size, Industry, and Region - Global Forecast to 2023

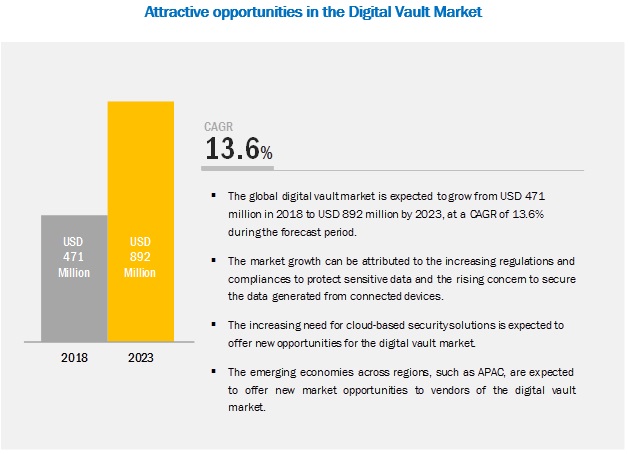

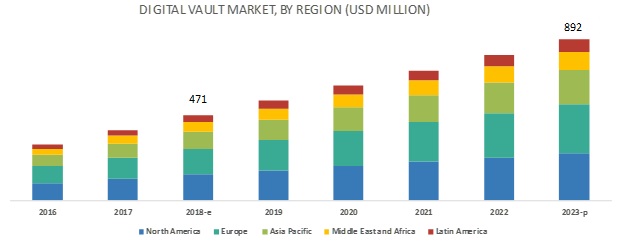

[114 Pages Report] The global digital vault market size is expected to grow approximately from USD 471 million in 2018 to USD 892 million by 2023, at a Compound Annual Growth Rate (CAGR) of 13.6% during 2018–2023. Major growth factors for the market include increasing regulations and compliances to protect sensitive data, and rising concerns for protecting data from connected devices.

By industry vertical, the BFSI vertical to be the largest contributor to the digital vault market growth during the forecast period

The BFSI industry vertical is a major adopter of digital vault solutions due to the highly sensitive financial data. The vertical faces various challenges related to stringent regulatory and security requirements, providing superior service to customers, and others. In addition, the vertical is always on the lookout for security products and services that could protect its employees, customers, assets, offices, branches, and operations. Hence, it holds a significant share in the overall digital vault market. The vertical introduces new and improved financial products and services to enhance their business operations, which makes it attractive for frauds to target sensitive customer information.

Consulting services segment to hold a larger market size during forecast period

Consulting services provide a set of services based on the service providers product portfolio as well as third-party product offerings. Typical consulting services include advices, in-depth product description, planning of solution implementation, architecture design, and post-production support. Consulting services help organizations to understand the need and implementation of solutions. It also provides a robust model of solutions to help clients achieve their strategic goals. These services ensure increased realization of benefits and proactive risk management, and better alignment of program objectives and business goals in large-scale transformation programs.

North America to hold the largest market size during the forecast period

North America is the leading region in the digital vault market. The region has developed economies (the US and Canada), which give it an upper hand over other regions in terms of utilization of highly secured platform for storing data gathered from vital sources. The region is expected to provide immense growth opportunities for digital vault vendors, due to the increasing demand for secured repository for long-term storage of critical information. The financial sector needs to be preventive than responsive for securing the information related to customers and enterprises. Banks and financial institutions are indulged in continuous business operations in which important documents need to be stored. The US and Canada are at the forefront as these countries have sustainable and well-established economies, which empower them to strongly invest in R&D activities, thereby contributing to the development of innovative technologies.

Key Digital Vault Market Players

Major vendors in the digital vault market include Johnson Controls (Ireland), CyberArk (US), IBM (US), Oracle (US), Hitachi (Japan), Microfocus (UK), Fiserv (US), Symantec (US), Microsoft (US), Multicert (Portugal), Keeper Security (US), Accruit (US), DSwiss (Switzerland), Safe4 (UK), TokenEx (US), Logic Choice (US), Eclypses (US), Harshicorp (US), Insoft Software (Germany), DaxTech IT Solutions (Canada), eOriginal (US), LexTrado (South Africa), OPSWAT (US), FutureVault (Canada), and ENC Security (Netherlands).

