Dental Diamond Burs Market by type (Diamonds, Tungsten Carbide, Stainless Steel), Application (Hospitals, Clinics), Technology (Electrolytic Co-deposition, Micro brazing, CVD (Chemical Vapor desposition), Sintering), and Region - Global Forecasts to 2026

Updated on : September 03, 2025

Dental Diamond Burs Market

The global dental diamond burs market was valued at USD 130 million in 2021 and is projected to reach USD 191 million by 2026, growing at 8.0% cagr from 2021 to 2026. Growth in the market can primarily be attributed to the rising cases of dental diseases, increasing demand for cosmetic dentistry, growing dental tourism in emerging markets, changing lifestyles, unhealthy food habits, and the increasing disposable income in developing countries. These are the key factors driving the demand for dental diamond burs during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Dental Diamond Burs Market

The COVID-19 pandemic has significantly impacted the dental care industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. The outbreak of the coronavirus disease resulted in the shutdown of approximately 198,000 active dental hospitals and clinics in the US (data as of August 2020). This has disrupted the delivery of dental services in the country. According to the Irish Dental Association, about 75% of dental practitioners are witnessing a financial loss of over 70% during the outbreak. Dental healthcare workers are at the highest risk of contracting COVID-19 as the virus that causes COVID-19 is present in nasopharyngeal and salivary secretions of patients infected with the virus and is believed to spread through respiratory droplets, as well as aerosols and fomites. As a result, dental services were limited to emergency and urgent cases during the early days of the pandemic. However, dental care providers reopened in the third and fourth quarters of 2020.

Dental Diamond Burs Market Dynamics

Driver: Changing lifestyles and unhealthy food habits

Lifestyle changes, unhealthy food habits, and the growing intake of high-sugar food and aerated drinks result in a rapid decline in oral hygiene and increasing incidences of dental problems. According to the World Health Organization (WHO) Global Burden of Disease Study (2017), oral diseases have impacted ~3.5 billion people across the globe. Nearly 2.3 billion people and 530 million children suffer from cavities. This suggests an increased uptake of dental procedures and demand for dental equipment. Dental equipment is utilized for diagnosis, teeth removal, ortho-dentistry, restoration, and other dental treatments and procedures. This helps dentists in finding the cause of dental problems.

Growth in the prevalence of dental problems is due to factors, such as:

- Increasing consumption of high-sugar foods: Chocolates, sugary cookies, cakes, ice cream, and donuts contain sugar in abundance. Bacteria present in the mouth grow as a result of high sugar. Sugary drinks leave a coating on gums and teeth that increases the bacterial attack leading to weakened dental health.

- Consumption of tobacco-related products: The adverse impacts of tobacco on oral health include relatively harmless discoloration, halitosis, staining of teeth, oral mucosal diseases, smoker’s palate, smoker’s melanosis, increasing candidiasis, cavities, and malignant lesions; it could also lead to life-threatening oral cancer.

- Gum diseases: Bleeding gums, swelling, chronic bad breath, or sensitivity to cold or hot foods due to stubborn bacteria in oral cubicles are major factors resulting in poor oral health.

Oral piercing: According to the American Dental Association, a rising number of people are opting for oral piercing, resulting in a high rate of infection. Oral piercings are commonly seen in young adults, and the tongue is considered the most common site for oral piercing placement. This results in bleeding, chipped or damaged teeth, lacerations/scarring, palatal erythema, swelling, gingival recession, or unusual discharge from the pierced region. Such instances boost the demand for dental procedures.

Restraint: Changing frequency of dental diamond burs

A proper tooth preparation is essential for better aesthetics, acceptable prosthetic rehabilitation, fracture resistance, and healthy soft tissues. Dental diamond burs are manufactured in various shapes and sizes with different features to offer various utilization. They have better cutting efficiency and life span than other burs like carbide or stainless steel. The hardness of the surface particles, sterilization. Disinfection procedures, storage conditions, corrosion, and multiple use are some of the determinants with the potential to alter the cutting efficiency of the diamond burs. The cutting/milling efficiency of dental diamond burs evidently decreases after multiple usage. The cutting efficiency decreases as the number of cuts increases regardless of the type of burs. It has been found that this reduction is highest after the first use. These worn-out burs may require excessive pressure application during tooth preparation, which may cause undesired heat generation and waste of time. On the other hand, they cannot generate adequate roughness on tooth surfaces, which is essential for mechanical retention of cements, for instance, zinc-phosphate cement, because of ineffective particle size. Moreover, problems are encountered due to repeated sterilization of the instruments, which decreases their cutting effectiveness resulting in diamond particle loss causing oral contamination. Diamond burs wear after multiple usage, and they should be changed after five teeth preparations at the most. A diamond bur should not be used for teeth preparation after try-in procedures of metal or zirconia substructures.

Opportunity: Increasing number of dental laboratories investing in CAD/CAM technologies

The dental industry is increasingly embracing computer-aided design (CAD)/computer-aided manufacturing (CAM) due to its high precision in dental restoration and digital orthodontics. These technologies are used for developing milled crowns, dentures, bridges, and fabricated abutments that are used in dental restoration procedures. They can also provide personalized brackets and removable braces for orthodontic treatments. The increasing use of CAD/CAM has reduced the need to wear temporary bridges/crowns during dental restoration treatments, enabled less time-consuming treatment procedures, and reduced the number of doctor visits.

