Dewatering Equipment Market by Type (Sludge (Application (Industrial,Municipal), Technology (Centrifuges, Belt Presses,Filter Presses, Vacuum Filters,Drying Beds,Sludge Lagoons)), Others (Paper, Plastic)), and Region - Global Forecast to 2025

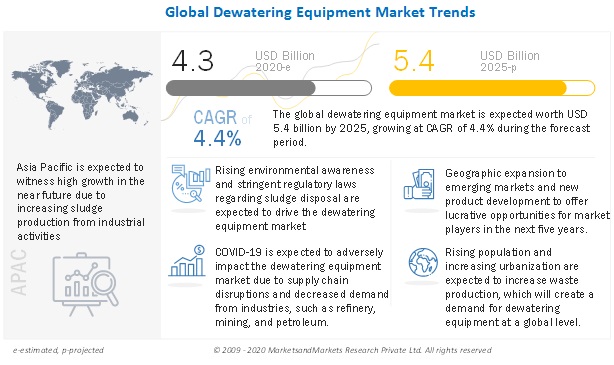

[228 Pages Report] The global dewatering equipment market size is projected to grow from USD 4.3 billion in 2020 to USD 5.4 billion by 2025, at a CAGR of 4.4% from 2020 to 2025. Rising environmental awareness and stringent regulatory laws regarding sludge disposal are expected to drive the dewatering equipment market.

Request for Free Sample Report, Request for Free Sample Report

COVID-19 Impact on the Global Dewatering equipment Market

The dewatering equipment market includes major Tier I and II suppliers like Alfa Laval AB (Sweden), Andritz AG (Austria), Veolia Environnment SA (France), HUBER SE (Germany), and Gruppo Pieralisi (Italy), among others. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses as well.

- In March 2020, Alfa Laval AB has set up a cross-functional Global Response Team to tackle the challenges presented by the COVID-19 pandemic. The company has restricted all business-related travel and recommended the work from home option to its employees. The company has also cut down on investments and is aiming to reach a fixed cost savings of USD 110 million on a twelve-month rolling basis. The company has limited its manufacturing operations and project expansions based on the severity of the infection.

- In March 2020, The COVID-19 pandemic has affected the operations of Andritz AG globally. Hence, the company has restricted all business-related travel and recommended work from home options to its employees. The company has also initiated temporary cost-saving initiatives in many countries to balance out the drop in its business revenue. The company has also limited its manufacturing operations and project expansions based on the severity of the infection.

- In March 2020, in response to the public health crisis, Veolia Environnment SA has been deemed as an essential service provider due to its business operations in water purification, waste management, and energy provision. As a result, the company put forward a business continuity plan tailored for each country to maintain the production and delivery of drinking water as well as the treatment of wastewater, waste collection, and energy generation. The company has also initiated temporary cost-saving initiatives in many countries to balance out the drop in business revenue. The company has also limited its manufacturing operations and project expansions based on the severity of the infection.

- In May 2020, HUBER SE has set up a cross-functional Global Response Team to tackle the challenges presented by the COVID-19 pandemic. The pandemic has affected its operations globally and, hence, the company has restricted all business-related travel and recommended work from home options to its employees. The company has limited its manufacturing operations and project expansions based on the severity of the infection.

Dewatering equipment Market Dynamics

Driver: Stringent regulations on the use and disposal of sludge

Industrial sludge and sewage sludge contain varying amounts of organic chemicals, toxic metals, chemical irritants, and pathogens, which may cause diseases. Untreated sludge disposed into rivers and seas adversely affects aquatic life and poses serious health hazards to communities living in the vicinity. Several environmental protection organizations have laid down sludge disposal laws that necessitate pretreatment as well as standards to be met prior to the disposal or reuse of sludge in agricultural or power generation activities.

In the Biosolids Laws and Regulations of the US Environmental Protection Agency, as per 40 CFR Part 503 (the Rule or Regulation), standards for the use or disposal of sewage sludge have been established. The standards consist of general requirements, pollutant limits, management practices, and operational standards for the final use or disposal of sewage sludge generated during the treatment of domestic sewage in the treatment facility. Standards are also included for sewage sludge applied to land, placed on a surface disposal site, or fired in a sewage sludge incinerator. Also included are pathogen and alternative vector attraction reduction requirements for sewage sludge applied to land or placed on a surface disposal site.

Similarly, in the European Union, the Sewage Sludge Directive 86/278/EEC on the protection of the environment and soil prohibits the use of untreated sludge on agricultural land. Sewage sludge needs to undergo biological, chemical, or heat treatment, as well as long-term storage or any other appropriate process, so as to significantly reduce its fermentability and health hazards resulting from its use. This directive specifies rules for treatment, sampling, analysis, and keeping detailed records of the composition and properties of the sludge prior to being used in agricultural and other purposes.

Hence, increasing pressure from environment protection organizations for the treatment of sludge before its disposal has triggered the growth of the market for dewatering equipment.

