Digital Badges Market by Offering (Platforms and Services), Type (Certification, Participation, Recognition, Achievement, Contribution), End User (Academic, Corporate, Government, Non-profit Organizations) and Region - Global Forecast to 2028

Updated on : Nov 17, 2025

Overview

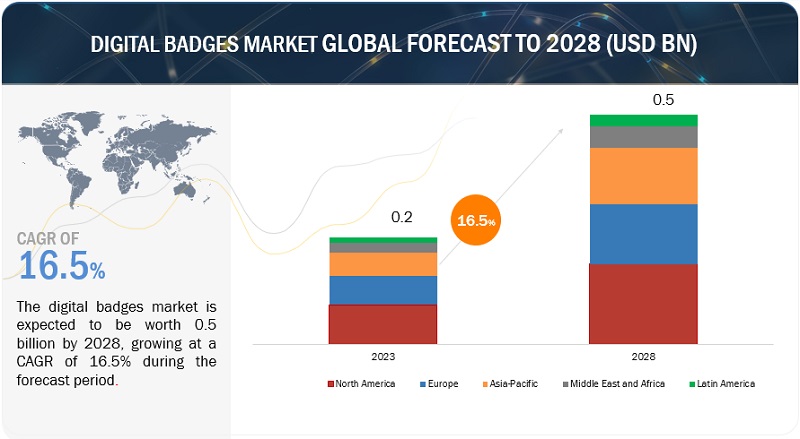

The digital badges market is projected to grow significantly, increasing from USD 0.2 billion in 2023 to USD 0.5 billion in 2028, with a robust CAGR of 16.5%.

Key growth drivers include the rising need for skills-validation in work and education, increased online and micro-credential learning, and demand for digital sharing of achievements. Using blockchain technology in the digital badge enhances security, prevents fraud, and builds trust among the issuers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Digital Badges Market Dynamics

Driver: Increasing focus on employees’ professional development

Businesses invest a lot of resources on the professional development of employees. Professional development programs have been introduced by a number of large businesses, including IBM, SAP, SAS, and Oracle, to support the culture of ongoing learning and development. The visible recognition of staff skills through the digital badge system promotes professional development. Employees are encouraged to take part in professional development programs, and their completion of learning programs is acknowledged. Similar to this, IBM has introduced a number of courses and gives its staff members the chance to advance their education and demonstrate their expertise by earning digital badges.

Restraint: Lack of IT infrastructure in developing countries

For the market for digital badges to expand, a strong IT infrastructure is one of the key factors. Digital badge implementation in educational institutions is hampered by poor IT infrastructure. For example, due to a lack of suitable IT infrastructures and connectivity options, the adoption of digital badges in Africa continues to be raised. There is virtually limited internet usage in nations like Nigeria, Kenya, and Uganda. An additional obstacle to the expansion of the digital badges market is the absence of proper roadmaps for utilizing digital technologies, such as eLearning, social learning, and adaptive learning in emerging nations.

Opportunity: Gamification in the education industry

Gaming-based learning is known as gamification. It is fundamentally a collection of course materials that functions like a game and is growing in popularity among students. It enables the application of game-design ideas to engage students in problem-solving. Gamification brings 3 major elements, i.e., mechanical components, personal aspects, and emotional components in the education industry. Additionally, it encourages reluctant and unmotivated students to participate in the learning process. Gamification provides students with a secure setting in which to overcome obstacles in practical settings. This idea is centered on providing learners with interactive experiences to encourage motivating learning. Many digital badge vendors are attempting to seize this market potential. They supply badging APIs that are combined with gamification tools in learning programs.

Challenge: Lack of digital badge equivalents

One of the key issues impeding the growth of digital badges is the lack of an equivalent. Badges awarded by an organization or region are rarely accepted by other institutions or nations. Equivalence is one of the most important considerations when introducing digital badges in academic institutions like schools and colleges. Both validating and portable badges are required. Across a range of issuers and audiences, they must share the same instantly recognizable characteristics.