Although a majority of prosthetic elements are still manufactured manually, the use of CAD/CAM prosthetic elements is increasing due to their advantages, for instance, customization. Their adoption has also grown due to the increasing shift toward digitalization. Recent developments in this regard include:

- In November 2019, 3 Shape partnered with Ivoclar. This involved the integration of the 3Shape TRIOS Intraoral Scanner and the TRIOS Design Studio to provide an advanced CAD/CAM milling solution.

- From 2016–2018, many leading players in the orthodontic supplies market, including 3M, Ormco, Henry Schein, Align Technology, American Orthodontics, and Rocky Mountain Orthodontics, entered into a partnership agreement with 3Shape (Denmark) for the integration of 3Shape’s orthodontic workflow software and digital CAD/CAM technologies, along with their existing product offerings.

- In 2017, Align Technology collaborated with Digital Smile Design (DSD) for providing software that streamlines workflows with Align Technology’s Invisalign system by utilizing concepts and protocols from DSD.

- In March 2017, Kuraray and DENTSPLY Sirona signed a material partnership for CAD/CAM blocks. The CAD/CAM materials from Kuraray Noritake Dental will be used in CEREC and Lab systems from DENTSPLY Sirona.

Challenges: Quality of dental diamond burs

Dental diamond burs are precision instruments used in dental procedures. These are typically used for precision shaping and polishing, but as diamond is one of the hardest known materials, they are often used to cut through zirconia or grind porcelain during the preparation and placement of veneers and crowns. The quality of dental diamond burs depends on shank size, coating, concentricity of the shank, and polish process of burs. Burs shank size has to be standard at 1.6 mm. It will be difficult to install into handpieces if the size is not accurate. The high-quality durable diamond sand coating is the crucial factor for the lifespan of diamond burs, as low-quality diamond sand coating leads to frequent change of instrument. The concentricity of diamond burs shank is crucial for during treatment. If the concentricity of diamond burs is not good, the handpiece will shake strongly during treatment. The polishing process is the last step for diamond burs and is also very important for making a good first impression on customers.

Diamonds is the largest type segment of the dental diamond burs market

The dental diamond burs market is segmented on the basis of material diamonds, tungsten carbide, and stainless steel. The diamond type segment accounted for a larger market share. Diamond is projected to be the fastest-growing type segment. This is attributed to its unique hardness properties. Diamond is also projected to be the fastest-growing type segment. Due to this property it can be used to cut through zirconia or grind porcelain while veneers and crowns are being prepared and placed.

Hospitals is the largest application segment of the dental diamond burs market

The dental diamond burs market is segmented on the basis of application into hospitals, clinics and others. The hospitals segment led the market in terms of both value and volume. It is attributed to the use of dental diamond burs into small and big surgeries and other treatments.

Electrolytic co-deposition is the largest technology segment of the dental diamond burs market

The dental diamond burs market is segmented on the basis of technology into electrolytic co-deposition, micro brazing, CVD (Chemical vapor deposition), sintering, and others. Electrolytic co-deposition technology segment accounts for the largest market share in the market. Electrolytic co-deposition of natural or synthetic diamond particles inside a nickel or duplex nickel–chromium matrix onto a stainless-steel shank is the most prevalent bonding method, currently. The diamond particles are embedded in the metal matrix like chopped almonds coated in caramel. This technology offers good adhesions to the plated metal layer to the substrate. Hence, this segment of technology ends up to be the largest segment.

North America is the largest market for dental diamond burs market

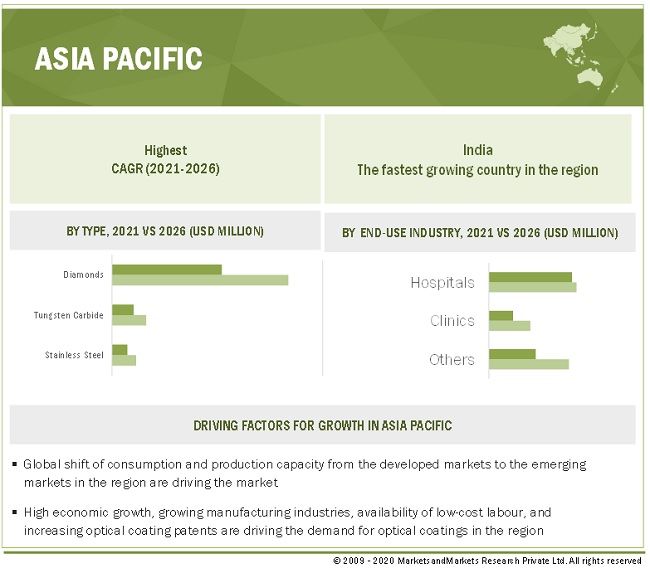

The APAC region is projected to be the largest market and to grow at the highest CAGR during the forecast period. Growth in APAC is backed by the increase in disposable income of people in countries such as China and India, growing middle-class population, rise in demand for packaged food, and the growth of the food & beverage industry. Moreover, the growth of the dental diamond burs market in the APAC region is attributed to the higher consumer spending and manufacturing of packaging materials in developing economies, such as China and India. China is projected to be the fastest-growing market across the globe during the forecast period. This is attributed to the population growth in the country, along with the high availability of packaging material coupled with technological development. This directly affects the growth of the dental diamond burs market in the APAC region.

Dentsply Sirona Inc. (US), Henry Schein, Inc. (US), SHOFU Inc. (Japan), MANI, INC. (Germany), Bresseler USA (US) are key players in dental diamond burs market.