IBM is one of the leading providers of IT solutions with its innovative and wide range of technology products, which meet the changing paradigm of businesses. IBM offers EVault solution, enriched with advanced features, such as multivaulting capabilities, web-based User Interface (UI), scheduled backups, plug-in software support, end-to-end encryption, system image and granular recovery, deltaPro deduplication, and intelligent compression. The solution is capable of multivaulting, by which a client or server can be connected to multiple EVault locations. With this capability, data security is ensured, as it is stored in more than one location. IBM focuses high on the acquisition strategy for growing its business in the digital vault market. For instance, in January 2017, the company acquired Agile 3 Solutions, a provider of a cybersecurity solution that helps uncover, analyze, and visualize data-related business risks.

Johnson Controls is one of the leading providers of digital vault solutions. The company’s Digital Vault solution collects and stores data securely from different sources. The solution enhances cybersecurity by encrypting data at rest and in transit. The access control system protects the data by enabling access of data to only authorized entities. Data stored in the Digital Vault is masked, which prevents the security breach of any PII. Johnson Controls' Digital Vault improves data security by monitoring and identifying potential data breach. The solution eases the data mining process and serves as a medium of communication among various building subsystems and devices. Earlier, the data gathering process involved human efforts, which used to take a long duration. With the automation achieved through Johnson Controls’ Digital Vault, this process has become easier and quicker.

Scope of the report:

|

Report Metrics |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component (Solutions and Services), Services (Consulting, Design and Implementation, Support and Maintenance, and Managed Services), Organization Size, Industry, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East and Africa, and Latin America |

|

Companies covered |

Johnson Controls (Ireland), CyberArk (US), IBM (US), Oracle (US), Hitachi (Japan), Micro Focus (UK), Fiserv (US), Symantec (US), Microsoft (US), Multicert (Portugal), Keeper Security (US), Accruit (US), DSwiss (Switzerland), Safe4 Information Management (UK), TokenEx (US), Logic Choice (US), Eclypses (US), HarshiCorp (US), Insoft Infotel Solutions (Germany), Daxtech IT Solutions (Canada), eOriginal (US), LexTrado (South Africa), OPSWAT (US), FutureVault (Canada), and ENC Security (Netherlands). |

This research report categorizes the digital vault market based on component (solutions and services), services, organization size, industry, and regions.

By Component, the digital vault market has been segmented as follows:

- Solutions

- Services

By Services, the digital vault market has been segmented as follows:

- Consulting

- Design and implementation

- Support and maintenance

- Managed services

By Organization Size, the digital vault market has been segmented as follows:

- Large enterprises

- Small and medium enterprises

By Industry, the digital vault market has been segmented as follows:

- BFSI

- Government

- IT and Telecommunication

- Real Estate

- Defense

- Others (Legal and Non-Profit Organizations)

By Region, the digital vault market has been segmented as follows:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the digital vault market in the US and Canada

- Further breakup of the digital vault market in the UK and Germany

Company Information

- Detailed analysis and profiling of additional market players

Key Questions addressed by the report:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for the digital vault market?

- Which are the major factors expected to drive the market in near future?

- Which region would offer a higher growth for the vendors in the market?

- Which service would account for the highest market share in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Digital Vault Market: Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Forecast

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Digital Vault Market

4.2 Market Top 3 Industries and Regions

4.3 Market By Region

4.4 Market Investment Scenario

5 Market Overview (Page No. - 31)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Regulations and Compliances to Protect Sensitive Data