Digital badges market Ecosystem

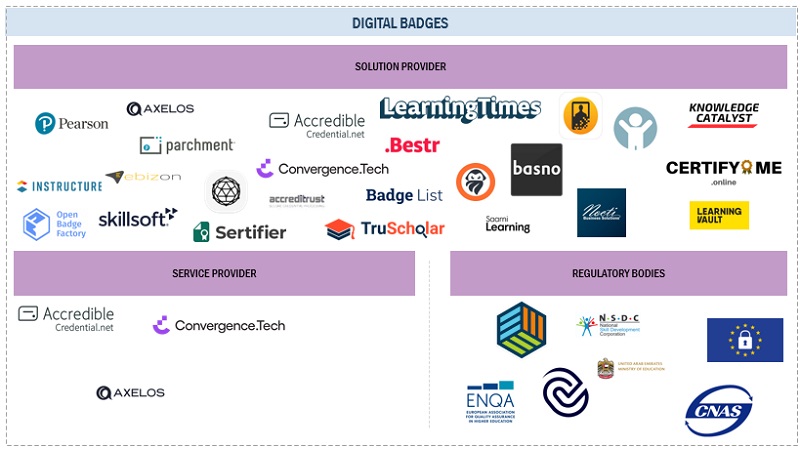

The digital badges market comprises solution providers, service providers, regulatory bodies, and end users working together to deliver digital badges solutions for skill enhancement and motivation.

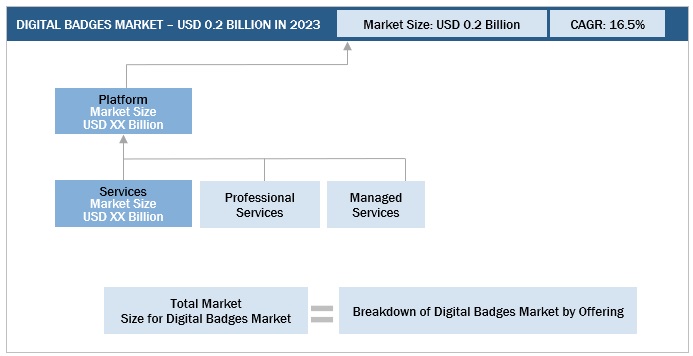

By offering, services segment holds the highest growth rate during the forecast period.

Market vendors provide digital badge services to help badge issuers set up an easy issuance process. Designing, development and support, training, and advising services are just a few of platform providers' many professional services. Designing services also involve graphic and program design. Service providers can aid in the process design for issuing badges. They may assist in defining the appropriate proof, establishing learner criteria, outlining the awarding process, and many other things. The platform interface and brand selection are both included in the visual design services. Services for development and support include assistance for development and maintenance problems and end-user support available around the clock. Training services aid in educating program managers about a company's digital credential program.

By end user, government is expected to register the fastest growth rate during the forecast period.

Digital Badges are slowly growing in Government organizations as it has significant benefits it implemented correctly can help efficiently operations within any kind of organization. Digital badges enable government agencies to validate and manage the skills and competencies of their employees. By awarding badges for specific training programs, certifications, or achievements, agencies can ensure that their workforce possesses the necessary expertise to fulfill their roles effectively. This promotes accountability and helps align employee skills with organizational objectives. Digital badges provide a standardized approach to skill recognition and competency assessment across government agencies. Badge programs can be designed based on established frameworks and industry standards, ensuring consistency in training and development efforts. Digital badges contribute to public transparency and trust in government services. By showcasing badges earned for compliance training, ethics, or specialized expertise, agencies can demonstrate their commitment to accountability and professionalism. Badges can be publicly displayed on government websites or profiles, providing transparency and instilling confidence in the public.