To know about the assumptions considered for the study, download the pdf brochure

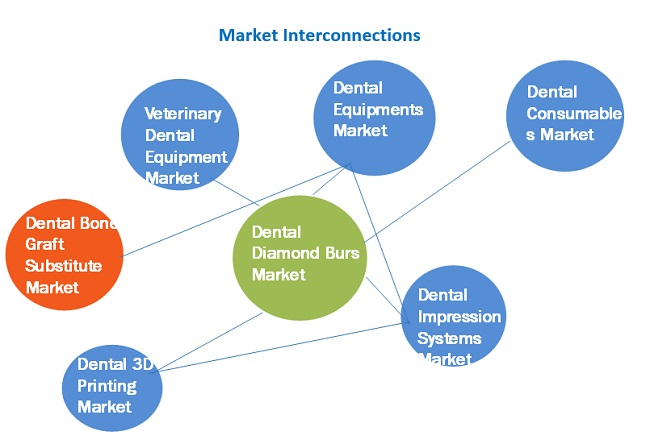

Dental Diamond Burs Market Interconnections

Dental Diamond Burs Market Players

Dentsply Sirona Inc. (US), Henry Schein, Inc. (US), SHOFU Inc. (Japan), MANI, INC. (Germany), Bresseler USA (US) are the key players operating in the dental diamond burs market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to dental diamond burs from emerging economies.

Dental Diamond Burs Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 130 million |

|

Revenue Forecast in 2026 |

USD 191 million |

|

CAGR |

8.0% |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, Application, Technology and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies |

Dentsply Sirona Inc. (US), Henry Schein, Inc. (US), SHOFU Inc. (Japan), MANI, INC. (Germany), Bresseler USA (US) |

This research report categorizes the dental diamond burs market based on type, application, technology and region.

Dental Diamond Burs Market by Type:

- Diamonds

- Tungsten Carbide

- Stainless Steel

Dental Diamond Burs Market by Application:

- Hospitals

- Clinics

- Others (dental academic, research institutes, and forensic laboratories)

Dental Diamond Burs Market by Technology:

- Electrolytic co-deposition

- Micro brazing

- CVD (Chemical vapor deposition)

- Sintering

- Others (adhesives, electroplating, and computer-aided-design(CAD)/ computer-aided-manufacture(CAM))

Dental Diamond Burs Market by Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In June 2021, Dentsply Sirona Inc. acquired the assets of Propel Orthodontics' substantially. The VPro gadget and the Fastrack Mobile App were among the assets purchased. Dentsply Sirona Inc. will benefit from the purchase by strengthening its position in the fast-growing clear aligner industry. The purchased product lines are a decent match for Byte and SureSmile.

- In July 2021. Henry Schein Inc. has entered into an agreement with The Dentists Supply Company. This agreement will help Henry Schein Inc. achieve its goal of providing state dental association members with an online-only alternative for acquiring dental supplies. TDSC.com, which is powered by Henry Schein Inc., has been opened in October 2020 and will continue to offer everyday low prices to dental association members while expanding its offers for dental supplies and small equipment.

- In July 2020, Shofu Inc. entered into an agreement with Mitsui Chemicals, Inc., and Sun Medical Co., Ltd. for the enhancement of business and capital tie-up. The three participants agreed to optimize their dental material business operations.

- In 2017, MANI, INC. established MANI MEDICAL INDIA PRIVATE LIMITED in Delhi (India) as an Indian subsidiary to expand its business. It deals in MANI Dental Instruments and Materials, MANI Suture Needles, MANI Skin Stapler, MANI Ophthalmic Knife, Vessel Knife, etc.

- In December 2017, Brasseler USA introduced new BrioShine Feather Lite Composite & Ceramic Single-Use Polishers. BrioShine Feather Lite Composite & Ceramic Single-Use Polishers are designed for consistent polishing and finishing of ceramic and composite surfaces.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the dental diamond burs market?

Rise in demand for dental diamond burs from emerging economies and growing popularity of growing consciousness towards dental health are hot bets for the market.

What are the market dynamics for the different type of dental diamond burs?

On the basis of type, The diamond type segment accounted for a larger market share. Diamond is projected to be the fastest-growing type segment. This is attributed to its unique hardness properties. Diamond is also projected to be the fastest-growing type segment. Due to this property it can be used to cut through zirconia or grind porcelain while veneers and crowns are being prepared and placed.

What are the market dynamics for the different applications of dental diamond burs?

The hospitals segment led the market in terms of both value and volume. It is attributed to the use of dental diamond burs into small and big surgeries and other treatments.

Who are the major manufacturers of dental diamond burs market?

Dentsply Sirona Inc. (US), Henry Schein, Inc. (US), SHOFU Inc. (Japan), MANI, INC. (Germany), Bresseler USA (US are the key players operating in the dental diamond burs market.

What are the major factors which will impact market growth during the forecast period?

Stringent government regulations will be a restraint to the growth of the market during the forecast period. Governments worldwide are addressing this issue by imposing strict laws, which results in the dental diamond burs market being subjected to governance. . Diamond burs wear after multiple usage, and they should be changed after five teeth preparations at the most.

What are the effects of COVID-19 on dental diamond burs market?