5.1.1.2 Rising Concern for Protecting Data Generated From Connected Devices

5.1.2 Restraints

5.1.2.1 Lack of Awareness About Data Security Measures

5.1.3 Opportunities

5.1.3.1 Increasing Need for Cloud-Based Security Solutions

5.1.4 Challenges

5.1.4.1 Lack of IT Cybersecurity Skills

5.1.4.2 Diversified IT Ecosystem Leads to Complex Deployment of Digital Vault Software

6 Digital Vault Market, By Component (Page No. - 35)

6.1 Introduction

6.2 Solutions

6.2.1 Identity and Access Management

6.2.1.1 Increasing Use of Connected Devices to Fuel the Growth of Identity and Access Management Solutions

6.2.2 Data Loss Prevention

6.2.2.1 Increasing Implementation of Government Regulations and Laws to Fuel the Growth of Data Loss Prevention Solutions

6.2.3 Digital Asset Management

6.2.3.1 Need for Managing the Crucial Information Within Enterprises to Increase the Demand for Digital Asset Management Solutions

6.2.4 Privileged Account Management

6.2.4.1 Critical Need for Protecting Data From Unauthorized Users to Fuel the Growth of Privilege Account Management Solutions

6.3 Services

7 Digital Vault Market, By Service (Page No. - 39)

7.1 Introduction

7.2 Consulting

7.2.1 Critical Need for Achieving Business Objectives to Increase the Demand for Consulting Services

7.3 Design and Implementation

7.3.1 Need for Integration of Digital Vault With Organizations’ IT Ecosystem to Fuel the Growth of Design and Implementation Services

7.4 Support and Maintenance

7.4.1 Need for Seamless Performance of Software Solutions to Increase the Demand for Support and Maintenance Services

7.5 Managed Services

7.5.1 Increasing Adoption of High-End Technologies to Increase the Demand for Managed Services

8 Digital Vault Market, By Organization Size (Page No. - 45)

8.1 Introduction

8.2 Large Enterprises

8.2.1 Increasing Sophisticated Cyber-Attacks to Fuel the Growth of Digital Vault Software in Large Enterprises

8.3 Small and Medium-Sized Enterprises

8.3.1 Critical Need for Securing the Confidential Information to Increase the Demand for Digital Vault Solutions in SMEs

9 Digital Vault Market, By Industry (Page No. - 49)

9.1 Introduction

9.2 BFSI

9.2.1 Increasing Cyber Threats and Concern of Protective Sensitive Financial Data to Drive the Growth of Digital Vault in the BFSI Industry

9.3 Government

9.3.1 Increasing Data Storage and Lack of Data Security in Government to Fuel the Growth of the Market in the Government Industry

9.4 IT and Telecommunications

9.4.1 Concern of Protecting Data Generated From New Technologies to Increase the Demand for Digital Vault Software in the IT and Telecommunications Industry

9.5 Real Estate

9.5.1 Increasing Concerns for Protecting Data of Lease and Contract Management to Fuel the Growth of the Market in the Real Estate Industry

9.6 Defense

9.6.1 Rising Threats and Attacks to Increase the Demand for Digital Vault Software in the Defense Industry

9.7 Others

10 Digital Vault Market, By Region (Page No. - 57)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Increasing Cyber-Attacks and Threats to Fuel the Growth of the Market

10.2.2 Canada

10.2.2.1 Rising Demand for Data Security in Finance and IT Industries to Fuel the Growth of the Market

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Growing Demand for Information Security in Banking and Legal Industries to Fuel the Growth of the Market in the Uk

10.3.2 Germany

10.3.2.1 Rising Concerns for Protecting Data Generated Through Connected Machines to Drive the Growth of Digital Vault Software

10.3.3 France

10.3.3.1 Increasing Distributed Denial of Service and Transaction Frauds to Fuel the Growth of the Digital Vault Market

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Adoption of Advent Technologies to Increase Possibilities of Cyber Threats

10.4.2 Australia

10.4.2.1 Increasing Awareness of Data Security Applications to Drive the Growth of Market

10.4.3 India

10.4.3.1 Increasing Adoption of Technologies in Various Industries to Lead the Demand for Digital Vault Software in India

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 United Arab Emirates

10.5.1.1 Rise in the Adoption of Data Security Solutions in the Telecom Industry to Lead the Growth of Digital Vault Software