Restraint: Varying sludge characteristics and measuring dewatering performance

Dewatering technology has witnessed considerable advancements with more efficient equipment such as decanter centrifuges, screw presses, and belt presses available in the market. However, the dewatering process still depends primarily on the characteristic of the sludge that must be treated. For instance, waste activated sludge is difficult to dewater, as the water gets attached to the bacterial cells or is taken up chemically in the cell structures of these microorganisms. On the other hand, well-digested primary sludge is relatively easy to dewater. Along with the improvements in sludge dewatering to achieve the highest solid content, it is also essential to establish a reliable dewatering index. Most traditional dewaterability techniques include Capillary Suction Time (CST) and Specific Resistance to Filtration (SRF), but these methods only measure the rate of filtration and do not consider complex variables associated with the dewatering process. Also, different dewatering equipment have different operations and intensity, which greatly affect the efficiency of sludge dewatering. Hence, the evaluation of sludge dewaterability is critical for any sludge treatment system where optimizing the dewatering process is the primary goal.

Opportunity: Use of recycled dry sludge in other end-use industries

Sewage sludge from the municipal and industrial sectors is polluted with harmful substances, such as heavy metals, organic pollutants, residues of pharmaceuticals products, pathogens, and microplastics. Disposal of dry sludge has become a major worldwide problem for many reasons, including the rapidly shrinking landfill space, increased environmental awareness, and more stringent environmental standards. Hence, finding alternatives for the proper disposal of dry sludge has become important.

Some emerging alternatives for the reuse of dry sludge are in the power generation, construction, and agricultural industries. One of the more environmentally friendly applications of dry sludge is energy recovery. It includes conversion of the sludge into biogas, syngas, or bio-oil, which can be further converted into electricity, mechanical energy, and heat. Similarly, dry sludge can be incinerated directly, or mixed with coal. Incineration can solve problems related to the disposal of dry sludge at landfills as most of it is converted into fine ash and, if used in place of coal for power generation, can yield positive financial benefits. Dry sludge can also be used directly in waste-to-energy plants, which are prevalent in countries such as Sweden, Denmark, and Norway.

Recycled dry sludge can also be used in fabricating construction materials, such as bio-bricks, artificial aggregate, concrete mixtures, materials for reinstating eroded roadways, and replanting landfills, and in the manufacturing of low-grade ceramics & glass. Dry sewage sludge contains phosphorous, which is essential for the growth of living organisms and hence finds application in the agricultural industry as well. However, its use in agriculture necessitates pretreatment to remove heavy metals and plastics, which can degrade soil quality.

These additional uses of recycled dry sludge from municipal and industrial sectors provide a good opportunity to generate additional revenue for organizations involved in construction activities and, hence, may boost the demand for dewatering equipment.

Challenge: Dewatering sticky wastewater sludge

The sludge dewatering process is more complex than an ideal sedimentation process, and it requires additional pressure to dewater the material further once a certain threshold concentration is reached, called the gel point.

The major issue with dewatering and drying of activated sludge is the sticky behavior it exhibits when being partially dewatered, due to the so-called sticky phase of the sludge. The level of the stickiness of the sludge depends upon a host of factors, such as dryness, organic content, colloidal nature, and concentration of the sludge. This paste-like substance glues onto the surface of the dewatering equipment and causes operational and mechanical difficulties.

In practical applications, the capacity of dewatering equipment is significantly reduced due to partially dried sludge sticking onto the separator walls, screw presses, or decanter centrifuges. For this sticky sludge to be removed, the system must be stopped for a prolonged period of time for flushing. In cases where the sludge has been dewatered to the extent that it reaches the dryness range, the residue acts stickier and glues itself to the rotating parts of the equipment. This results in increased torque on the shaft and can also lead to substantial mechanical damage.

Sludge management in industrial sludge-handling installations is and will continue to be a challenge, and the sticky phase of the sludge is an issue common to all

Based on type, sludge dewatering segment accounted for the largest market share in 2019

By type, the sludge dewatering segment accounted for the largest share of the dewatering equipment market in 2019. The sludge dewatering process significantly reduces the volume of sludge and increases the solid content. The reduction in volume reduces costs related to treatment and transportation of the sludge. Dry solids content, retention time, type of compounds present, and type and efficiency of the sludge stabilization process are some of the factors that affect the dewatering ability of sludge. Sludge dewatering equipment is the more widely used dewatering equipment in comparison to other dewatering equipment, such as plastic, paper, cloth, mineral tailing, and food. Sludge dewatering equipment led the dewatering equipment market in 2019 and is projected to have a higher demand in the coming years.

Based on technology, the centrifuge segment accounted for the largest market share in 2019

By technology, the centrifuge segment accounted for the largest share of the dewatering equipment market in 2019. Centrifuges separate solids from liquids through sedimentation and centrifugal force. Although there are several types of centrifuges available, the solid bowl decanter type, also known as scroll centrifuge, is most widely used for the dewatering of water and sewage plant sludge. Some of the key factors driving the demand for centrifuges include lower capital cost required in comparison to filter press, minimal requirement of attention by the operator, and compact modular and closed system design that reduces the potential for messy spillage or splashing of sludge or water onto floors.