The COVID-19 pandemic has significantly impacted the dental care industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. The outbreak of the coronavirus disease resulted in the shutdown of approximately 198,000 active dental hospitals and clinics in the US (data as of August 2020). This has disrupted the delivery of dental services in the country. According to the Irish Dental Association, about 75% of dental practitioners are witnessing a financial loss of over 70% during the outbreak. Dental healthcare workers are at the highest risk of contracting COVID-19 as the virus that causes COVID-19 is present in nasopharyngeal and salivary secretions of patients infected with the virus and is believed to spread through respiratory droplets, as well as aerosols and fomites. As a result, dental services were limited to emergency and urgent cases during the early days of the pandemic. However, dental care providers reopened in the third and fourth quarters of 2020. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 3 DENTAL DIAMOND BURS MARKET: RESEARCH DESIGN

2.2 KEY INDUSTRY INSIGHTS

FIGURE 4 DATA VALIDATION FROM PRIMARY EXPERTS

TABLE 1 LIST OF STAKEHOLDERS INVOLVED

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.3 BASE NUMBER CALCULATION

2.3.1 SUPPLY-SIDE APPROACH – 1

FIGURE 6 DENTAL DIAMOND BURS MARKET: SUPPLY-SIDE APPROACH – 1

2.3.2 SUPPLY-SIDE APPROACH – 2

FIGURE 7 DENTAL DIAMOND BURS MARKET: SUPPLY-SIDE APPROACH - 2

2.3.3 SUPPLY-SIDE APPROACH – 3

FIGURE 8 DENTAL DIAMOND BURS MARKET: SUPPLY-SIDE APPROACH – 3

2.3.4 DEMAND-SIDE APPROACH – 1

FIGURE 9 DENTAL DIAMOND BURS MARKET: DEMAND-SIDE APPROACH – 1

2.4 MARKET SIZE ESTIMATION

2.4.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 TRIANGULATION

2.5.1 SECONDARY DATA

2.5.2 PRIMARY DATA

FIGURE 10 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS & LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RISKS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 11 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPP0RTUNITIES

2.8 FACTOR ANALYSIS

2.8.1 INTRODUCTION

2.8.2 DEMAND-SIDE ANALYSIS

2.8.3 SUPPLY-SIDE ANALYSIS

FIGURE 12 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 13 DIAMOND BURS TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 14 ELECTROLYTIC CO-DEPOSITION TECHNOLOGY SEGMENT TO LEAD THE MARKET

FIGURE 15 HOSPITALS APPLICATION TO LEAD THE DENTAL DIAMOND BURS MARKET

FIGURE 16 DENTAL DIAMOND BURS MARKET IN APAC TO REGISTER THE FASTEST GROWTH

FIGURE 17 NORTH AMERICA LED THE DENTAL DIAMOND BURS MARKET

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE DENTAL DIAMOND BURS MARKET

FIGURE 18 THE INCREASING PREVALENCE OF DENTAL DISEASES IS A MAJOR FACTOR DRIVING THE MARKET GROWTH

4.2 DENTAL DIAMOND BURS MARKET, BY REGION

FIGURE 19 APAC TO BE THE FASTEST-GROWING REGION DURING THE FORECAST PERIOD

4.3 DENTAL DIAMOND BURS MARKET, BY TYPE

FIGURE 20 DIAMOND BURS TO BE THE LARGEST SEGMENT

4.4 DENTAL DIAMOND BURS MARKET, BY TECHNOLOGY

FIGURE 21 ELECTROLYTIC CO-DEPOSITION TO ACCOUNT FOR LARGEST MARKET SHARE

4.5 DENTAL DIAMOND BURS MARKET, BY APPLICATION

FIGURE 22 CLINICS TO BE THE FASTEST-GROWING APPLICATION SEGMENT

4.6 DENTAL DIAMOND BURS MARKET: EMERGING VS. MATURE MARKETS

FIGURE 23 INDIA TO EMERGE AS THE MOST LUCRATIVE MARKET BETWEEN 2021 AND 2026

4.7 DENTAL DIAMOND BURS MARKET IN NORTH AMERICA, 2020

FIGURE 24 US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN DENTAL DIAMOND BURS MARKET

4.8 DENTAL DIAMOND BURS MARKET: MAJOR COUNTRIES SNAPSHOT

FIGURE 25 THE MARKET IN INDIA IS PROJECTED TO GROW AT THE HIGHEST RATE

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DENTAL DIAMOND BURS MARKET

5.2.1 DRIVERS

5.2.1.1 Changing lifestyles and unhealthy food habits

5.2.1.2 Rising dental tourism in emerging markets

TABLE 3 COST SAVINGS: TOP DESTINATIONS FOR DENTAL RESTORATION TREATMENTS

5.2.1.3 Growing consumer awareness and rising focus on cosmetic dental aesthetics

5.2.1.4 Increasing prevalence of oral health disorders

5.2.1.4.1 Dental caries and other periodontal disorders

5.2.1.4.2 Edentulism

FIGURE 27 US: NUMBER OF PEOPLE SUFFERING FROM ABSENCE OF ALL-NATURAL TEETH (2018)

TABLE 4 INCREASE IN GERIATRIC POPULATION, 2019 VS 2050

5.2.2 RESTRAINTS

5.2.2.1 Changing frequency of dental diamond burs

5.2.2.2 Limited reimbursement

TABLE 5 COST OF DENTAL CROWNS, BY MATERIAL

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing number of dental laboratories investing in CAD/CAM technologies

