Depth of Anesthesia Monitoring Market by Product (Devices, Consumables), Device (Module, Standalone), Mode of Purchase (Group Purchasing Organization, Direct Purchase), End User (Hospitals, Ambulatory Surgery Center, Clinic) - US Forecast to 2024

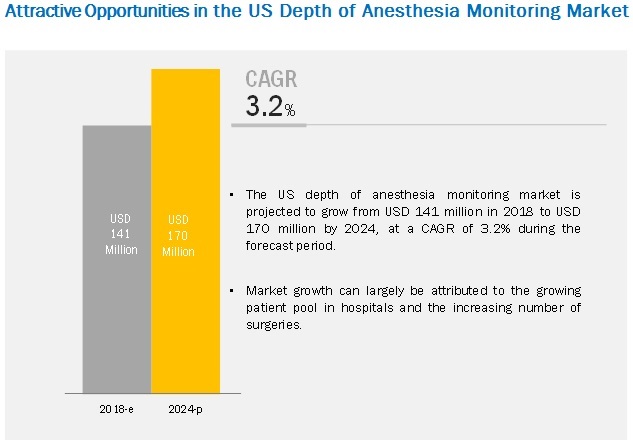

The depth of anesthesia monitoring market size is projected to reach USD 170 million by 2024, at a CAGR of 3.2%. The growth of this market is primarily driven by the growing patient pool in hospitals in the US and the increasing number of surgeries. However, the high installation and maintenance costs of depth of anesthesia monitoring devices are expected to restrain the growth of this market in the coming years.

By device type, the modules segment dominated the market in 2018

Modules can be integrated into different DOA devices, which has resulted in their widespread use in different clinical settings. Many of the modules in the US are provided by GE Healthcare, Philips, Mindray, and Spacelabs. These market players provide different modules to measure DOA parameters, including BIS, Entropy, and Patient State Index (PSI). However, bundled devices have multiparameter modules with inbuilt software, which measure a wide range of parameters. Mennen Medical and Masimo are the major players providing bundled devices.

Depth of anesthesia monitoring products are majorly purchased through GPOs in the US

The superior bargaining power of GPOs for bulk purchases over individual clinical settings is the major factor responsible for the large volume of device purchases done through GPOs. However, the role of GPOs in medical device purchasing is shrinking as they focus on cost and volume to earn administrative fees (which they charge as a certain percentage of the total purchase value) from manufacturers rather than on the quality and functionality of products.

Hospitals accounted for the largest share of the US depth of anesthesia monitoring market, by end user, in 2018

The growing patient pool in hospitals and the increasing number of surgeries are the major factors that are expected to drive the demand for depth of anesthesia monitoring products in hospitals in the US in the coming years. The adoption of depth of anesthesia monitoring devices is higher among hospitals as compared to smaller clinical settings due to their high installation and maintenance costs.

Key Market Players

The prominent players operating in this market include Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Medtronic Public Limited Company (Ireland), GE Healthcare (US), Mennen Medical Ltd. (Israel), Masimo Corporation (US), and Philips Healthcare (Netherlands).

GE Healthcare (US) is one of the prominent players operating in the US depth of anesthesia monitoring market. The company serves customers in more than 130 countries across the Americas, Europe, Asia, the Middle East, and Africa. Currently, GE Healthcare is the only player with a proprietary Entropy technology designed to provide information on the state of the central nervous system during general anesthesia. The company also offers the E-BIS module, which uses the BIS expanded performance (BIS XP) technology to measure the effects of anesthetics and sedatives on the brain with a four-electrode Quatro sensor.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2024 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2024 |

|

Forecast units |

Values (USD Million), Volume (number of units) |

|

Segments covered |

Product, device type, mode of purchase, and end user |

|

Geographies covered |

US |

|

Companies covered |

Medtronic Public Limited Company (Ireland), GE Healthcare (US), Masimo Corporation (US), Philips Healthcare (Netherlands), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Spacelabs Healthcare Inc. (US), and Mennen Medical Ltd. (Israel). |

On the basis of product, the US depth of anesthesia monitoring market is segmented as follows:

- Devices

- Consumables

On the basis of device type, the US depth of anesthesia monitoring market is segmented as follows:

- Standalone Devices

- Bundled (Combined) Devices

On the basis of end user, the US depth of anesthesia monitoring market is segmented as follows:

- Hospitals

- Ambulatory Surgical Centers & Clinics

On the basis of purchase mode, the US depth of anesthesia monitoring market is segmented as follows:

- Hospitals

- Ambulatory Surgical Centers & Clinics

Recent Developments

- In 2018, Masimo Corporation (US) introduced the RD SedLine EEG sensor for use with Masimo SedLine Brain Function Monitoring.