Europe accounted for the largest share of the dewatering equipment market in 2019

Europe accounted for the largest share of the dewatering equipment market in 2019. This large share can be attributed to the increased sludge production due to the rising urbanization and population along with strict sludge treatment legislation introduced by the European Union. The dewatering equipment market is highly competitive in the European region due to the presence of established players, such as HUBER SE, Veolia Environnment SA, SUEZ, and Aqseptence Group. Stringent European laws on wastewater treatment and reuse of sludge for agriculture purposes are expected to drive the demand for dewatering equipment in the process chain of sludge treatment.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Alfa Laval AB (Sweden), Andritz AG (Austria), Veolia Environnement SA (France), HUBER SE (Germany), Gruppo Pieralisi (Italy), Hitachi Zosen Corporation (Japan), Evoqua Water Technologies Corp. (US), SUEZ (France), GEA (Germany), Mitsubishi Kakoki Kaisha, Ltd. (Japan) are some of the leading players operating in the dewatering equipment market.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

20182025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

20202025 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Type, Technology, and Application |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

Alfa Laval AB (Sweden), Andritz AG (Austria), Veolia Environnement SA (France), HUBER SE (Germany), Gruppo Pieralisi (Italy), Hitachi Zosen Corporation (Japan), Evoqua Water Technologies Corp. (US), SUEZ (France), GEA (Germany), Mitsubishi Kakoki Kaisha, Ltd. (Japan), among others |

This research report categorizes the dewatering equipment market based on type, technology, application and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on the Type:

- Sludge Dewatering

- Other Dewatering (Paper Dewatering, Plastic Dewatering)

Based on the Application:

- Industrial

- Refineries

- Mining

- Petroleum

- Chemical & Pharmaceuticals

- Food & Beverages

- Others(Paper & Pulp, Textile)

- Municipal

- Residential

- Commercial

Based on the Technology

- Centrifuges

- Belt Presses

- Filter Presses

- Vacuum Filters

- Drying Beds

- Sludge Lagoons

- Others (Rotary Press, Screw Press)

Based on the Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In September 2019, Alfa Laval AB launched its new ALDEC G3 VecFlow decanter centrifuge for sludge dewatering and thickening at the WEFTEC exhibition in Chicago, US. The new decanter centrifuge features the companys unique VecFlow feed zone that reduces power consumption by 30% by reducing the turbulence of the systems by more than 80%, thus increasing separation performance. This product has been specifically designed for industrial and municipal wastewater treatment plants.

- In March 2020, HUBER SE expanded its footprint in the US with the opening of a new office and a production unit in Denver, North Carolina. The company has a presence in the US market since the 1980s. However, all the equipment was either imported or sold through third-party vendors. The company has been experiencing a yearly increase in order intake but, at the same time, facing local restrictions, such as the Buy American Act, which prompted the company to set up the new facility in Denver. This new unit includes over 44,000 sq. ft. of a manufacturing facility and will focus on producing the companys screening and dewatering products, such as HUBER Wash Press WAP series.

Frequently Asked Questions (FAQ):

What is dewatering equipment?

Dewatering equipment are equipments that are used to remove water from a volume of liquid, solid material or soil.

What are the major types of dewatering equipment?

There are two major types of equipments sludge dewatering equipments and other dewatering such as paper dewatering, plastic dewatering, among others.

Which are the key countries expected to fuel the dewatering equipment market?

The dewatering equipment market is expected to grow the fastest in China, followed by India

What are the key driving factors for the dewatering equipment market? Why?

Rising environmental awareness and stringent regulatory laws regarding sludge disposal are expected to drive the dewatering equipment market.

What are the major challenges which may hinder the growth of the dewatering equipment market?

Dewatering sticky wastewater sludge is a major challenge that the manufacturers of dewatering equipment are facing and this can hinder the growth of the overall dewatering equipment market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 REGIONAL SCOPE

1.4 MARKETS COVERED

FIGURE 1 DEWATERING EQUIPMENT MARKET: SEGMENTATION

1.4.1 YEARS CONSIDERED IN THE REPORT

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

FIGURE 2 HISTORICAL SLUDGE DEWATERING EQUIPMENT MARKET: 20142021

FIGURE 3 CURRENT SLUDGE DEWATERING EQUIPMENT MARKET: 20182025

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 4 RESEARCH DESIGN

2.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 KEY DATA FROM PRIMARY SOURCES

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

2.3.1 SUPPLY SIDE APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DEWATERING EQUIPMENT MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 8 SLUDGE DEWATERING EQUIPMENT ESTIMATED TO LEAD DEWATERING EQUIPMENT MARKET IN 2020