5.2.4 CHALLENGES

5.2.4.1 Quality of dental diamond burs

5.2.4.2 Stringent government regulation for dental diamond burs

5.2.4.3 Dearth of trained dental practitioners

5.3 TREND AND DISRUPTIONS

FIGURE 28 DENTAL DIAMOND BURS MARKET: TREND AND DISRUPTIONS

5.4 SCENARIO ANALYSIS

FIGURE 29 RANGE SCENARIOS OF THE DENTAL DIAMOND BURS MARKET

5.4.1 OPTIMISTIC SCENARIO

5.4.2 PESSIMISTIC SCENARIO

5.4.3 REALISTIC SCENARIO

5.5 PATENT ANALYSIS

5.5.1 INTRODUCTION

5.5.2 METHODOLOGY

5.5.3 DOCUMENT TYPE

TABLE 6 DENTAL DIAMOND BURS MARKET: REGISTERED PATENTS

FIGURE 30 DENTAL DIAMOND BURS MARKET: REGISTERED PATENTS

5.5.4 PATENT PUBLICATION TRENDS

FIGURE 31 DENTAL DIAMOND BURS MARKET: PATENT PUBLICATION TRENDS, 2010-2020

5.5.5 INSIGHT

5.5.6 JURISDICTION ANALYSIS

FIGURE 32 DENTAL DIAMOND BURS MARKET: JURISDICTION ANALYSIS

5.5.7 TOP PATENT APPLICANTS

FIGURE 33 DENTAL DIAMOND BURS MARKET: TOP PATENT APPLICANTS

5.5.8 LIST OF SIGNIFICANT PATENTS

TABLE 7 DENTAL DIAMOND BURS MARKET SIZE: LIST OF PATENTS

5.6 REGULATORY LANDSCAPE

5.6.1 US

5.6.2 EUROPEAN UNION (EU)

5.6.3 CHINA

5.6.4 INDIA

TABLE 8 DENTAL DIAMOND BURS MARKET: BUREAU OF INDIAN STANDARDS PROVISIONS

5.7 PRICING ANALYSIS

FIGURE 34 AVERAGE SELLING PRICE (2020-2026)

5.8 TECHNOLOGY ANALYSIS

5.9 VALUE CHAIN ANALYSIS AND ECOSYSTEM/MARKET MAP

FIGURE 35 VALUE CHAIN ANALYSIS

FIGURE 36 DENTAL DIAMOND BURS MARKET: ECOSYSTEM/MARKET MAP

5.10 SUPPLY CHAIN

FIGURE 37 DENTAL DIAMOND BURS MARKET: SUPPLY CHAIN

5.11 TRADE ANALYSIS

5.11.1 IMPORT-EXPORT SCENARIO OF DENTAL DIAMOND BURS MARKET

5.11.2 EXPORT SCENARIO OF DENTAL DIAMOND BURS

FIGURE 38 DENTAL DIAMOND BURS MARKET: EXPORTING COUNTRIES

5.11.3 IMPORT SCENARIO OF DENTAL DIAMOND BURS

FIGURE 39 DENTAL DIAMOND BURS MARKET: IMPORTING COUNTRIES

5.12 IMPACT OF COVID-19 ON DENTAL DIAMOND BURS MARKET

5.12.1 INTRODUCTION

5.12.2 COVID-19 IMPACT ON DENTAL CARE INDUSTRY

5.13 CASE STUDY ANALYSIS

5.13.1 DENTAL DIAMOND BURS MADE WITH CVD TECHNOLOGY

5.13.1.1 Objective

5.13.1.2 Solution statement

5.13.1.3 Benefits

6 INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 40 DENTAL DIAMOND BURS: PORTER’S FIVE FORCES ANALYSIS

TABLE 9 DENTAL DIAMOND BURS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.2.1 THREAT FROM NEW ENTRANTS

6.2.2 THREAT FROM SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

6.3 MACROECONOMIC INDICATORS

6.3.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 10 TRENDS AND FORECASTS OF GDP, 2019–2026 (GROWTH RATE)

7 DENTAL DIAMOND BURS MARKET, BY TYPE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 41 DIAMOND BURS PROJECTED TO REGISTER HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 11 DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

7.2 DIAMOND BURS

7.2.1 ENABLE FASTER AND SMOOTHER CUTTING AND PROVIDE EXTREME PRECISION

TABLE 13 DIAMOND BURS: DENTAL DIAMOND BURS MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 14 DIAMOND BURS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

7.3 TUNGSTEN CARBIDE BURS

7.3.1 REDUCE DISCOMFORT FOR PATIENTS

TABLE 15 TUNGSTEN CARBIDE BURS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 TUNGSTEN CARBIDE BURS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

7.4 STAINLESS-STEEL BURS

7.4.1 FLEXIBLE AND REQUIRE LOWER MAINTENANCE

TABLE 17 STAINLESS-STEEL BURS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 18 STAINLESS-STEEL BURS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

8 DENTAL DIAMOND BURS MARKET, BY TECHNOLOGY (Page No. - 83)

8.1 INTRODUCTION

FIGURE 42 MICRO BRAZING TECHNOLOGY TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 20 DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

8.1.1 ELECTROLYTIC CO-DEPOSITION

8.1.1.1 Manufacturers increasingly using electrolytic co-deposition technology

TABLE 21 ELECTROLYTIC CO-DEPOSITION: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 ELECTROLYTIC CO-DEPOSITION: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

8.1.2 MICRO BRAZING

8.1.2.1 Micro brazing enhances the reusability of the dental diamond burs

TABLE 23 MICRO BRAZING: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 MICRO BRAZING: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

8.1.3 CVD

8.1.3.1 CVD technology improving the cutting ability of dental diamond burs

TABLE 25 CVD: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 CVD: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

8.1.4 SINTERING

8.1.4.1 Sintering imparts optimum surface roughness, pressure, and takes less time

TABLE 27 SINTERING: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 SINTERING: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