- In 2017, Shenzhen Mindray Bio-Medical Electronics received FDA approval for its Passport Series Patient Monitors (Passport 12m, Passport 17m).

- In 2016, Masimo and Philips entered into a multi-year partnership for the joint marketing and sales of Masimo’s technologies in North America and certain markets in Asia and Europe.

- In 2015, Medtronic plc acquired Covidien plc, an Ireland-based global manufacturer of medical devices and supplies.

Key questions addressed by the report

- Who are the major players operating in the US depth of anesthesia monitoring market?

- What are the major product segments in the US depth of anesthesia monitoring market?

- What are the major device type segments in the US depth of anesthesia monitoring market?

- What are the major mode of purchase segments in the US depth of anesthesia monitoring market?

- What are the major end-user segments in the US depth of anesthesia monitoring market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Market Overview

1.2 Opportunity Analysis

2 Research Methodology

2.1 Research Methodology- Devices and Consumables

2.2 Research Methodology – Eeg Strips (Volume Market)

3 Depth of Anesthesia Monitoring Market, By Technology

3.1 Bispectral Index

3.2 Entropy

3.3 Patient State Index (PSI)

4 Depth of Anesthesia Monitoring Market, By Device Type (Value, Volume)

4.1 Modules

4.2 Bundled Devicese

4.3 Stanalone Devices

5 Depth of Anesthesia Monitoring Market, By Product (Value, Volume)

5.1 Devices

5.2 Consumables

6 Depth of Anesthesia Monitoring Market, By Mode of Purchase (Value, Volume)

6.1 Purchase Through GPO

6.2 Direct Purchase

7 Depth of Anesthesia Monitoring Market, By End User (Value, Volume)

7.1 Hospitals

7.2 Ambulatory Surgical Centers & Clinics

8 Competitive Landscape

8.1 Overview

8.2 Medtronic PLC

8.3 GE Healthcare

8.4 Masimo Corporation

8.5 Philips Healthcare

8.6 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

8.7 OSI Systems, Inc. – Spacelabs Healthcare Inc. & Mennen Medicals Ltd

* Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

9 Depth of Anesthesia Monitoring Market: Market Share Analysis

9.1 DOA Modules Market Share, By Key Players (Value)

9.2 DOA Modules Market Share, By Key Players (Volume)

9.3 DOA Bundled Devices Market Share, By Key Players (Value)

9.4 DOA Bundled Devices Market Share, By Key Players (Volume)

9.5 DOA Sensors Market Share, By Key Players (Value)

9.6 DOA Sensors Market Share, By Key Players (Volume)

10 DOA Monitoring Market: Market Share Analysis

11 Appendix

11.1 Marketsandmarkets Knowledge Store: Snapshot

11.2 Related Reports

11.3 Disclaimer

List of Tables (25 Tables)

Table 1 US: DOA Monitoring Market, By Device Type, 2016–2024 (USD Million)

Table 2 US: DOA Monitoring Market, By Device Type, 2016–2024 (No. of Units)

Table 3 US: DOA Monitoring Market, By Product, 2016–2024 (USD Million)

Table 4 US: DOA Monitoring Market, By Product, 2016–2024 (No. of Units)

Table 5 US: DOA Monitoring Devices Market, By Mode of Purchase, 2016–2024 (USD Million)

Table 6 US: DOA Monitoring Sensors Market, By Mode of Purchase, 2016–2024 (USD Million)

Table 7 US: DOA Monitoring Devices Market, By Mode of Purchase, 2016–2024 (No. of Units)

Table 8 US: DOA Monitoring Sensors Market, By Mode of Purchase, 2016–2024 (No. of Units)

Table 9 US: DOA Monitoring Market, By End User, 2016–2024 (USD Million)

Table 10 Number of Hospitals, By Region, 2010 vs 2014

Table 11 US: DOA Monitoring Market, By End User, 2016–2024 (No. of Units)

Table 12 Medtronic PLC: Number of Devices and Consumables Sold, 2016–2024

Table 13 Medtronic PLC: Revenue From Sales of Devices & Consumables, 2016–2024 (USD Million)

Table 14 GE Healthcare: Revenue From Sales of Devices & Consumables, 2016–2024 (USD Million)

Table 15 GE Healthcare: Revenue From Sales of Devices & Consumables, 2016–2024 (USD Million)

Table 16 Masimocorporation: Number of Devices and Consumables Sold, 2016–2024

Table 17 Masimocorporation: Revenue From Sales of Devices & Consumables, 2016–2024 (USD Million)