FIGURE 9 BY SUB-APPLICATION, REFINERY ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL SLUDGE DEWATERING EQUIPMENT MARKET IN 2019 (USD MILLION)

FIGURE 10 EUROPE LED THE DEWATERING EQUIPMENT MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 MARKET ATTRACTIVENESS OF DEWATERING EQUIPMENT MARKET

FIGURE 11 SIGNIFICANT OPPORTUNITIES FOR DEWATERING EQUIPMENT MARKET (2020 & 2025)

4.2 DEWATERING EQUIPMENT MARKET, BY REGION

FIGURE 12 ASIA PACIFIC AND EUROPE PROJECTED TO BE FASTEST-GROWING MARKETS FOR DEWATERING EQUIPMENT FROM 2020 TO 2025

4.3 SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY

FIGURE 13 CENTRIFUGES ACCOUNTED FOR LARGEST SHARE OF SLUDGE DEWATERING EQUIPMENT MARKET IN 2019

4.4 SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION

FIGURE 14 INDUSTRIAL SEGMENT ACCOUNTED FOR LARGEST SHARE OF SLUDGE DEWATERING EQUIPMENT MARKET IN 2019

4.5 SLUDGE DEWATERING EQUIPMENT MARKET: MAJOR COUNTRIES

FIGURE 15 CHINA TO EMERGE AS LUCRATIVE MARKET FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

FIGURE 16 DEWATERING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Stringent regulations on the use and disposal of sludge

5.1.1.2 Increasing population & urbanization resulting in increased waste & sludge generation

FIGURE 17 GLOBAL POPULATION, 20102020

FIGURE 18 WORLD POPULATION GROWTH, 20102020

5.1.1.3 Low cost of mechanical dewatering technologies compared to other alternatives

TABLE 1 QUALITATIVE COST COMPARISON OF VARIOUS DEWATERING TECHNOLOGIES

5.1.2 RESTRAINTS

5.1.2.1 Varying sludge characteristics and measuring dewatering performance

TABLE 2 INITIAL CHARACTERIZATION OF SEWAGE SLUDGE BEFORE DEWATERING

5.1.3 OPPORTUNITIES

5.1.3.1 Use of recycled dry sludge in other end-use industries

5.1.3.2 Need for innovative equipment due to COVID-19 pandemic

5.1.4 CHALLENGES

5.1.4.1 Dewatering sticky wastewater sludge

FIGURE 19 CHANGES IN PHYSICAL CONSISTENCY OF WASTE SLUDGE DURING DEWATERING

5.1.4.2 Supply chain, trade, and economic disruptions due to the COVID-19 pandemic

5.2 PORTERS FIVE FORCES ANALYSIS

FIGURE 20 DEWATERING EQUIPMENT MARKET: PORTERS FIVE FORCES ANALYSIS

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 OVERVIEW OF DEWATERING EQUIPMENT MARKET VALUE CHAIN

6 COVID-19 IMPACT (Page No. - 58)

6.1 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COVID-19 PROPAGATION: SELECT COUNTRIES

6.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.2.1 COVID-19 IMPACT ON THE ECONOMYSCENARIO ASSESSMENT

TABLE 3 CRITERIA IMPACTING THE GLOBAL ECONOMY

TABLE 4 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

6.3 COVID-19 IMPACT ON DEWATERING EQUIPMENT MARKET

7 DEWATERING EQUIPMENT MARKET, BY METHOD (Page No. - 65)

7.1 INTRODUCTION

TABLE 5 KEY DEWATERING METHODS FOR DIFFERENT SOIL APPLICATIONS

7.2 WELL POINTS

7.3 SUMP PUMPING

7.4 EDUCTOR WELLS

7.5 DEEP WELLS

7.6 OTHER METHODS

8 DEWATERING EQUIPMENT MARKET, BY TYPE (Page No. - 68)

8.1 INTRODUCTION

FIGURE 24 SLUDGE DEWATERING EQUIPMENT SEGMENT ESTIMATED TO DOMINATE DEWATERING EQUIPMENT MARKET IN 2020

TABLE 6 DEWATERING EQUIPMENT MARKET, BY TYPE, 20192025 (USD MILLION)

TABLE 7 DEWATERING EQUIPMENT MARKET, BY REGION, 20142026 (USD MILLION)

8.2 SLUDGE DEWATERING EQUIPMENT

8.2.1 SLUDGE TYPE

FIGURE 25 SLUDGE DEWATERING EQUIPMENT SEGMENT, BY REGION, 2020 & 2025

TABLE 8 SLUDGE DEWATERING EQUIPMENT SEGMENT, BY REGION, 20182025 (USD MILLION)

8.3 OTHER DEWATERING EQUIPMENT

8.3.1 PLASTIC DEWATERING EQUIPMENT

8.3.2 PAPER DEWATERING EQUIPMENT

8.3.3 OTHER DEWATERING EQUIPMENT

TABLE 9 OTHER DEWATERING EQUIPMENT SEGMENT, BY TYPE, 20182025 (USD MILLION)