8.1.5 OTHERS

TABLE 29 OTHER TECHNOLOGIES: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 OTHER TECHNOLOGIES: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

9 DENTAL DIAMOND BURS MARKET, BY APPLICATION (Page No. - 91)

9.1 INTRODUCTION

FIGURE 43 CLINICS APPLICATION PROJECTED TO REGISTER HIGHEST GROWTH RATE

TABLE 31 DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 32 DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION UNITS)

9.2 HOSPITALS

9.2.1 RISE IN DENTAL TOURISM IS EXPECTED TO SUPPORT THE MARKET

TABLE 33 TOP DESTINATIONS FOR COST-EFFECTIVE DENTAL TREATMENTS

TABLE 34 HOSPITALS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 35 HOSPITALS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

9.3 CLINICS

9.3.1 PROVIDE PROMPT SERVICE AND COMFORT TO PATIENTS

TABLE 36 CLINICS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 CLINICS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

9.4 OTHERS

TABLE 38 OTHER APPLICATIONS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 39 OTHER APPLICATIONS: DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

10 DENTAL DIAMOND BURS MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

FIGURE 44 INDIA PROJECTED TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

TABLE 40 DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 DENTAL DIAMOND BURS MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

10.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 44 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 46 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

TABLE 48 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION UNITS)

10.2.1 US

10.2.1.1 Growing geriatric population and dental disorders will drive the demand for dental diamond burs

FIGURE 46 US: RISE IN DENTAL EXPENDITURE, 2010–2019

TABLE 50 US: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 US: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 52 US: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 53 US: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.2.2 CANADA

10.2.2.1 Rising cases of dental caries expected to fuel the growth of the dental diamond burs market in the country

TABLE 54 CANADA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 CANADA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 56 CANADA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 57 CANADA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.2.3 MEXICO

10.2.3.1 Dental tourism is expected to support the growth of the market

TABLE 58 MEXICO: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 MEXICO: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 60 MEXICO: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 61 MEXICO: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.3 EUROPE

FIGURE 47 EUROPE: DENTAL DIAMOND BURS MARKET SNAPSHOT

TABLE 62 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 64 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 66 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

TABLE 68 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 69 EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION UNITS)

10.3.1 GERMANY

10.3.1.1 Favorable reimbursement for dental treatment is driving the demand for dental diamond burs in the country

TABLE 70 GERMANY: MACROECONOMIC INDICATORS

TABLE 71 GERMANY: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 GERMANY: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 73 GERMANY: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 74 GERMANY: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.3.2 FRANCE

10.3.2.1 Favorable government healthcare strategies are fueling market growth

TABLE 75 FRANCE: MACROECONOMIC INDICATORS

TABLE 76 FRANCE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 FRANCE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 78 FRANCE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 79 FRANCE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.3.3 UK

10.3.3.1 Increasing cases of dental disorders is a major factor driving the demand for dental diamond burs in the country

TABLE 80 UK: MACROECONOMIC INDICATORS

TABLE 81 UK: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 UK: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 83 UK: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 84 UK: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.3.4 ITALY

10.3.4.1 Low-cost treatments and growing penetration of dental products to drive the market for dental diamond burs

TABLE 85 ITALY: MACROECONOMIC INDICATORS

TABLE 86 ITALY: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 ITALY: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 88 ITALY: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 89 ITALY: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.3.5 SPAIN

10.3.5.1 Increasing demand for cosmetic dentistry and growing medical tourism are driving the demand for dental diamond burs

TABLE 90 SPAIN: MACROECONOMIC INDICATORS

TABLE 91 SPAIN: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 SPAIN: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 93 SPAIN: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 94 SPAIN: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.3.6 RUSSIA

10.3.6.1 Huge growth potential with increasing number of hospitals and dentists in the country

TABLE 95 RUSSIA: MACROECONOMIC INDICATORS

TABLE 96 RUSSIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 RUSSIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 98 RUSSIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 99 RUSSIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.3.7 REST OF EUROPE

TABLE 100 REST OF EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 REST OF EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 102 REST OF EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 103 REST OF EUROPE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.4 ASIA PACIFIC (APAC)

FIGURE 48 APAC: DENTAL DIAMOND BURS MARKET SNAPSHOT

TABLE 104 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 105 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 106 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 108 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 109 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

TABLE 110 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 111 APAC: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION UNITS)

10.4.1 CHINA

10.4.1.1 Growing prevalence of dental diseases to drive market growth in the country

TABLE 112 CHINA: MACROECONOMIC INDICATORS

TABLE 113 CHINA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 CHINA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 115 CHINA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 116 CHINA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.4.2 JAPAN

10.4.2.1 Increasing geriatric population and favorable reimbursement scenario are driving market growth

TABLE 117 JAPAN: MACROECONOMIC INDICATORS

TABLE 118 JAPAN: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 JAPAN: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 120 JAPAN: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 121 JAPAN: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.4.3 INDIA

10.4.3.1 India to offer lucrative growth opportunities for market players

TABLE 122 COST COMPARISON OF DENTAL TREATMENTS: INDIA VS. US & UK

TABLE 123 INDIA: MACROECONOMIC INDICATORS

TABLE 124 INDIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 INDIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 126 INDIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 127 INDIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.4.4 SOUTH KOREA

10.4.4.1 High penetration of dental implants to drive the dental diamond burs market in the country

TABLE 128 SOUTH KOREA: MACROECONOMIC INDICATORS

TABLE 129 SOUTH KOREA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 SOUTH KOREA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 131 SOUTH KOREA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 132 SOUTH KOREA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.4.5 AUSTRALIA