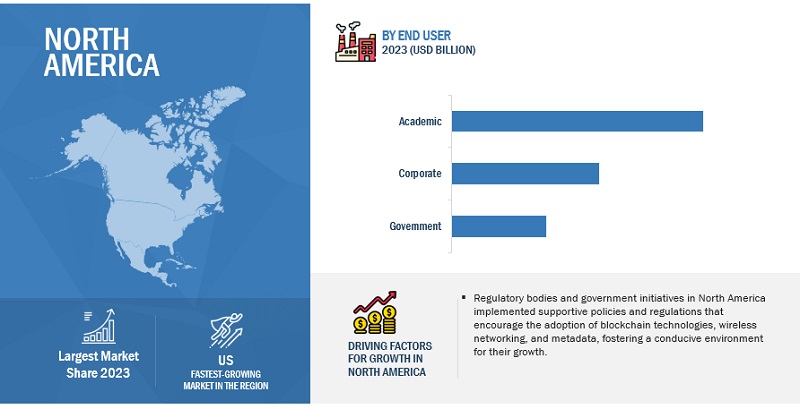

North America is expected to hold the largest market size during the forecast period.

The adoption of digital badges in North America is growing rapidly. Being a fast technology adopting region, North America is expected to have the largest market share in the digital badges market. North America holds the highest degree of competitiveness, and it accounts for the presence of more than 40% of the total digital badges providers. The US and Canada are the major contributors in the North American region. The region has well established large number of prominent educational institutes with quality education provided by them. Technological advancements have led to a rise in the adoption of digital badges in educational and corporate sectors. Digital badges help entities in these setups document and verify specific skills, thereby focusing on an individual’s credentials. There are numerous factors driving this growth, including adoption of online learning, the growing recognition of the value of digital badges by employers, the development of open badge standards, and the increasing availability of digital badge platforms in the region. The US is a leading country in the region in terms of digital badge adoption. The Digital Badges market is expected to be dominated by North America, and this trend is expected to continue during the forecast period. The presence of firms that utilize the digital badge technology has also contributed to the growth of the market.

Market Players:

The major players in the Digital badges market are Pearson (UK), Instructure (US), SkillSoft Corporation (US), PeopleCert (UK), Accredible (US), Parchment (US), EbizON (India), Accreditrust Technologies (US), Badgecraft (Lithuania), Badge List (US), Bestr (Italy), Basno (US), Saarni Learning Oy (Finland), ForAllSystems (US), LearningTimes (US), Nocti Business Solutions (US), Knowledge Catalyst, Learning Vault, Hyperstack (US), TruScholar (India), CredSure.io (Germany), CertifyMe (US), Convergence.Tech (Canada), Open Badge Factory (Finland), Sertifier (US), Certopus (India), and Virtualbadge.io (Germany). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the Digital badges market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering (Platform and Services), Type, End User, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Pearson (UK), Instructure (US), SkillSoft Corporation (US), PeopleCert (UK), Accredible (US), Parchment (US), EbizON (India), Accreditrust Technologies (US), Badgecraft (Lithuania), Badge List (US), Bestr (Italy), Basno (US), Saarni Learning Oy (Finland), ForAllSystems (US), LearningTimes (US), Nocti Business Solutions (US), Knowledge Catalyst, Learning Vault, Hyperstack (US), TruScholar (India), CredSure.io (Germany), CertifyMe (US), Convergence.Tech (Canada), Open Badge Factory (Finland), Sertifier (US), Certopus (India), and Virtualbadge.io (Germany). |

This research report categorizes the Digital badges market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Platform

-

Services

- Professional Services

- Managed Services

Based on Type:

- Certification Badges

- Recognition Badges

- Participation Badges

- Achievement Badges

- Contribution Badges

Based on End User:

- Academic

- Corporate

- Government

- Non-profit Organizations

- Other End Users

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- South Korea

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2023, Accredible partnered with Cengage Partners to offer Digital Badging and Micro-credentials and integrate it with Cengage Partners learning platform.