FIGURE 26 OTHER DEWATERING EQUIPMENT SEGMENT, BY REGION, 2020 & 2025

TABLE 10 OTHER DEWATERING EQUIPMENT SEGMENT, BY REGION, 20182025 (USD MILLION)

9 SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY (Page No. - 74)

9.1 INTRODUCTION

TABLE 11 COMPARISON OF TECHNOLOGY TYPES OF SLUDGE DEWATERING EQUIPMENT

FIGURE 27 CENTRIFUGES ESTIMATED TO BE FASTEST-GROWING TECHNOLOGY SEGMENT OF SLUDGE DEWATERING EQUIPMENT MARKET

TABLE 12 SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

9.2 CENTRIFUGES

FIGURE 28 CENTRIFUGES TECHNOLOGY SEGMENT, BY REGION, 2020 & 2025

TABLE 13 CENTRIFUGES TECHNOLOGY SEGMENT, BY REGION, 2018-2025 (USD MILLION)

9.3 BELT PRESSES

FIGURE 29 BELT PRESSES TECHNOLOGY SEGMENT, BY REGION, 2020 & 2025

TABLE 14 BELT PRESSES TECHNOLOGY SEGMENT, BY REGION, 20182025 (USD MILLION)

9.4 FILTER PRESSES

FIGURE 30 FILTER PRESSES TECHNOLOGY SEGMENT, BY REGION, 2020 & 2025

TABLE 15 FILTER PRESSES TECHNOLOGY SEGMENT, BY REGION, 20182025 (USD MILLION)

9.5 VACUUM FILTERS

FIGURE 31 VACUUM FILTERS TECHNOLOGY SEGMENT, BY REGION, 2020 & 2025

TABLE 16 VACUUM FILTERS TECHNOLOGY SEGMENT, BY REGION, 20182025 (USD MILLION)

9.6 DRYING BEDS

FIGURE 32 DRYING BEDS TECHNOLOGY SEGMENT, BY REGION, 2020 & 2025

TABLE 17 DRYING BEDS TECHNOLOGY SEGMENT, BY REGION, 20182025 (USD MILLION)

9.7 SLUDGE LAGOONS

FIGURE 33 SLUDGE LAGOONS TECHNOLOGY SEGMENT, BY REGION, 2020 & 2025

TABLE 18 SLUDGE LAGOONS TECHNOLOGY SEGMENT, BY REGION, 20182025 (USD MILLION)

9.8 OTHER TECHNOLOGIES

FIGURE 34 OTHER TECHNOLOGIES SEGMENT, BY REGION, 2020 & 2025

TABLE 19 OTHER TECHNOLOGIES SEGMENT, BY REGION, 20182025 (USD MILLION)

10 SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION (Page No. - 87)

10.1 INTRODUCTION

FIGURE 35 SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 2020 & 2025

TABLE 20 SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

10.2 MUNICIPAL

FIGURE 36 SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL APPLICATION, BY REGION, 2020 & 2025 (USD MILLION)

TABLE 21 MUNICIPAL SLUDGE DEWATERING EQUIPMENT MARKET, BY REGION, 20182025 (USD MILLION)

FIGURE 37 SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL, BY SUB-APPLICATION, 2020 & 2025

TABLE 22 SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

10.2.1 RESIDENTIAL

10.2.1.1 COVID-19 impact on residential sub-application

FIGURE 38 RESIDENTIAL SUB-APPLICATION SEGMENT, BY REGION, 2020 & 2025

TABLE 23 RESIDENTIAL SUB-APPLICATION SEGMENT, BY REGION, 20182025 (USD MILLION)

10.2.2 COMMERCIAL

10.2.2.1 COVID-19 impact on commercial sub-application

FIGURE 39 COMMERCIAL SUB-APPLICATION SEGMENT, BY REGION, 2020 & 2025

TABLE 24 COMMERCIAL SUB-APPLICATION SEGMENT, BY REGION, 20182025 (USD MILLION)

10.3 INDUSTRIAL

FIGURE 40 SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL APPLICATION, BY REGION, 2020 & 2025

TABLE 25 SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL APPLICATION, BY REGION, 20182025 (USD MILLION)

FIGURE 41 SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL, BY SUB-APPLICATION, 2020 & 2025

TABLE 26 SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

10.3.1 REFINERY

10.3.1.1 COVID-19 impact on refinery sub-application

FIGURE 42 REFINERY SUB-APPLICATION SEGMENT, BY REGION, 2020 & 2025

TABLE 27 REFINERY SUB-APPLICATION SEGMENT, BY REGION, 20182025 (USD MILLION)

10.3.2 MINING

10.3.2.1 COVID-19 impact on mining sub-application

FIGURE 43 MINING SUB-APPLICATION SEGMENT, BY REGION, 2020 & 2025

TABLE 28 MINING SUB-APPLICATION SEGMENT, BY REGION, 20182025 (USD MILLION)