10.5.2 South Africa

10.5.2.1 Increasing Government Initiatives for Information Security to Fuel the Growth of the Market

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Increasing Awareness of Data Security Measures to Enforce Digital Vault Vendors to Invest in Brazil

10.6.2 Mexico

10.6.2.1 High Growth in the Adoption of Advanced Technologies to Fuel the Growth of the Market

11 Competitive Landscape (Page No. - 75)

11.1 Overview

11.2 Market Ranking

11.3 Competitive Scenario

11.3.1 New Product Launches and Enhancements

11.3.2 Partnerships, Collaborations, and Agreements

11.3.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 78)

12.1 Johnson Controls

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Cyberark

12.3 IBM

12.4 Oracle

12.5 Hitachi

12.6 Micro Focus

12.7 Fiserv

12.8 Symantec

12.9 Microsoft

12.10 Multicert

12.11 Keeper Security

12.12 Accruit

12.13 Dswiss

12.14 Safe4

12.15 Tokenex

12.16 Logic Choice

12.17 Eclypses

12.18 Harshicorp

12.19 Insoft Infotel Solutions

12.20 Daxtech IT Solutions

12.21 Eorginal

12.22 Lextrado

12.23 Opswat

12.24 Futurevault

12.25 ENC Security

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 108)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (50 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Digital Vault Market Size and Growth Rate, 2018–2023 (USD Million, Y-O-Y %)

Table 4 Market Size By Component, 2016–2023 (USD Million)

Table 5 Solutions: Market Size By Region, 2016–2023 (USD Million)

Table 6 Services: Market Size By Region, 2016–2023 (USD Million)

Table 7 Digital Vault Market Size, By Service, 2016–2023 (USD Million)

Table 8 Consulting: Market Size By Region, 2016–2023 (USD Million)

Table 9 Design and Implementation: Market Size By Region, 2016–2023 (USD Million)

Table 10 Support and Maintenance: Market Size By Region, 2016–2023 (USD Million)

Table 11 Managed Services: Market Size By Region, 2016–2023 (USD Million)

Table 12 Digital Vault Market Size, By Organization Size, 2016–2023 (USD Million)

Table 13 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 14 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 15 Digital Vault Market Size: By Industry, 2016–2023 (USD Million)

Table 16 BFSI: Market Size By Region, 2016–2023 (USD Million)

Table 17 Government: Market Size By Region, 2016–2023 (USD Million)

Table 18 IT and Telecommunications: Market Size By Region, 2016–2023 (USD Million)

Table 19 Real Estate: Market Size By Region, 2016–2023 (USD Million)

Table 20 Defense: Market Size By Region, 2016–2023 (USD Million)

Table 21 Others: Market Size By Region, 2016–2023 (USD Million)

Table 22 Digital Vault Market Size, By Region, 2016–2023 (USD Million)

Table 23 North America: Market Size By Component, 2016–2023 (USD Million)

Table 24 North America: Market Size By Service, 2016–2023 (USD Million)

Table 25 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 26 North America: Market Size By Industry, 2016–2023 (USD Million)

Table 27 North America: Market Size By Country, 2016–2023 (USD Million)

Table 28 Europe: Digital Vault Market Size, By Component, 2016–2023 (USD Million)

Table 29 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 30 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 31 Europe: Market Size By Industry, 2016–2023 (USD Million)

Table 32 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 33 Asia Pacific: Digital Vault Market Size, By Component, 2016–2023 (USD Million)

Table 34 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 35 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 36 Asia Pacific: Market Size By Industry, 2016–2023 (USD Million)

Table 37 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 38 Middle East and Africa: Digital Vault Market Size, By Component, 2016–2023 (USD Million)

Table 39 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 40 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 41 Middle East and Africa: Market Size By Industry, 2016–2023 (USD Million)

Table 42 Middle East and Africa: Market Size By Country, 2016–2023 (USD Million)

Table 43 Latin America: Digital Vault Market Size, By Component, 2016–2023 (USD Million)

Table 44 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 45 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 46 Latin America: Market Size By Industry, 2016–2023 (USD Million)