- In November 2022, Credly by Pearson and NovoEd partnered Credly will integrates its services for NovoEd’s learning journey learning and development professional would issue digital badges to let learners track progress and celebrate their achievements.

- In April 2022, Instructure acquired Concentric Sky the creator of Badgr a micro-credentialing platform, Instructure expands its offering in credential space through this acquisition.

- In June 2021, PeopleCert acquired Axelos UK based provider of framework and certification strengthening its position in exam and certification delivery and management.

Frequently Asked Questions (FAQ):

What is the definition of Digital badges market?

Digital badges market can be defined as a set of platforms and services that are used to issue badges to the learners. A digital badge is a type of digital credential that represents the accomplishments of certain skills. It includes online images offered by issuers and displayed by professionals and learners to showcase their expertise in a certain subject, skill, or task.

What is the market size of the Digital badges market?

The digital badges market is estimated at USD 0.2 billion in 2023 and is projected to reach USD 0.5 billion by 2028, at a CAGR of 16.5% from 2023 to 2028.

What are the major drivers in the Digital badges market?

The major drivers in Digital badges market are the growth in the adoption of online education, increasing focus on employees’ professional development, and use of blockchain for digital badges.

Who are the key players operating in the Digital badges market?

The key market players profiled in the Digital badges market are Pearson (UK), Instructure (US), SkillSoft Corporation (US), PeopleCert (UK), Accredible (US), Parchment (US), EbizON (India), Accreditrust Technologies (US), Badgecraft (Lithuania), Badge List (US), Bestr (Italy), Basno (US), Saarni Learning Oy (Finland), ForAllSystems (US), LearningTimes (US), Nocti Business Solutions (US), Knowledge Catalyst, Learning Vault, Hyperstack (US), TruScholar (India), CredSure.io (Germany), CertifyMe (US), Convergence.Tech (Canada), Open Badge Factory (Finland), Sertifier (US), Certopus (India), and Virtualbadge.io (Germany).

Which are the key technology trends prevailing in Digital badges market?

Web technologies, metadata, blockchain, and APIs are the key technology trends for digital badges market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in adoption of online education- Increase in focus on employees’ professional development- Use of blockchain for digital badgesRESTRAINTS- Lack of IT infrastructure in emerging economiesOPPORTUNITIES- Growth in emphasis on lifelong learning- Gamification of education industryCHALLENGES- Lack of digital badge equivalents- Budget constraints for educational institutions

-

5.3 INDUSTRY TRENDSOPEN BADGE INFRASTRUCTUREECOSYSTEM ANALYSISCASE STUDY ANALYSIS- GMAC uses digital badges to increase visibility of admissions program- TruScholar modernizing WIRC of ICAI- JigsawMindz growing its visibility through digital badges- Hootsuite uses digital badges to recognize and reward learningVALUE CHAIN ANALYSIS- Government regulatory authorities- Digital badge solution providers- Service providersREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizations- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaKEY CONFERENCES & EVENTSPRICING ANALYSIS- Average selling price of key players- Average selling price trendPORTER’S FIVE FORCE MODEL- Threat from new entrants- Threat from substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- Blockchain- Metadata- Big dataPATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsTRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS

-

6.1 INTRODUCTIONOFFERING: DIGITAL BADGES MARKET DRIVERS

-

6.2 PLATFORMSSHOWCASING EXPERTISE WITH DIGITAL CREDENTIALS

-

6.3 SERVICESPROFESSIONAL SERVICES- Gaining competitive edge in digital badges through professional servicesMANAGED SERVICES- Managing digital badges through expert guidance while saving time and cost

-

7.1 INTRODUCTIONEND USER: DIGITAL BADGES MARKET DRIVERS

-

7.2 ACADEMICNURTURING MOTIVATION AND PERSONALIZED LEARNINGK-12- Ensuring future-ready school and studentsHIGHER EDUCATION- Complementary and supplementary credentials to traditional transcripts