10.3.3 PETROLEUM

10.3.3.1 COVID-19 impact on petroleum sub-application

FIGURE 44 PETROLEUM SUB-APPLICATION SEGMENT, BY REGION, 2020 & 2025

TABLE 29 PETROLEUM SUB-APPLICATION SEGMENT, BY REGION, 20182025 (USD MILLION)

10.3.4 CHEMICAL & PHARMACEUTICAL

10.3.4.1 COVID-19 impact on chemical & pharmaceutical sub-application

FIGURE 45 CHEMICAL & PHARMACEUTICAL SUB-APPLICATION SEGMENT, BY REGION, 2020 & 2025

TABLE 30 CHEMICAL & PHARMACEUTICAL SUB-APPLICATION SEGMENT, BY REGION, 20182025 (USD MILLION)

10.3.5 FOOD & BEVERAGE

10.3.5.1 COVID-19 impact on food & beverage sub-application

FIGURE 46 FOOD & BEVERAGE SUB-APPLICATION SEGMENT, BY REGION, 2020 & 2025

TABLE 31 FOOD & BEVERAGE SUB-APPLICATION SEGMENT, BY REGION, 20202025 (USD MILLION)

10.3.6 OTHERS

10.3.6.1 SLUDGE-TO-ENERGY RECOVERY

10.3.6.2 COVID-19 impact on sludge-to-recovery sub-application

10.3.6.3 PAPER & PULP

10.3.6.4 COVID-19 impact on paper & pulp sub-application

10.3.6.5 Textile

10.3.6.6 COVID-19 impact on textile sub-application

FIGURE 47 OTHER SUB-APPLICATIONS SEGMENT, BY REGION, 2020 & 2025

TABLE 32 OTHER SUB-APPLICATIONS SEGMENT, BY REGION, 20182025 (USD MILLION)

11 SLUDGE DEWATERING EQUIPMENT MARKET, BY REGION (Page No. - 108)

11.1 INTRODUCTION

FIGURE 48 COUNTRY-WISE SNAPSHOT (20202025): ASIA PACIFIC EMERGING AS NEW HOT SPOT

TABLE 33 SLUDGE DEWATERING EQUIPMENT MARKET, BY REGION, 20182025 (USD MILLION)

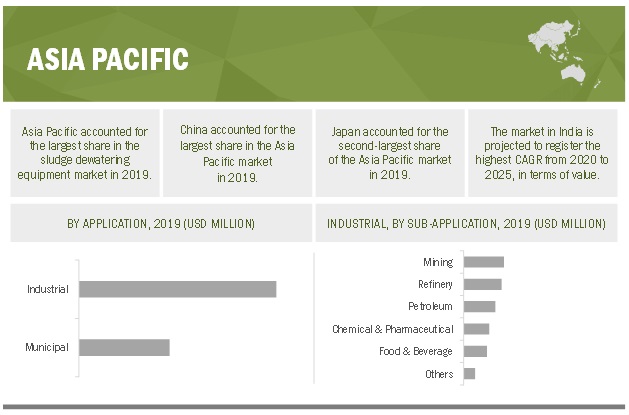

11.2 ASIA PACIFIC

FIGURE 49 ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET SNAPSHOT

TABLE 34 ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 35 ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 36 ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 37 ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

TABLE 38 ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

11.2.1 COVID-19 IMPACT ON ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET

FIGURE 50 IMPACT OF COVID-19 ON ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET, 20182025 (USD MILLION)

11.2.2 CHINA

11.2.2.1 Largest market for sludge dewatering equipment globally

11.2.2.2 COVID-19 impact on China

TABLE 39 CHINA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.2.3 INDIA

11.2.3.1 Industrial applications to drive demand for sludge dewatering equipment

TABLE 40 INDIA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.2.3.2 COVID-19 impact on India

11.2.4 JAPAN

11.2.4.1 Japan expected to register second-fastest growth in Asia Pacific market

11.2.4.2 COVID-19 impact on Japan

TABLE 41 JAPAN SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.2.5 SOUTH KOREA

11.2.5.1 Use of sludge dewatering equipment in municipal applications to drive market growth

11.2.5.2 COVID-19 impact on South Korea

TABLE 42 SOUTH KOREA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.2.6 MALAYSIA

11.2.6.1 Malaysia set to register lowest growth in Asia Pacific market

11.2.6.2 COVID-19 impact on Malaysia

TABLE 43 MALAYSIA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.2.7 SINGAPORE

11.2.7.1 Application of sludge dewatering equipment in waste-to-energy plants to spur market growth

11.2.7.2 COVID-19 impact on Singapore

TABLE 44 SINGAPORE SLUDGE DEWATERING EQUIPMENT MARKET, APPLICATION, 20182025 (USD MILLION)

11.2.8 AUSTRALIA

11.2.8.1 Focus on reuse of municipal sludge for producing biosolids to increase demand for sludge dewatering equipment

11.2.8.2 COVID-19 impact on Australia

TABLE 45 AUSTRALIA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.2.9 REST OF ASIA PACIFIC