Table 18 Philips Healthcare: Number of Devices Sold, 2016–2024

Table 19 Philips Healthcare: Revenue From Sales of Devices, 2016–2024 (USD Million)

Table 20 Shenzhen Mindraybio-Medical Electronics Co., Ltd.: Number of Devices Sold, 2016–2024

Table 21 Shenzhen Mindraybio-Medical Electronics Co., Ltd.: Revenue From Sales of Devices, 2016–2024 (USD Million)

Table 22 Osisystems, Inc.-Spacelabs Healthcare Inc.: Number of Devices Sold, 2016–2024

Table 23 Mennen Medical: Number of Devices Sold, 2016–2024

Table 24 Osisystems, Inc.-Spacelabs Healthcare Inc.: Revenue From Sales of Devices, 2016–2024 (USD Million)

Table 25 Mennen Medical: Revenue From Sales of Devices, 2016–2024 (USD Million)

List of Figures (9 Figures)

Figure 1 Commercially Available Depth of Anesthesiamonitors in the Us, 2017

Figure 2 Percentage of Surgeries Performed in ASCS

Figure 3 Partnerships, the Key Growth Strategy Adopted By Market Players (2015-2018)

Figure 4 DOA Monitoring Modules Market Share, By Key Player, 2017 (Value)

Figure 5 DOA Monitoring Modules Market Share, By Key Player, 2017 (Volume)

Figure 6 DOA Monitoring Bundled Devices Market Share, By Key Player, 2017 (Value)

Figure 7 DOA Monitoring Bundled Devices Market Share, By Key Player, 2017 (Volume)

Figure 8 DOA Monitoring Sensors Market Share Analysis, By Key Player, 2017 (Value)

Figure 9 DOA Monitoring Sensors Market Share, By Key Player, 2017 (Volume)

This study involved four major activities in estimating the current market size of the US depth of anesthesia monitoring market, by value and volume. Exhaustive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the US depth of anesthesia monitoring market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and sub-segments.

Secondary Research

Secondary research included the study of the annual and financial reports, presentations, websites, and press releases of top players; news articles and journals; and paid databases, white papers, certified publications, articles from recognized authors, directories, and sources such as the World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), Association of Medical Diagnostics Manufacturers (AMDM), Brain Injury Association of America, American Neurological Association, and American Brain Foundation.

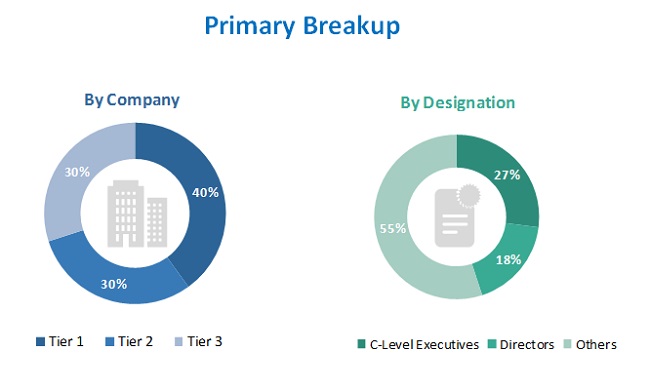

Primary Research

The US depth of anesthesia monitoring market comprises several stakeholders such as raw material suppliers, manufacturers of anesthesia monitoring devices and sensors, and regulatory organizations. Primary research included extensive interviews with demand-side and supply-side experts. The primary interviewees from the demand side include professionals from hospitals and ambulatory surgery centers. The primary sources from the supply side include key opinion leaders, CEOs, vice presidents, directors, marketing executives, and related key executives from various companies’ distributors. The percentage splits, shares, and breakdowns of the segments were determined using secondary sources and verified through primary sources. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the US depth of anesthesia monitoring market. These approaches were also used extensively to estimate the size of various subsegments in the market. After arriving at the overall market size—using market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the US depth of anesthesia monitoring industry.

To know about the assumptions considered for the study, download the pdf brochure

Report Objectives

- To define, describe, and forecast the US depth of anesthesia monitoring market based on product, device type, mode of purchase, and end user

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of market segments with respect to both the volume and value of devices as well as consumables

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments (such as acquisitions, product launches, partnerships, and agreements) in the US depth of anesthesia monitoring market

Available Customization

With the given market data, MarketsandMarkets can offer customizations according to company-specific needs.

The following customization options are available for the report:

Geographic Analysis

- Additional geographies and countries other than the US can be provided

Technology Segmentation

- Detailed analysis and value & volume market analysis can be provided for different technologies, such as Bispectral Index (BIS), Entropy, and Patient State Index (PSI)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Depth of Anesthesia Monitoring Market