-

7.3 CORPORATETANGIBLE REWARDS TO FOSTER EMPLOYEE ENGAGEMENTSMES- Demand to keep track of employee competenciesLARGE ENTERPRISES- Standardization by aligning badge programs with desired skill frameworks to ensure consistency in training efforts

-

7.4 GOVERNMENTSTANDARDIZING EMPLOYEE SKILLS ACROSS ESTABLISHED FRAMEWORKS TO MEET ORGANIZATIONAL OBJECTIVES AND BUILD PUBLIC TRUST

-

7.5 NON-PROFIT ORGANIZATIONSDIGITAL NON-PROFIT CREDENTIALS SHOWCASING EXPERTISE IN SOCIAL GOOD

- 7.6 OTHER END USERS

-

8.1 INTRODUCTIONTYPE: MARKET DRIVERS

-

8.2 CERTIFICATION BADGESRELIABLE MEANS OF EVALUATING CANDIDATES’ QUALIFICATIONS FOR EMPLOYERS

-

8.3 RECOGNITION BADGESENHANCING STAKEHOLDER ENGAGEMENT

-

8.4 PARTICIPATION BADGESMOTIVATING PARTICIPATION AND EXPANDING NETWORKS

-

8.5 ACHIEVEMENT BADGESSHOWCASING ACCOMPLISHMENTS TO BUILD CREDIBILITY

-

8.6 CONTRIBUTION BADGESRECOGNIZING CONTRIBUTIONS THAT MADE DIFFERENCE

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTNORTH AMERICA: DIGITAL BADGES MARKET DRIVERSUS- Adopted by big tech corporations to track employee skills and competenciesCANADA- Increase in implementation of digital badges by national professional associations

-

9.3 EUROPEEUROPE: RECESSION IMPACTEUROPE: DIGITAL BADGES MARKET DRIVERSUK- Growth in interest in education, employment, and skills development sectorGERMANY- Increase in government initiativesSPAIN- Rise in popularity of digital badges in education sectorREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: DIGITAL BADGES MARKET DRIVERSCHINA- Rise in number of people using mobile devicesJAPAN- Greater interest in lifelong learning and educational reformsINDIA- Increase in value for micro-credentials and upskillingAUSTRALIA & NEW ZEALAND- Rise in adoption of digital badge solutions in Australia & New ZealandSOUTH KOREA- Well-developed eLearning infrastructureREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: DIGITAL BADGES MARKET DRIVERSMIDDLE EAST- Increase in popularity of online training and government initiativesAFRICA- NGO initiatives and pilot badge programs

-

9.6 LATIN AMERICALATIN AMERICA: RECESSION IMPACTLATIN AMERICA: DIGITAL BADGES MARKET DRIVERSBRAZIL- Rise in digital badges projects and initiativesMEXICO- Potential for learning and development through NGO initiativesREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 10.5 COMPETITIVE BENCHMARKING

-

10.6 COMPANY EVALUATION MATRIXCOMPANY EVALUATION MATRIX METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 COMPETITIVE SCENARIODEALS

-

11.1 PEARSONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices made- Weaknesses and competitive threats

-

11.2 INSTRUCTUREBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices made- Weaknesses and competitive threats

-

11.3 SKILLSOFTBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices made- Weaknesses and competitive threats

-

11.4 PEOPLECERTBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices made- Weaknesses and competitive threats

-

11.5 ACCREDIBLEBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices made- Weaknesses and competitive threats

-

11.6 PARCHMENTBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.7 EBIZONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.8 ACCREDITRUST TECHNOLOGIES