11.2.9.1 COVID-19 impact on Rest of Asia Pacific

TABLE 46 REST OF ASIA PACIFIC SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.3 EUROPE

FIGURE 51 EUROPE SLUDGE DEWATERING EQUIPMENT MARKET SNAPSHOT

TABLE 47 EUROPE SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 48 EUROPE SLUDGE DEWATERING EQUIPMENT MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 49 EUROPE SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 50 EUROPE SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

TABLE 51 EUROPE SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

11.3.1 COVID-19 IMPACT ON EUROPE SLUDGE DEWATERING EQUIPMENT MARKET

FIGURE 52 IMPACT OF COVID-19 ON EUROPE SLUDGE DEWATERING EQUIPMENT MARKET, 20182025 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Largest and fastest-growing market for sludge dewatering equipment in Europe

11.3.2.2 COVID-19 impact on Germany

TABLE 52 GERMANY SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.3.3 UK

11.3.3.1 UK to register second-fastest growth in sludge dewatering equipment market during forecast period

11.3.3.2 COVID-19 impact on the UK

TABLE 53 UK SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Second-largest market for sludge dewatering equipment in Europe

11.3.4.2 COVID-19 impact on France

TABLE 54 FRANCE SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Use in municipal applications to spur demand for sludge dewatering equipment

11.3.5.2 COVID-19 impact on Italy

TABLE 55 ITALY SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.3.6 NETHERLANDS

11.3.6.1 Use in food & beverage and energy recovery industries to increase demand for sludge dewatering equipment during forecast period

11.3.6.2 COVID-19 impact on the Netherlands

TABLE 56 NETHERLAND SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.3.7 RUSSIA

11.3.7.1 Use in residential and commercial activities to increase demand for sludge dewatering equipment during forecast period

11.3.7.2 COVID-19 impact on Russia

TABLE 57 RUSSIA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.3.8 REST OF EUROPE

11.3.8.1 COVID-19 impact on Rest of Europe

TABLE 58 REST OF EUROPE SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.4 NORTH AMERICA

FIGURE 53 NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET SNAPSHOT

TABLE 59 NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 60 NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 61 NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 62 NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

TABLE 63 NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

11.4.1 COVID-19 IMPACT ON NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET

FIGURE 54 COVID-19 IMPACT ON NORTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, 2018-2025 (USD MILLION)

11.4.2 US

11.4.2.1 Largest share of North America sludge dewatering equipment market

11.4.2.2 COVID-19 impact on the US

TABLE 64 US SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.4.3 CANADA

11.4.3.1 Industrial applications to spur demand for sludge dewatering equipment

11.4.3.2 COVID-19 impact on Canada

TABLE 65 CANADA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.4.4 MEXICO

11.4.4.1 Second-fastest growth in North America sludge dewatering equipment market during forecast period

11.4.4.2 COVID-19 impact on Mexico

TABLE 66 MEXICO SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

FIGURE 55 MIDDLE EAST & AFRICA SLUDGE DEWATERING EQUIPMENT MARKET SNAPSHOT

TABLE 67 MIDDLE EAST & AFRICA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA SLUDGE DEWATERING EQUIPMENT MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

11.5.1 COVID-19 IMPACT ON THE MIDDLE EAST & AFRICA SLUDGE DEWATERING EQUIPMENT MARKET

FIGURE 56 IMPACT OF COVID-19 ON MIDDLE EAST * AFRICA SLUDGE DEWATERING EQUIPMENT MARKET, 20182025 (USD MILLION)

11.5.2 UAE

11.5.2.1 Largest share in Middle East & Africa sludge dewatering equipment market

11.5.2.2 COVID-19 impact on the UAE

TABLE 72 UAE SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.5.3 QATAR

11.5.3.1 Use in refineries and petroleum production to spur demand for sludge dewatering equipment

11.5.3.2 COVID-19 impact on Qatar

TABLE 73 QATAR SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.5.4 SOUTH AFRICA

11.5.4.1 Use in residential and commercial applications to increase demand for sludge dewatering equipment

11.5.4.2 COVID-19 impact on South Africa

TABLE 74 SOUTH AFRICA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.5.5 REST OF MIDDLE EAST & AFRICA

11.5.5.1 COVID-19 impact on Rest of MEA

TABLE 75 REST OF MEA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.6 SOUTH AMERICA

FIGURE 57 SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT SNAPSHOT

TABLE 76 SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 77 SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 78 SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 79 SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET IN INDUSTRIAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

TABLE 80 SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET IN MUNICIPAL, BY SUB-APPLICATION, 20182025 (USD MILLION)

11.6.1 COVID-19 IMPACT ON SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET

FIGURE 58 SLUDGE DEWATERING EQUIPMENT MARKET IN SOUTH AMERICA, 20182025 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Largest share in South America sludge dewatering equipment market