10.4.5.1 An increasing number of practicing dentists and oral diseases will contribute to market growth

TABLE 133 AUSTRALIA: MACROECONOMIC INDICATORS

TABLE 134 AUSTRALIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 AUSTRALIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 136 AUSTRALIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 137 AUSTRALIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.4.6 REST OF APAC

TABLE 138 REST OF APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 REST OF APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 140 REST OF APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 141 REST OF APAC: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.5 MIDDLE EAST & AFRICA

FIGURE 49 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SNAPSHOT

TABLE 142 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 144 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 146 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

TABLE 148 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION UNITS)

10.5.1 SAUDI ARABIA

10.5.1.1 Use of minimally invasive procedures and rising cases of dental diseases to drive the demand in the market

TABLE 150 SAUDI ARABIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 SAUDI ARABIA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 152 SAUDI ARABIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 153 SAUDI ARABIA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.5.2 SOUTH AFRICA

10.5.2.1 The rising private sector investment in the healthcare industry is expected to support the market

TABLE 154 SOUTH AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 SOUTH AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 156 SOUTH AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 157 SOUTH AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.5.3 UAE

10.5.3.1 Population growth and rising income levels to drive the demand for dental diamond burs

TABLE 158 UAE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 UAE: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 160 UAE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 161 UAE: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 162 GERIATRIC POPULATION IN REST OF MIDDLE EAST & AFRICAN COUNTRIES

TABLE 163 REST OF MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 165 REST OF MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 166 REST OF MIDDLE EAST & AFRICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.6 SOUTH AMERICA

FIGURE 50 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SNAPSHOT

TABLE 167 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 168 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 169 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 171 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 172 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

TABLE 173 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 174 SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION UNITS)

10.6.1 BRAZIL

10.6.1.1 Cosmetic dentistry is expected to support the market

TABLE 175 BRAZIL: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 176 BRAZIL: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 177 BRAZIL: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 178 BRAZIL: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.6.2 ARGENTINA

10.6.2.1 Low cost of dental procedures has led to the influx in medical and dental tourism

TABLE 179 ARGENTINA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 ARGENTINA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 181 ARGENTINA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 182 ARGENTINA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

10.6.3 REST OF SOUTH AMERICA

TABLE 183 GERIATRIC POPULATION IN REST OF SOUTH AMERICAN COUNTRIES

TABLE 184 REST OF SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 REST OF SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TYPE, 2019–2026 (MILLION UNITS)

TABLE 186 REST OF SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 187 REST OF SOUTH AMERICA: DENTAL DIAMOND BURS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 171)