- 11.9 BADGE LIST

- 11.10 BADGECRAFT

- 11.11 BESTR

- 11.12 BASNO

- 11.13 SAARNI LEARNING OY

- 11.14 FORALL SYSTEMS

- 11.15 LEARNINGTIMES

- 11.16 NOCTI BUSINESS SOLUTIONS

- 11.17 KNOWLEDGE CATALYST

- 11.18 LEARNING VAULT

- 11.19 HYPERSTACK

- 11.20 TRUSCHOLAR

- 11.21 CERTIFYME

- 11.22 CONVERGENCE.TECH

- 11.23 OPEN BADGE FACTORY

- 11.24 SERTIFIER

- 11.25 CREDSURE

- 11.26 VIRTUALBADGE.IO

- 11.27 CERTOPUS

- 12.1 INTRODUCTION

-

12.2 LEARNING MANAGEMENT SYSTEM MARKETMARKET DEFINITIONMARKET OVERVIEWLEARNING MANAGEMENT SYSTEM MARKET, BY COMPONENTLEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODELEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPELEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPELEARNING MANAGEMENT SYSTEM MARKET, BY REGION

-

12.3 SMART LEARNING MARKETMARKET DEFINITIONMARKET OVERVIEWSMART LEARNING MARKET, BY COMPONENTSMART LEARNING MARKET, BY SERVICESMART LEARNING MARKET, BY LEARNING TYPESMART LEARNING MARKET, BY END USERSMART LEARNING MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 DIGITAL BADGES MARKET: ECOSYSTEM

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 8 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED DIGITAL BADGE SERVICES

- TABLE 9 IMPACT OF EACH PORTER’S FORCE ON DIGITAL BADGES MARKET

- TABLE 10 PATENTS FILED, 2021–2023

- TABLE 11 PATENTS GRANTED IN MARKET, 2021–2023

- TABLE 12 MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 13 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 14 PLATFORMS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 15 PLATFORMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 17 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 SERVICES: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 19 SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 20 PROFESSIONAL SERVICES: DIGITAL BADGES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 25 MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 26 ACADEMIC: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 ACADEMIC: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 ACADEMIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 29 ACADEMIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 K-12: DIGITAL BADGES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 K-12: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 HIGHER EDUCATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 HIGHER EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 CORPORATE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 CORPORATE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 CORPORATE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 37 CORPORATE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 SMES: DIGITAL BADGES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 SMES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 GOVERNMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 NON-PROFIT ORGANIZATIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 NON-PROFIT ORGANIZATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 OTHER END USERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 OTHER END USERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 49 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 50 CERTIFICATION BADGES: DIGITAL BADGES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 CERTIFICATION BADGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 RECOGNITION BADGES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 RECOGNITION BADGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 PARTICIPATION BADGES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 PARTICIPATION BADGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 ACHIEVEMENT BADGES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 ACHIEVEMENT BADGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 CONTRIBUTION BADGES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 CONTRIBUTION BADGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 DIGITAL BADGES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: DIGITAL BADGES MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY ACADEMIC END USER, 2017–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY CORPORATE END USER, 2017–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY CORPORATE END USER, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 US: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 77 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 79 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 80 US: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 81 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 US: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 83 US: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 85 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 86 CANADA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 87 CANADA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 88 CANADA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 89 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 CANADA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 91 CANADA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: DIGITAL BADGES MARKET, BY ACADEMIC END USER, 2017–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY CORPORATE END USER, 2017–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY CORPORATE END USER, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 UK: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 107 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 108 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 109 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 110 UK: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 111 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 UK: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 113 UK: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MARKET, BY ACADEMIC END USER, 2017–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MARKET, BY CORPORATE END USER, 2017–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY CORPORATE END USER, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 CHINA: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 129 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 130 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 131 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 132 CHINA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 133 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 CHINA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 135 CHINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY ACADEMIC END USER, 2017–2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY CORPORATE END USER, 2017–2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: MARKET, BY CORPORATE END USER, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 151 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 165 LATIN AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: MARKET, BY ACADEMIC END USER, 2017–2022 (USD MILLION)