11.6.2.2 COVID-19 impact on Brazil

TABLE 81 BRAZIL SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.6.3 ARGENTINA

11.6.3.1 Use in municipal applications to drive demand for sludge dewatering equipment

11.6.3.2 COVID-19 impact on Argentina

TABLE 82 ARGENTINA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

11.6.4 REST OF SOUTH AMERICA

11.6.4.1 COVID-19 impact on Rest of South America

TABLE 83 REST OF SOUTH AMERICA SLUDGE DEWATERING EQUIPMENT MARKET, BY APPLICATION, 20182025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 164)

12.1 OVERVIEW

FIGURE 59 COMPANIES PRIMARILY ADOPTED ORGANIC GROWTH STRATEGIES BETWEEN 2016 AND 2020

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 60 MARKET EVALUATION FRAMEWORK: 2016 SAW NEW PRODUCT DEVELOPMENTS LEADING THIS SPACE

12.3 MARKET SHARE ANALYSIS

12.3.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN DEWATERING EQUIPMENT MARKET

12.4 KEY MARKET DEVELOPMENTS

TABLE 84 NEW PRODUCT DEVELOPMENTS, 20162020

TABLE 85 CONTRACTS, 20162020

TABLE 86 EXPANSIONS, 20162020

TABLE 87 JOINT VENTURES, 20162020

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 173)

13.1 OVERVIEW

13.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

13.2.1 PRODUCT FOOTPRINT

13.2.2 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 61 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN DEWATERING EQUIPMENT MARKET

13.2.3 BUSINESS STRATEGY EXCELLENCE

FIGURE 62 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN DEWATERING EQUIPMENT MARKET

13.2.4 STAR

13.2.5 EMERGING LEADERS

13.2.6 PERVASIVE

13.3 COMPANY EVALUATION MATRIX

FIGURE 63 DEWATERING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX, 2019

13.4 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Covid-19 related developments, MnM View)*

13.4.1 ALFA LAVAL AB

FIGURE 64 ALFA LAVAL AB: COMPANY SNAPSHOT

13.4.2 ANDRITZ AG

FIGURE 65 ANDRITZ AG: COMPANY SNAPSHOT

13.4.3 VEOLIA ENVIRONNEMENT SA

FIGURE 66 VEOLIA ENVIRONNEMENT SA: COMPANY SNAPSHOT

13.4.4 HUBER SE

13.4.5 GRUPPO PIERALISI

13.4.6 HITACHI ZOSEN CORPORATION

FIGURE 67 HITACHI ZOSEN CORPORATION: COMPANY SNAPSHOT

13.4.7 EVOQUA WATER TECHNOLOGIES CORP.

FIGURE 68 EVOQUA WATER TECHNOLOGIES CORP.: COMPANY SNAPSHOT

13.4.8 SUEZ

FIGURE 69 SUEZ: COMPANY SNAPSHOT

13.4.9 GEA

FIGURE 70 GEA: COMPANY SNAPSHOT

13.4.10 MITSUBISHI KAKOKI KAISHA, LTD.

FIGURE 71 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY SNAPSHOT

13.5 SME EVALUATION MATRIX, 2019

13.6 SME PROFILES

13.6.1 DEWACO LTD.

13.6.2 PHOENIX PROCESS EQUIPMENT

13.6.3 AQSEPTENCE GROUP

13.6.4 FLO TREND SYSTEMS, INC.

13.6.5 HILLER GMBH

13.6.6 EMO

13.6.7 KONTEK ECOLOGY SYSTEMS INC.

13.6.8 AES ARABIA LTD.

13.6.9 ENCON EVAPORATORS

13.6.10 GEOFABRICS AUSTRALASIA PTY. LTD.

13.6.11 TENCATE GEOSYNTHETICS AMERICAS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Covid-19 related developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 221)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

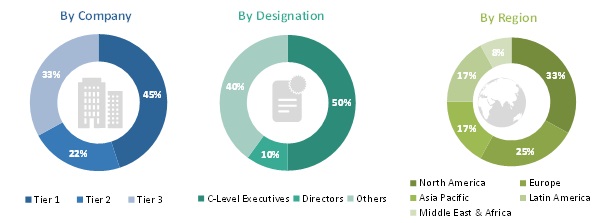

This study involved four major activities in estimating the current size of the dewatering equipment market. Exhaustive secondary research was undertaken to collect information on the dewatering equipment market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the dewatering equipment value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the market. After that, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the dewatering equipment market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the dewatering equipment market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

Primary Research

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the dewatering equipment market. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the dewatering equipment market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the dewatering equipment market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Request for Free Sample Report, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the dewatering equipment market based on application, type, technology and region

- To forecast the size of the market and its segments with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their respective key countries

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as expansions, new product developments, agreement, investments, and merger & acquisitions, in the dewatering equipment market

The following customization options are available for the report:

- Further breakdown of the Asia Pacific and Europe dewatering equipment markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Growth opportunities and latent adjacency in Dewatering Equipment Market