11.1 OVERVIEW

FIGURE 51 COMPANIES ADOPTED MERGER & ACQUISITION AND EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2015 AND 2021

11.2 MARKET RANKING ANALYSIS

FIGURE 52 DENTAL DIAMOND BURS MARKET: MARKET RANKING

11.3 MARKET SHARE ANALYSIS

FIGURE 53 SHARE OF KEY PLAYERS IN DENTAL DIAMOND BURS MARKET, 2020

11.4 REVENUE ANALYSIS OF TOP 4 MARKET PLAYERS

FIGURE 54 TOP 4 PLAYERS DOMINATED THE MARKET BETWEEN 2016 AND 2020

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 EMERGING COMPANIES

FIGURE 55 COMPETITIVE LEADERSHIP MAPPING: DENTAL DIAMOND BURS MARKET, 2020

TABLE 188 COMPANY TYPE FOOTPRINT

TABLE 189 COMPANY APPLICATION FOOTPRINT

TABLE 190 COMPANY REGION FOOTPRINT

11.6 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 STARTING BLOCKS

11.6.4 DYNAMIC COMPANIES

FIGURE 56 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

11.7 COMPETITIVE SCENARIO

11.7.1 DEALS

TABLE 191 DEALS: 2015 AND 2021

11.7.2 NEW PRODUCT LAUNCH

TABLE 192 NEW PRODUCT LAUNCHES, 2015 AND 2021

11.7.3 OTHERS

TABLE 193 OTHERS, 2015 AND 2021

12 COMPANY PROFILES (Page No. - 182)

12.1 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, MnM View)*

12.1.1 DENTSPLY SIRONA INC.

TABLE 194 DENTSPLY SIRONA INC.: BUSINESS OVERVIEW

FIGURE 57 DENTSPLY SIRONA INC.: COMPANY SNAPSHOT

TABLE 195 DENTSPLY SIRONA INC.: PRODUCTS OFFERED

TABLE 196 DENTSPLY SIRONA INC.: NEW PRODUCT LAUNCH

12.1.2 HENRY SCHEIN, INC.

FIGURE 58 HENRY SCHEIN, INC.: COMPANY SNAPSHOT

TABLE 197 HENRY SCHEIN, INC.: PRODUCTS OFFERED

TABLE 198 HENRY SCHEIN, INC.: DEALS

12.1.3 SHOFU INC.

TABLE 199 SHOFU INC.: BUSINESS OVERVIEW

FIGURE 59 SHOFU INC.: COMPANY SNAPSHOT

TABLE 200 SHOFU INC.: PRODUCTS OFFERED

12.1.4 MANI, INC.

TABLE 201 MANI, INC.: BUSINESS OVERVIEW

FIGURE 60 MANI, INC.: COMPANY SNAPSHOT

TABLE 202 MANI, INC.: PRODUCTS OFFERED

12.1.5 BRASSELER USA

TABLE 203 BRASSELER USA: BUSINESS OVERVIEW

TABLE 204 BRASSELER USA: PRODUCTS OFFERED

TABLE 205 BRASSELER USA: NEW PRODUCT LAUNCHES

12.1.6 SHANGHAI SMEDENT MEDICAL INSTRUMENT CO., LTD

TABLE 206 SHANGHAI SMEDENT MEDICAL INSTRUMENT CO., LTD: BUSINESS OVERVIEW

TABLE 207 SHANGHAI SMEDENT MEDICAL INSTRUMENT CO., LTD: PRODUCTS OFFERED

12.1.7 PIVOT FABRIQUE HP

TABLE 208 PIVOT FABRIQUE HP: BUSINESS OVERVIEW

TABLE 209 PIVOT FABRIQUE HP: PRODUCTS OFFERED

12.1.8 PYRAX POLYMARS

TABLE 210 PYRAX POLYMARS: BUSINESS OVERVIEW

TABLE 211 PYRAX POLYMARS: PRODUCTS OFFERED

12.1.9 BENSONS SURGICO

TABLE 212 BENSONS SURGICO: BUSINESS OVERVIEW

TABLE 213 BENSONS SURGICO: PRODUCTS OFFERED

12.1.10 GOLDEN NIMBUS INTERNATIONAL

TABLE 214 GOLDEN NIMBUS INTERNATIONAL: BUSINESS OVERVIEW

TABLE 215 GOLDEN NIMBUS INTERNATIONAL: PRODUCTS OFFERED

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 MICROCOPY DENTAL

TABLE 216 MICROCOPY DENTAL: COMPANY OVERVIEW

12.2.2 GEBR. BRASSELER GMBH & CO. KG

TABLE 217 GEBR. BRASSELER GMBH & CO. KG: COMPANY OVERVIEW

12.2.3 STRAUSS & CO.

TABLE 218 STRAUSS & CO.: COMPANY OVERVIEW

12.2.4 TRI HAWK

TABLE 219 TRI HAWK: COMPANY OVERVIEW

12.2.5 CONFIDENT SALES INDIA PVT LTD.

TABLE 220 CONFIDENT SALES INDIA PVT LTD.: COMPANY OVERVIEW

12.2.6 MDT- MICRO DIAMOND TECHNOLOGIES

TABLE 221 MDT- MICRO DIAMOND TECHNOLOGIES: COMPANY OVERVIEW

12.2.7 DENTAKRIS

TABLE 222 DENTAKRIS: COMPANY OVERVIEW

12.2.8 PRIMA DENTAL

TABLE 223 PRIMA DENTAL: COMPANY OVERVIEW

12.2.9 KERR CORPORATION

TABLE 224 KERR CORPORATION: COMPANY OVERVIEW

12.2.10 PISCIUM HEALTH SCIENCES

TABLE 225 PISCIUM HEALTH SCIENCES: COMPANY OVERVIEW

12.2.11 DENTAL FUTURE SYSTEM

TABLE 226 DENTAL FUTURE SYSTEM: COMPANY OVERVIEW

12.2.12 HU-FRIEDY MFG. CO., LLC

TABLE 227 HU-FRIEDY MFG. CO., LLC: COMPANY OVERVIEW

12.2.13 BENCO DENTAL

TABLE 228 BENCO DENTAL: COMPANY OVERVIEW

12.2.14 V DENT ENTERPRISE

TABLE 229 V DENT ENTERPRISE: COMPANY OVERVIEW

12.2.15 SHENZHEN DIAN FONG ABRASIVE TECHNOLOGIES

TABLE 230 SHENZHEN DIAN FONG ABRASIVE TECHNOLOGIES: COMPANY OVERVIEW

13 APPENDIX (Page No. - 220)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

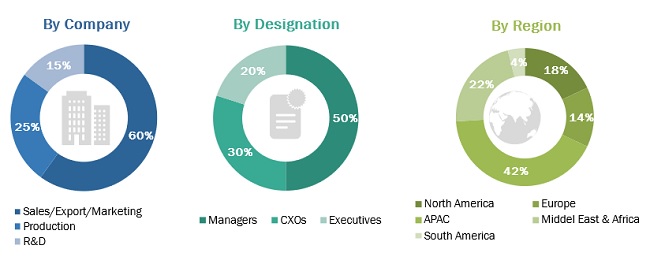

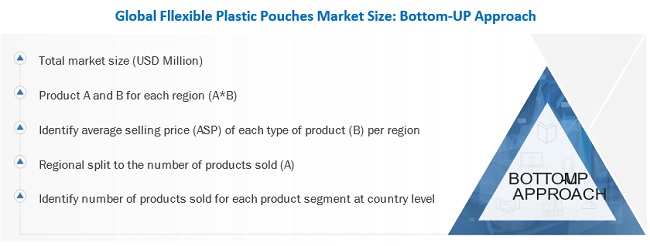

The study involved four major activities in estimating the current market size for the dental diamond burs market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The dental diamond burs comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The key growth drivers of the dental diamond burs market are rising cases of dental diseases, increasing demand for cosmetic dentistry, growing dental tourism in emerging markets, changing lifestyles, unhealthy food habits, and the increasing disposable income in developing countries. Growth in the market is also backed by the growing consumer preference on health consciousness, rising per-capita income, and development of end-use industries. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the dental diamond burs market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global dental diamond burs market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the dental diamond burs market based on type, application and technology

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Diamond Burs Market