- TABLE 167 LATIN AMERICA: MARKET, BY ACADEMIC END USER, 2023–2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: MARKET, BY CORPORATE END USER, 2017–2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: MARKET, BY CORPORATE END USER, 2023–2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 171 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 172 BRAZIL: DIGITAL BADGES MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 173 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 174 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 175 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 176 BRAZIL: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 177 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 178 BRAZIL: MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 179 BRAZIL: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 180 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 181 DIGITAL BADGES MARKET: DEGREE OF COMPETITION

- TABLE 182 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 183 DEALS, 2020–2023

- TABLE 184 PEARSON: BUSINESS OVERVIEW

- TABLE 185 PEARSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 PEARSON: DEALS

- TABLE 187 INSTRCUTURE: BUSINESS OVERVIEW

- TABLE 188 INSTRCUTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 INSTRUCTURE: DEALS

- TABLE 190 SKILLSOFT: BUSINESS OVERVIEW

- TABLE 191 SKILLSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 PEOPLECERT: BUSINESS OVERVIEW

- TABLE 193 PEOPLECERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 PEOPLECERT: DEALS

- TABLE 195 ACCREDIBLE: BUSINESS OVERVIEW

- TABLE 196 ACCREDIBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 ACCREDIBLE: DEALS

- TABLE 198 PARCHMENT: BUSINESS OVERVIEW

- TABLE 199 PARCHMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 PARCHMENT: DEALS

- TABLE 201 EBIZON: BUSINESS OVERVIEW

- TABLE 202 EBIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 LEARNING MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 204 LEARNING MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 205 LEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODE, 2017–2021 (USD MILLION)

- TABLE 206 LEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODE, 2022–2027 (USD MILLION)

- TABLE 207 LEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPE, 2017–2021 (USD MILLION)

- TABLE 208 LEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPE, 2022–2027 (USD MILLION)

- TABLE 209 LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 210 LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 211 LEARNING MANAGEMENT SYSTEM MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 212 LEARNING MANAGEMENT SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 213 SMART LEARNING MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

- TABLE 214 SMART LEARNING MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 215 SMART LEARNING MARKET, BY HARDWARE, 2017–2020 (USD MILLION)

- TABLE 216 SMART LEARNING MARKET, BY HARDWARE, 2021–2026 (USD MILLION)

- TABLE 217 SMART LEARNING MARKET, BY SOFTWARE, 2017–2020 (USD MILLION)

- TABLE 218 SMART LEARNING MARKET, BY SOFTWARE, 2021–2026 (USD MILLION)

- TABLE 219 SMART LEARNING MARKET, BY SERVICE, 2017–2020 (USD MILLION)

- TABLE 220 SMART LEARNING MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 221 SMART LEARNING MARKET, BY LEARNING TYPE, 2017–2020 (USD MILLION)

- TABLE 222 SMART LEARNING MARKET, BY LEARNING TYPE, 2021–2026 (USD MILLION)

- TABLE 223 SMART LEARNING MARKET, BY END USER, 2017–2020 (USD MILLION)

- TABLE 224 SMART LEARNING MARKET, BY END USER, 2021–2026 (USD MILLION)

- TABLE 225 SMART LEARNING MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 226 SMART LEARNING MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 DIGITAL BADGES MARKET: RESEARCH DESIGN

- FIGURE 3 APPROACHES USED FOR MARKET SIZE ESTIMATION

- FIGURE 4 APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM PLATFORMS AND SERVICES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 APPROACH 1 (BOTTOM-UP, SUPPLY SIDE): COLLECTIVE REVENUE OF DIGITAL BADGES VENDORS

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DEMAND-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 DIGITAL BADGES MARKET GROWTH TREND, 2023–2028 (USD MILLION)

- FIGURE 11 MARKET, BY REGION, 2023

- FIGURE 12 INCREASE IN ENROLMENT IN ONLINE COURSES TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 13 LEADING SEGMENTS IN DIGITAL BADGES MARKET IN 2023