Table 47 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 48 New Product Launches and Enhancements, 2014–2018

Table 49 Partnerships, Collaborations, and Agreements, 2016–2017

Table 50 Mergers and Acquisitions, 2016-2018

List of Figures (34 Figures)

Figure 1 Digital Vault Market: Research Design

Figure 2 Market Bottom-Up Approach

Figure 3 Market Top-Down Approach

Figure 4 Market Top 3 Segments, 2018

Figure 5 Market By Component, 2018

Figure 6 Increasing Regulations and Compliances to Protect Sensitive Data to Drive the Growth of the Digital Vault Market

Figure 7 Banking, Financial Services and Insurance Industry, and North America to Account for the Highest Market Shares in 2018

Figure 8 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 9 Asia Pacific to Emerge as the Best Market for Investments During the Next 5 Years

Figure 10 Drivers, Restraints, Opportunities, and Challenges: Digital Vault Market

Figure 11 Solutions Segment to Account for A Larger Market Size During the Forecast Period

Figure 12 Consulting Segment to Account for the Largest Market Size During the Forecast Period

Figure 13 Large Enterprises Segment to Account for A Larger Market Size During the Forecast Period

Figure 14 BFSI Industry to Account for the Largest Market Size During the Forecast Period

Figure 15 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Solutions Segment to Account for A Larger Market Size During the Forecast Period

Figure 18 Asia Pacific: Market Snapshot

Figure 19 Key Developments By the Leading Players in the Digital Vault Market During 2016–2018

Figure 20 Key Developments By the Leading Players in the Digital Vault Market During 2017–2018

Figure 21 Johnson Controls: Company Snapshot

Figure 22 Johnson Controls: SWOT Analysis

Figure 23 Cyberark: Company Snapshot

Figure 24 Cyberark: SWOT Analysis

Figure 25 IBM: Company Snapshot

Figure 26 IBM: SWOT Analysis

Figure 27 Oracle: Company Snapshot

Figure 28 Oracle: SWOT Analysis

Figure 29 Hitachi: Company Snapshot

Figure 30 Hitachi: SWOT Analysis

Figure 31 Micro Focus: Company Snapshot

Figure 32 Fiserv: Company Snapshot

Figure 33 Symantec: Company Snapshot

Figure 34 Microsoft: Company Snapshot

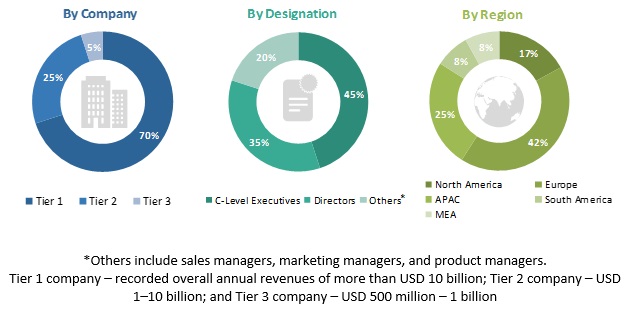

The study involved 4 major steps that helped estimate the current market size of the digital vault market. Exhaustive secondary research was done to collect information about the parent market and peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed for estimating the complete market size. Thereafter, market breakdown and data triangulation methods were used for estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; white papers; technology journals and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

The digital vault market comprises several stakeholders, such as digital vault software providers, private enterprises, technology consultants, technology service vendors, IT and telecommunication enterprises, and IT solution managed service providers. The demand side of the market is characterized by the development of industries, such as BFSI, government, IT and telecommunication, real estate, defense, and others (legal and non-profit organizations). The market’s supply side is characterized by advancements in technologies and solutions for data and information security. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the digital vault market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The digital vault market’s expenditure across regions and its geographic split in various segments have been considered to arrive at the overall market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation methods and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in all industry verticals.

Report Objectives:

- To define, describe, and forecast the digital vault market by component (solutions and services), organization size, industry, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze the competitive developments, such as mergers and acquisitions, new partnerships, product enhancements, and new product developments, in the digital vault market

Growth opportunities and latent adjacency in Digital Vault Market