- FIGURE 14 DIGITAL BADGE PLATFORMS TO DOMINATE OVER SERVICES MARKET IN 2023

- FIGURE 15 MANAGED SERVICES TO WITNESS HIGHER GROWTH THAN PROFESSIONAL SERVICES MARKET

- FIGURE 16 ACADEMIC END USERS TO LEAD MARKET IN 2023 AND 2028

- FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 OPEN BADGE INFRASTRUCTURE

- FIGURE 19 MARKET: ECOSYSTEM

- FIGURE 20 DIGITAL BADGES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 NUMBER OF PATENTS GRANTED ANNUALLY, 2021–2023

- FIGURE 22 DIGITAL BADGE SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 MANAGED SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 GOVERNMENT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 25 PARTICIPATION BADGE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 28 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 29 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 30 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- FIGURE 31 PEARSON: COMPANY SNAPSHOT

- FIGURE 32 SKILLSOFT: COMPANY SNAPSHOT

- FIGURE 33 PEOPLECERT: COMPANY SNAPSHOT

The digital badge market is an attractive market for the providers of digital badge platforms and services, as corporates and academic institutions across the world are bringing gamification into their learning content. Moreover, the rapid increase in the enrolment of online courses and MOOCs provides growth opportunities for the digital badge market worldwide.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals, such as the Institute of Electrical and Electronics Engineers (IEEE), ScienceDirect, ResearchGate, Academic Journals, Scientific.Net, and various telecom and Digital badges associations/forums, Wi-Fi Alliance, and 3GPP were also referred. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and in-depth segmentation according to industry trends, regional markets, and key developments.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Digital badges market. The primary sources from the demand side included Digital badges end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

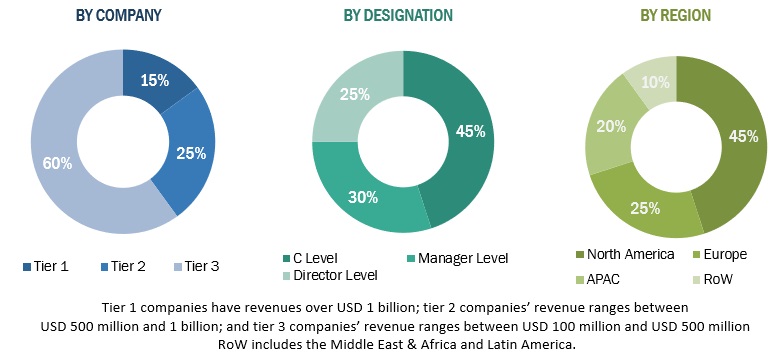

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the digital badges market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of digital badges offerings, such as platform and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Digital badges market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Digital badges Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Digital badges Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the Digital badges market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Digital badges market can be defined as a set of platforms and services that are used to issue badges to the learners. A digital badge is a type of digital credential that represents the accomplishments of certain skills. It includes online images offered by issuers and displayed by professionals and learners to showcase their expertise in a certain subject, skill, or task.

According to Sertifier, digital badges are digital representations of skills, accomplishments, or competencies that an individual has acquired. They are designed to be easily shared and verified, and often include metadata that provides information about the issuer, recipient, and criteria for earning the badge. Digital badges are a visual way to recognize and validate an individual’s accomplishments, skills, or knowledge in a particular area.

Key Stakeholders

- Digital badge platform providers

- IT service providers

- Badge issuers

- Digital badge displayers

- Digital badge designers

- Cloud service providers

- Consultants/consultancies/advisory firms

- Training and education service providers

Report Objectives

- To determine and forecast the global digital badges market by offering, end-user, and region from 2017 to 2023 and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 4 main regions, namely, North America, Europe, Asia Pacific, Middle east and Africa, and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To profile the key market players; provide comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the digital badges market

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East and Africa market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Digital Badges Market

"Gather insights into Digital Badging and credential management in the Middle East."